SMO Exclusive: Strength Report Financial Sector 2024-04-03

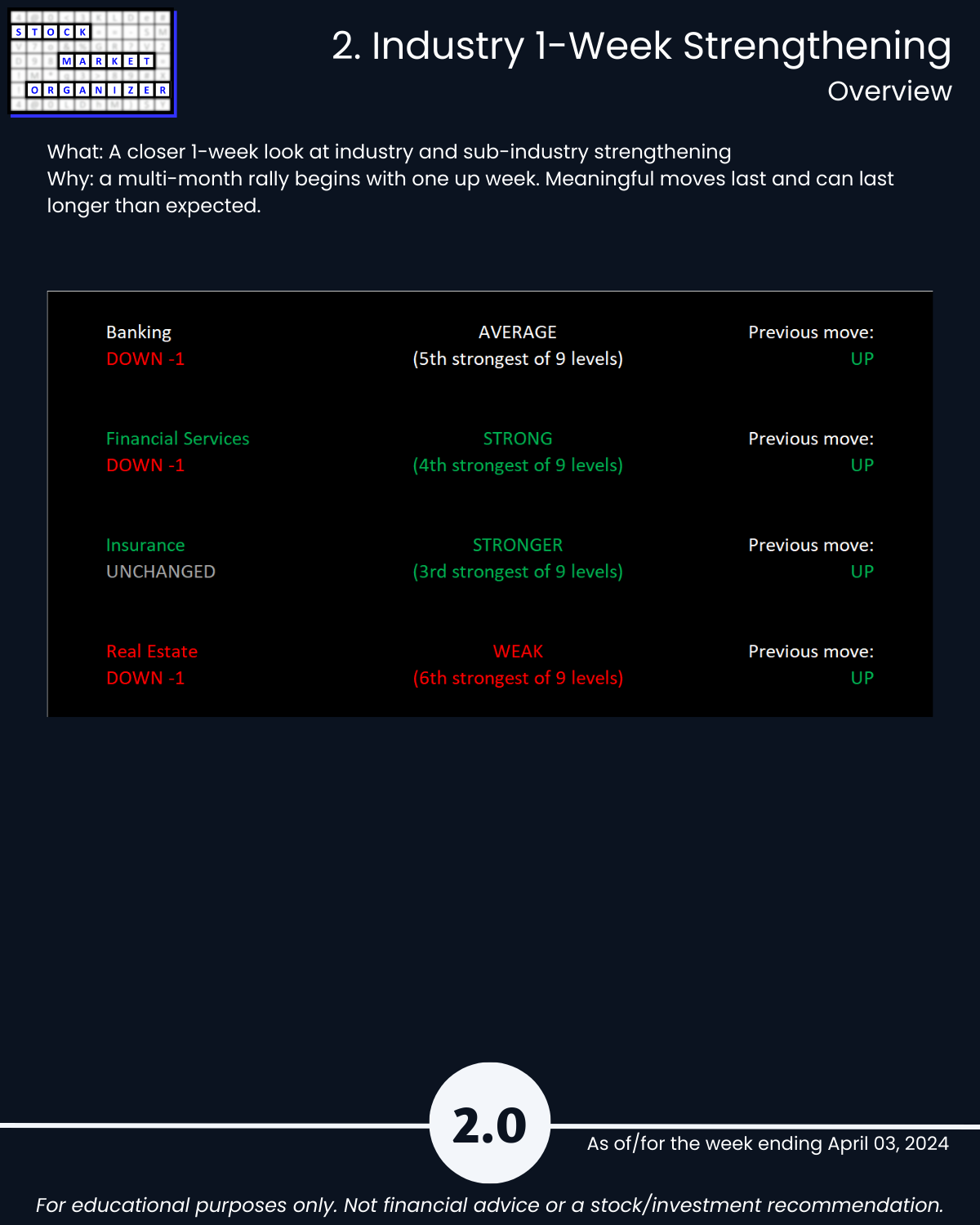

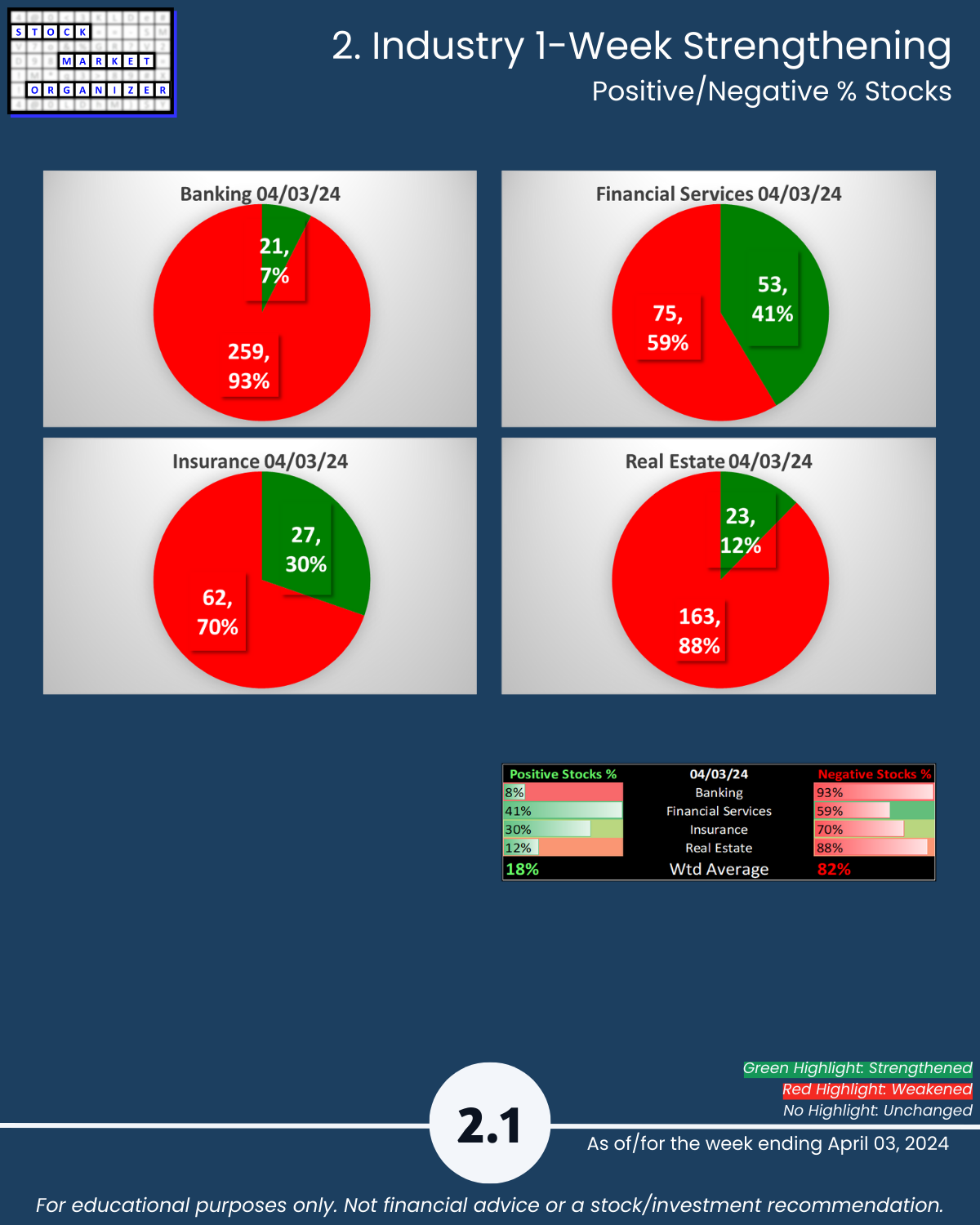

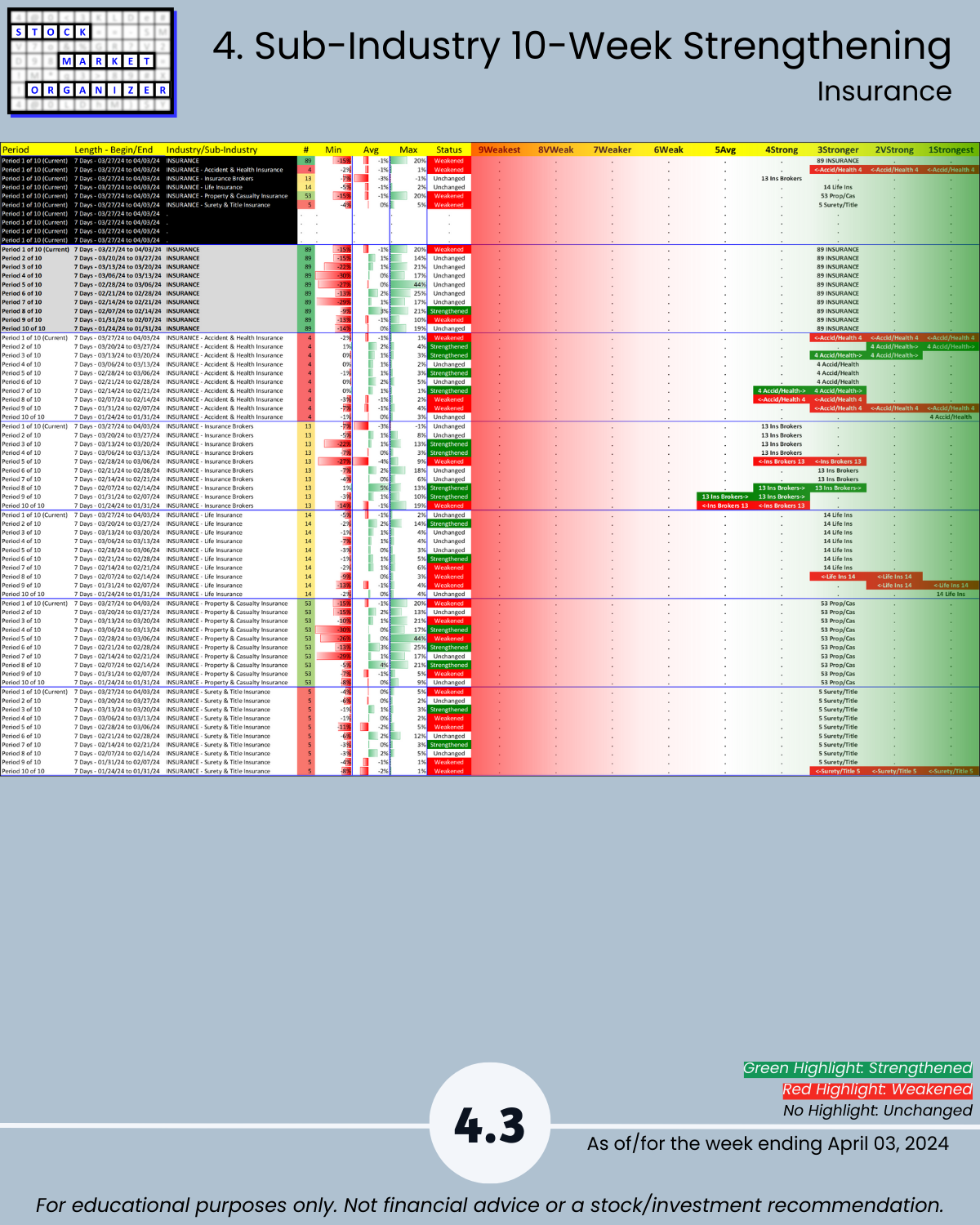

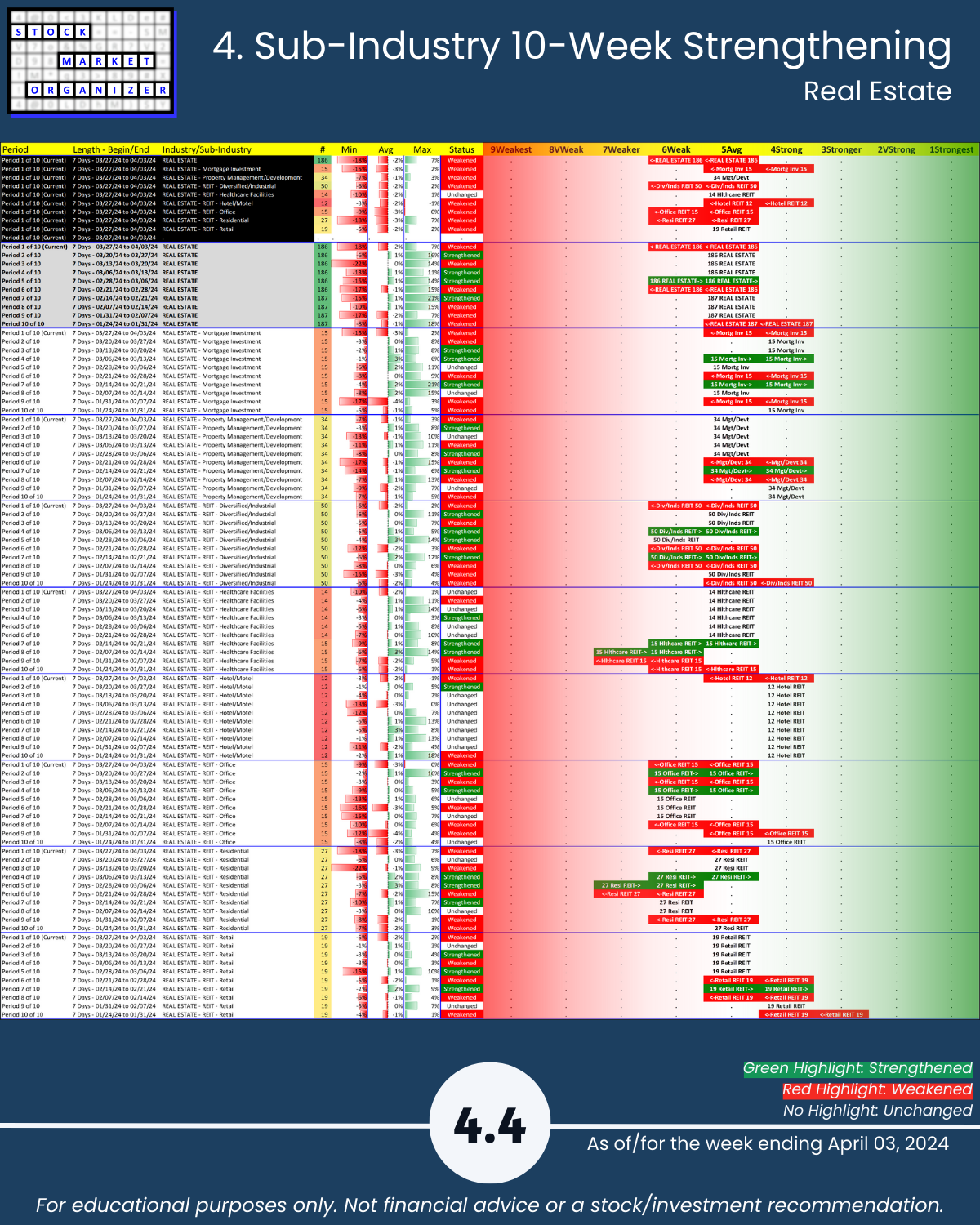

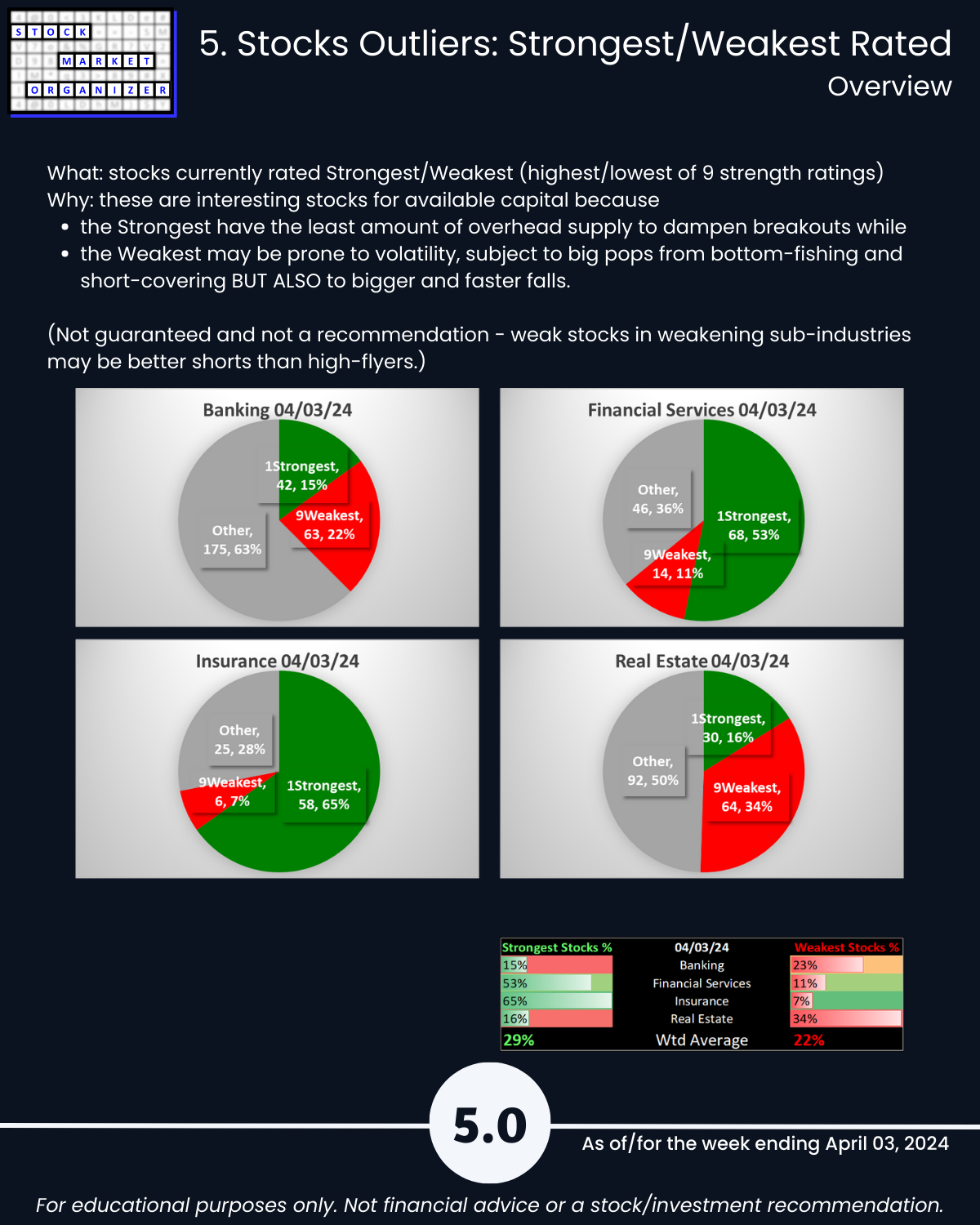

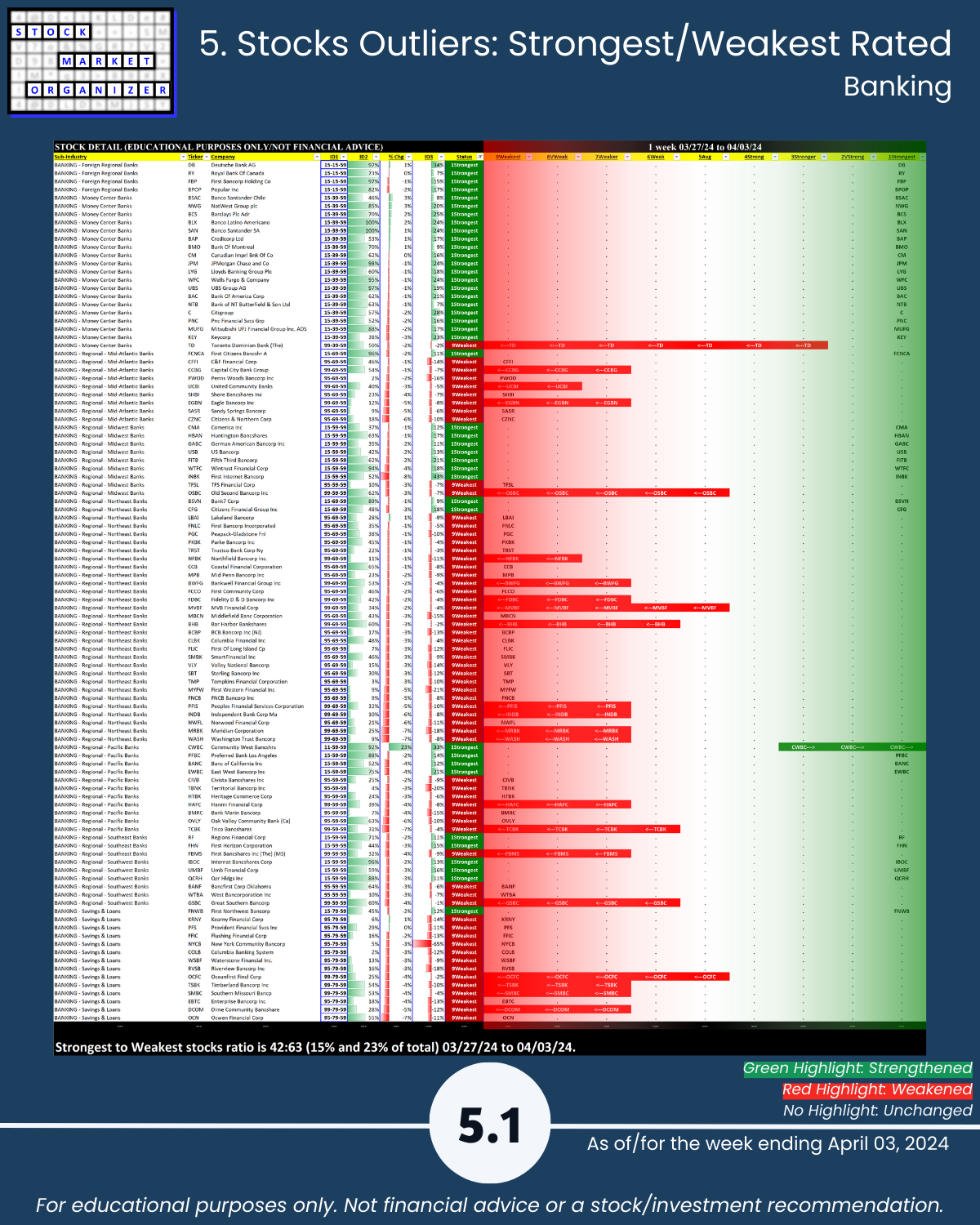

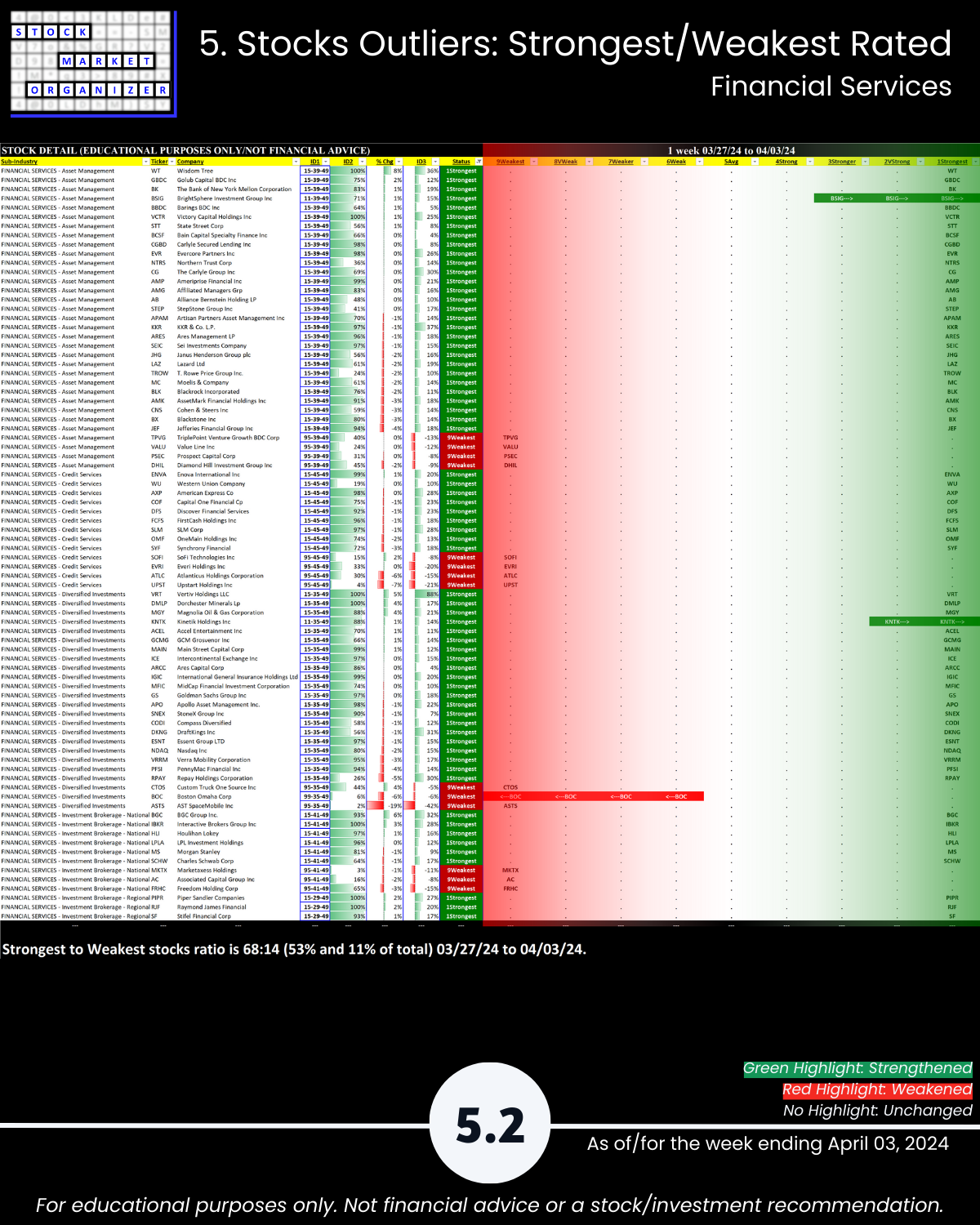

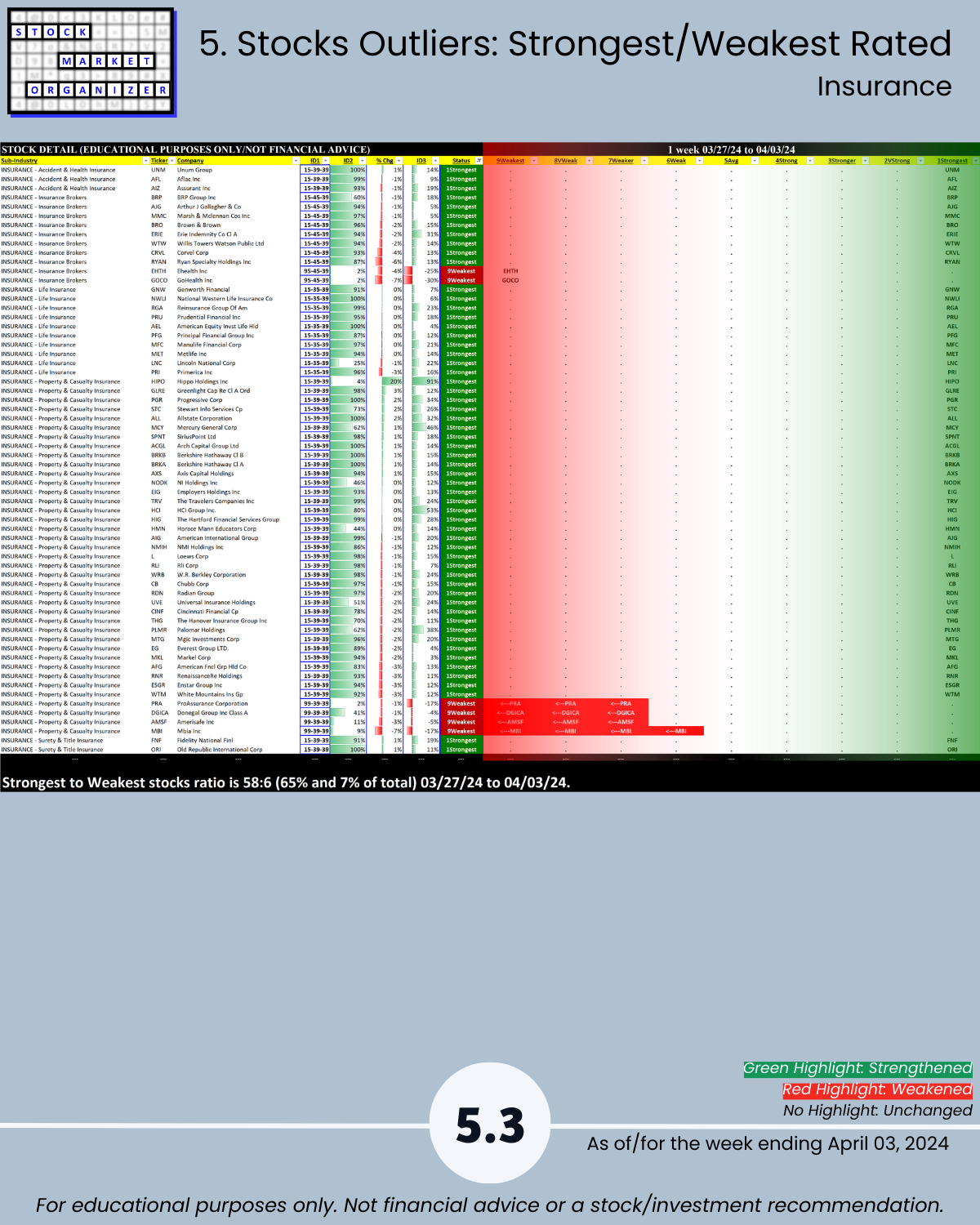

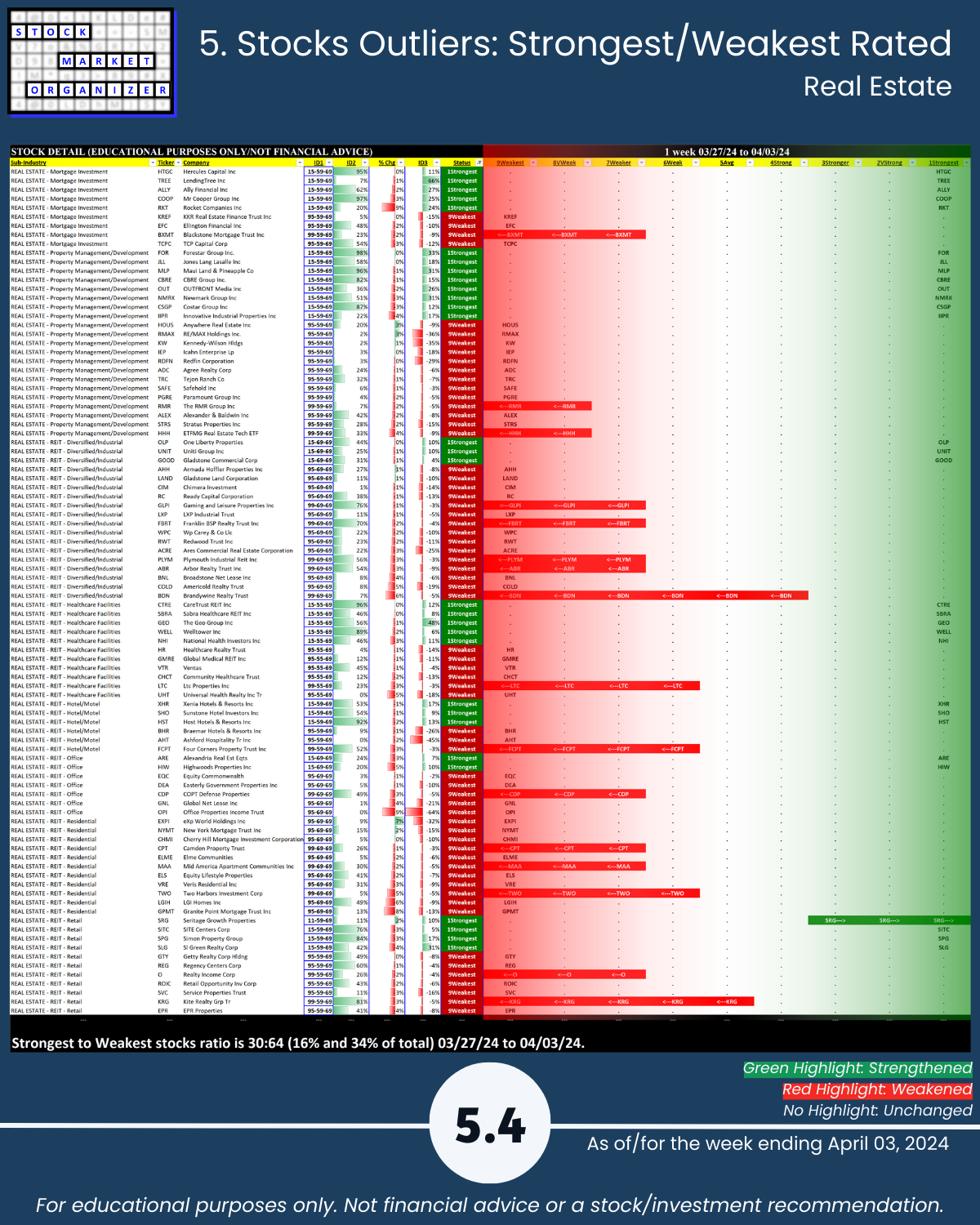

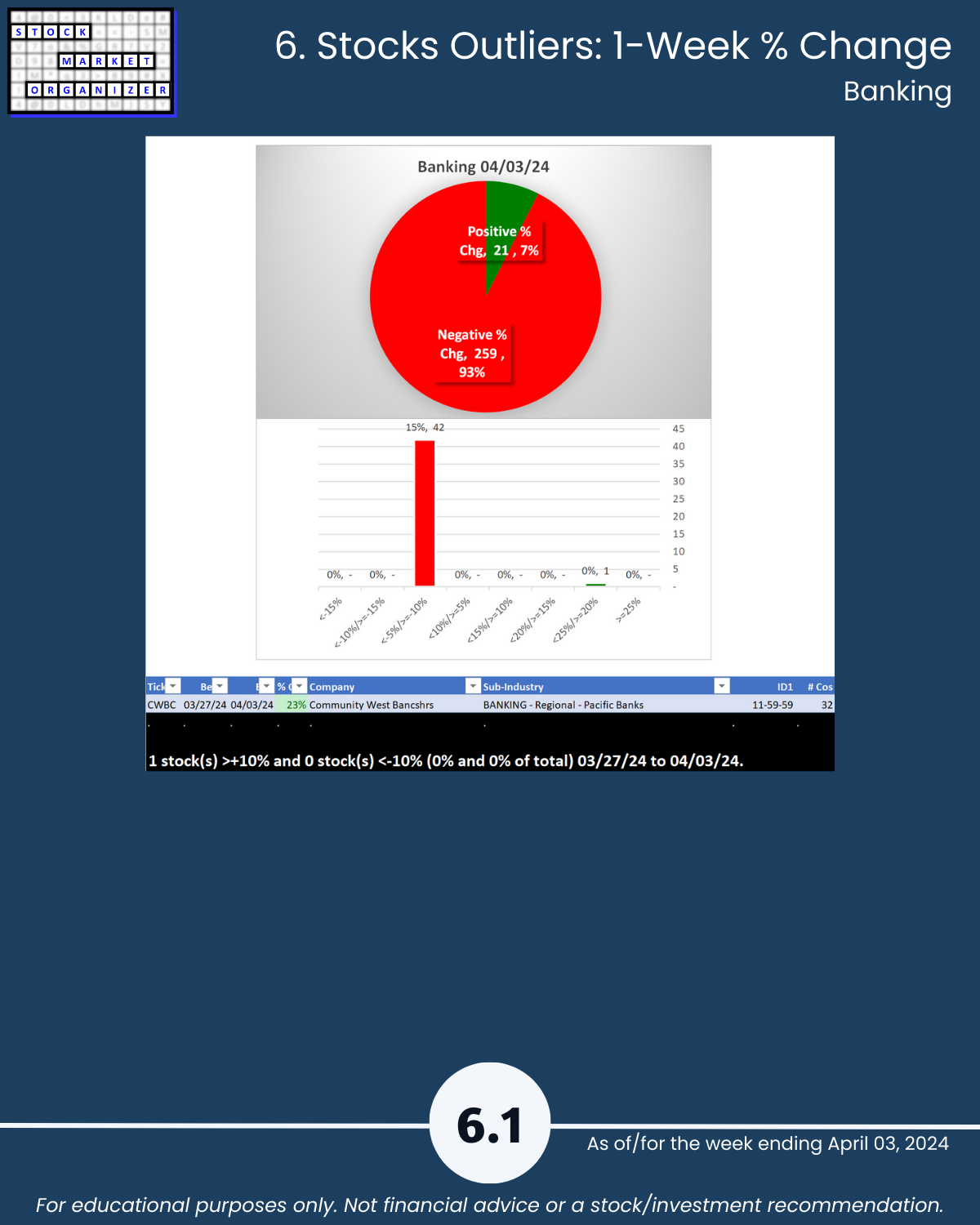

4/3/24 bad week for Financial Sector, opposite of last week - unique U.S. Stock Market strength-based insights: 🔹 3 of 4 industries weakened as the average score falls 0.9 (a large drop), 🔹 82% average negative stocks with Banking 93% and Real Estate 88%,🔹 56% of 27 sub-industries weakened, as 8 of 9 Banking and 5 of 8 Real Estate sub-industries weakened,🔹 Insurance remains Stronger with 13% stocks at multi-year highs and 65%:7% stocks rated Strongest:Weakest, but it did have 70% negative stocks.

WHAT’S HAPPENING HERE?

I am…

Finding U.S. Stock Market strength from the

top down,

inside out,

and bottom up, because

the stronger your stocks, the greener your P&L.

WHAT CAN I TELL YOU THAT YOU MAY NOT ALREADY KNOW?

FINANCIALS REVERSE TO A WEAK WEEK AS INSURANCE REMAINS STRONGER

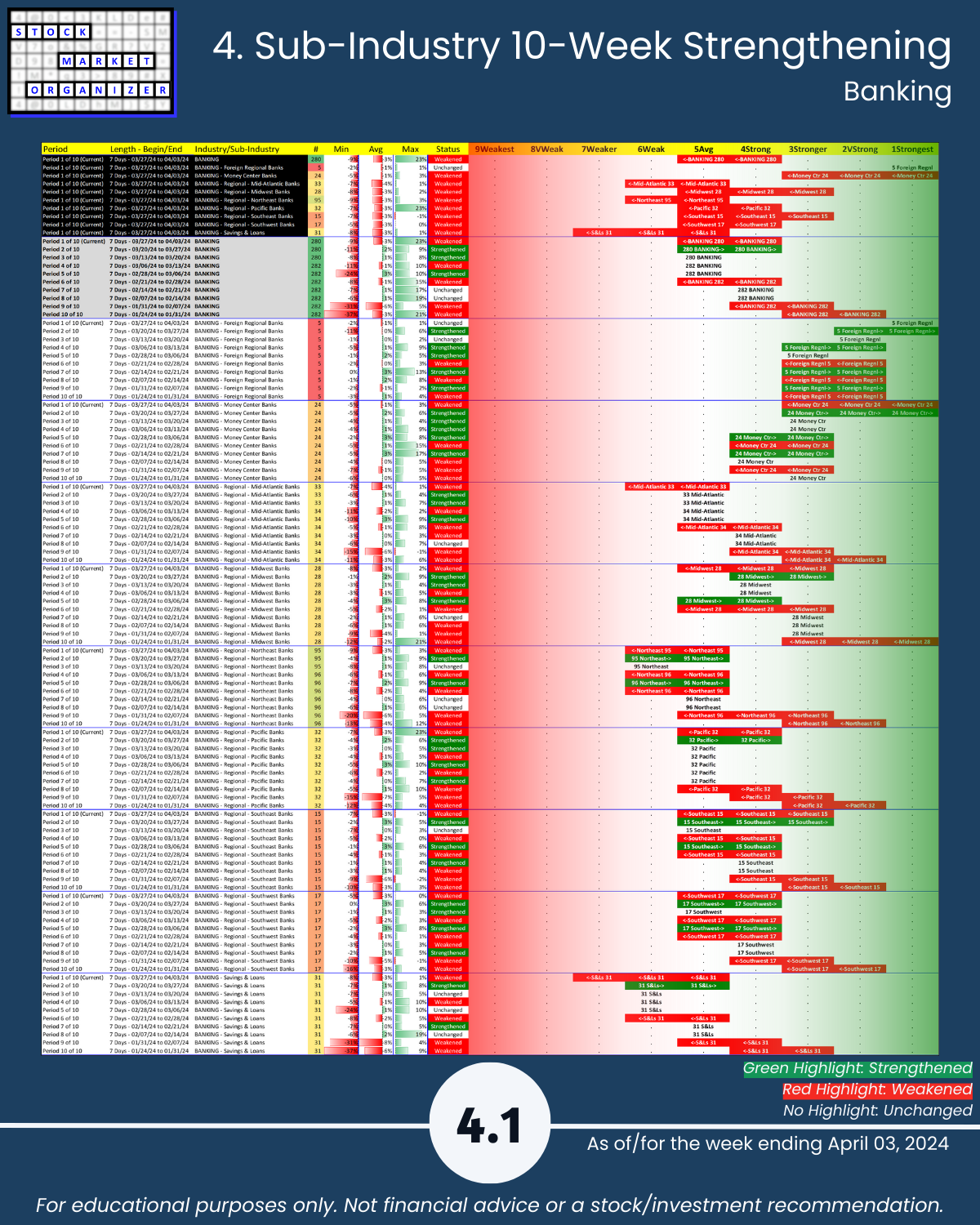

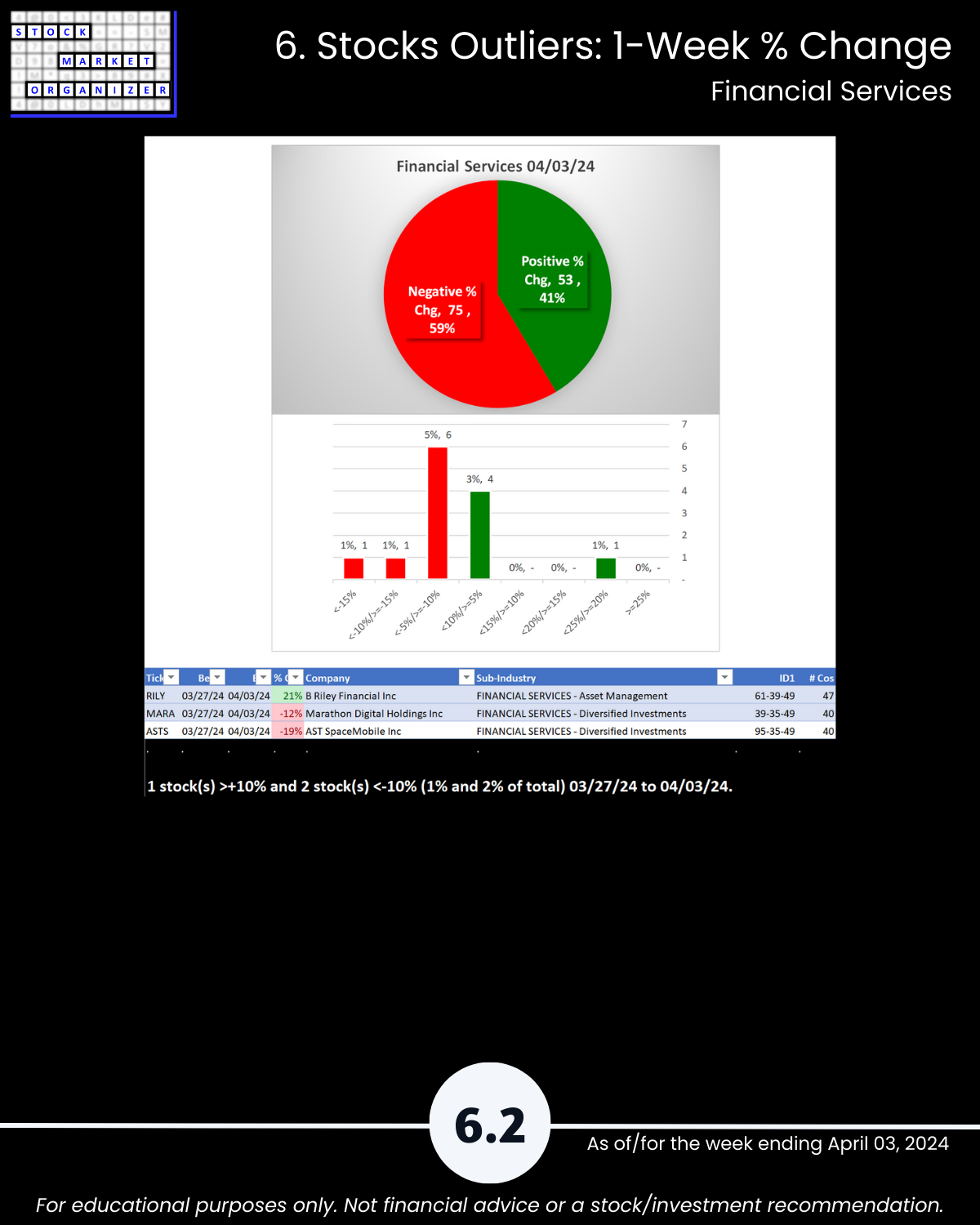

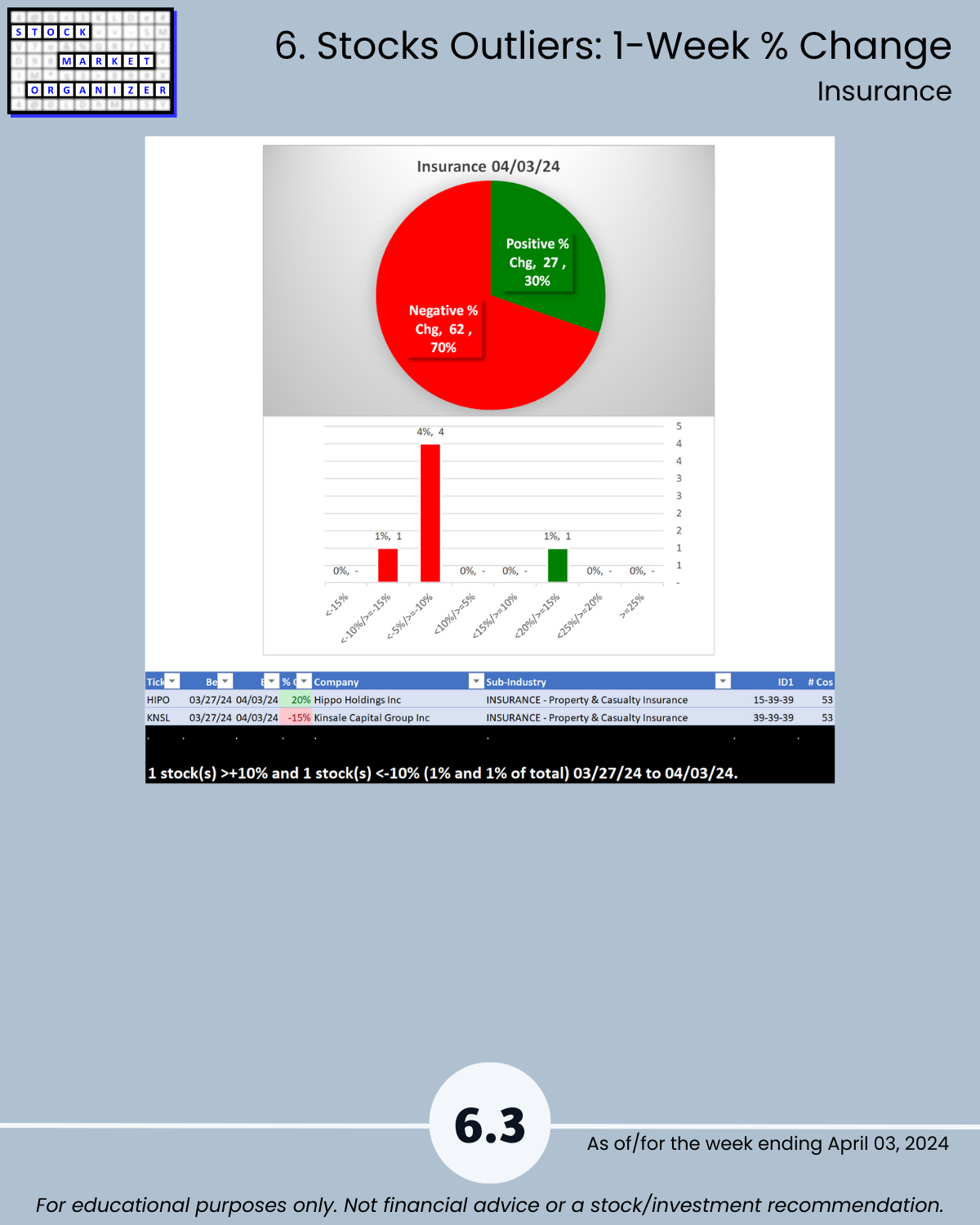

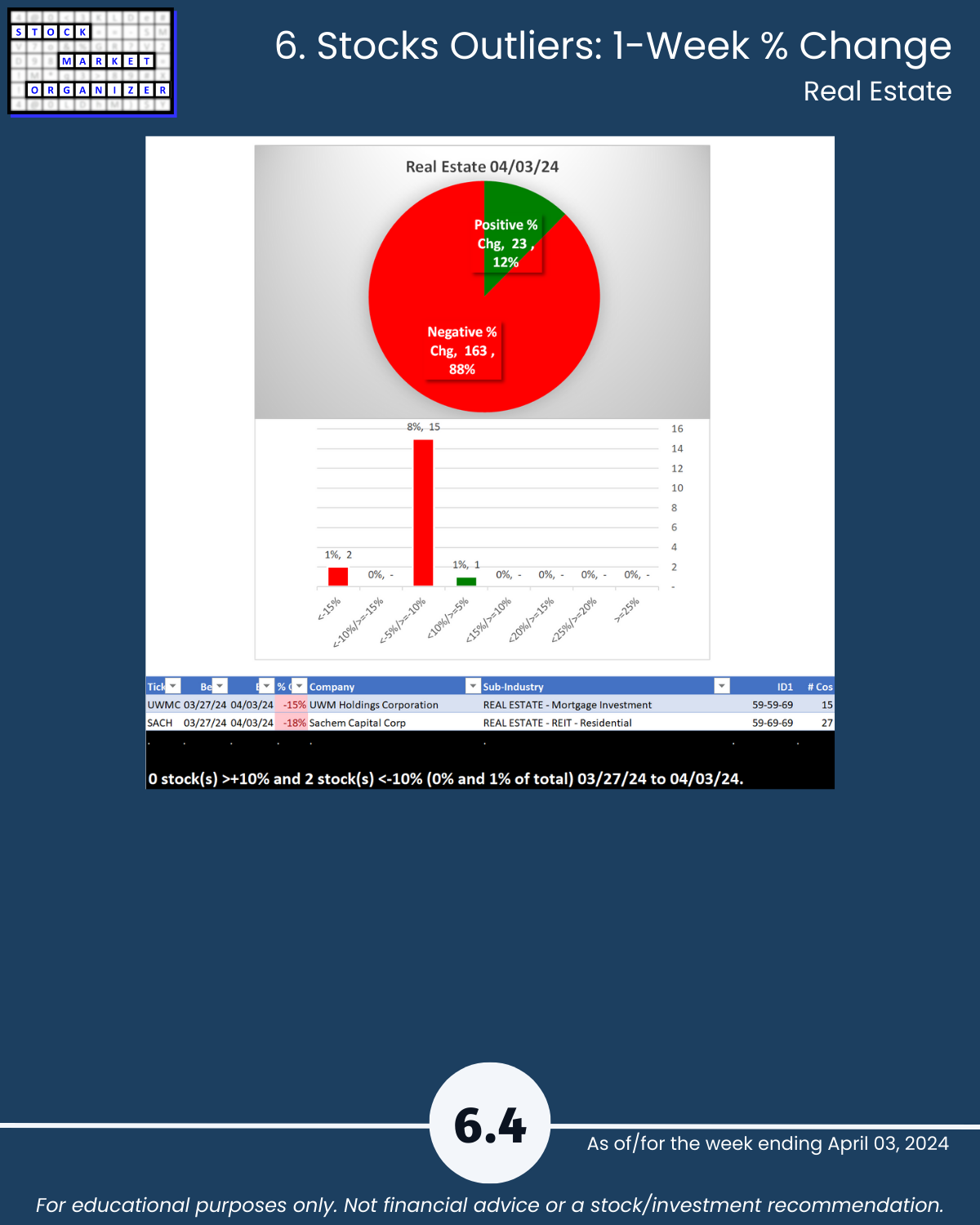

🔹 Industry Strength Level Changes: Banking, Financial Services, Real Estate WEAKENED

🔹 Industries:

- Strongest Insurance (3Stronger)

- Weakest Real Estate (6Weak)

🔹 Sub-industries (27):

- 0% Strengthened, 56% Weakened

- Strongest: Foreign Regional Banks (1Strongest)

- Weakest: S&Ls (7Weaker)

- @ 5 Year+ Highs/Lows: Insurance 13% highs

🔹 Stocks

- Positive:Negative: Industry avg 18%/82%; Banking 93%, Insurance 70%, Real Estate 88% negative

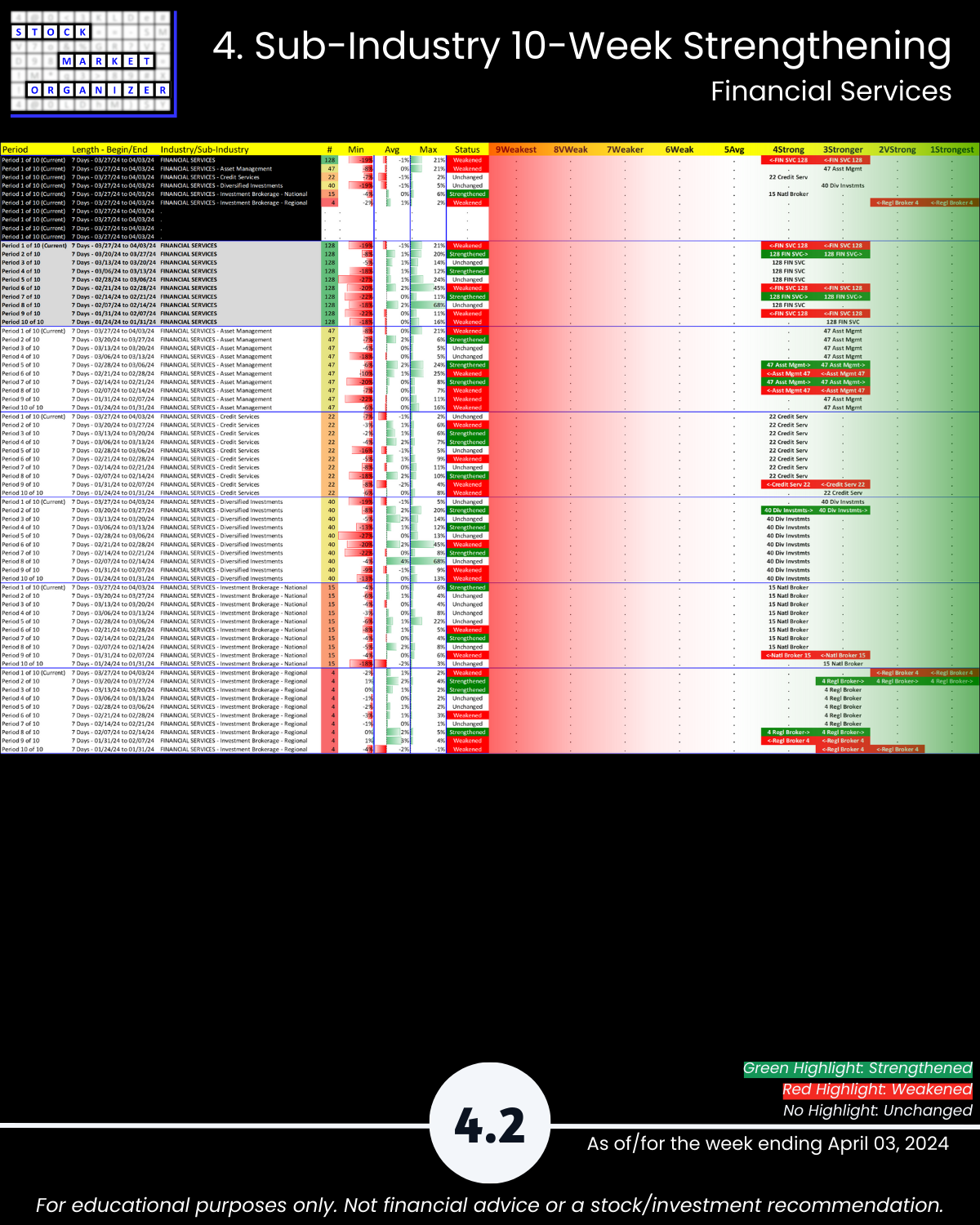

- Stocks, Strongest:Weakest: Industry avg 29%/22%; Financial Services 53%:11%, Insurance 65%:7%

- Outlier Stocks: CWBC +23%, RILY +21%

THE “WHY” BEHIND THIS METHOD (SEEKING STRENGTH MARKETWIDE)

The stronger your stocks the greener your P&L.

The journey to 100%+ returns begins with 10% returns.

The journey to multi-month rallies begins with one up week.

You won’t find what you aren’t looking for.

Look at any number of triple-digit gainers over the past year or less - obviously NVDA, certainly CVNA, SKYW, POWL, ANF, SMCI.

Each started with 10% gains.

Maybe 10% gainers keep going, and maybe they don’t.

But if you aren’t looking for them, and what might keep them rising (strengthening sub-industry, industry, and market), then you won’t find them.

The market does not have to be so complicated.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction - Industry Components

2. Industry 1-Week Strengthening

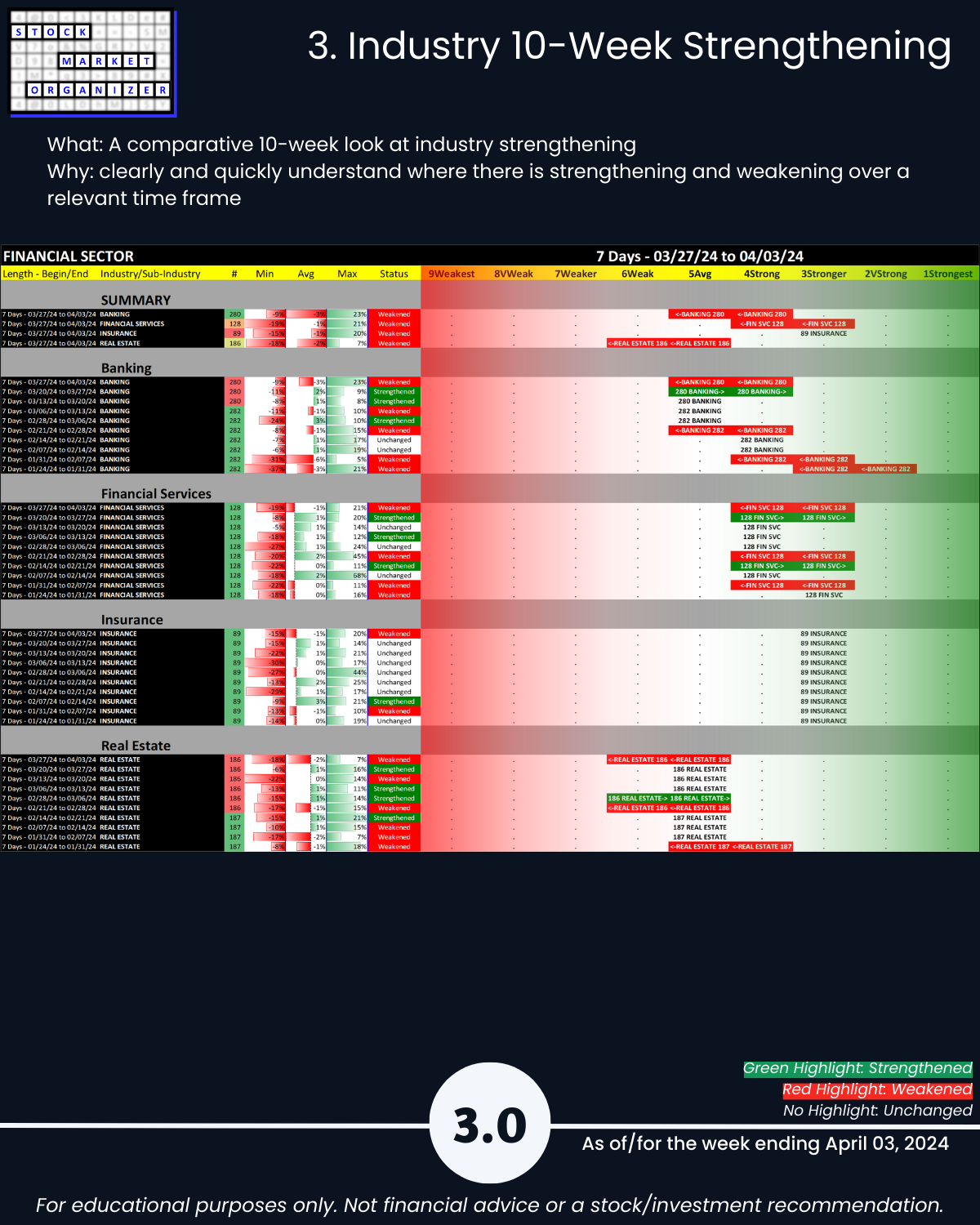

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows