SMO Exclusive: Strength Report Financial Sector 2024-03-13

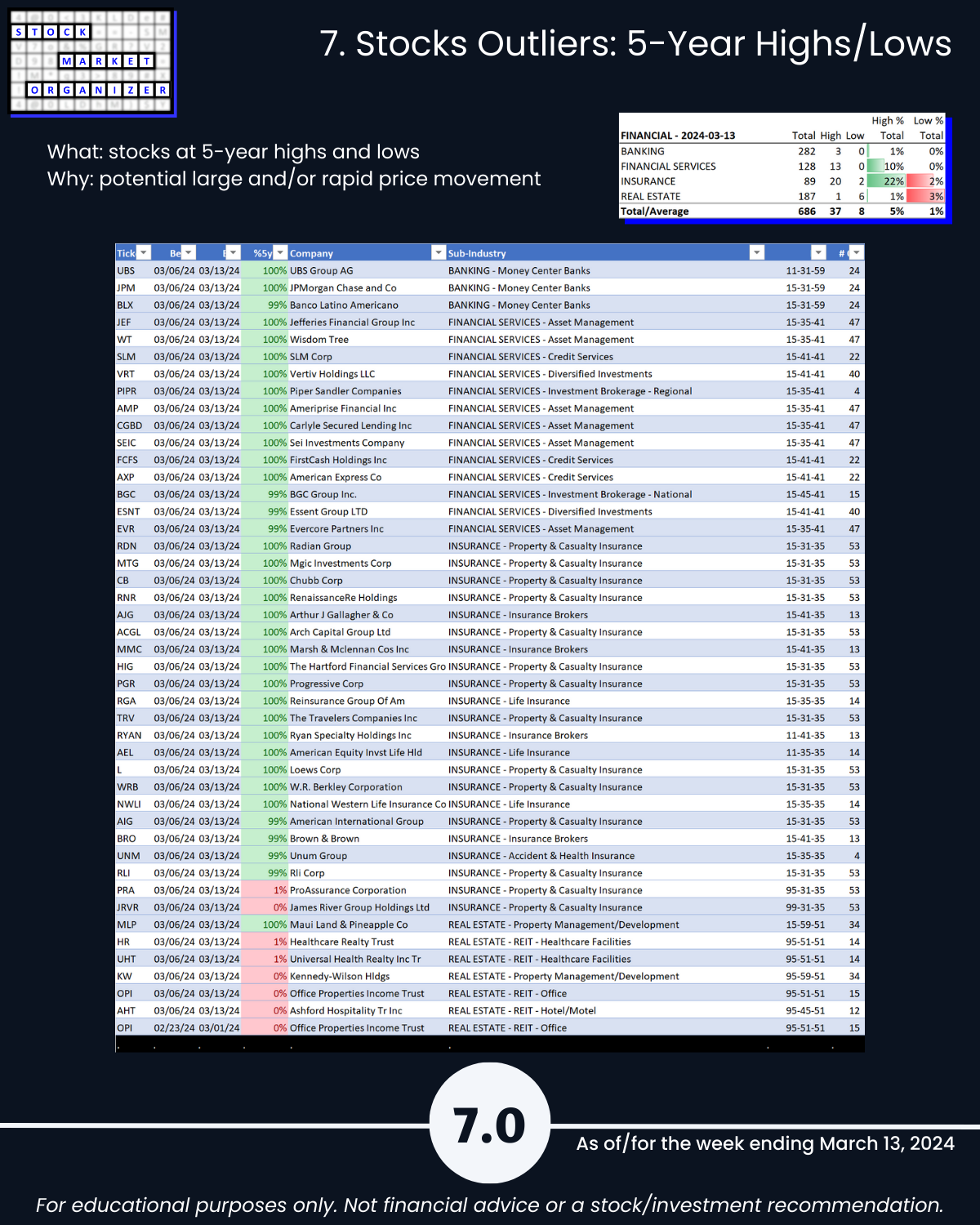

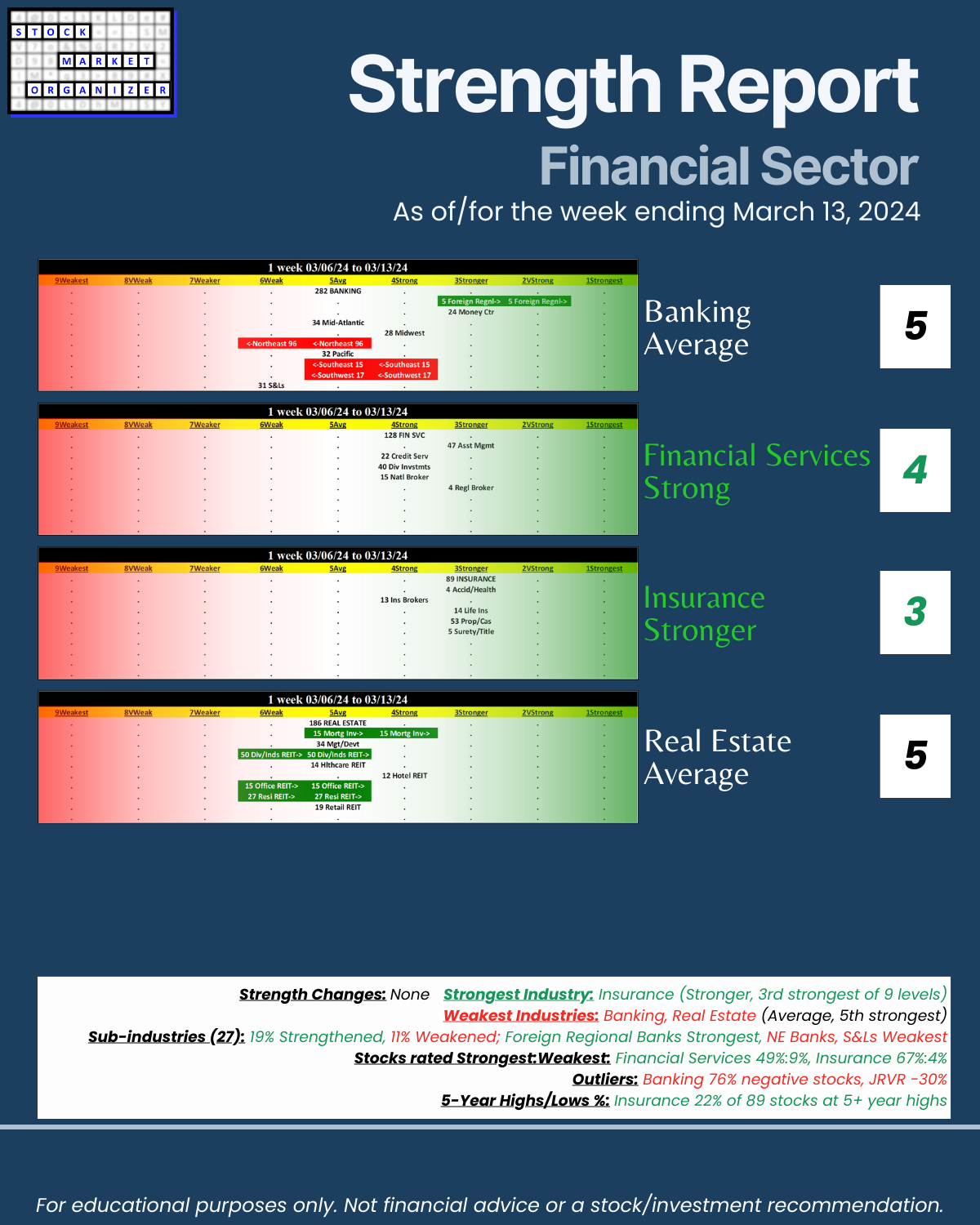

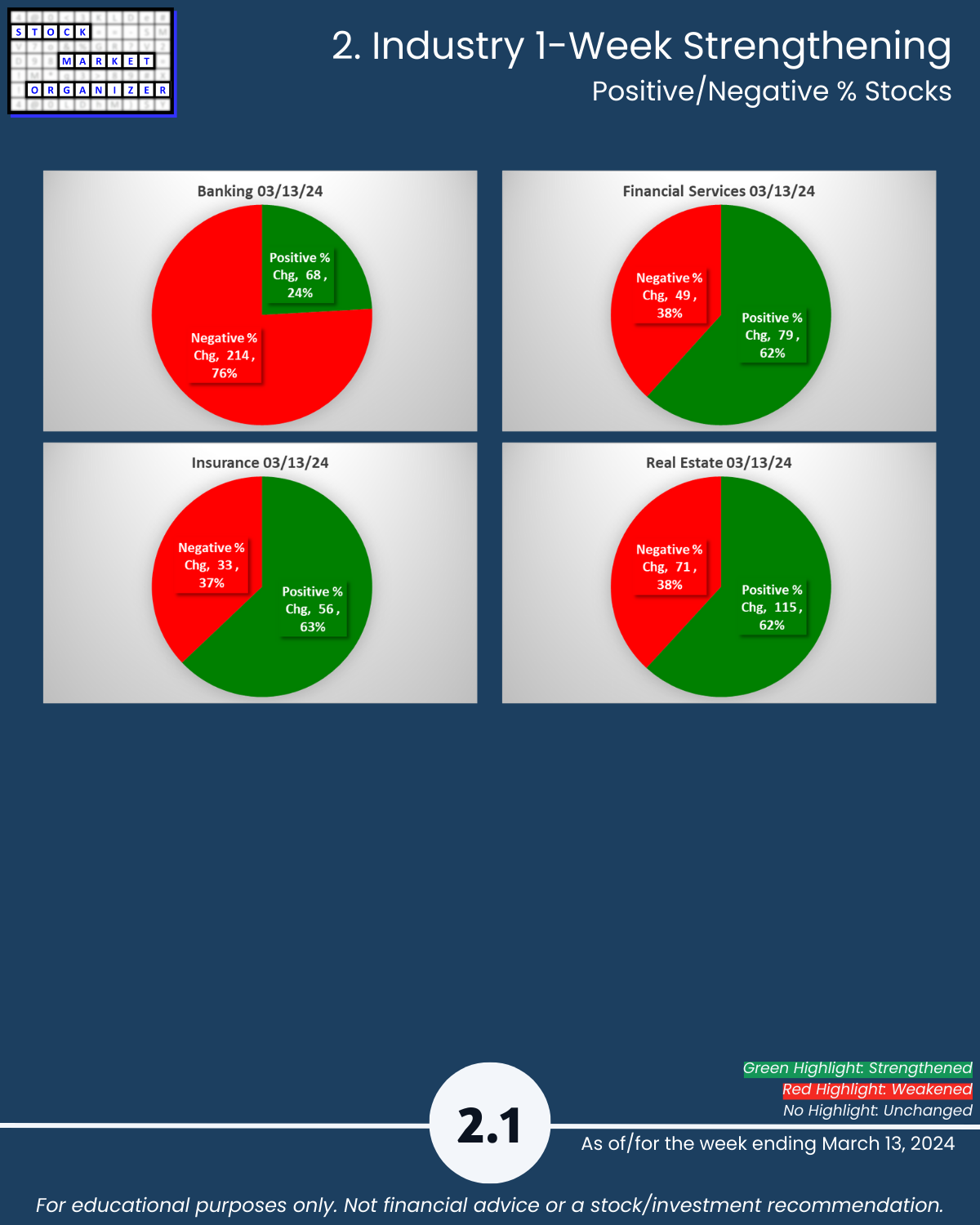

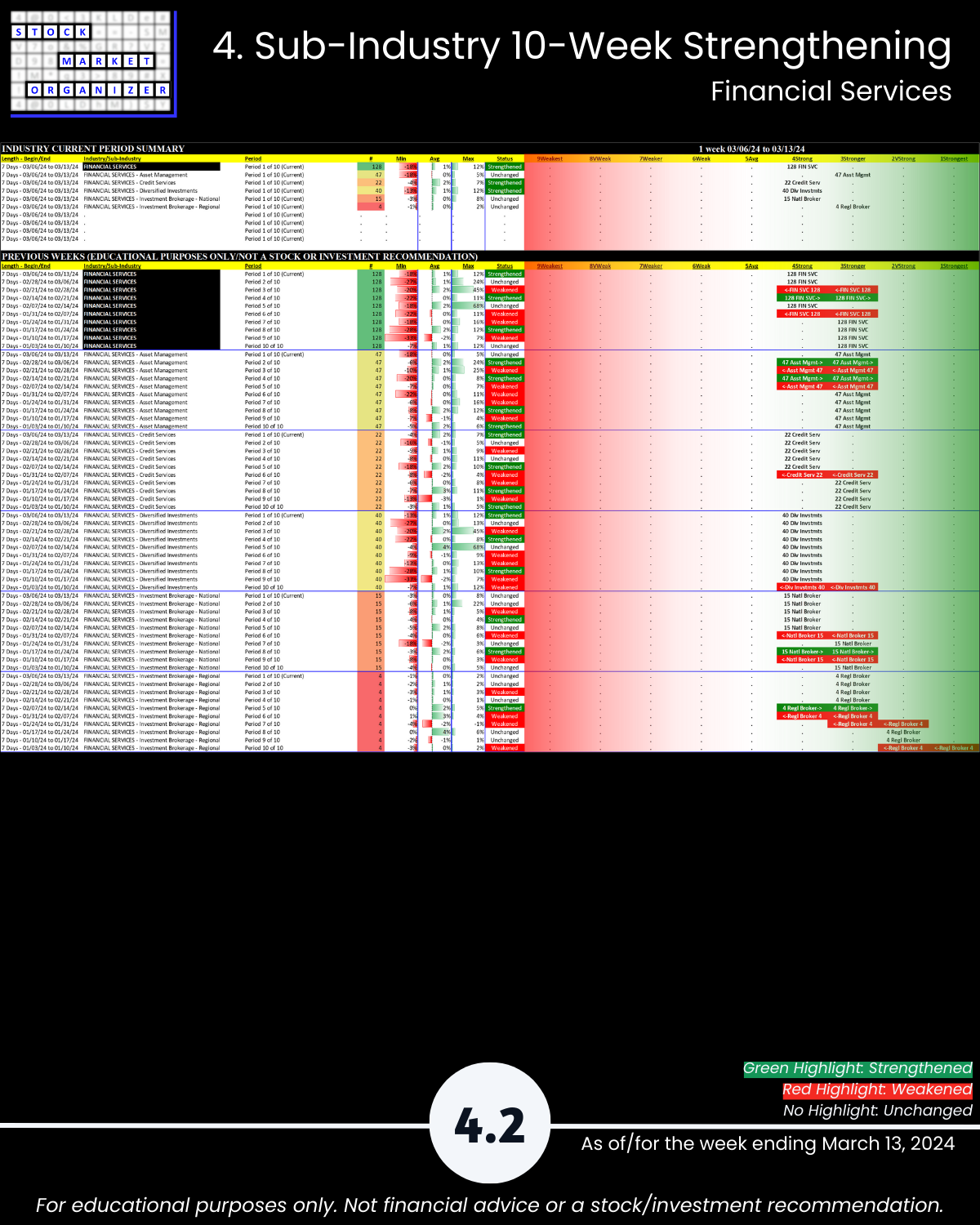

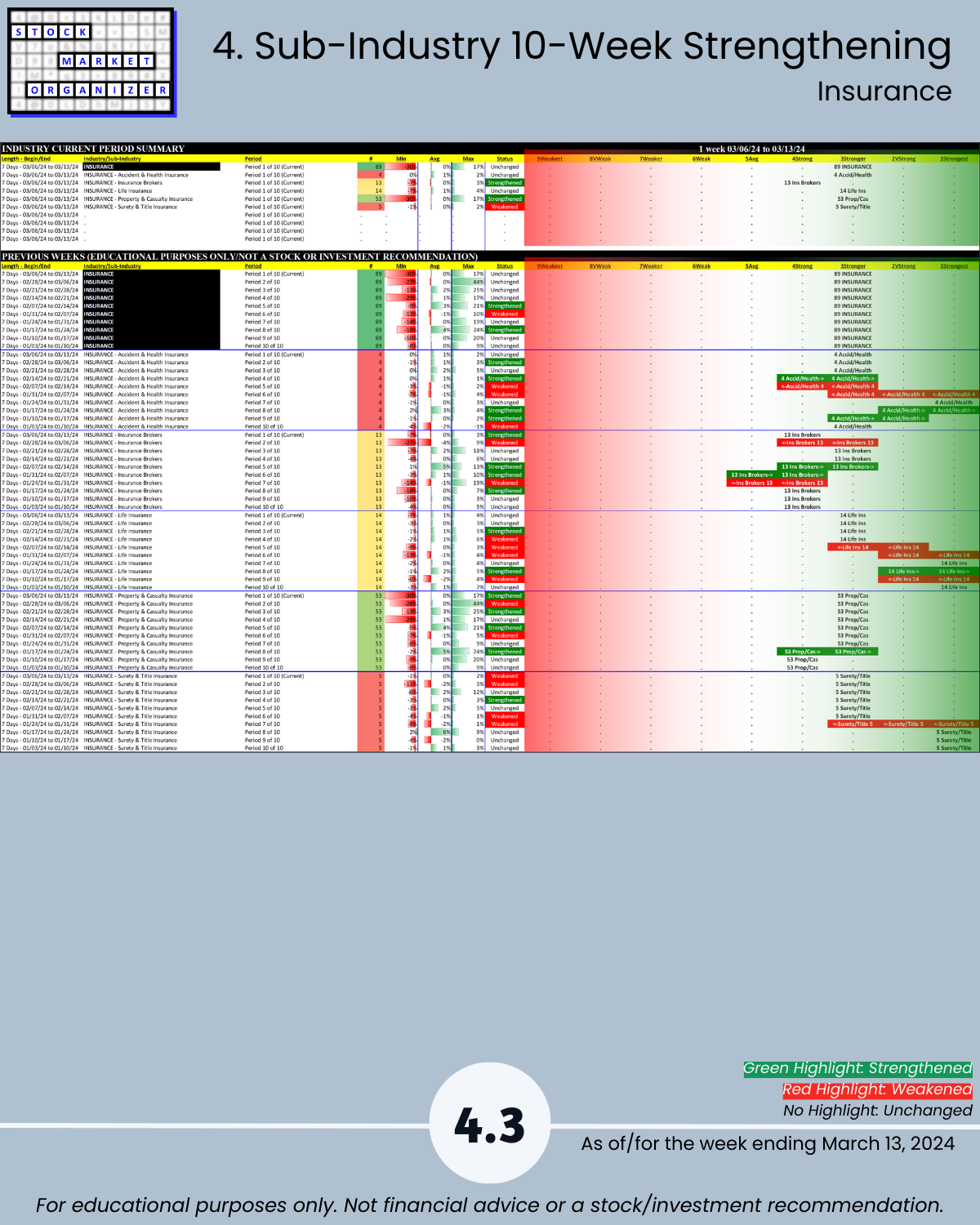

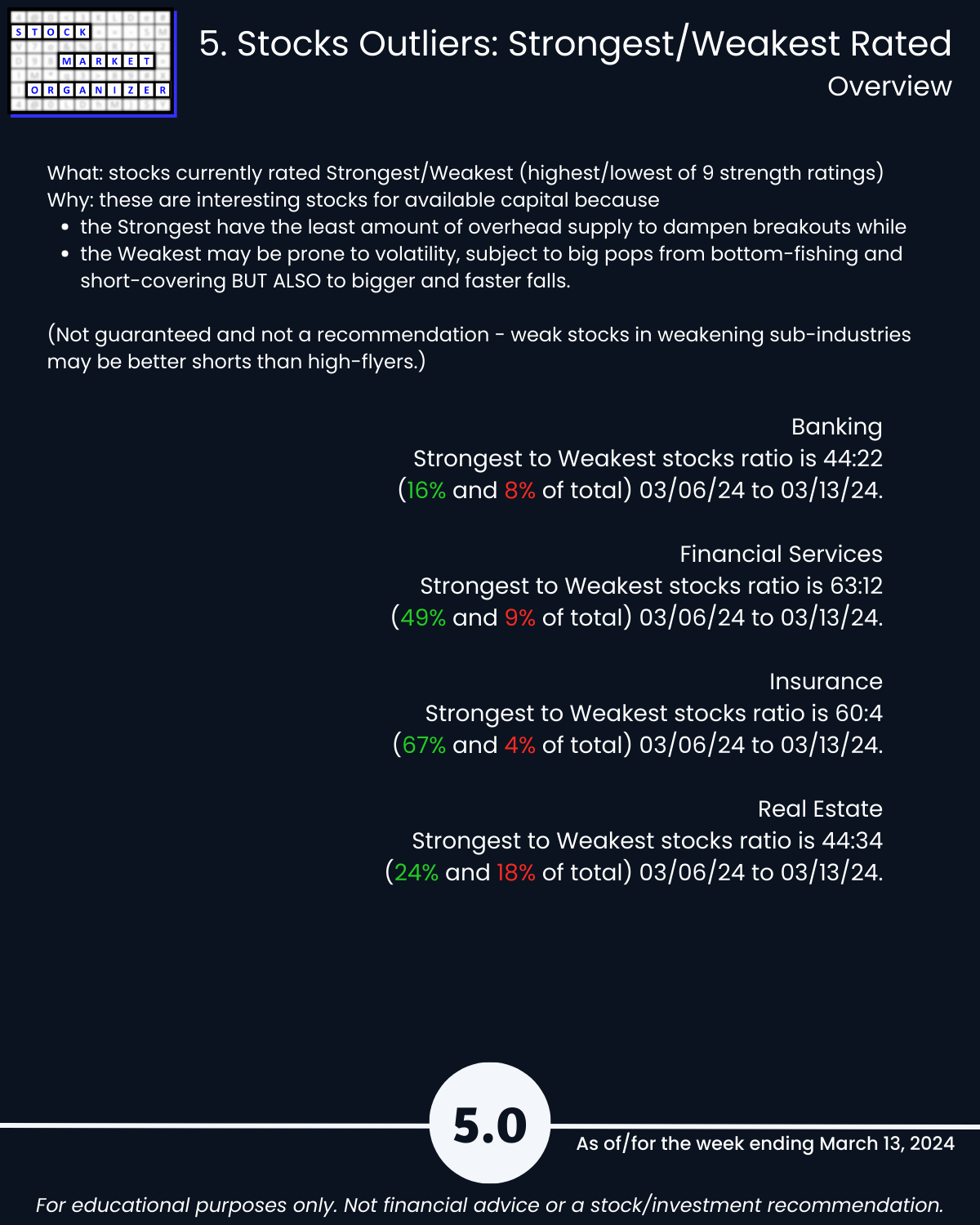

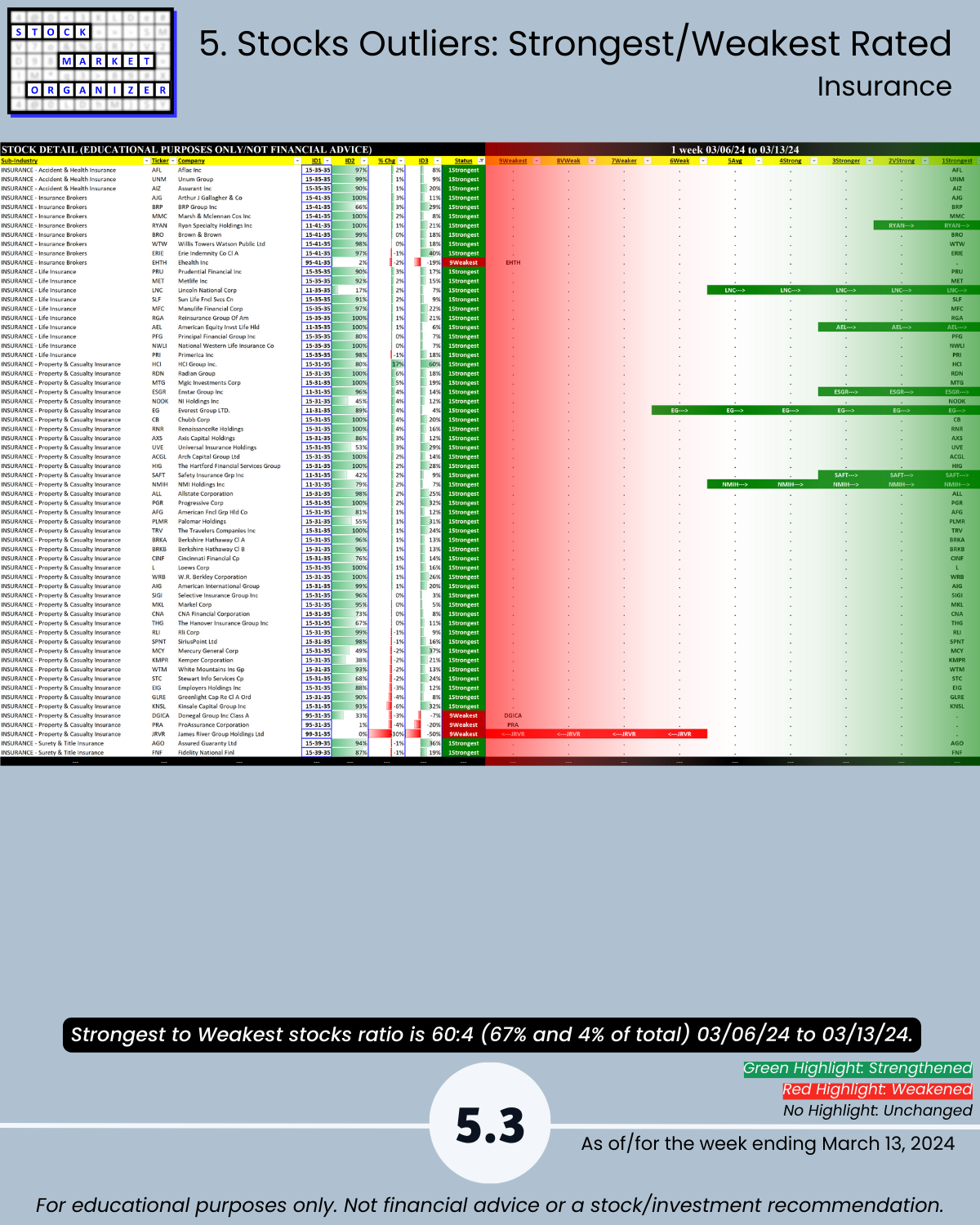

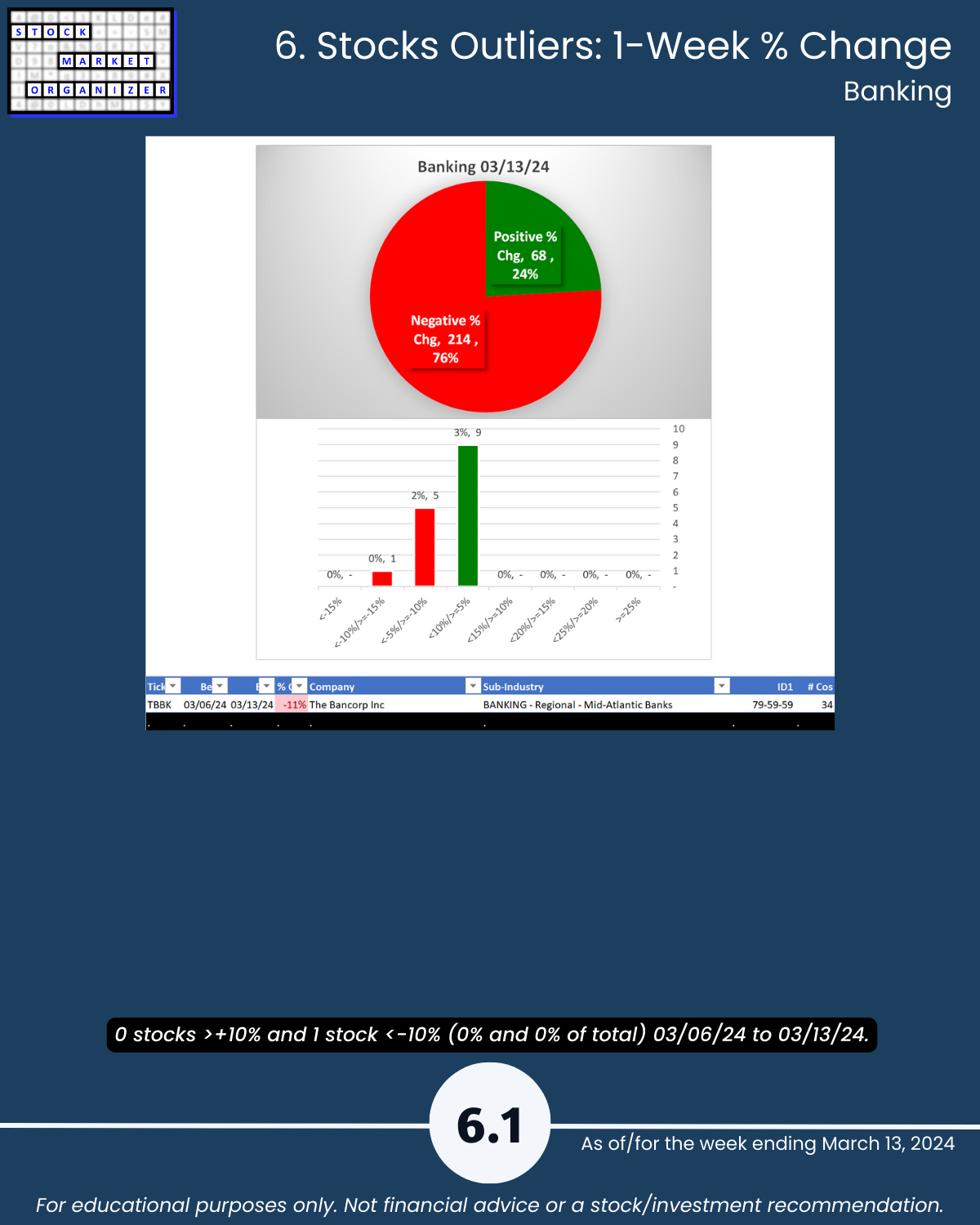

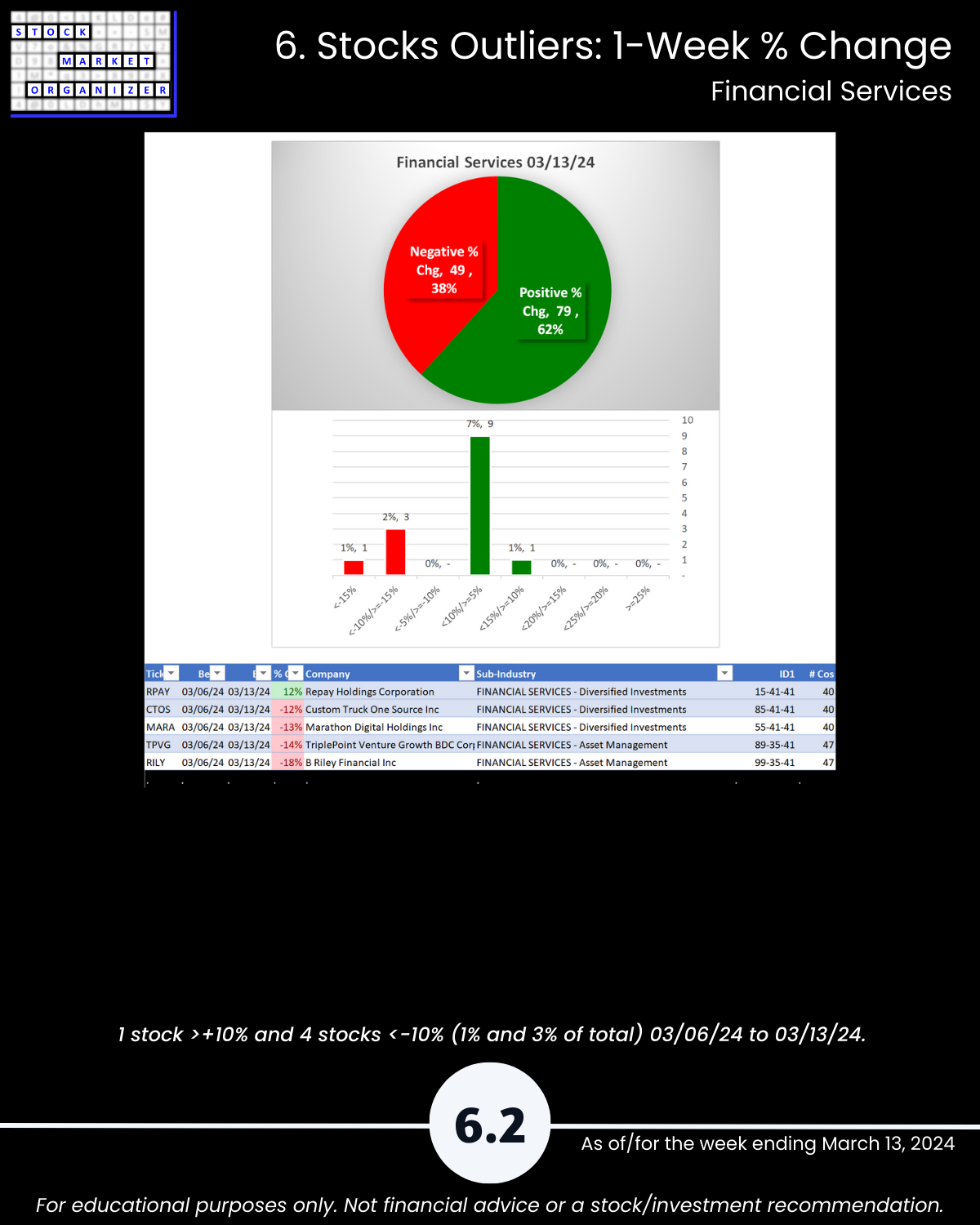

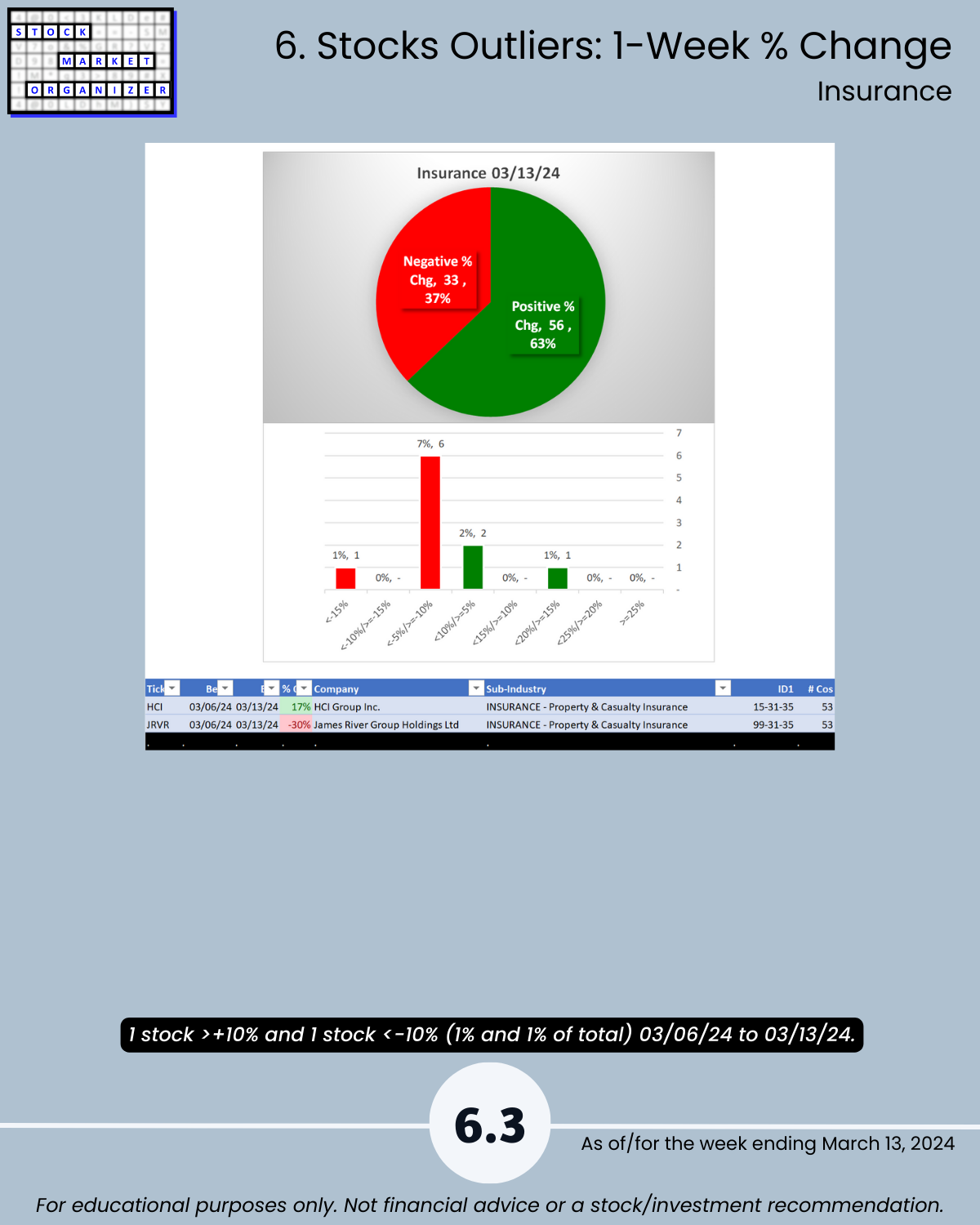

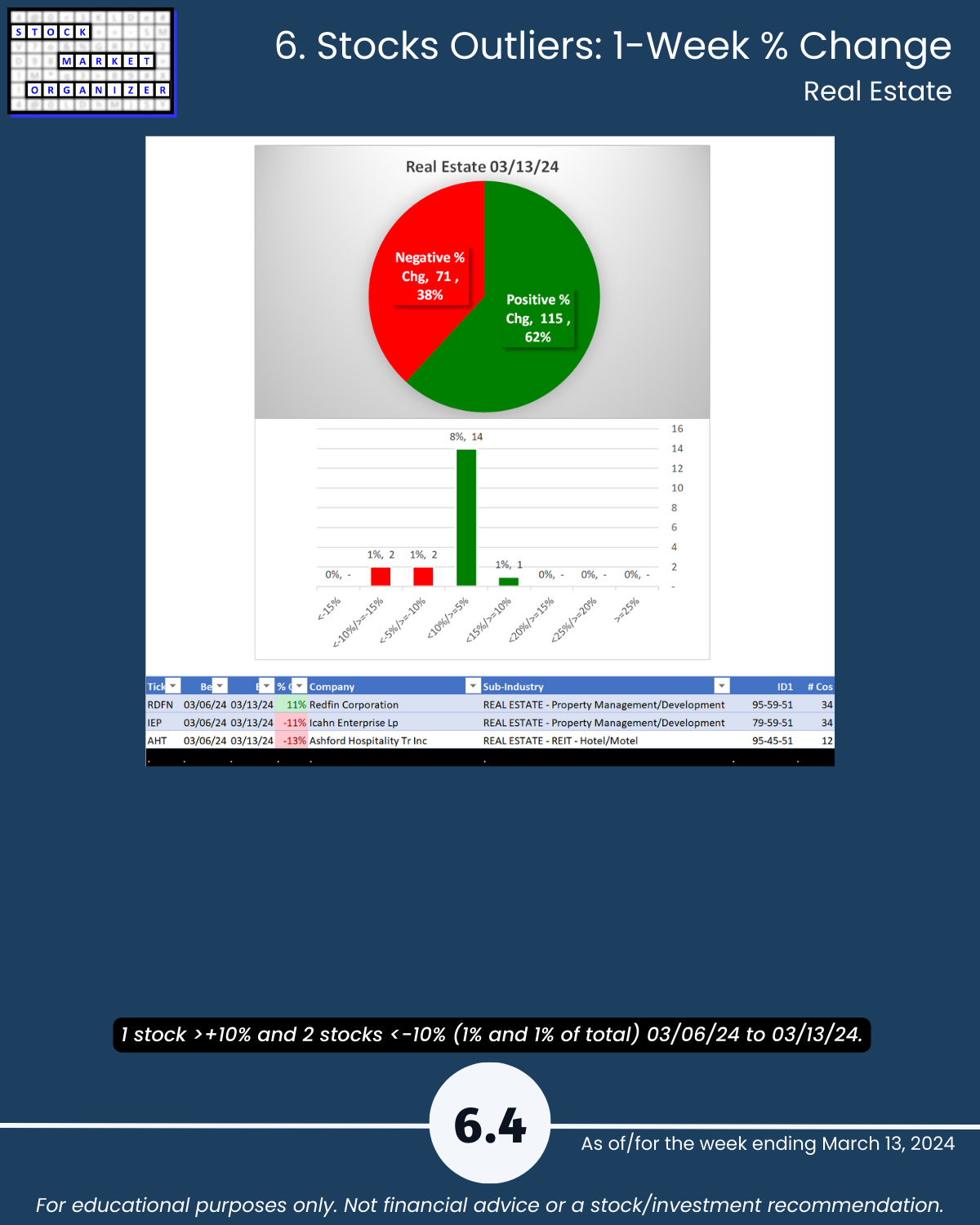

Financial Sector quiet week ending 3/13/24 but a unique strength view helpfully reveals: 🔹 4/8 Real Estate sub-industries STRENGTHENED, 🔹 Banking 76% NEGATIVE stocks, 🔹 >1 in 5 insurance Stocks = 5+ year highs with 67% stocks rated Strongest (highest of 9 strength levels), 🔹 Financial Services 49% stocks rated Strongest.

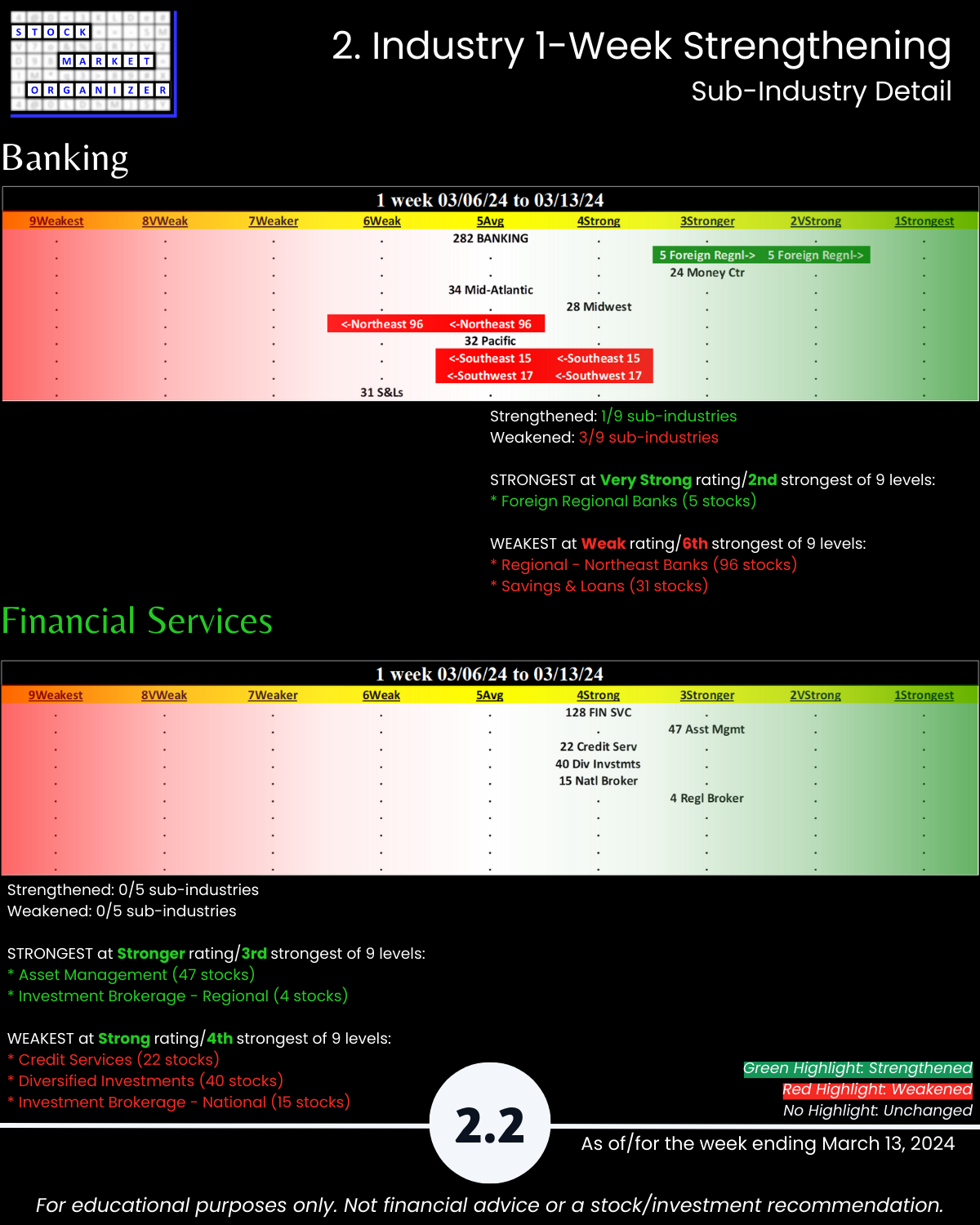

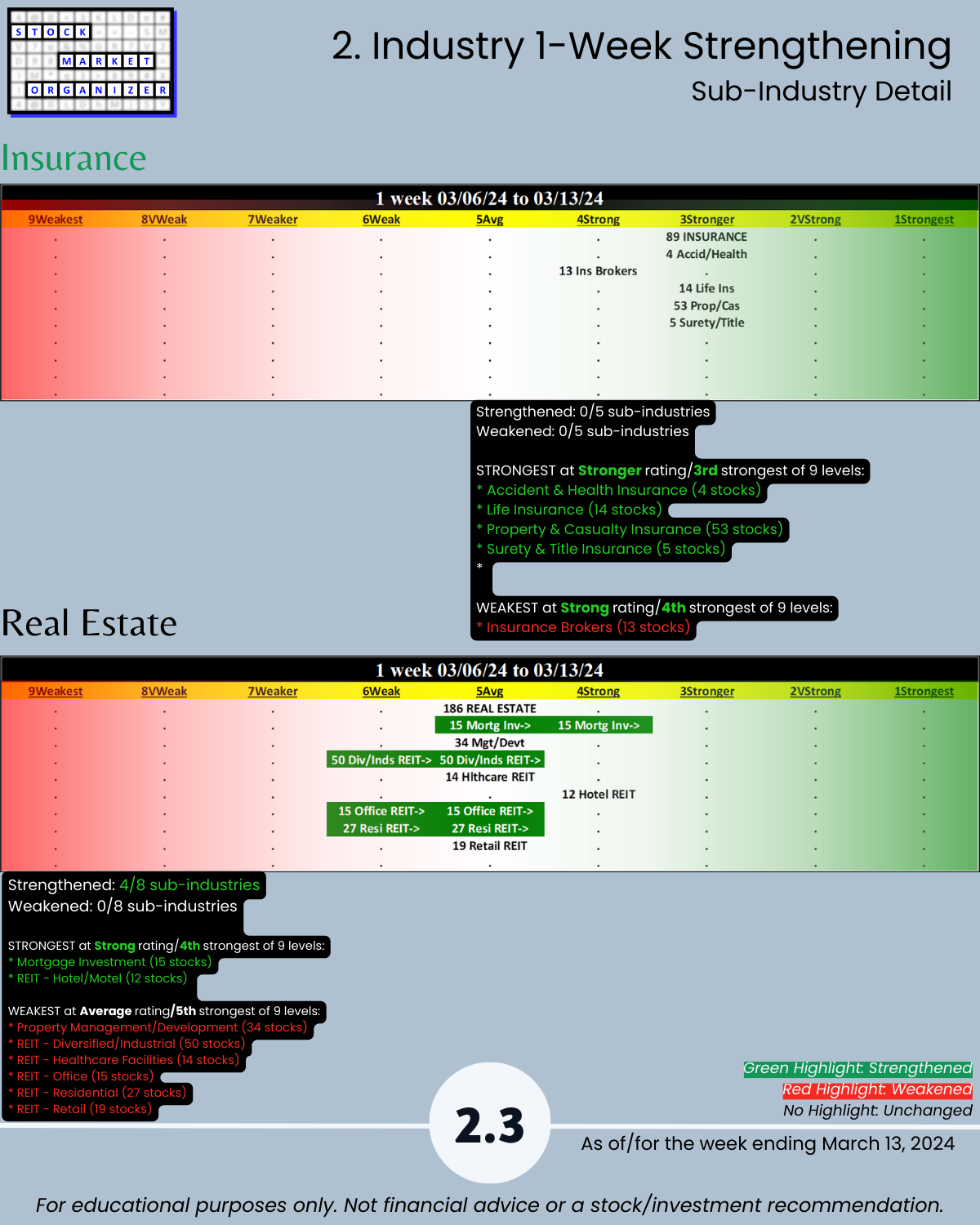

Today, a unique strengthening view of the Banking, Financial Services, Insurance, and Real Estate industries.

With Insurance’s strength, it would be unfortunate if you still owned DGICA, PRA, or JRVR. These are the 3 stocks rated Weakest (9th of 9 strength levels). There are so many other stocks that would have been better. Opportunity cost is certainly (and painfully in these cases) real. If one was looking at strength, these would have been gone long ago.

HIGHLIGHTS

🔹 Strength Changes: None

🔹 Strongest Industry: Insurance (Stronger, 3rd strongest of 9 levels)

🔹 Weakest Industries: Banking, Real Estate (Average, 5th strongest)

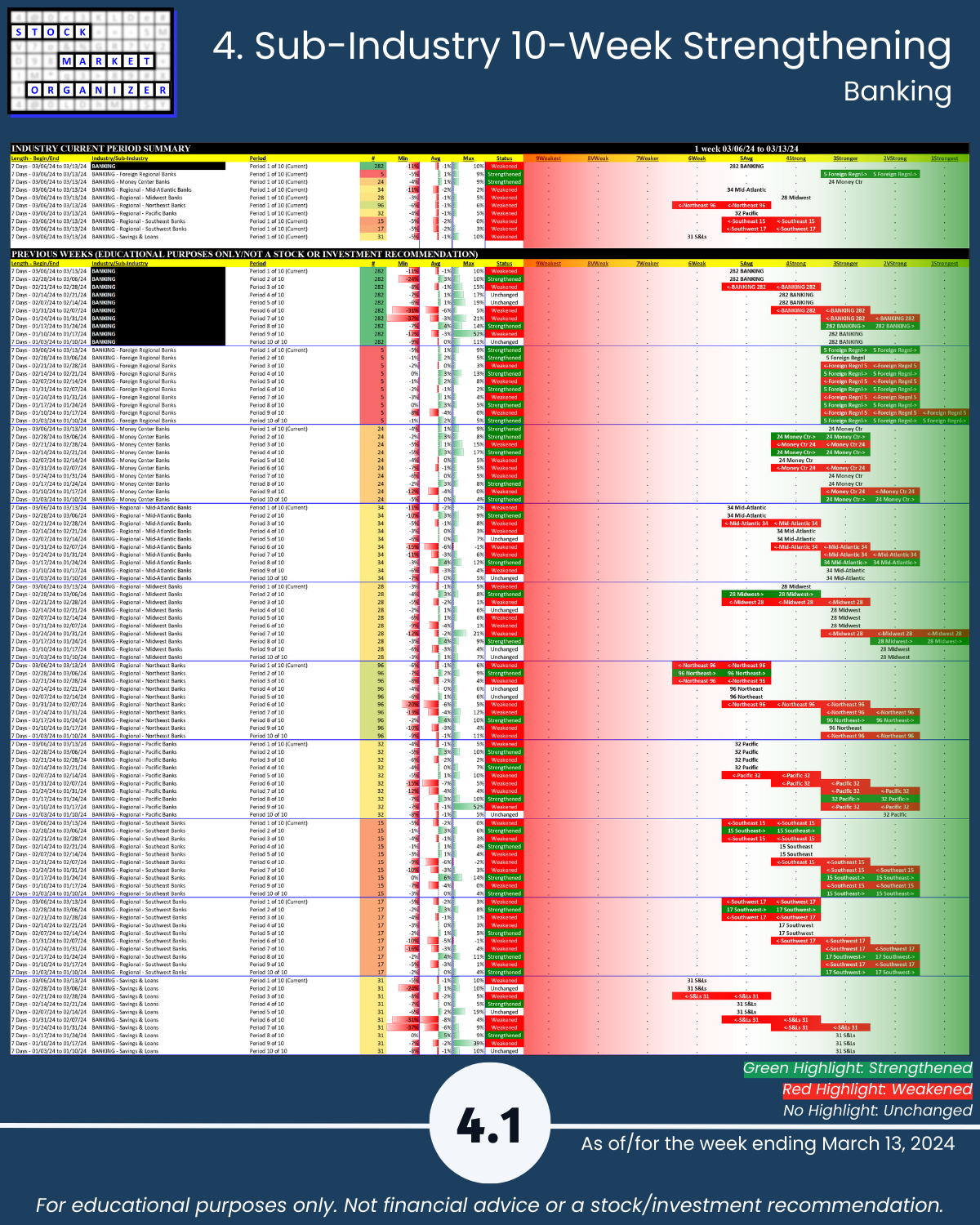

🔹 Sub-industries (27): 19% Strengthened, 11% Weakened; Foreign Regional Banks Strongest, NE Banks, S&Ls Weakest

🔹 Stocks rated Strongest:Weakest: Financial Services 49%:9%, Insurance 67%:4%

🔹 Outliers: Banking 76% negative stocks, JRVR -30%

🔹 5-Year Highs/Lows %: Insurance 22% of 89 stocks at 5+ year highs

DEEP DOWN YOU PROBABLY KNOW

The market doesn’t have to be so complicated.

I look for strength in every corner and every level of the U.S. stock market because the stronger your stocks the greener your P&L.

🔹 Individual stock strength is great.

🔹 It’s even better when stacked with sub-industry, industry, and market strength.

WHAT’S GOING ON HERE?

I’m finding strong stocks in strengthening sub-industries and strengthening industries by tracking strengthening/weakening from the individual stock through overall market levels.

From this you know:

🔹 The strongest stocks in each industry. Helpful for “the stronger your stocks, the greener your P&L” believers. Ditch portfolio dogs until they begin strengthening.

🔹 Whether sub-industries and industries are currently strengthening. “The trend is your friend” applies to sub-industries and industries too.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction - Industry Components

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

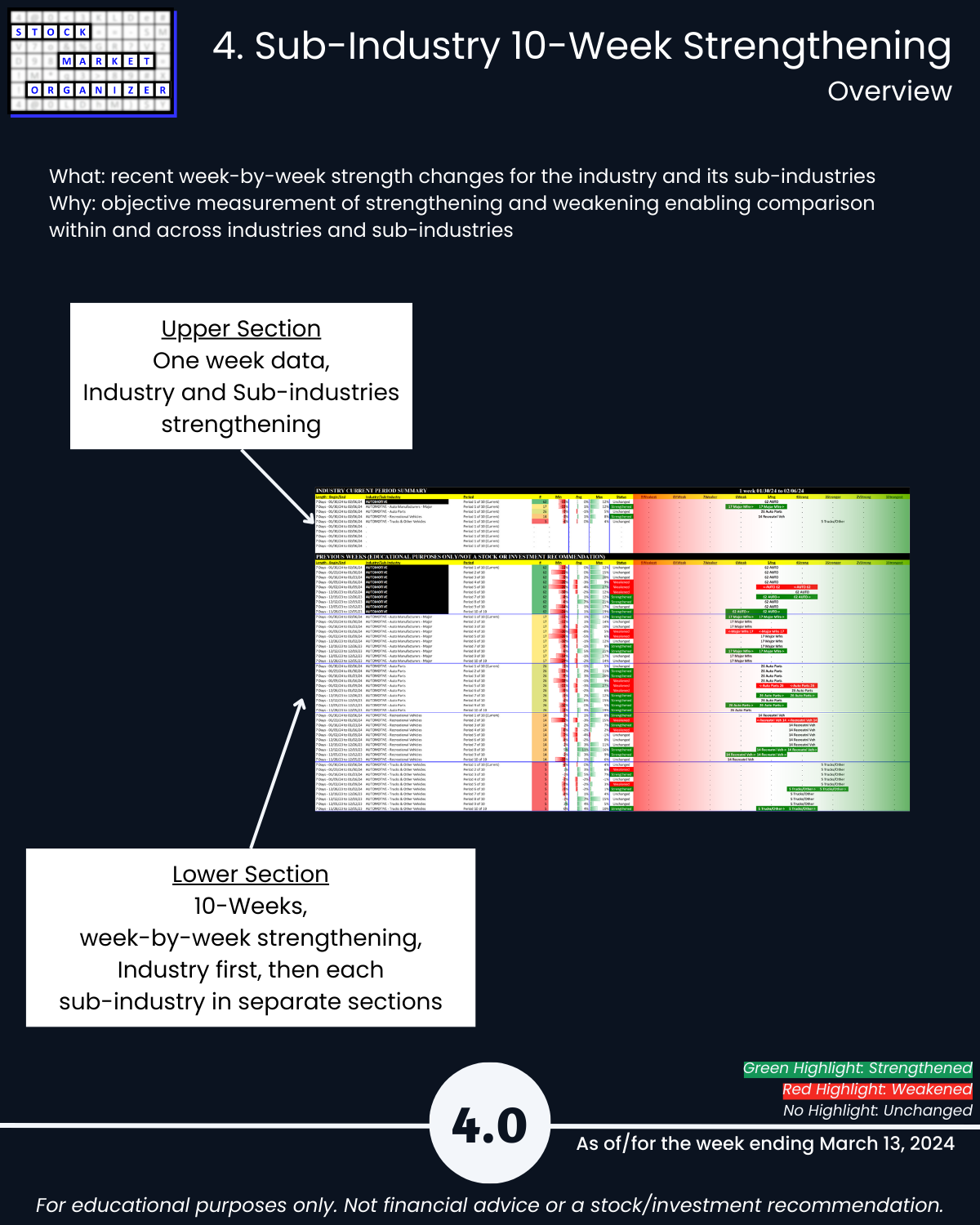

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows