SMO Exclusive: Strength Report Financial Sector 2024-02-21

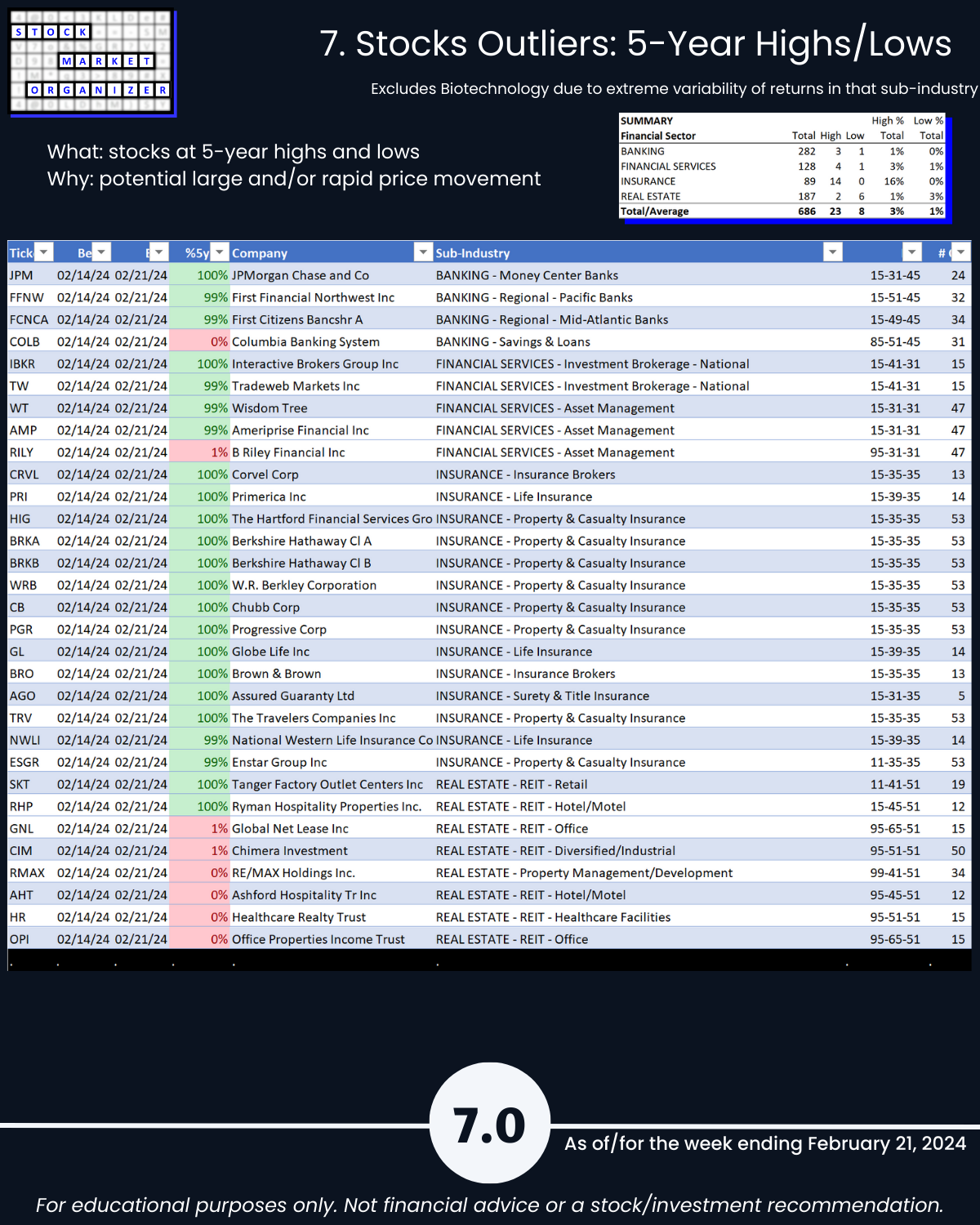

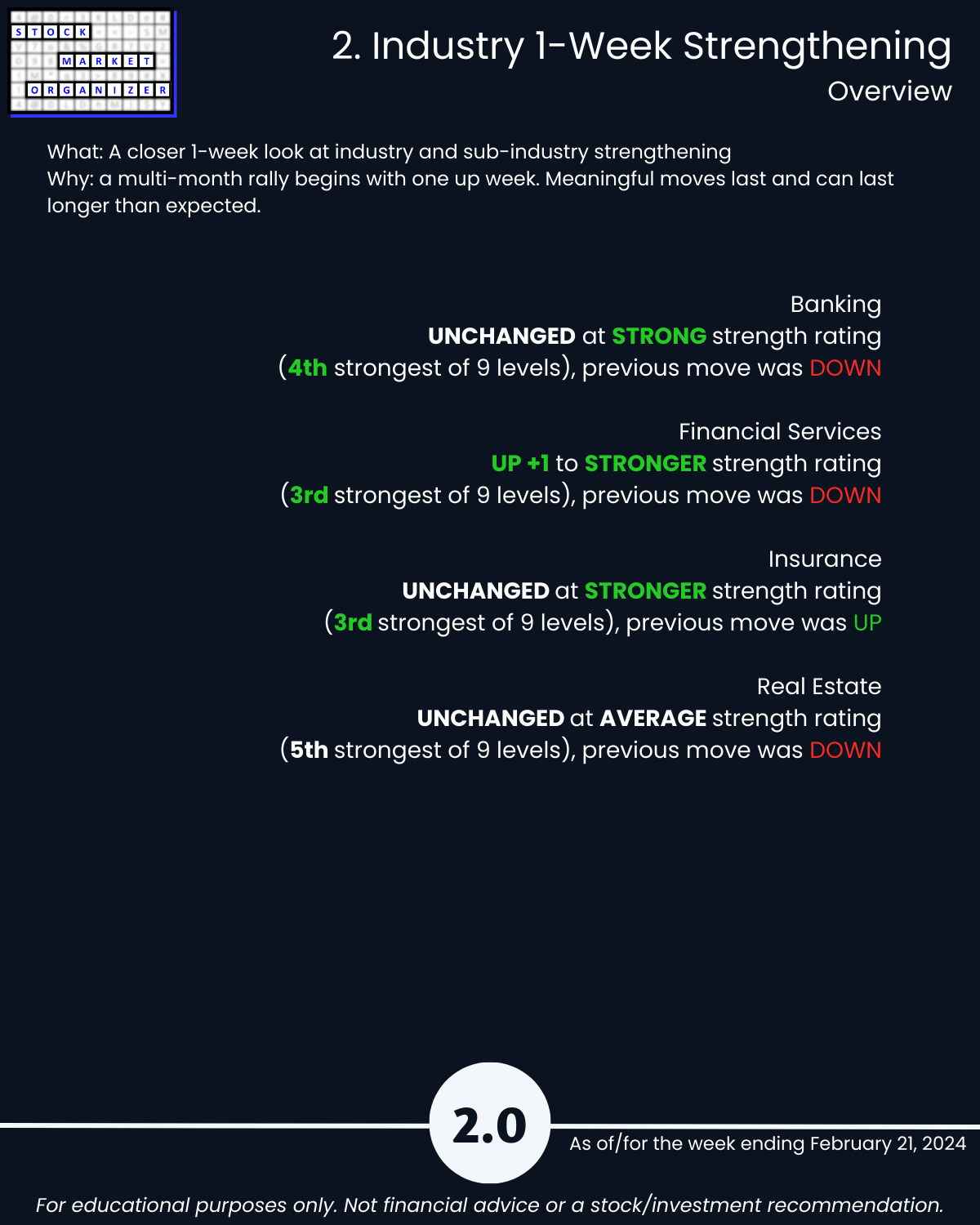

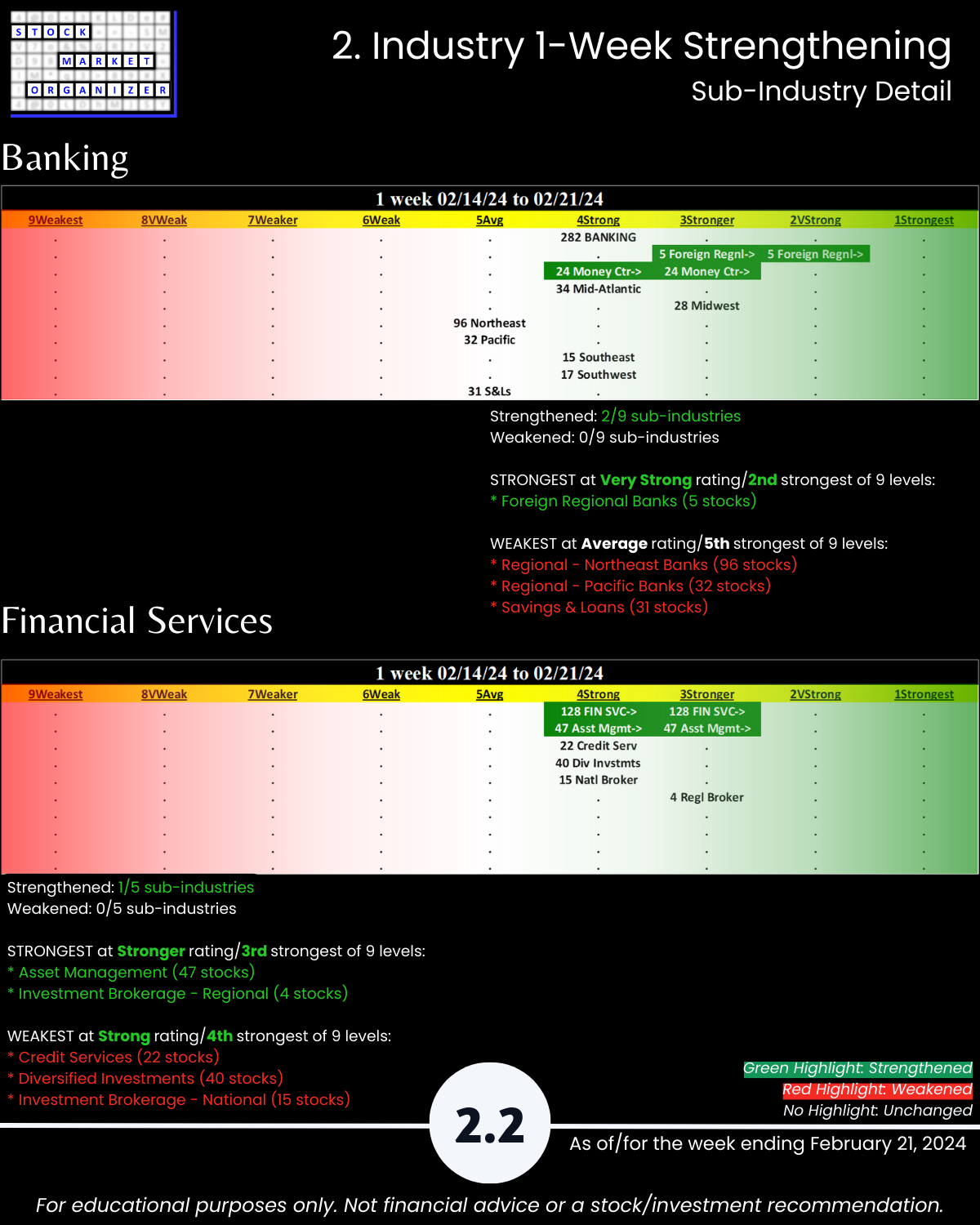

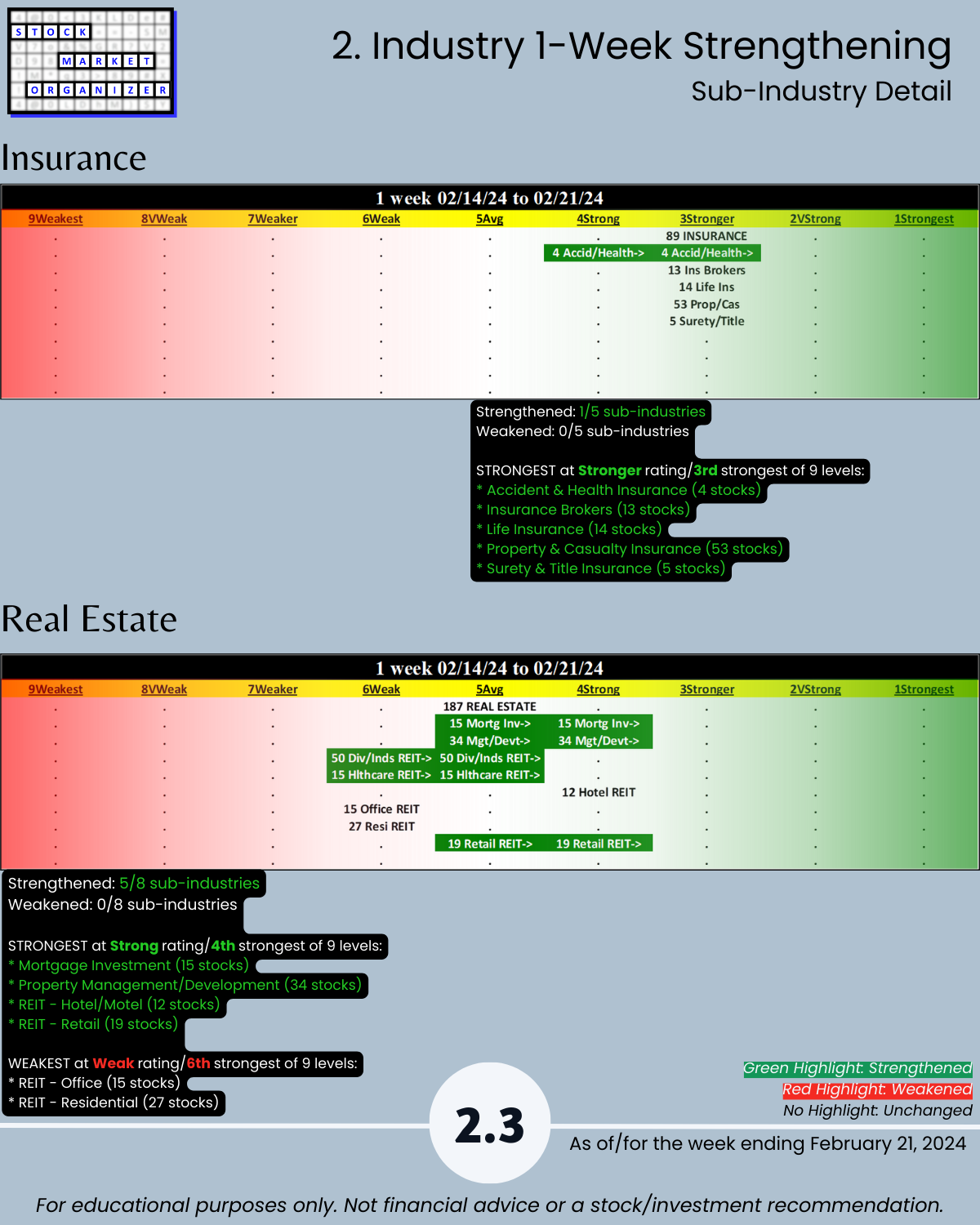

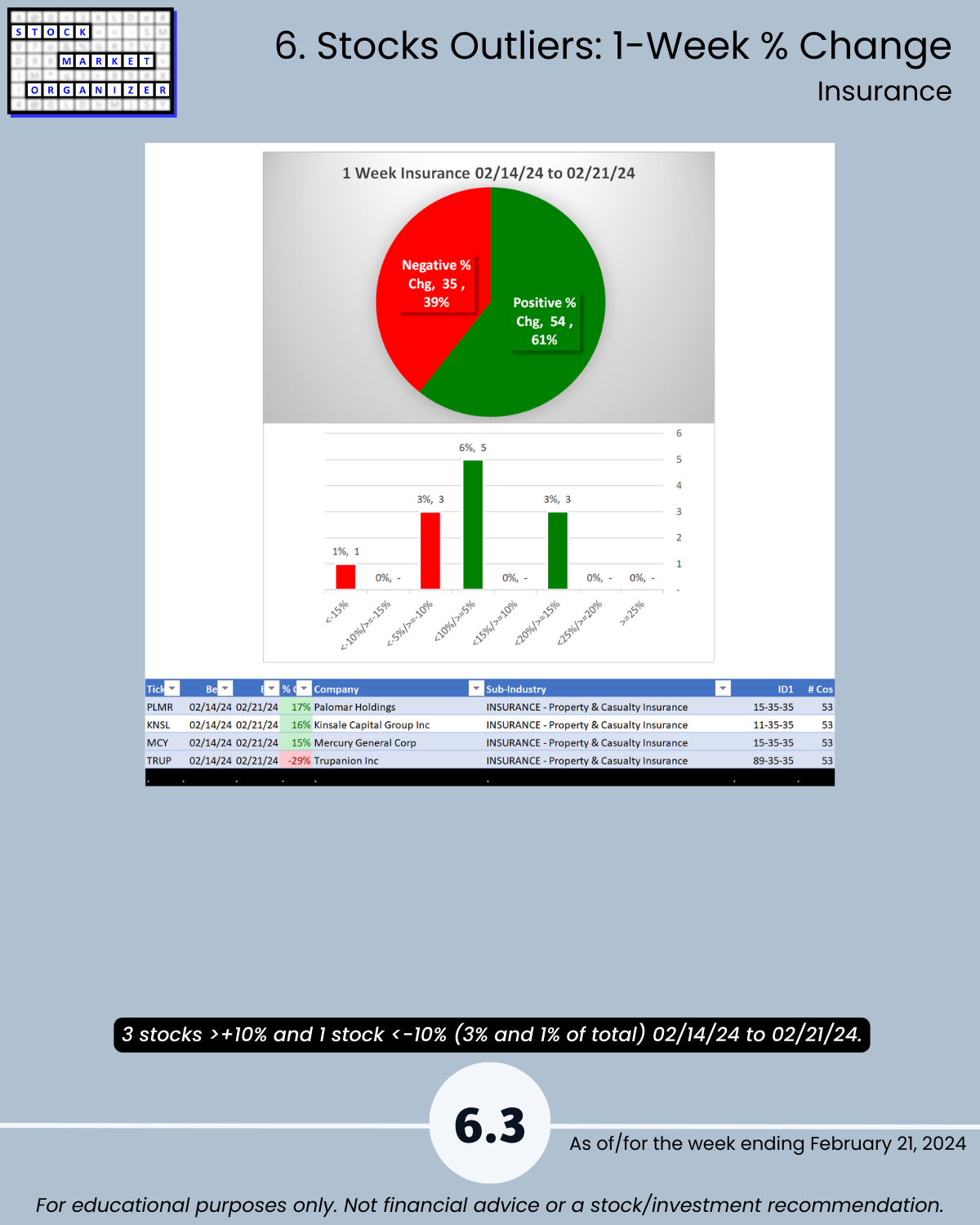

U.S. stock market… see you tomorrow for the Electronics industry report (w/ post-earnings NVDA), today 2/21/24 is the Financial sector where the Insurance industry is en fuego with 16% of its 83 stocks at 5+ year highs, a Stronger strength rating (3rd strongest of 9 levels), and a 63%:2% Strongest:Weakest stocks ratio. Today’s industries: Banking, Financial Services, Insurance, and Real Estate.

Strength:

🔹 Insurance 14/89 stocks (16%) at all-time highs (page 7.0)

🔹 1-year returns Insurance: 16/89 (18%) stocks > 40%

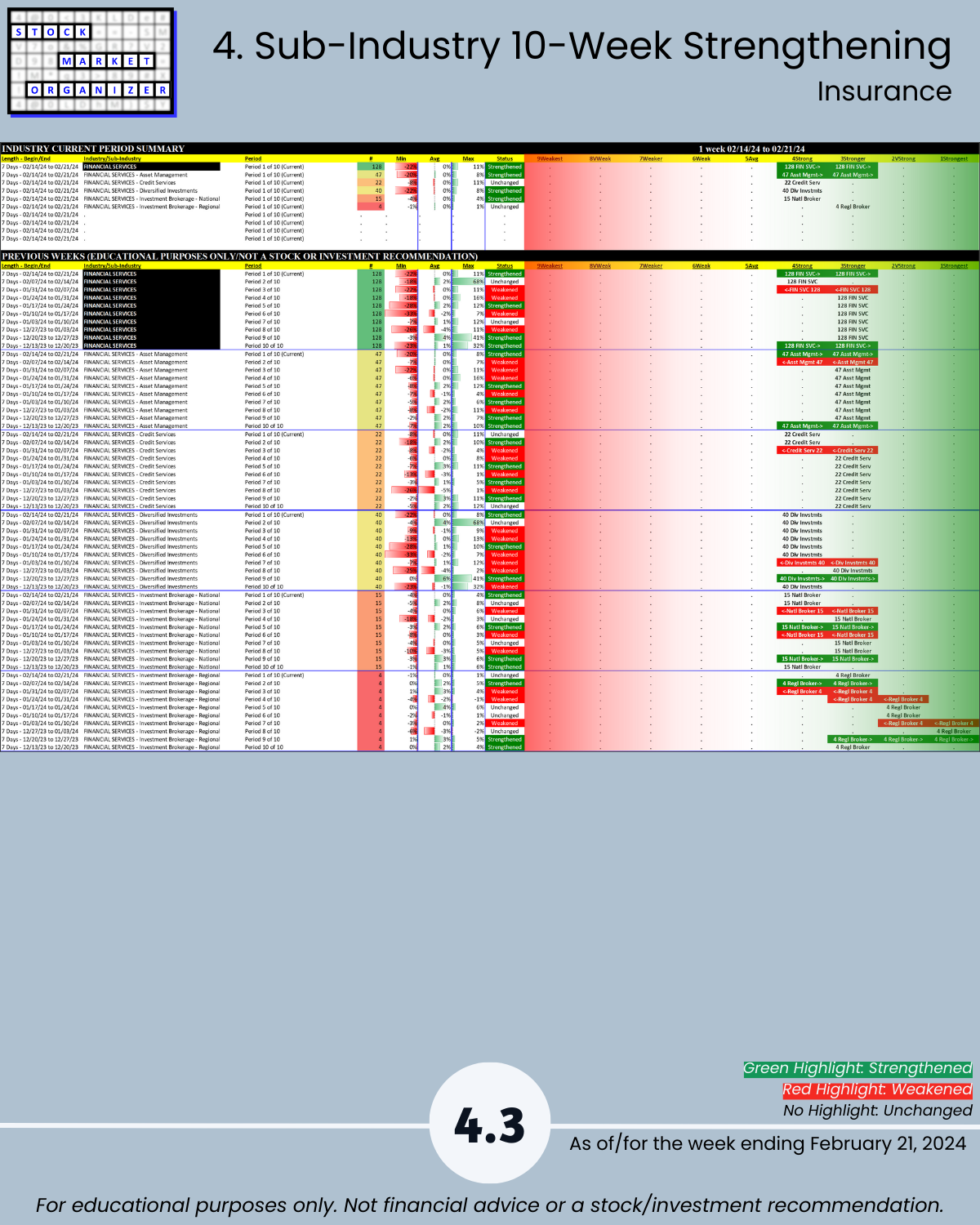

🔹 Financial Services STRENGTHENED to Stronger (3rd strongest)

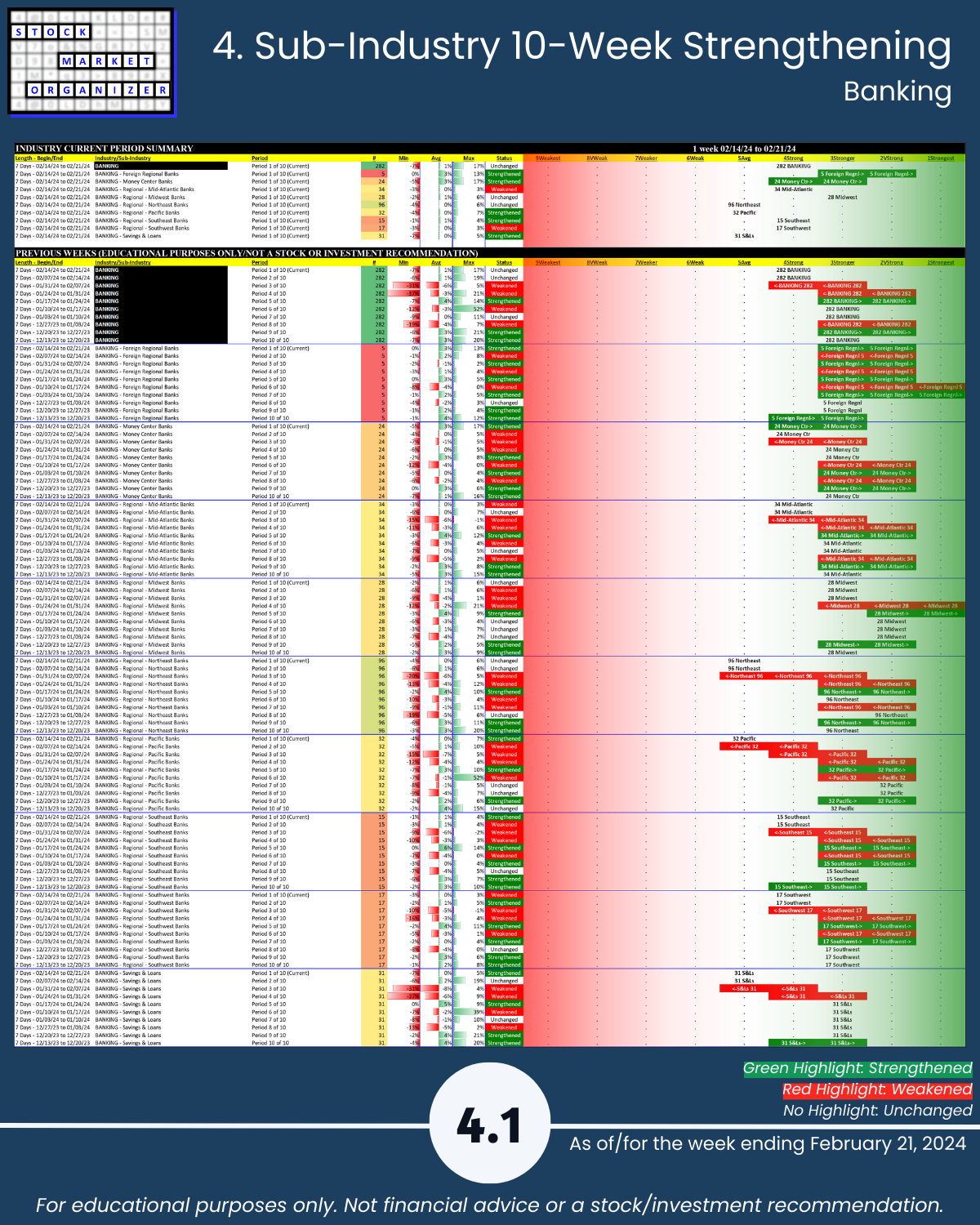

🔹 Foreign Regional Banks = strongest sub-industry, strengthened to Very Strong (2nd strongest) (page 4.1)

ACIC 1-year return 822%, crushing recent darling MARA (still +221%) and the sector’s runner-up VRT +284%.

Vs. NVDA: +227% (pre-earnings).

More detail below/attached including Strongest-/Weakest-rated stocks and objective strengthening/weakening measurements.

HIGHLIGHTS

🔹 Strongest Industries: Financial Services (STRENGTHENED), Insurance (Stronger, 3rd strongest)

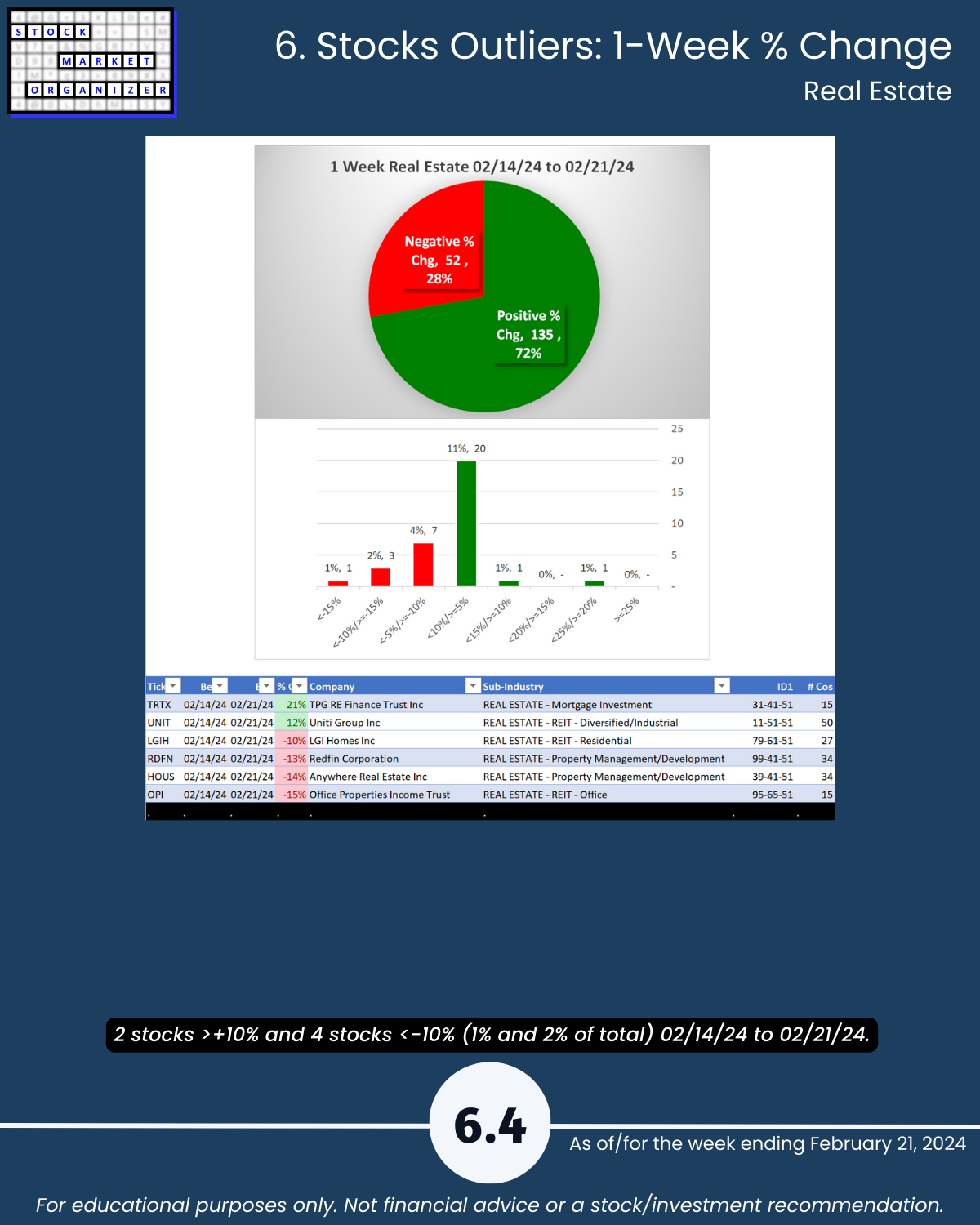

🔹 Weakest Industry: Real Estate (Average, 5th strongest)

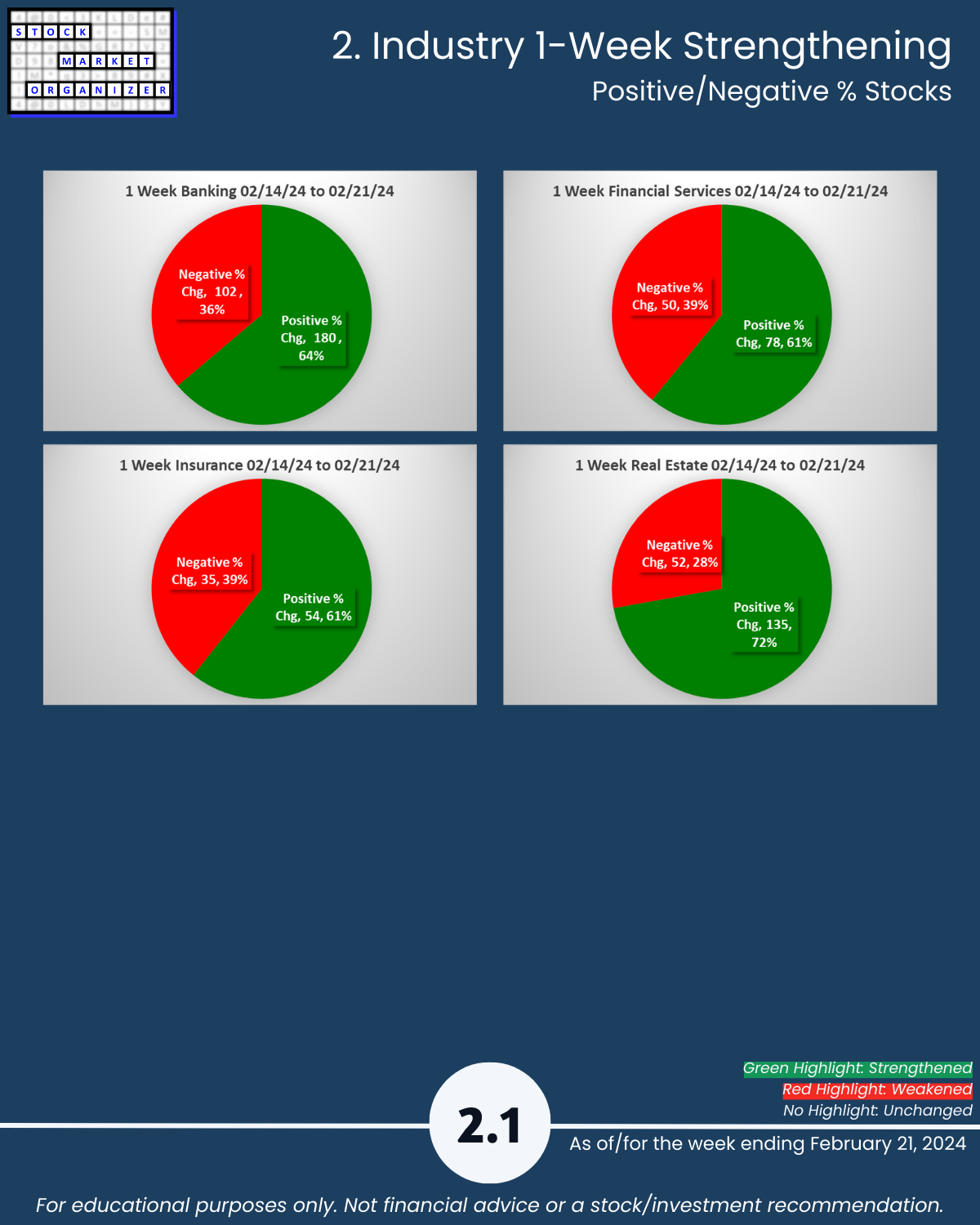

🔹 % Positive Stocks: Real Estate 72%

🔹 Sub-industries (27): 33% Strengthened, 0% Weakened; Foreign Reg’l Banks Strongest, Office/Resi REITs Weakest

🔹 Stocks rated Strongest:Weakest: Financial Services 50%:9% of total, Insurance 63%:2%

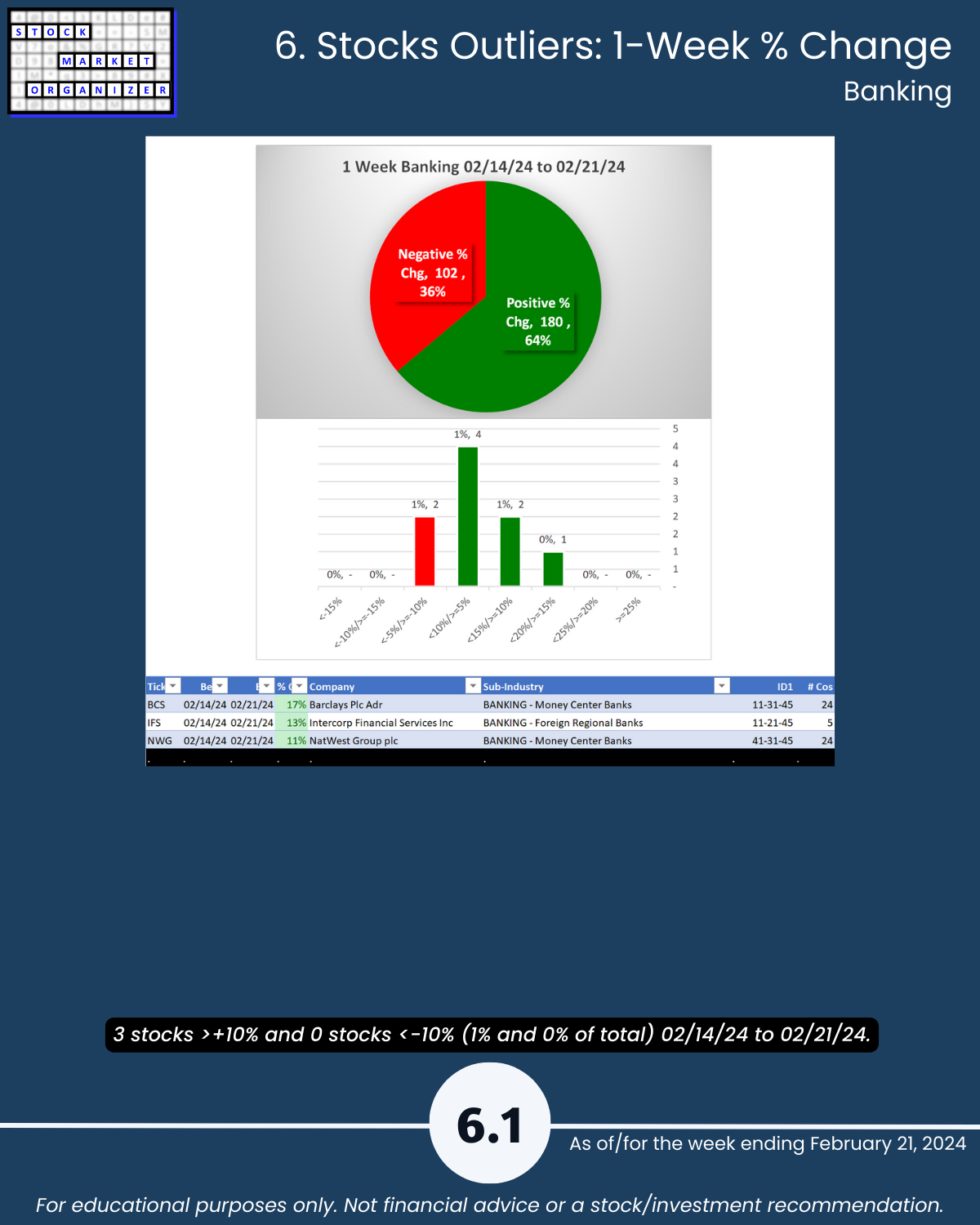

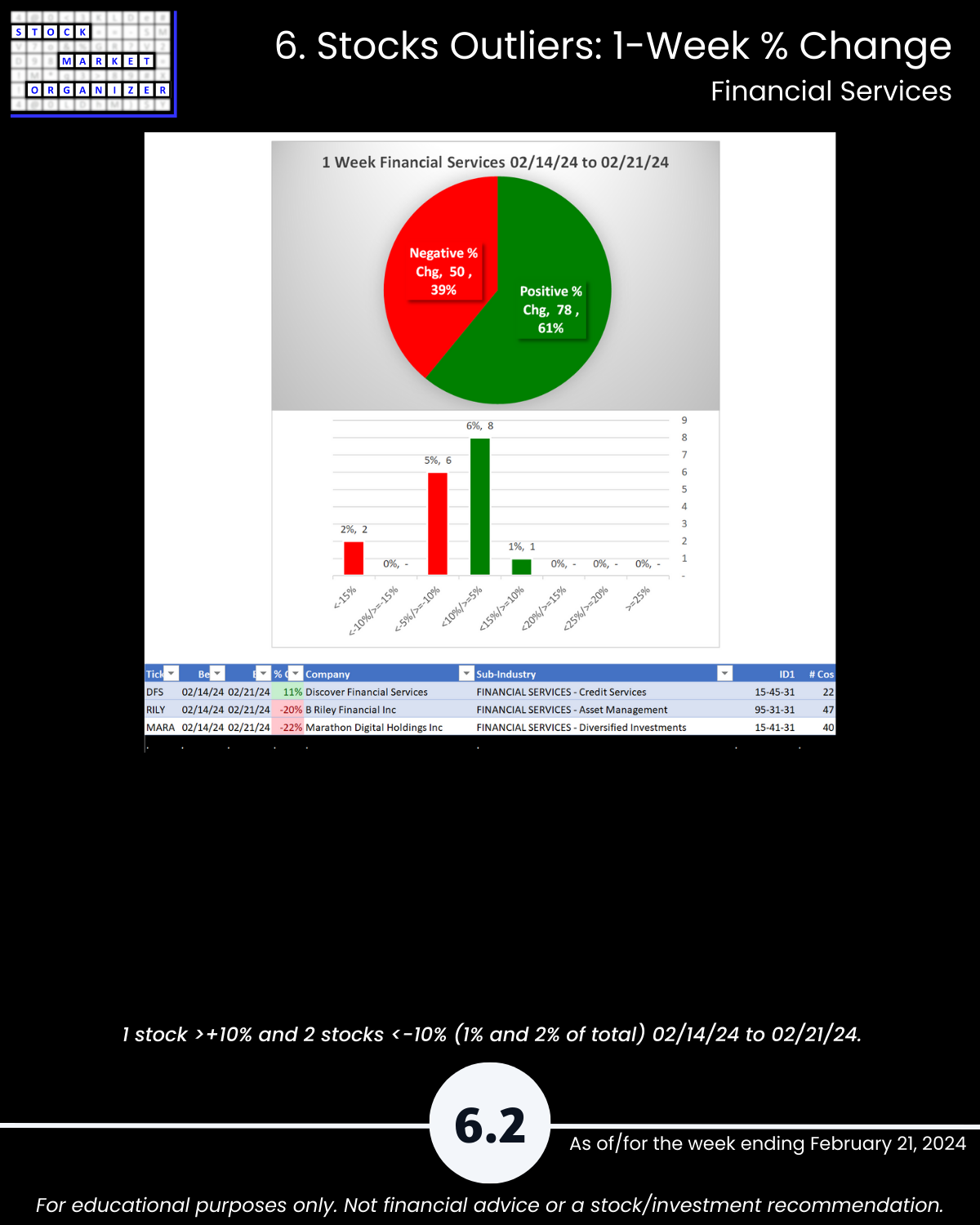

🔹 Outliers: BCS +17%, RILY -20%, MARA -22%, PLMR +17%, TRUP -29%, TRTX +21%, OPI -15%

🔹 5-Year Highs/Lows %: Insurance 16% of 89 stocks at 5+ year highs

23 Financial sector stocks at 5+ year highs:

3 Banking FCNCA, JPM, FFNW

4 Financial Services AMP, IBKR, TW, WT

14 Insurance AGO, BRKA, BRKB, BRO, CB, CRVL, ESGR, GL, HIG, NWLI, PGR, PRI, TRV, WRB

2 Real Estate RHP, SKT

SO WHAT?

Through tracking strengthening/weakening from the individual stock through overall market levels, you know:

🔹 The strongest stocks in each industry. Helpful for “the stronger your stocks, the greener your P&L” believers. Ditch portfolio dogs until they begin strengthening.

🔹 How all stocks in each sub-industry/industry compare in current strengthening and weakening. No guarantee the relationships will continue but it’s hard to game plan where they could go if you don’t know where they are now.

🔹 Whether sub-industries and industries are currently strengthening. “The trend is your friend” applies to sub-industries and industries too.

It really doesn’t have to be so complicated.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows