SMO Exclusive: Strength Report Financial Sector 2024-01-31

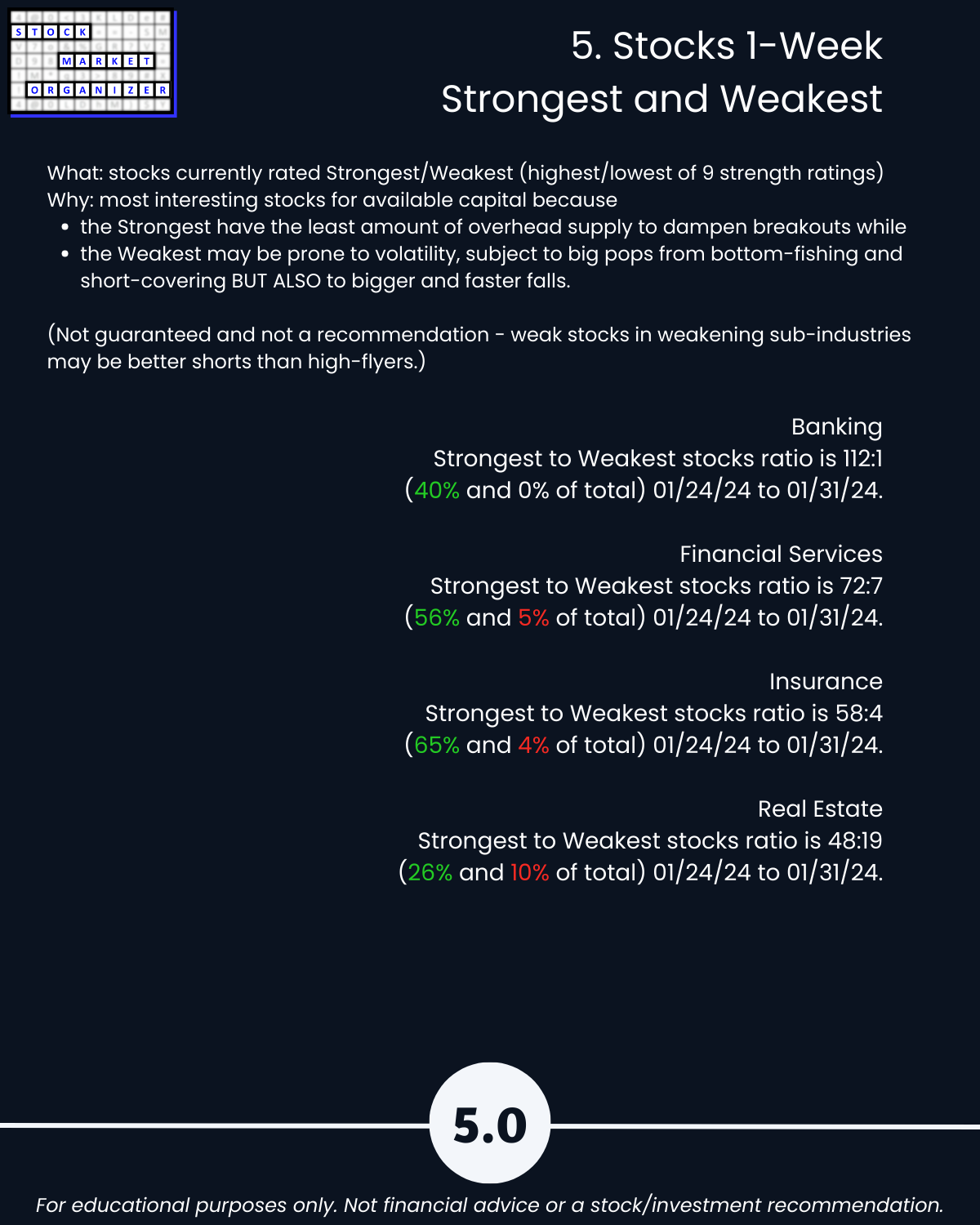

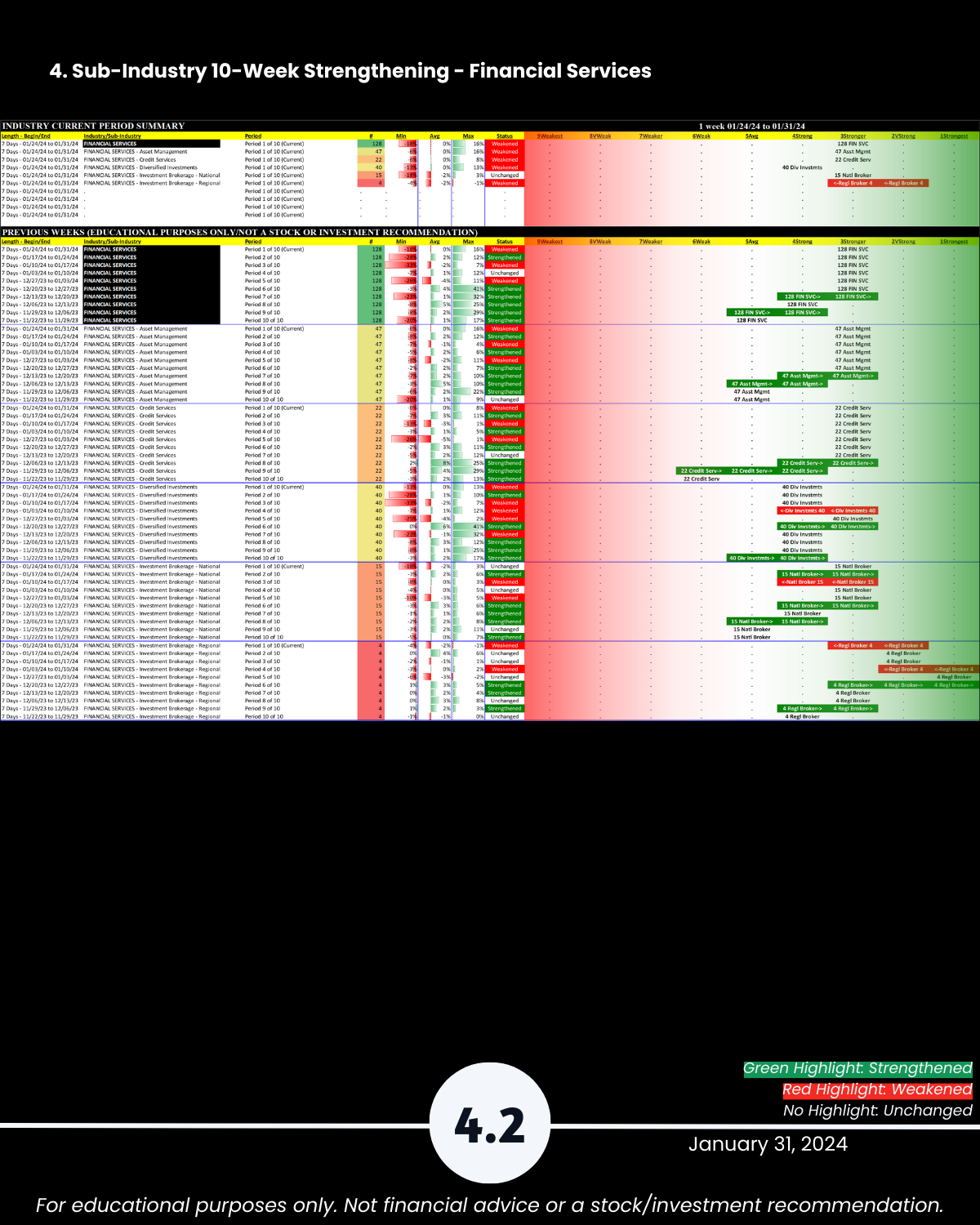

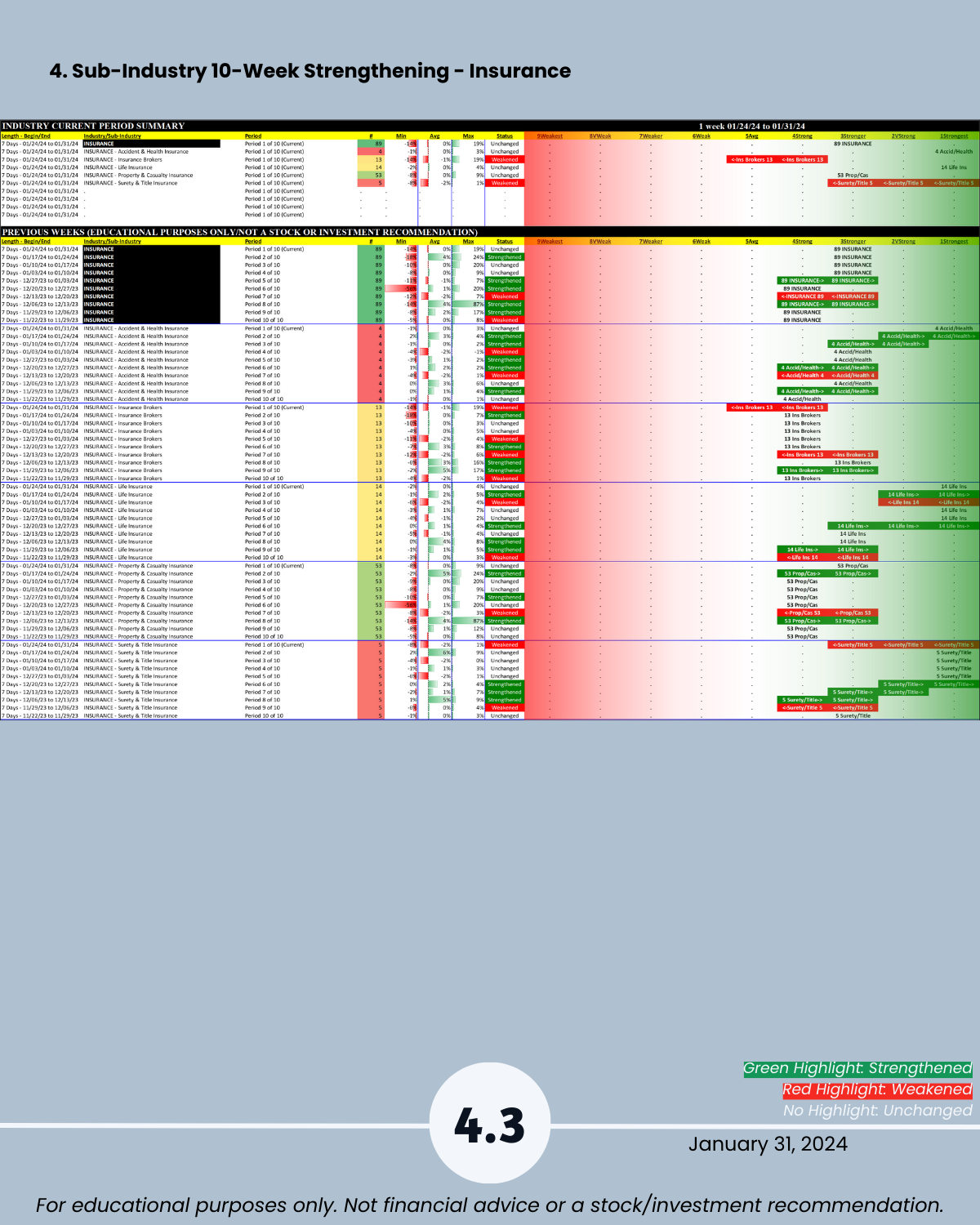

Attached: Financial Sector 1/31/24 Strength report, after today’s Fed market knee-capping, including Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements for the Banking, Financial Services, Insurance, and Real Estate industries.

HIGHLIGHTS

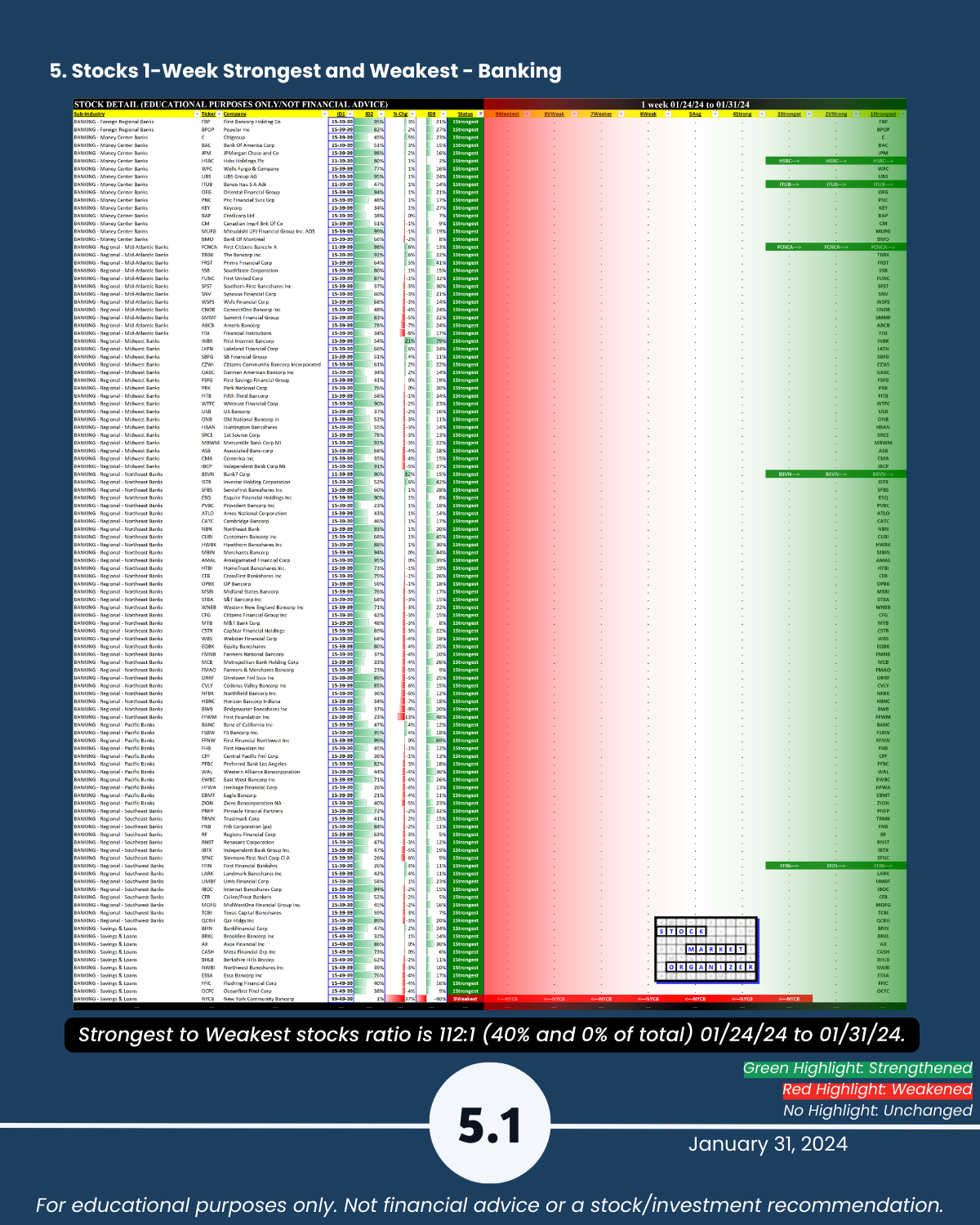

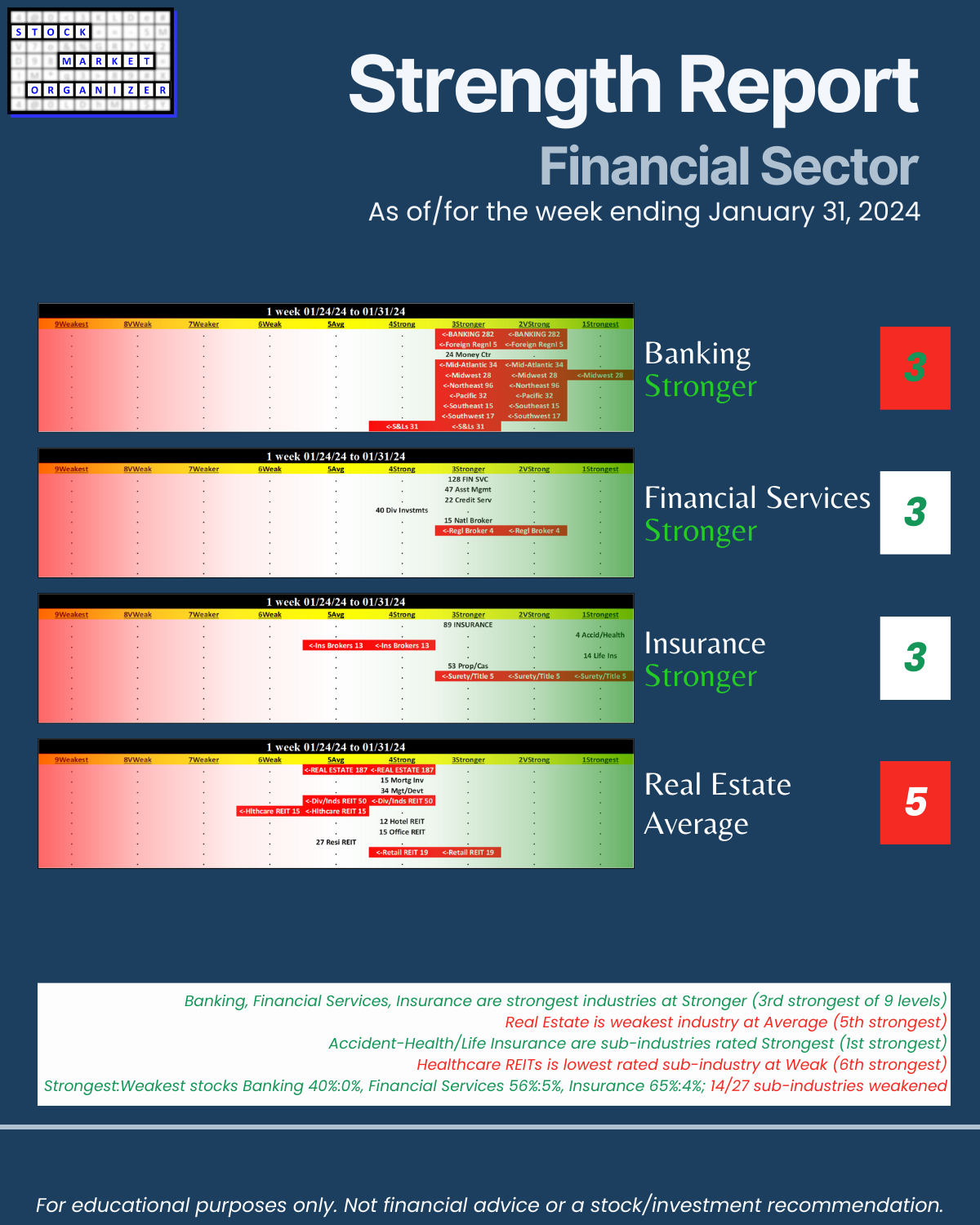

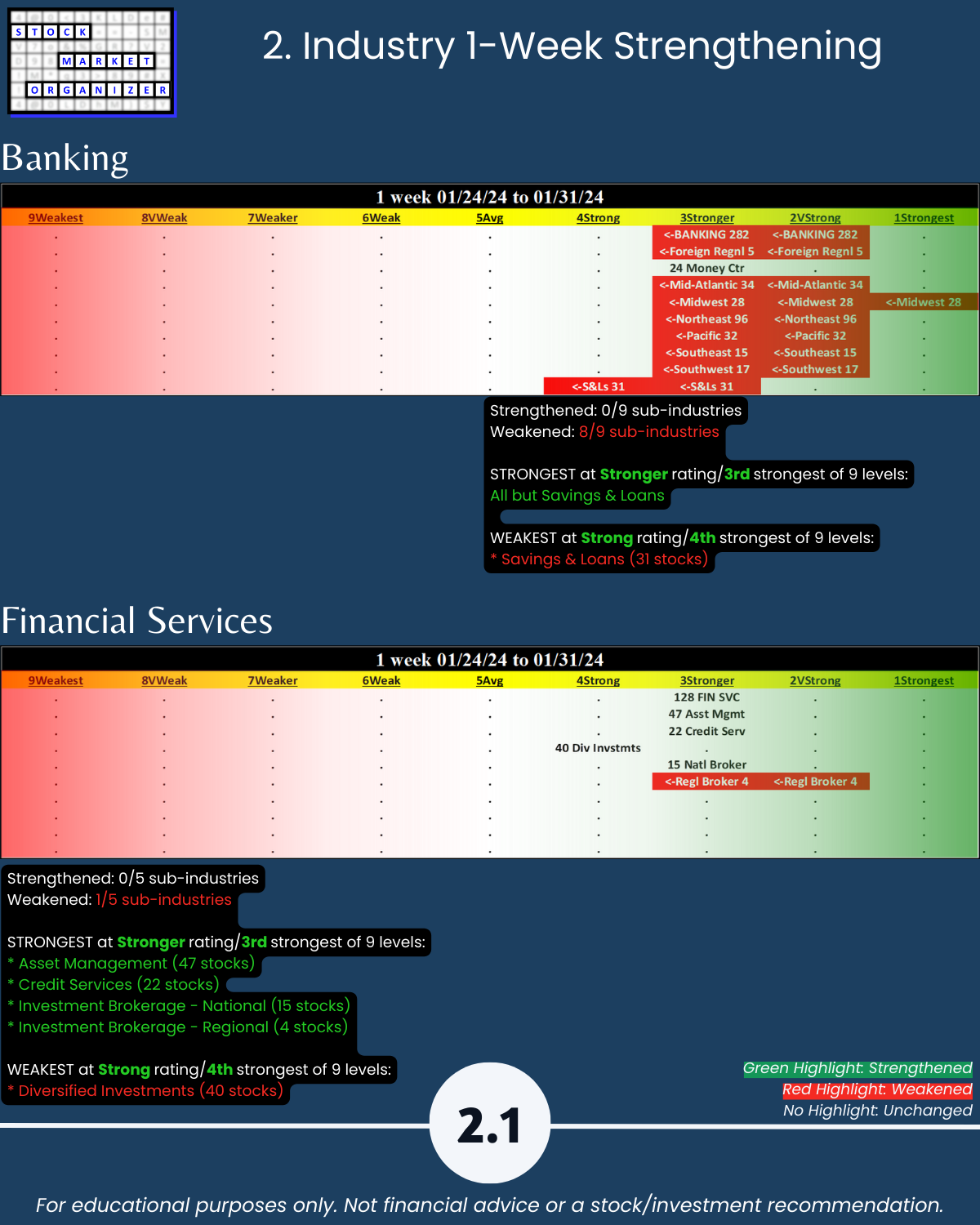

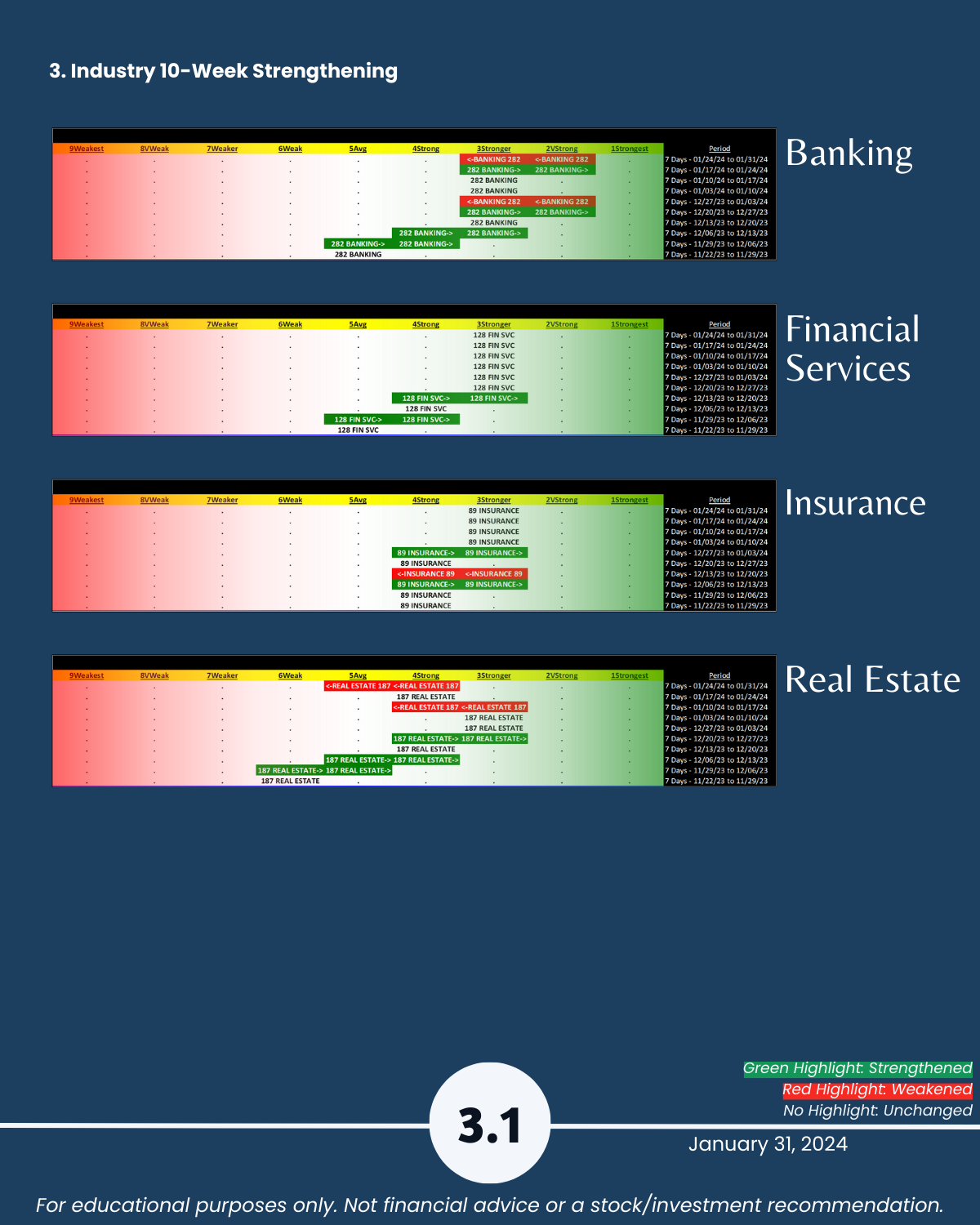

🔹 Banking and Real Estate industries weakened

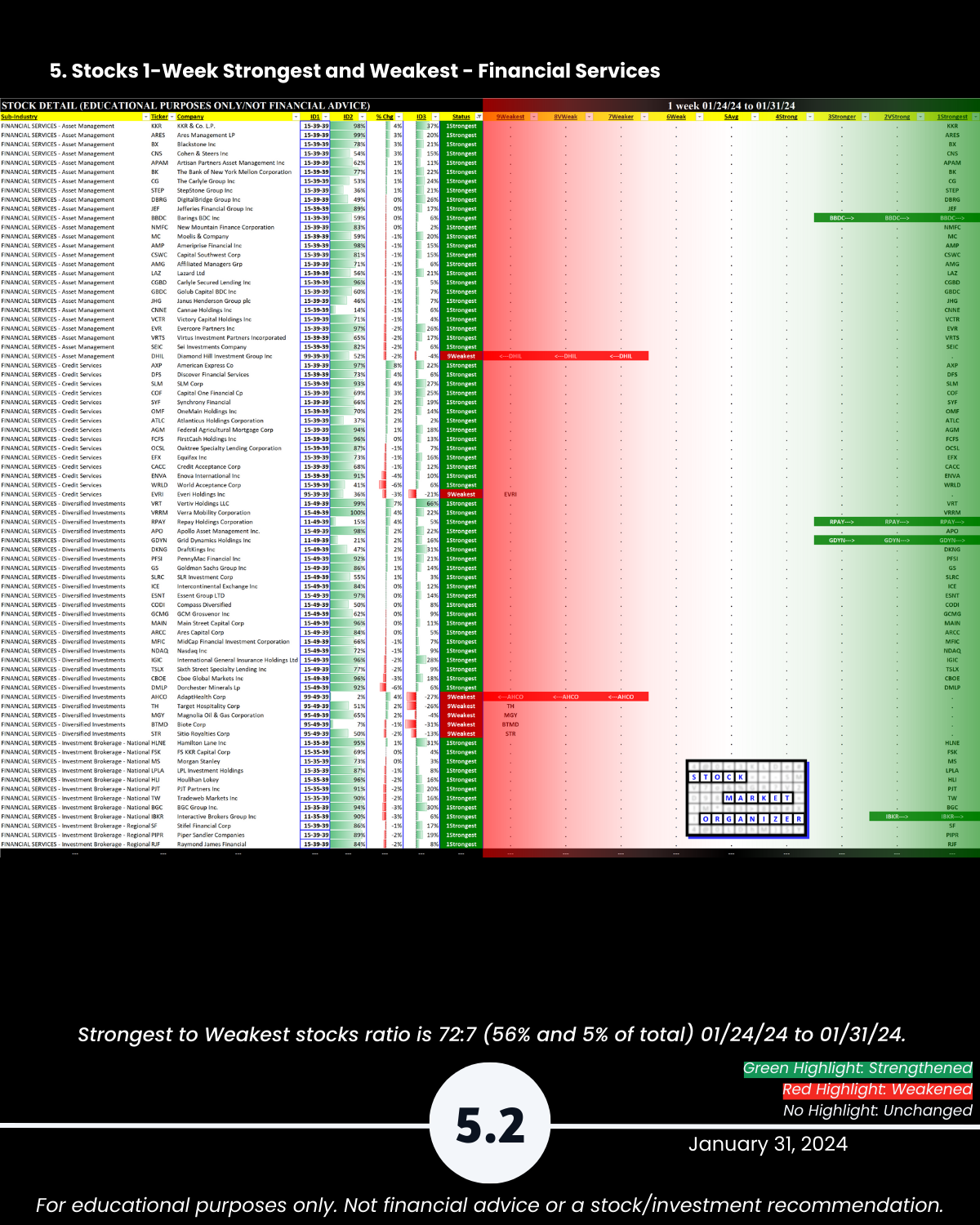

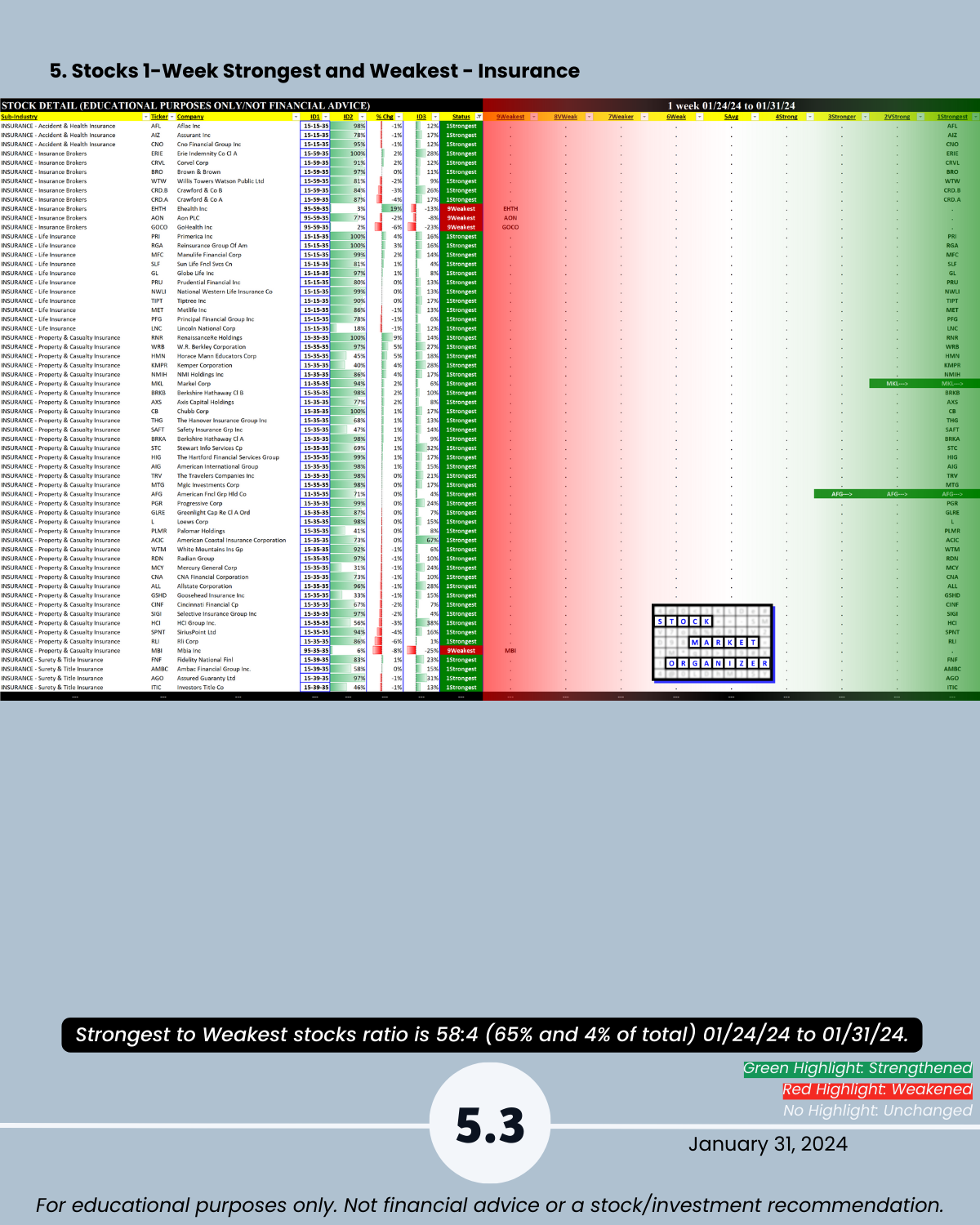

🔹 Banking, Financial Services, Insurance are strongest industries at Stronger (3rd strongest of 9 levels)

🔹 Real Estate is weakest industry at Average (5th strongest)

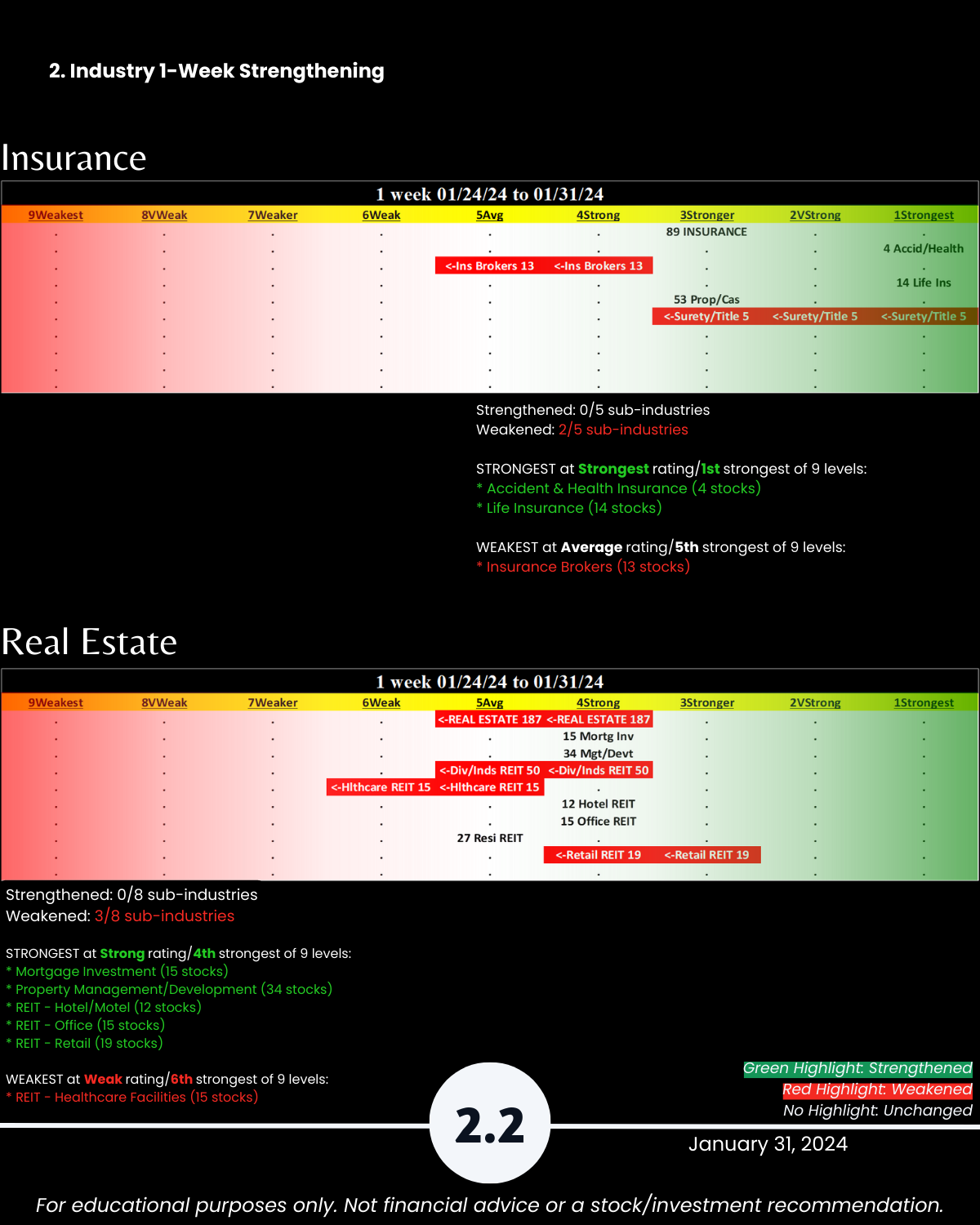

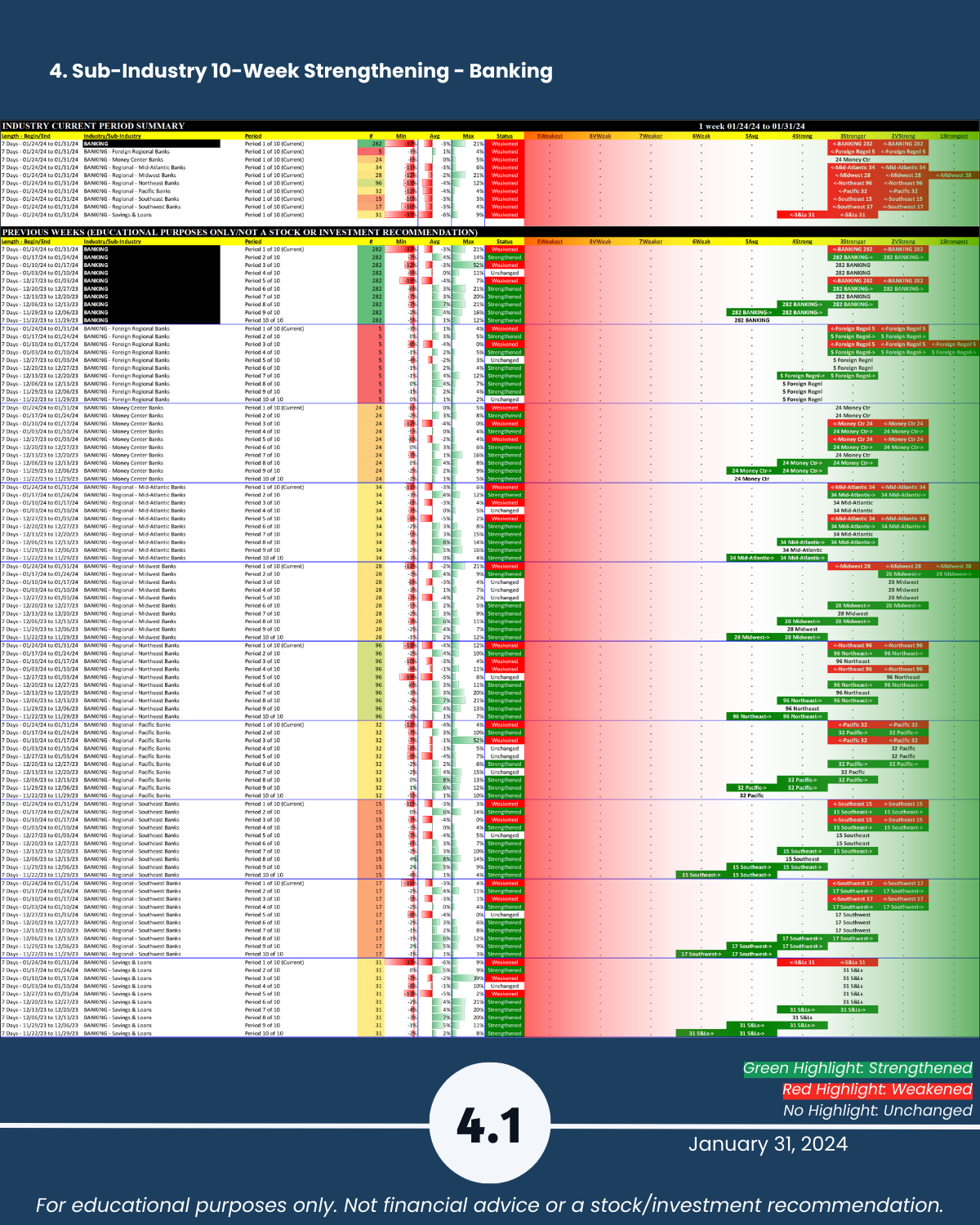

🔹 Accident-Health/Life Insurance are sub-industries rated Strongest (1st strongest)

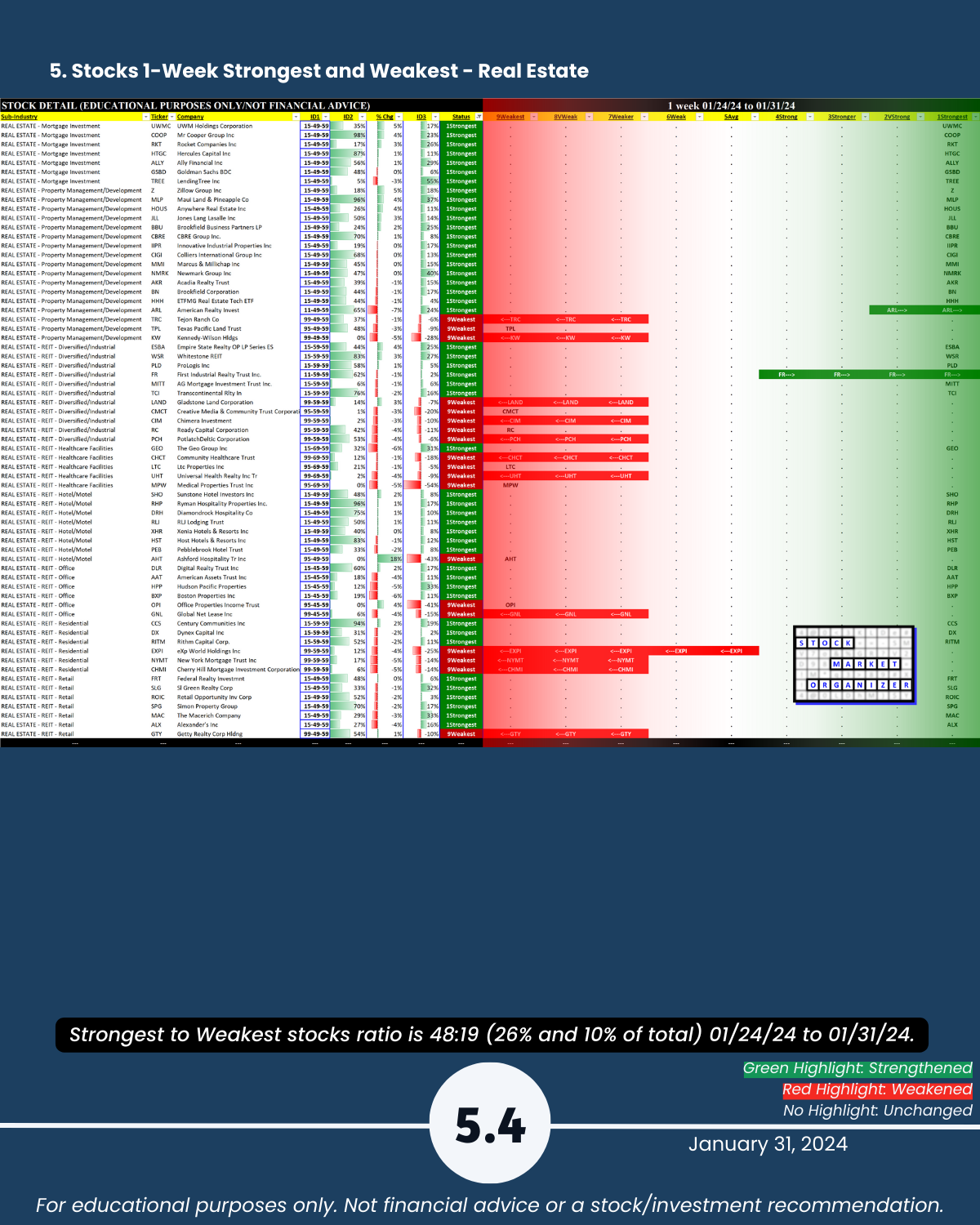

🔹 Healthcare REITs is lowest rated sub-industry at Weak (6th strongest)

🔹 Strongest:Weakest stocks Banking 40%:0%, Financial Services 56%:5%, Insurance 65%:4%

🔹 14/27 sub-industries weakened

SO WHAT?

Through tracking strengthening and weakening from the individual stock through overall market levels, what does this tell you?

🔹 The strongest stocks in each industry so you can see by this measurement if there are better options than whatever you may currently own.

🔹 How all stocks in each sub-industry and industry stack up against each other in terms of current strengthening and weakening. These relationships may not continue, but it’s hard to meaningfully discern where you could go if you don’t know where you currently are. This analysis enables you to quickly see the best and worst stocks and ignore the rest.

🔹 Whether sub-industries and industries are currently strengthening – does their action support new entries or is it better to wait?

This cannot guarantee profits. The market is no one’s ATM. But…

It aligns with the concepts that

THE STRONGER YOUR STOCKS, THE GREENER YOUR P&L, and

IT DOESN’T HAVE TO BE SO COMPLICATED.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-industry 10-Week Strengthening

5. Stocks 1-Week Strongest and Weakest