SMO Exclusive: Strength Report Consumer Sector 2024-03-28

Attached: Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements in the Consumer Durables, Consumer Non-Durables, Food & Beverage, Retail, and Specialty Retail industries.

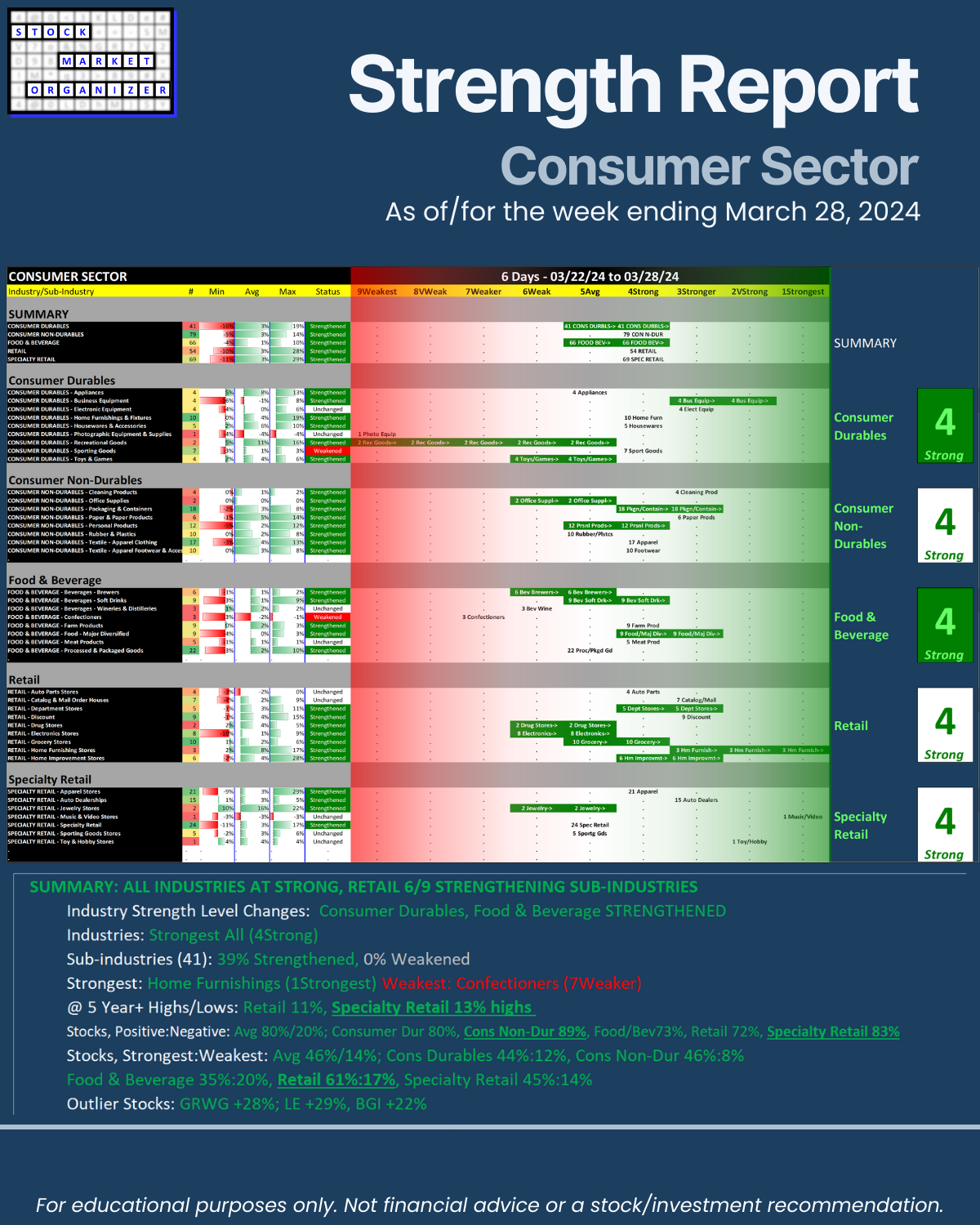

SUMMARY: ALL INDUSTRIES AT STRONG, RETAIL 6/9 STRENGTHENING SUB-INDUSTRIES

Takeaways:

🔹 Industry Strength Level Changes: Consumer Durables, Food & Beverage STRENGTHENED

🔹 Industries: Strongest All (4Strong)

🔹 Sub-industries (41):

- 39% Strengthened, 0% Weakened

- Strongest: Home Furnishings (1Strongest) Weakest: Confectioners (7Weaker)

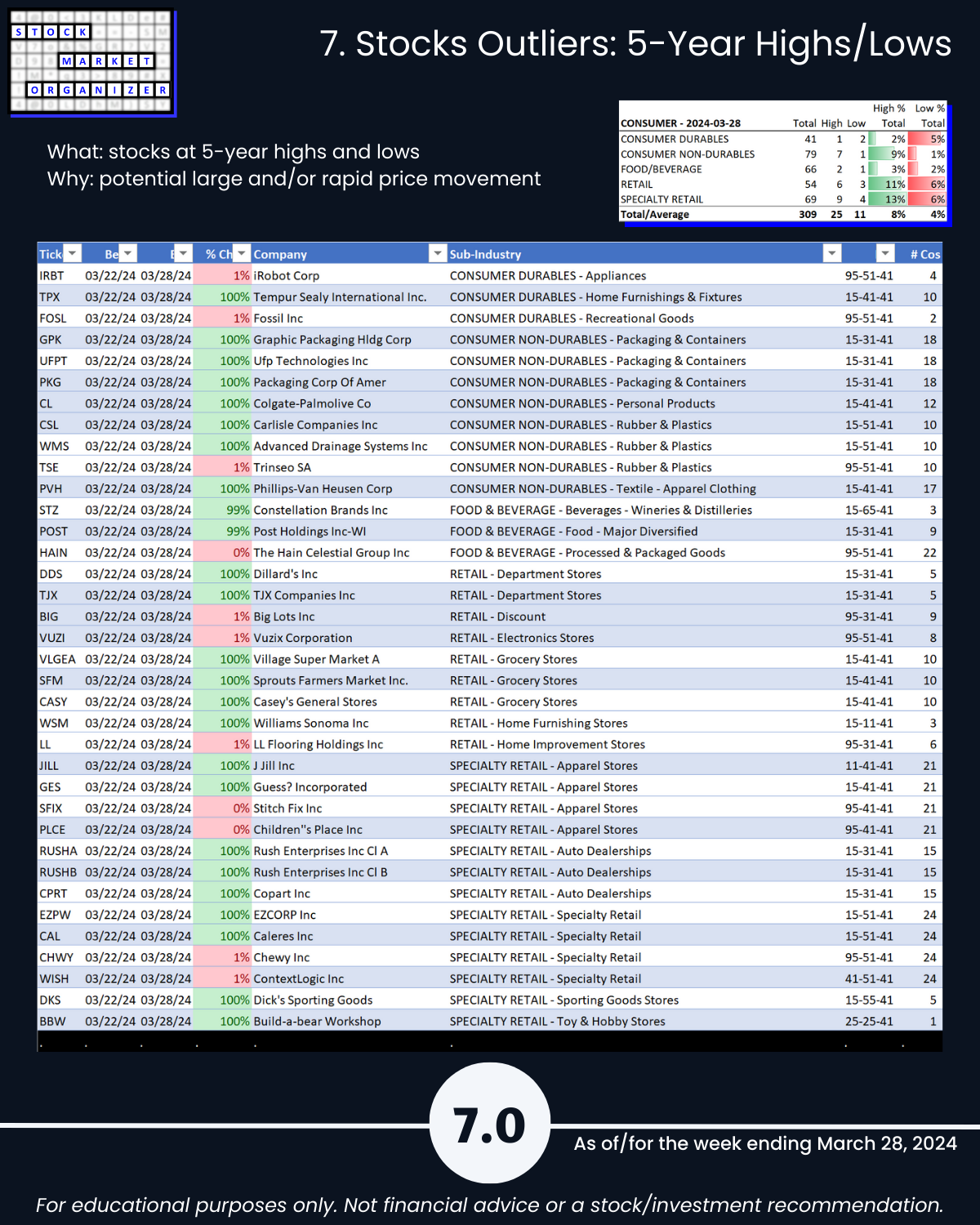

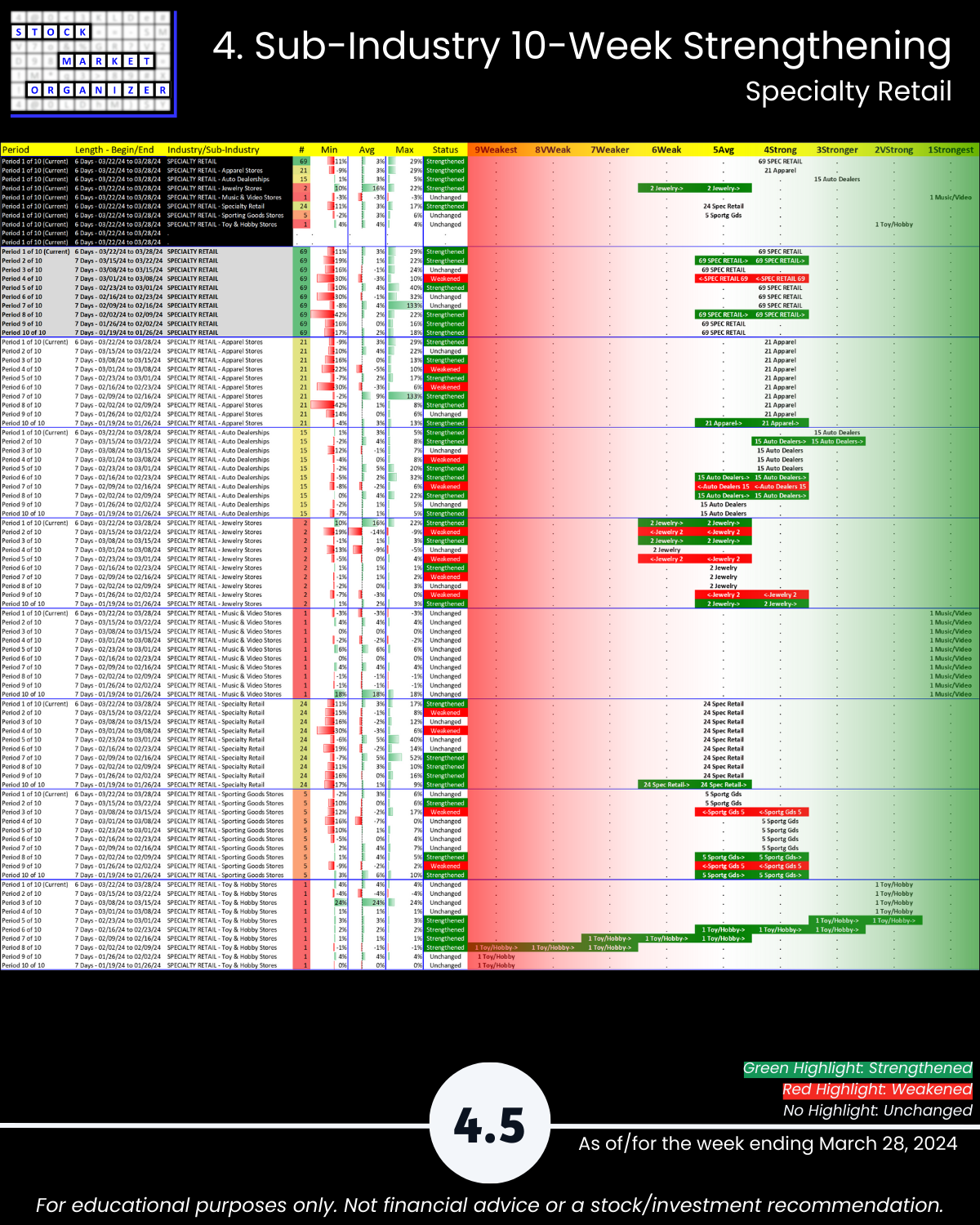

- @ 5 Year+ Highs/Lows: Retail 11%, Specialty Retail 13% highs

🔹 Stocks:

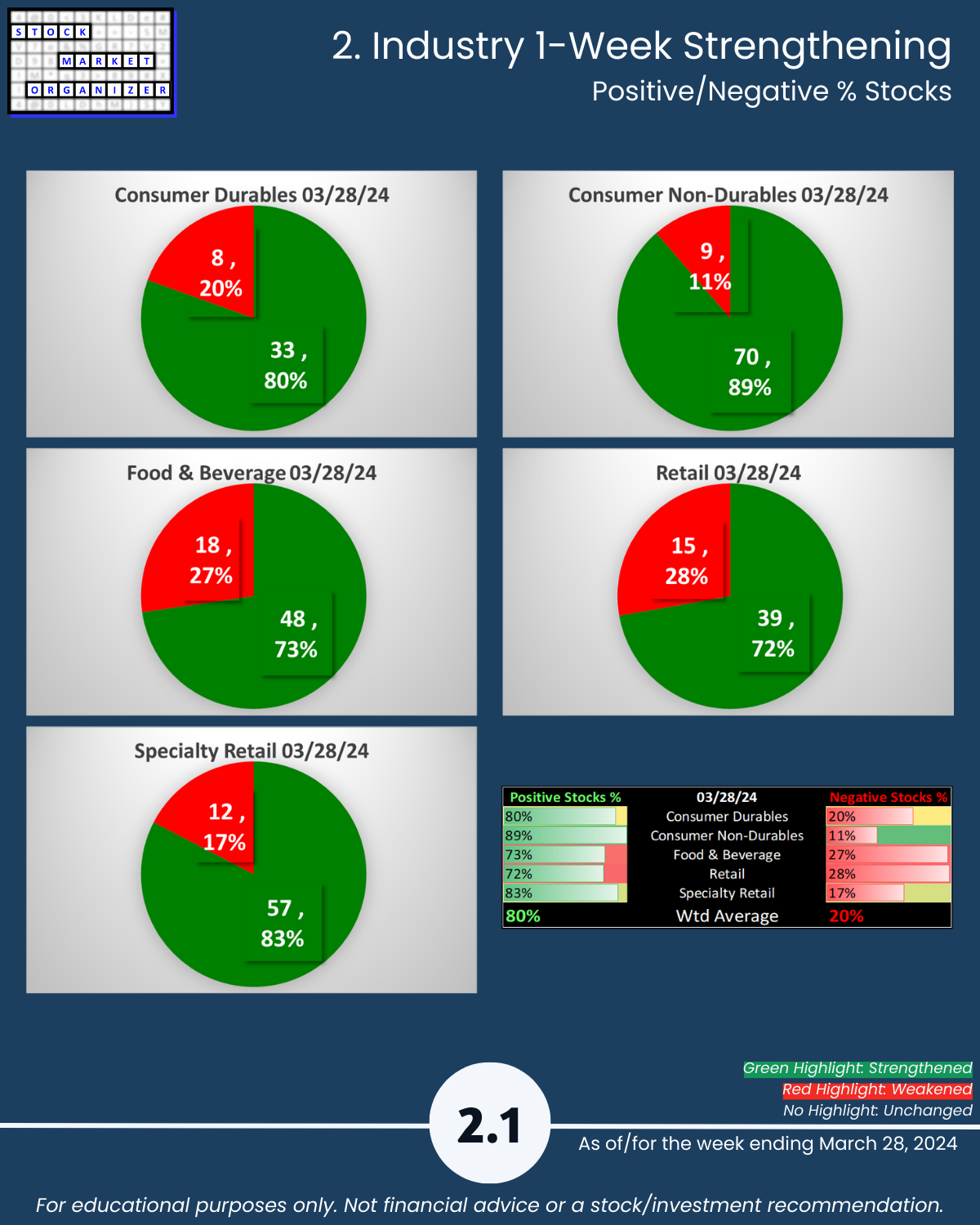

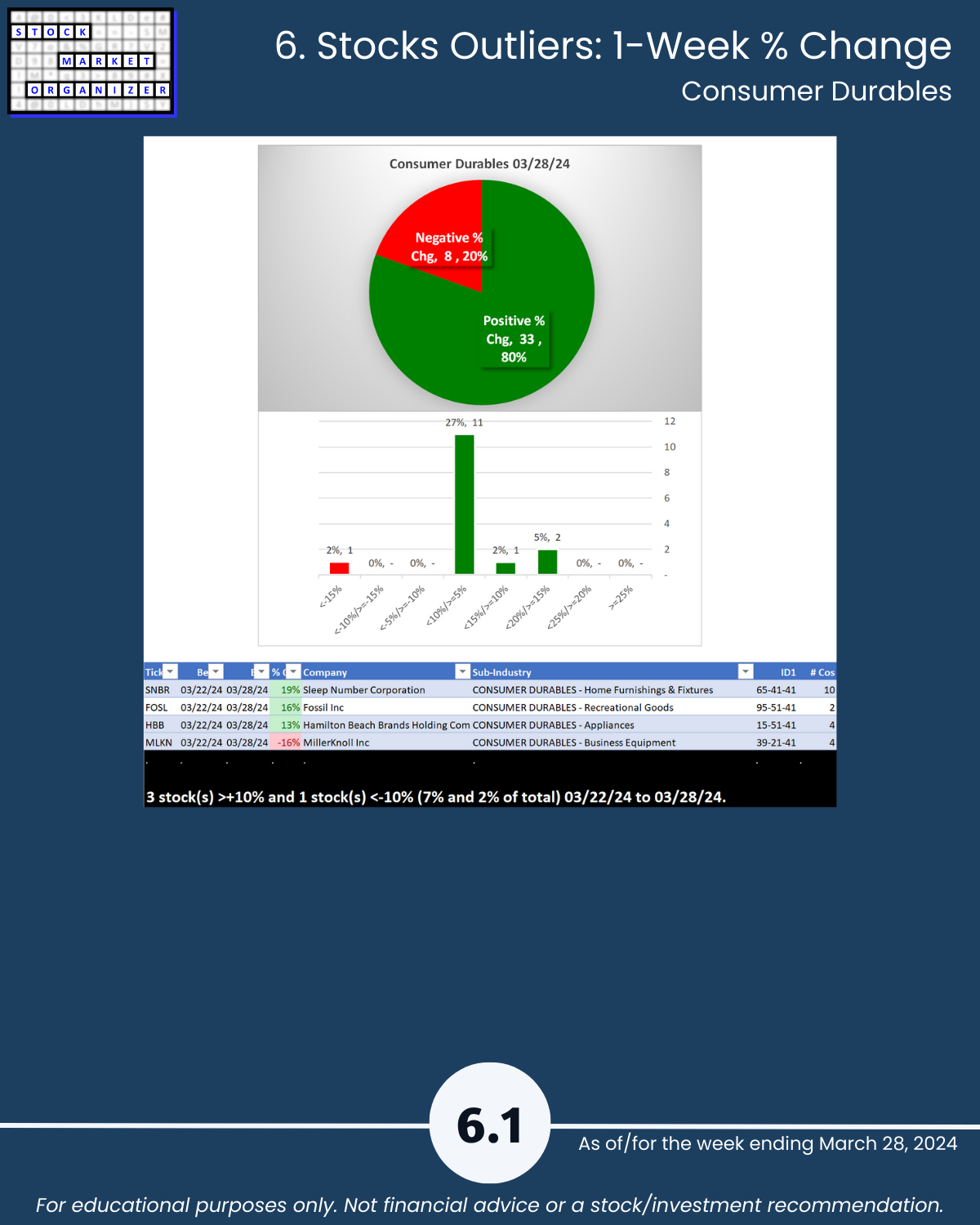

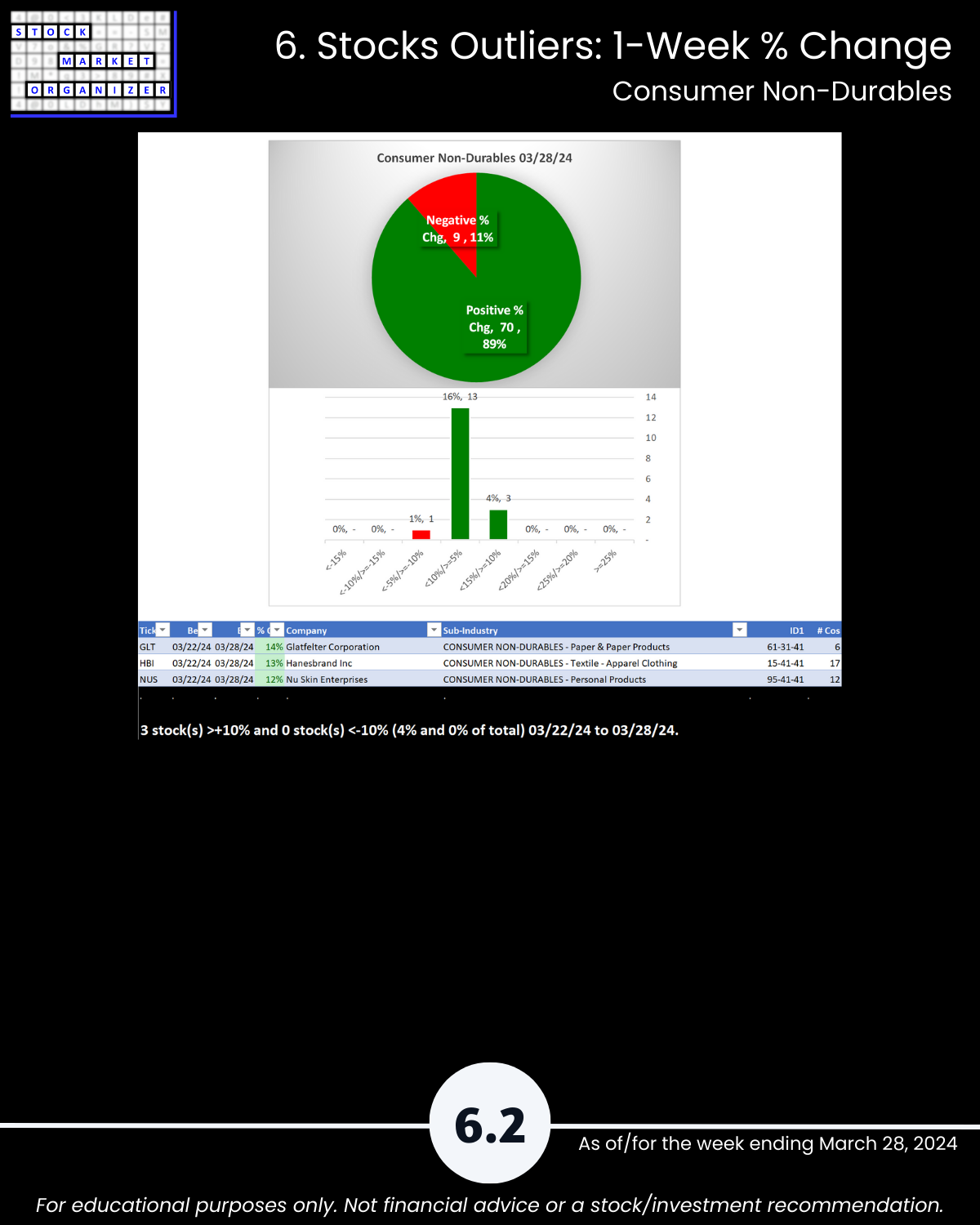

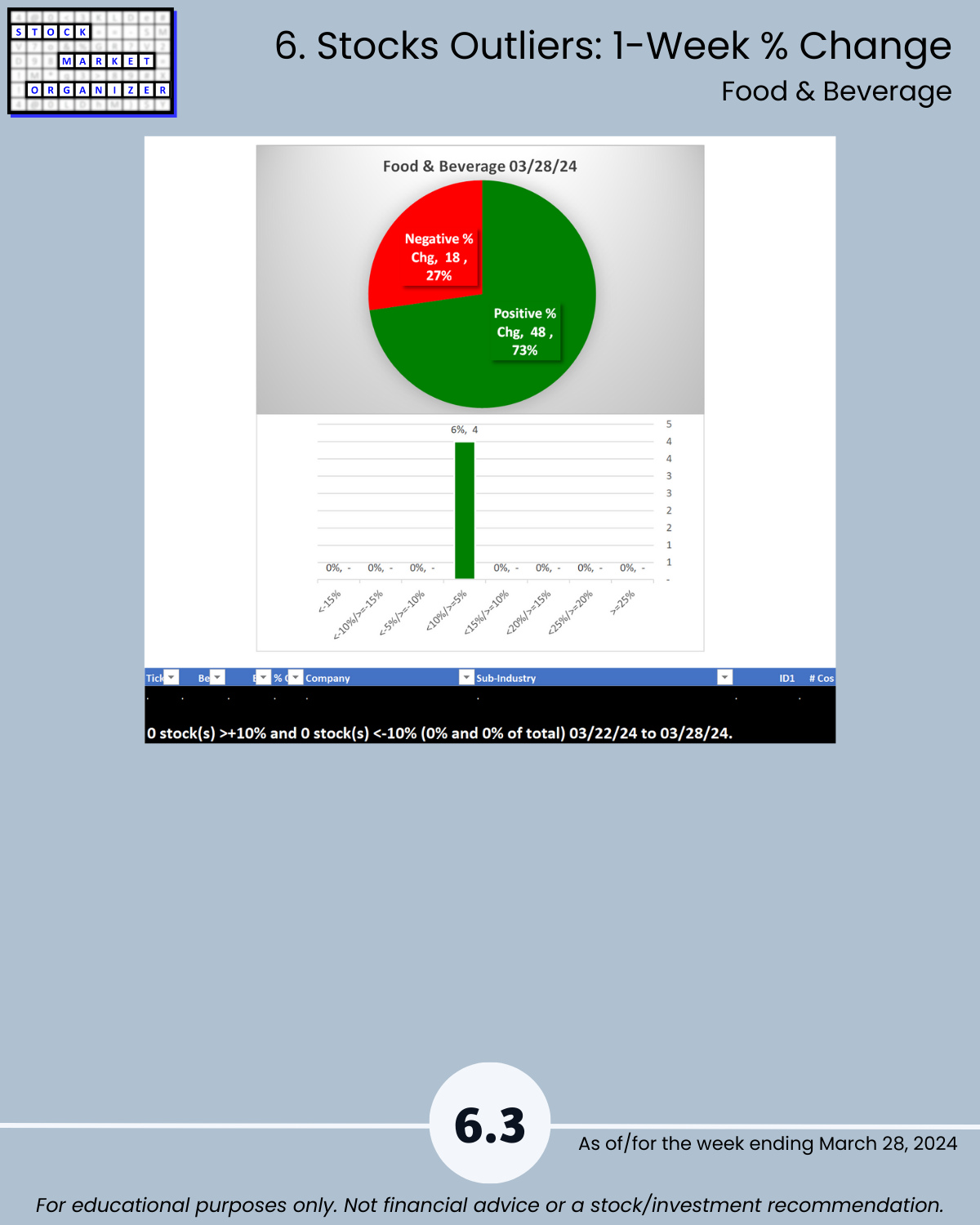

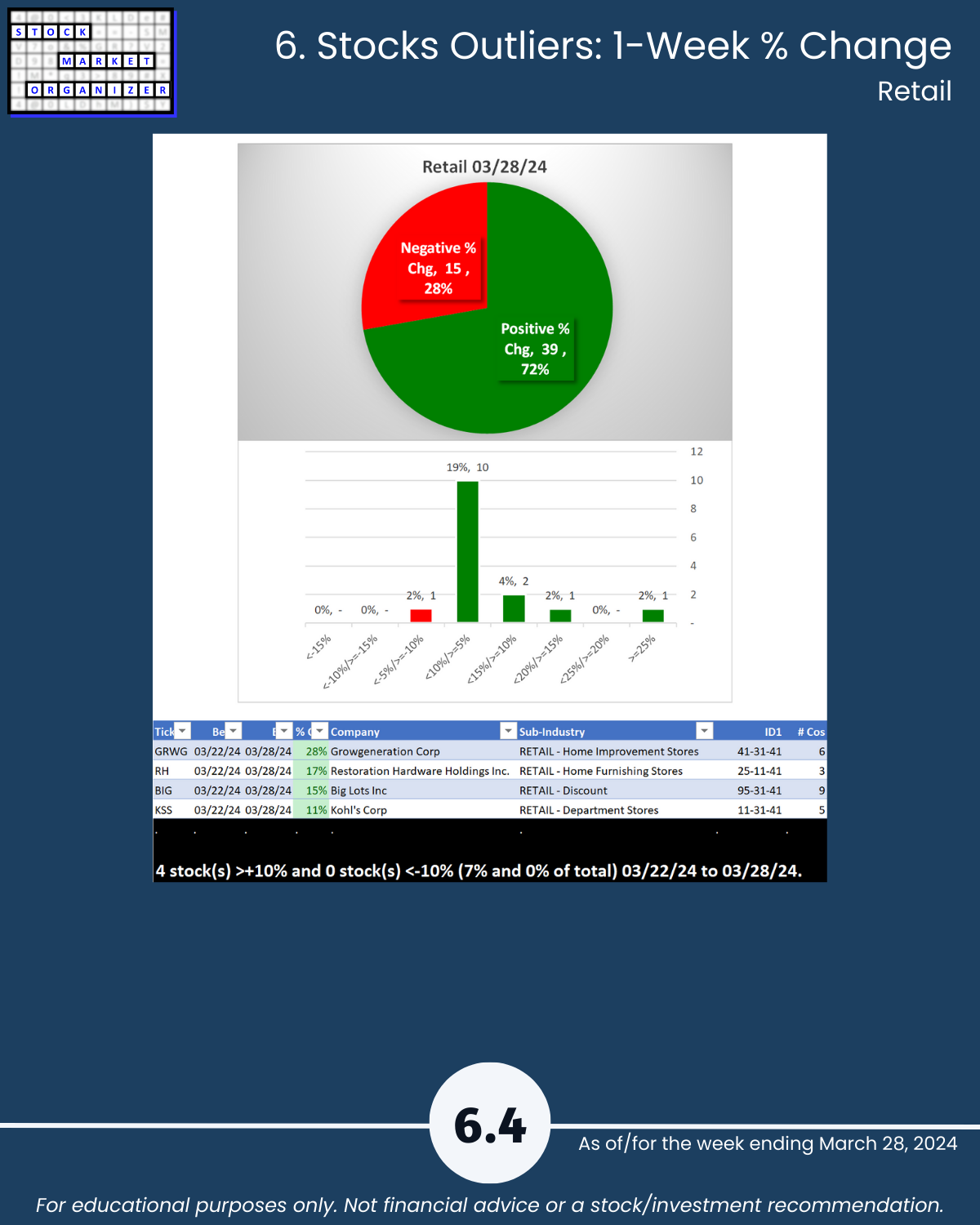

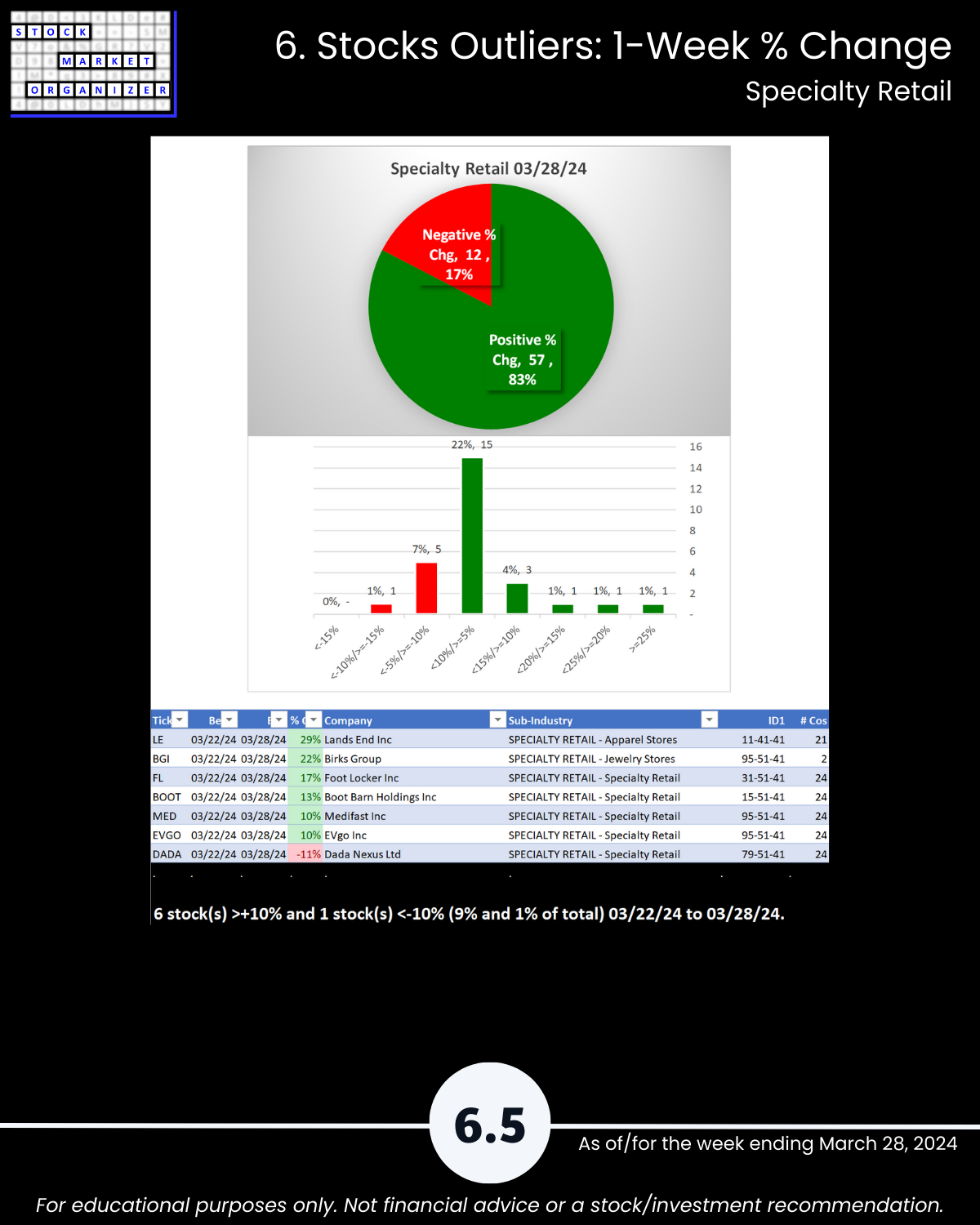

- Positive:Negative: Avg 80%/20%; Consumer Dur 80%, Cons Non-Dur 89%, Food/Bev73%, Retail 72%, Specialty Retail 83%

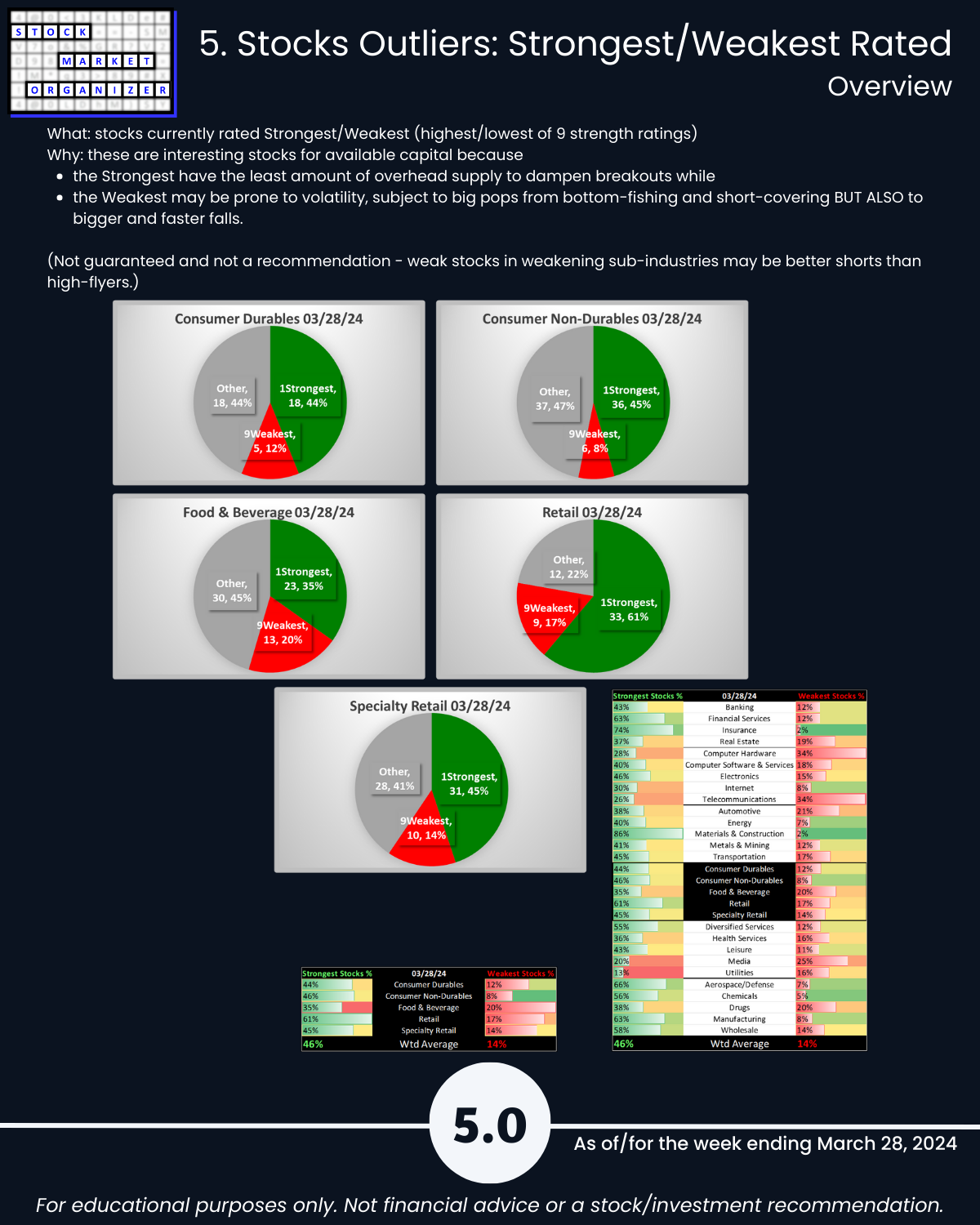

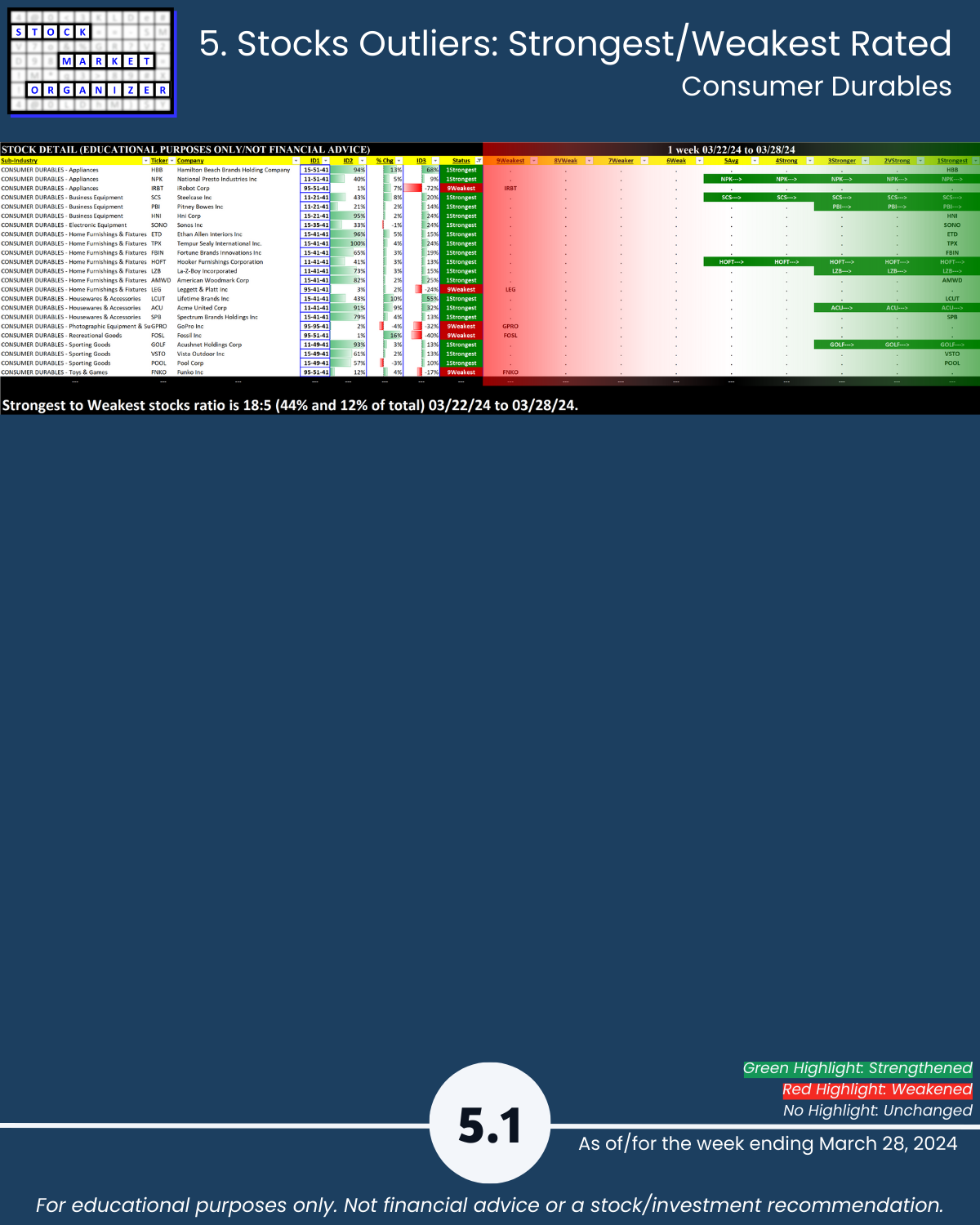

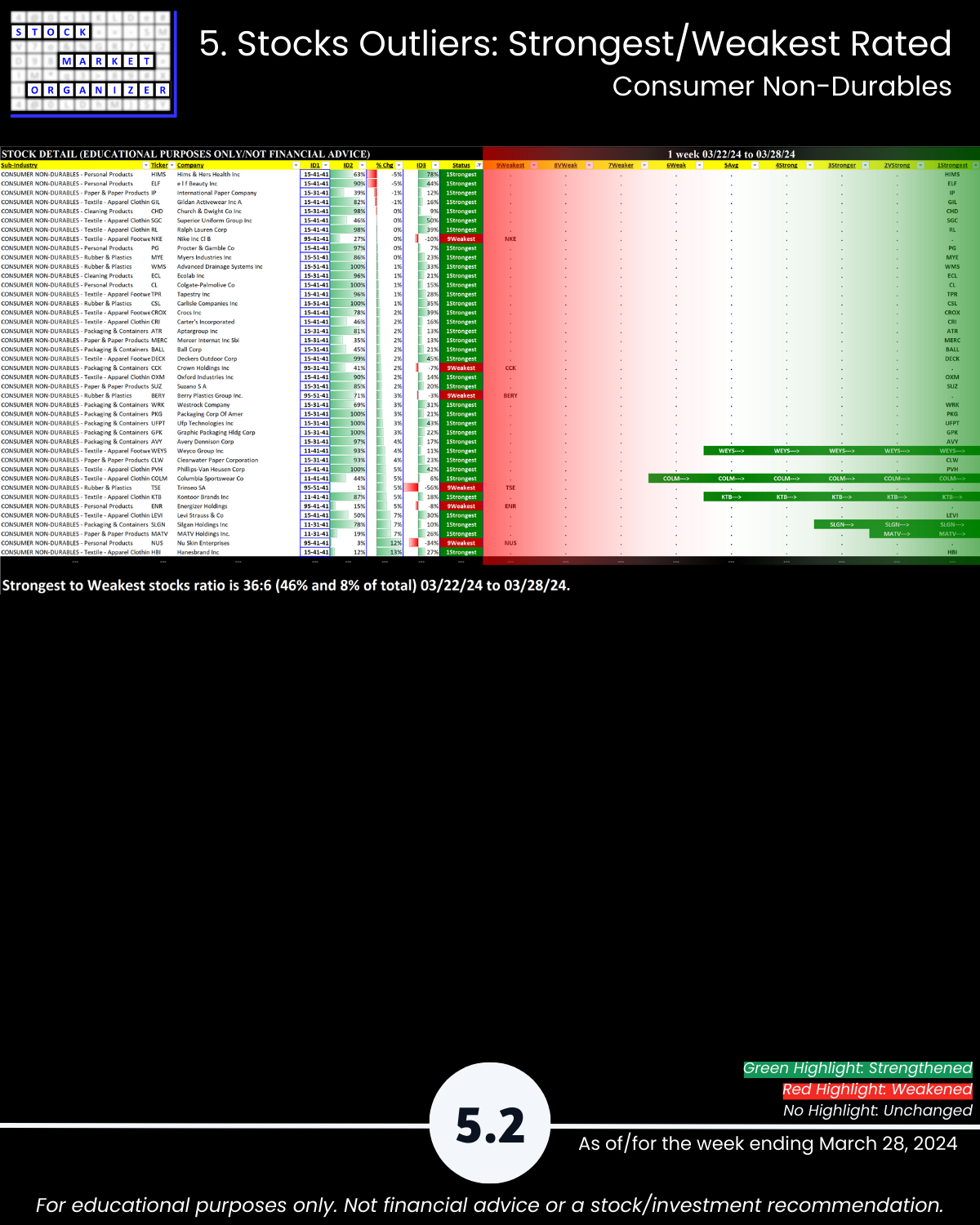

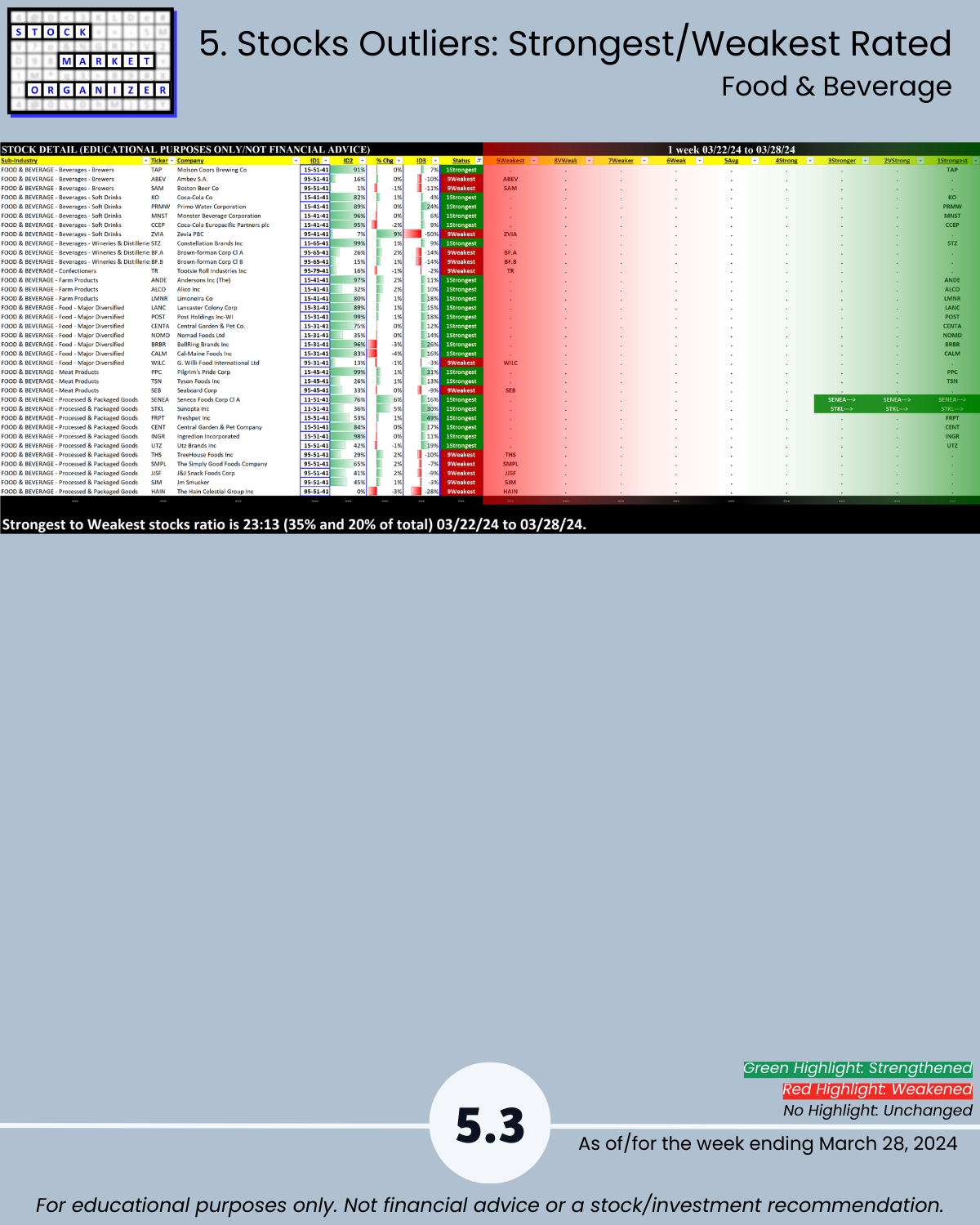

- Strongest:Weakest: Avg 46%/14%; Cons Durables 44%:12%, Cons Non-Dur 46%:8%, Food & Beverage 35%:20%, Retail 61%:17%, Specialty Retail 45%:14%

- Outlier Stocks: GRWG +28%; LE +29%, BGI +22%

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

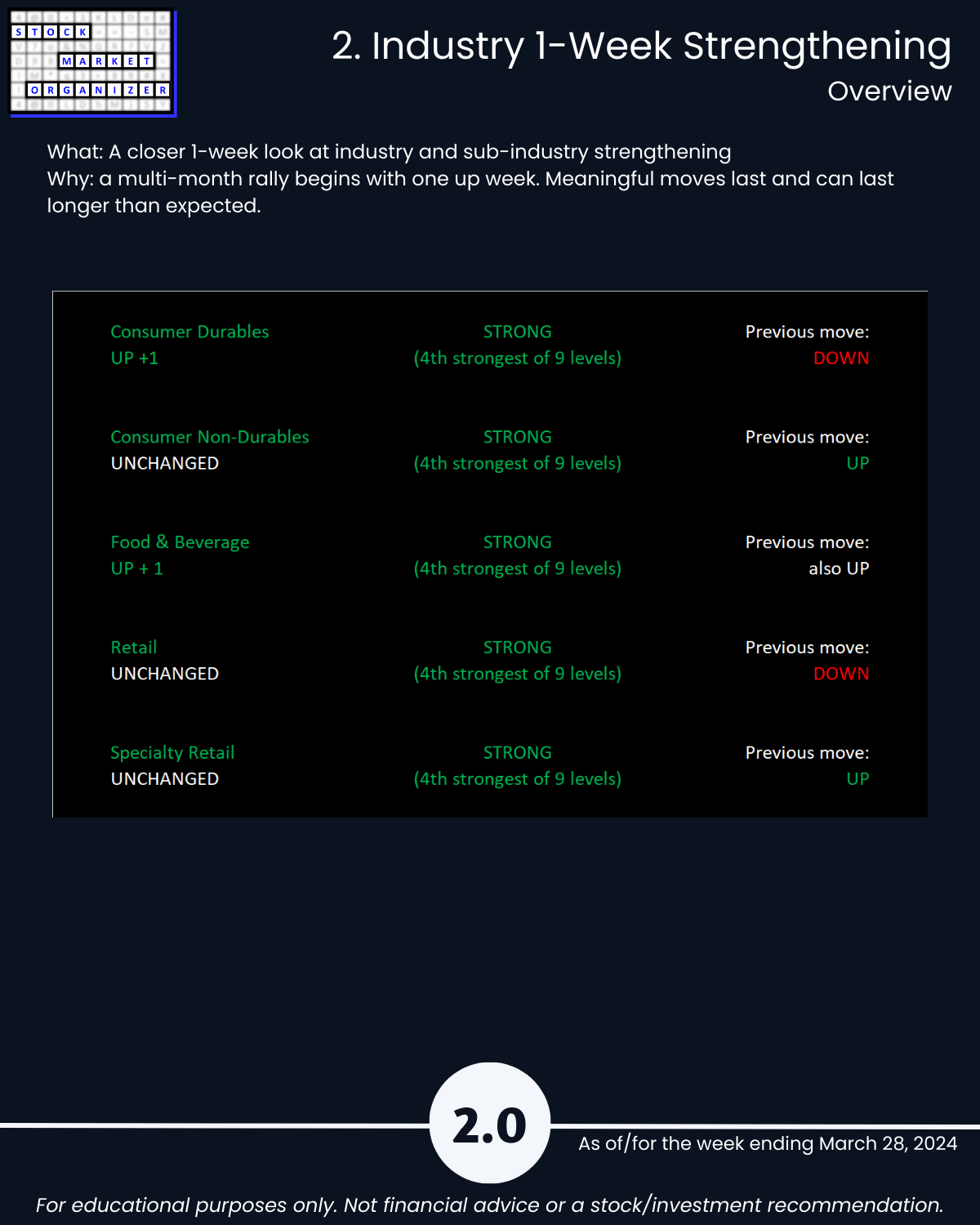

2. Industry 1-Week Strengthening

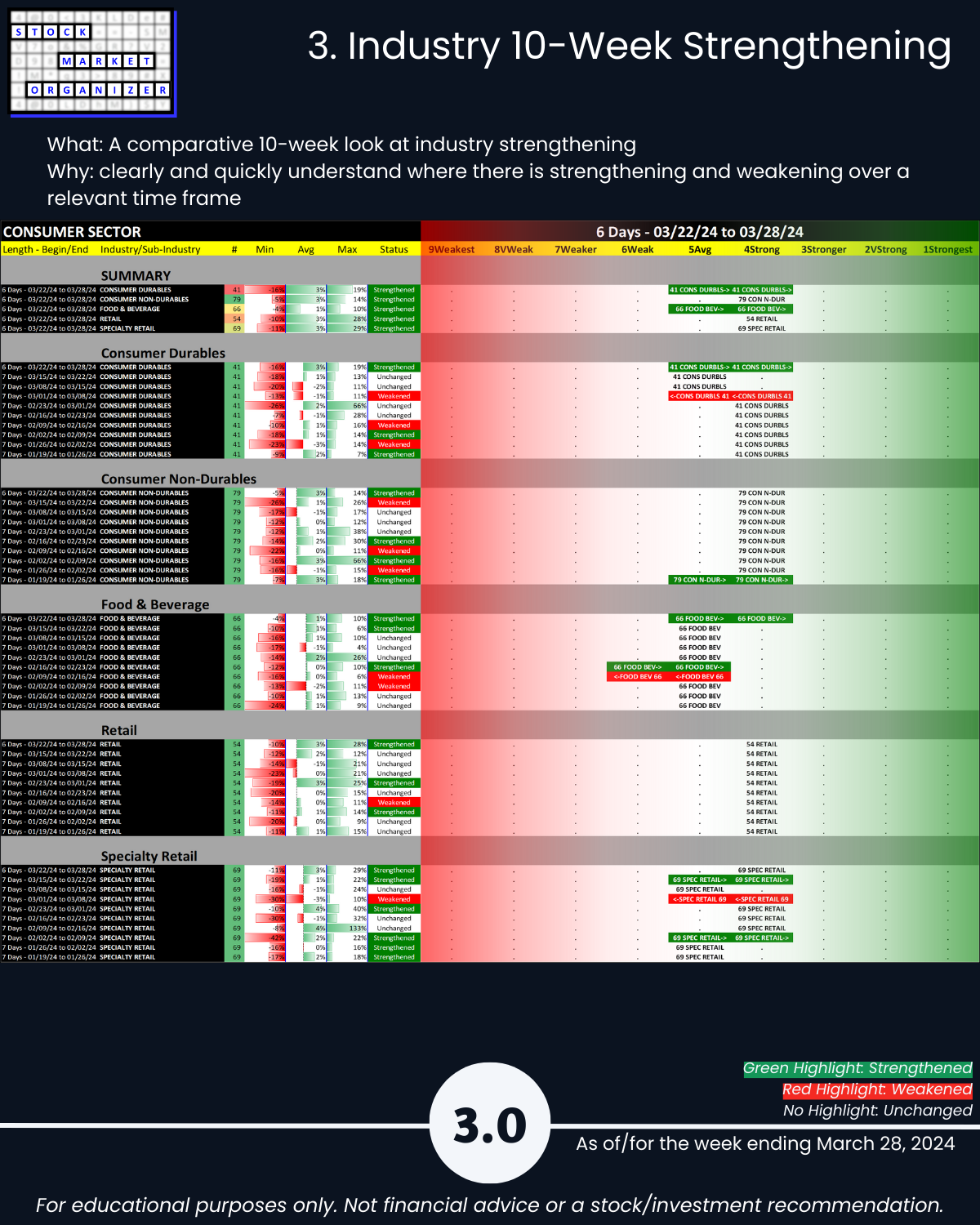

3. Industry 10-Week Strengthening

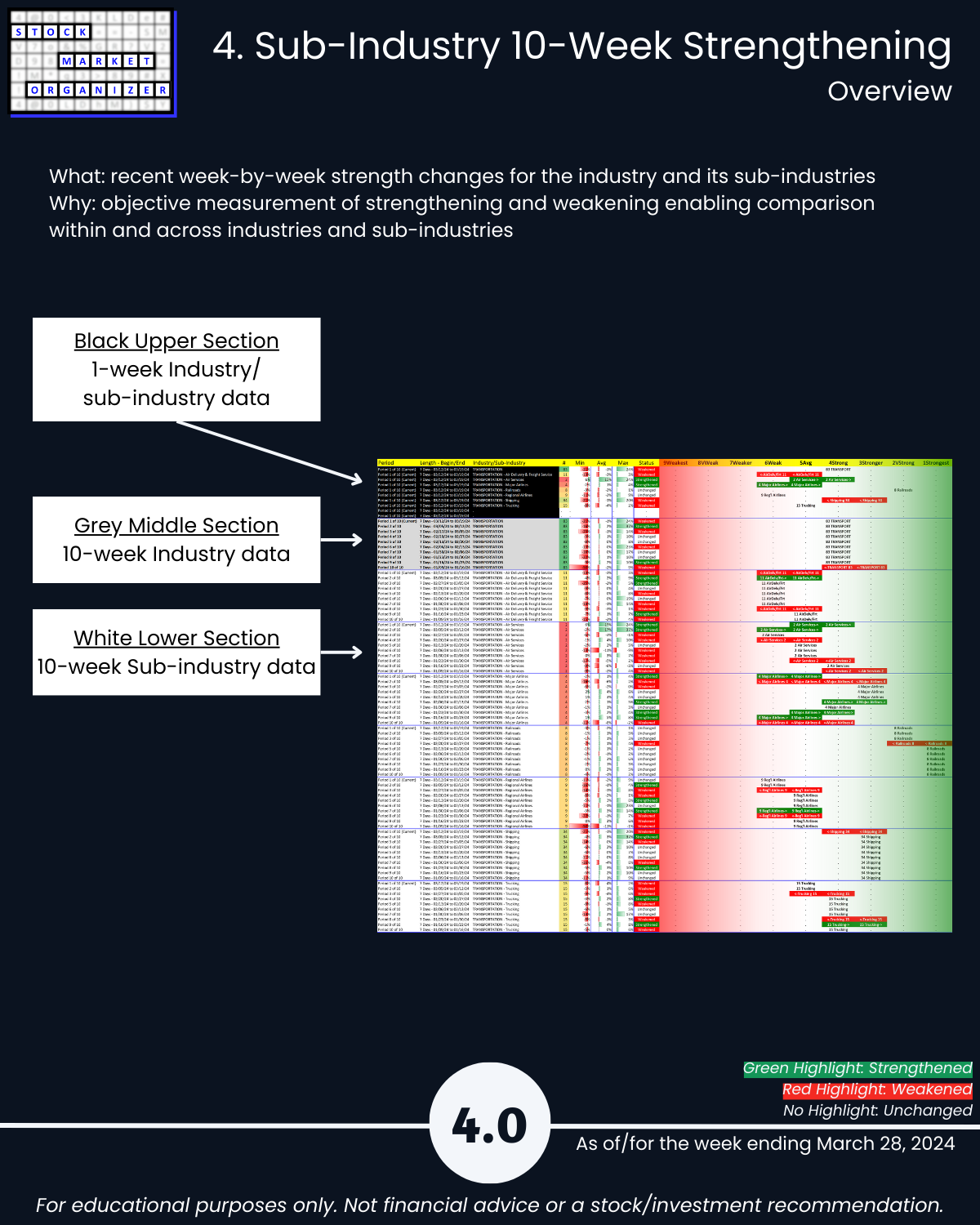

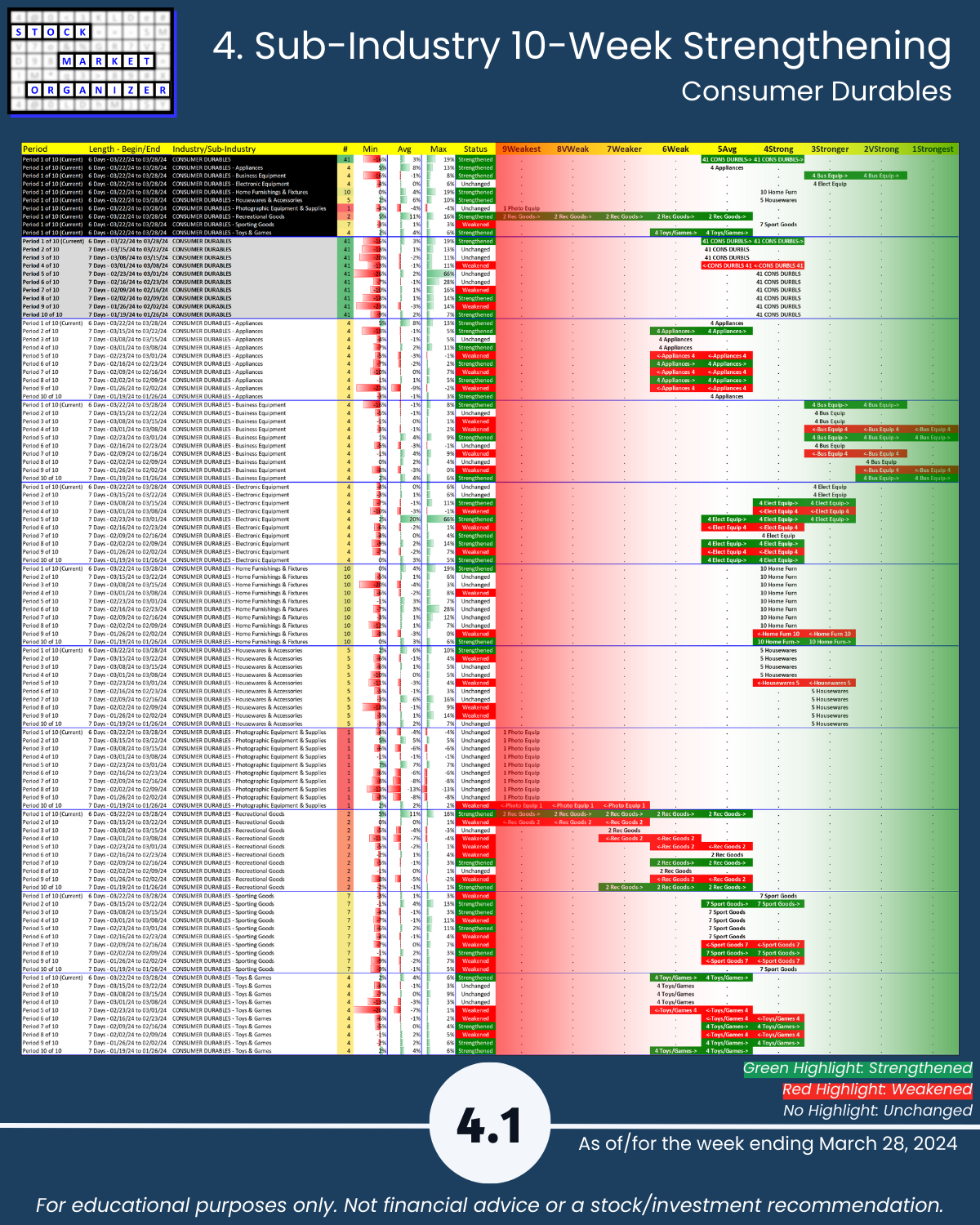

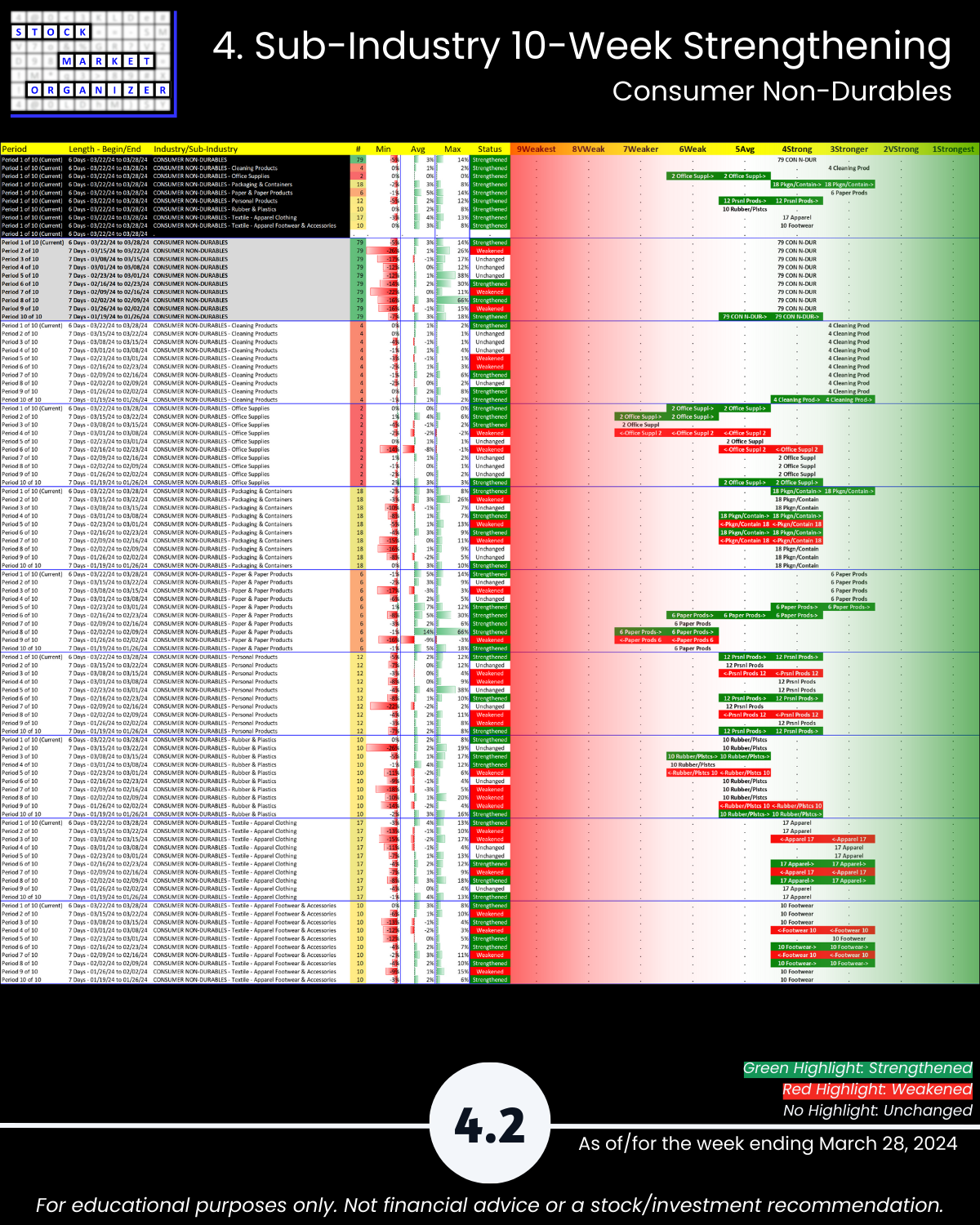

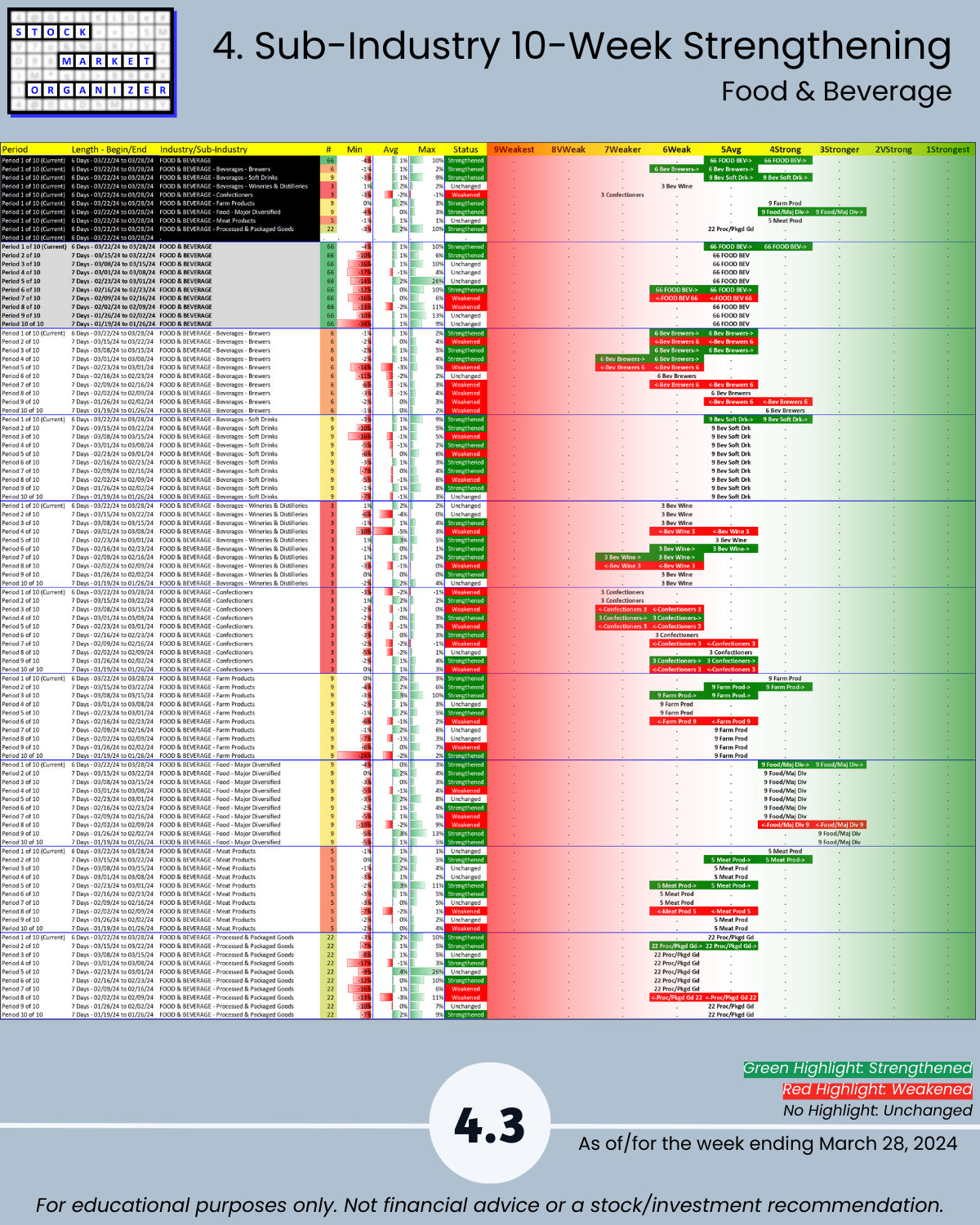

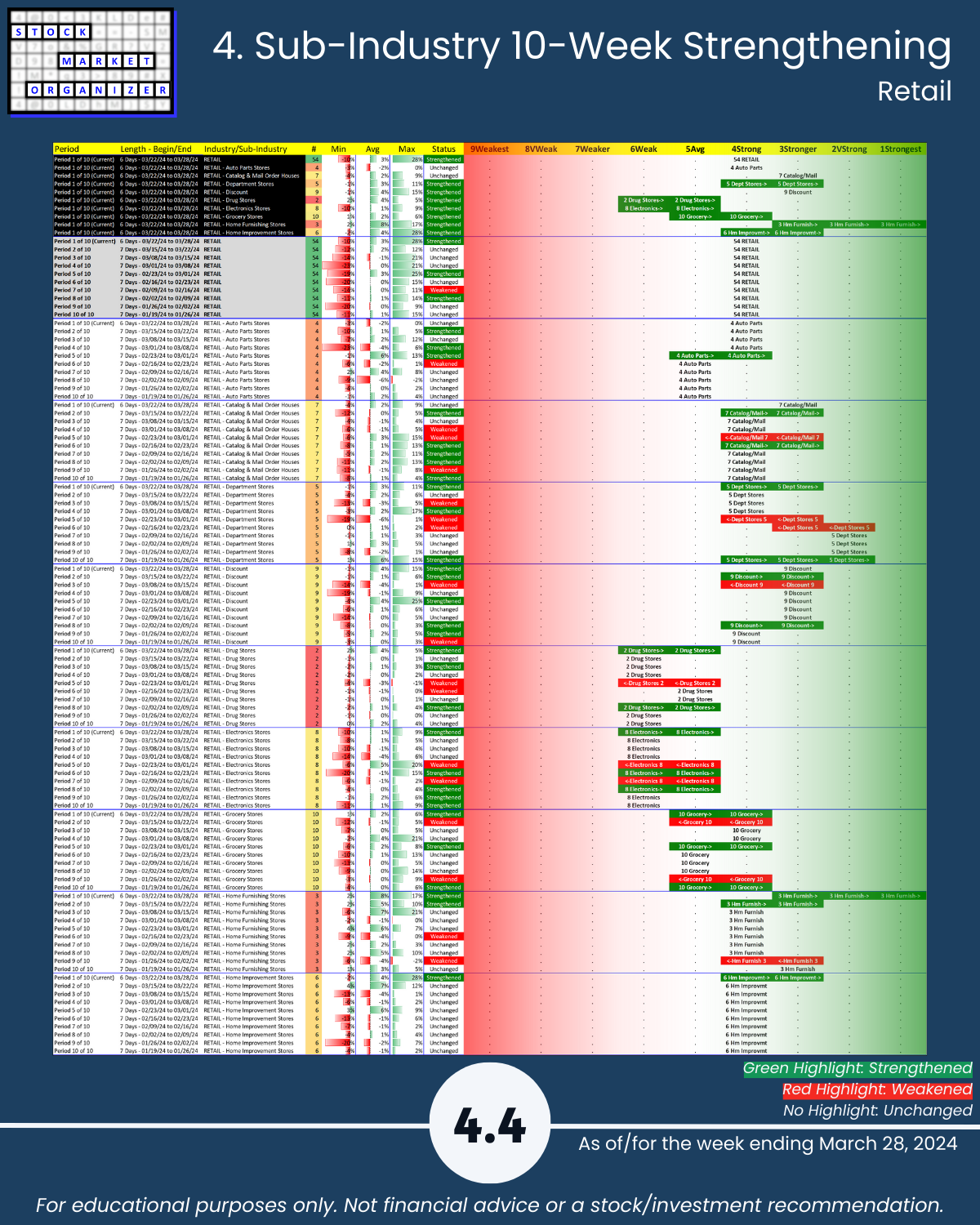

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows