SMO Exclusive: Strength Report Consumer Sector 2024-03-15

What you may not know about the Consumer Sector 3/15/24 - though no industry strength changes, 37% of its stocks are >+20% since 5/4/23 led by ANF +477%. 🔹 Question: what outstanding return opportunities are you missing every day you aren’t looking everywhere for strengthening?

Strength can beget strength. Welcome it. Don’t fear it.

Prime example: CVNA, +1,977% 1 year, and +1,005% since 5/4/23 - AFTER it rose 88% from 12/7/22 to 5/4/23.

Sure, 10% returns can turn into -10% returns. But this is what risk management is for.

And 10% returns are needed to turn into 100% returns. And more.

10%+ returns = strengthening = a “pay attention now” signal.

Stock strengthening + a rising sub-industry, industry, and market = strength stacking at its finest.

As noted last week, you don’t have to catch exact bottoms to enjoy healthy returns. SKYW +49% in 4 months 11/14/23 to 3/8/24 - AFTER it rose 200% December 2022 to August 2023. (49% in this period was a top 5% return in my universe.)

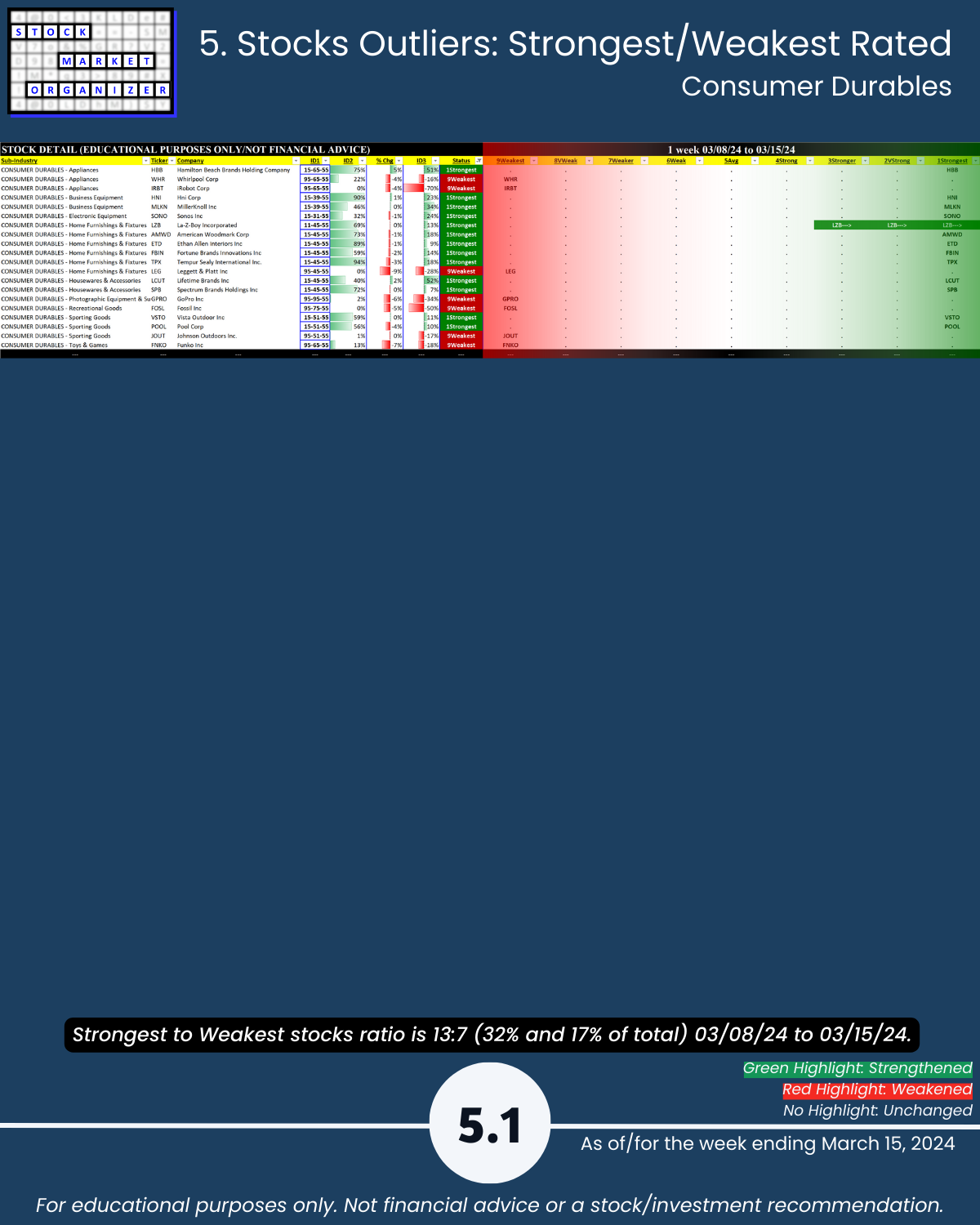

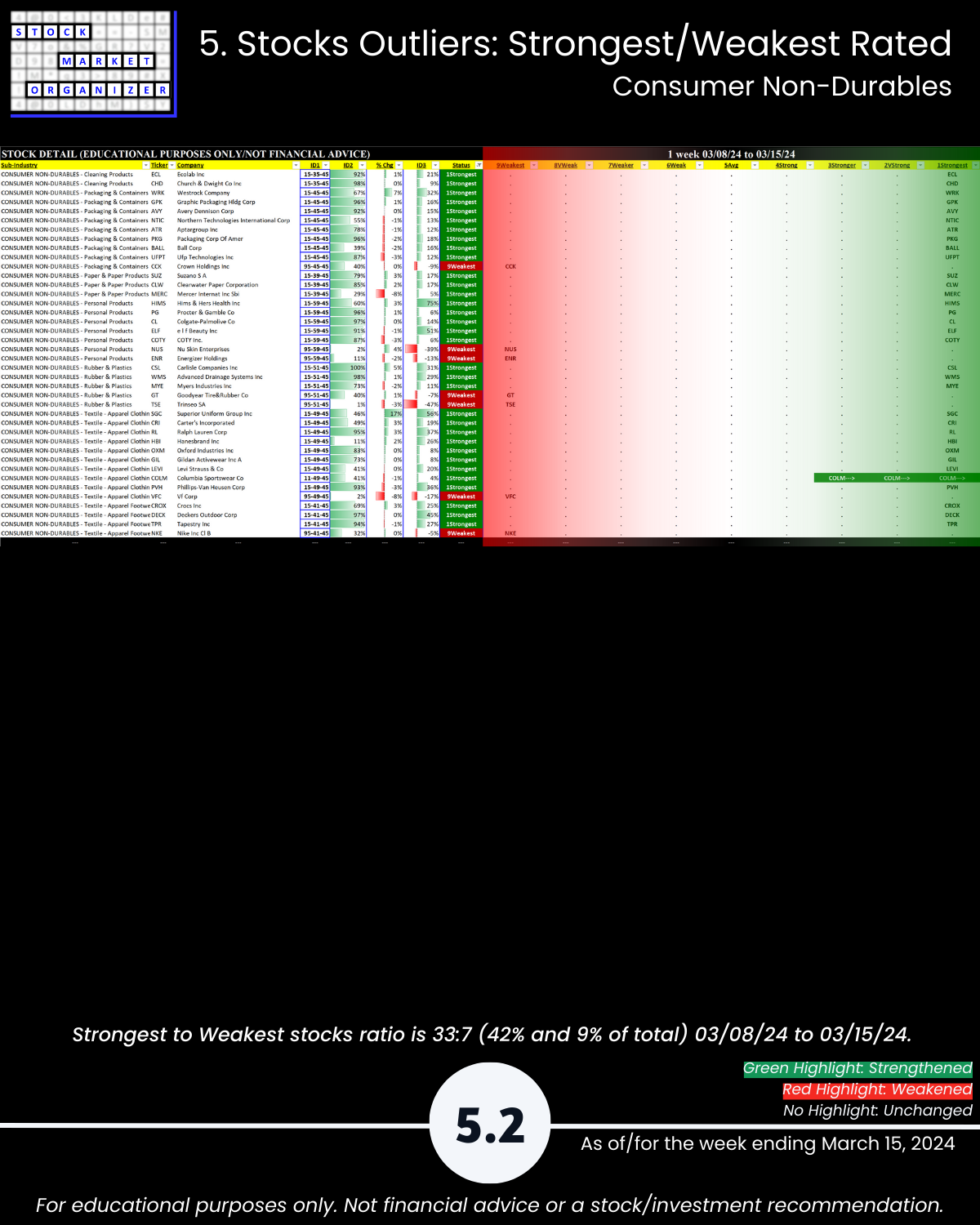

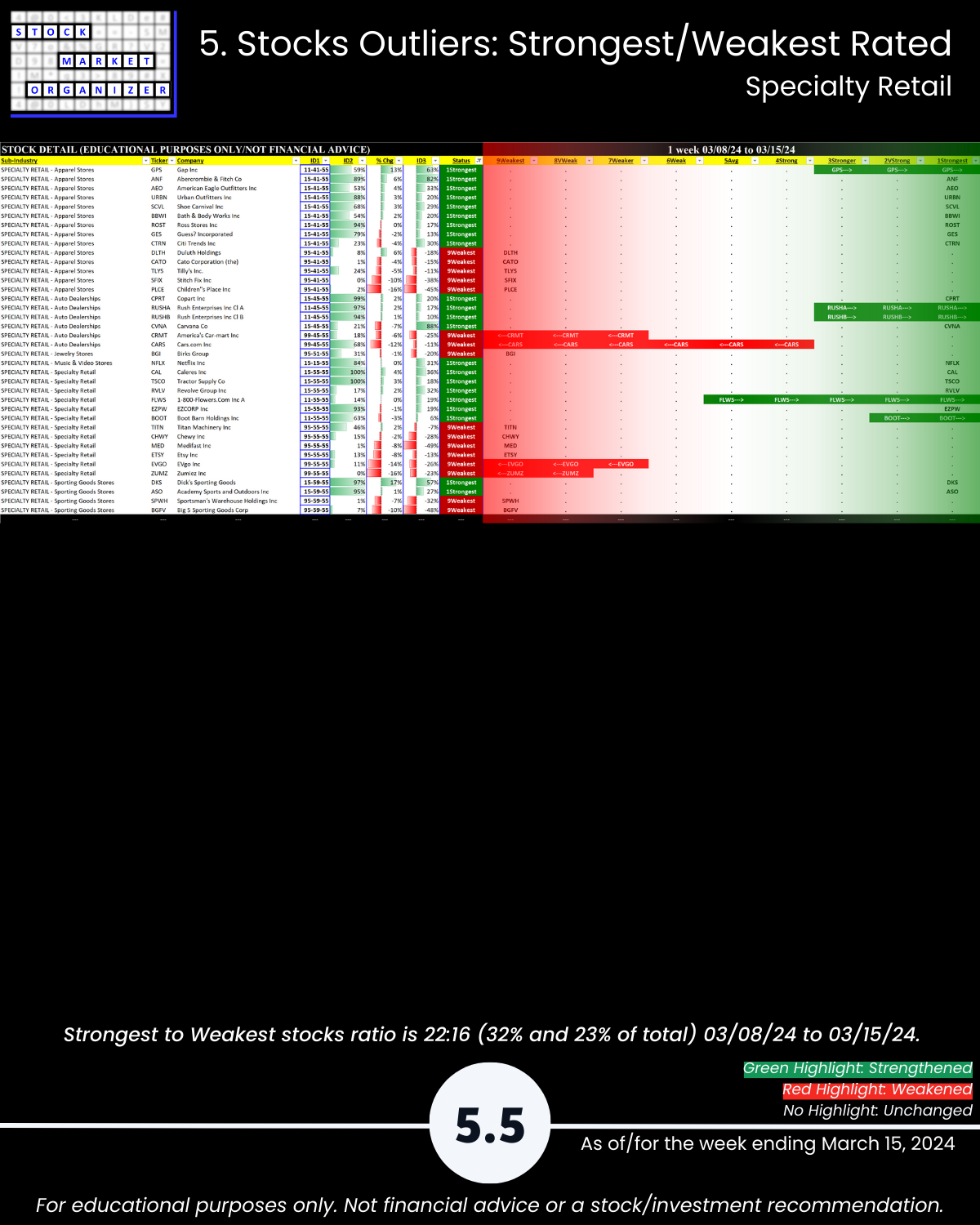

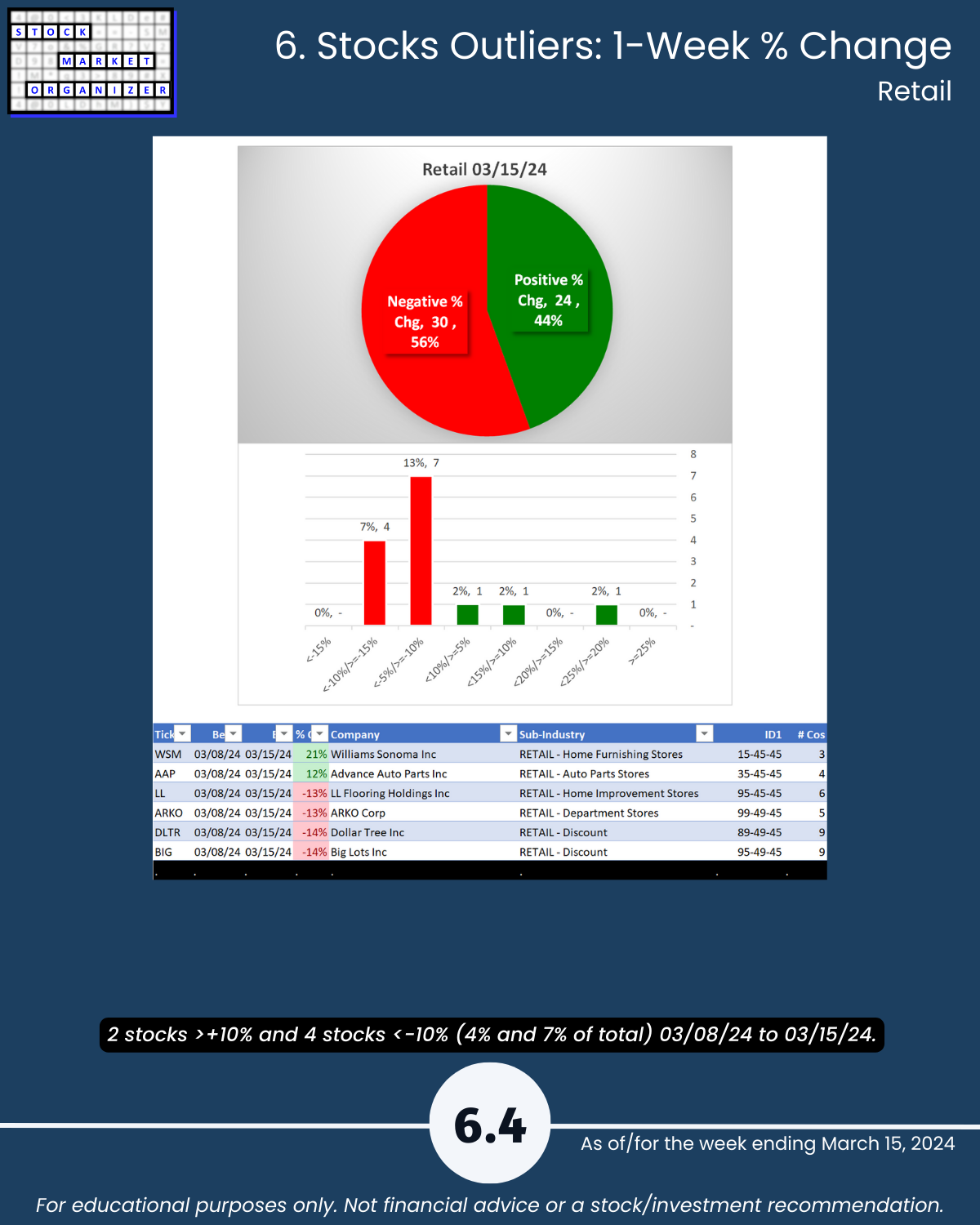

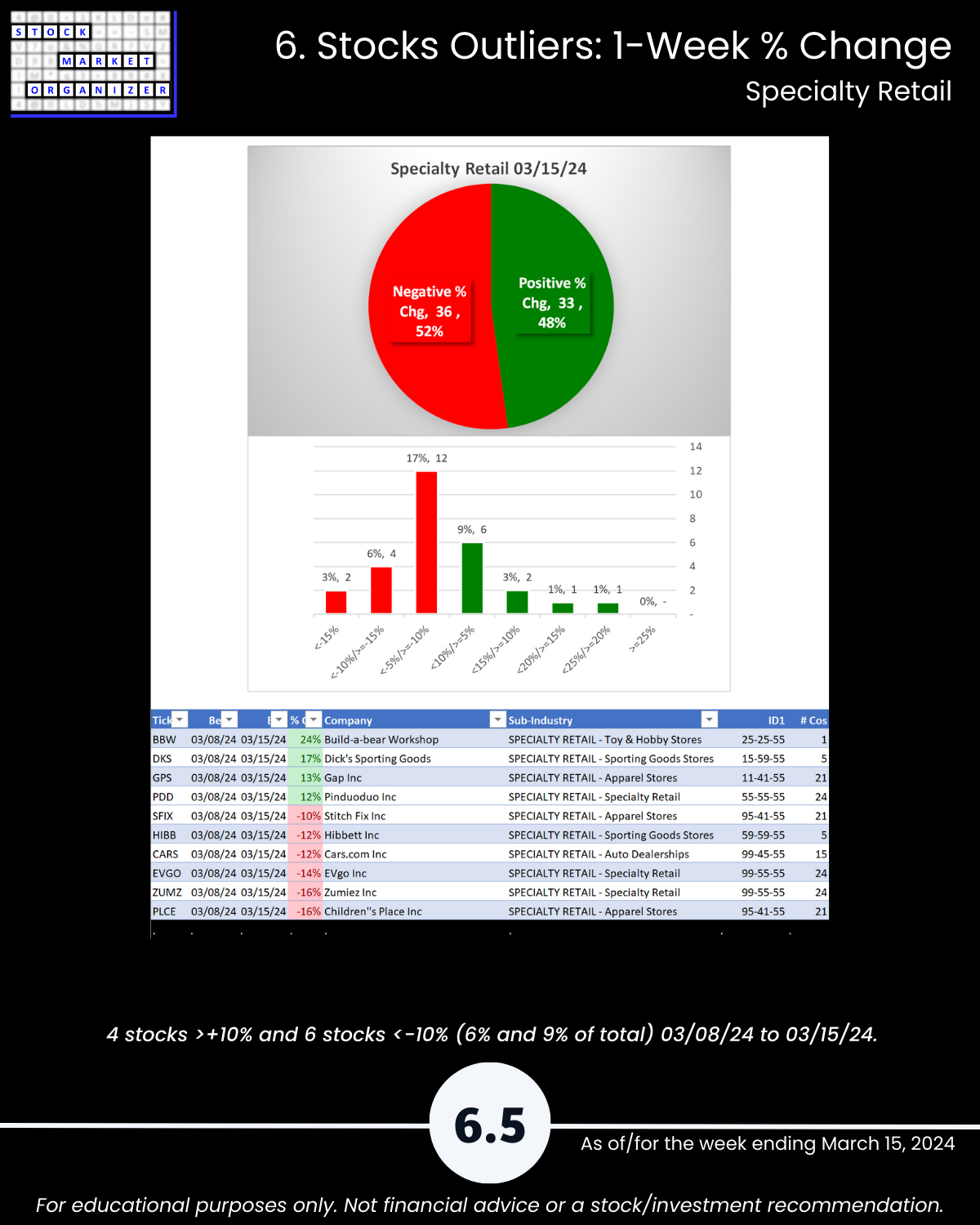

Attached: Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements in the Consumer Durables, Consumer Non-Durables, Food & Beverage, Retail, and Specialty Retail industries.

Takeaways:

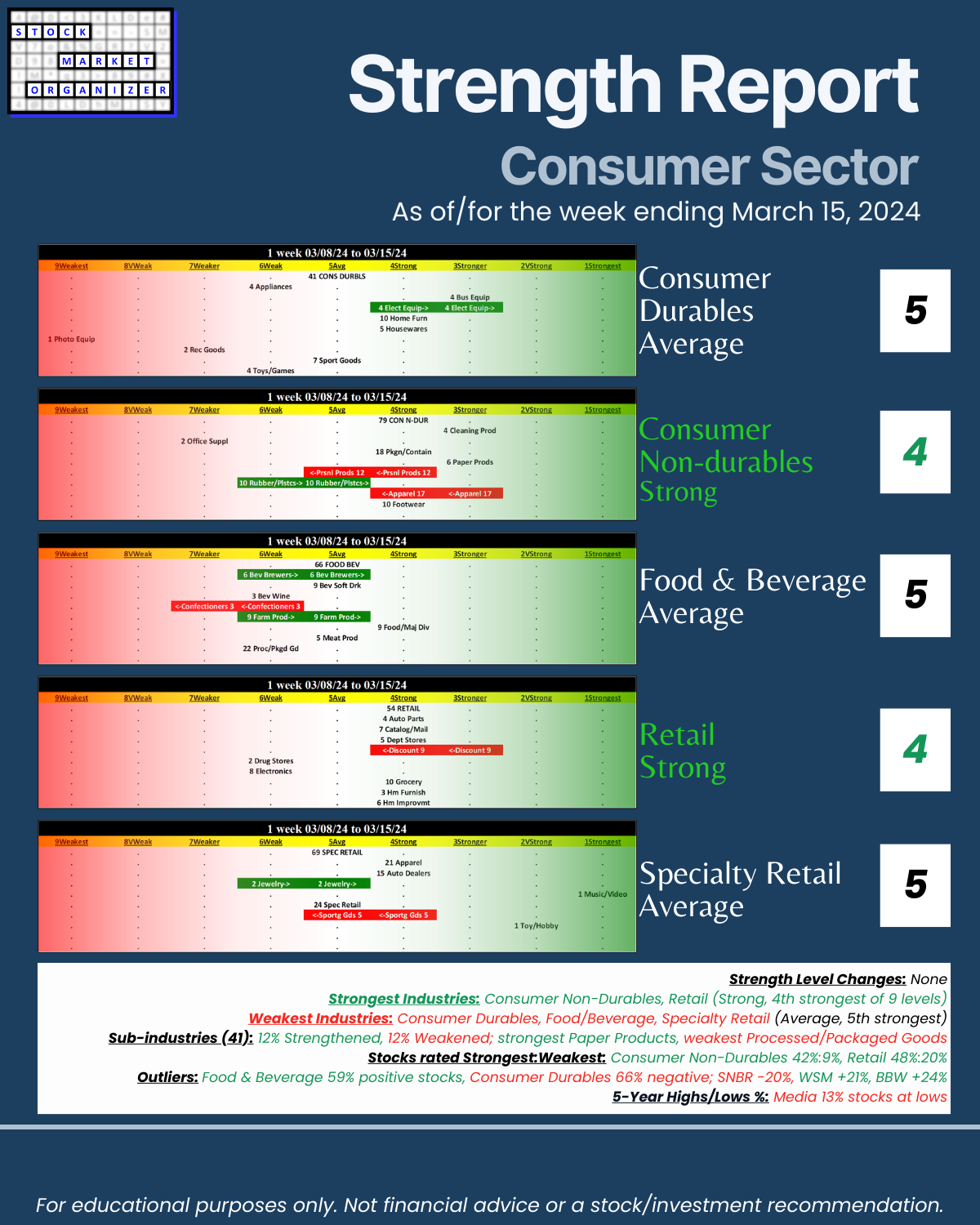

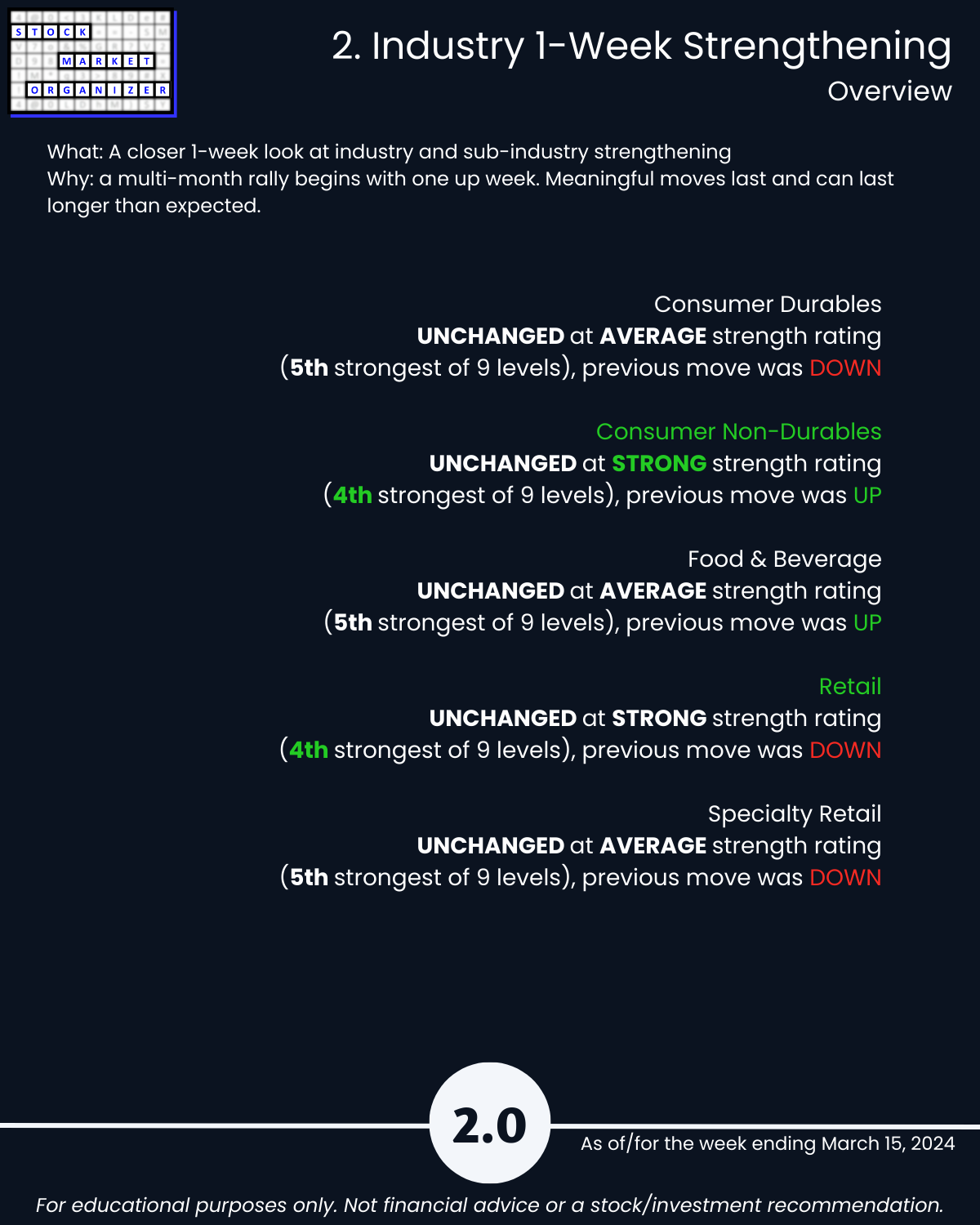

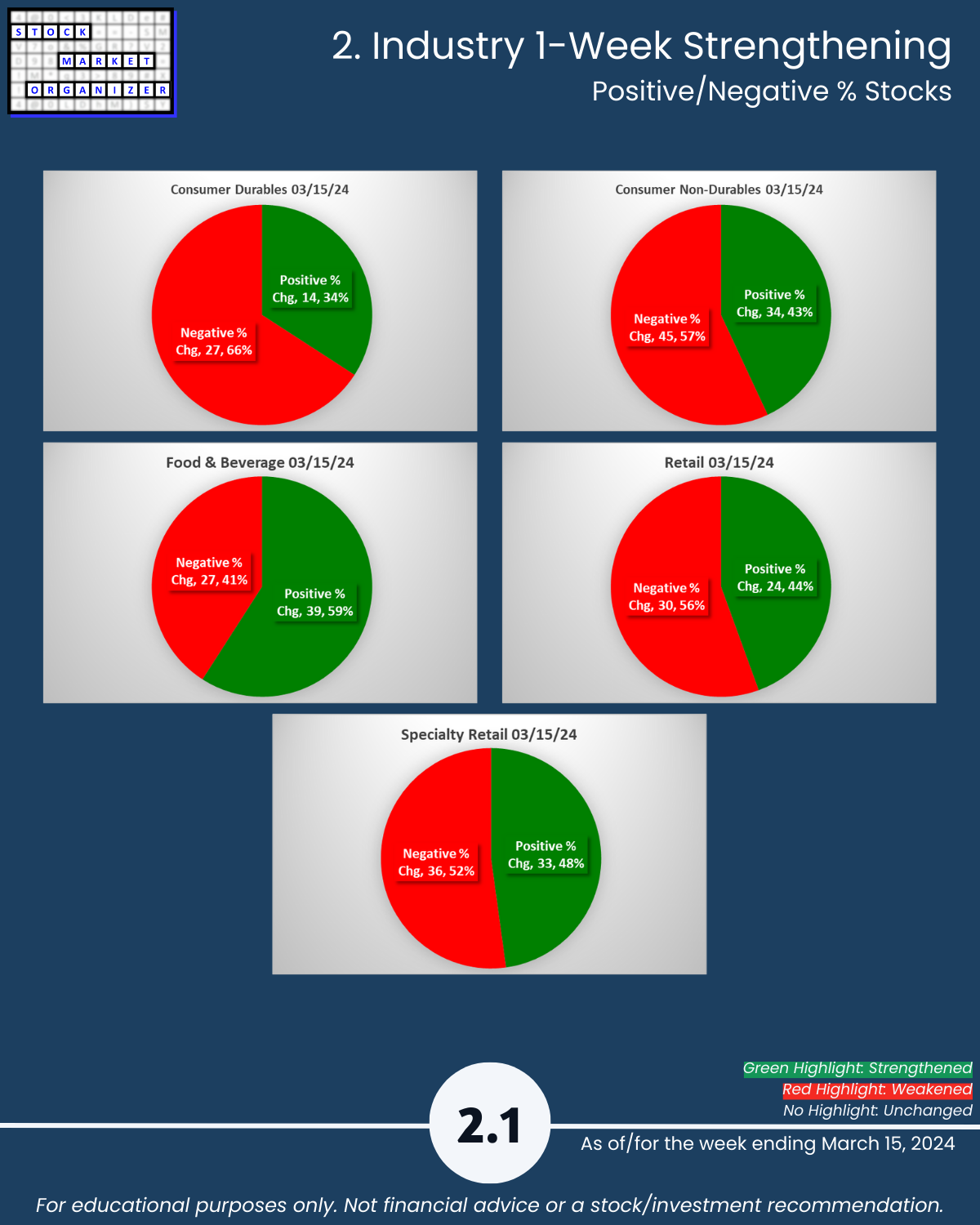

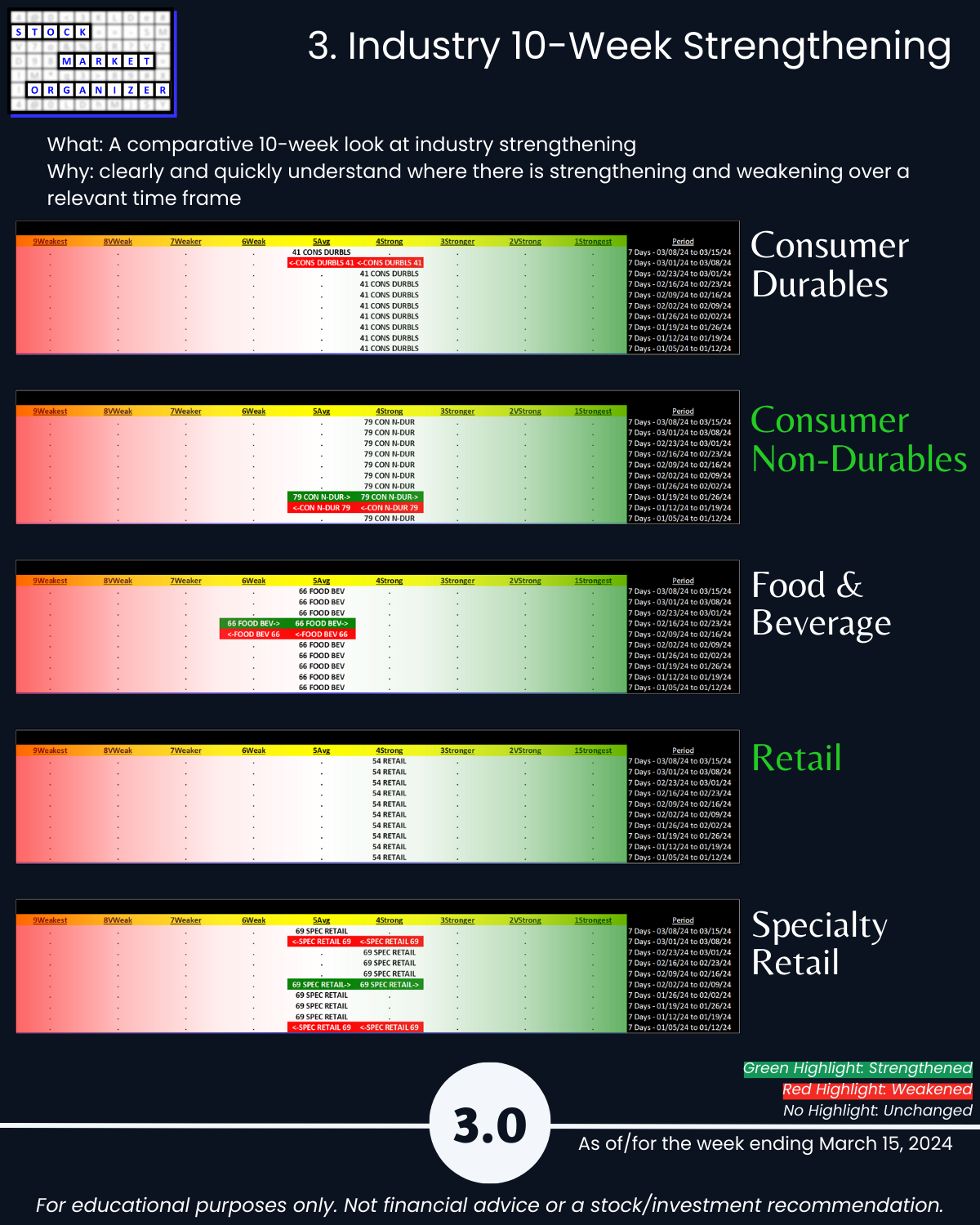

🔹 Strength Level Changes: None

🔹 Strongest Industries: Consumer Non-Durables, Retail (Strong, 4th strongest of 9 levels)

🔹 Weakest Industries: Consumer Durables, Food/Beverage, Specialty Retail (Average, 5th strongest)

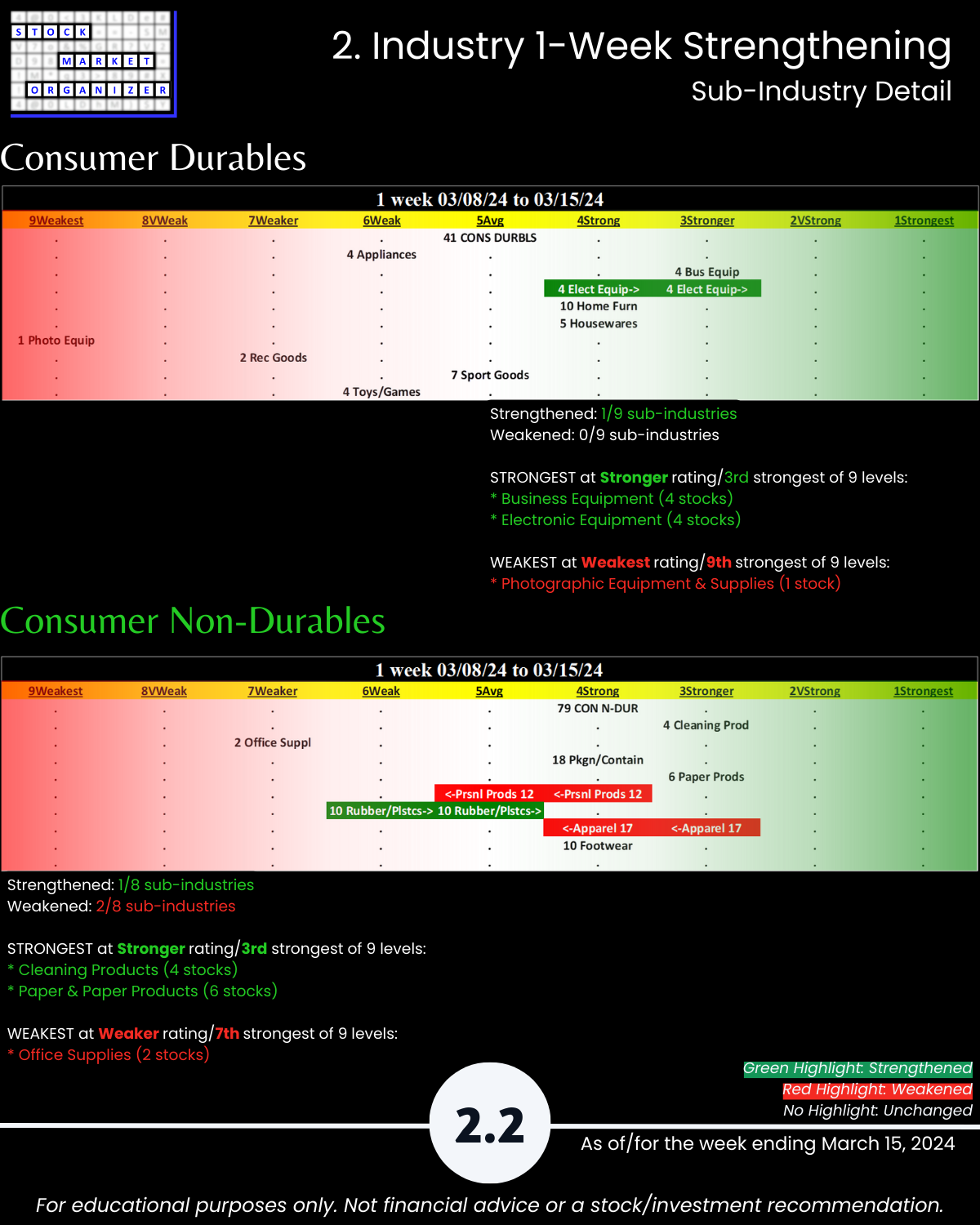

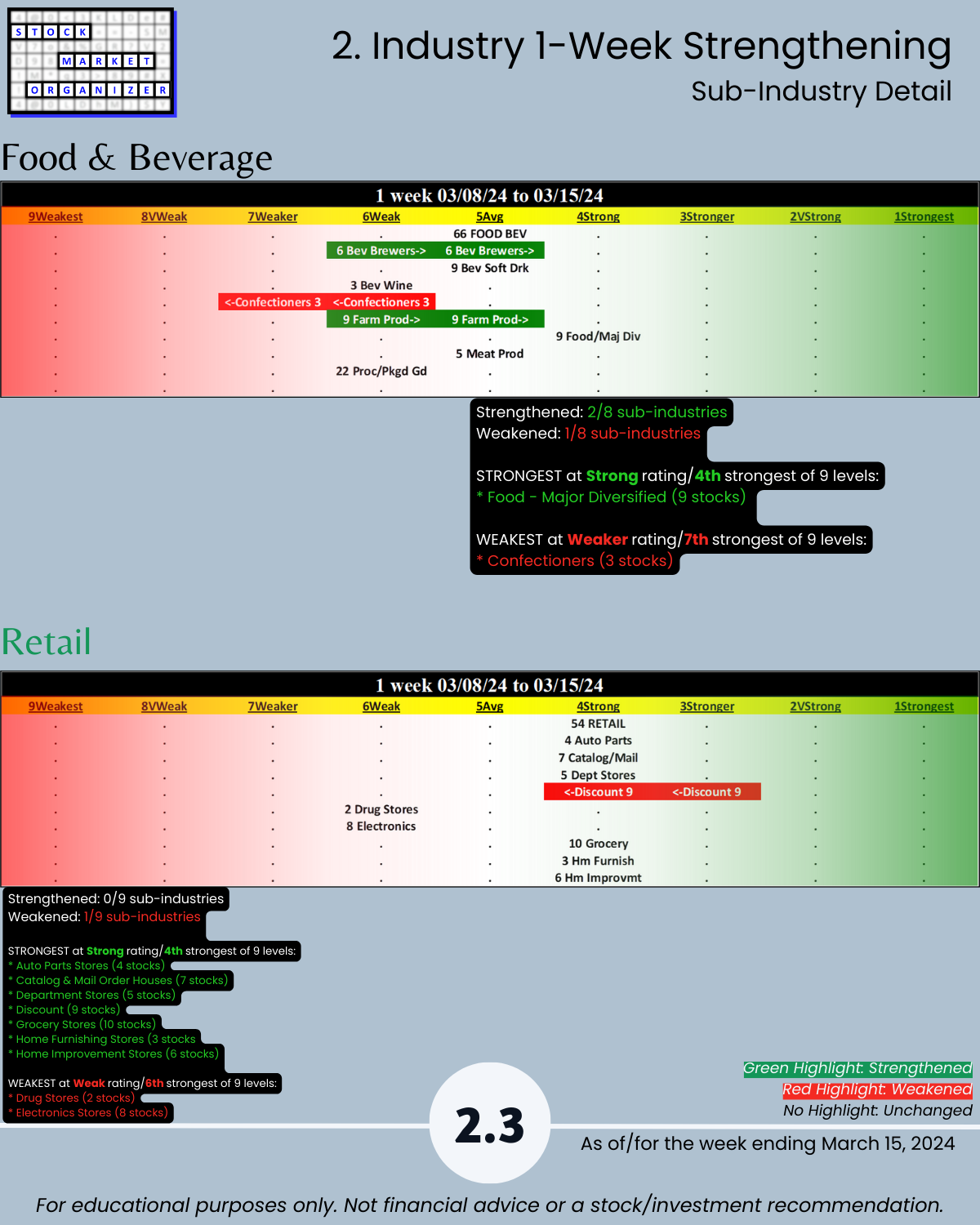

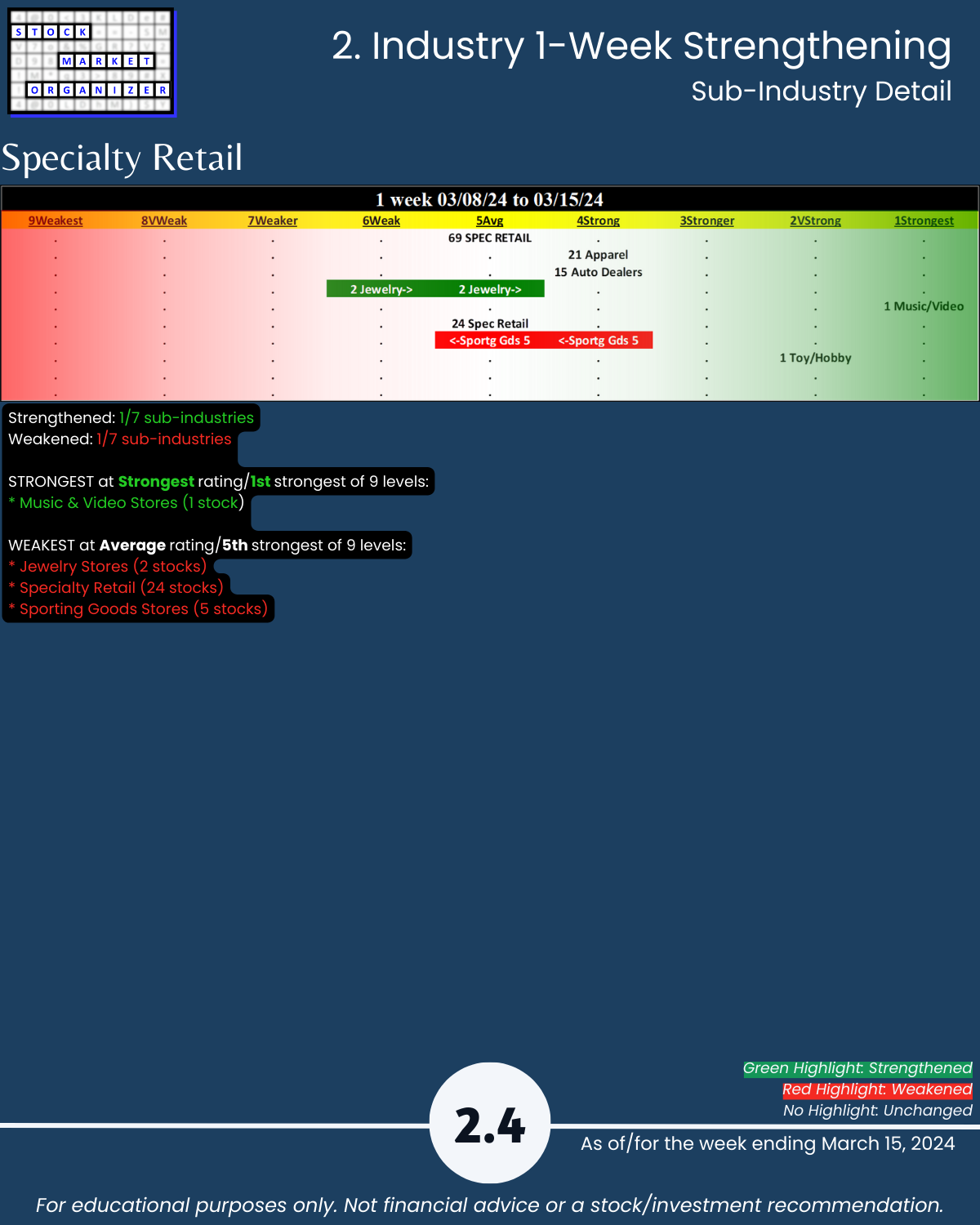

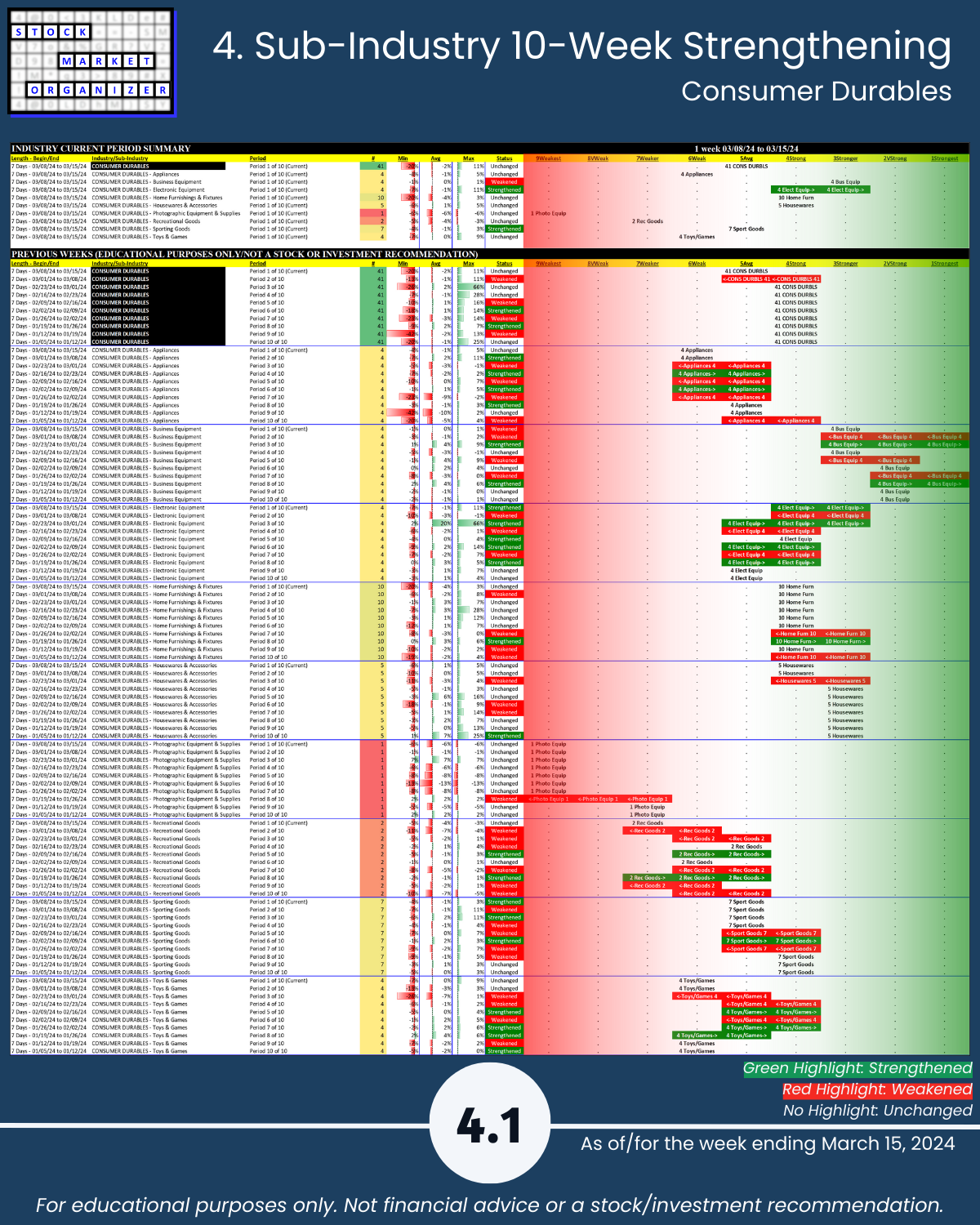

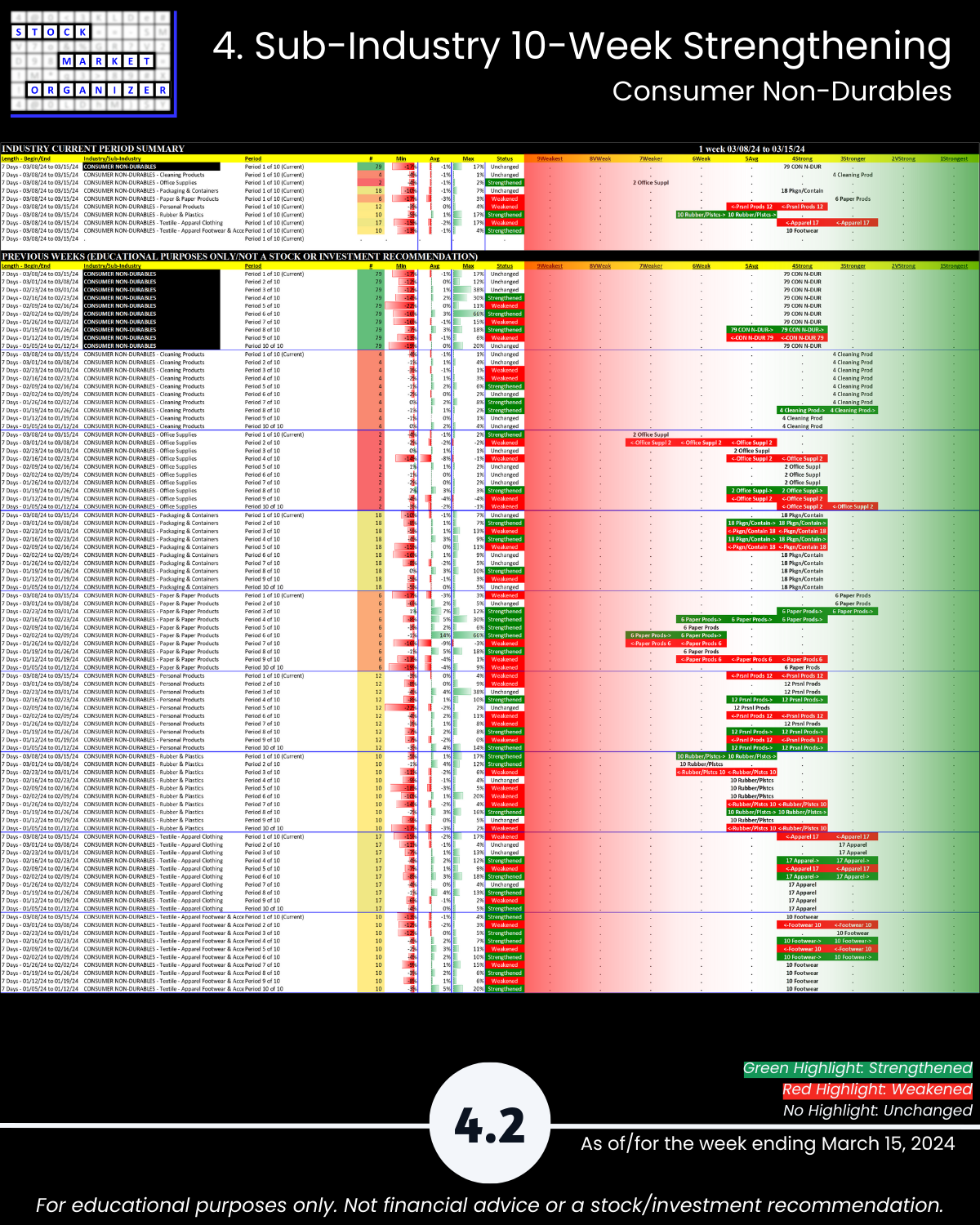

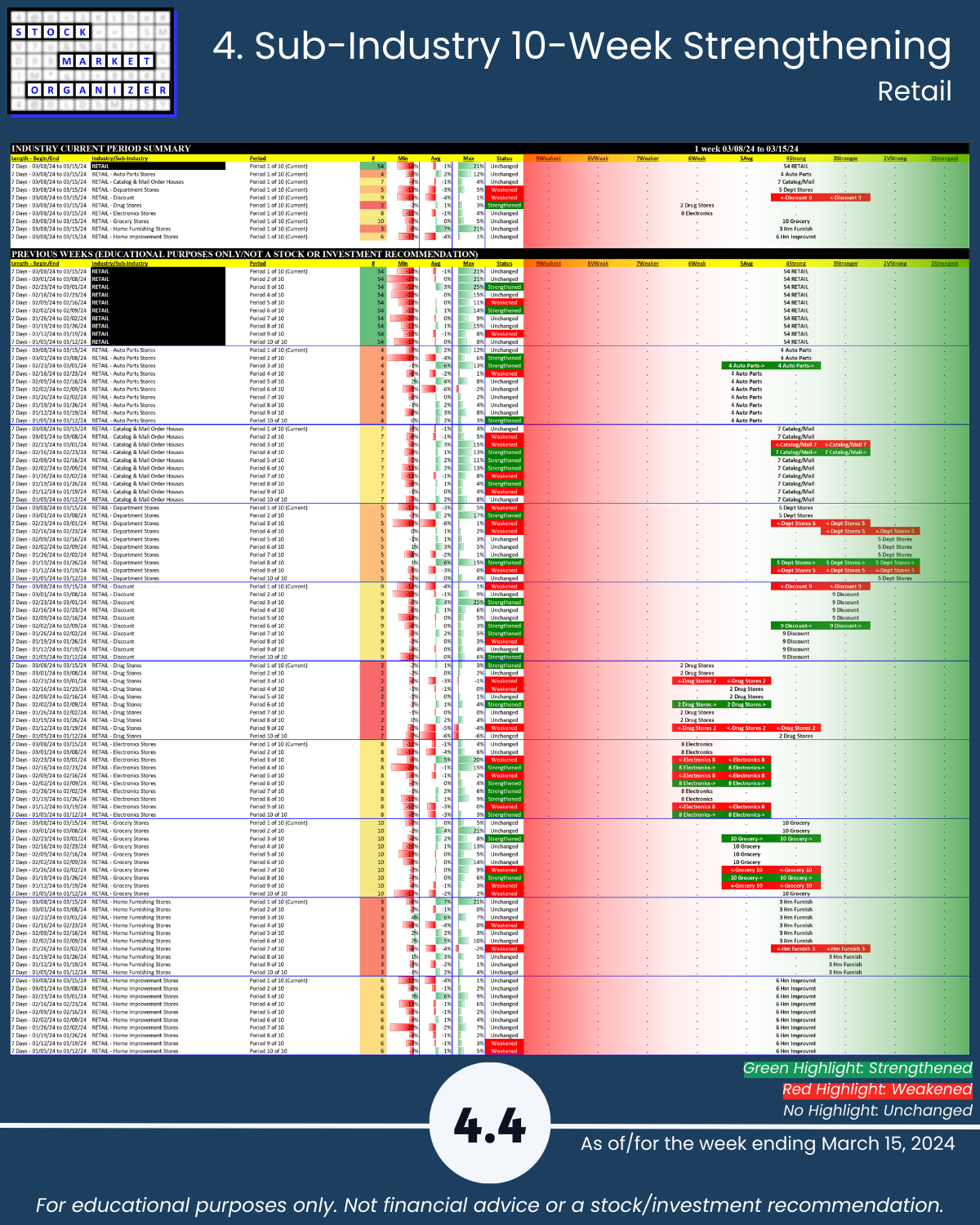

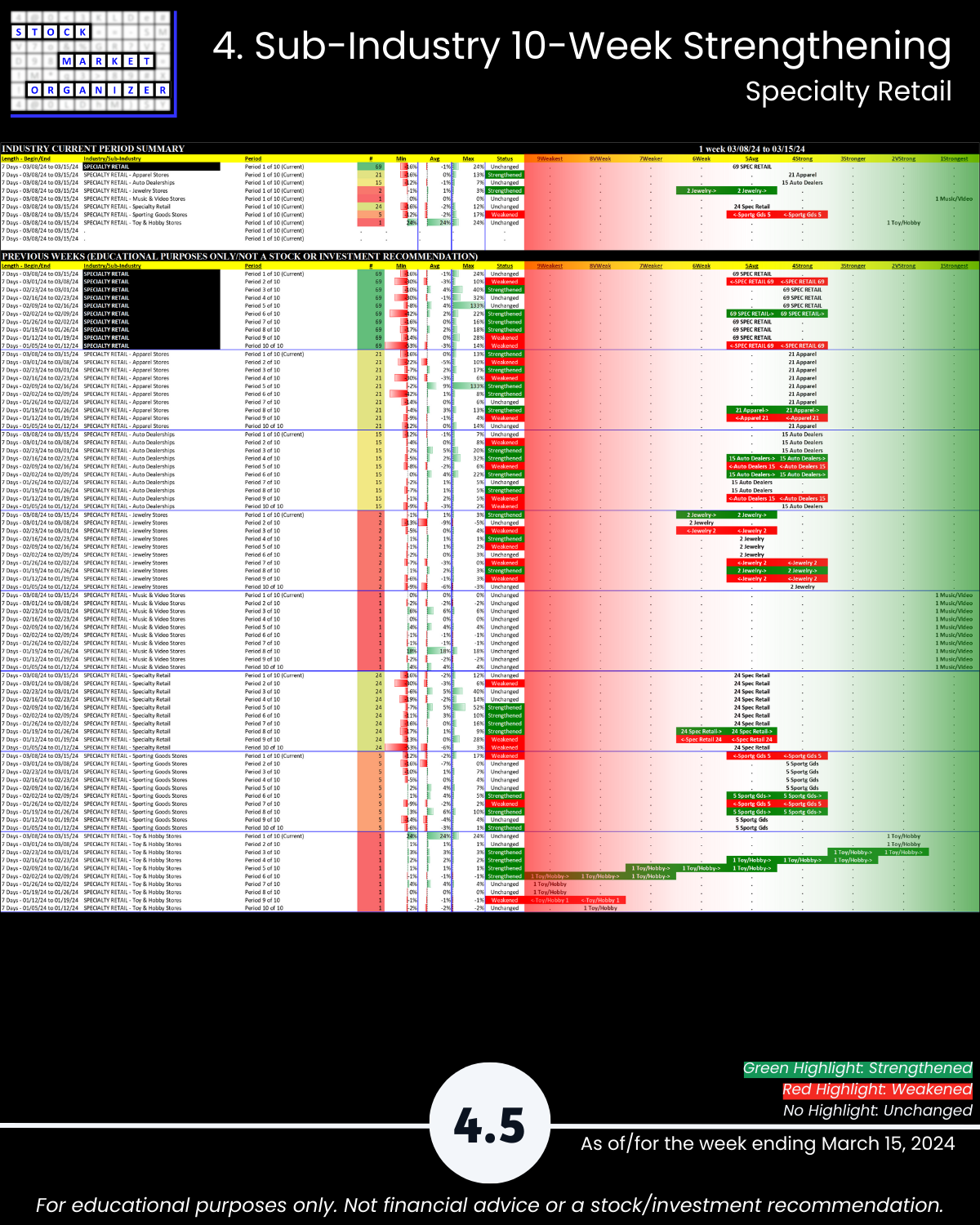

🔹 Sub-industries (41): 12% Strengthened, 12% Weakened; strongest Paper Products, weakest Processed/Packaged Goods

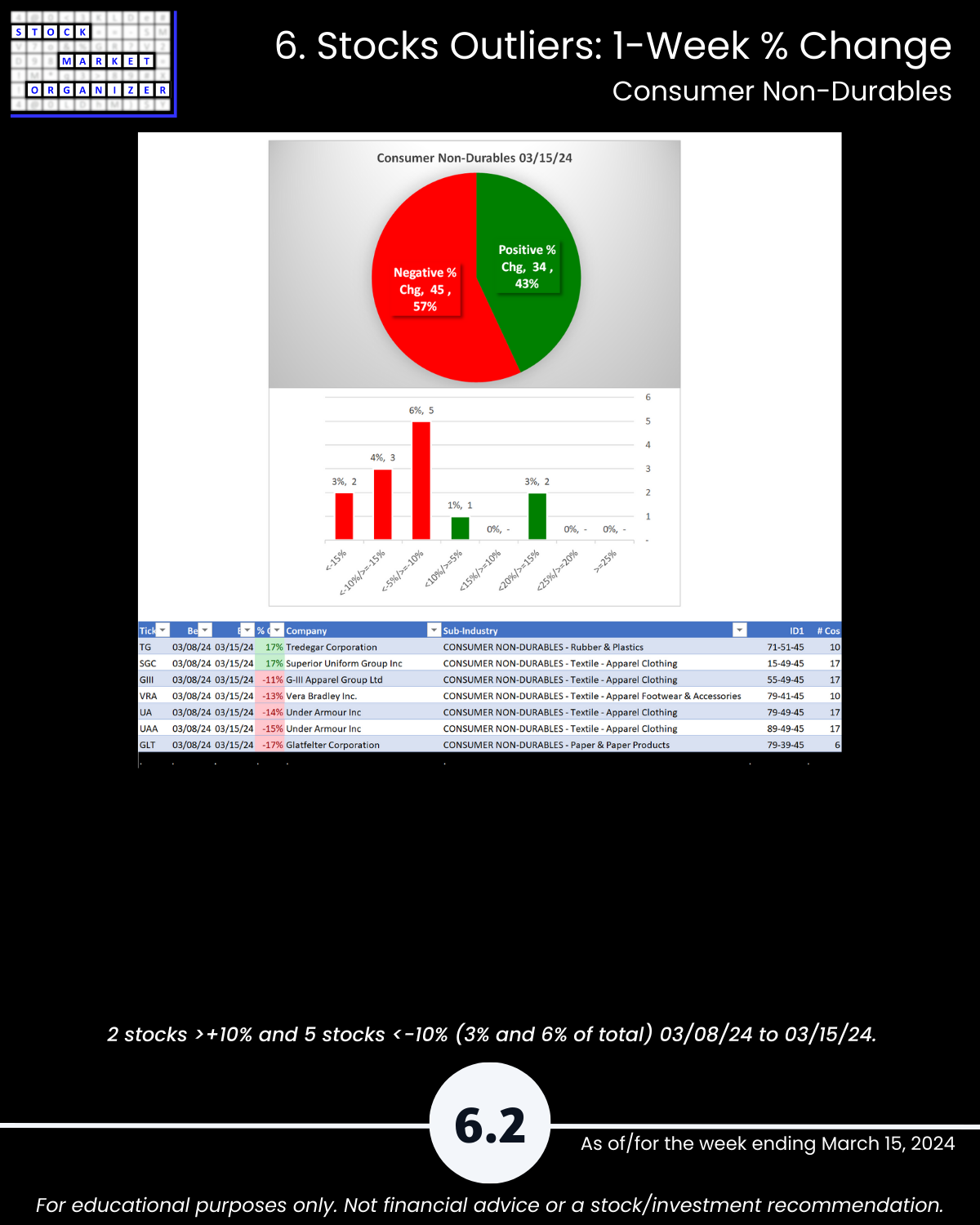

🔹 Stocks rated Strongest:Weakest: Consumer Non-Durables 42%:9%, Retail 48%:20%

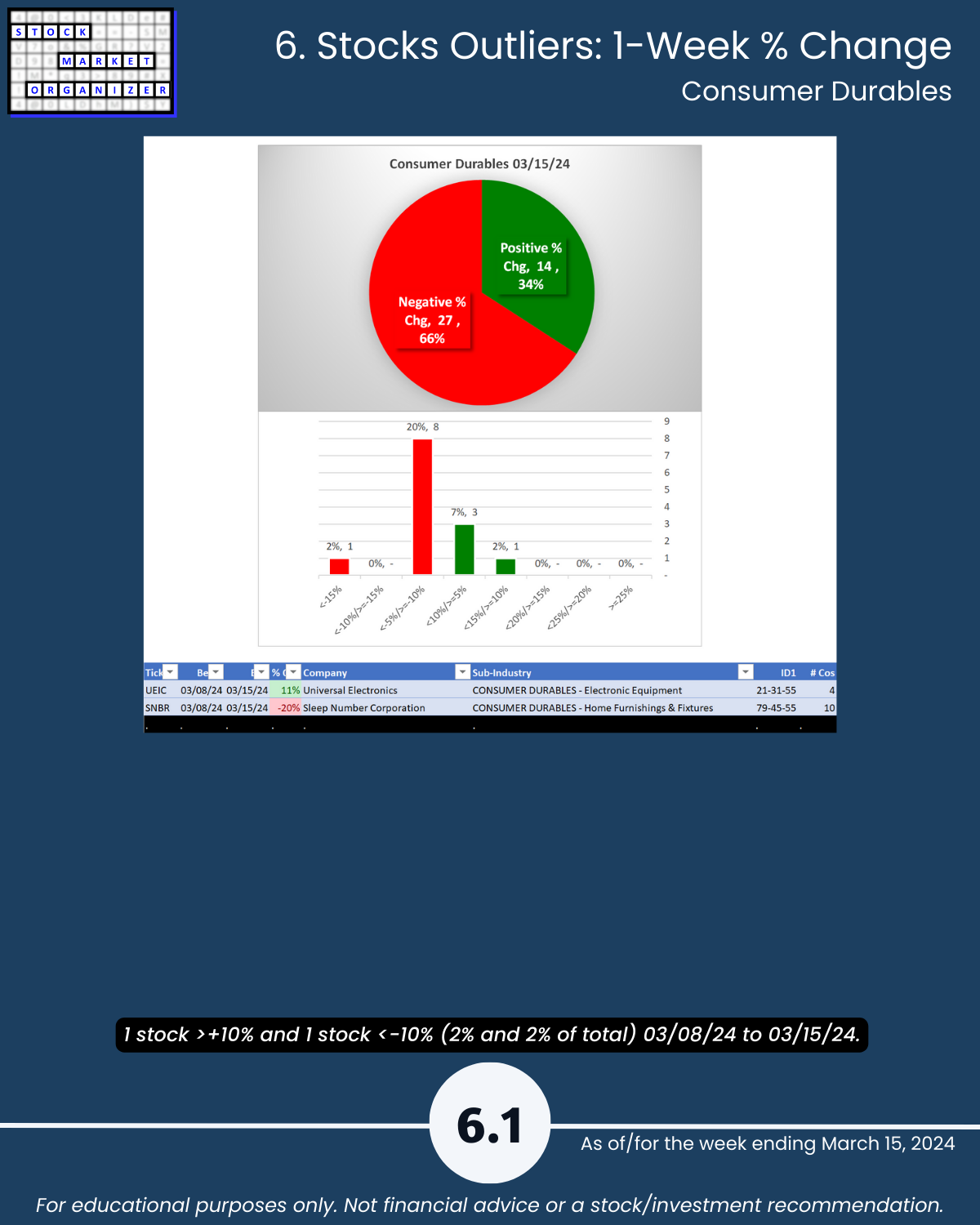

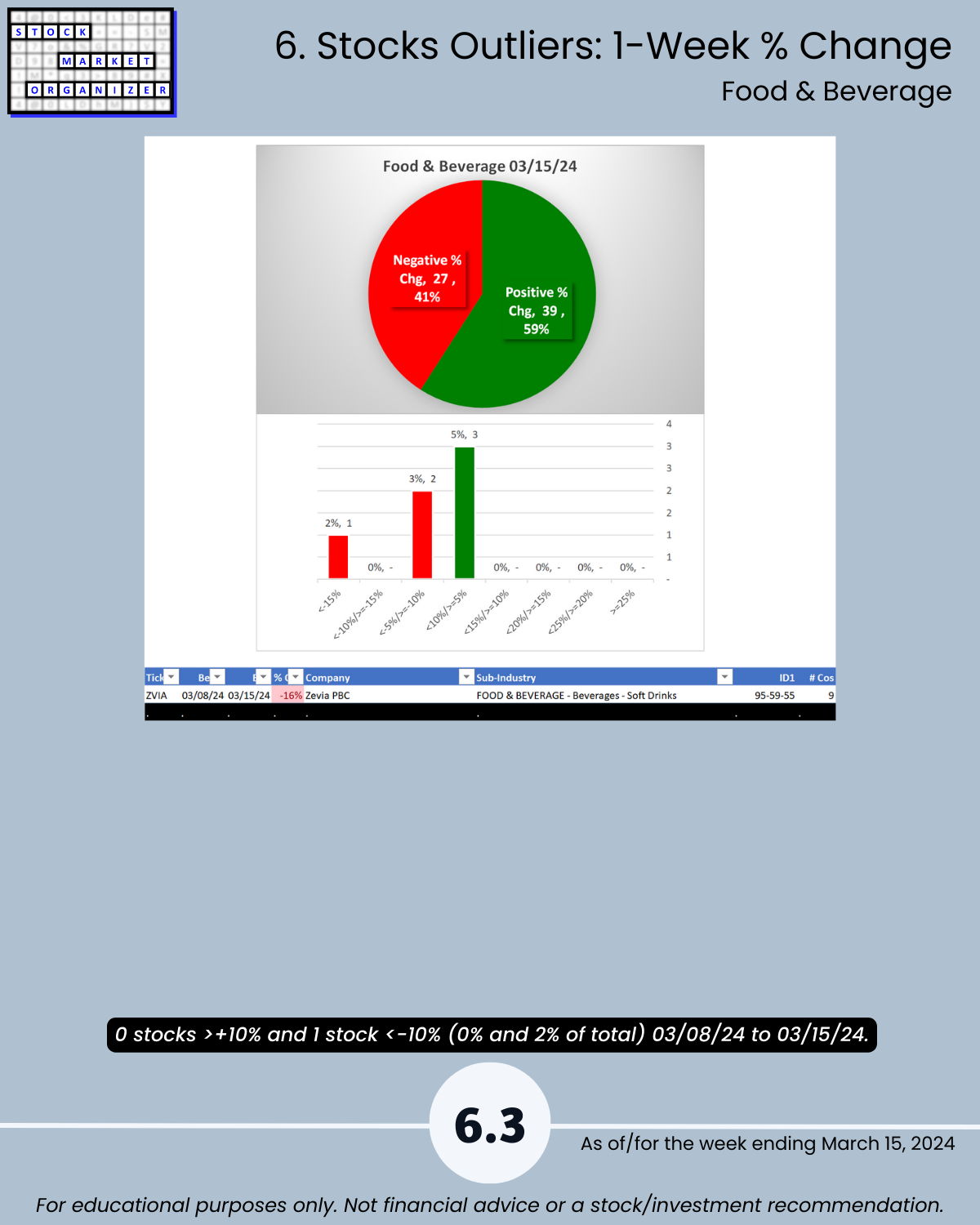

🔹 Outliers: Food & Beverage 59% positive stocks, Consumer Durables 66% negative; SNBR -20%, WSM +21%, BBW +24%

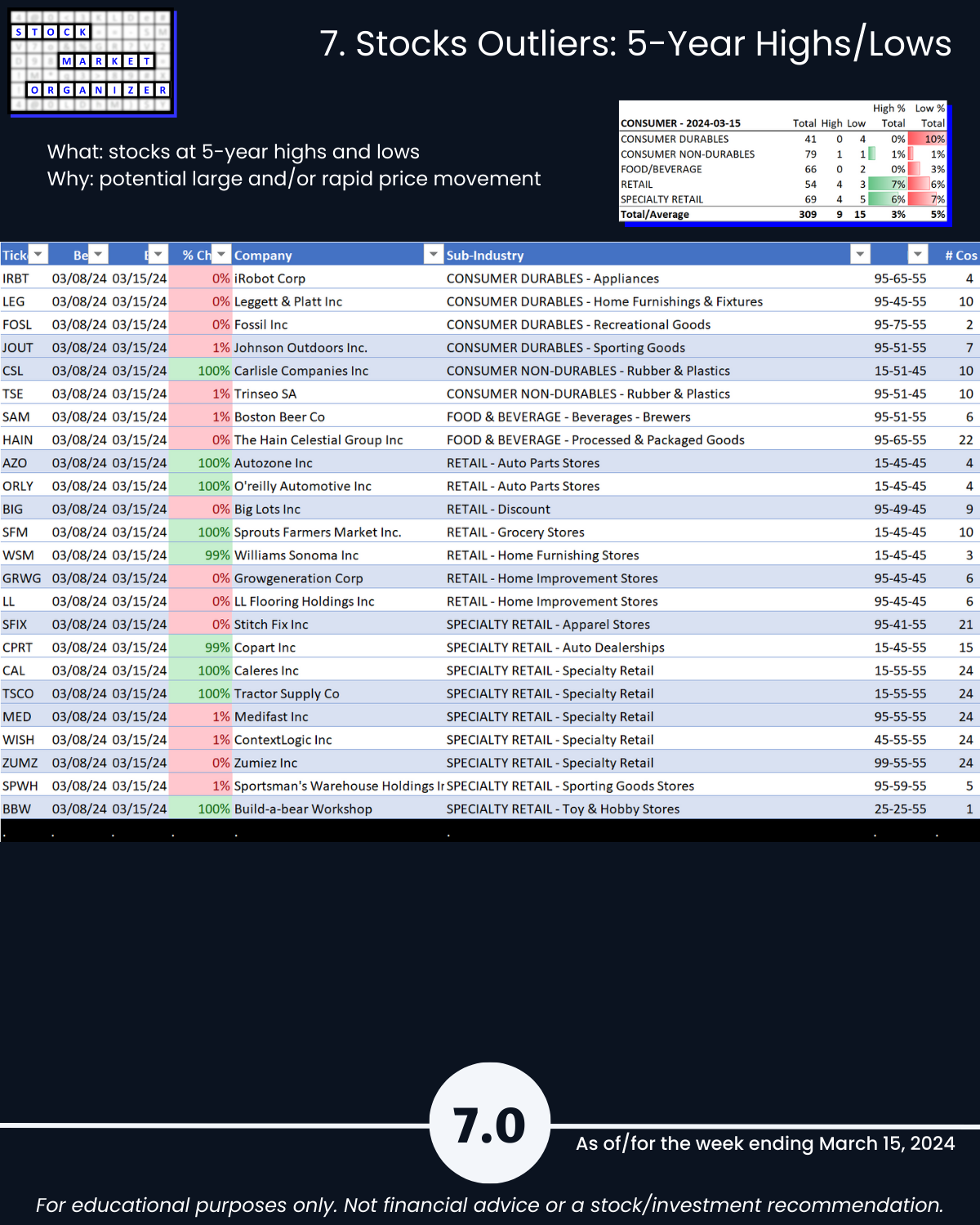

🔹 5-Year Highs/Lows %: Media 13% stocks at lows

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

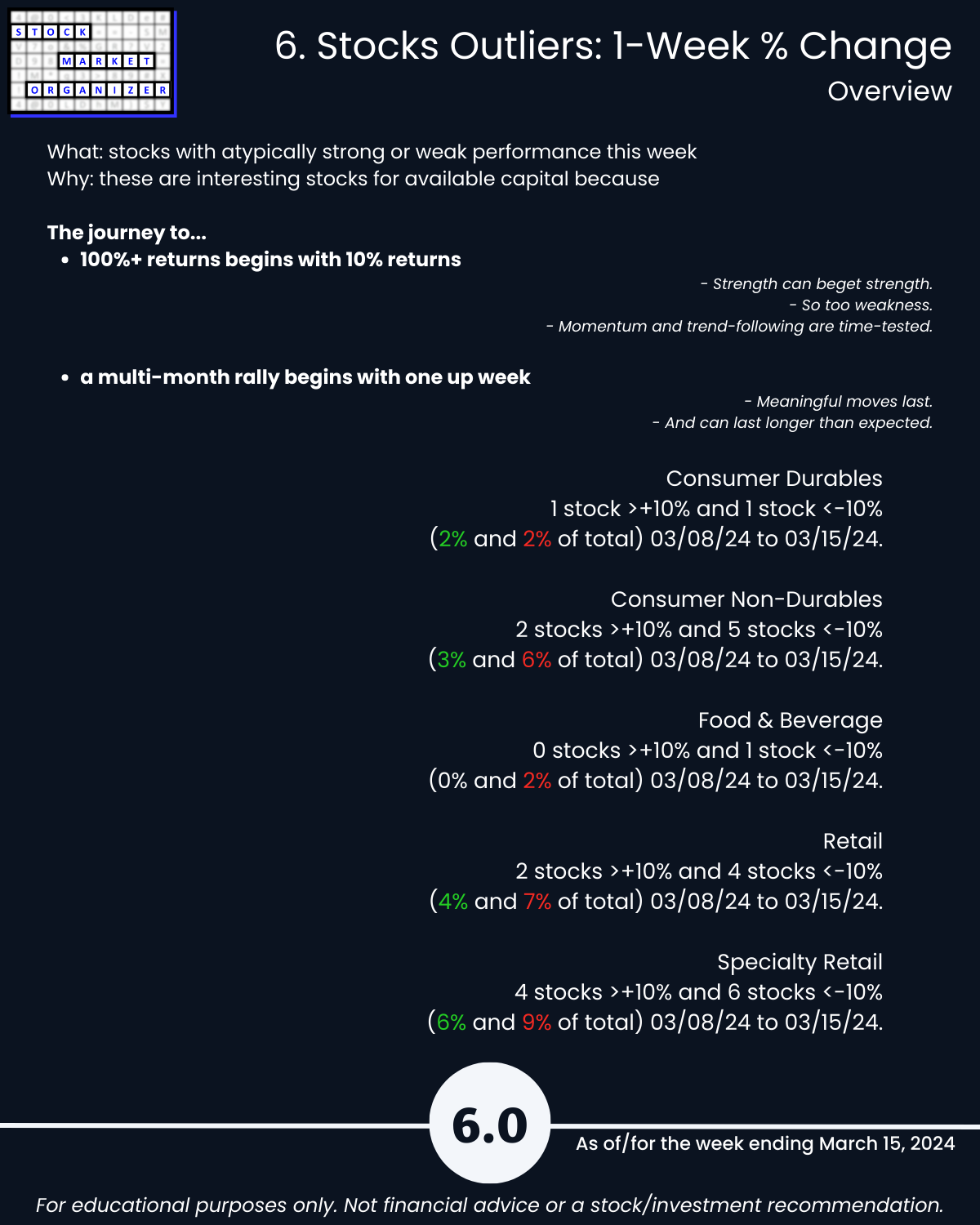

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows