SMO Exclusive: Strength Report Consumer Sector 2024-03-08

Stock Market Strength Stacking: your P&L’s BFF. (More below.) Consumer Sector analysis 3/8/24, 2 of 5 industries WEAKENED. If you’re not watching everywhere for strengthening opportunities, how do you know what you are missing? CVNA, POWL, LIM, SKYW and ANF are all non-AI/not NVDA 200%+ 1-year club members. ANF +329% 1 year vs. NVDA +262%.

Strength can beget strength. Same with weakness. Yes, 10% returns turn into -10% returns. Yet 10% returns are needed to turn into 100% returns. And more. 10%+ returns = strengthening = something to look for, not fear.

Stock strengthening + a rising sub-industry, industry, and market = strength stacking at its finest.

And you don’t have to catch exact bottoms to enjoy healthy returns. SKYW +49% in 4 months 11/14/23 to 3/8/24 - AFTER it rose 200% December 2022 to August 2023. (49% in this period was a top 5% return in my universe.)

Strength can beget strength. Look for it.

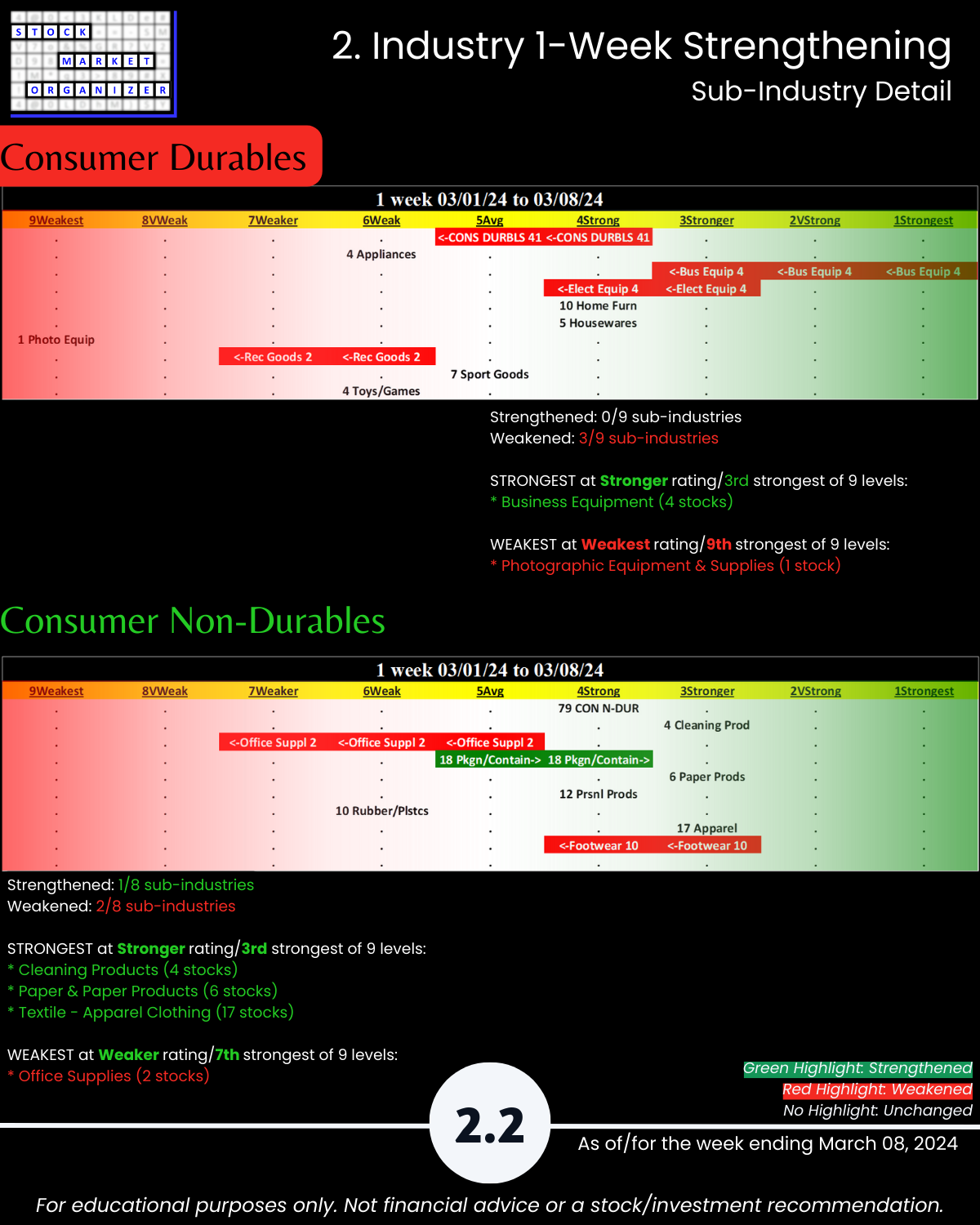

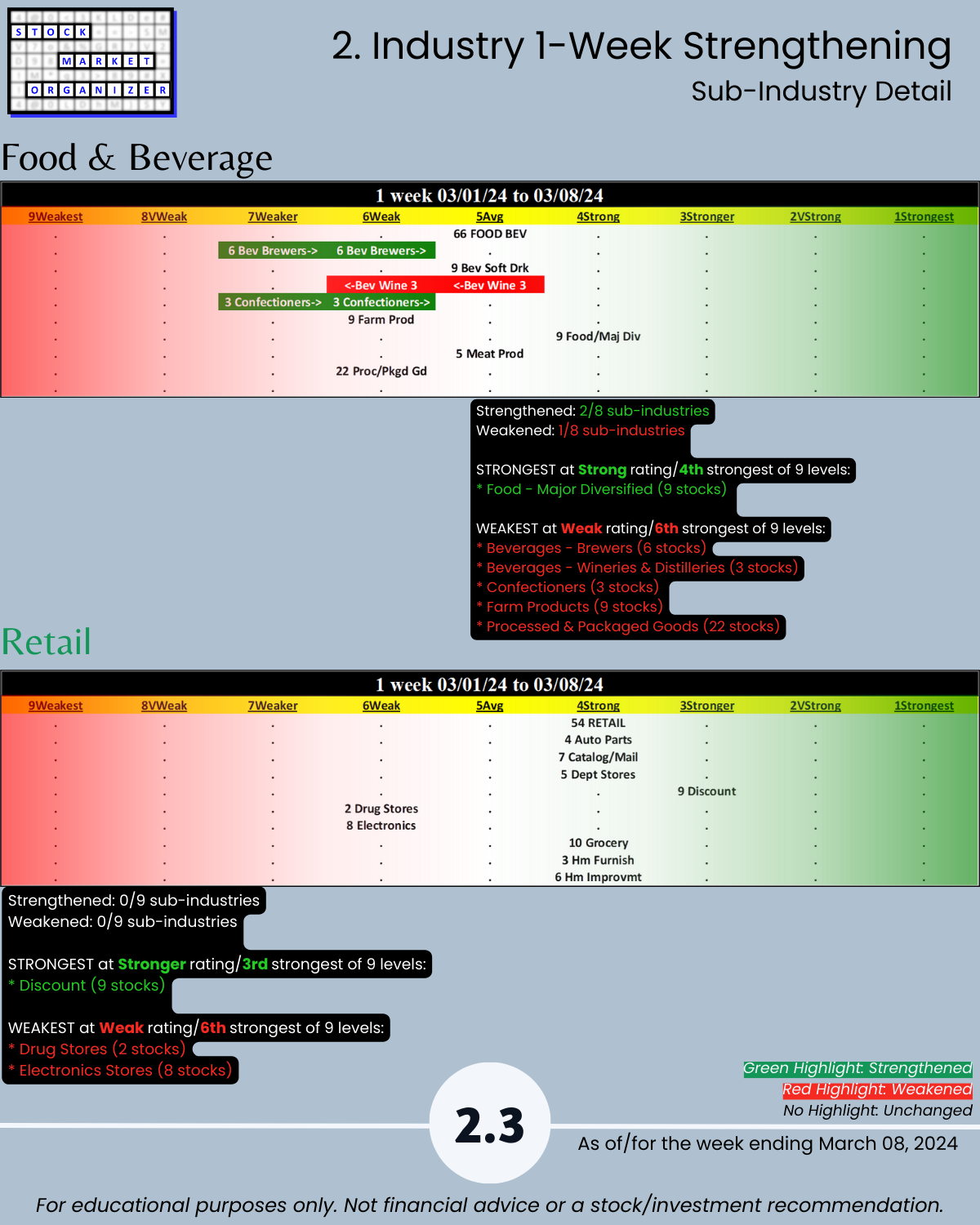

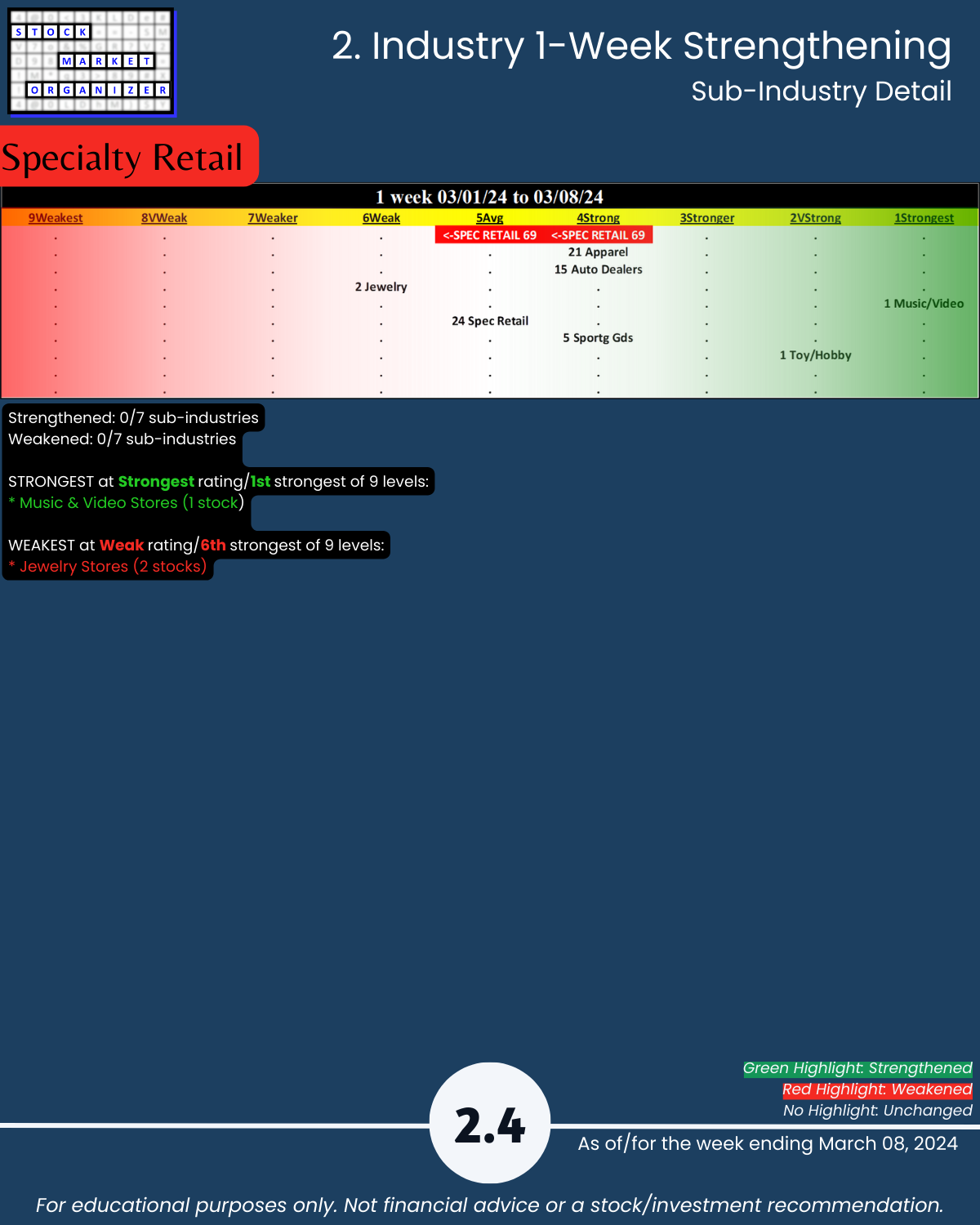

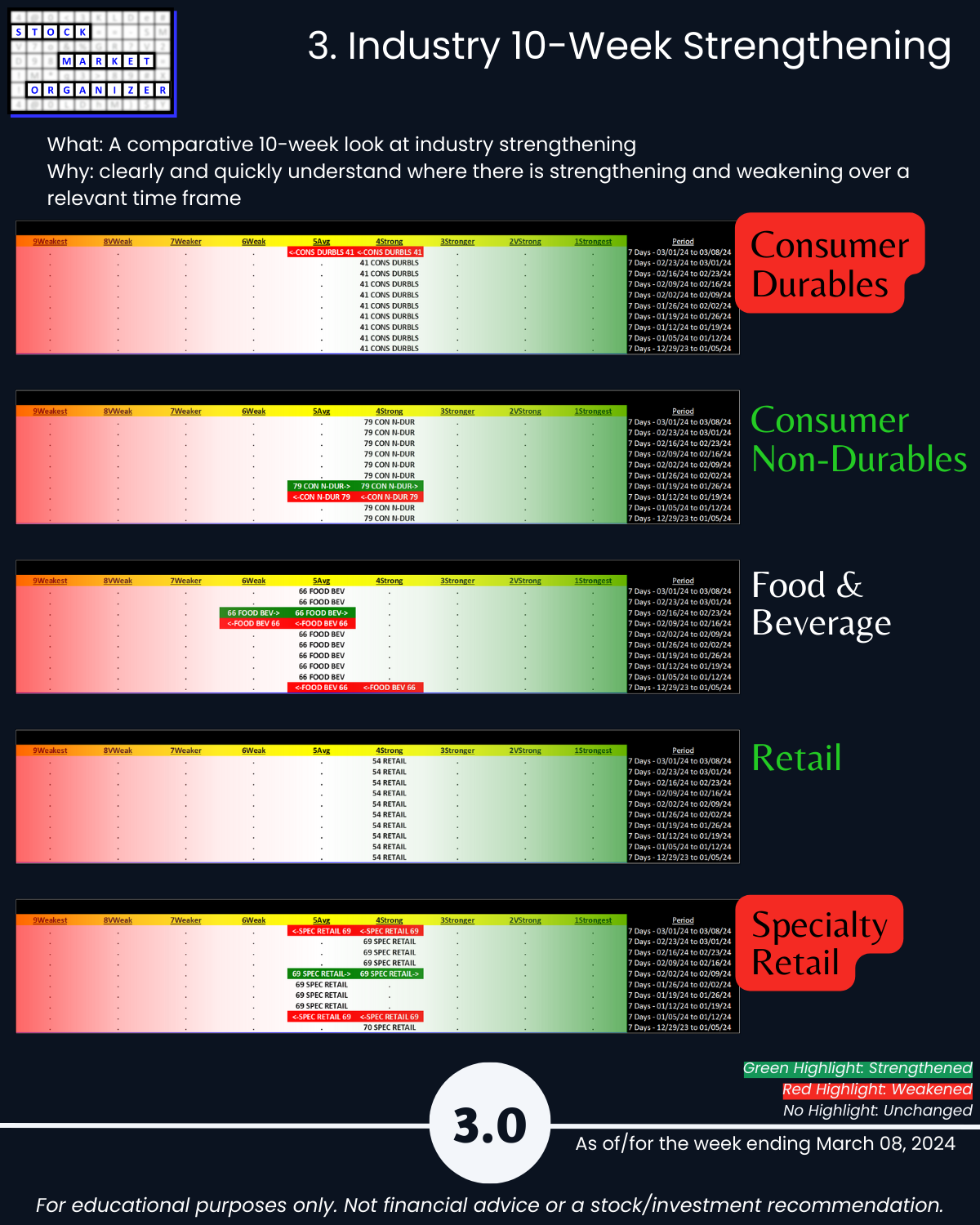

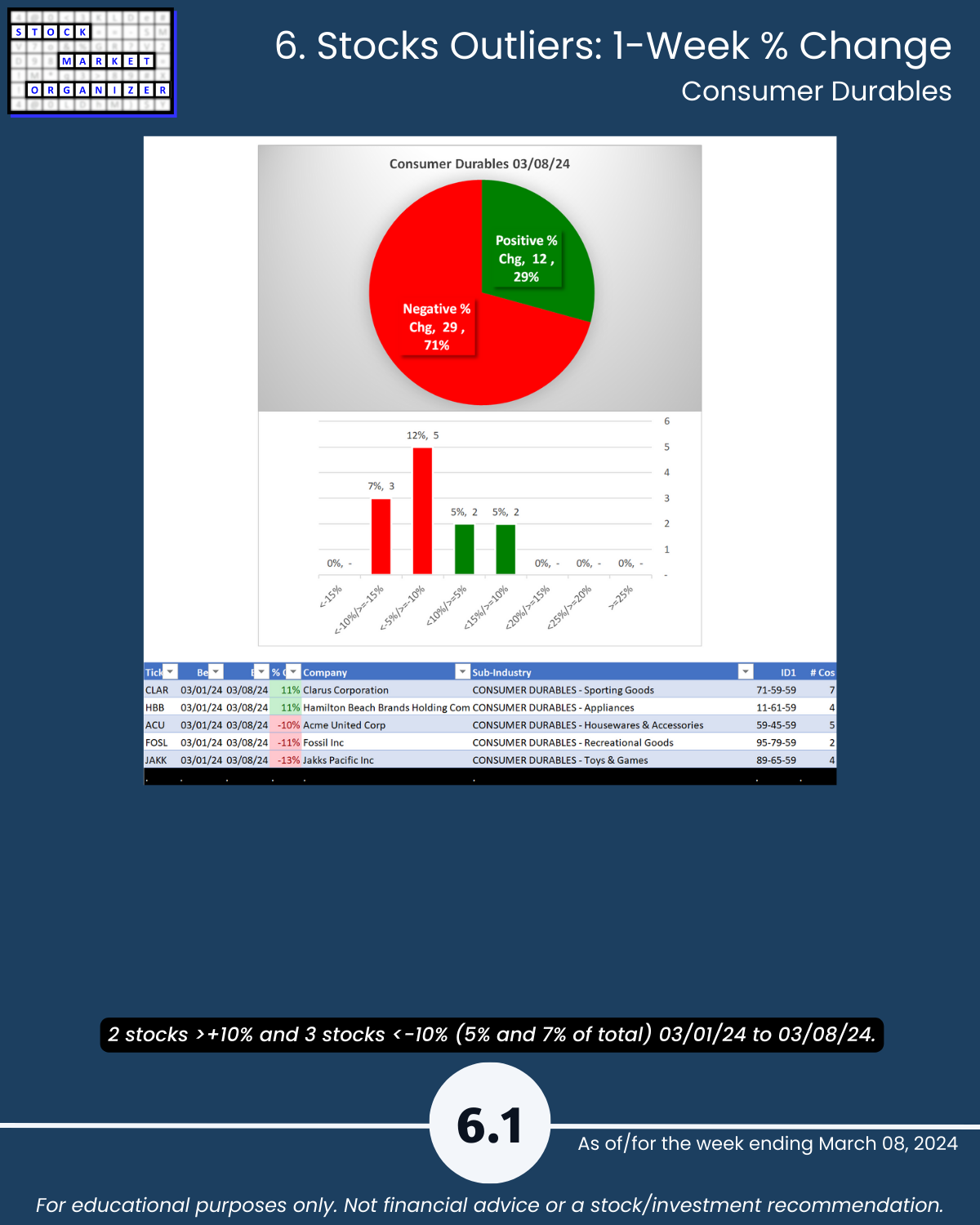

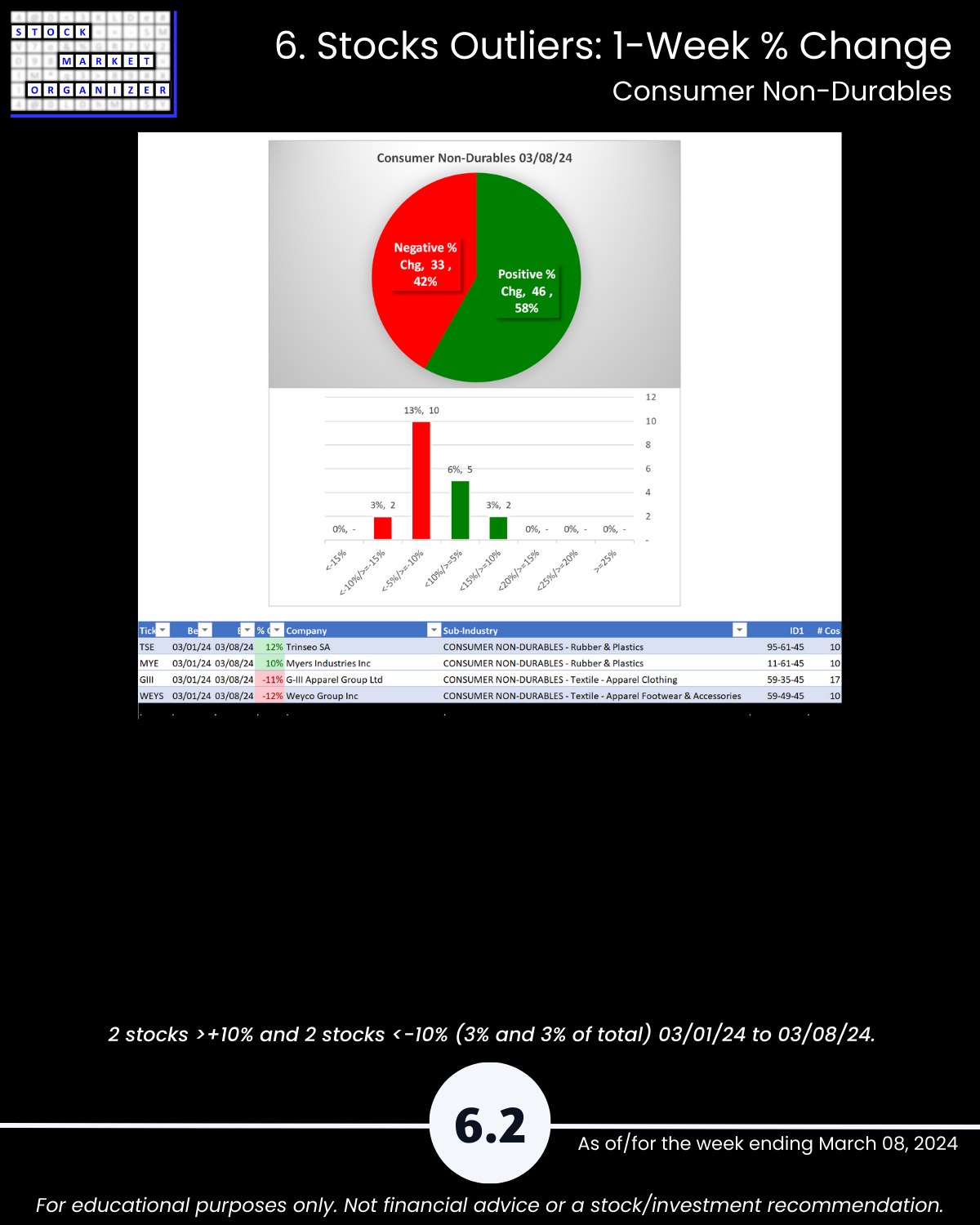

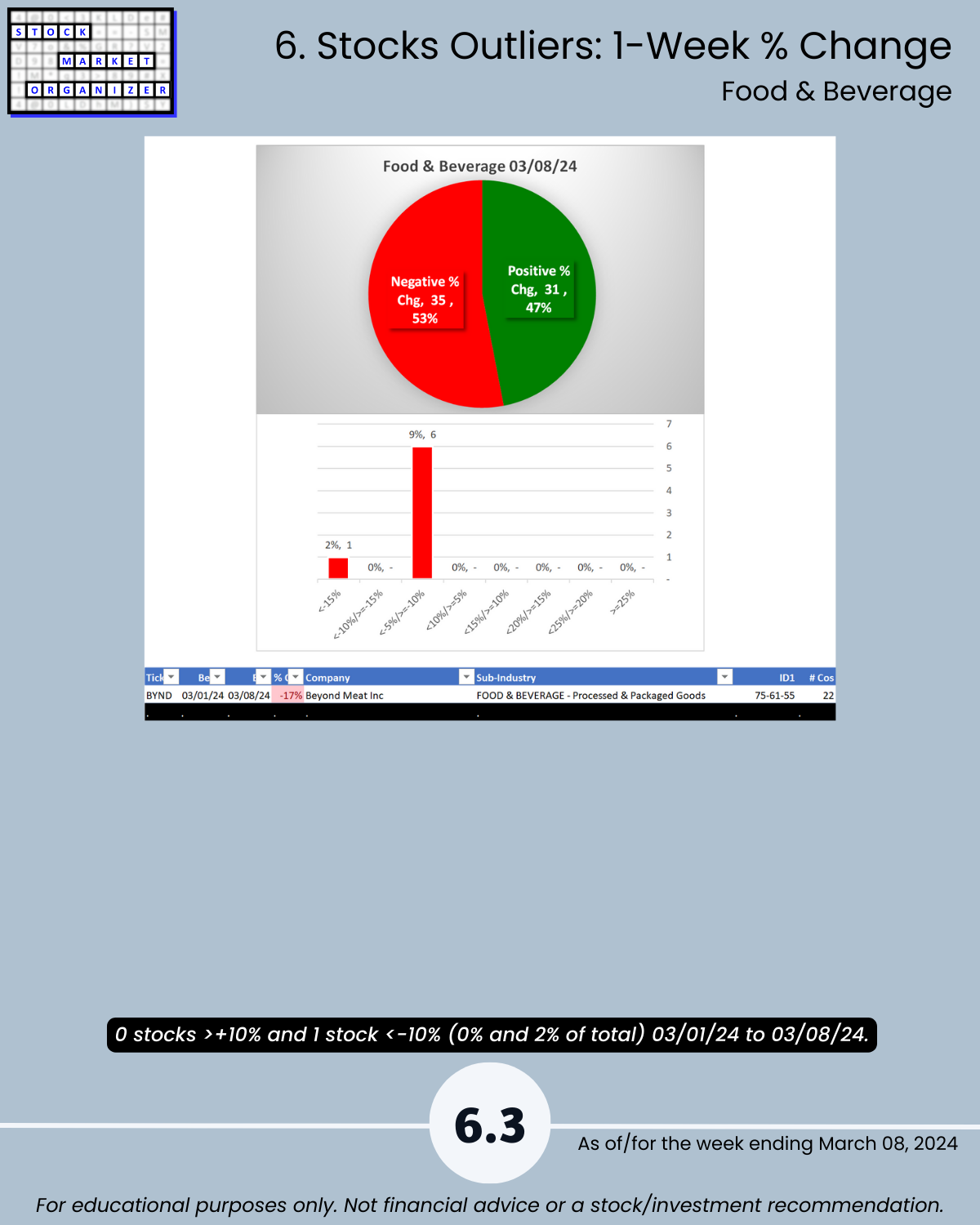

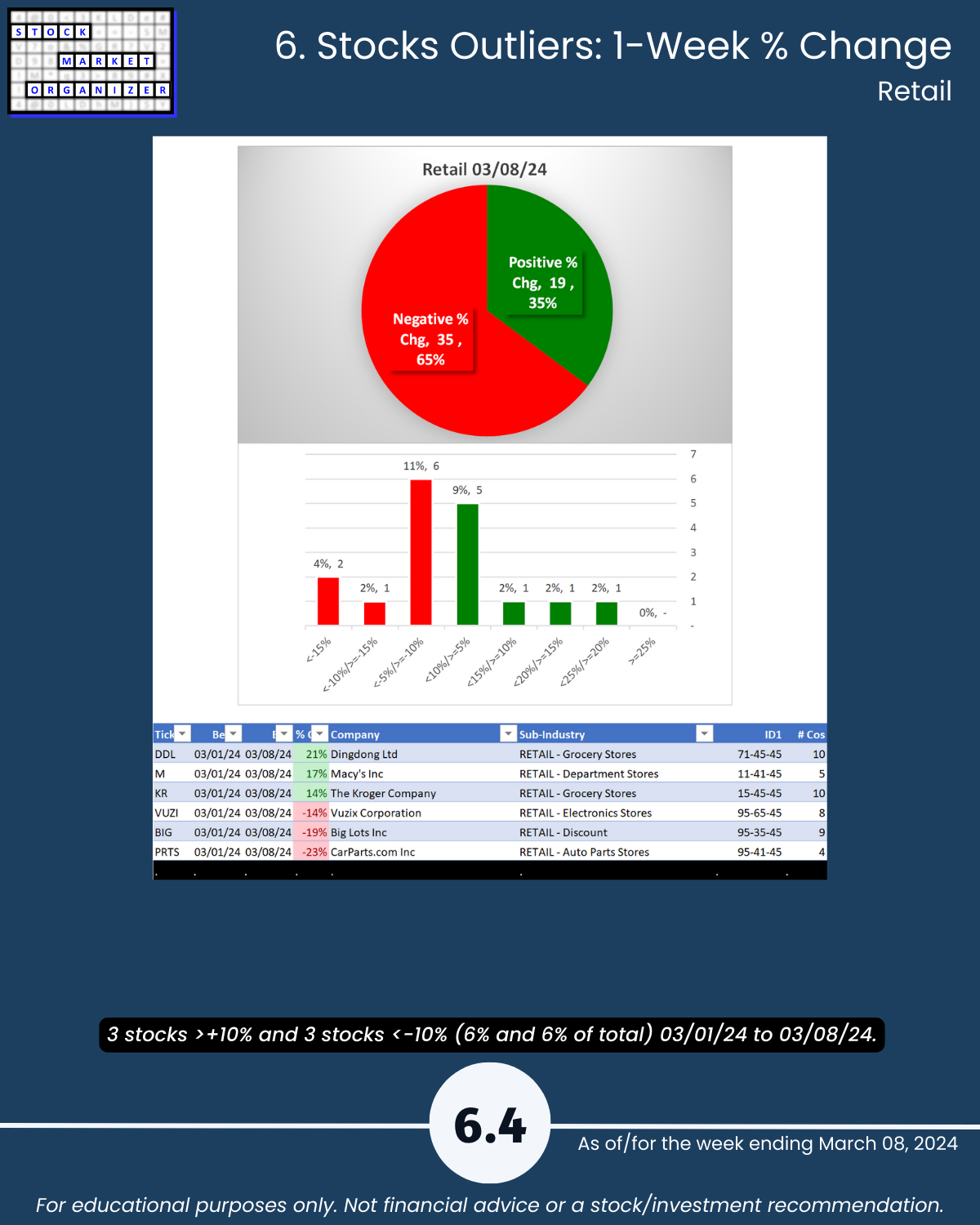

Attached: Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements in the Consumer Durables, Consumer Non-Durables, Food & Beverage, Retail, and Specialty Retail industries.

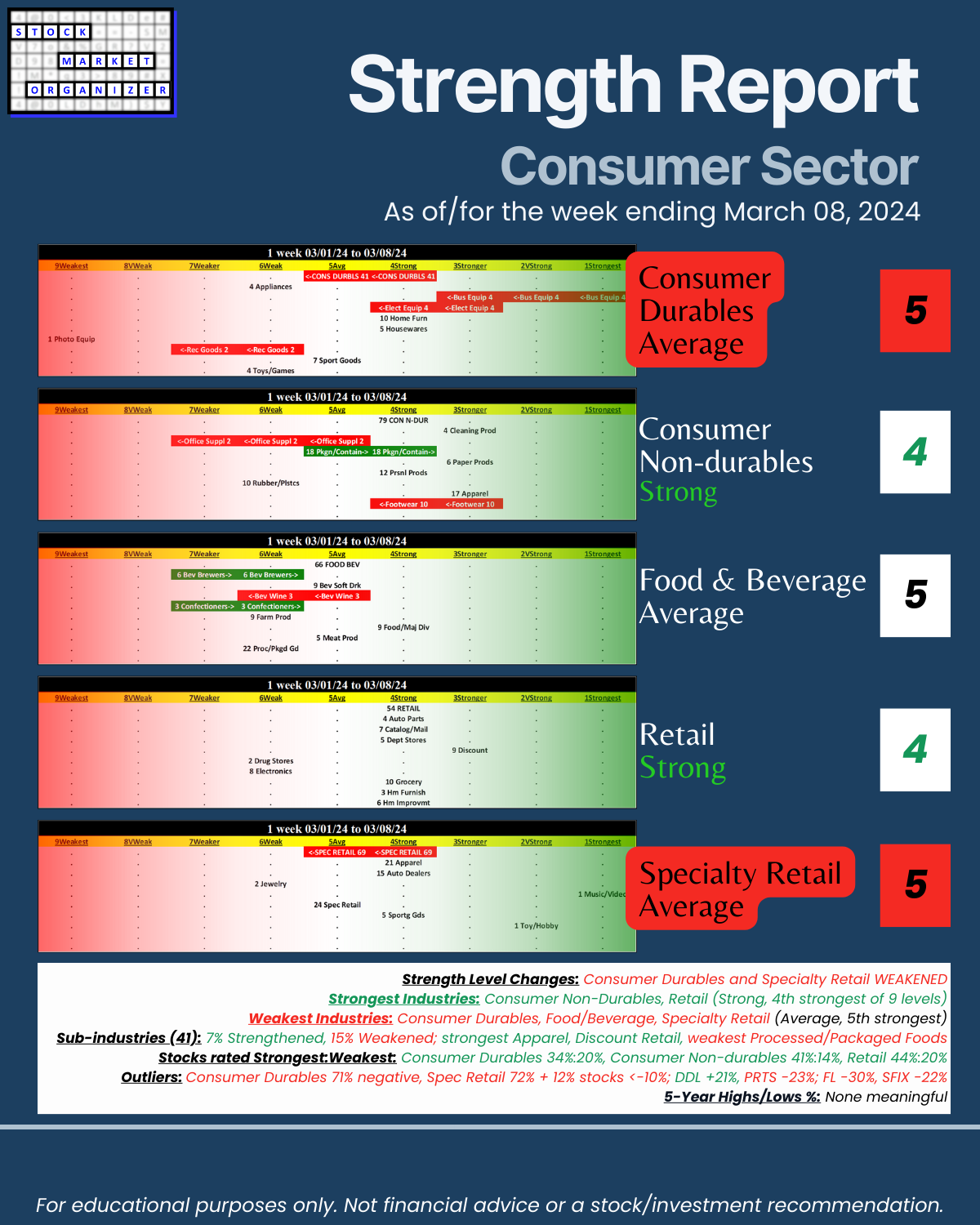

Takeaways:

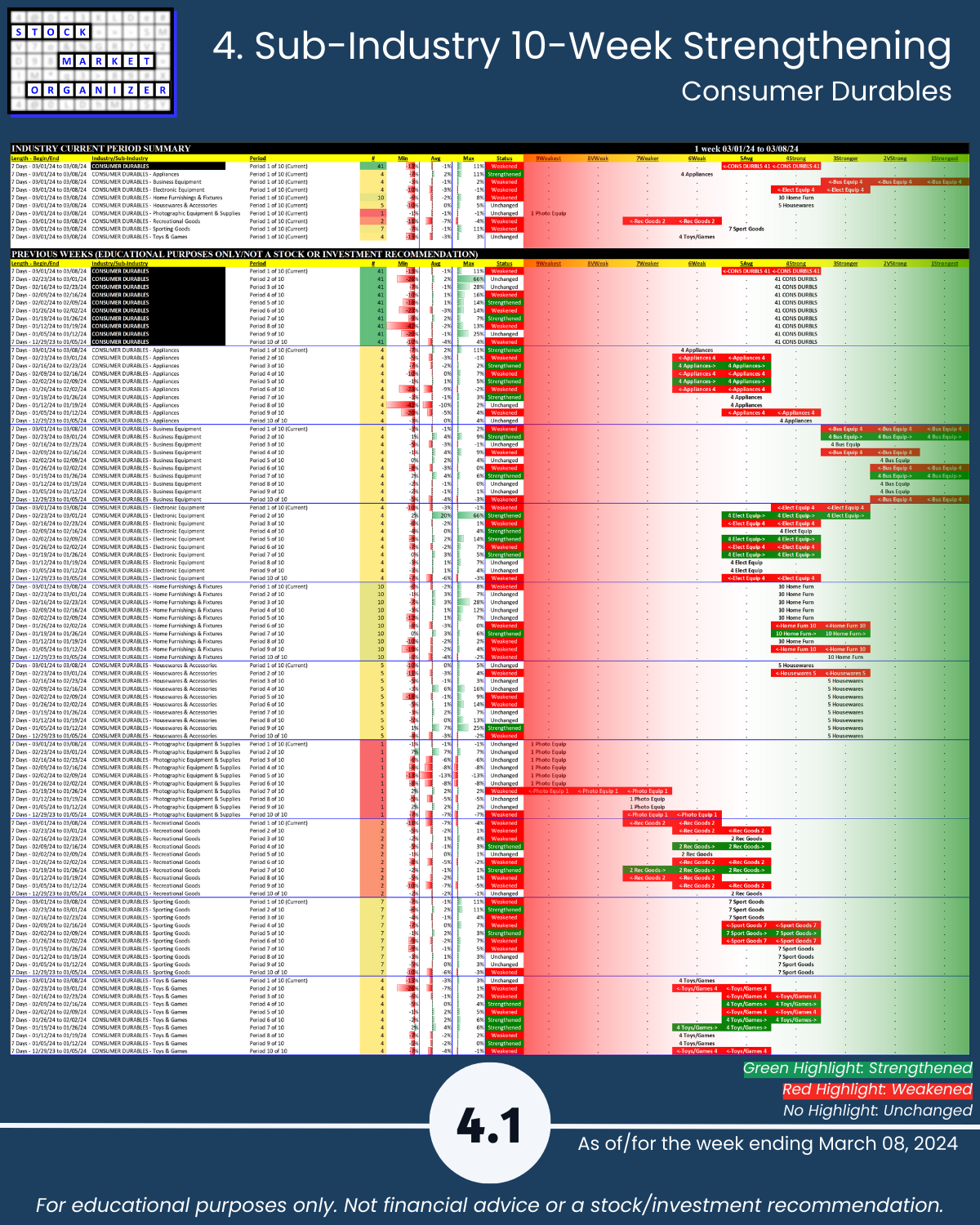

🔹 Strength Level Changes: Consumer Durables and Specialty Retail WEAKENED

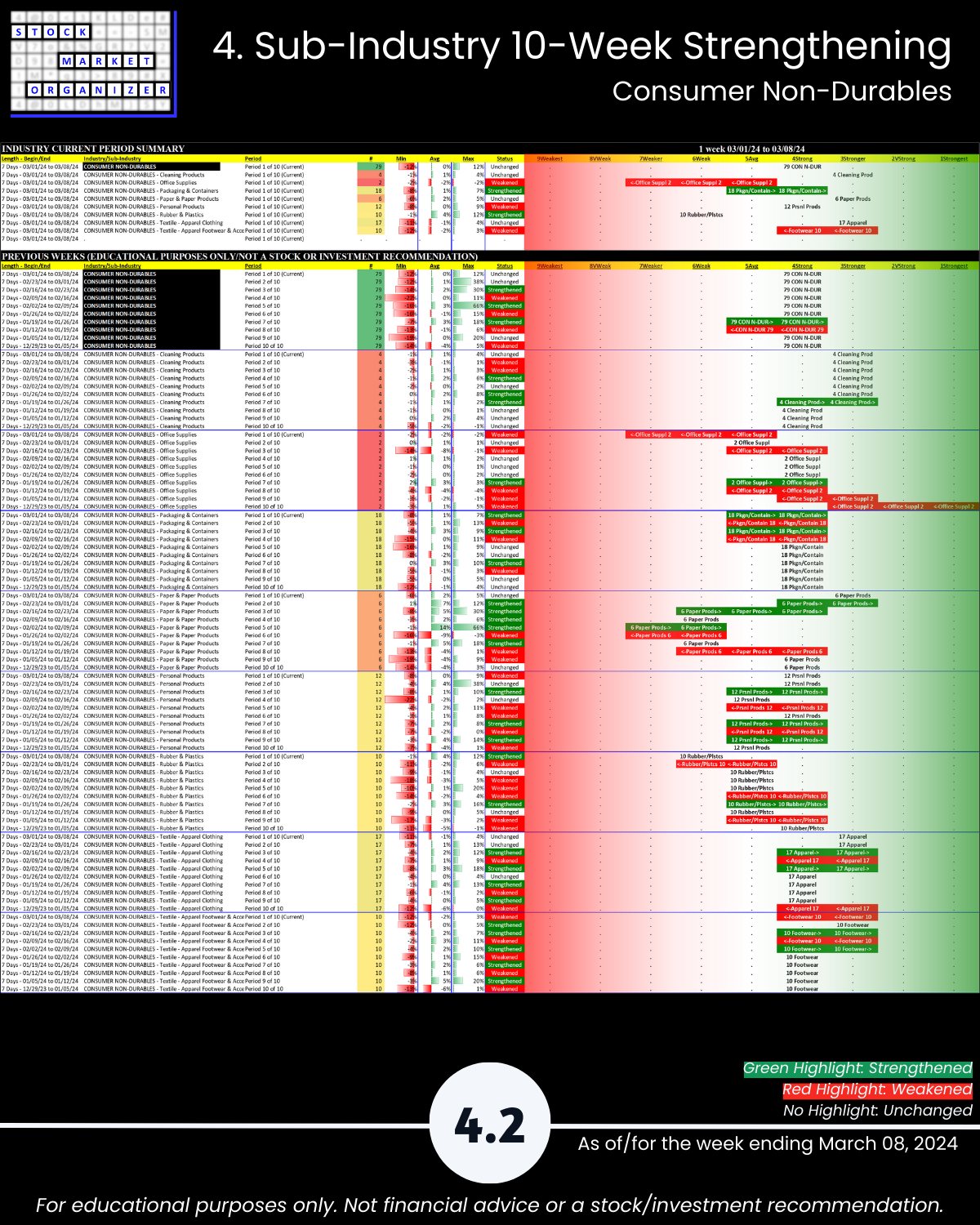

🔹 Strongest Industries: Consumer Non-Durables, Retail (Strong, 4th strongest of 9 levels)

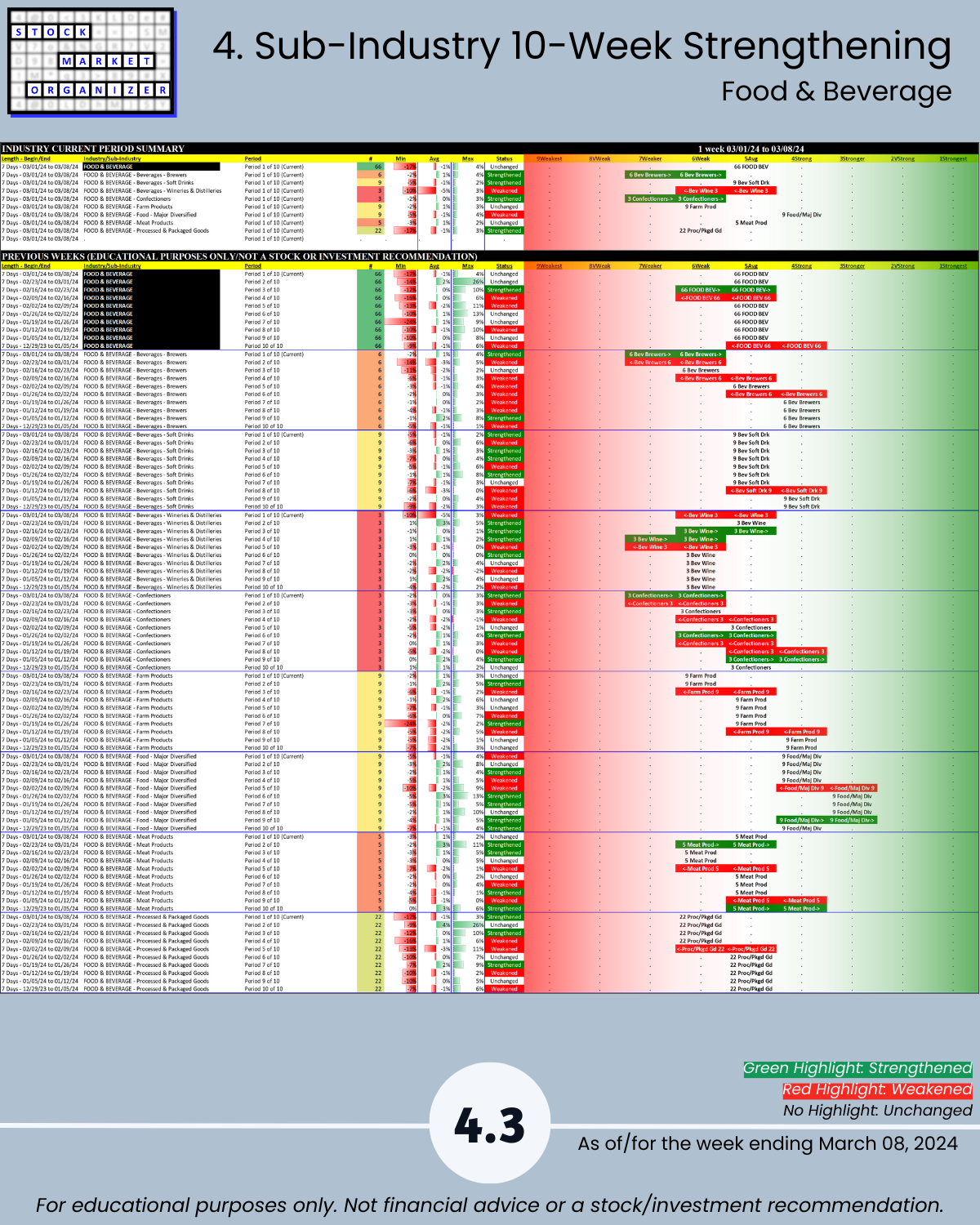

🔹 Weakest Industries: Consumer Durables, Food/Beverage, Specialty Retail (Average, 5th strongest)

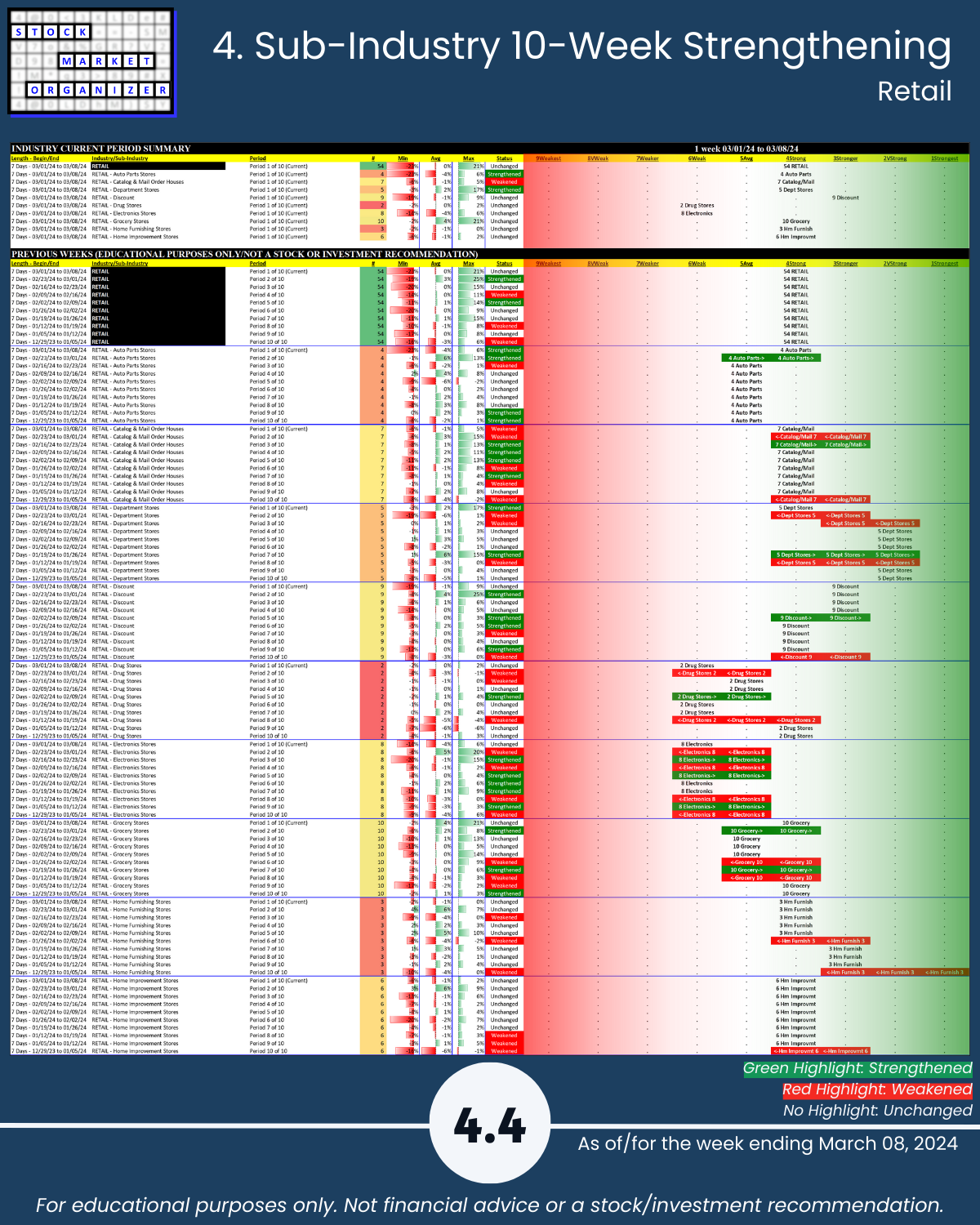

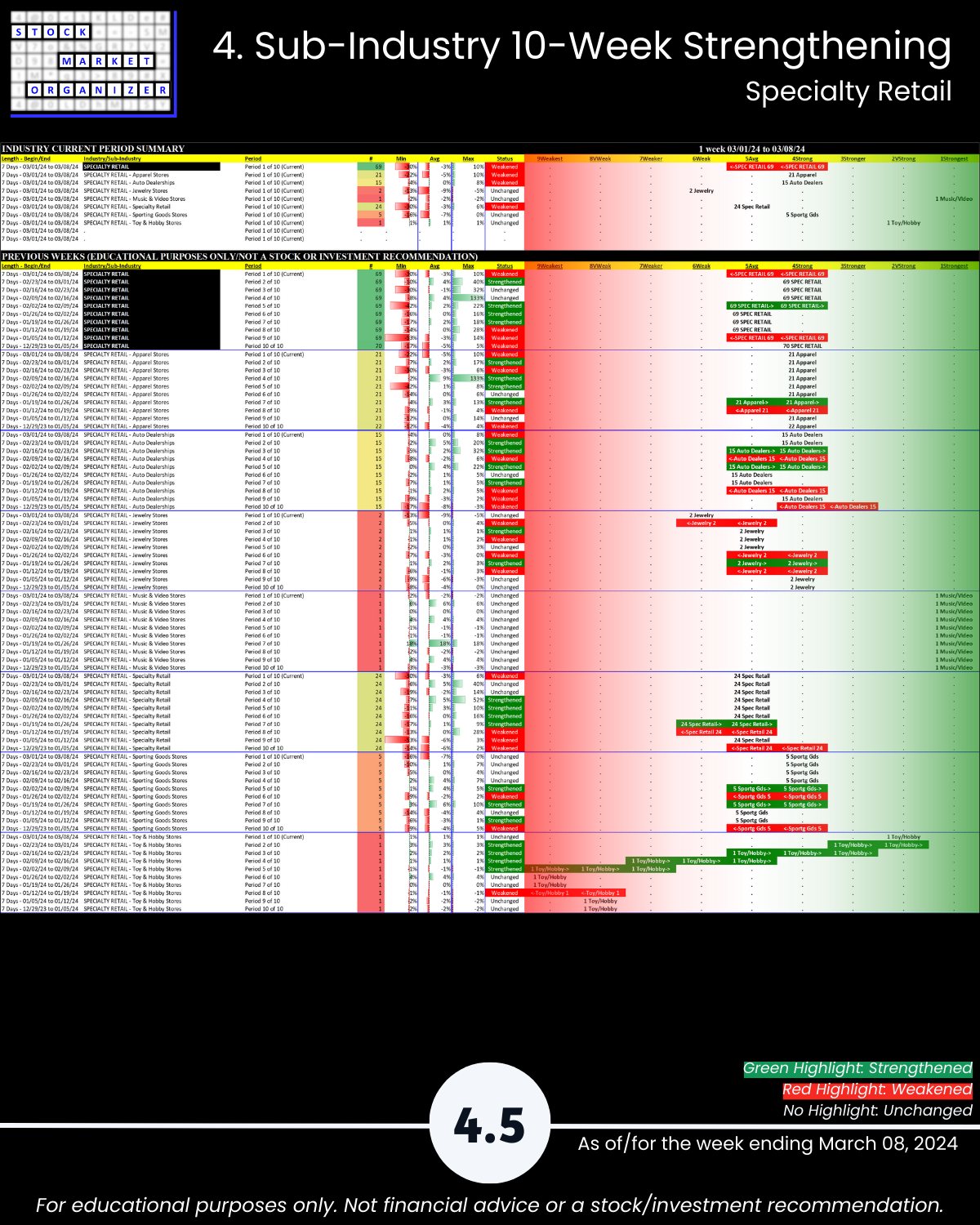

🔹 Sub-industries (41): 7% Strengthened, 15% Weakened; strongest Apparel, Discount Retail, weakest Processed/Packaged Goods

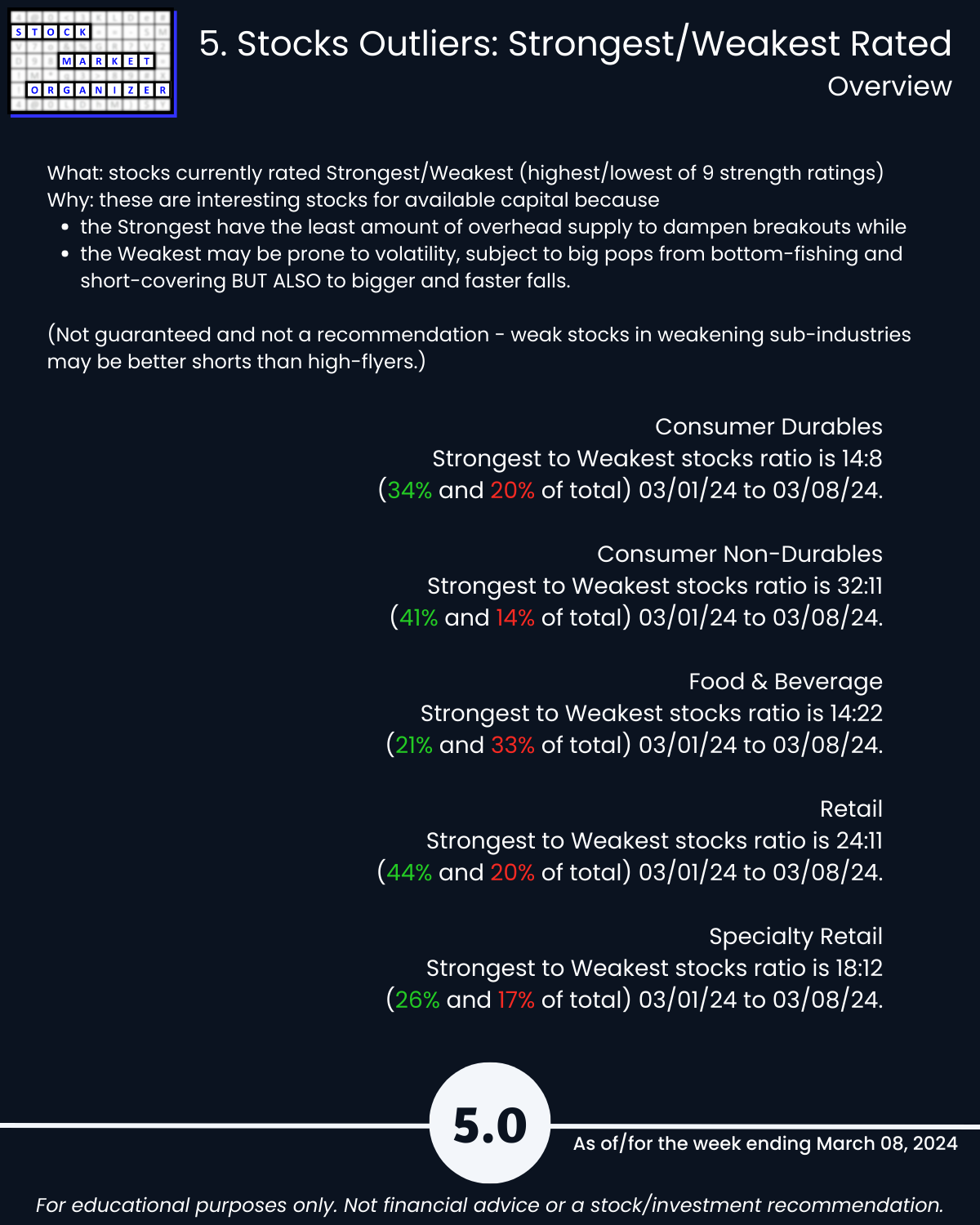

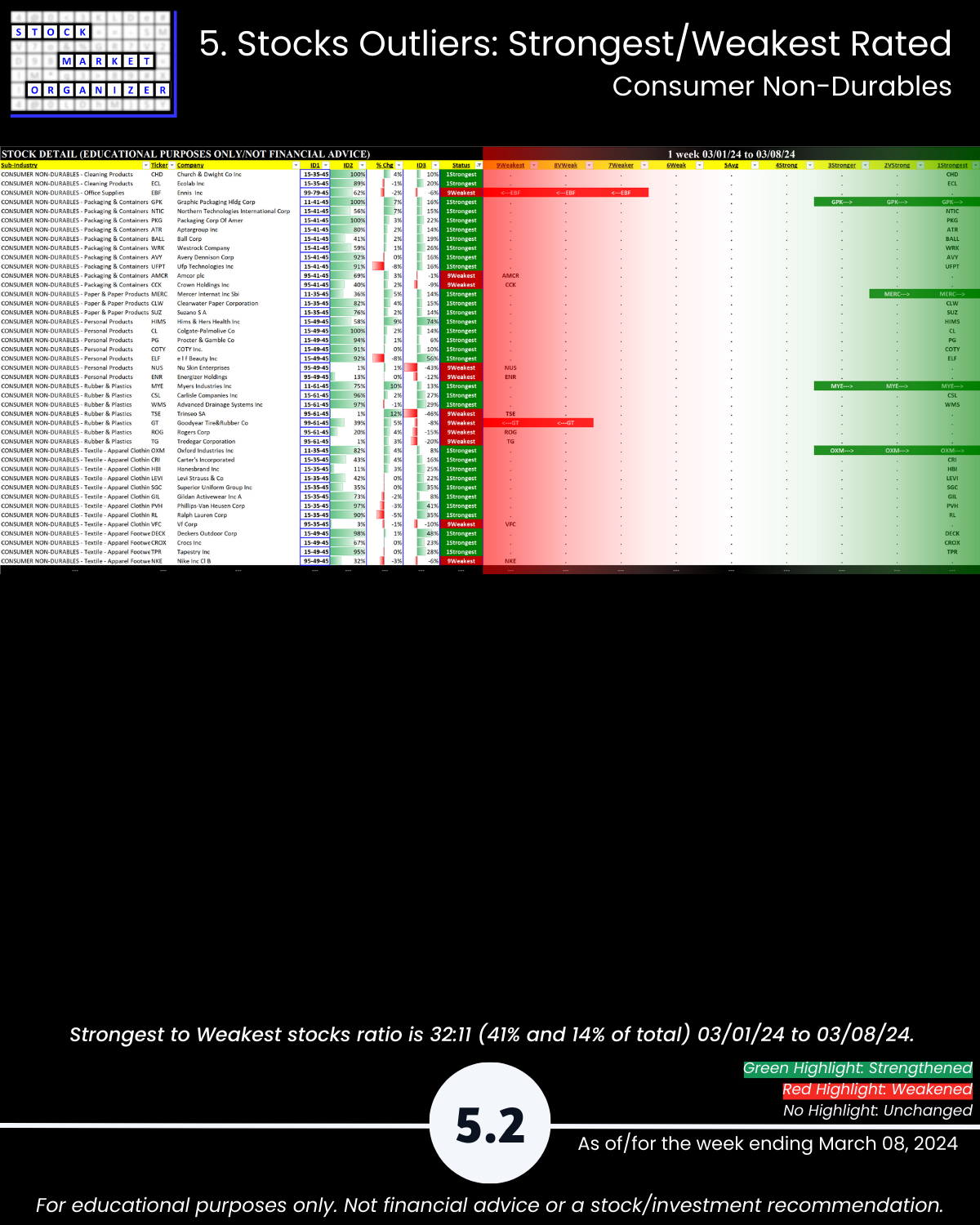

🔹 Stocks rated Strongest:Weakest: Consumer Durables 34%:20%, Consumer Non-durables 41%:14%, Retail 44%:20%

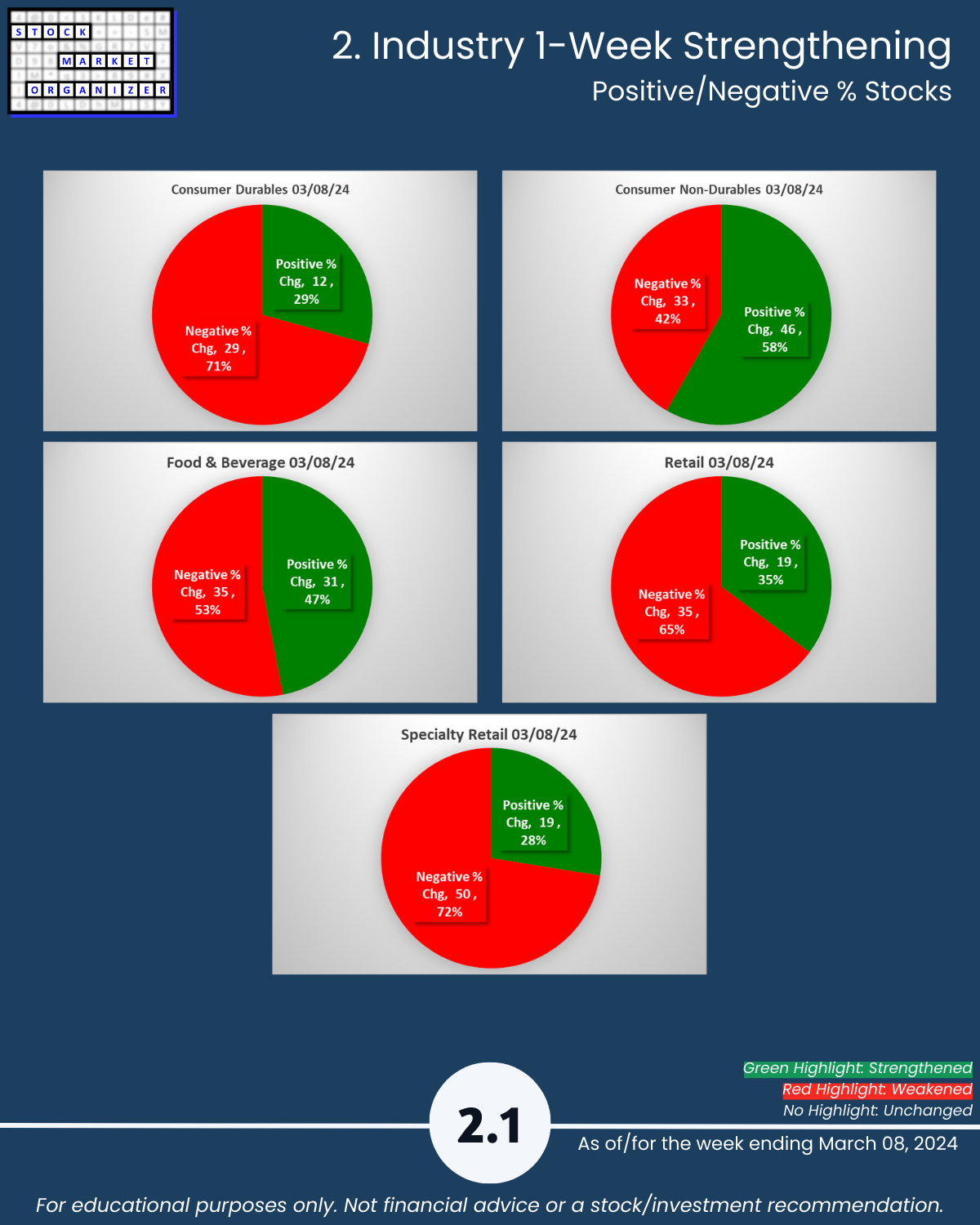

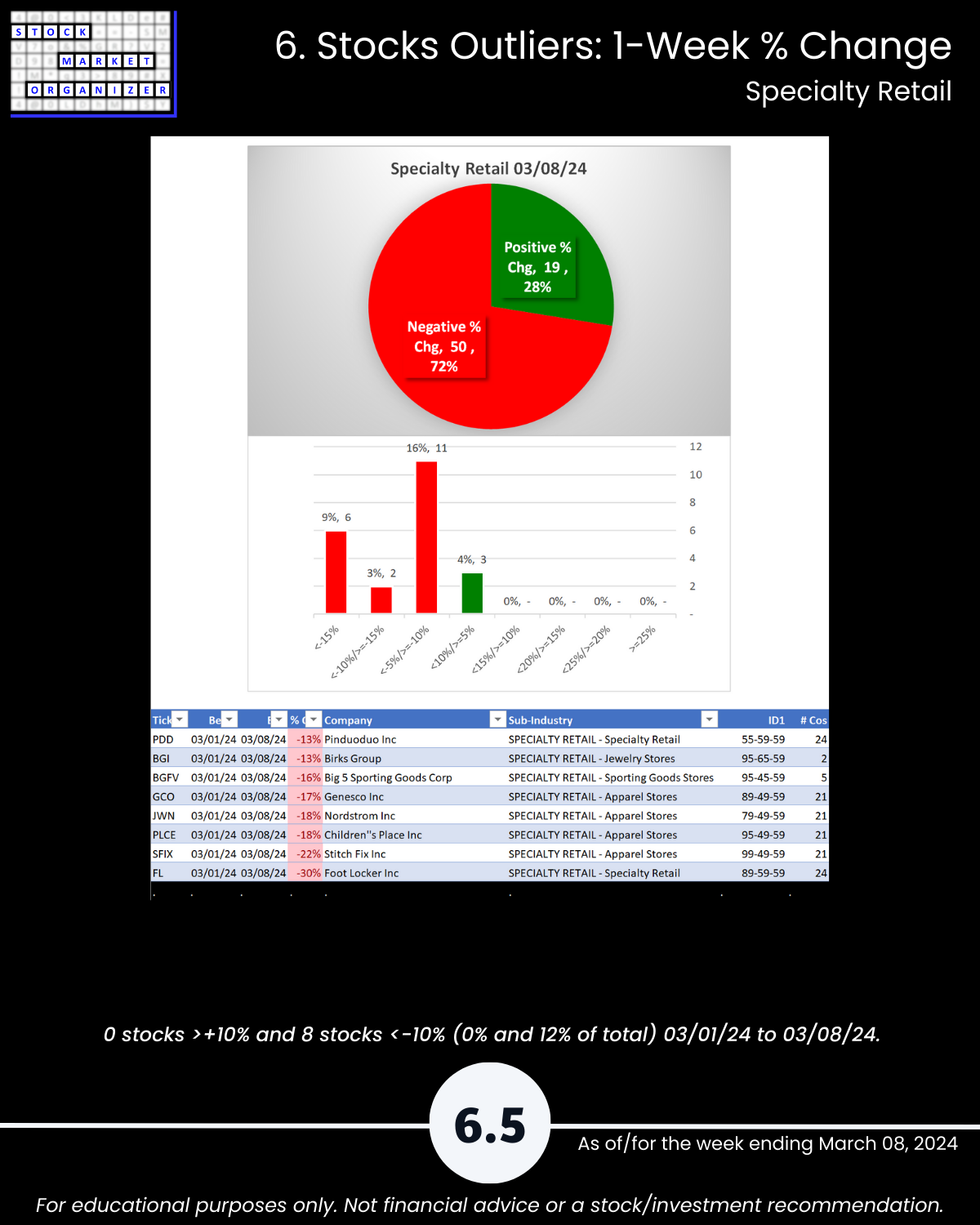

🔹 Outliers: Consumer Durables 71% negative, Spec Retail 72% + 12% stocks <-10%; DDL +21%, PRTS -23%; FL -30%, SFIX -22%

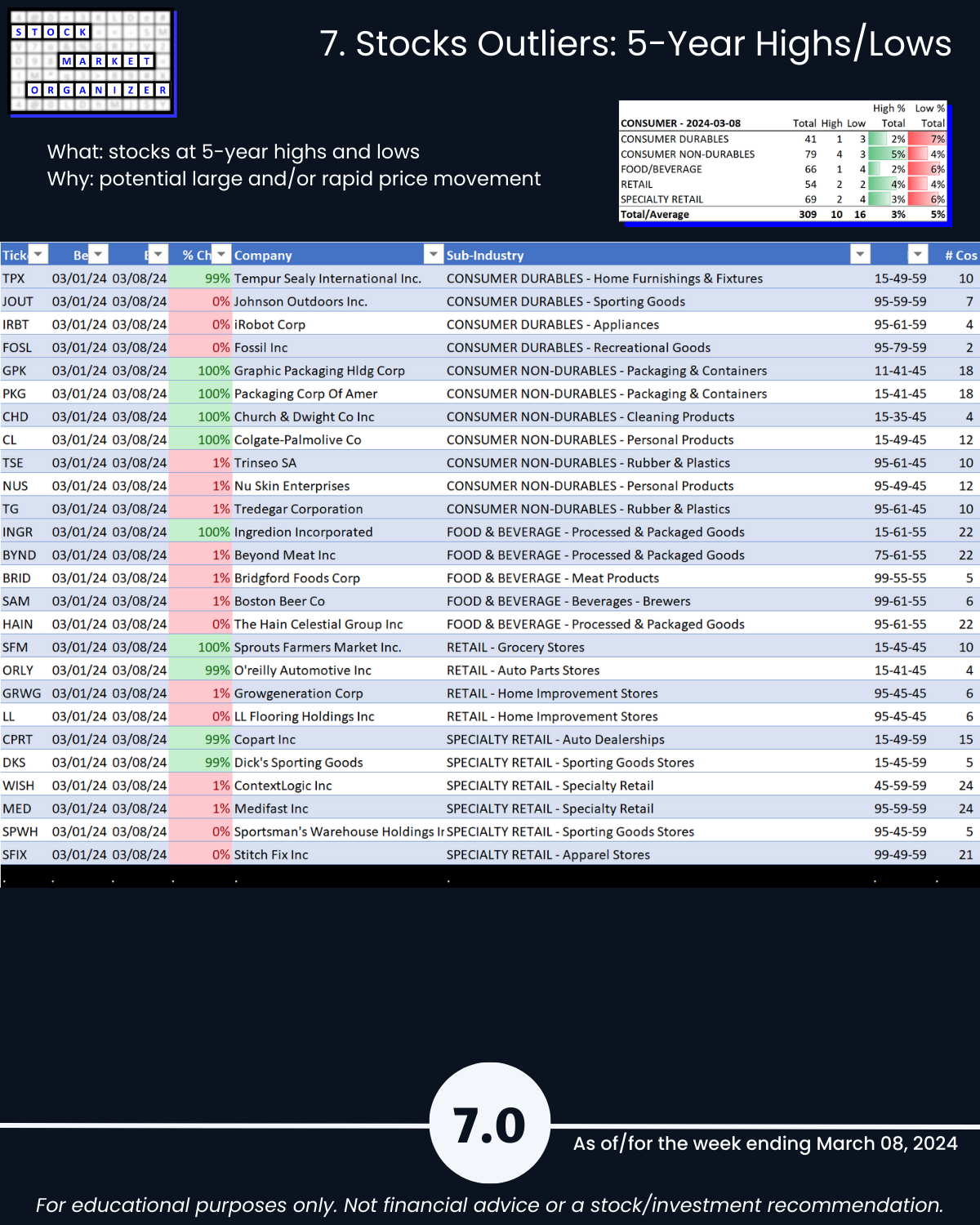

🔹 5-Year Highs/Lows %: None meaningful

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

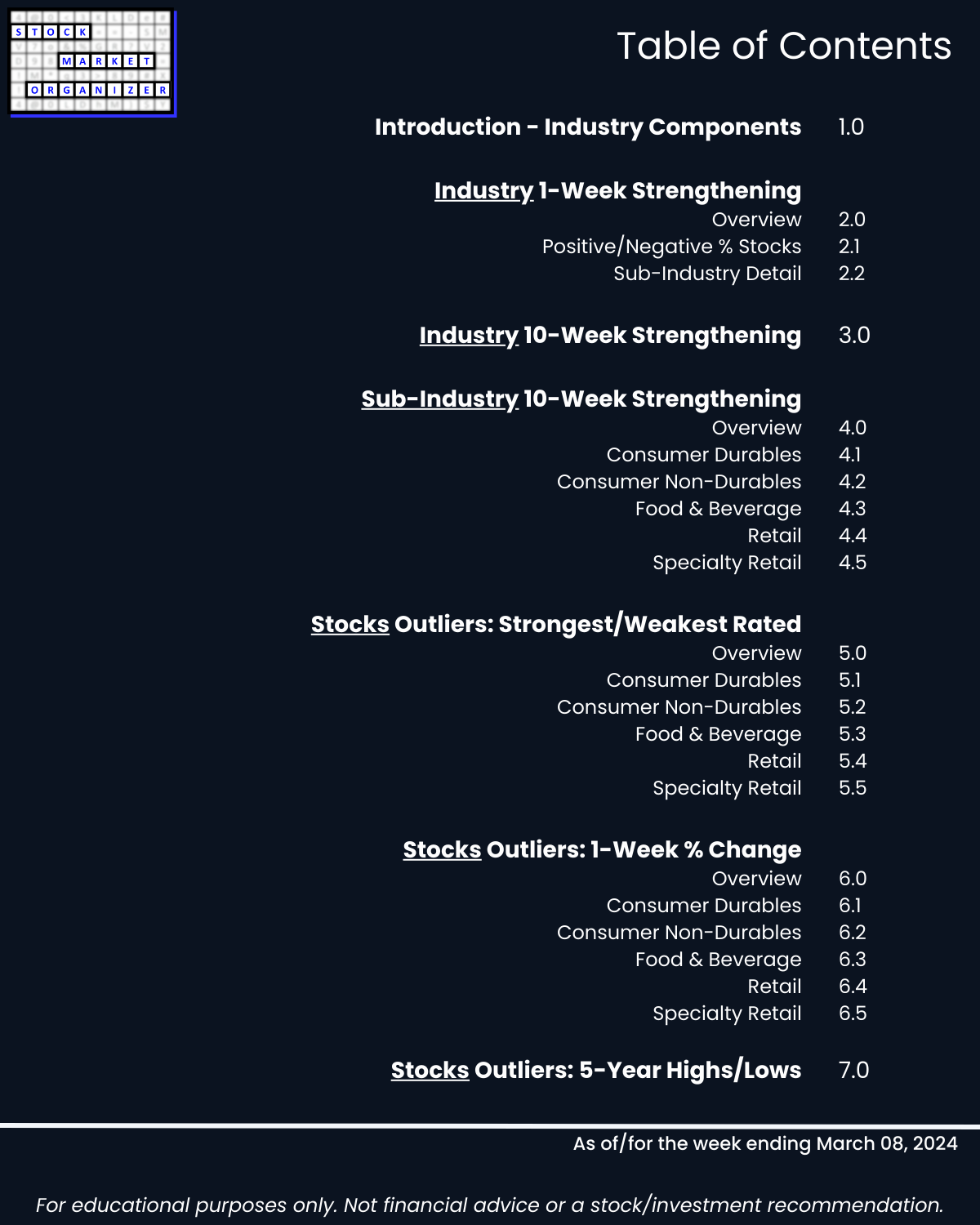

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

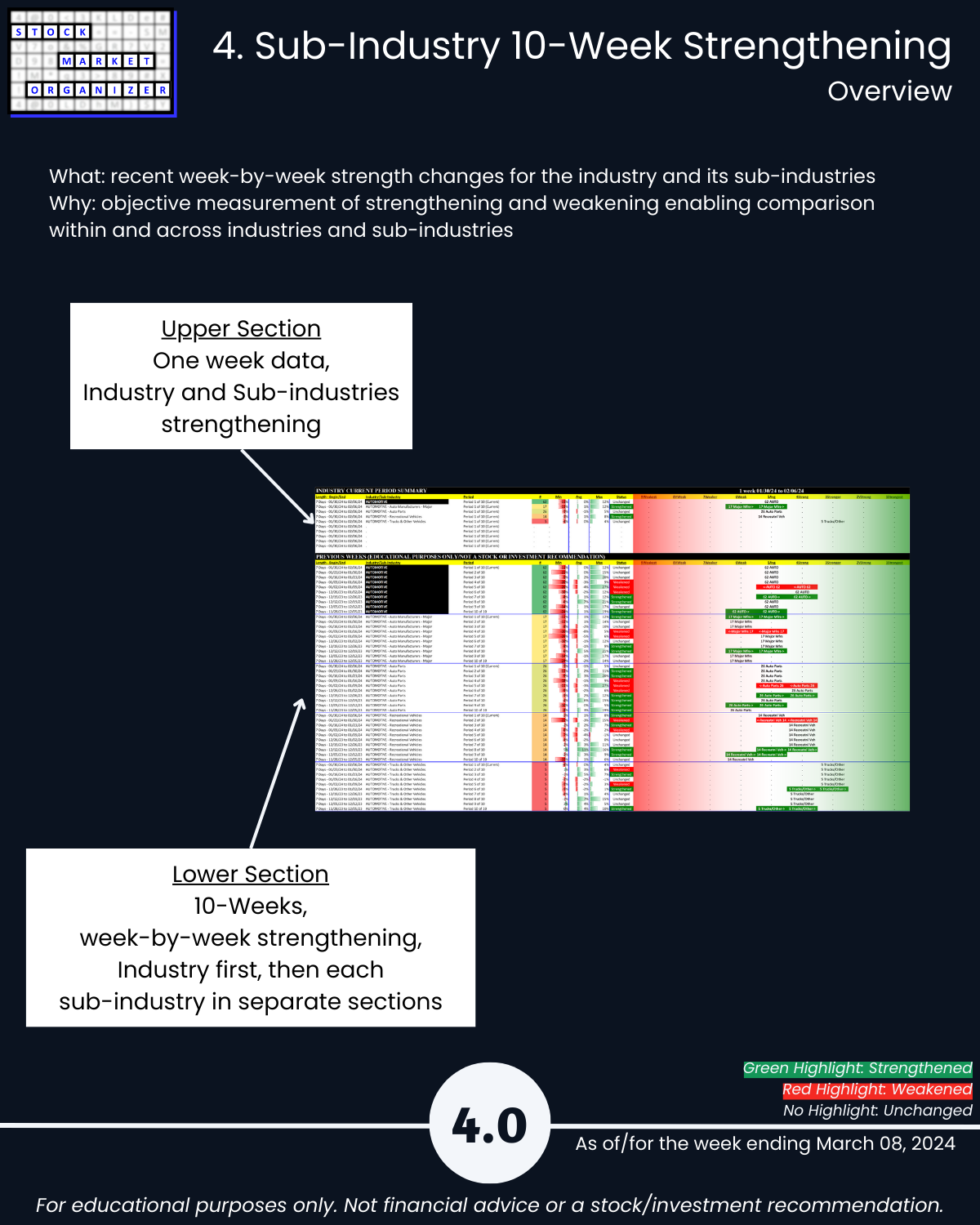

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows