SMO Exclusive: Strength Report Consumer Sector 2024-03-01

Consumer Sector analysis 3/1/24, ANF keeps cranking +502% since 5/4/23 vs. NVDA +199%. An ANF all-time high going back to early/mid-December when it rose above $83/share NOT on blow-out volume. Since 12/12/23: +57%. 8/23/23 it DID gap up 24% on monster volume. NOT a value stock – yet +158% in 6+ months since then, a decent 15 years’ worth of progress.

Can strength beget strength? And weakness beget weakness? If you study the market and individual stocks closely, you’d say yes. Not every time – and this is what disciplined risk control is for. If it was that easy the stock market would not exist. But certainly enough to base a system on buying strength and selling weakness.

The gain of 100%+ begins with 10% gains. It DOES happen.

New strength: KODK. What?

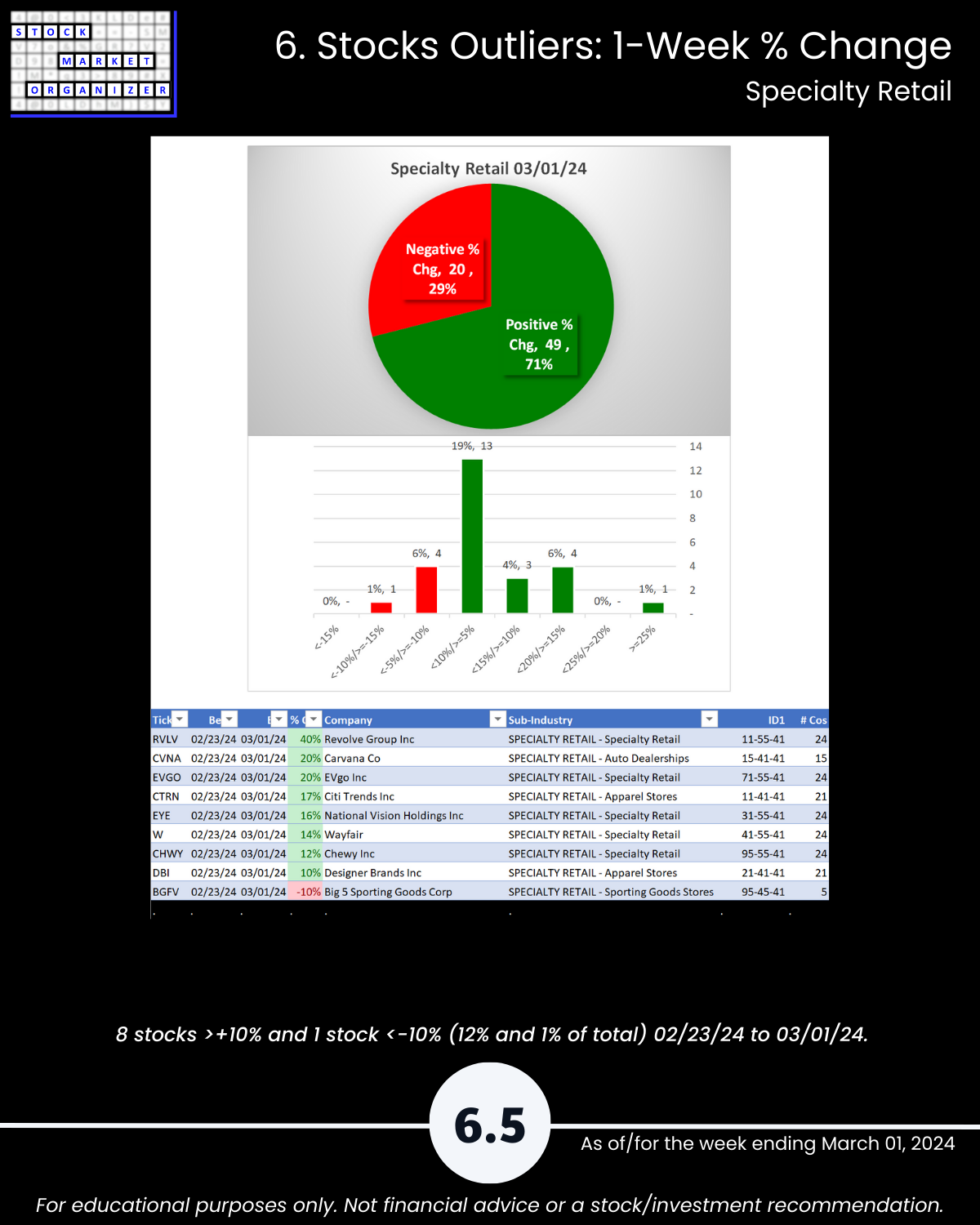

Continued strength: CVNA. Weren’t they supposed to go BK a year or so ago? They didn’t get the memo and are up 2,066% since 12/7/22 - a -43% day.

The gain of 1000%+ begins with 100% gains. It DOES happen.

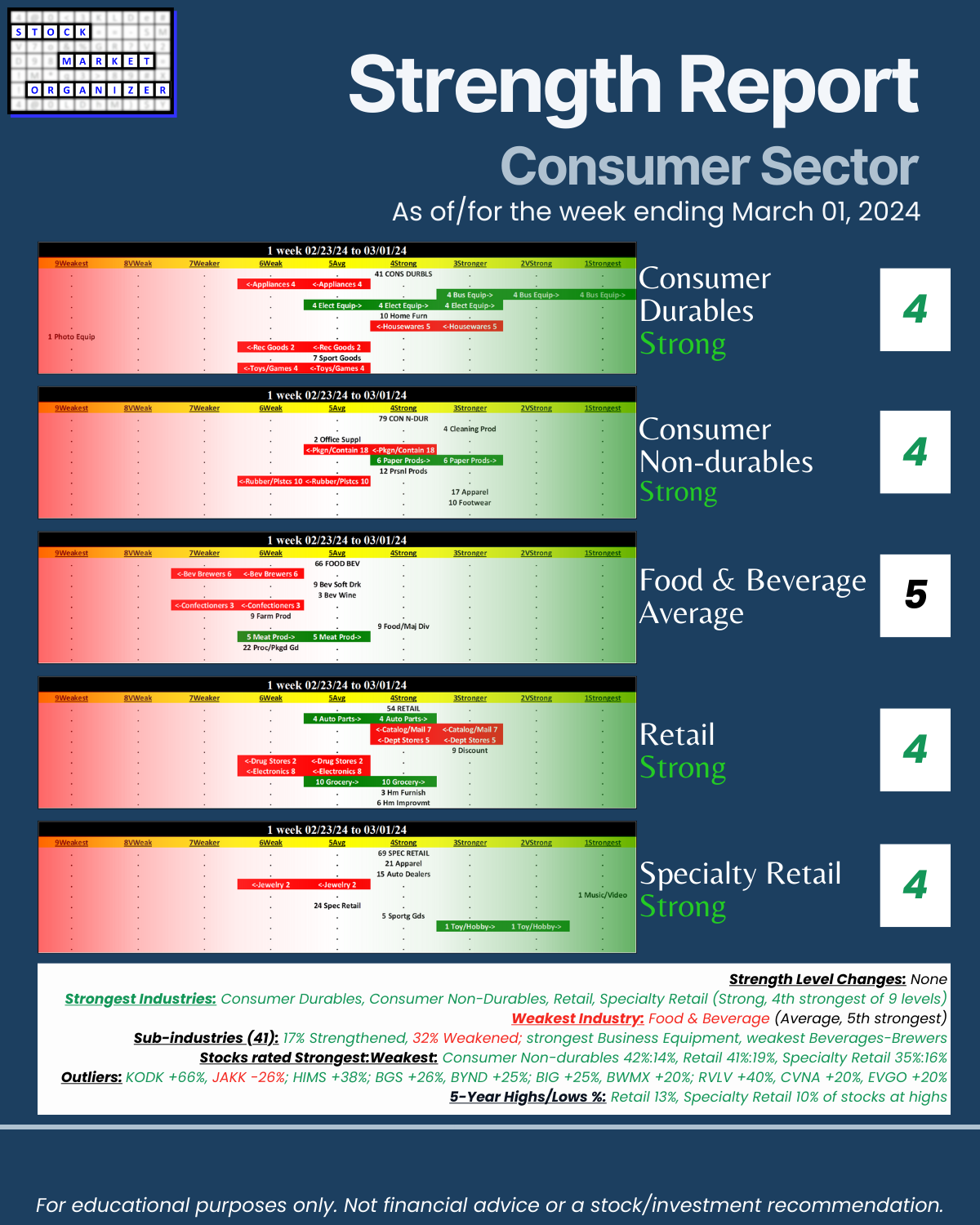

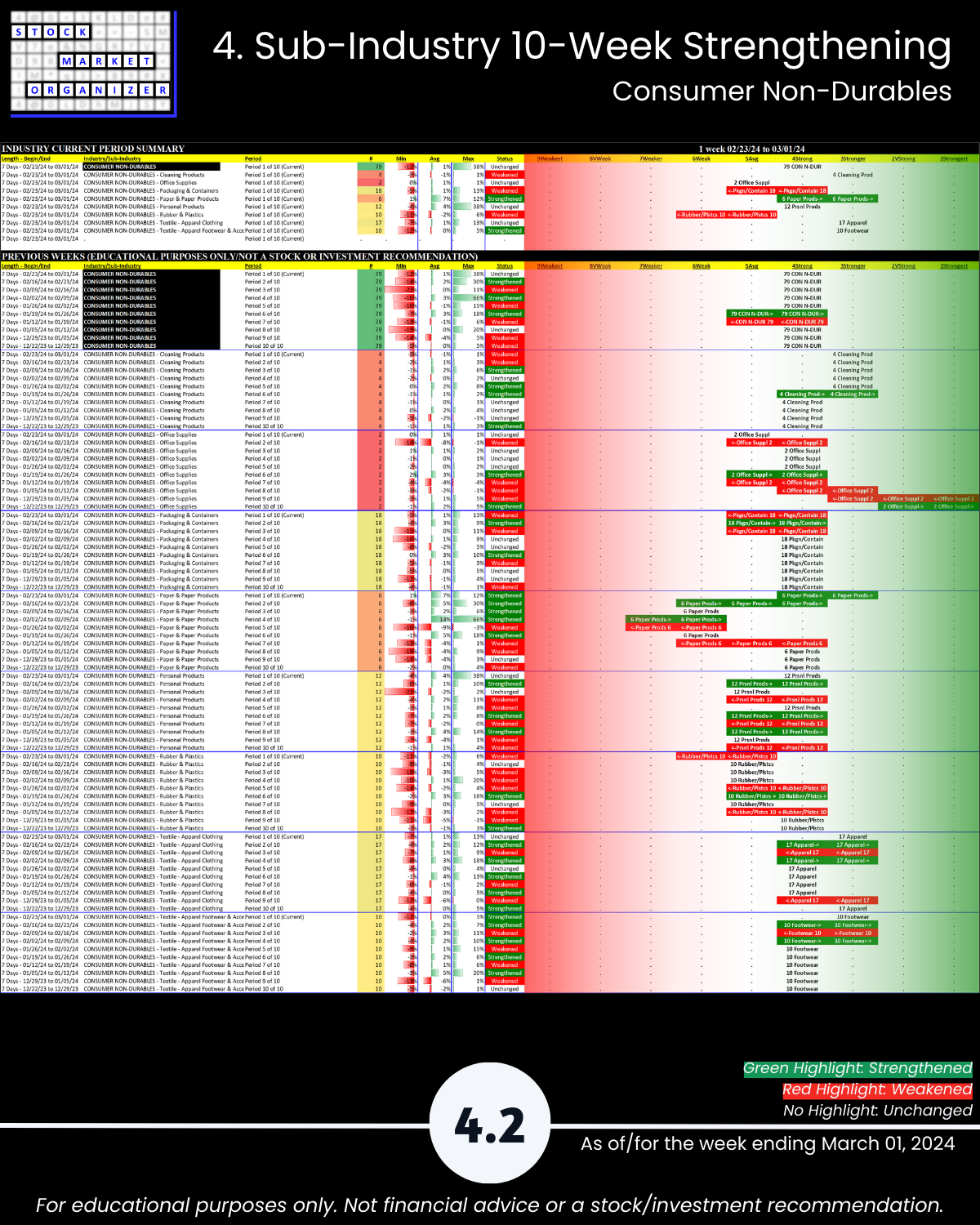

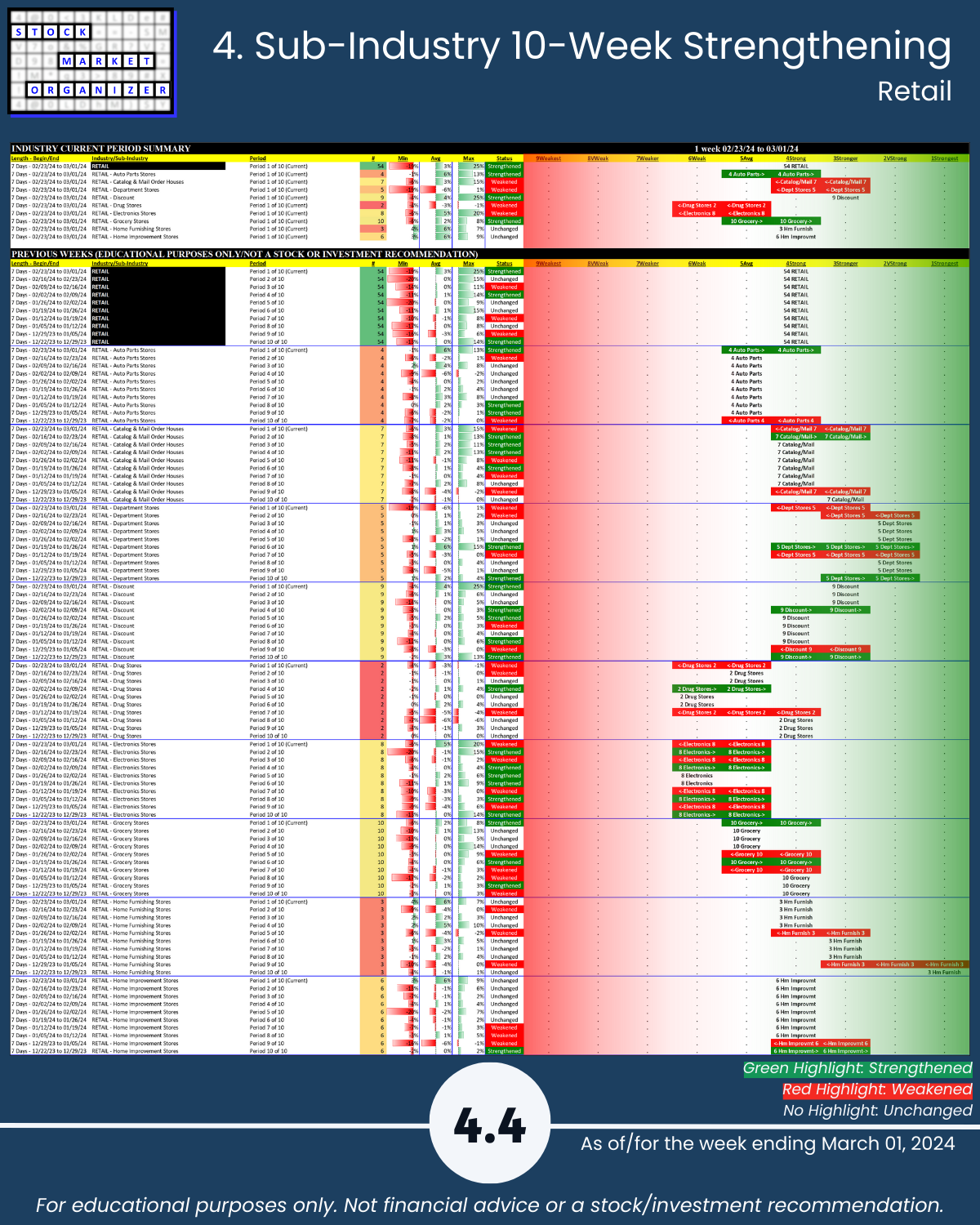

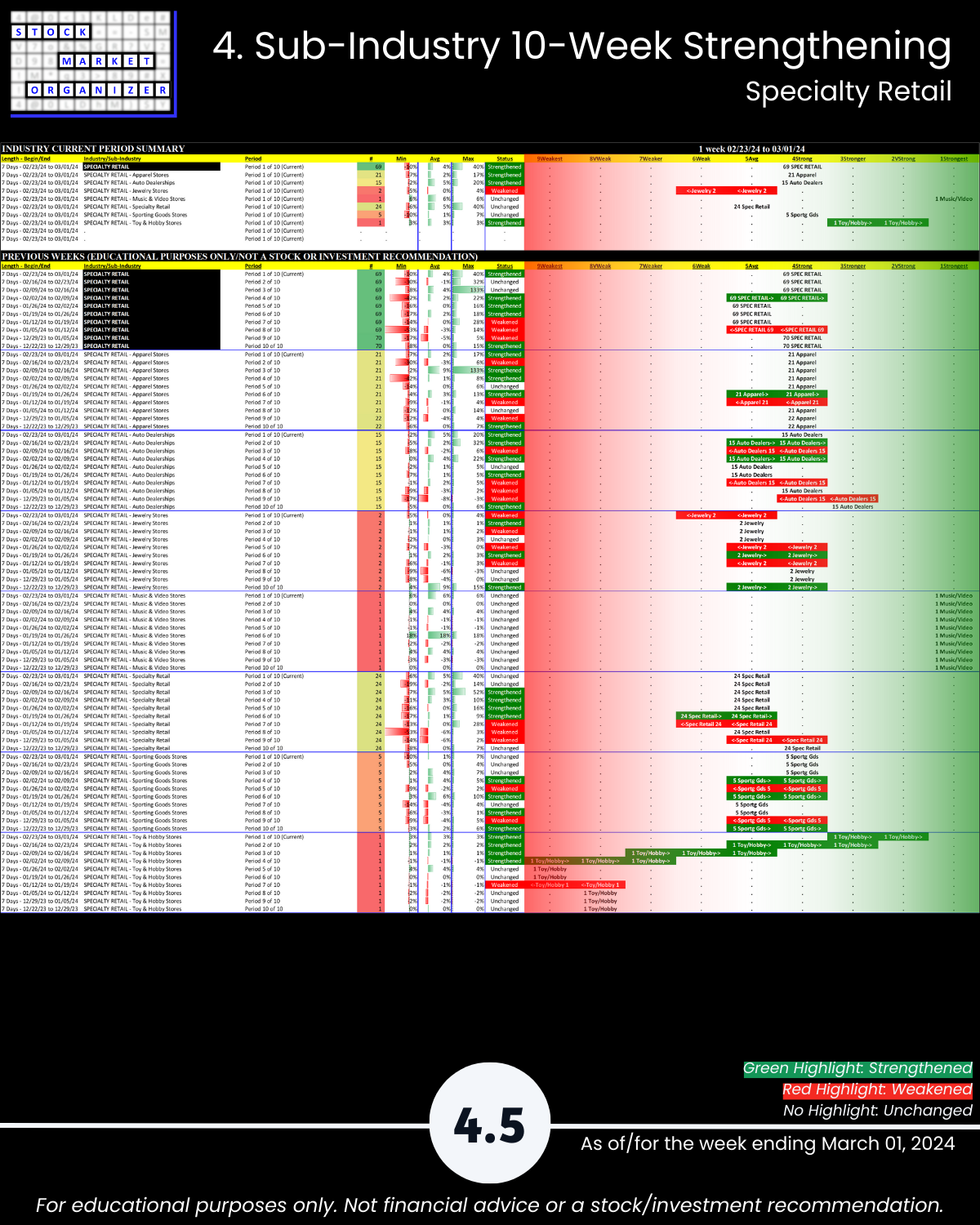

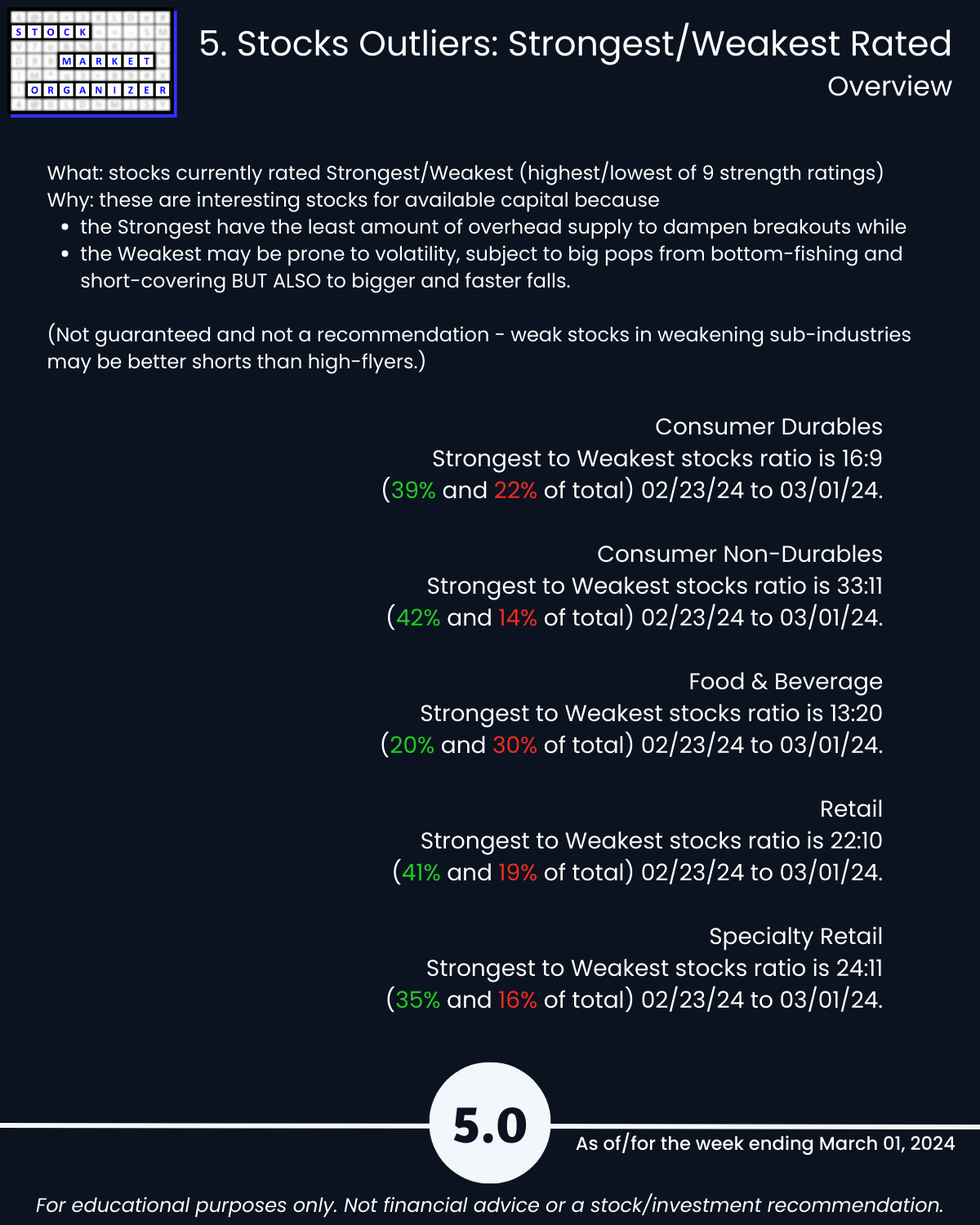

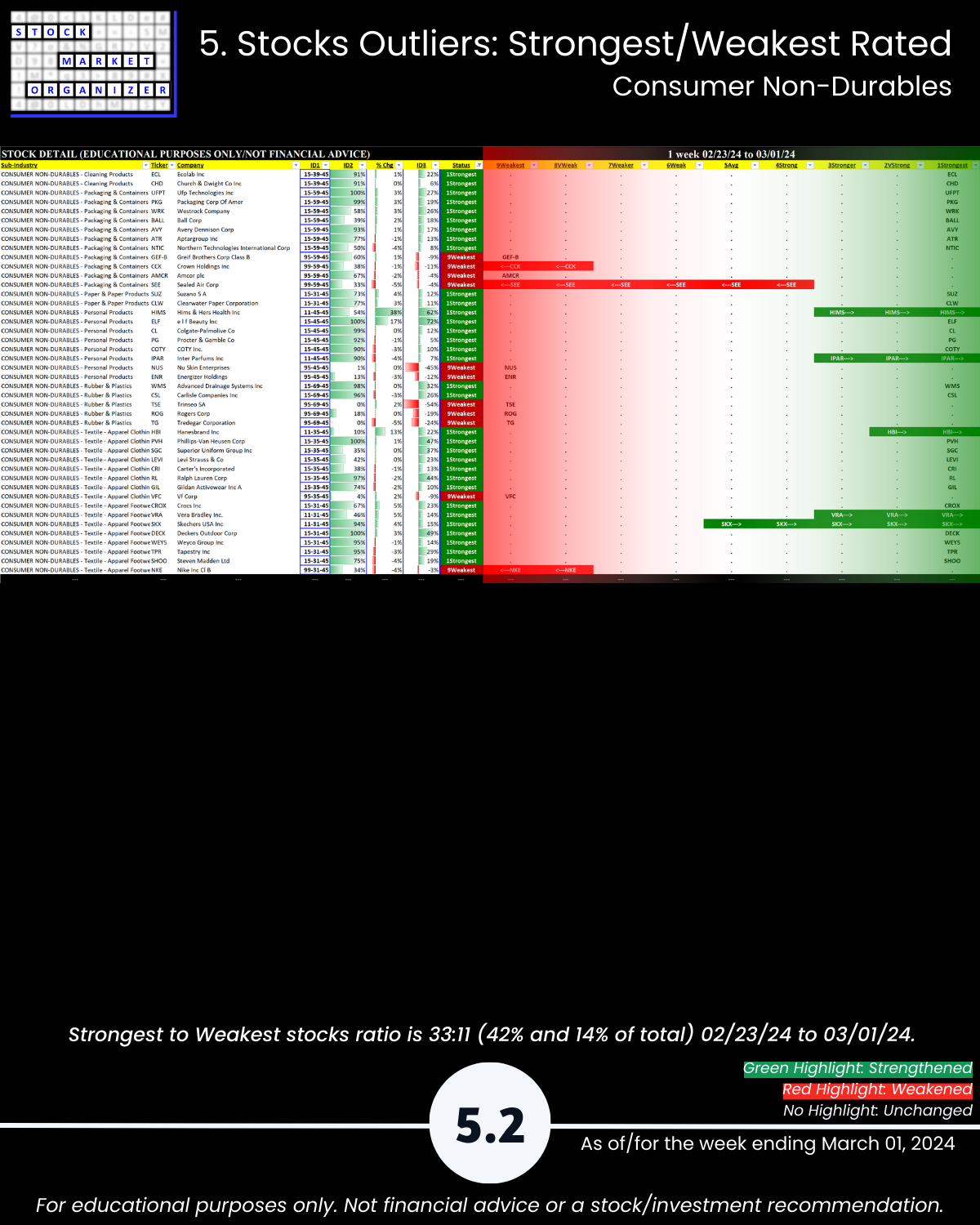

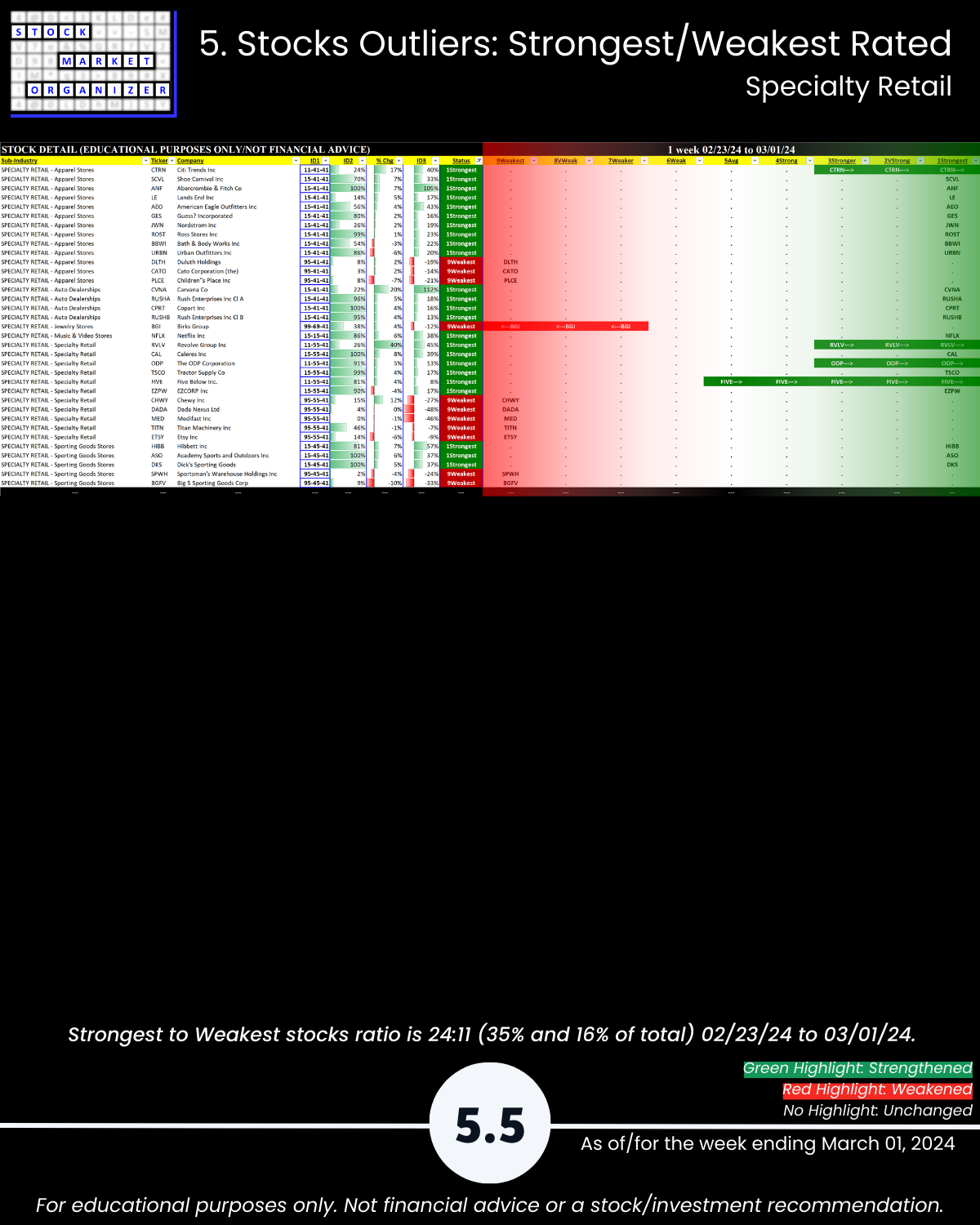

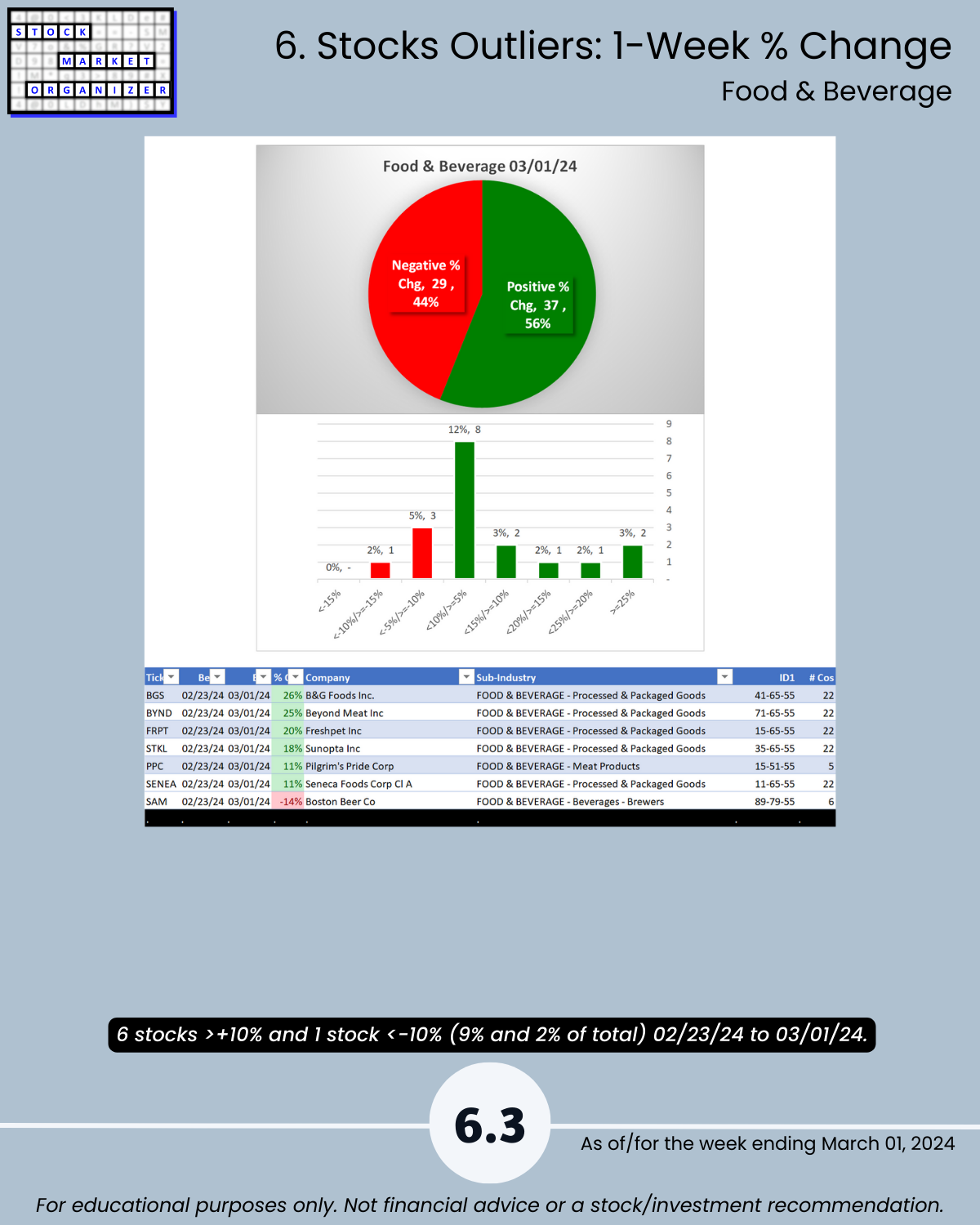

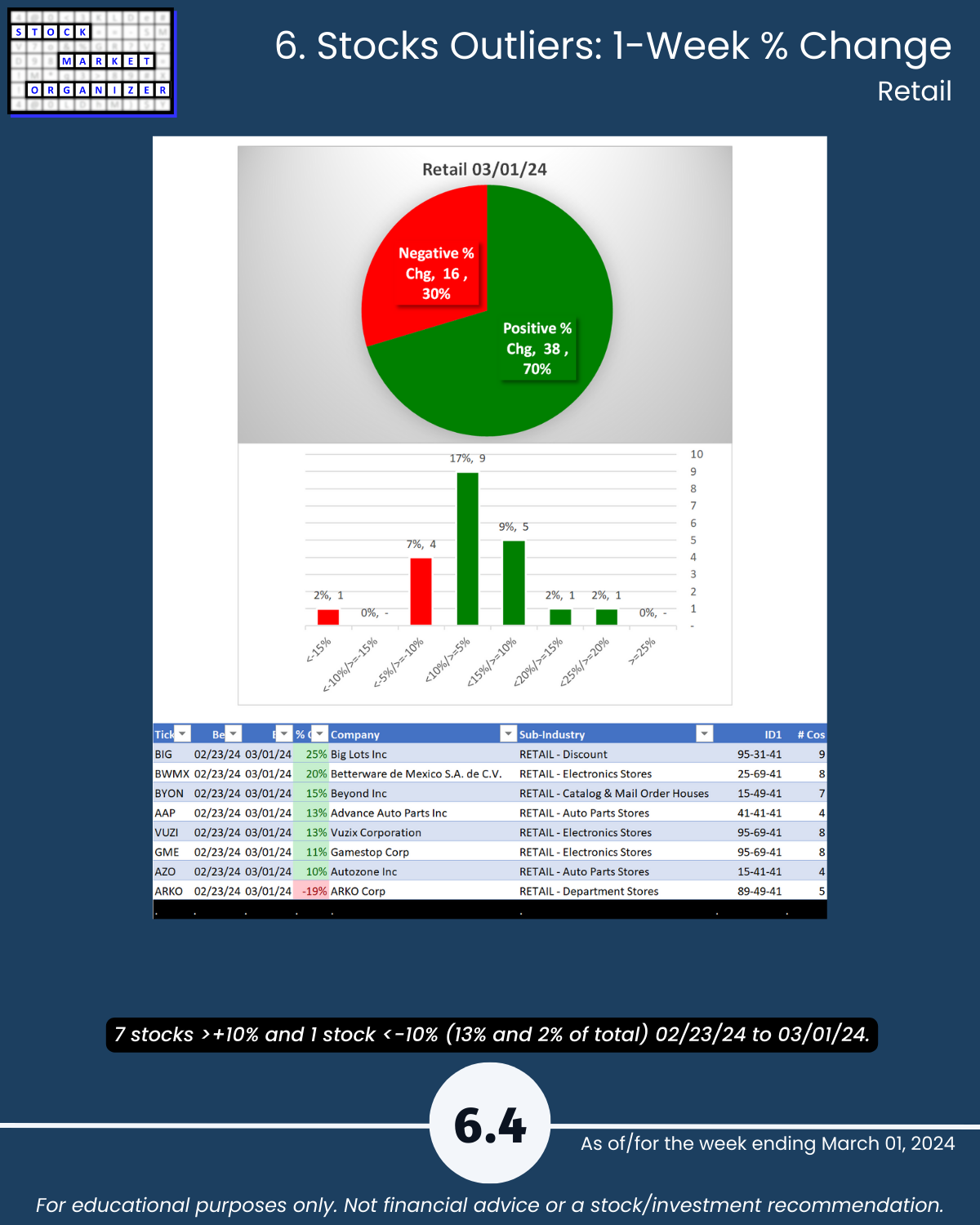

Attached: Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements in the Consumer Durables, Consumer Non-Durables, Food & Beverage, Retail, and Specialty Retail industries.

Takeaways:

🔹 Strength Level Changes: None

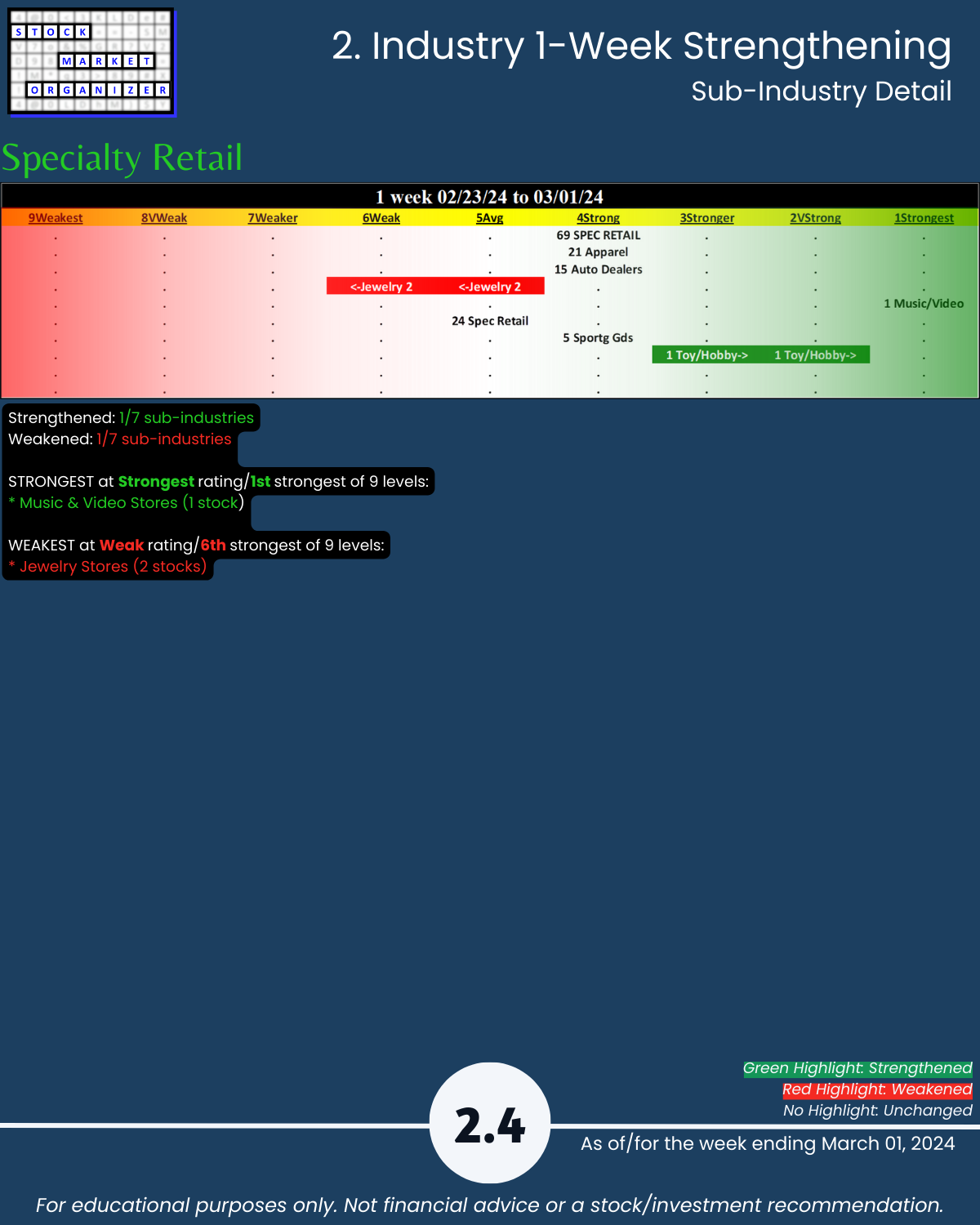

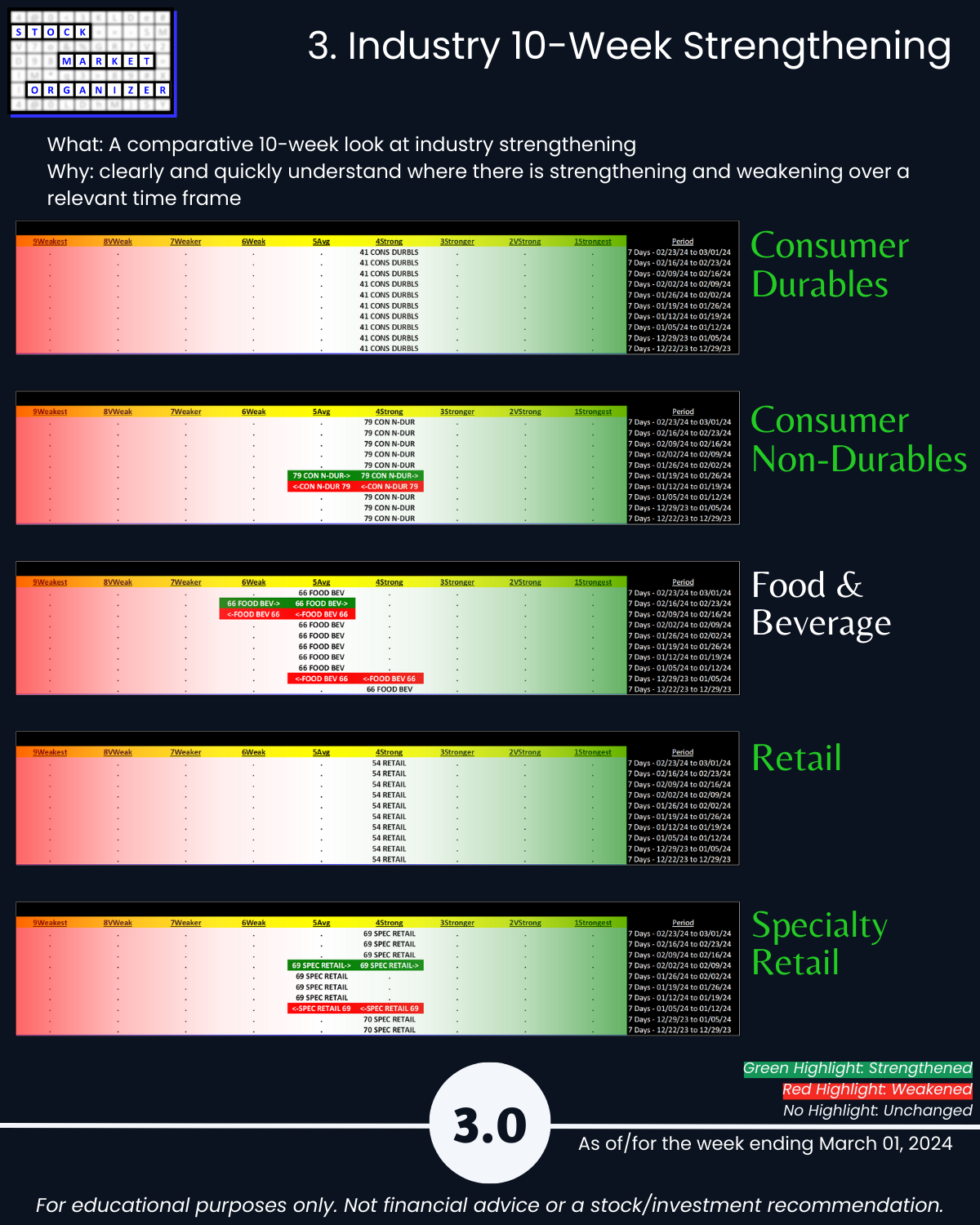

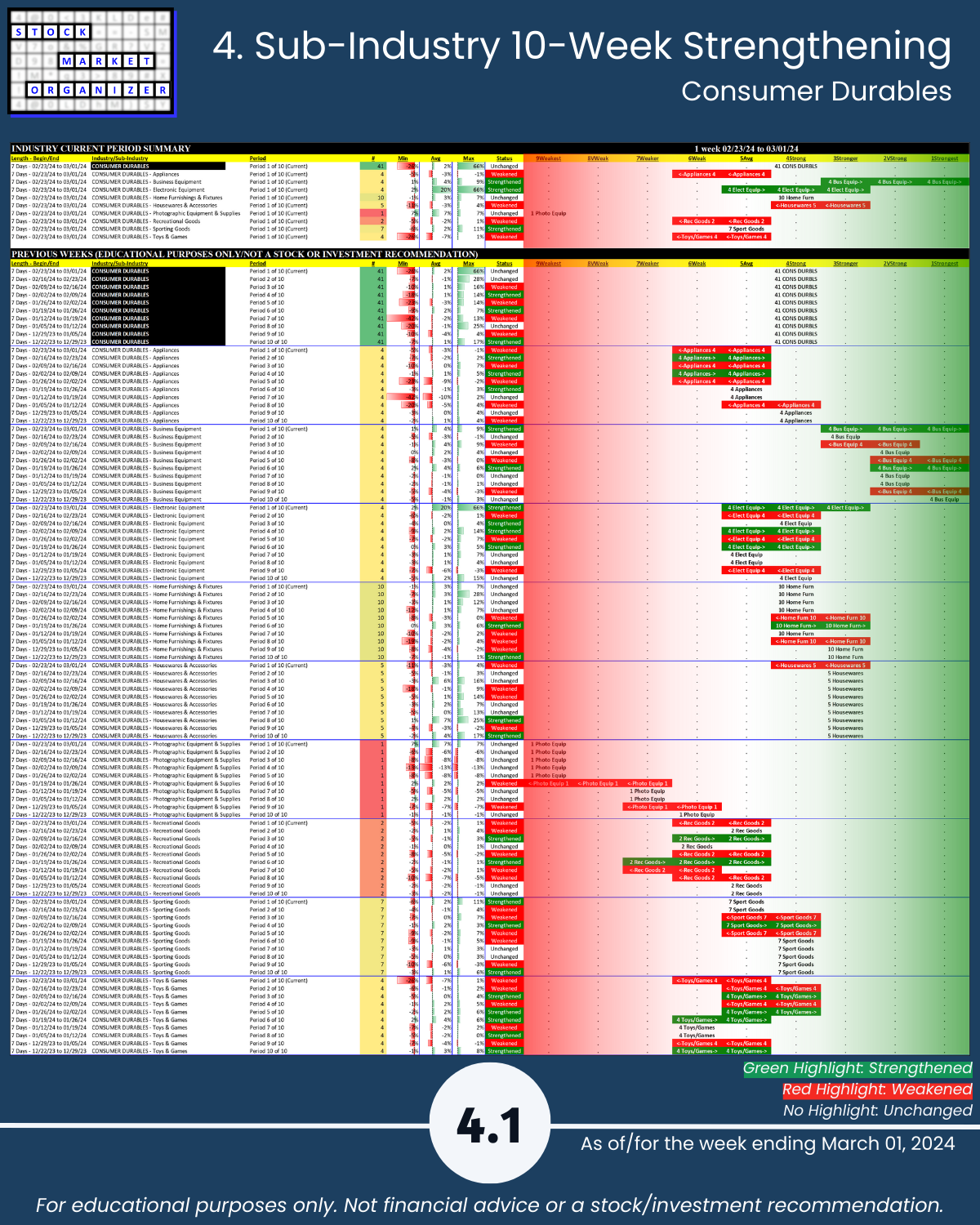

🔹 Strongest Industries: Consumer Durables, Consumer Non-Durables, Retail, Specialty Retail (Strong, 4th strongest of 9 levels)

🔹 Weakest Industry: Food & Beverage (Average, 5th strongest)

🔹 Sub-industries (41): 17% Strengthened, 32% Weakened; strongest Business Equipment, weakest Beverages-Brewers

🔹 Stocks rated Strongest:Weakest: Consumer Non-durables 42%:14%, Retail 41%:19%, Specialty Retail 35%:16%

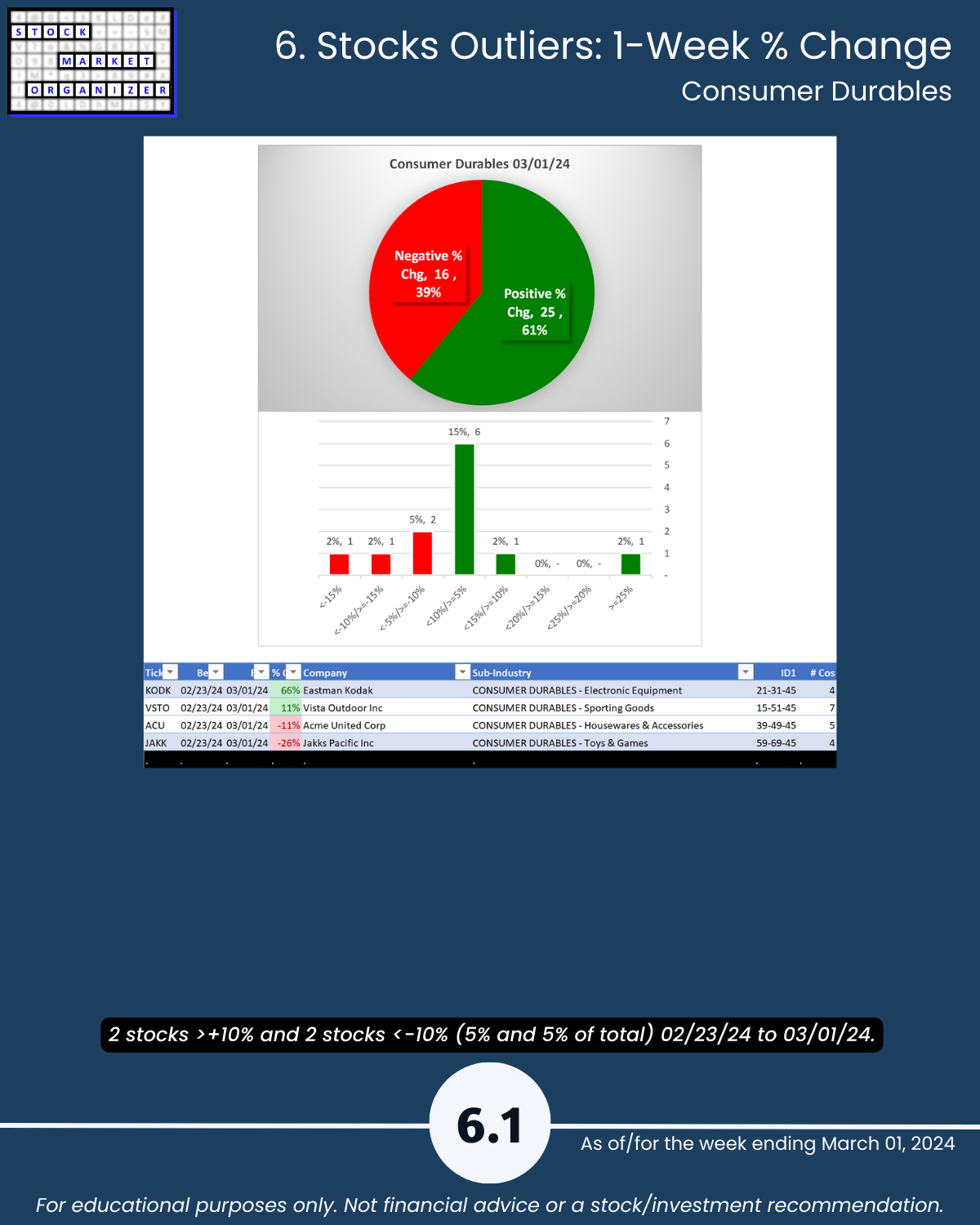

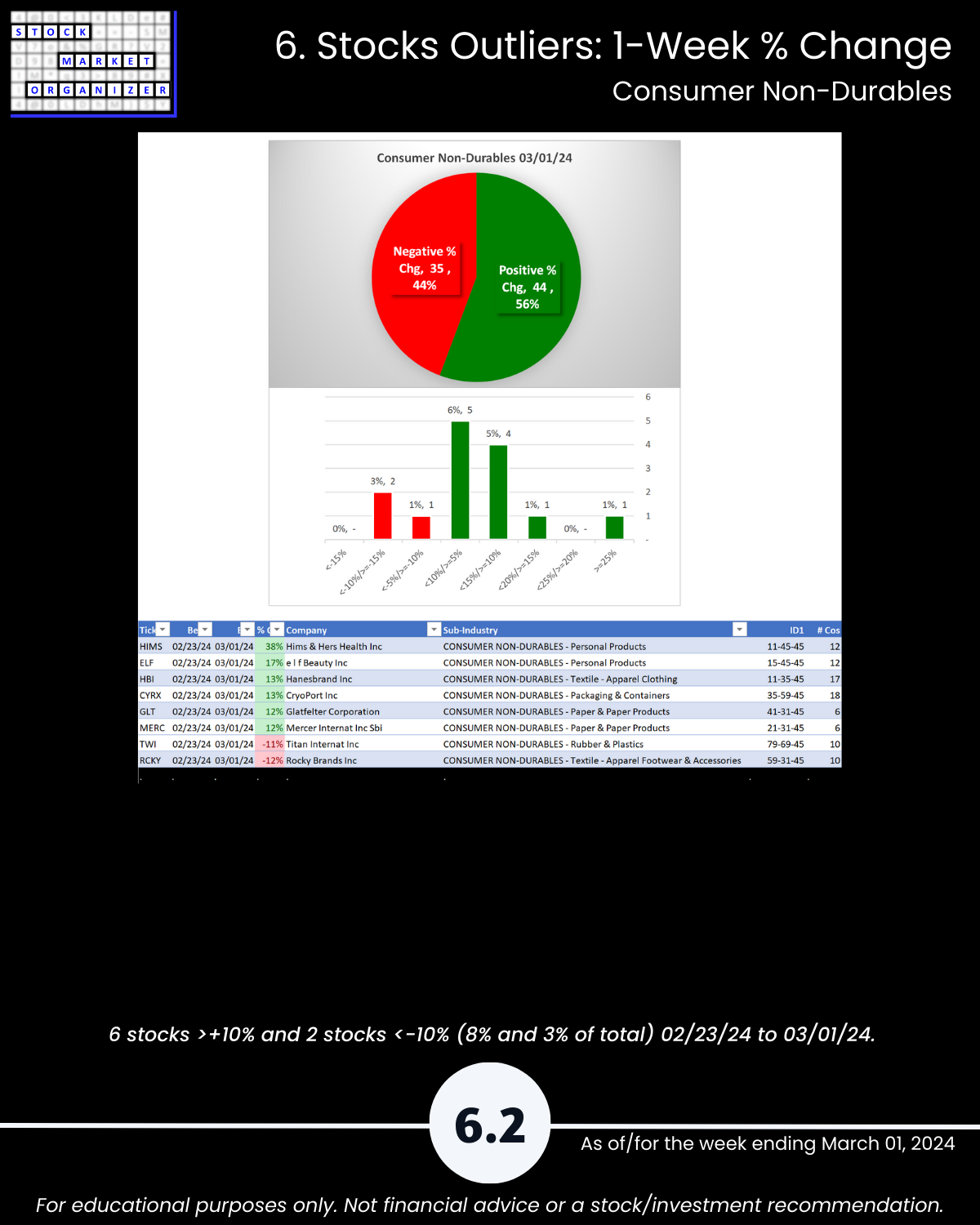

🔹 Outliers: KODK +66%, JAKK -26%; HIMS +38%; BGS +26%, BYND +25%; BIG +25%, BWMX +20%; RVLV +40%, CVNA +20%, EVGO +20%

🔹 5-Year Highs/Lows %: Retail 13%, Specialty Retail 10% of stocks at highs

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

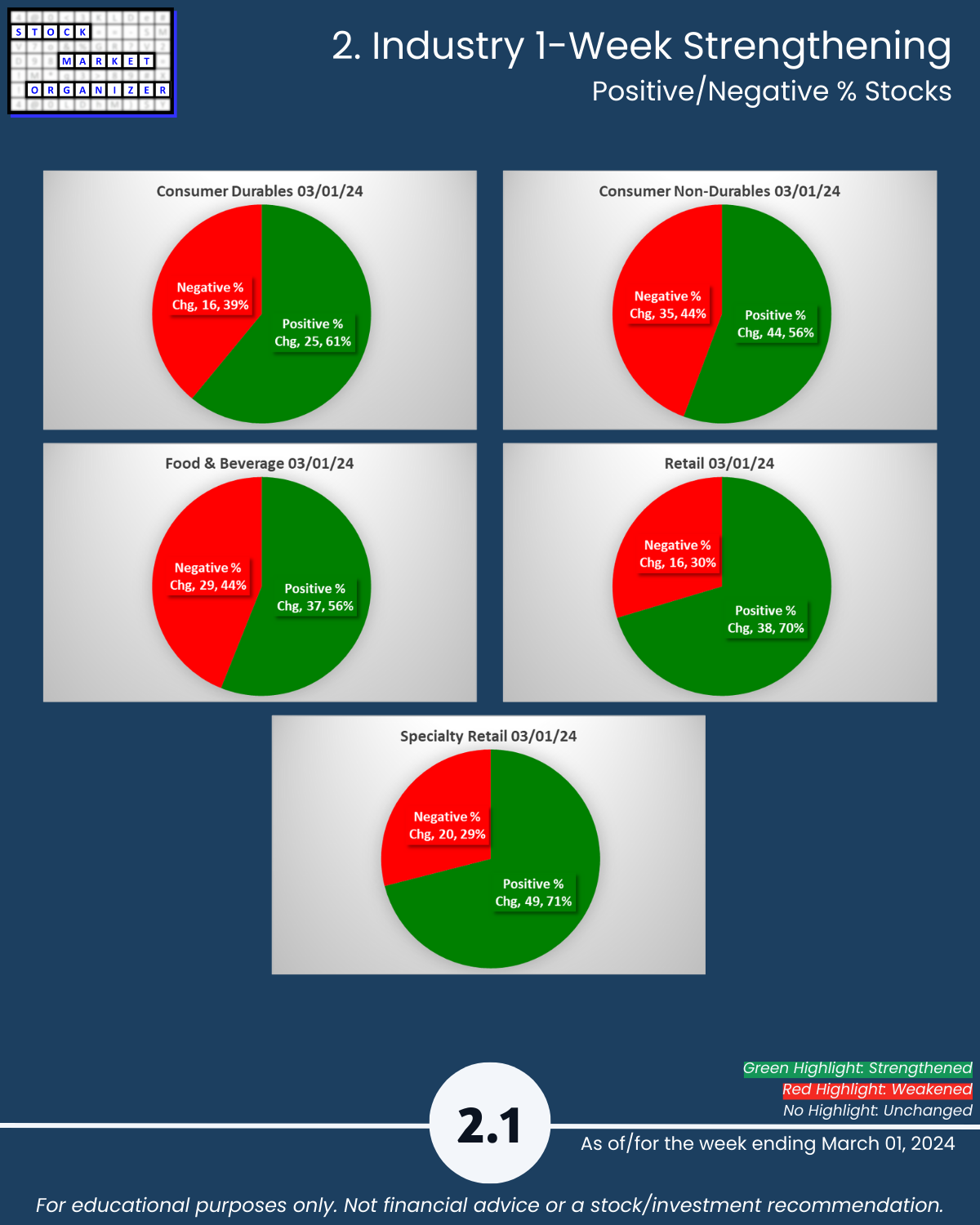

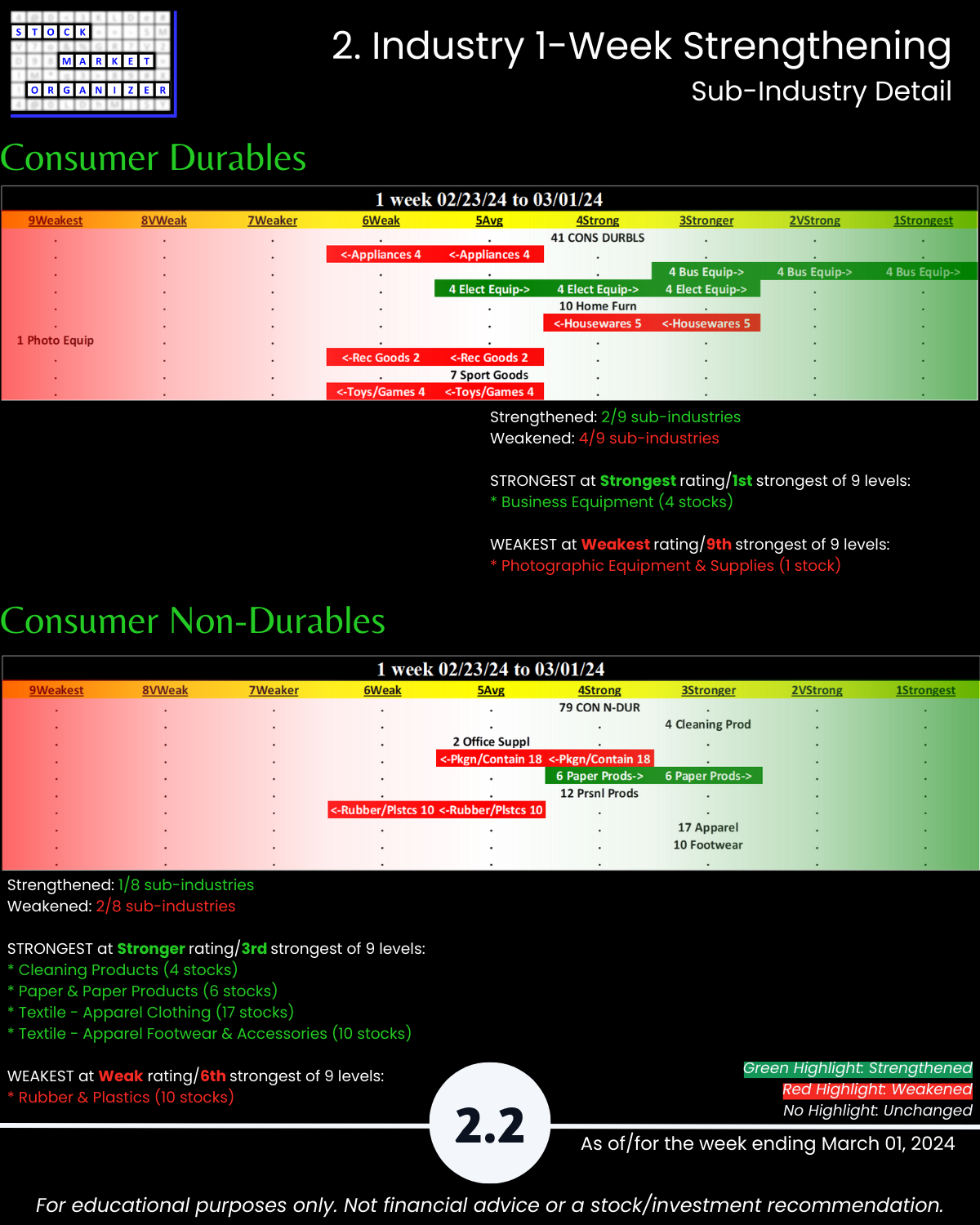

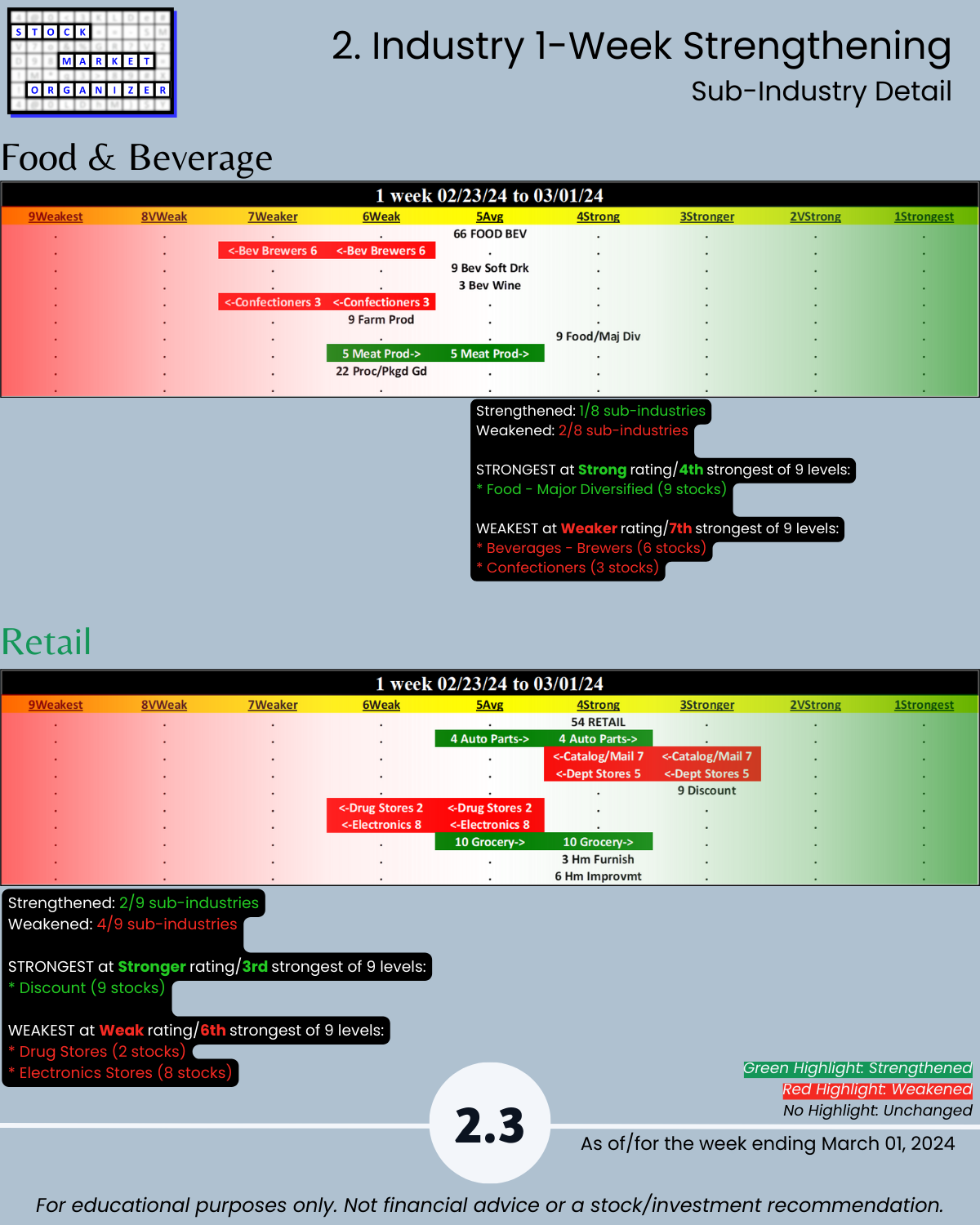

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

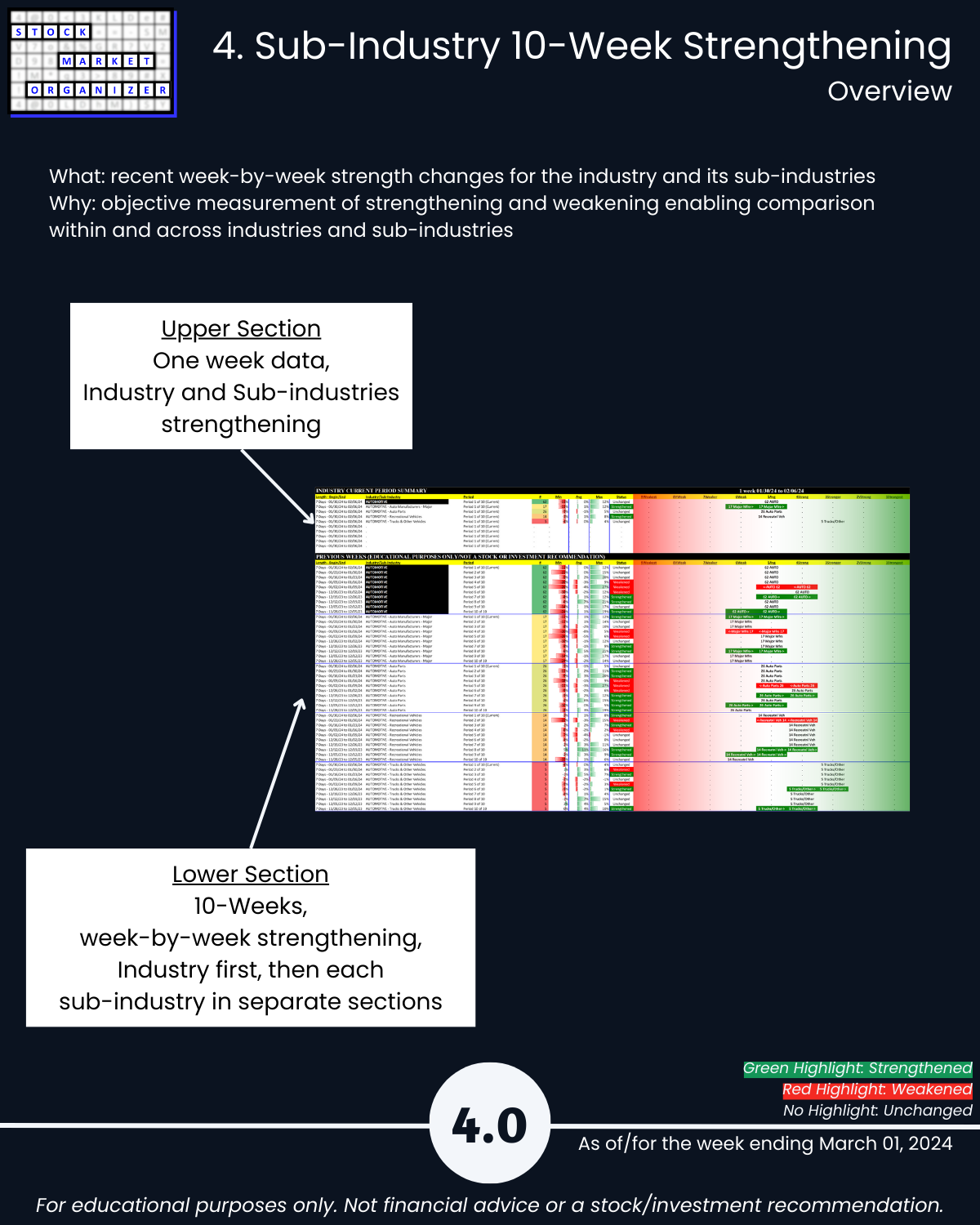

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows