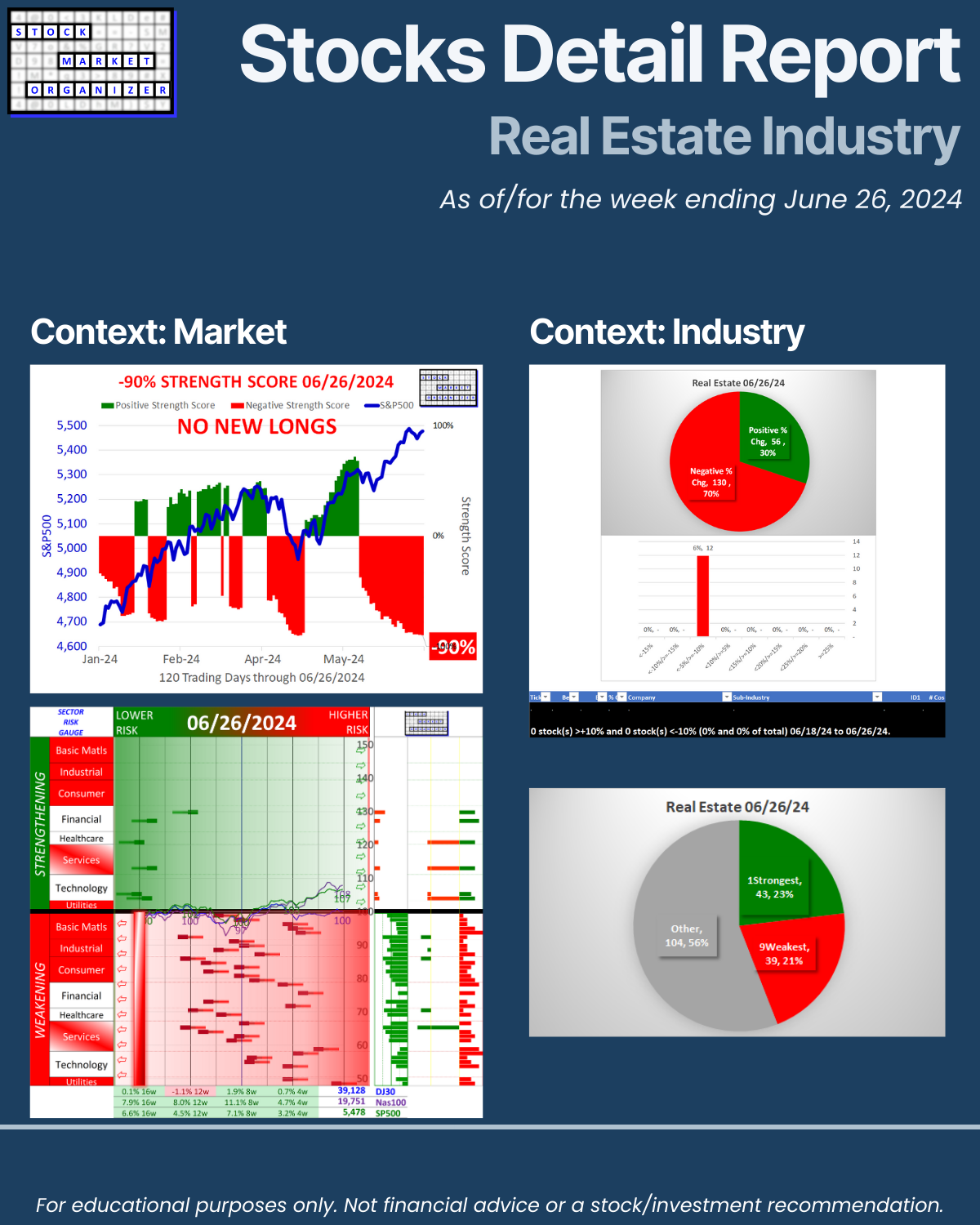

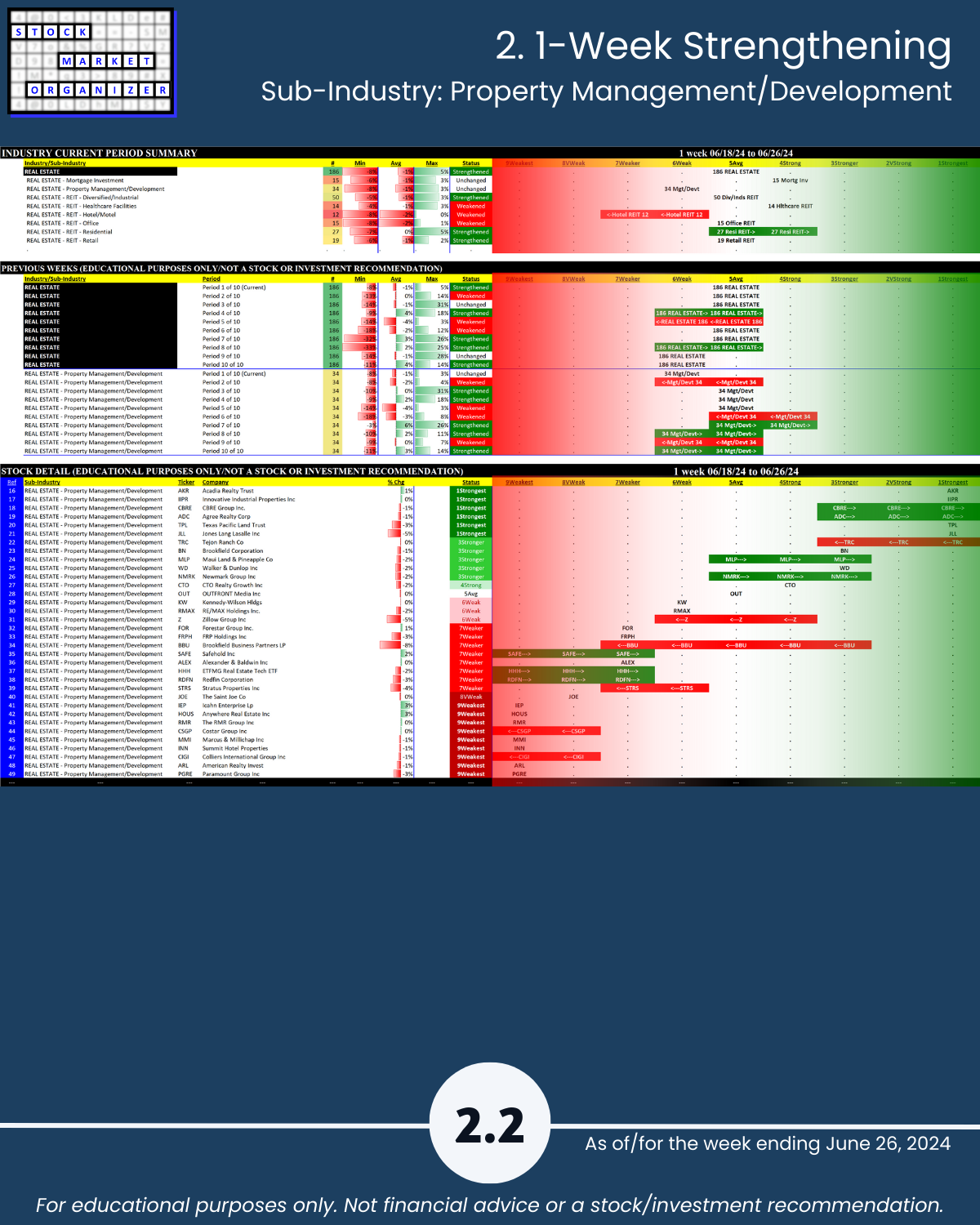

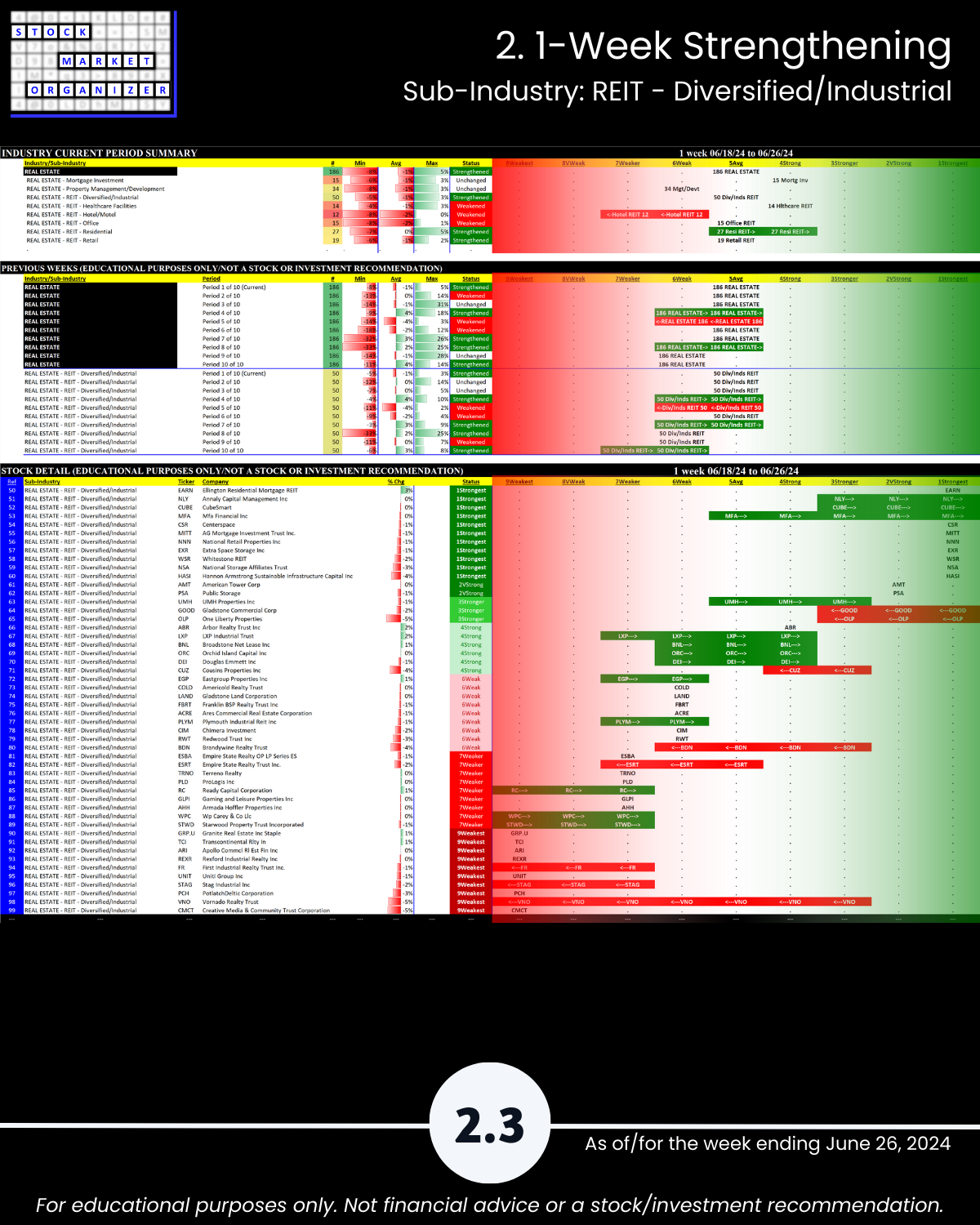

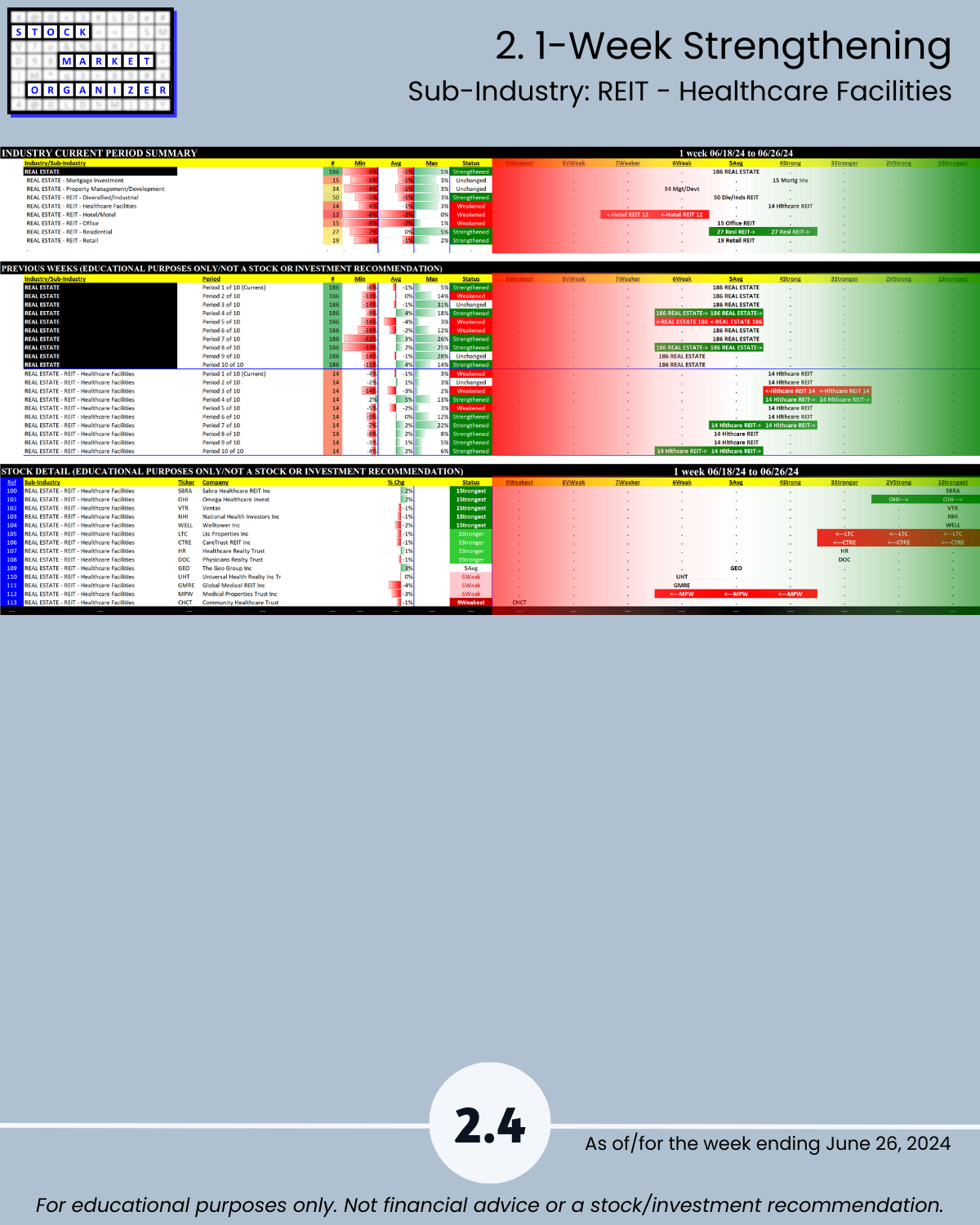

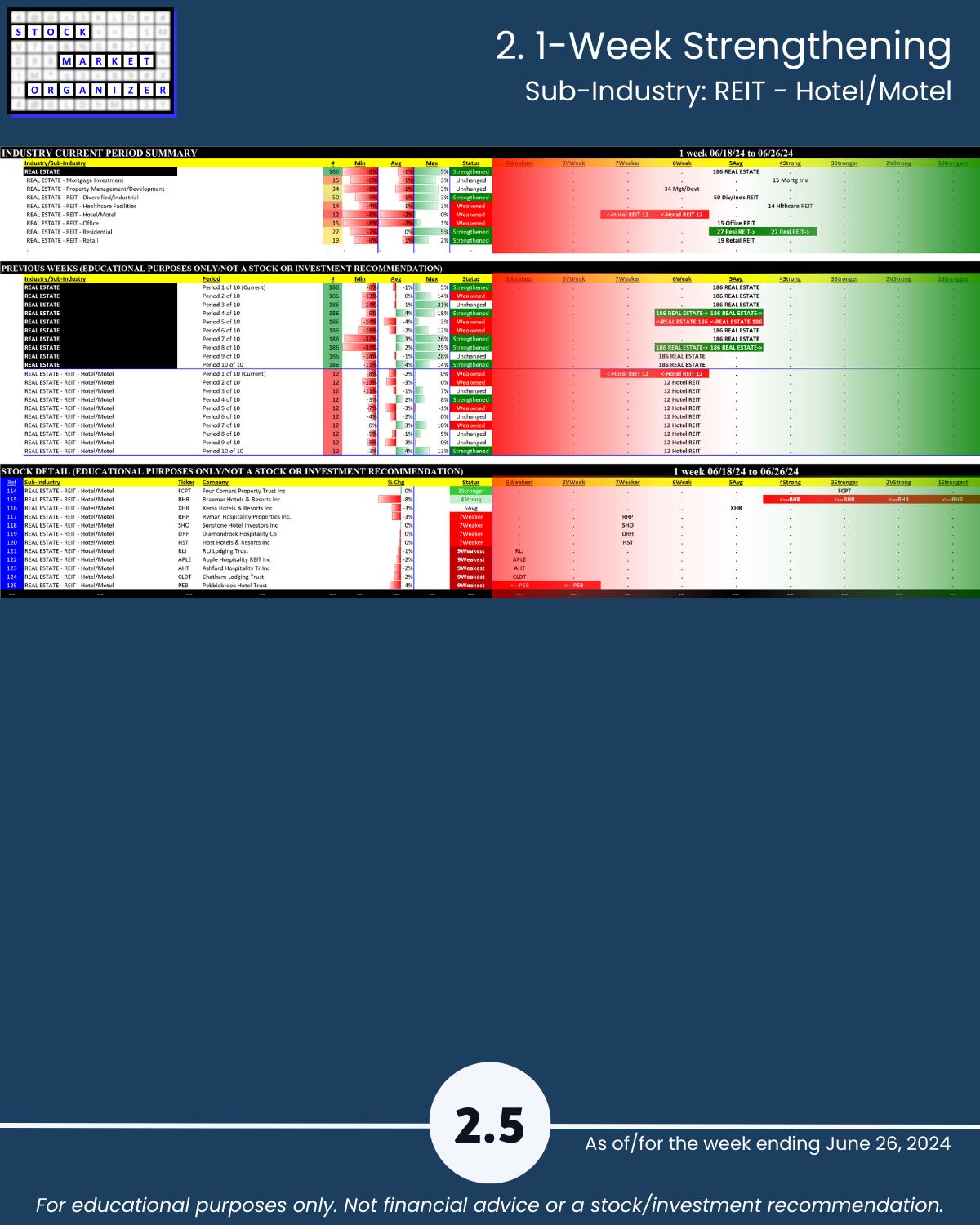

SMO Exclusive: Stocks Detail Report Real Estate Industry 2024-06-26

Commercial Real Estate fans, this 6/26/24 report is for you. Ranked based on current strength: 186 stocks in 8 sub-industries. You won’t find this anywhere else, because I created it from scratch. Sincere questions: would you rather own a strong stock in a strengthening sub-industry or a weak stock in a weakening sub-industry? And, how do you discern this?

I know my own answer to the first question. (I’m a strength stacker.)

See below/attached for a unique answer to the second.

HOW TO READ THE ATTACHED

(It tells you where you can find strong stocks in strengthening sub-industries)

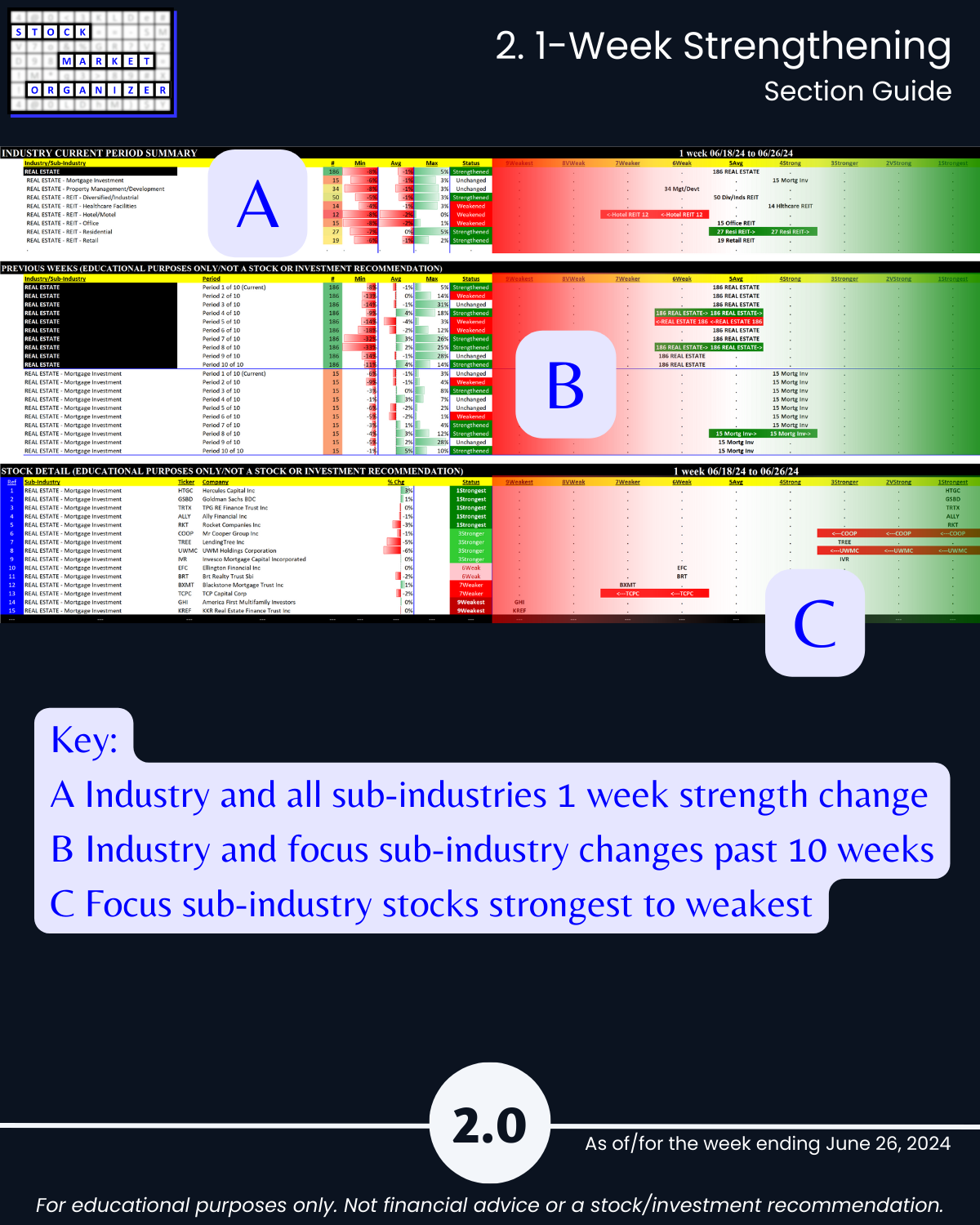

Page 2.0 = guide, tells you what is where on the pages in this section

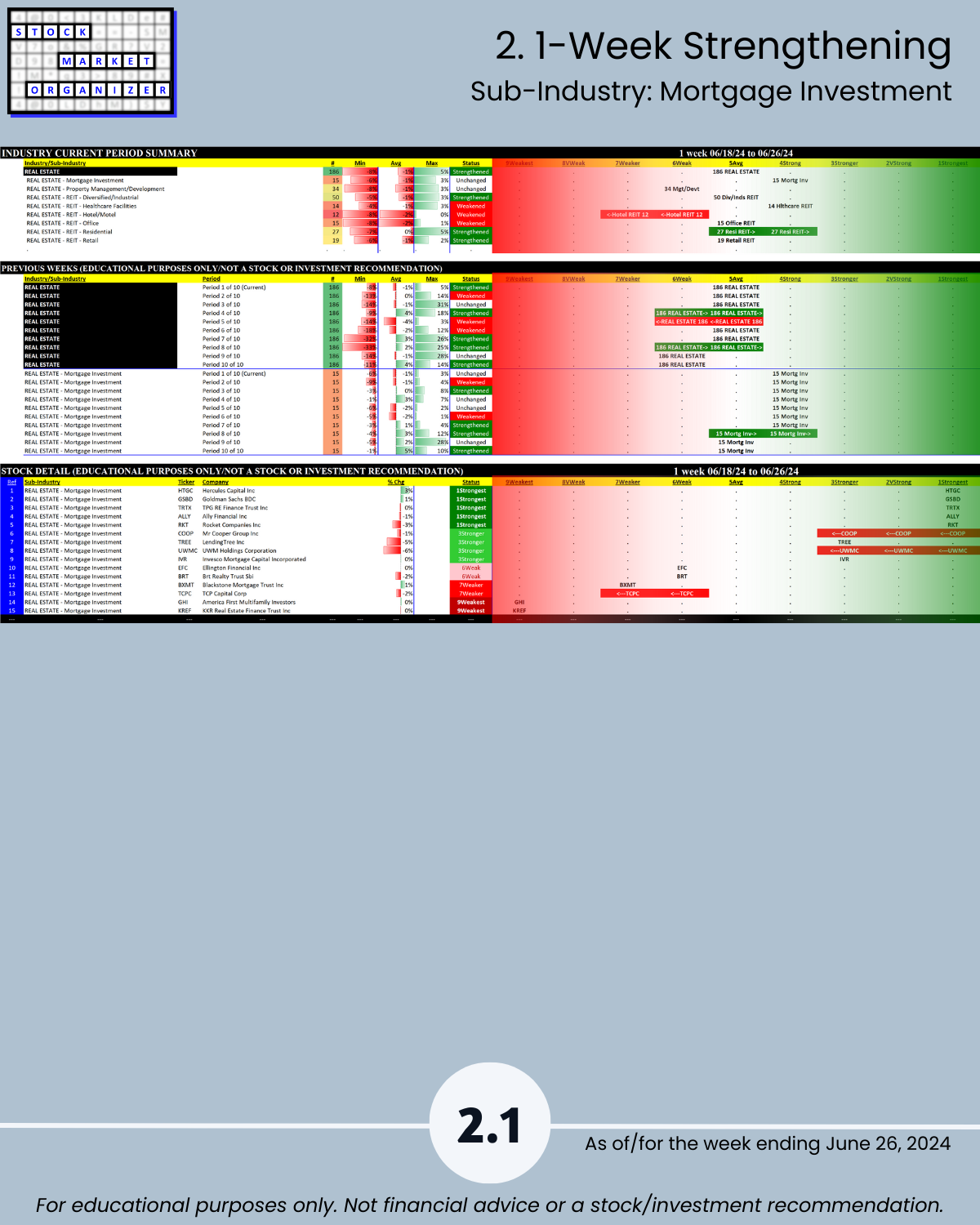

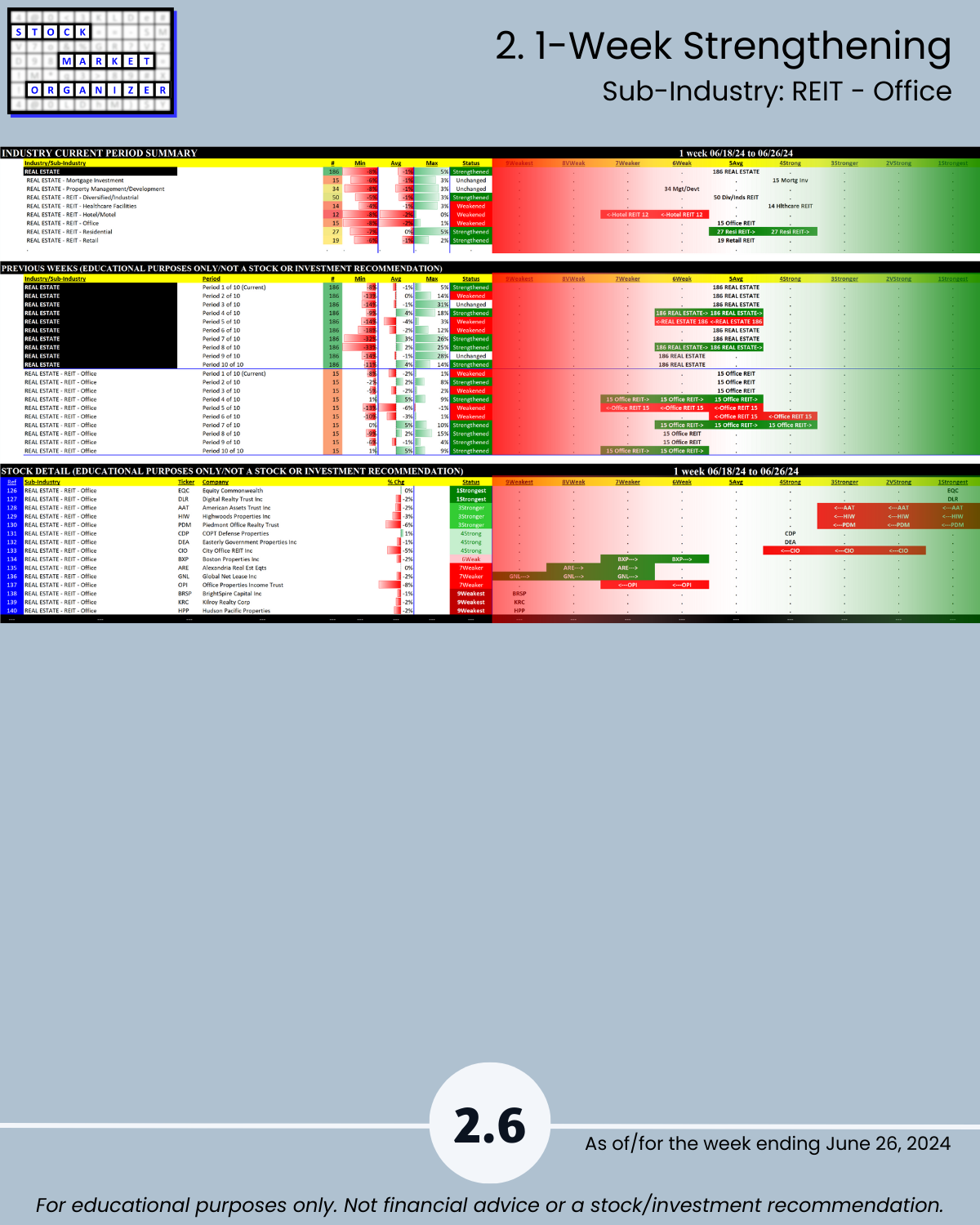

Page 2.1 = see top portion A

- Strongest sub-industries at 4Strong:

Mortgage Investment

Healthcare Facilities REITs

Residential REITs (which strengthened from 5Average to 4Strong) - Weakest sub-industry at 7Weaker:

Hotel REITs (which weakened from 6Weak to 7Weaker)

Page 2.5 = see bottom portion C

Hotel REITs detail

- Strongest rated stock at 3Stronger:

FCPT/Four Corners Property Trust - Weakest rated stocks at 9Weakest:

RLJ/RLJ Lodging Trust

APLE/Apple Hospitality REIT Inc

AHT/Ashford Hospitality

CLDT/Chatham Lodging Trust

PEB/Pebblebrook Hotel Trust (weakened this week)

(NOTE: middle section B shows this is the first weakening week in the past 10 for this sub-industry. Start of something important/material? I don’t know. But it’s what IS.)

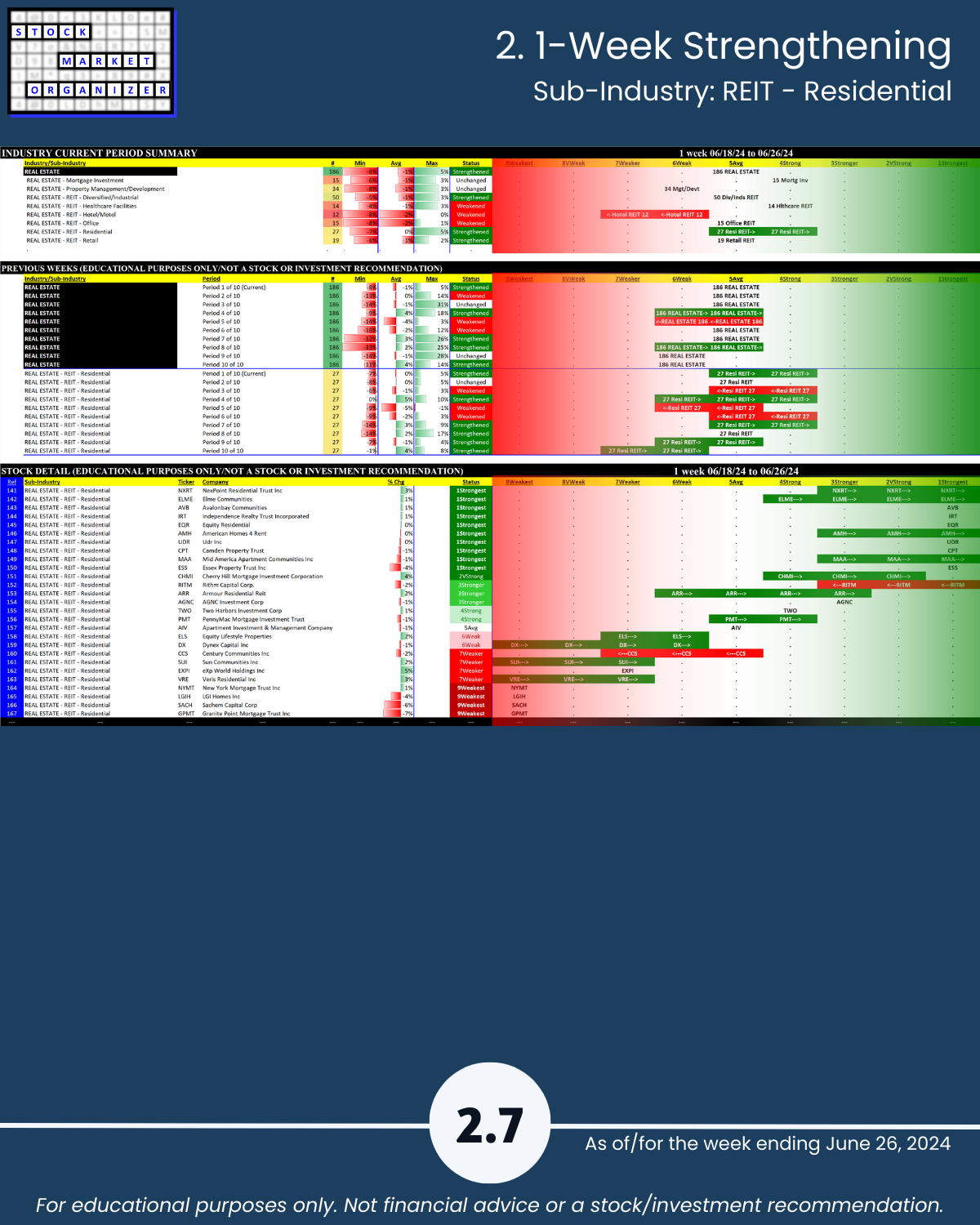

Page 2.7 = see bottom portion C

Multifamily REITs detail

- Strongest rated stocks at 1Strongest =

NXRT/NexPoint Residential Trust Inc

ELME/Elme Communities

AVB/Avalonbay Communities

IRT/Independence Realty Trust Incorporated

EQR/Equity Residential

AMH/American Homes 4 Rent

UDR/UDR Inc

CPT/Camden Property Trust

MAA/Mid America Apartment Communities Inc

ESS/Essex Property Trust Inc - Weakest rated stocks at 9Weakest:

NYMT/New York Mortgage Trust Inc

LGIH/LGI Homes Inc

SACH/Sachem Capital Corp

GPMT/Granite Point Mortgage Trust Inc

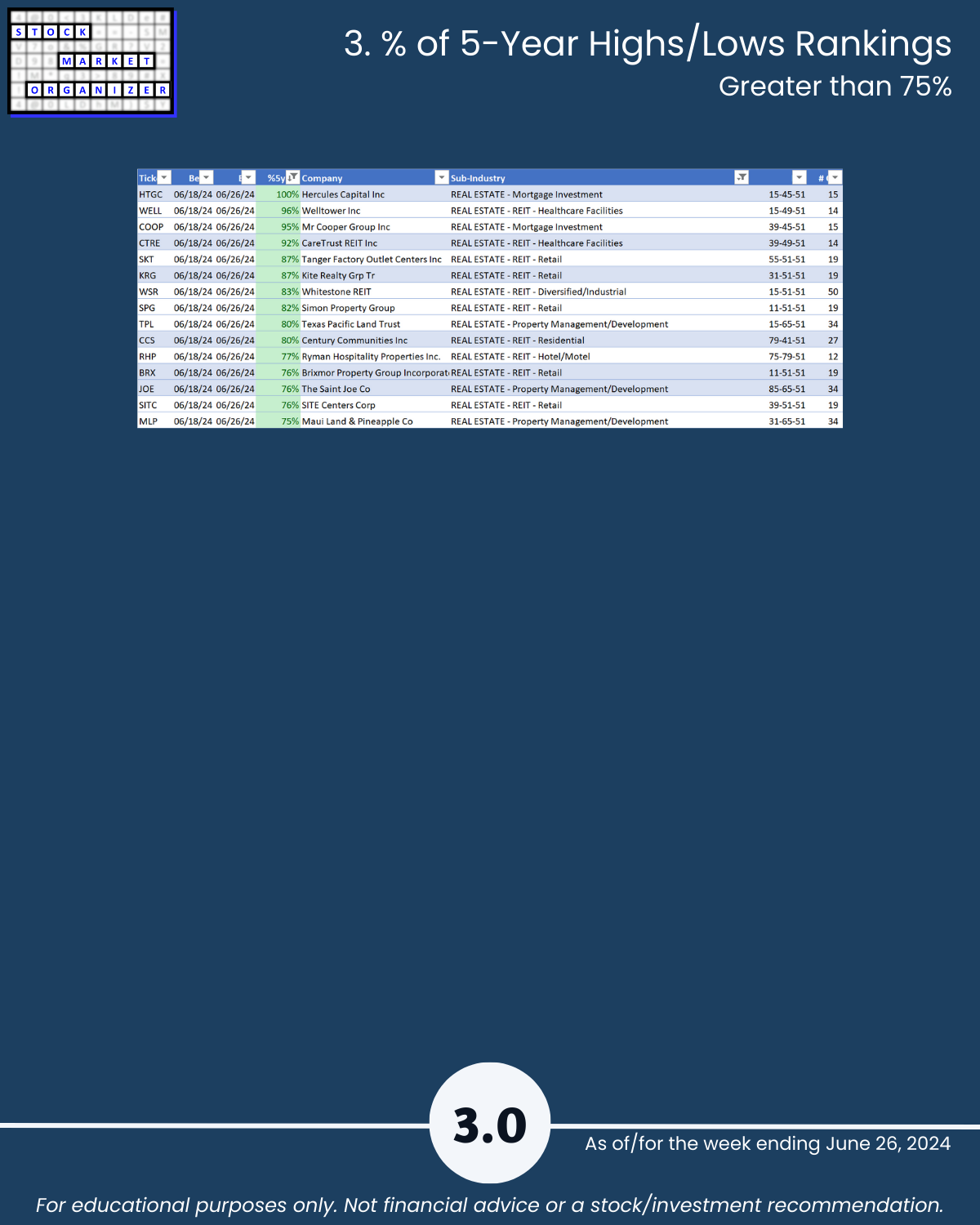

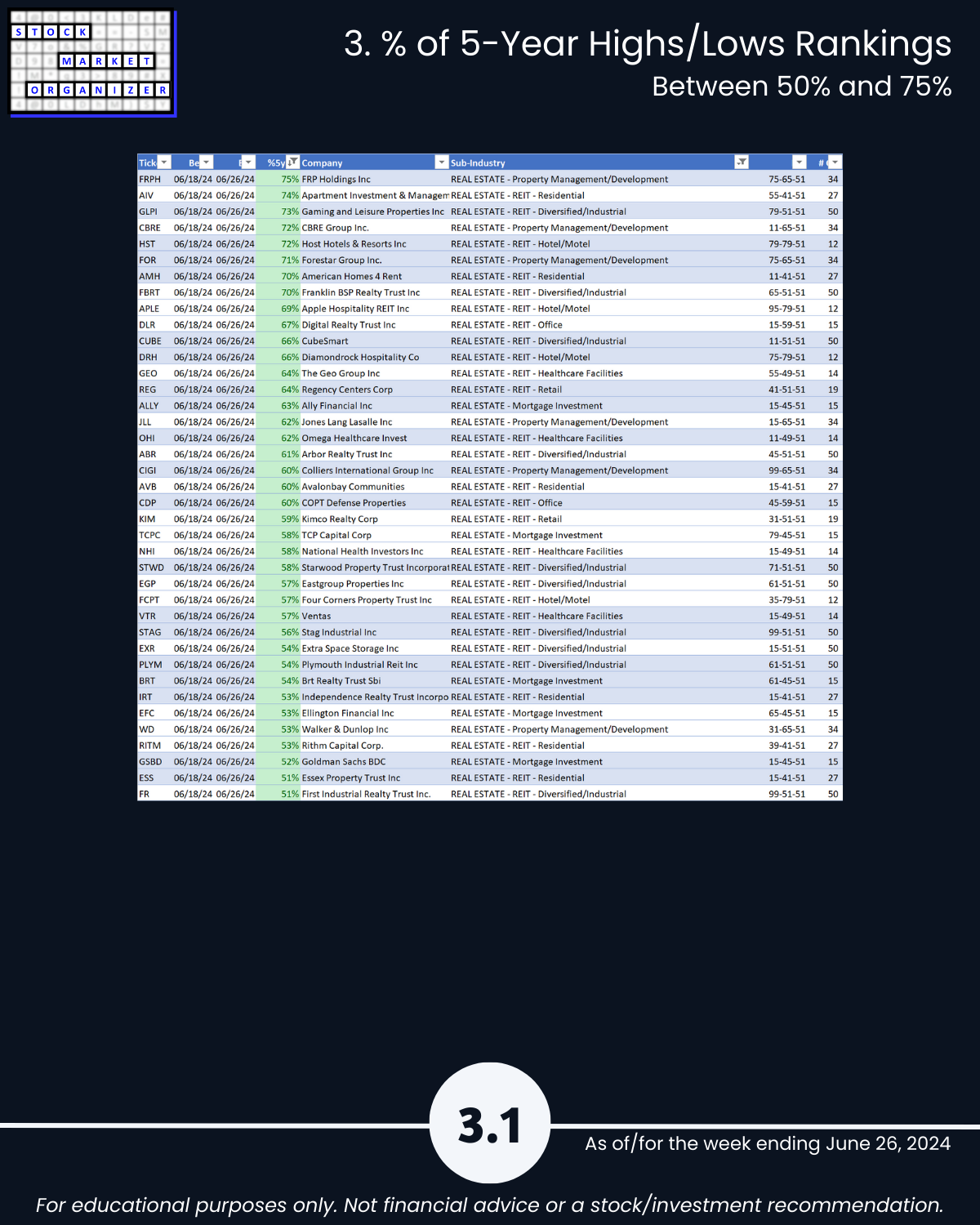

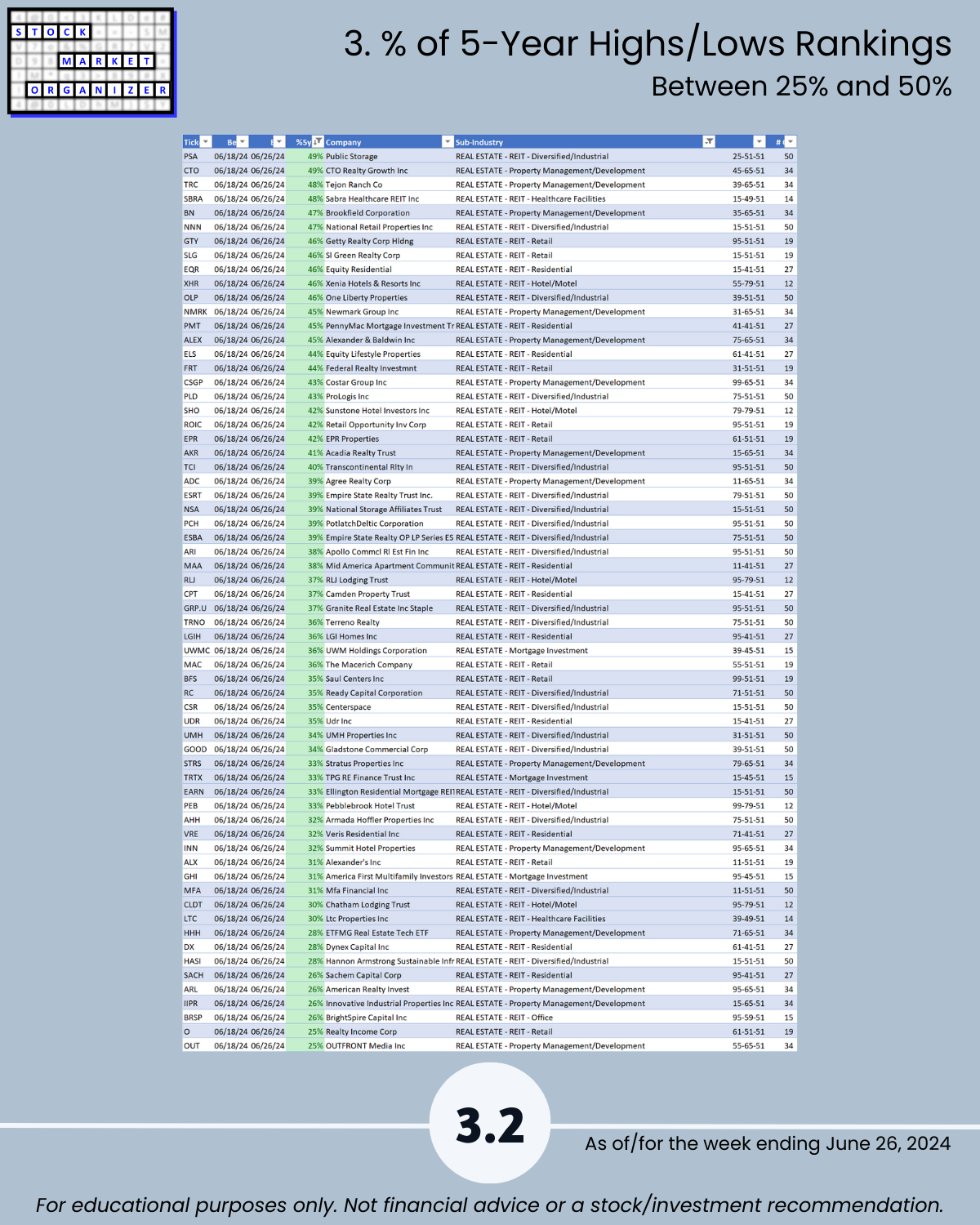

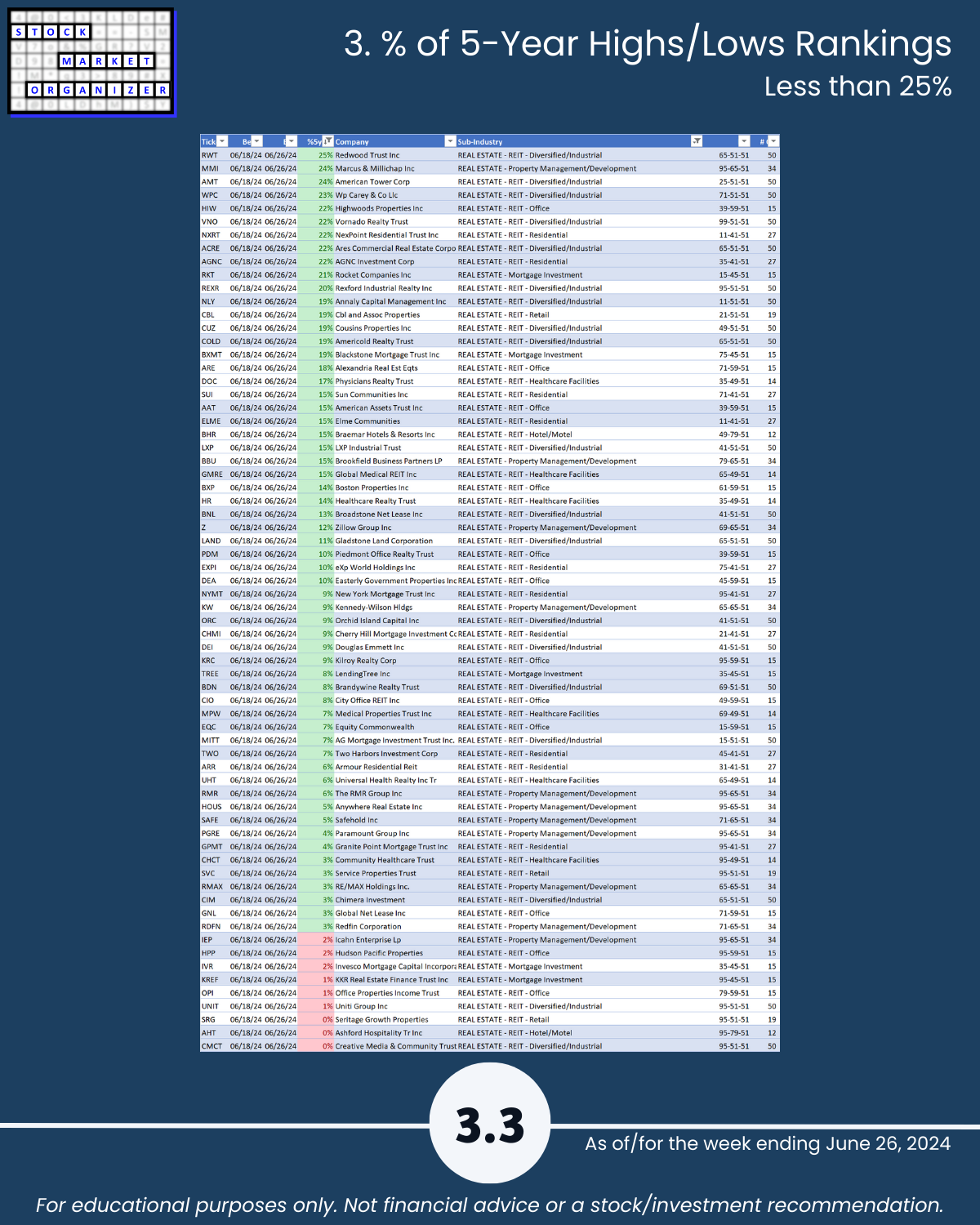

Pages 3.0 (stocks at >75% of 5-year Highs/Lows) and 3.3 (stocks at <25% of 5-year Highs/Lows)

Can you consistently discern tops and bottoms of stocks that “The Market” loves and hates, respectively? In other words, are you really smarter than everyone else? (Not saying you aren’t, but I know I’m not.)

You won’t find what you aren’t looking for.

This report offers unique, logical, and actionable insights from using conventional tools in unconventional ways.

It may resonate with you if you subscribe to the following:

- The stock market does not have to be so complicated.

- “What” matters, not “why.”

- Market conditions matter.

- The 100%+ rally begins with a 10% rally.

- The multi-month rally begins with one up week. (Also applies to declines.)

- The stronger your stocks, the greener your P&L.

1. Introduction/Industry Components

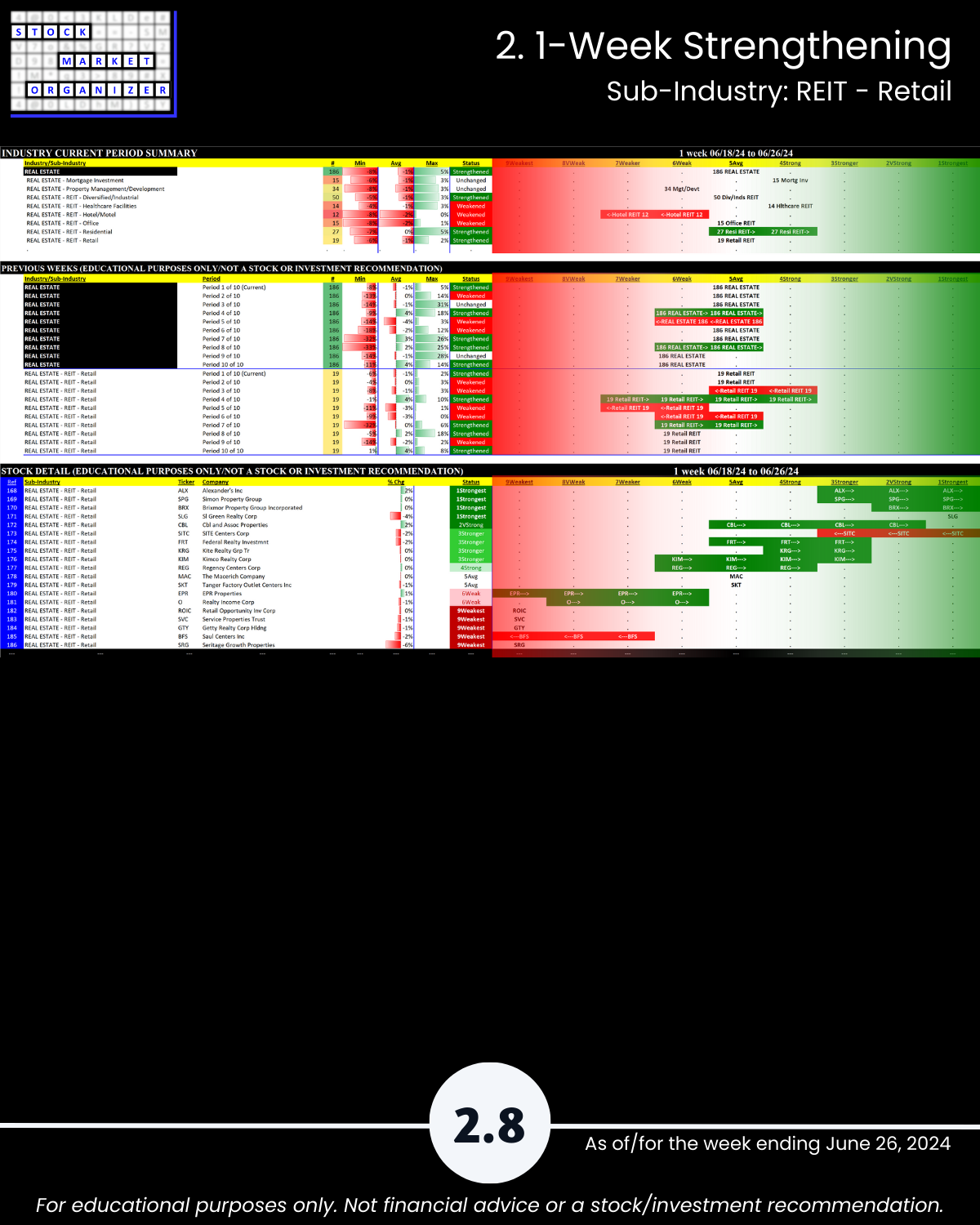

2. 1-Week Strengthening

3. % of 5-Year Highs/Lows Rankings