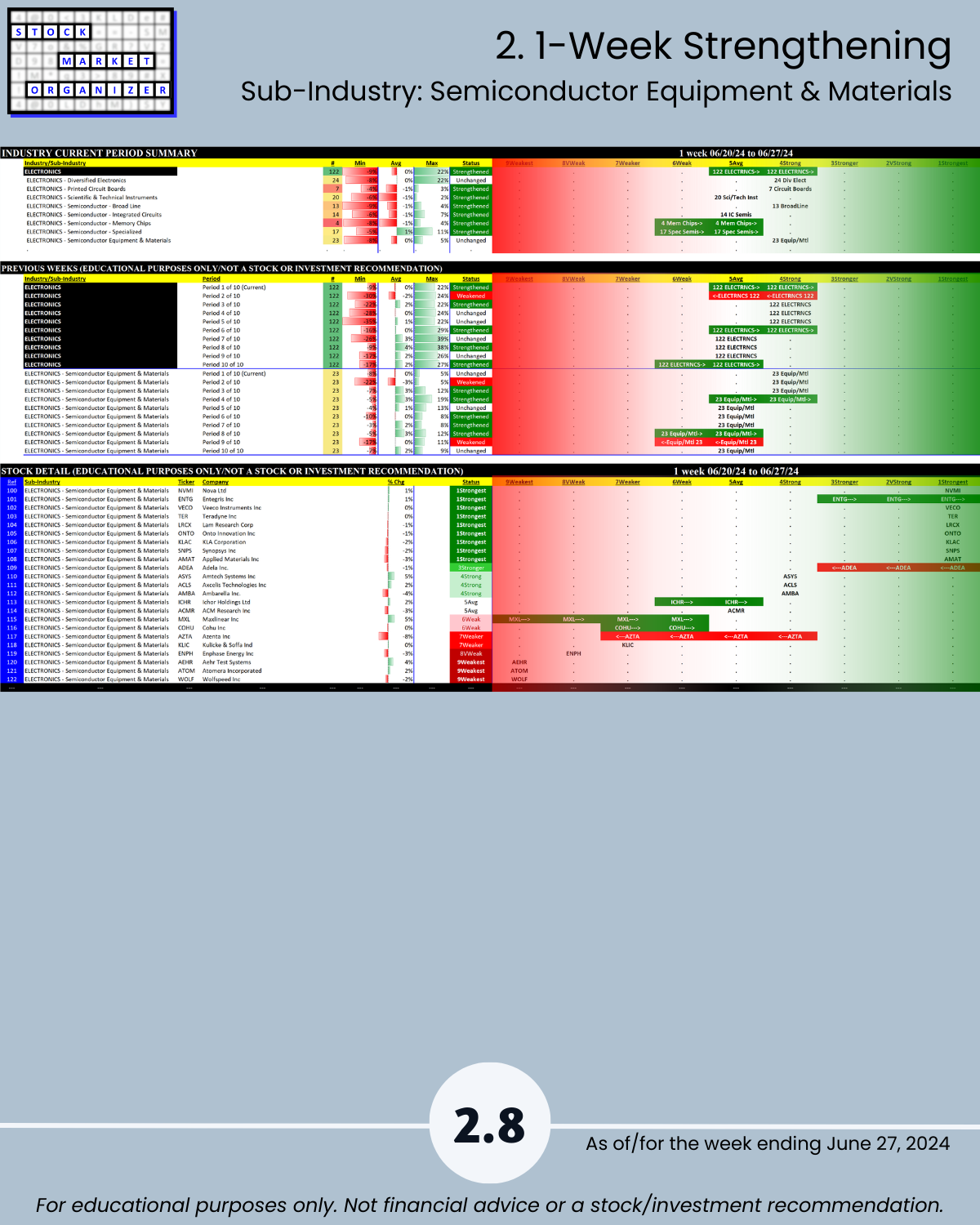

SMO Exclusive: Stocks Detail Report Electronics Industry 2024-06-27

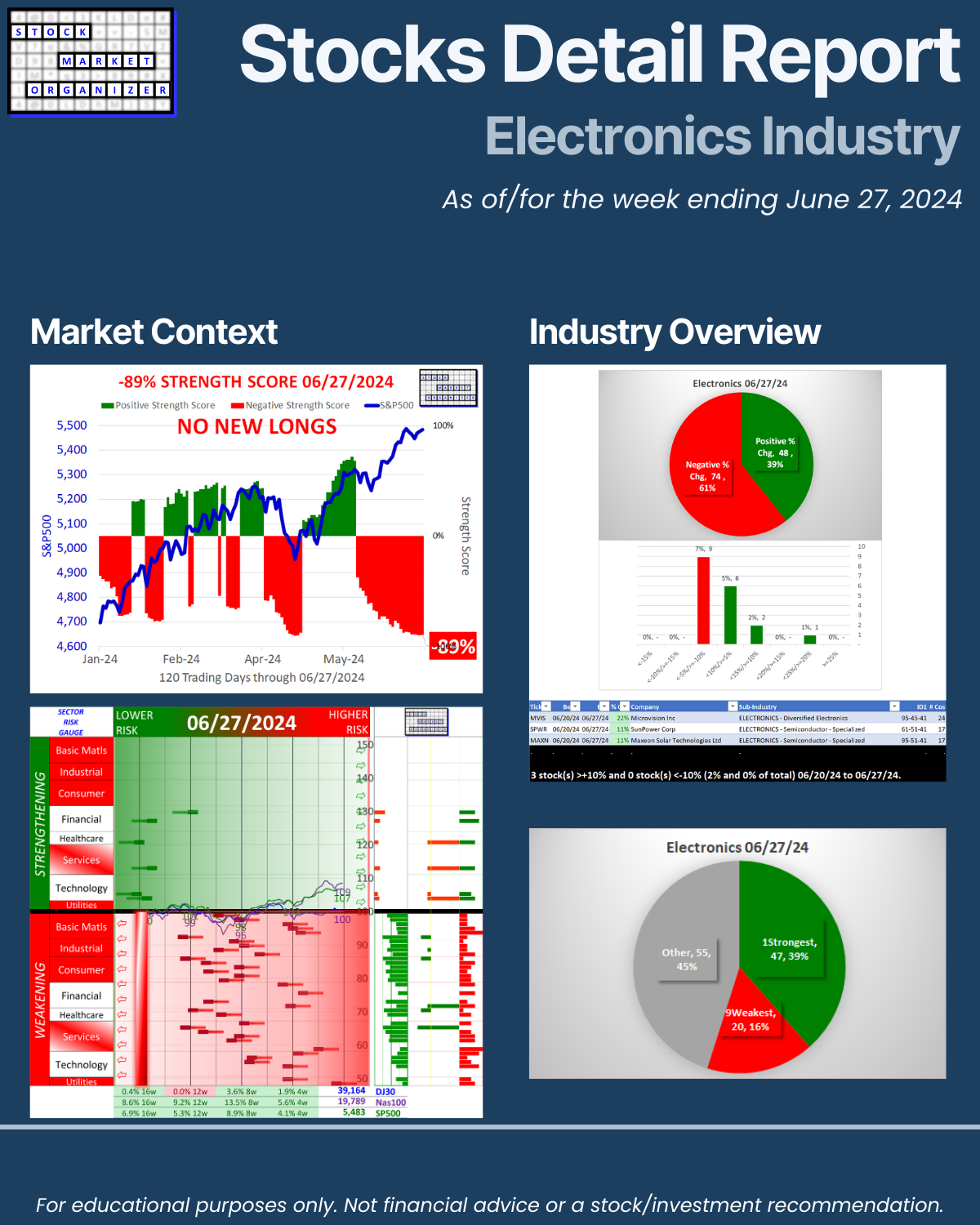

Chips/semis fans, this 6/27/24 report is for you. Ranked based on current strength: 122 stocks in 8 sub-industries. You won’t find this anywhere else, because I created it from scratch. Sincere questions: would you rather own a strong stock in a strengthening sub-industry or a weak stock in a weakening sub-industry? And, how do you discern this?

I know my own answer to the first question. (I’m a strength stacker.)

See below/attached for a unique answer to the second.

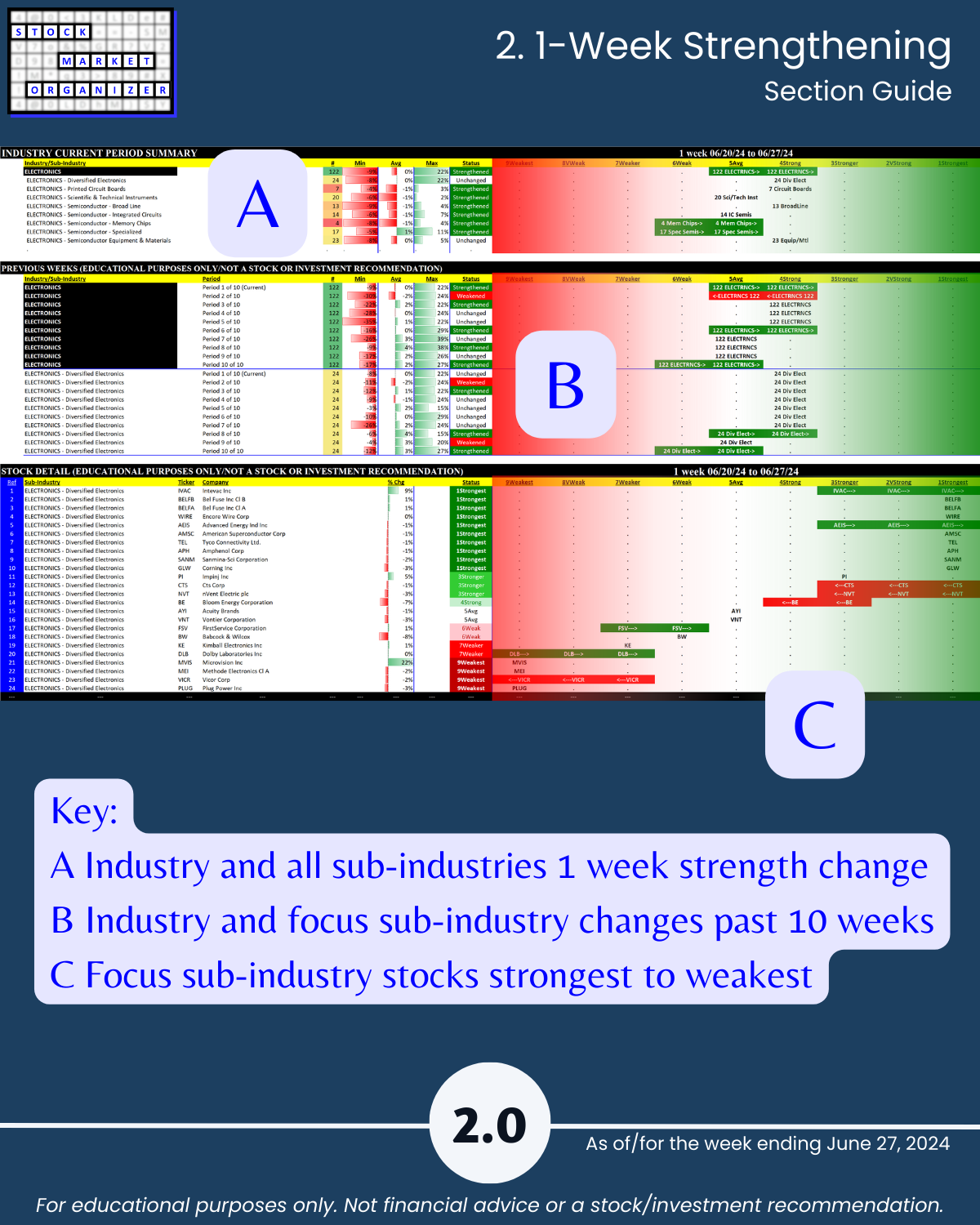

HOW TO READ THE ATTACHED

(It tells you where you can find strong stocks in strengthening sub-industries)

Page 2.0 = guide, tells you what is where on the pages in this section

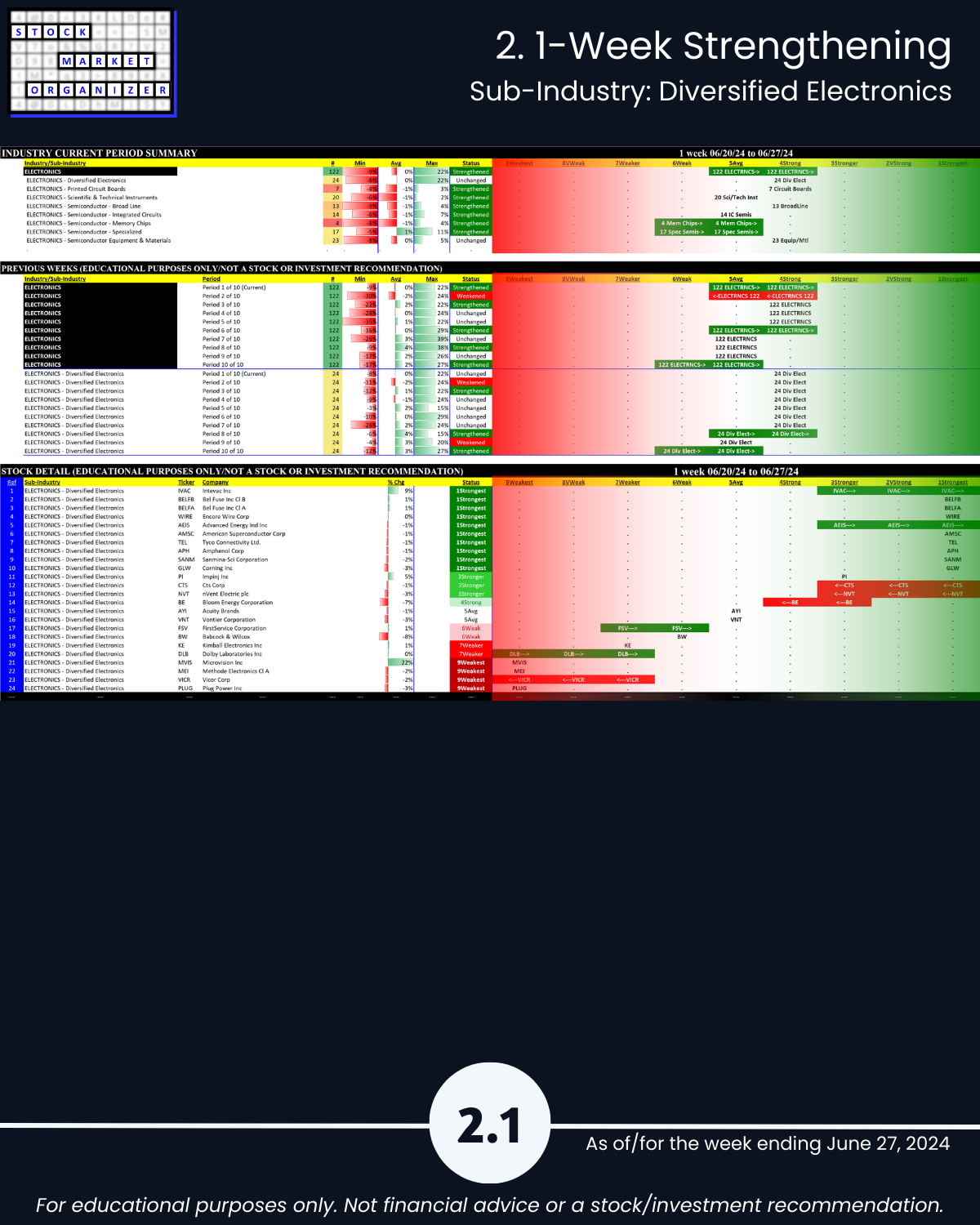

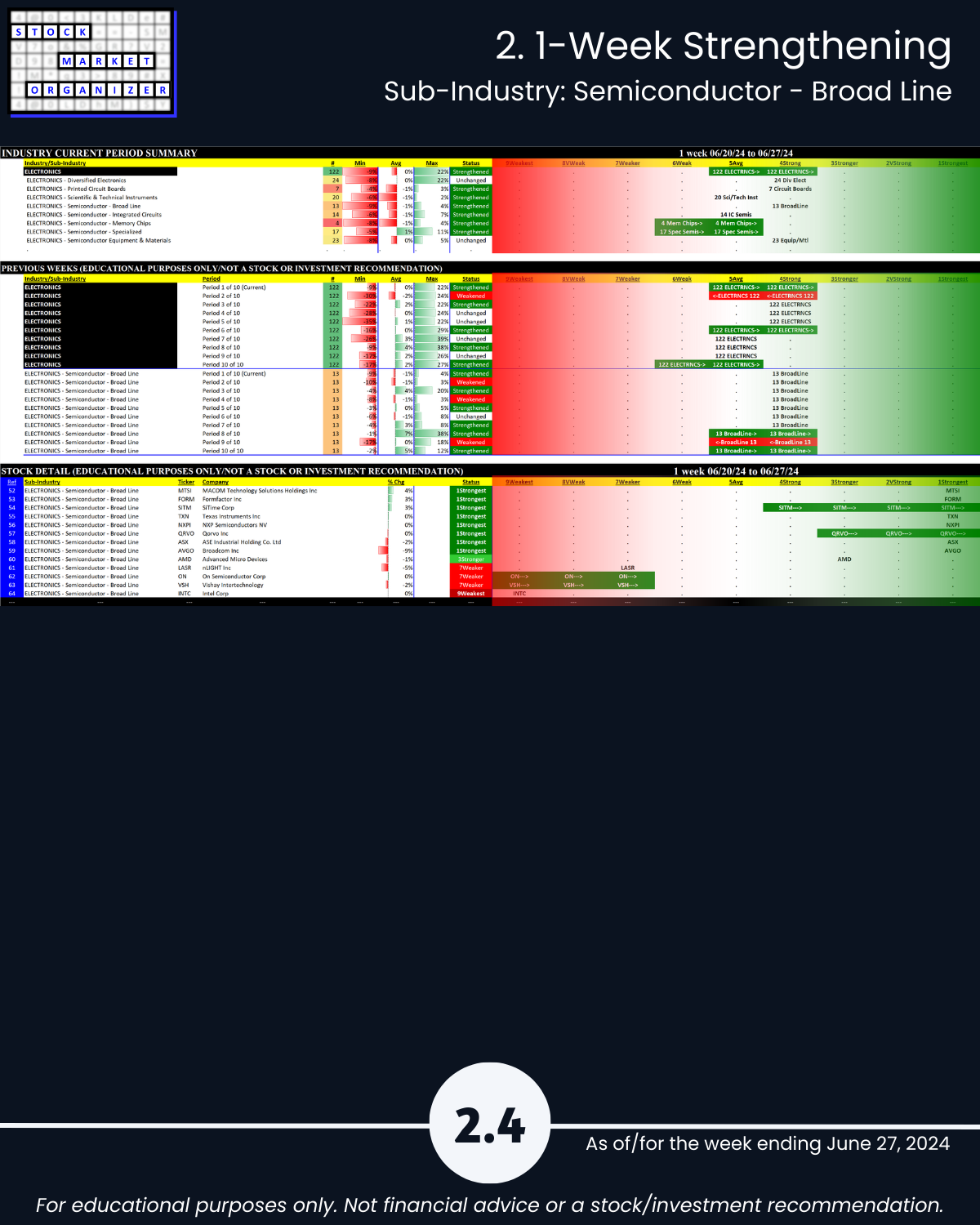

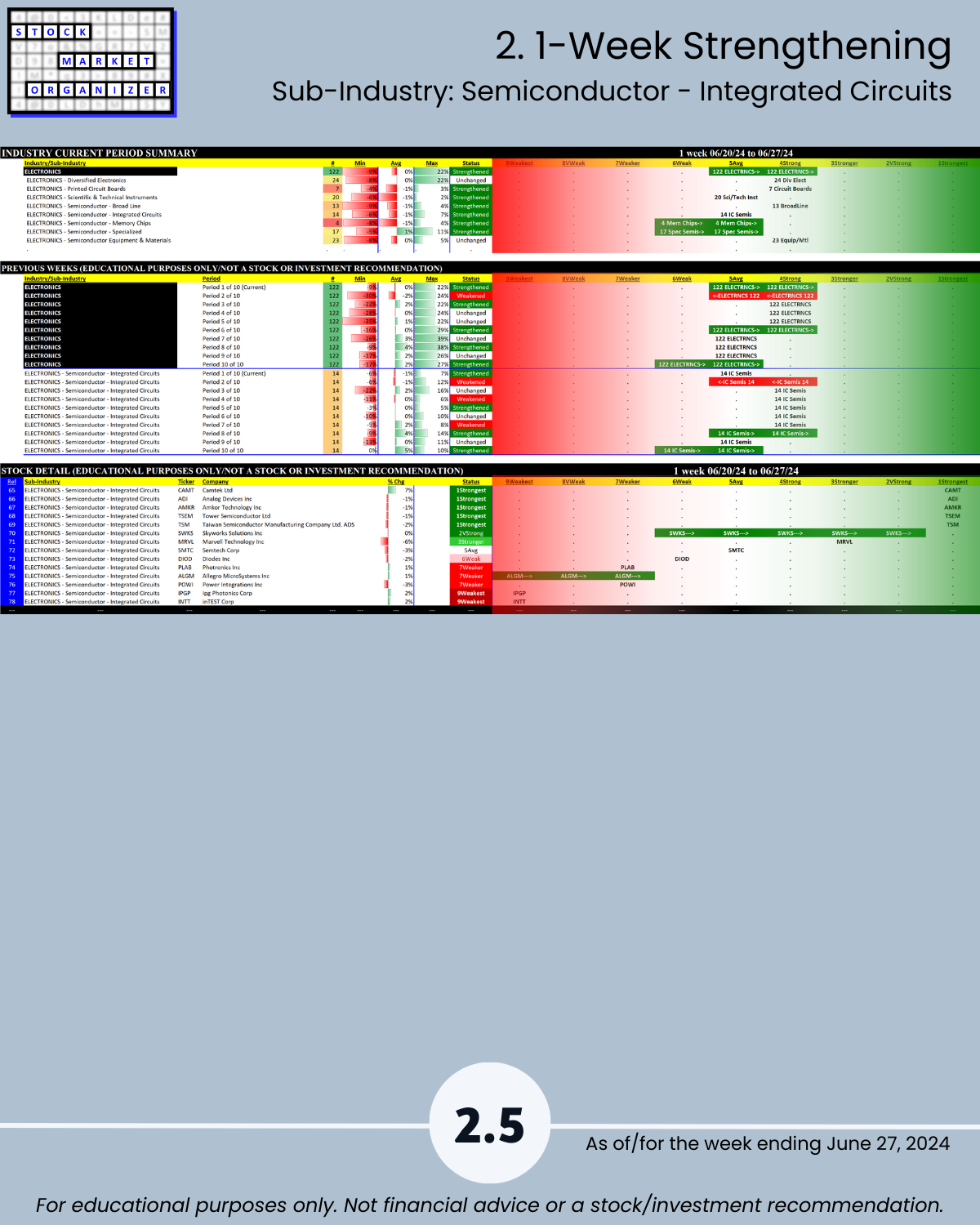

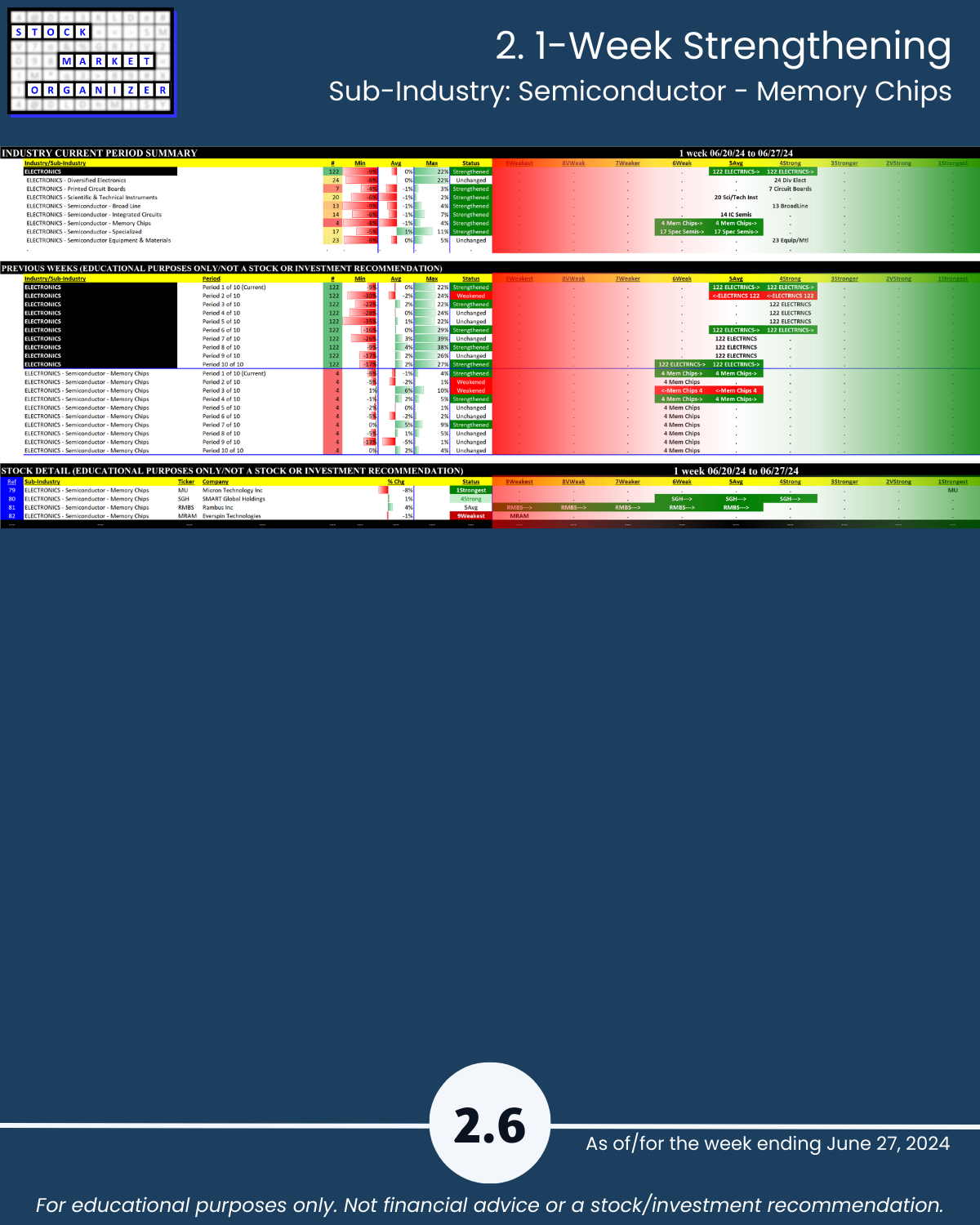

Page 2.1 = see top portion A, note all 8 sub-industries are clustered at 4Strong and 5Average

- Strongest sub-industries at 4Strong:

Diversified Electronics

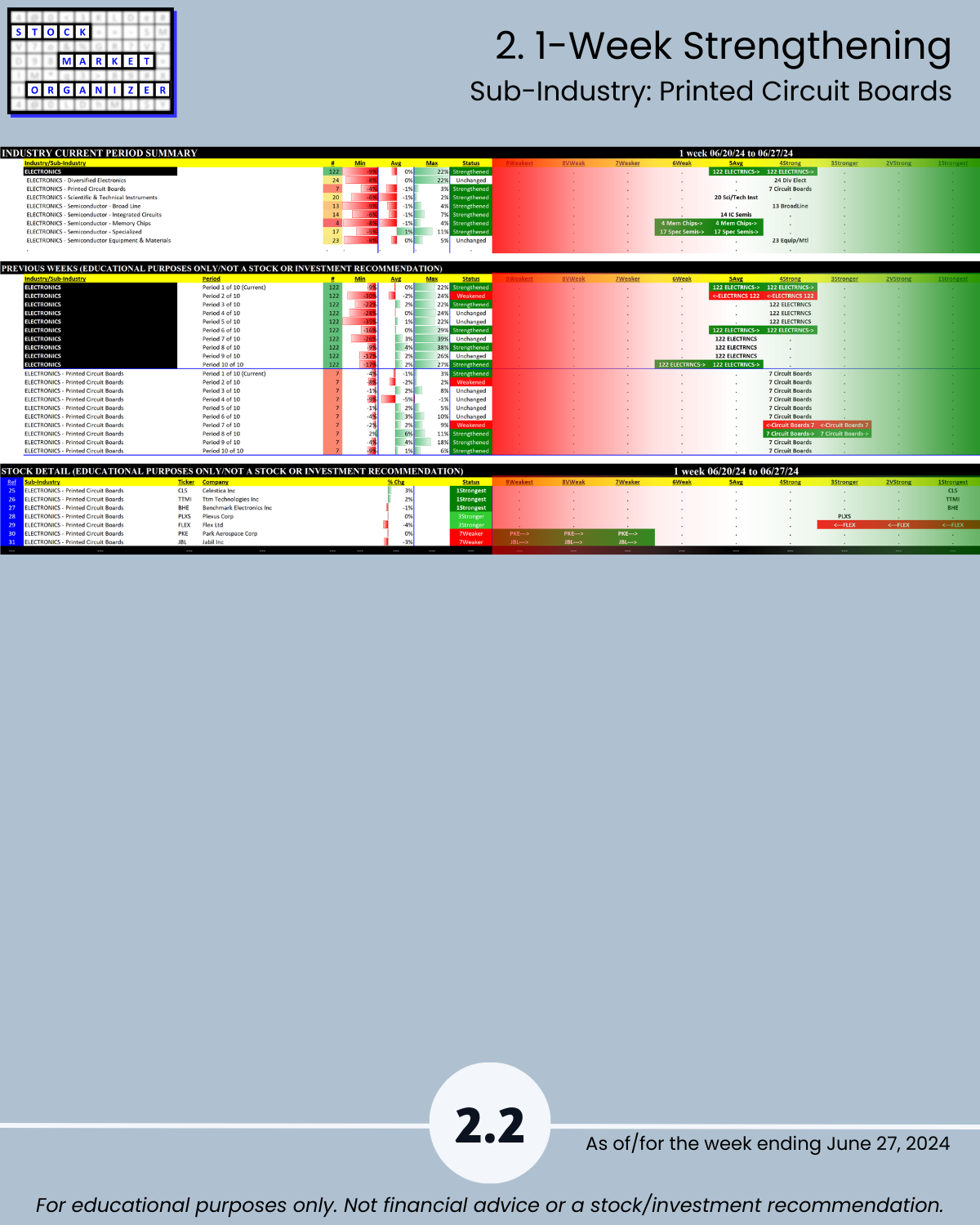

Circuit Boards

Semiconductor - Broad Line

Semiconductor Equipment & Materials - Weakest sub-industries at 5Average:

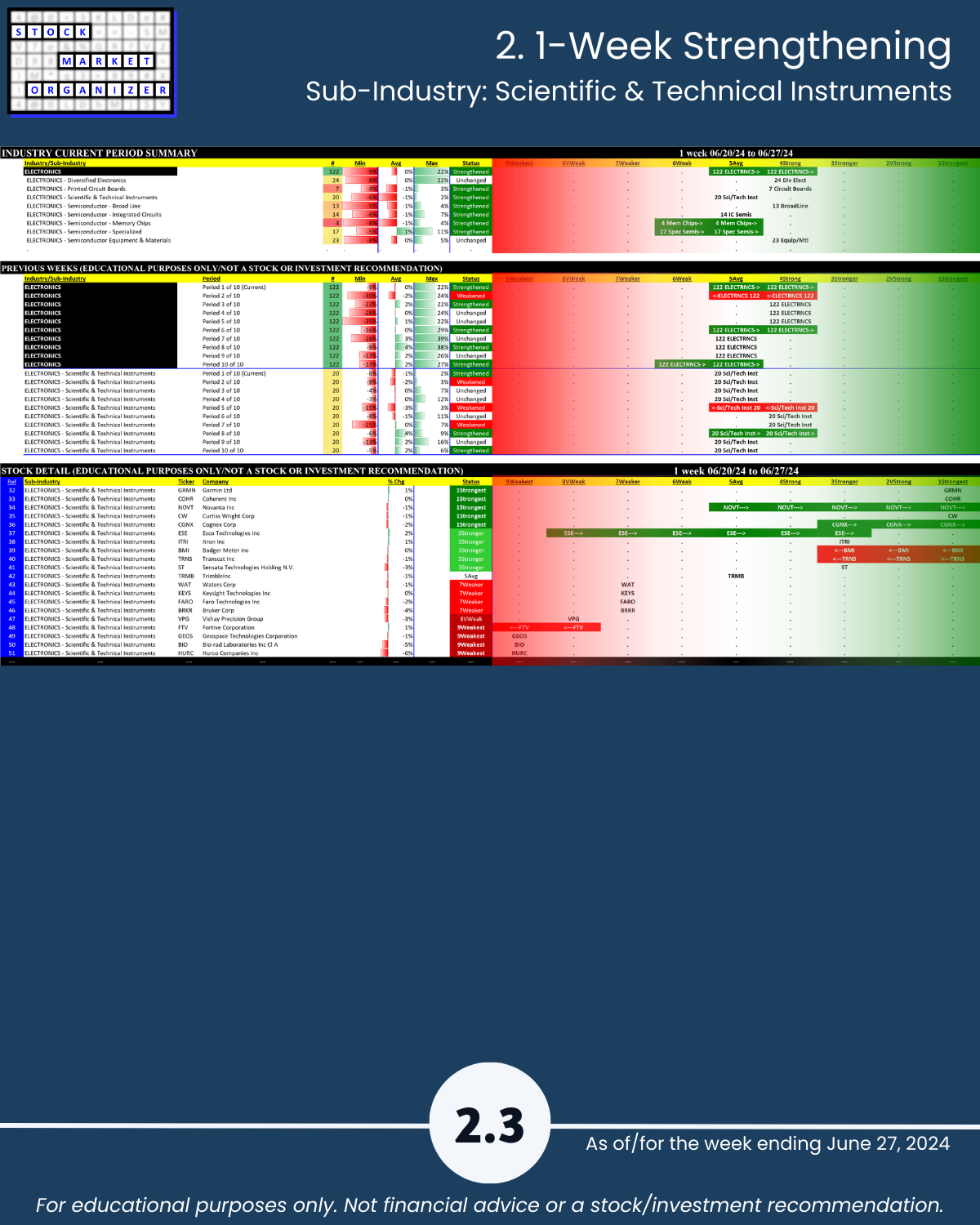

Scientific & Technical Instruments

Semiconductor - Integrated Circuits

Semiconductor - Memory Chips (which strengthened from 6Weak to 5Average)

Semiconductor - Specialized (also strengthened from 6Weak to 5Average)

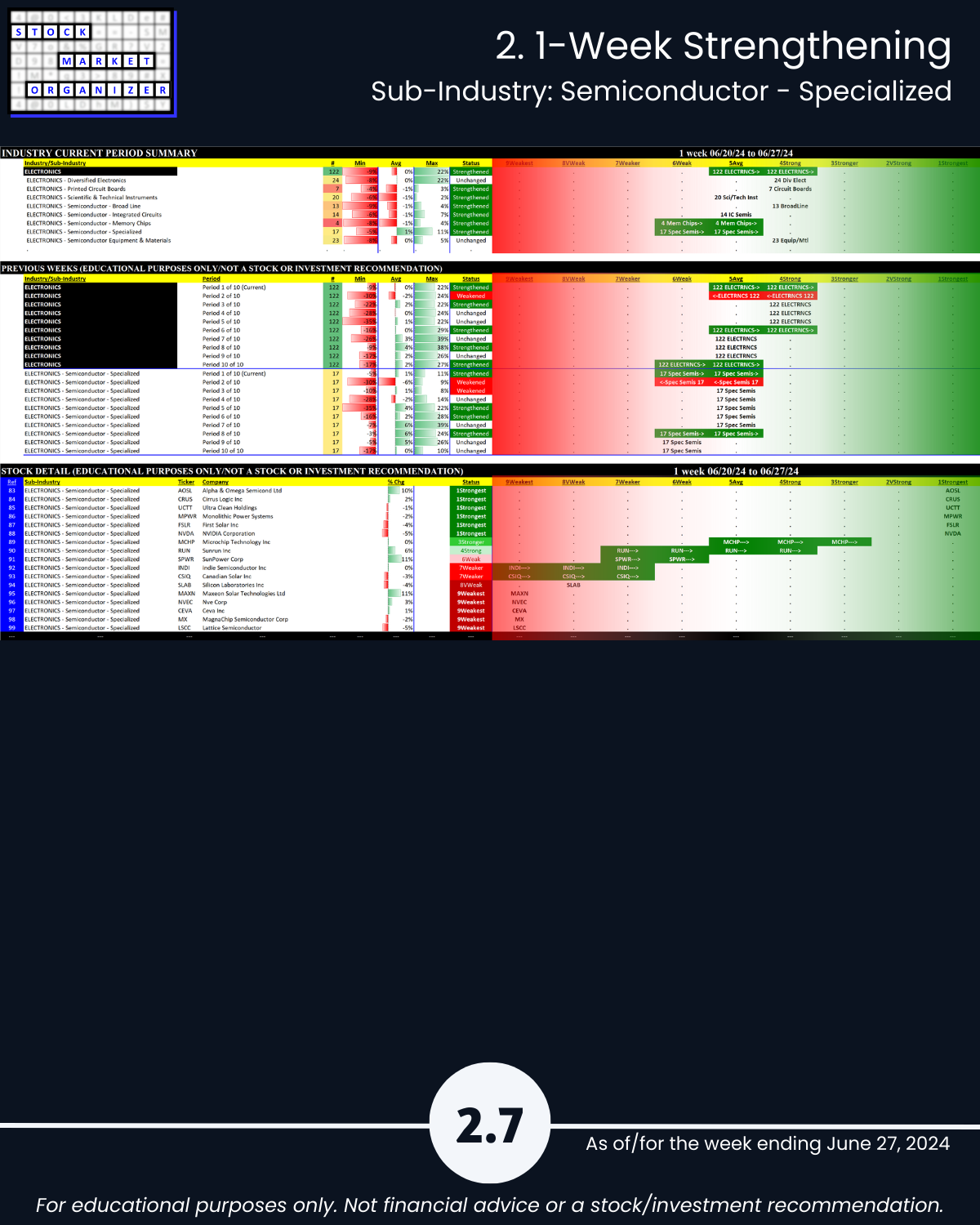

Page 2.7 = see bottom portion C

Semiconductor - Specialized detail (the home of NVDA)

- Strongest rated stocks at 1Strongest:

AOSL/Alpha & Omega Semicond Ltd

CRUS/Cirrus Logic Inc

UCTT/Ultra Clean Holdings

MPWR/Monolithic Power Systems

FSLR/First Solar Inc

NVDA/NVIDIA Corporation - Weakest rated stocks at 9Weakest:

MAXN/Maxeon Solar Technologies Ltd

NVEC/NVE Corp

CEVA/Ceva Inc

MX/MagnaChip Semiconductor Corp

LSCC/Lattice Semiconductor

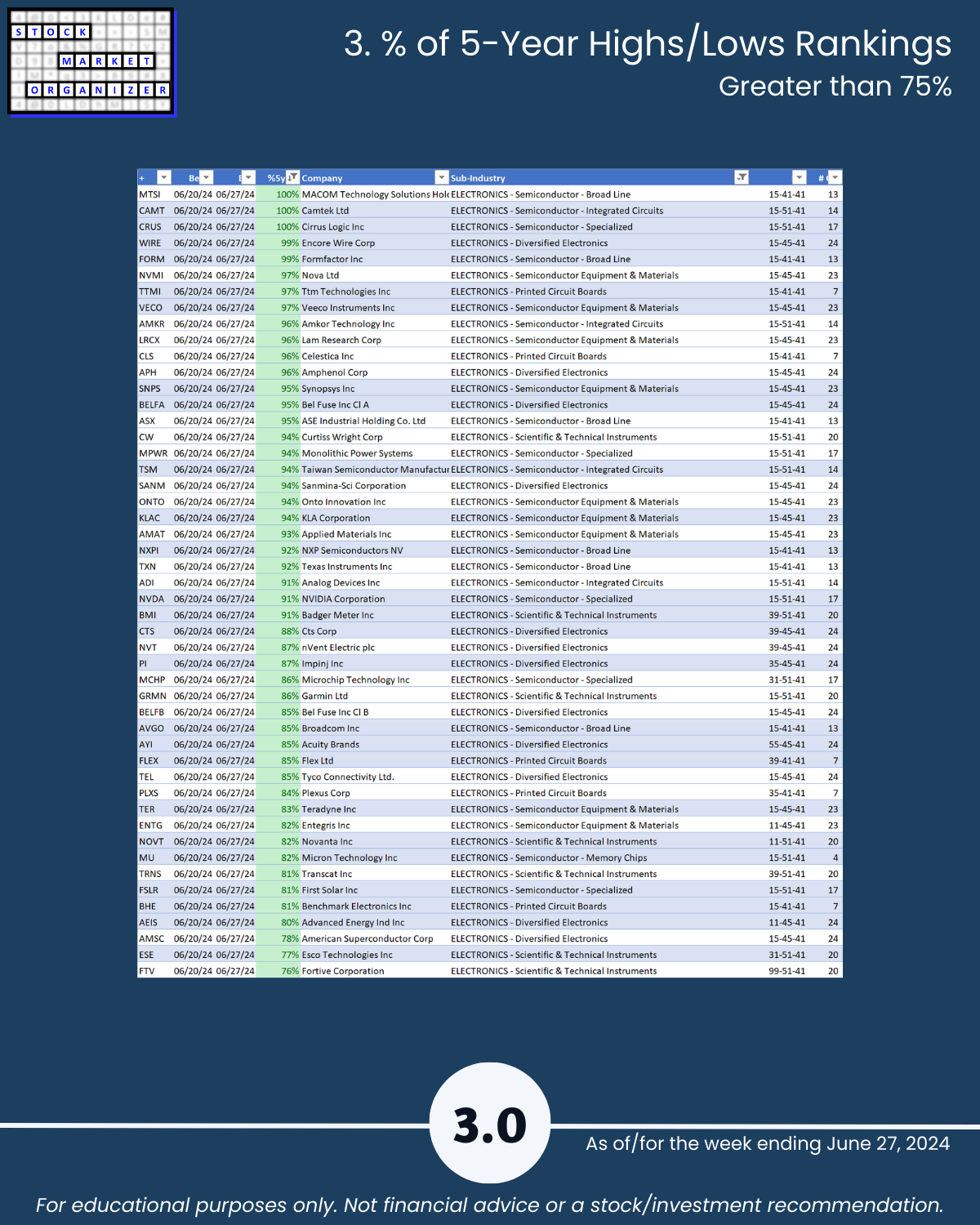

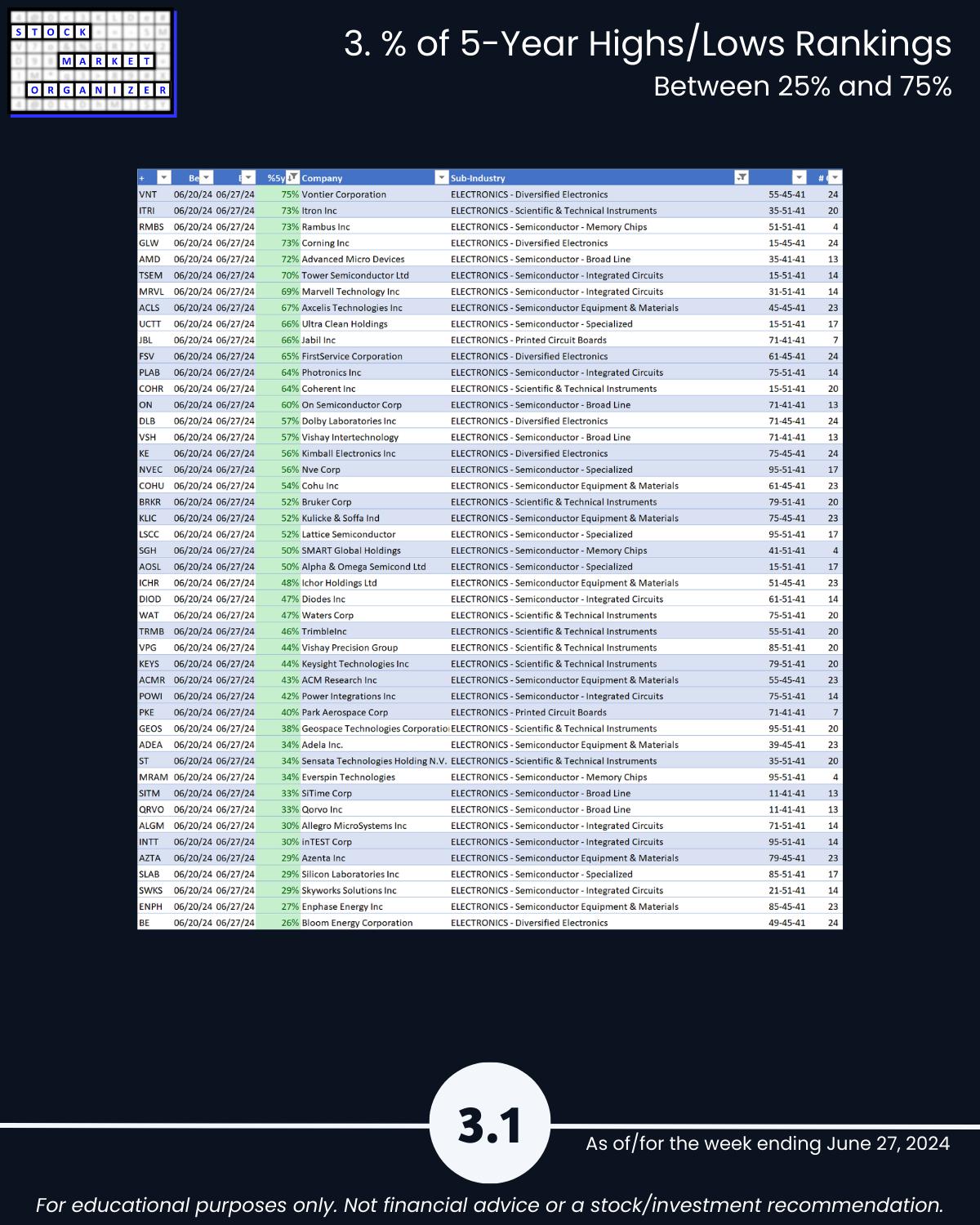

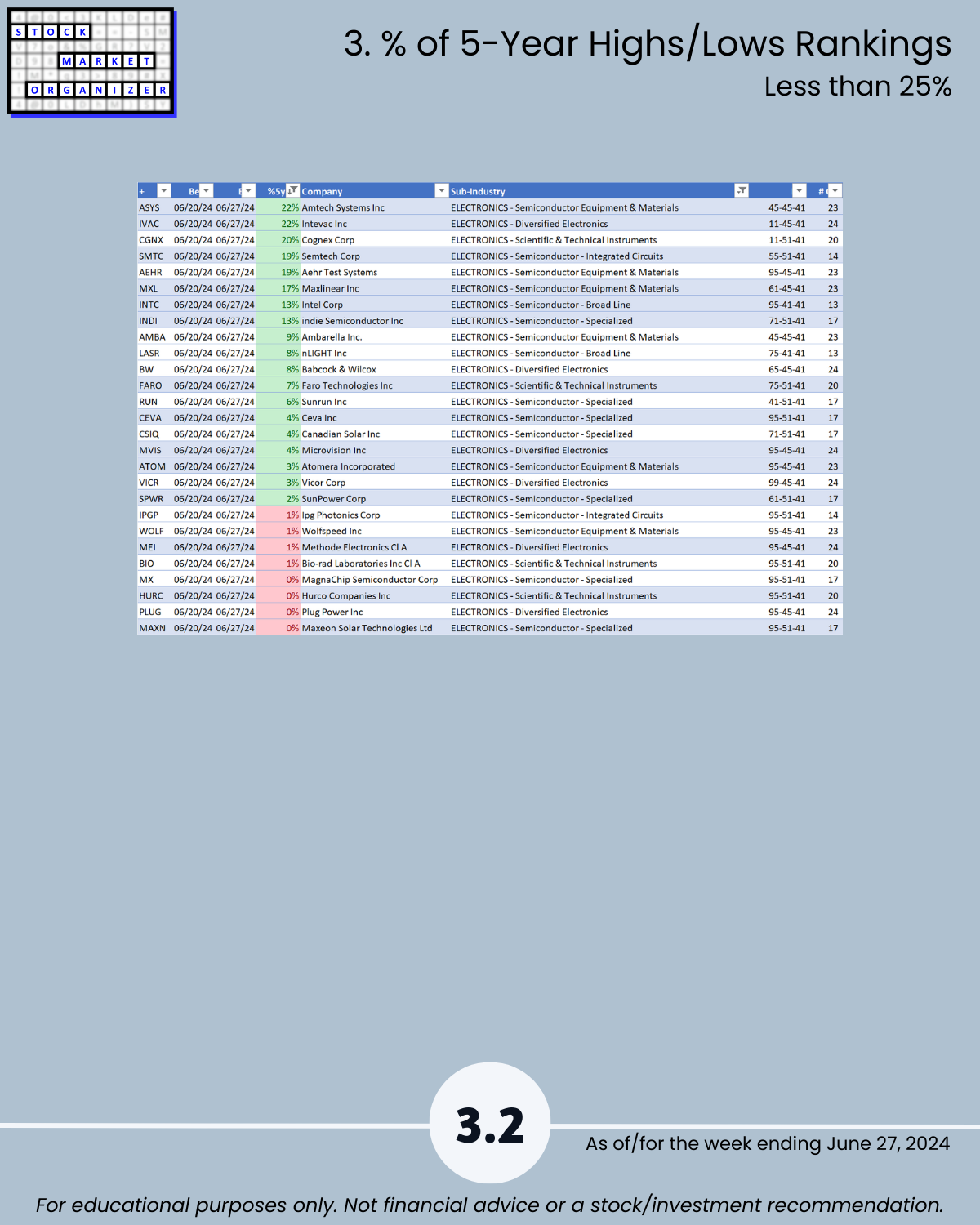

Pages 3.0 (stocks at >75% of 5-year Highs/Lows) and 3.2 (stocks at <25% of 5-year Highs/Lows)

Can you consistently discern tops and bottoms of stocks that “The Market” loves and hates, respectively? In other words, are you really smarter than everyone else? (Not saying you aren’t, but I know I’m not.)

You won’t find what you aren’t looking for.

This report offers unique, logical, and actionable insights from using conventional tools in unconventional ways.

It may resonate with you if you subscribe to the following:

- The stock market does not have to be so complicated.

- “What” matters, not “why.”

- Market conditions matter.

- The 100%+ rally begins with a 10% rally.

- The multi-month rally begins with one up week. (Also applies to declines.)

- The stronger your stocks, the greener your P&L.

1. Introduction/Industry Components

2. 1-Week Strengthening

3. % of 5-Year Highs/Lows Rankings