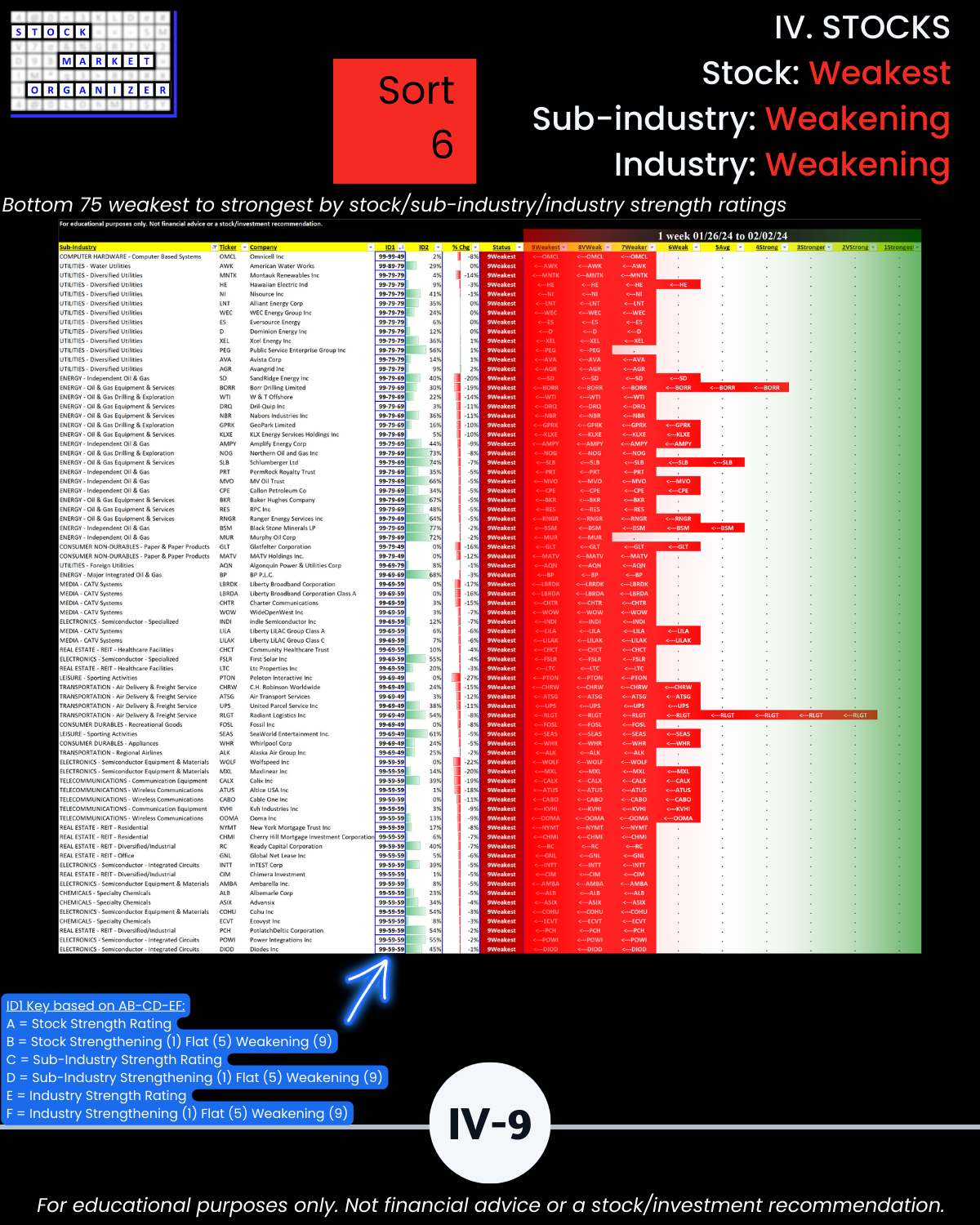

SMO Exclusive: Stock Report 2024-02-02, Weakest Stocks Weakening Sub-industries Weakening Industries

U.S. stock market at ATHs yet there are floundering stocks rated Weakest (9th strongest of 9 levels), in Weakening industries and Weakening sub-industries? Since most stocks do what the market does (rising tides do lift all boats), what happens if/when the market falls from current levels? Will these floundering stocks somehow buck the market tide, despite their inability to rise as the market has risen?

WHAT IS THIS?

Page IV-9 from the 2/2/24 U.S. Stock Market Strength Report. This page lists the worst 75 (by % return) of stocks that per the above intro line were

- rated Weakest (the weakest of 9 strength levels) and are members of

- Weakening sub-industries and

- Weakening industries.

HOW DO YOU READ THIS?

Look about 2/3 down the page and you’ll see 4 stocks in the TRANSPORTATION - Air Delivery & Freight Service sub-industry:

🔹 CHRW C.H. Robinson Worldwide

🔹 ATSG Air Transport Services

🔹 UPS United Parcel Services

🔹 RLGT Radiant Logistics Inc.

Per Stock Market Organizer metrics these stocks are identified as 99-69-49 candidates.

99 = stock weakening to Weakest rating (9th strongest of 9 levels)

69 = sub-industry (Air Delivery & Freight Service) weakening to Weak rating (6th strongest)

49 = industry (Transportation) weakening to Strong rating (4th strongest)

WHY DO YOU CARE?

Simply…

The SIGNAL here = the WEAKENING of each level – Stock, Sub-industry, and Industry.

The 80/20 rule in action.

Of the insane number of potential chaotic and conflicting influences on a stock’s price action, what are the 20% of influences that lead to 80% of the results?

In the Stock Market Organizer world, it is Strengthening and Weakening – at the Market, Industry, Sub-industry, and Stock levels.

WHAT NOW?

Immediate, not necessarily all-inclusive/all-encompassing thoughts (THESE ARE NOT INVESTMENT/STOCK RECOMMENDATIONS):

🔹 If you own these, consider if there are better candidates for your portfolio.

🔹 If you don’t own these and you are a mean reverter, here are some long candidates for you.

🔹 If you have no current position and you are a trend follower, here are some short candidates for you that you can feel comfortable have objectively-calculated tail winds supporting short positions in these.