SMO Exclusive: Stock Report 2023-12-15

What’s happening beneath the surface of the market indexes? Strengthening and weakening – at the Sector, Industry, Sub-Industry, and Stock levels.

Why do you care? Because this makes it possible to find Strong stocks in strengthening Sub-Industries and strengthening Industries.

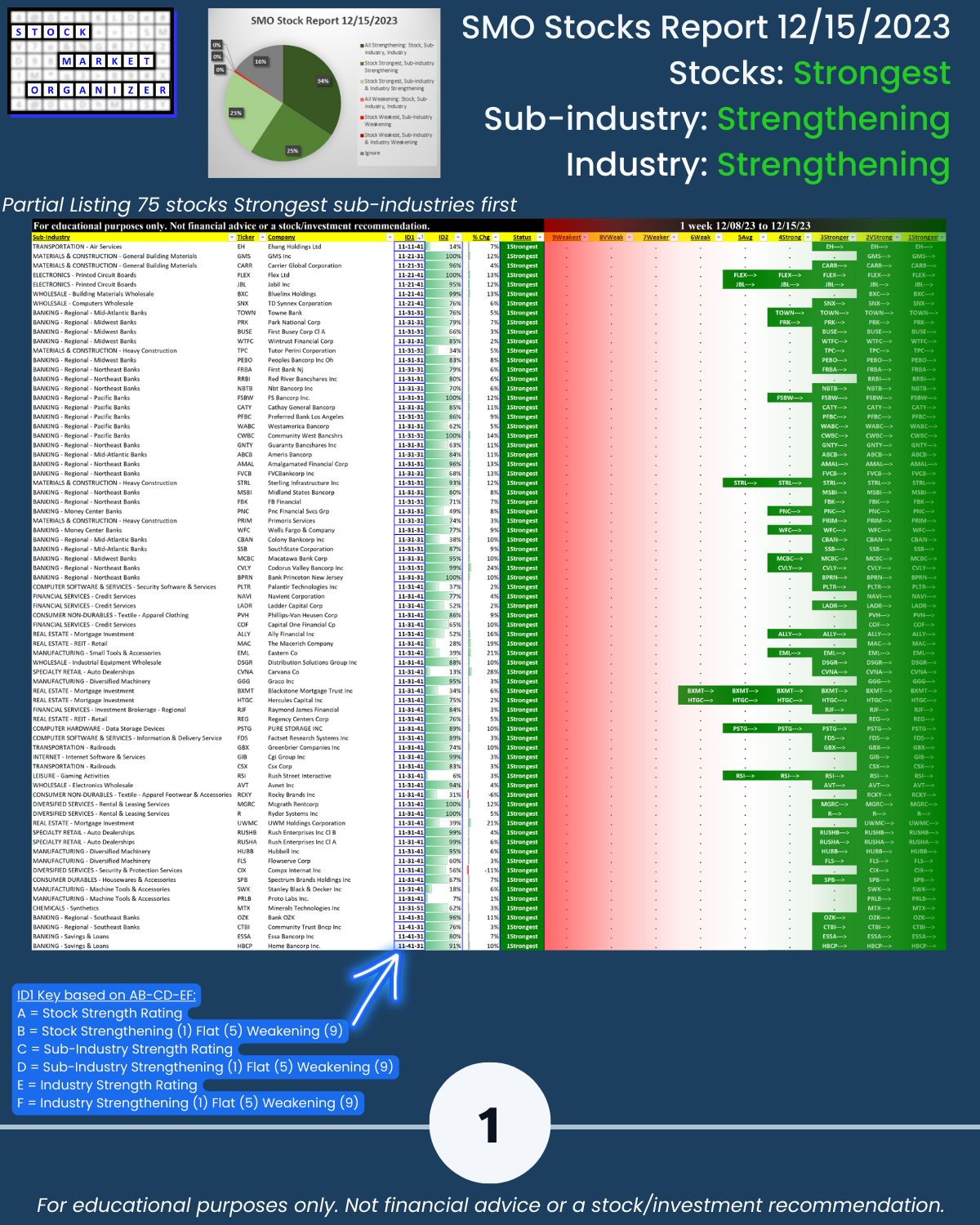

Below: the next logical step to this top-down market report and this industry strengthening/weakening report, a Stock Market Organizer exclusive sample report listing

A. Category 3 = Stocks rated Strongest in Strengthening Industries and Strengthening Sub-industries

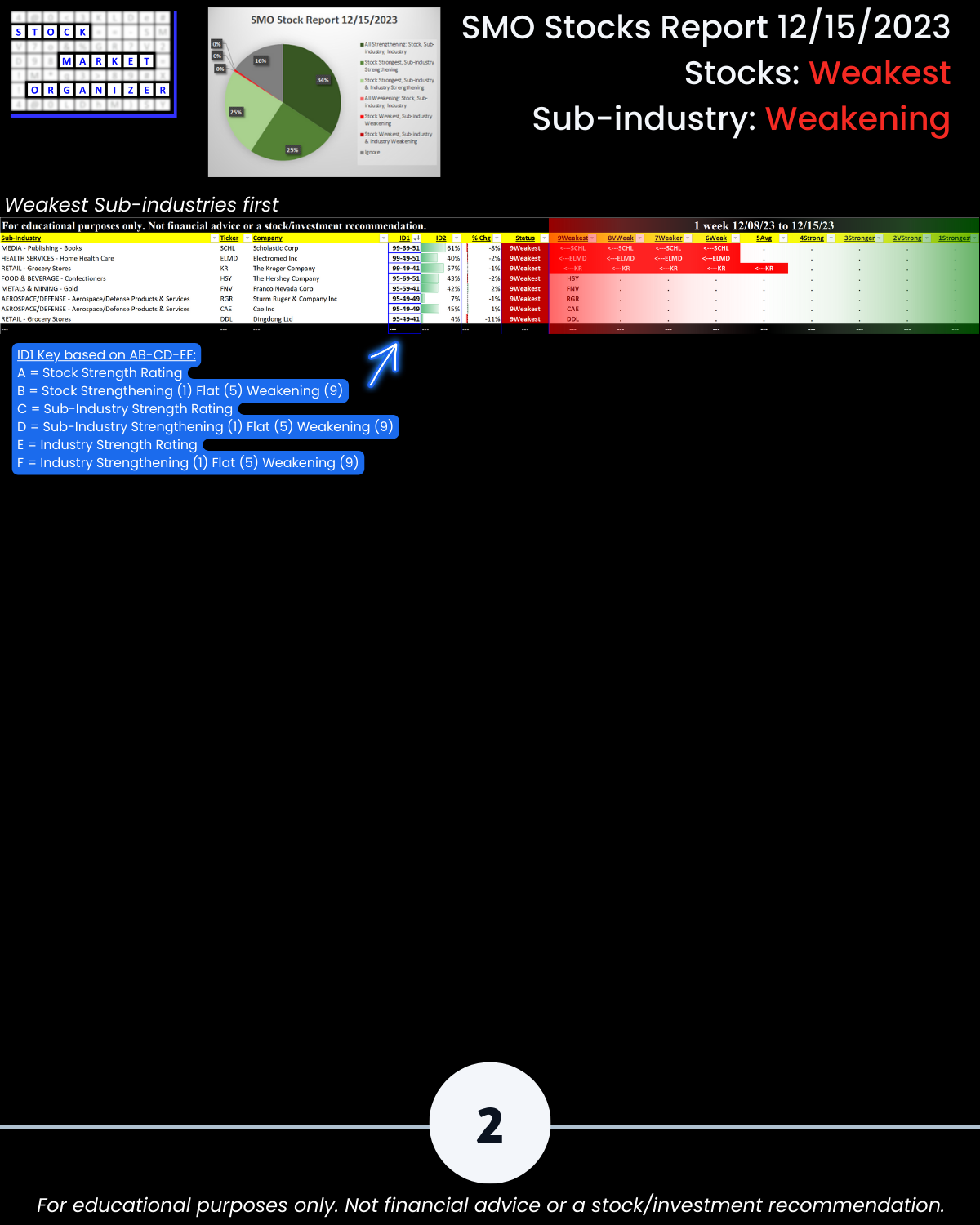

B. Category 5 = Stocks rated Weakest in Weakening Sub-Industries

(Why no Category 6 = Stocks rated Weakest in Weakening Industries and Weakening Sub-industries? Because no stocks fit that criteria this week.)

This information is usable regardless of your style.

🔹 Like going with the trend? Look in A. above for longs and B. above for shorts.

🔹 Mean reverter? Look in B. above for longs and A. above for shorts.

Key Instructions

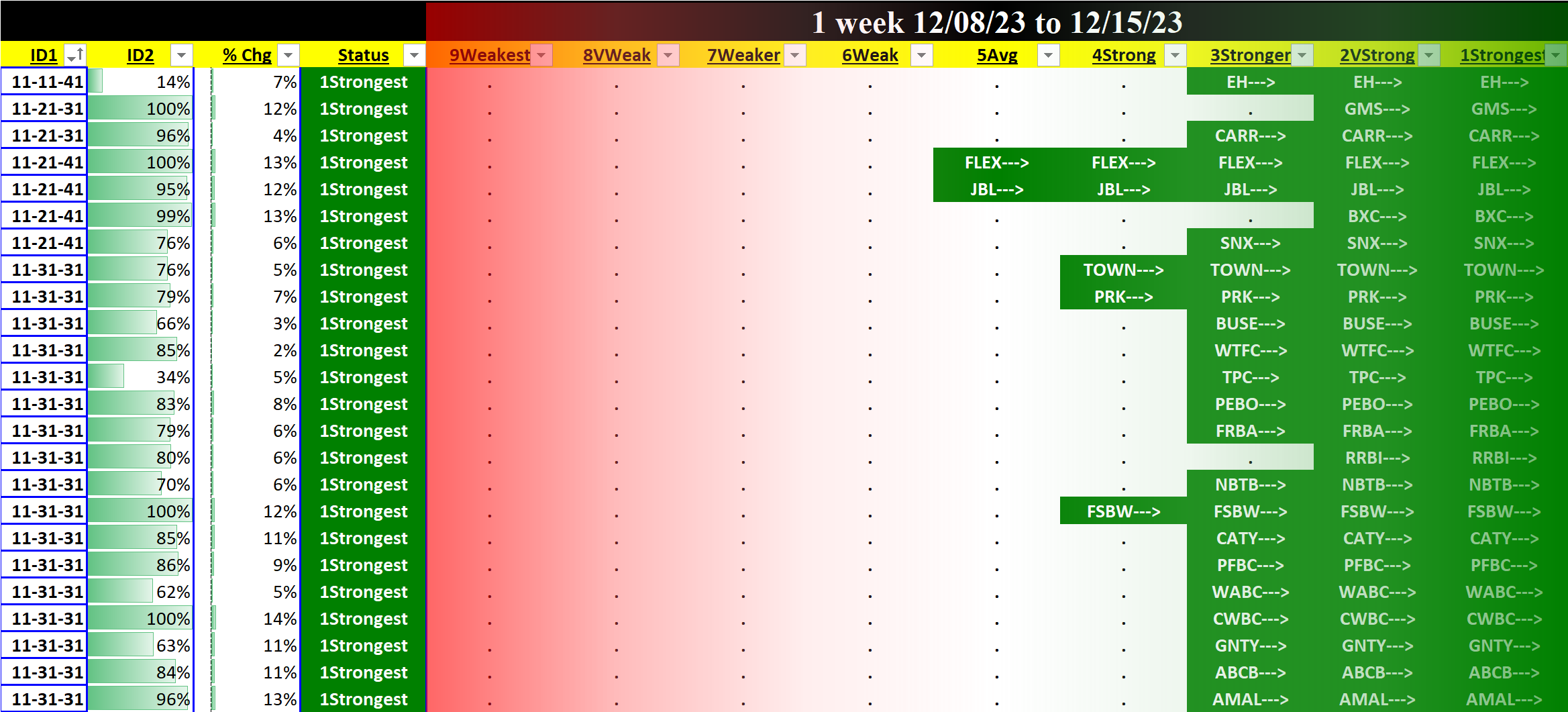

Focus on the ID1 Key column based on AB-CD-EF digits where:

A = Stock Strength Rating

B = Stock Strengthening (1) Flat (5) Weakening (9)

C = Sub-Industry Strength Rating

D = Sub-Industry Strengthening (1) Flat (5) Weakening (9)

E = Industry Strength Rating

F = Industry Strengthening (1) Flat (5) Weakening (9)

A stock classified as 11-35-69:

- is rated Strongest (strongest of 9 strength levels) and is STRENGTHENING,

- is in a sub-industry rated Stronger (3rd strongest) and is FLAT, and

- is in an industry rated Weak (6th strongest) and is WEAKENING