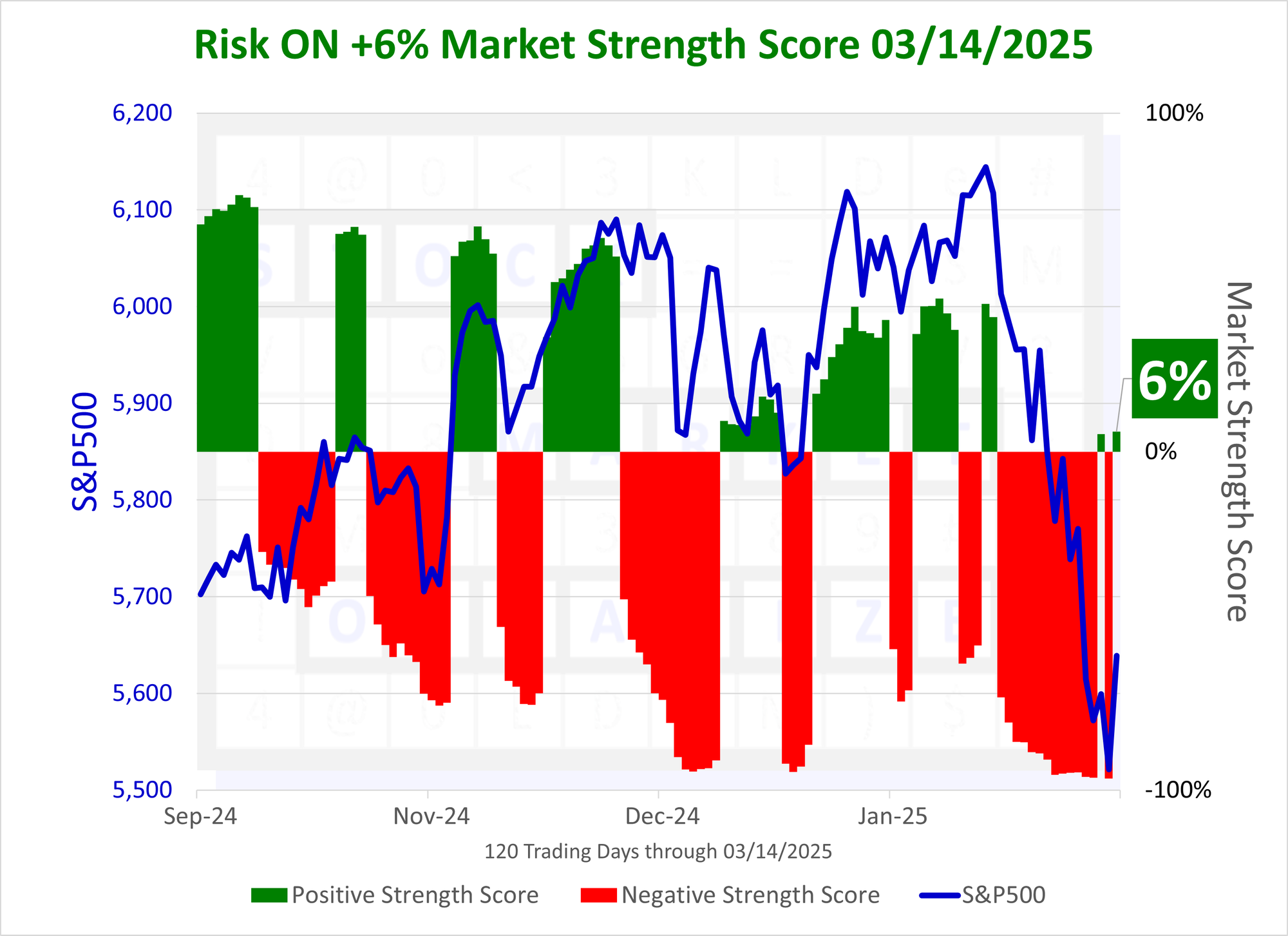

SMO Exclusive: Status Change, +6% Market Strength Score Fri 2025-03-14 (Risk On)

A Note About Current Volatility

Three changes in three days is unprecedented. A 6% Market Strength Score is on the low/early end of the range so my basic bias is up. At the same time, current volatility is clearly high - if not necessarily measured by the VIX (currently 21.77), then by this unique measure I use to objectively guide market environment decisions.

Current Market Status

Risk On because the current Stock Market Organizer Market Strength Score is POSITIVE at +6% as of Friday, 2025-03-14.

Anything can happen in the market at any time for any reason but this reading implies there is room to run before the gauge reaches +100% should it even get there. This reading would be unusual as tops are typically events with drawn-out distribution, as compared to washout bottoms marked by capitulation (see this post for examples of washout bottoms). There is not nor can there be any realistic expectation as to what this would translate to in index readings.

Below is today's corresponding Sector Risk Gauge.

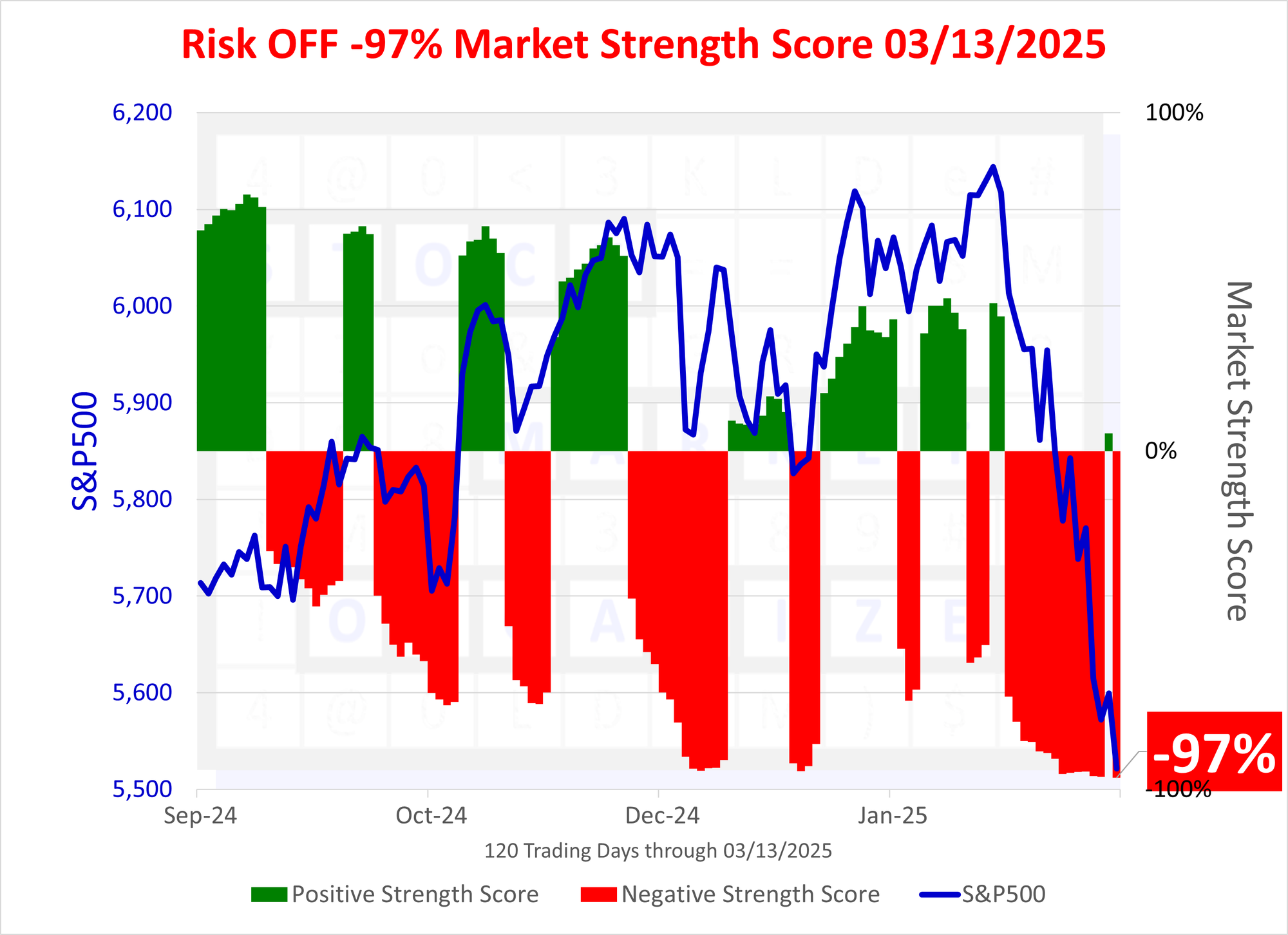

Most Recent Change to Negative

The most recent change to Negative was Thursday 2025-03-13 to -97%.

Here is the corresponding Sector Risk Gauge.

Underlying Key Concepts

🔹 Signal duration depends solely on objective market action measurement.

🔹 It conveys what “is” – not “why,” or for how long.

🔹 It is an objective, repeatable, and reliable tool to

- enforce discipline,

- prevent unforced errors,

- eliminate emotion and confusion, and

- make sound decisions in all market environments.

This enforced discipline ensures new positions are opened only in the direction of market strengthening or weakening.

If strengthening, only new long positions can be opened.

If weakening, only new short positions can be opened.

Why? Trend respect.

Market weakening does not mean “exit existing long positions.” Only potential new positions are impacted by the critical question of “what is the market doing now?”

Existing open positions are exited when their behavior negates the entry thesis.