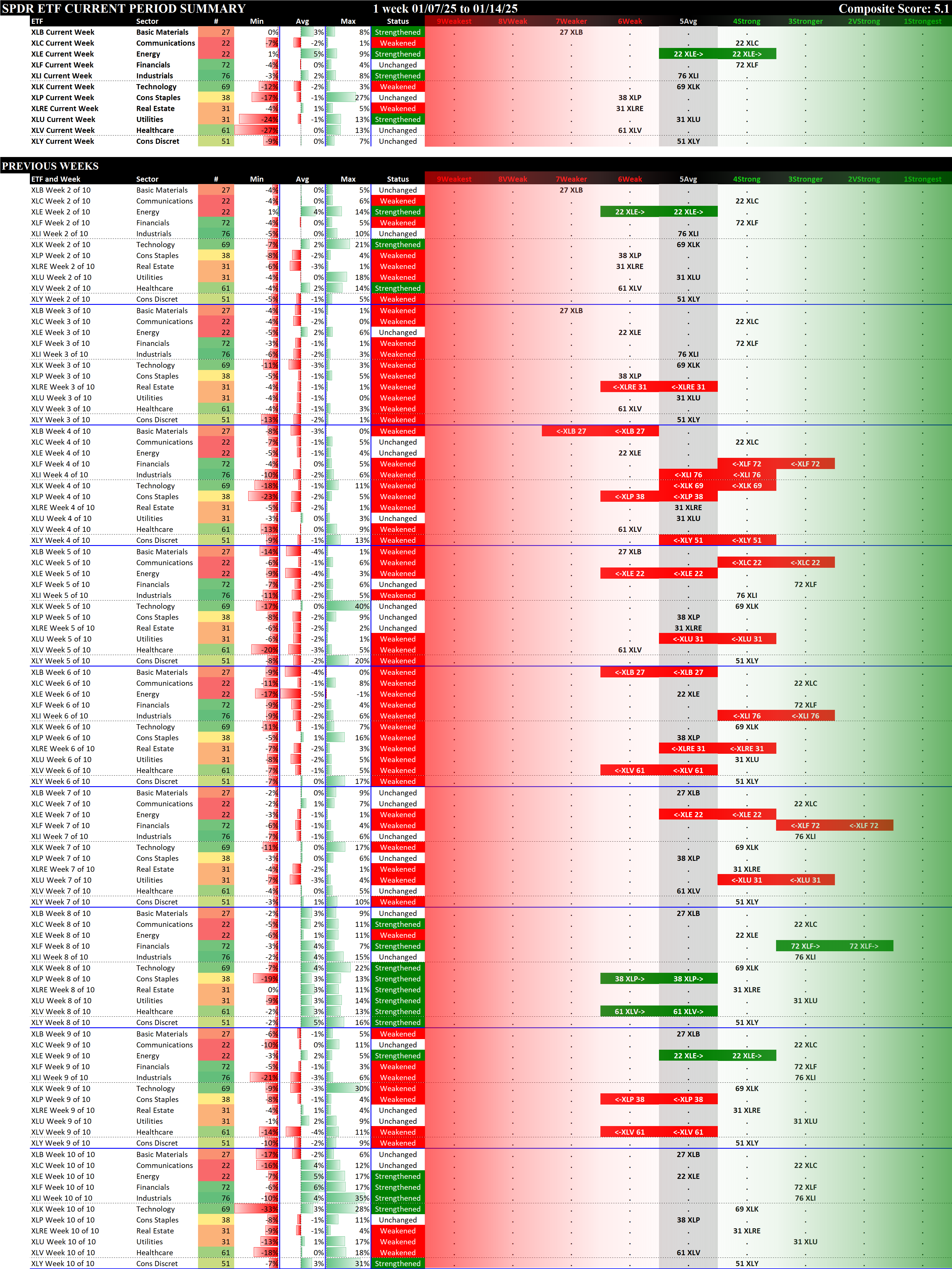

SMO Exclusive: SPDR Sector ETFs Strength Report Tuesday 2025-01-14 Strengthened +0.1 to 5.1 Strength Score

This post consists of the following five sections:

I. Introduction

II. Weekly Returns

III. Spectrum Graph Analysis

IV. Today's Market Context

V. Detailed Sector ETF Analysis

I. Introduction

Background

This analysis consists of the Stock Market Organizer stock-by-stock strength analysis applied to the 500 stocks that comprise the 11 SPDR Select ETFs.

These results are combined with overall market environment readings - the Market Strength Score and the Sector Risk Gauge, which reflect "risk OFF"as of Friday, January 10, 2025 - to discern appropriate portfolio exposure given prevailing market and sector conditions.

Why do you care?

This dynamic market analysis provides a continuously updated, apples-to-apples comparison of the strengthening and weakening trends in the US market. By tracking the 500 large-cap stocks across 11 key sectors (via SPDR ETFs), this analysis offers valuable insights for investors seeking to harness momentum in their portfolios.

Each week, the analysis clearly identifies which sectors and stocks have gained, remained flat, or lost ground. With this data, investors can objectively assess sector and stock strength, refining their timing and positioning for new investments. Ultimately, this approach aims to enhance long-term portfolio performance by leveraging momentum – a proven market factor – to inform data-driven investment decisions.

Most Important Ranking: Strengthening Status

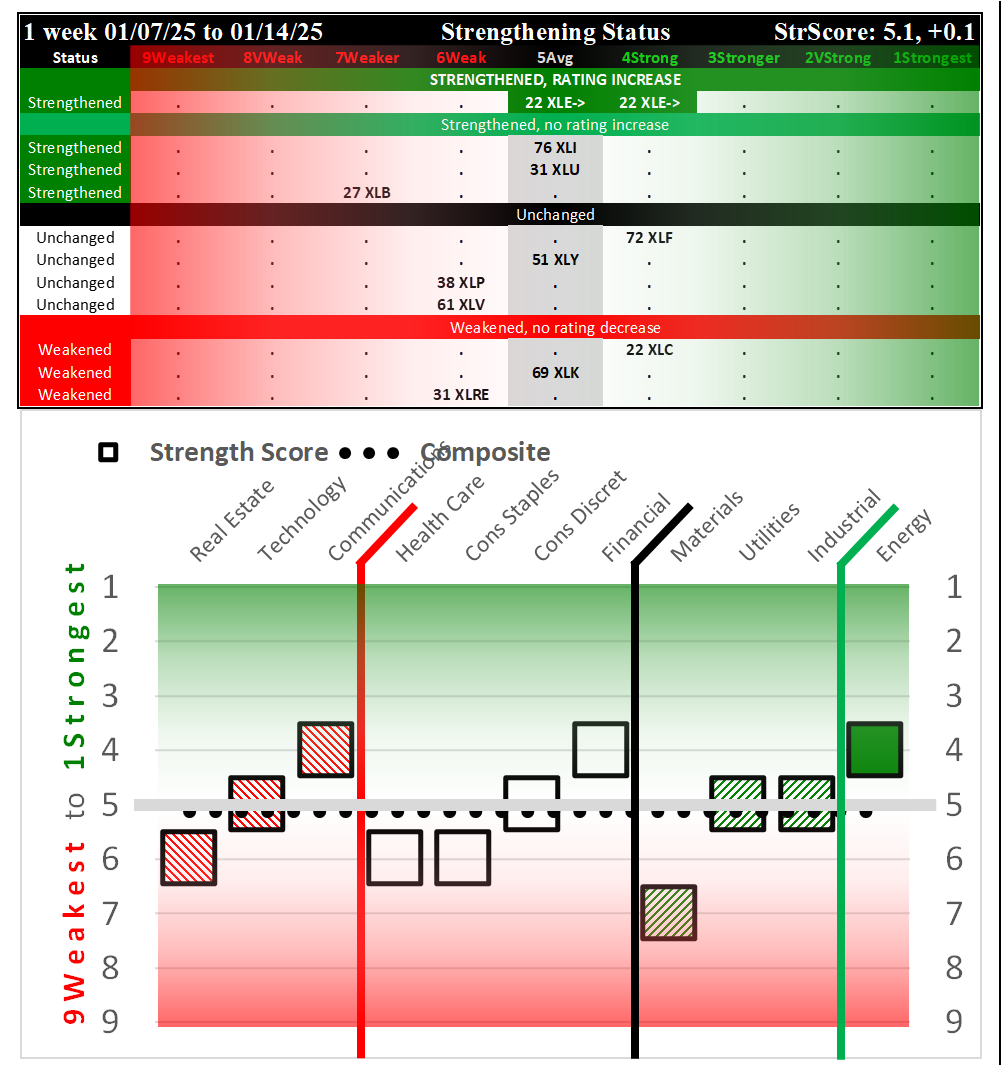

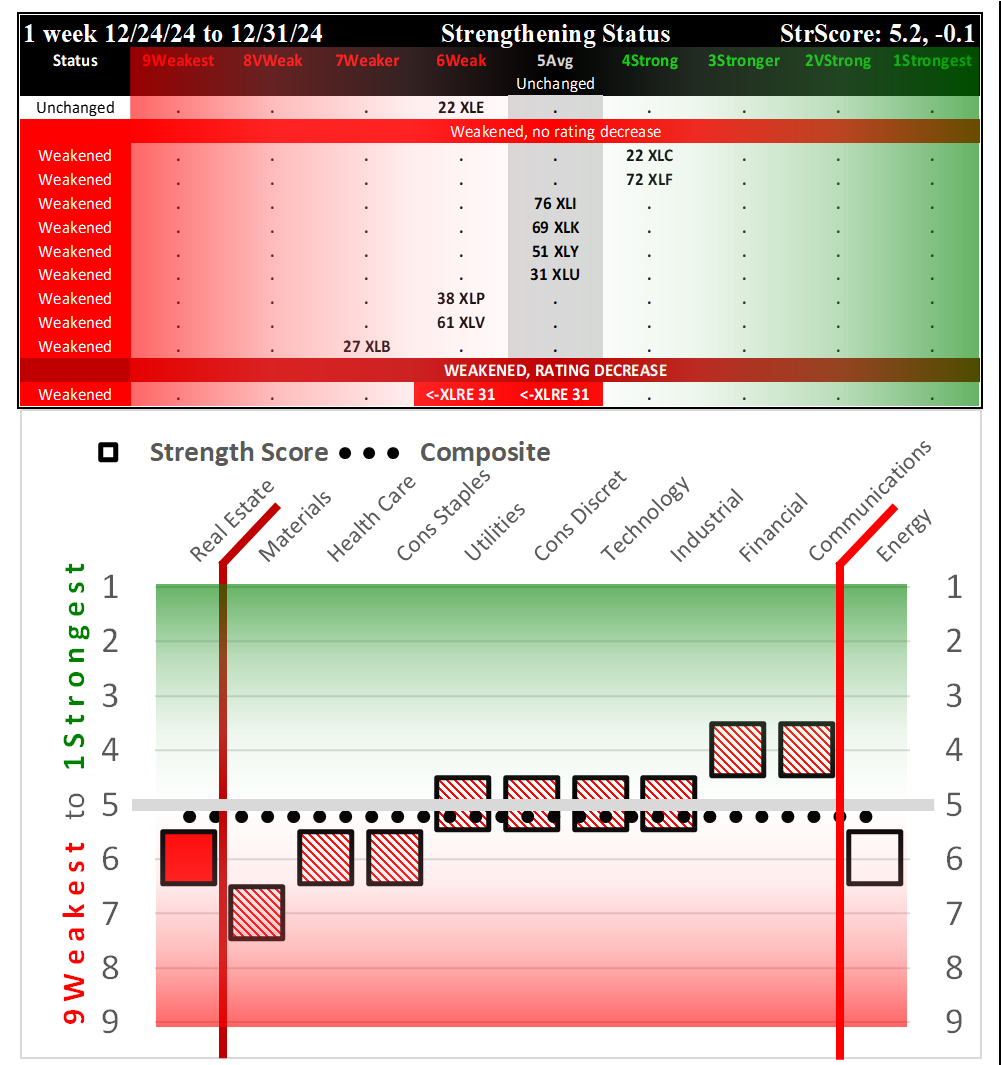

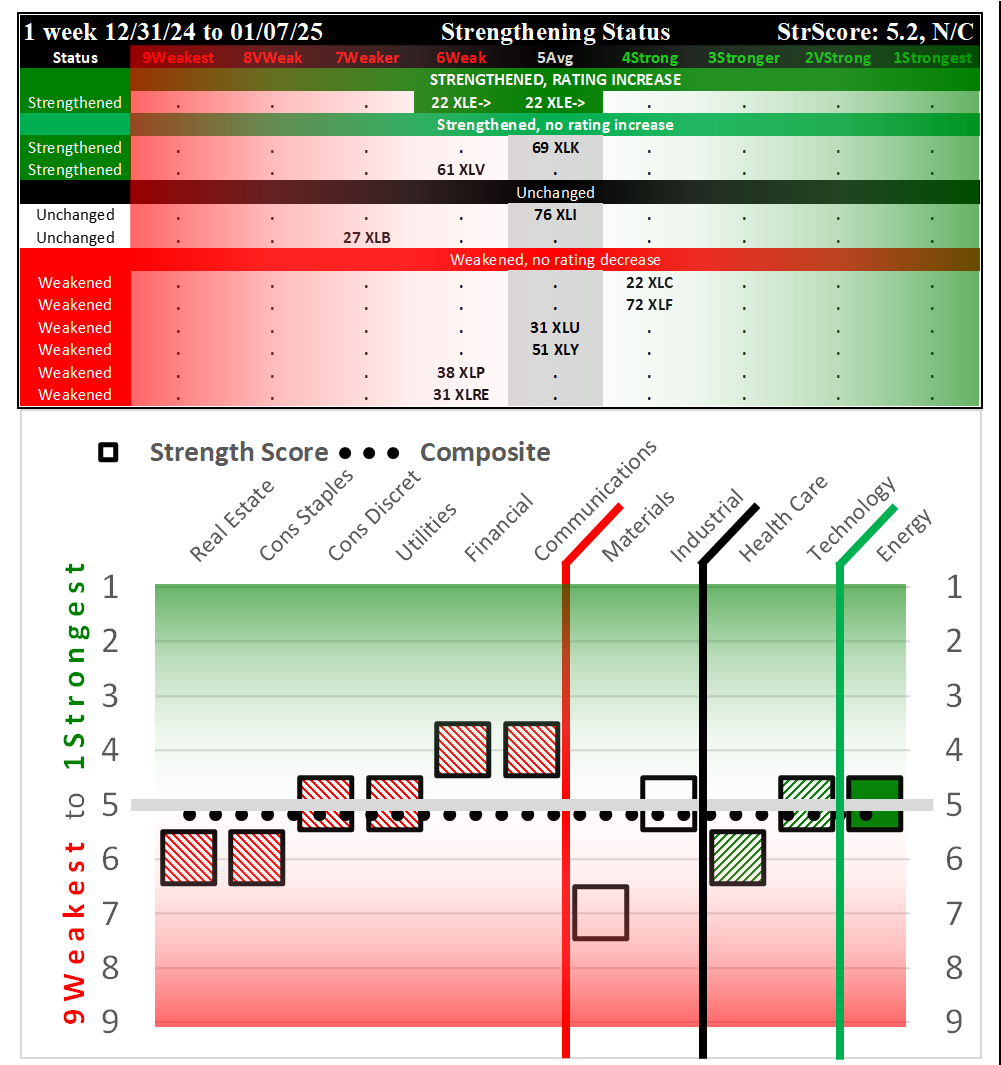

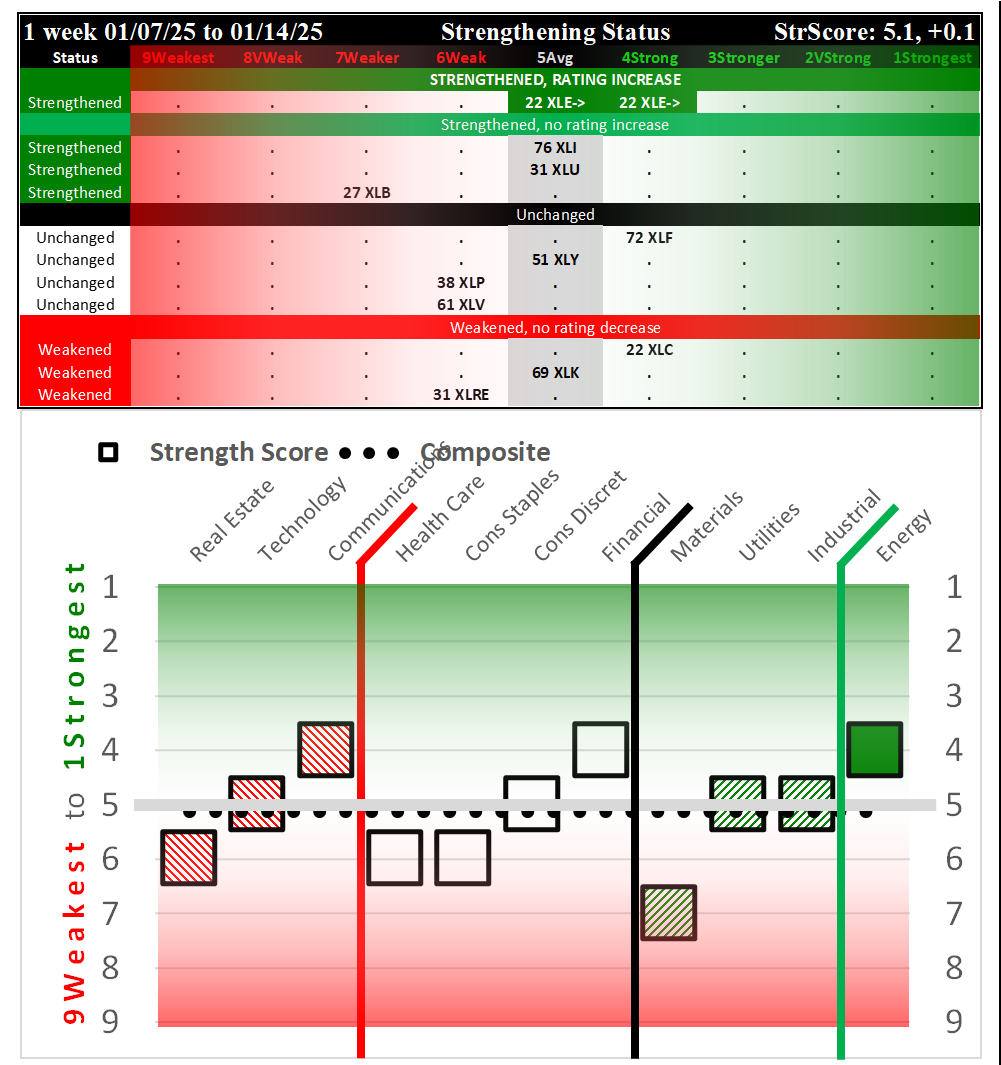

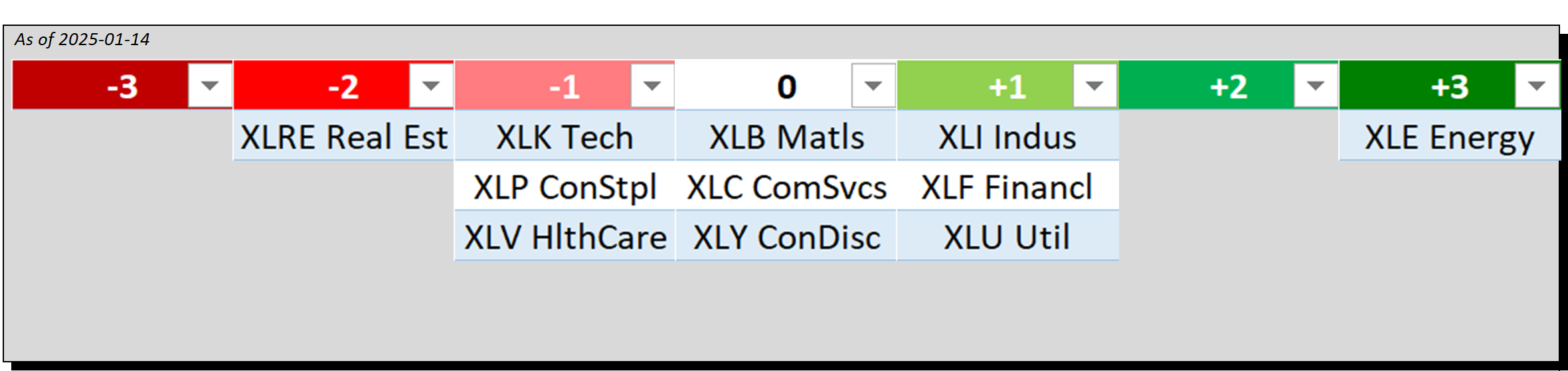

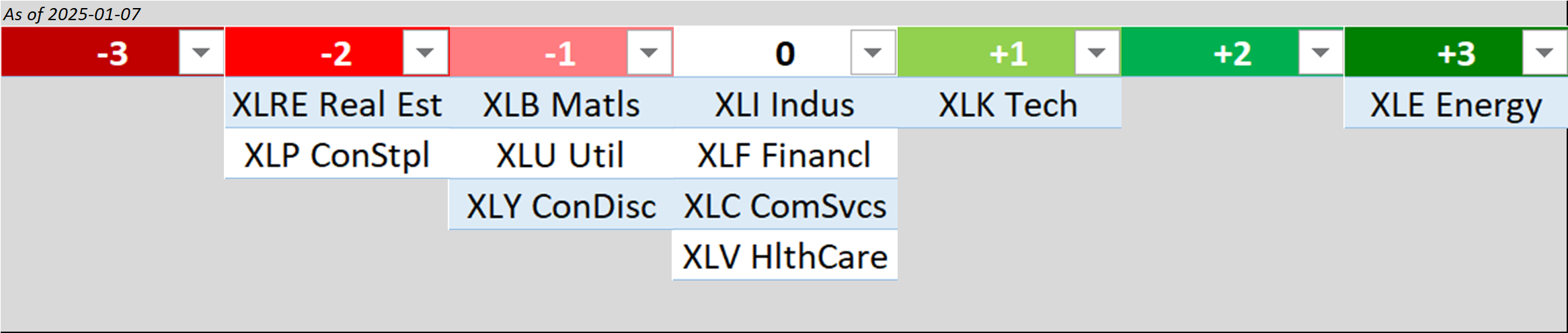

The following Strengthening Status spectrum graph shows the ETFs based on their current strengthening status, as compared to last week.

These are ordered based on important distinctions - did an ETF strengthen or weaken, enough (or not) to change rating, and where in the ratings scale (aka the spectrum of possibilities) does the ETF currently lie?

This graphic clearly provides this key information at a glance.

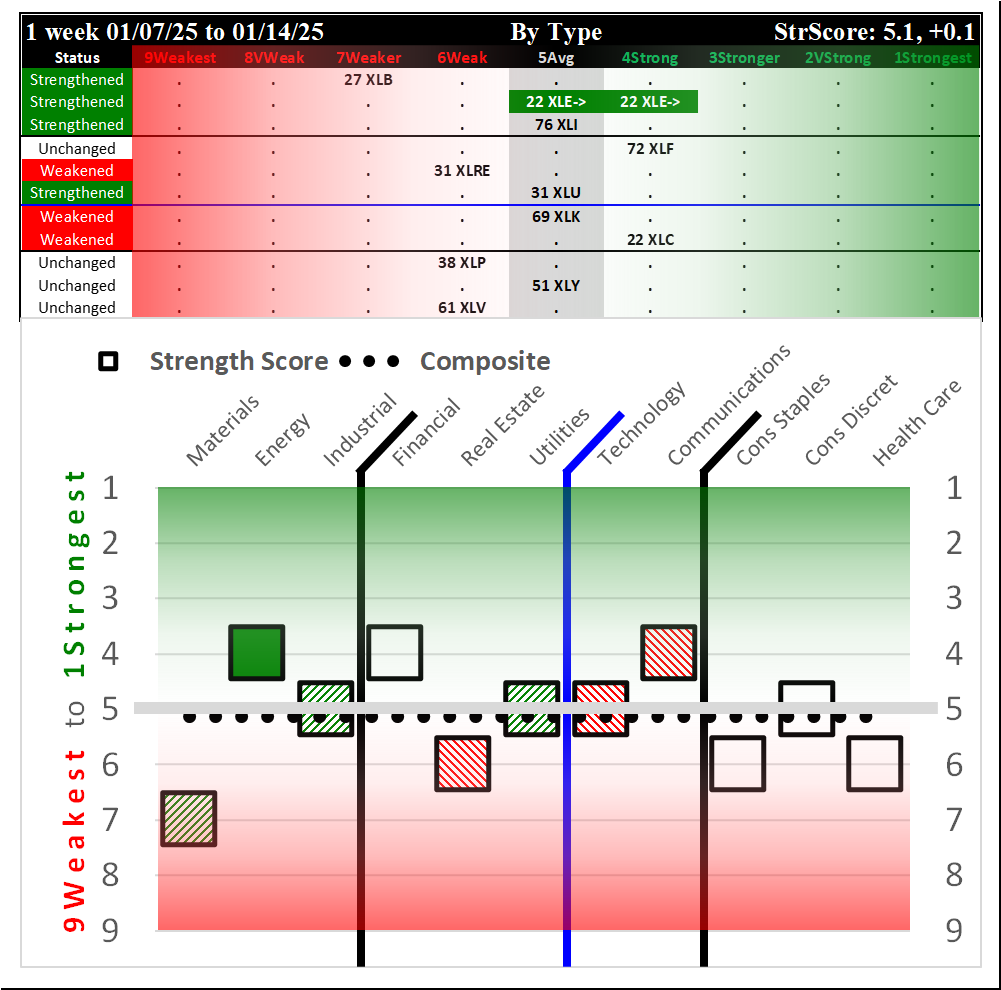

Comparison of this week vs. the past two weeks. THIS REVEALS AN INSIDE-OUT STRENGTHENING OVER THE PAST THREE WEEKS. The upper portions show strengthening from the top row down, while the lower portions show strengthening from right to left. These graphics are set up to clearly convey which ETFs/sectors strengthened or weakened, and from/to where this happened. Though it is impossible to determine how long these signals will last (what will be), the critical point is that these are the objective strength levels of these ETFs right now (what is).

Bottom Line Translation

Each ETF/Sector is given a Bottom Line rating below on a scale of -3 (Worst) to +3 (Best) based on A) the ending strength rating of each ETF and B) the strengthening/weakening action of the ETFs during the week, with the five possibilities being 1) strengthened enough to increase rating, 2) strengthened but not enough to increase rating, 3) unchanged, 4) weakened but not enough to decrease rating, and 5) weakened enough to decrease rating.

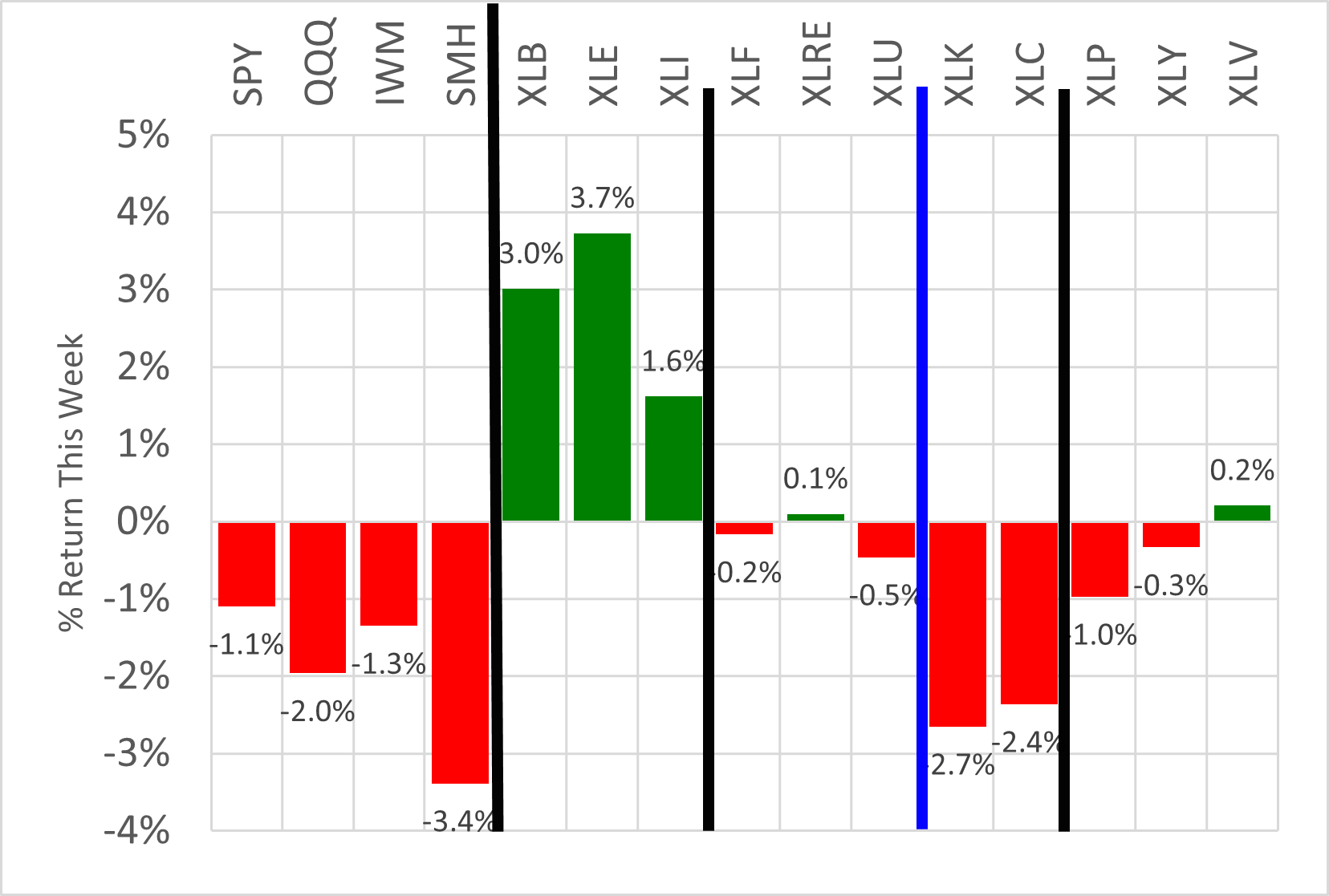

II. Weekly Returns

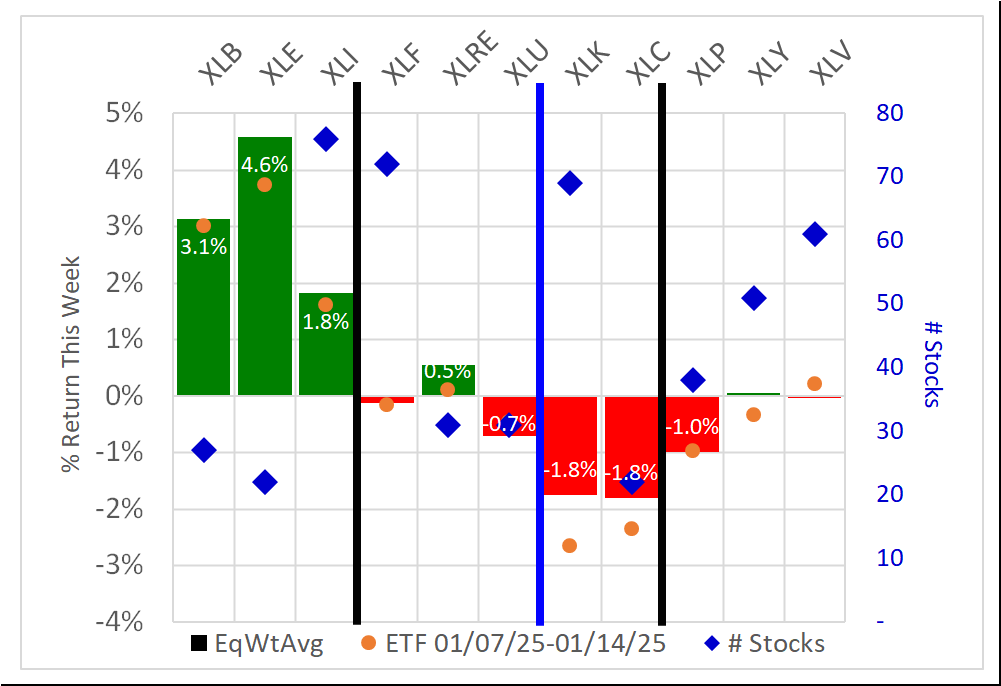

Average Returns

The average returns for the underlying stocks in each ETF are shown below - note this is NOT the return for the ETF for this week.

The best and worst are highlighted below:

Best:

- XLE/Energy, 4.6% average for 22 stocks

- XLB/Materials, 3.1% average for 27 stocks

- XLI/Industrial, 1.8% average for 76 stocks

Worst:

- XLC/Communications, -1.8% average for 22 stocks

- XLK/Technology, -1.8% average for 69 stocks

- XLP/Consumer Staples, -1.0% average for 38 stocks

The Materials/Energy/Industrial complex had a good weak, interest rate-related ETFs were effectively flatlined (Real Estate was in the positive), while Technology/Communication Services both fell. The bar chart shows the AVERAGE returns for the underlying component stocks, meaning the Equal Weight Average returns. The orange markers show the actual ETF return for this period.

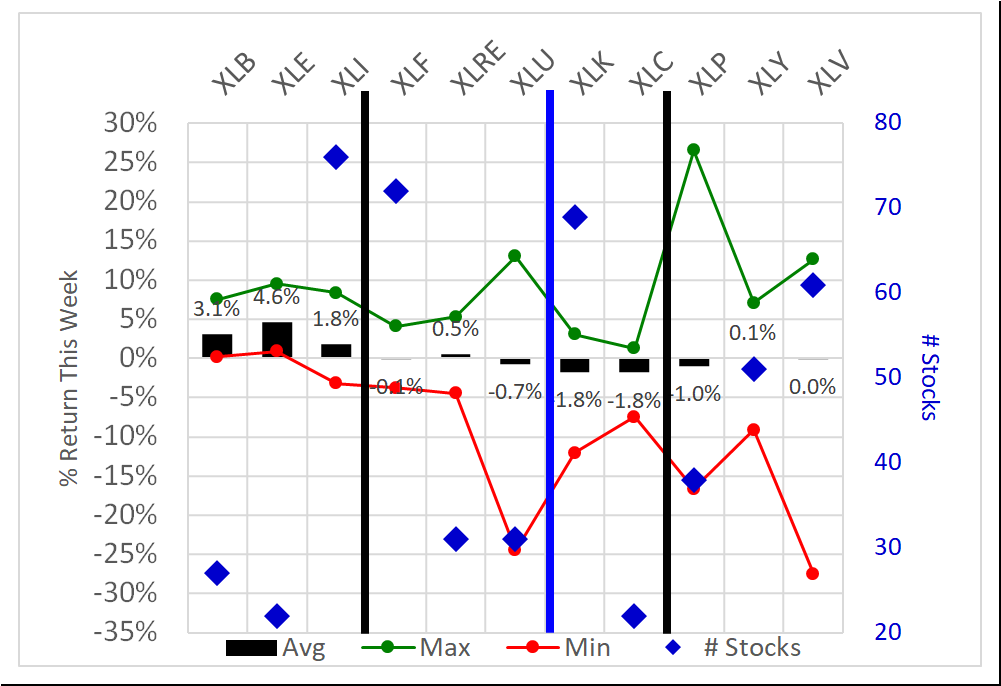

High and Low Returns

The following graphic overlays the lowest and highest returns in each sector.

The XLP/Consumer Staples outlier to the upside was WBA/Walgreens Boots Alliance +27% which strengthened from 6Weak to 4Strong during the week. The XLV/Health Care outlier to the downside was MRNA/Moderna -27% which weakened from 7Weaker to 9Weakest.

III. Spectrum Graph Analysis

This methodology uses spectrum graphs to obtain key insights unavailable elsewhere.

There are currently four types of spectrum graphs in this ETF analysis:

- By Strengthening - this is the most important graph, and it clearly shows in order the ETFs/sectors based on their strengthening/weakening performance during the week:

- Strengthened rating (rating change is most important signal)

- Strengthened but not enough to change rating

- Unchanged

- Weakened but not enough to change rating, and

- Weakened rating (rating change is most important signal). - By Type - logically groups the ETFs (for example, interest rate-sensitive, technology-related, consumer-related) for direct comparison with similar ETFs.

- By Strongest to Weakest

- Alphabetically

The remainder of this section uses types 2, 3, and 4 above to show current performance.

Context: Comparison to Recent Weeks

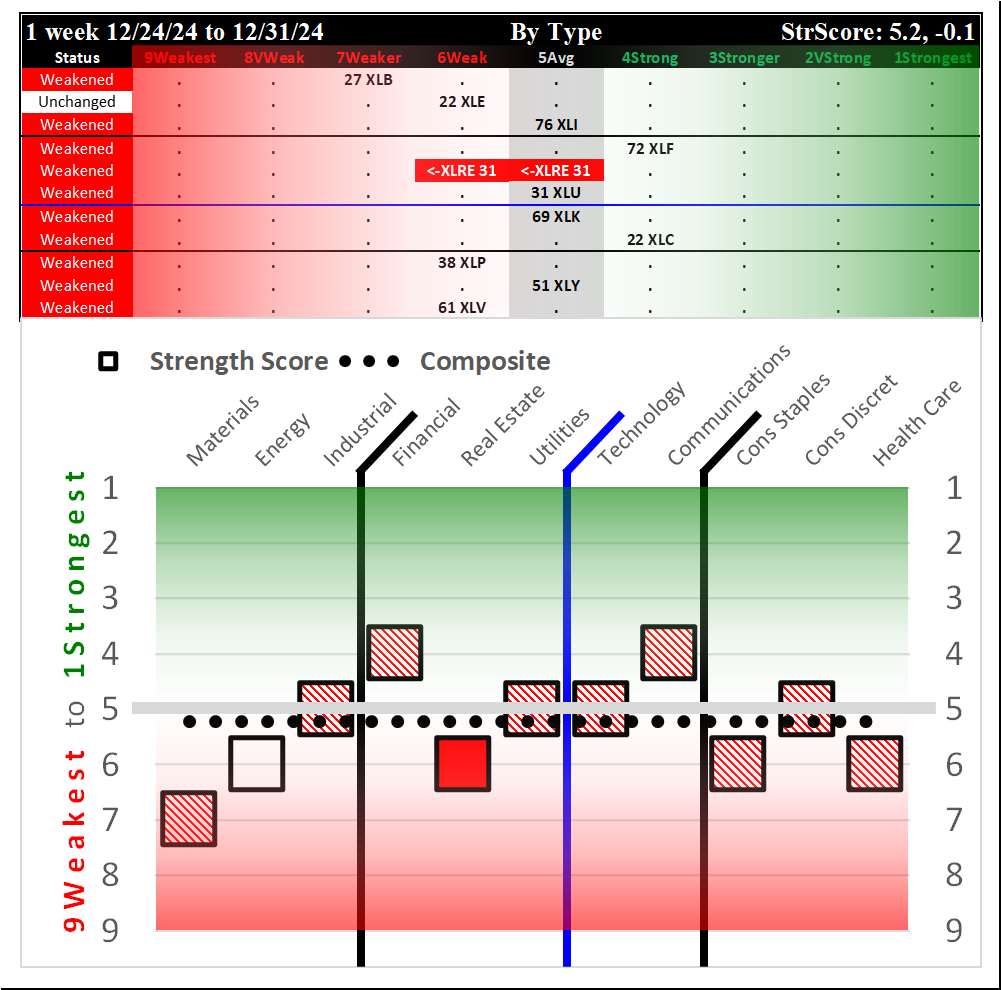

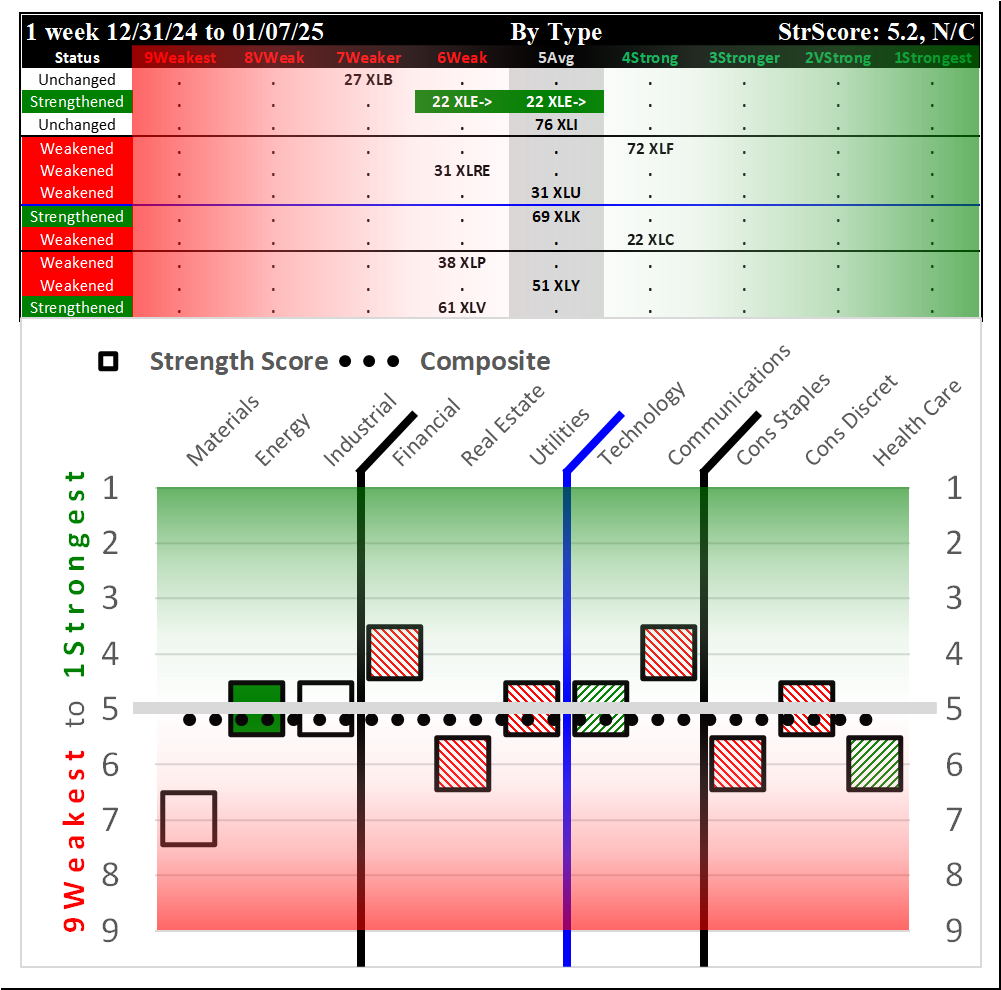

The following spectrum graphs by ETF Type show recent Friday week-to-week changes compared to the current week:

- 12/31/24: Weakening

- 01/07/25: Unchanged

- 01/14/25: Strengthened

Strengthening performance among the sectors for the just-completed week, an improvement over the past two weeks.

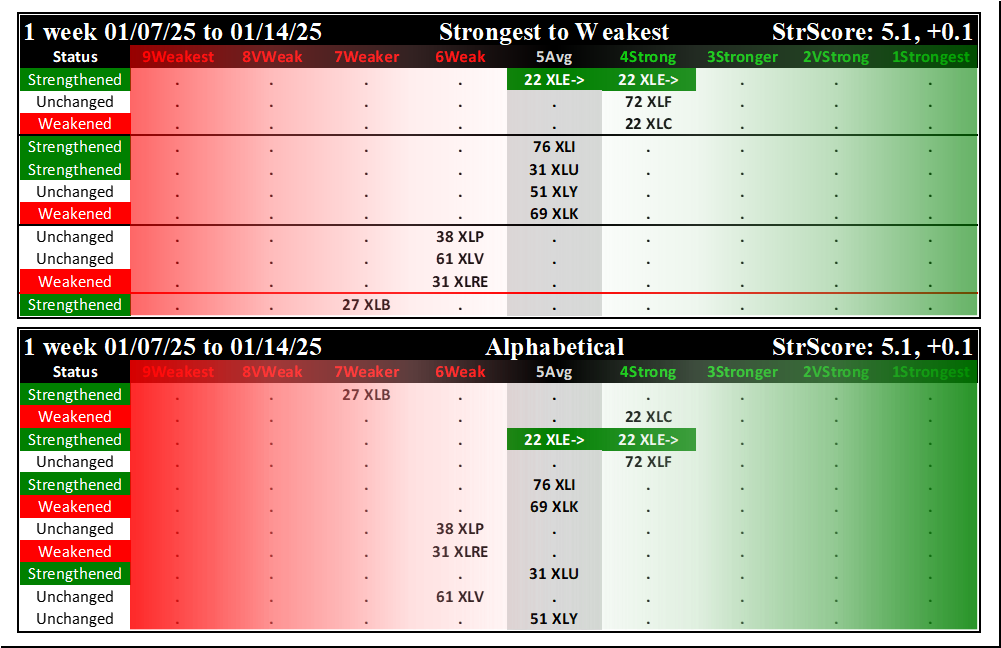

Current Status: 5.1 Composite Score, +0.1 this week

The following spectrum graph "Strongest to Weakest" shows the composition of the ETF ratings that comprise the current composite score, in order of Strength Rating. This is followed by an Alphabetical spectrum graph.

The ETFs are listed below based on their strength rating.

1Strongest

None

2VeryStrong

None

3Stronger

None

4Strong

- XLE/Energy (STRENGTHENED RATING)

- XLF/Financial (Unchanged)

- XLC/Communication (Weakened)

5Average

- XLI/Industrial (Strengthened)

- XLU/Utilities (Strengthened)

- XLY/Consumer Discretionary (Unchanged)

- XLK/Technology (Weakened)

5.1 - Composite Score

6Weak

- XLP/Consumer Staples (Unchanged)

- XLV/Health Care (Unchanged)

- XLRE/Real Estate (Weakened)

7Weaker

- XLB/Materials (Strengthened)

8VeryWeak

None

9Weakest

None

IV. Today's Market Context

Indexes and ETFs Weekly Performance

Key Headlines

"Stock investors brace for possibly the ‘most important inflation reading in recent memory’ - Wednesday’s CPI data for December has investors exposed to surprises in either direction"

"Stock Market News, Jan. 14, 2025: Dow, S&P 500 end higher, Nasdaq falls for 5th straight day ahead of CPI inflation report - Investors awaited the release of the consumer-price index for December that could decide how much further the Fed will cut interest rates in 2025."

"Bond ETFs are down in 2025 ahead of highly anticipated U.S. inflation data - A jump in Treasury yields has weighed on bond funds so far in January"

"U.S. budget deficit swells to record $711 billion in first quarter of fiscal year -

Government spending rises, in part due to hurricane relief"

(Marketwatch)

"Dow rises more than 200 points on Tuesday after wholesale inflation report comes in light"

"Trump says he’ll create ‘External Revenue Service’ to collect tariffs, foreign revenue"

"Bitcoin rebounds after better-than-expected inflation data"

"Los Angeles firefighters brace for return of extreme winds"

"Inflation watch: Wholesale prices rose 0.2% in December, less than expected"

"Budget deficit rose in December and is now 40% higher than it was a year ago"

(CNBC)

"Stock market today: Dow pops, Nasdaq slips as focus turns to CPI inflation report"

"Bond yields dip, S&P 500 ends up; CPI, earnings ahead"

"Quantum computing stocks rebound after massive sell-off as industry exec says opportunity is 'real'"

"LA Wildfire Insurance-Loss Estimates Approach $40 Billion"

"SEC’s Gensler not backing down from crypto crackdown as he exits: 'I feel very good about what we’ve done'"

(Yahoo!)

Key Current Readings

SP500: 5,842.91

Nasdaq: 19,044.39

Nasdaq 100: 20,757.41

Russell 2000: 2,219.24

10Y Treasury: 4.661%

2YT: 4.27%

Oil (WTI Crude): $79.78

Bitcoin: $99,017.81

Dollar Index: 109.11

Gold: $2,718.9

VIX: 16.51

(CNBC)

V. Detailed Sector ETF Analysis

The following Stock Market Organizer strengthening/weakening analysis looks at the 11 SPDR ETFs and their underlying component stocks for the week just ended, as follows:

- ETFs Summaries

1.1 Current: Component Stocks Strength Ratings (1Strongest vs. 9Weakest vs. Ignore Status)

1.2 Current: Component Stocks Positive vs. Negative Weekly Returns

1.3 Historical: 10 Week Ratings by ETF

1.4 Historical: 10 Week Ratings by Week - ETFs Detail

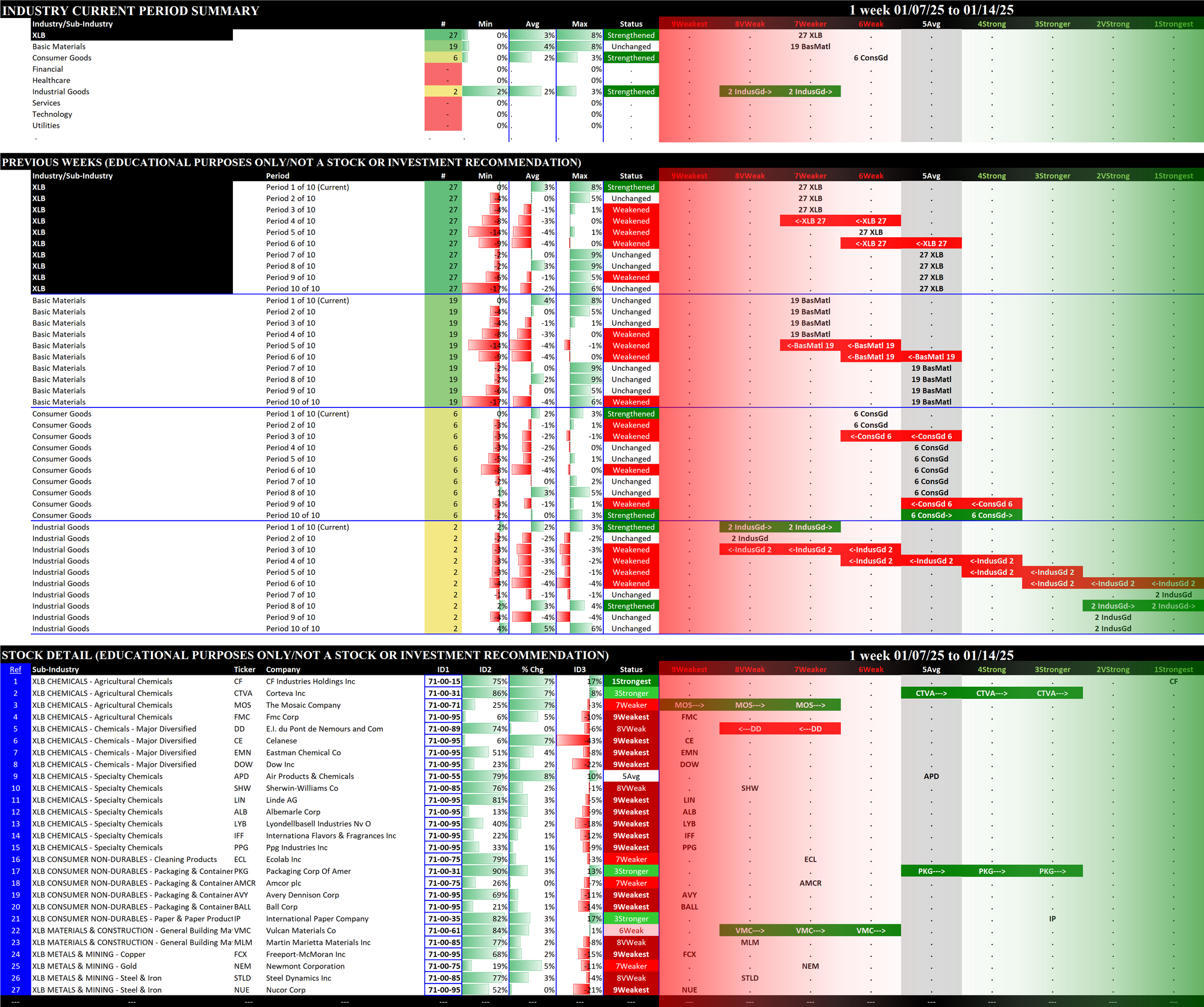

2.1 XLB Materials

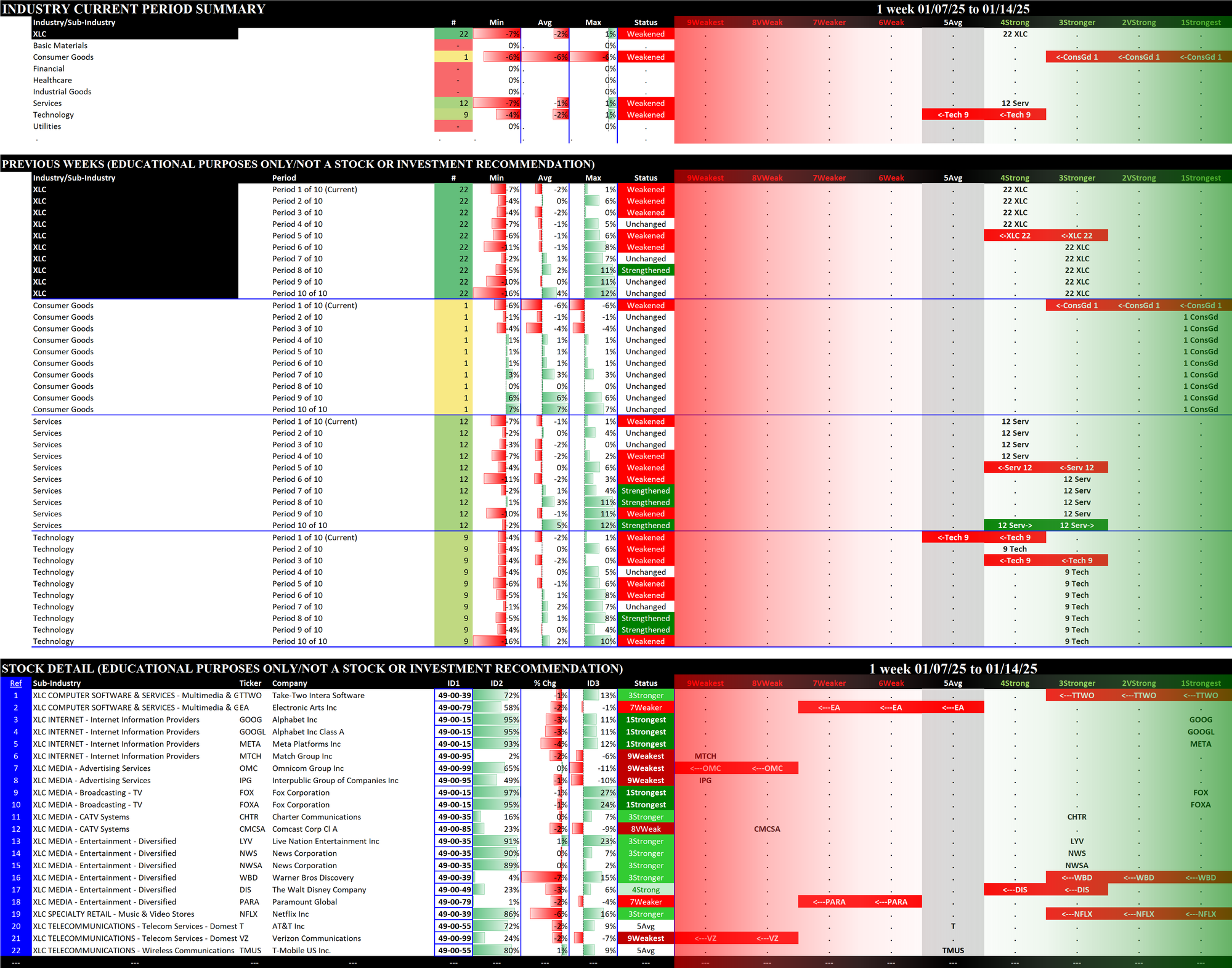

2.2 XLC Communications

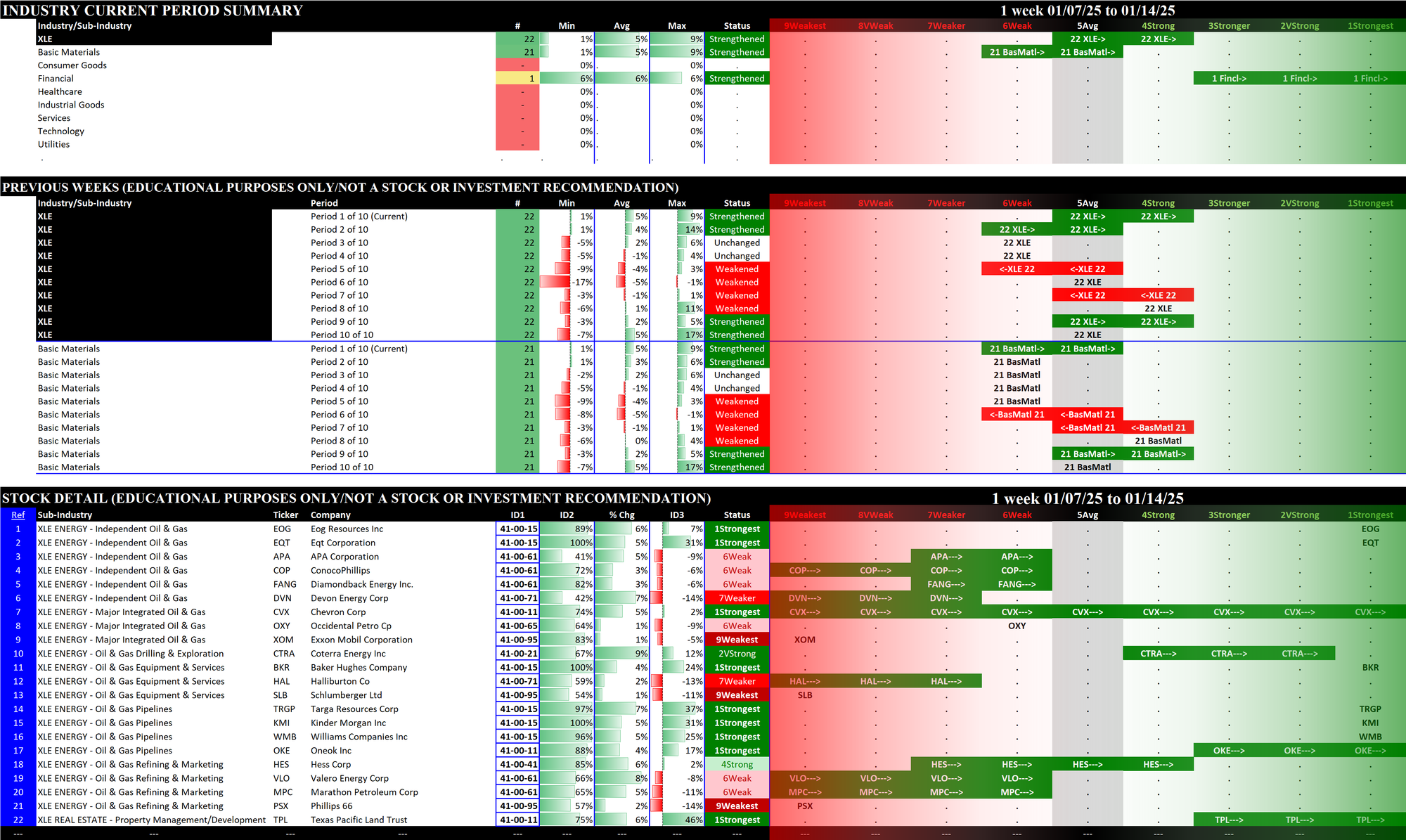

2.3 XLE Energy

2.4 XLF Financial

2.5 XLI Industrial

2.6 XLK Technology

2.7 XLP Consumer Staples

2.8 XLRE Real Estate

2.9 XLU Utilities

2.10 XLV Health Care

2.11 XLY Consumer Discretionary - Stock Detail (downloads)

1. ETFs Summaries

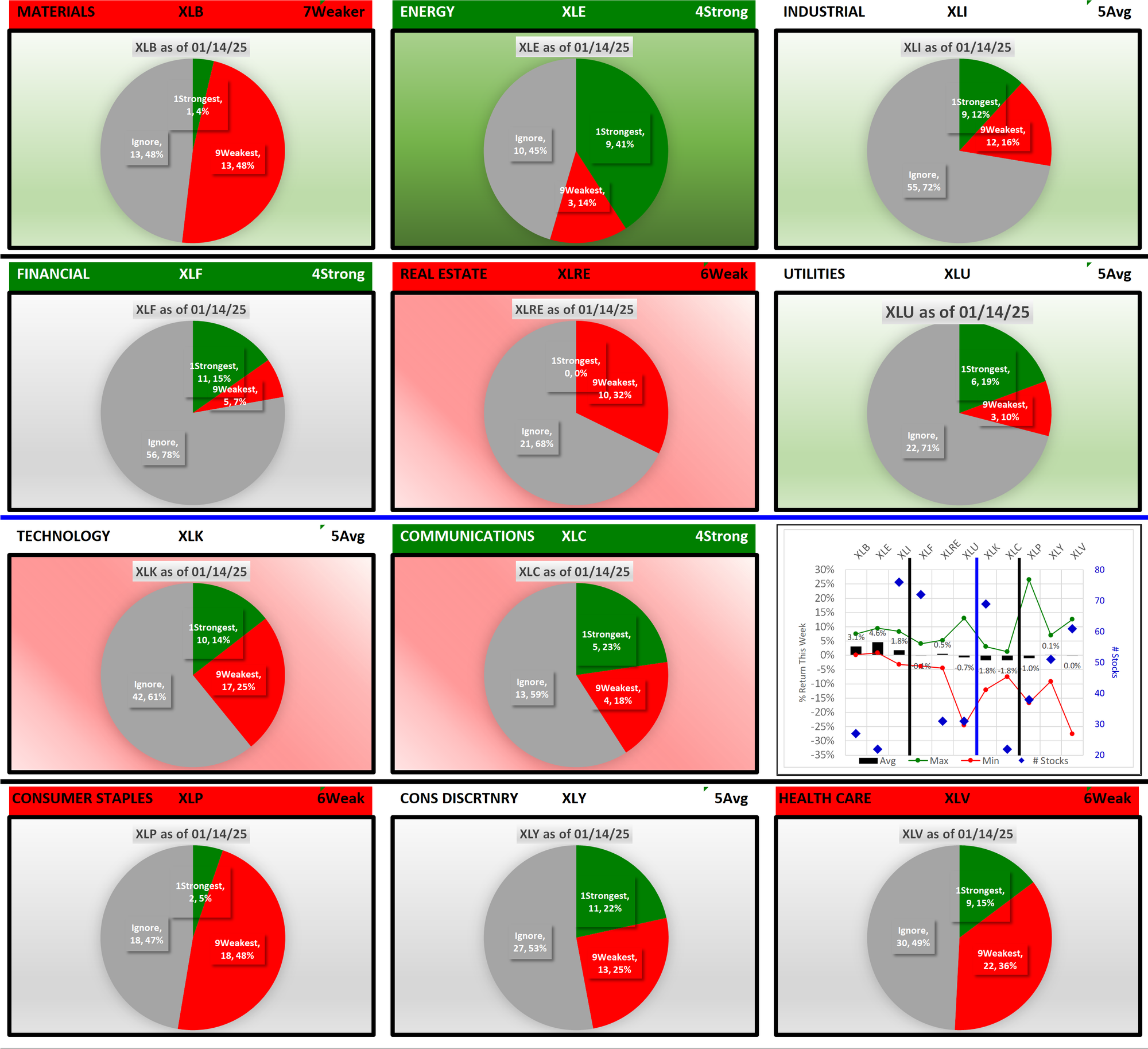

1.1 Current: Component Stocks Strength Ratings (1Strongest vs. 9Weakest vs. Ignore Status)

The following graphs reflect the composition of each of the ETFs based on their underlying component stock strength ratings which range from 1Strongest to 9Weakest. I only care about the strongest and weakest in each sector and thus categorize as "Ignore" stocks rated from 2VeryStrong through 8VeryWeak.

- Top row: XLB/Basic Materials, XLE/Energy, and XLI/Industrial

- Second row: interest rate-sensitive ETFs XLF/Financial, XLRE/Real Estate, and XLU/Utilities

- Third row: XLK/Technology and XLC/Communications

- Bottom row: XLP/Consumer Staples, XLY/Consumer Discretionary, and XLV/Health Care

The headers for each graphic are color-coded. ETFs rated 4Strong or better have green headings - currently, only three of 11 ETFs qualify. ETFs that changed rating this week have deep green or red backgrounds. ETFs that strengthened or weakened but did not change rating have pale green or red backgrounds. Notably, the weakest sector XLB/Materials at 7Weaker has only one stock rated 1Strongest while one of the other weakest ETFs - XLRE/Real Estate which is rated 6Weak - has no stocks rated 1Strongest.

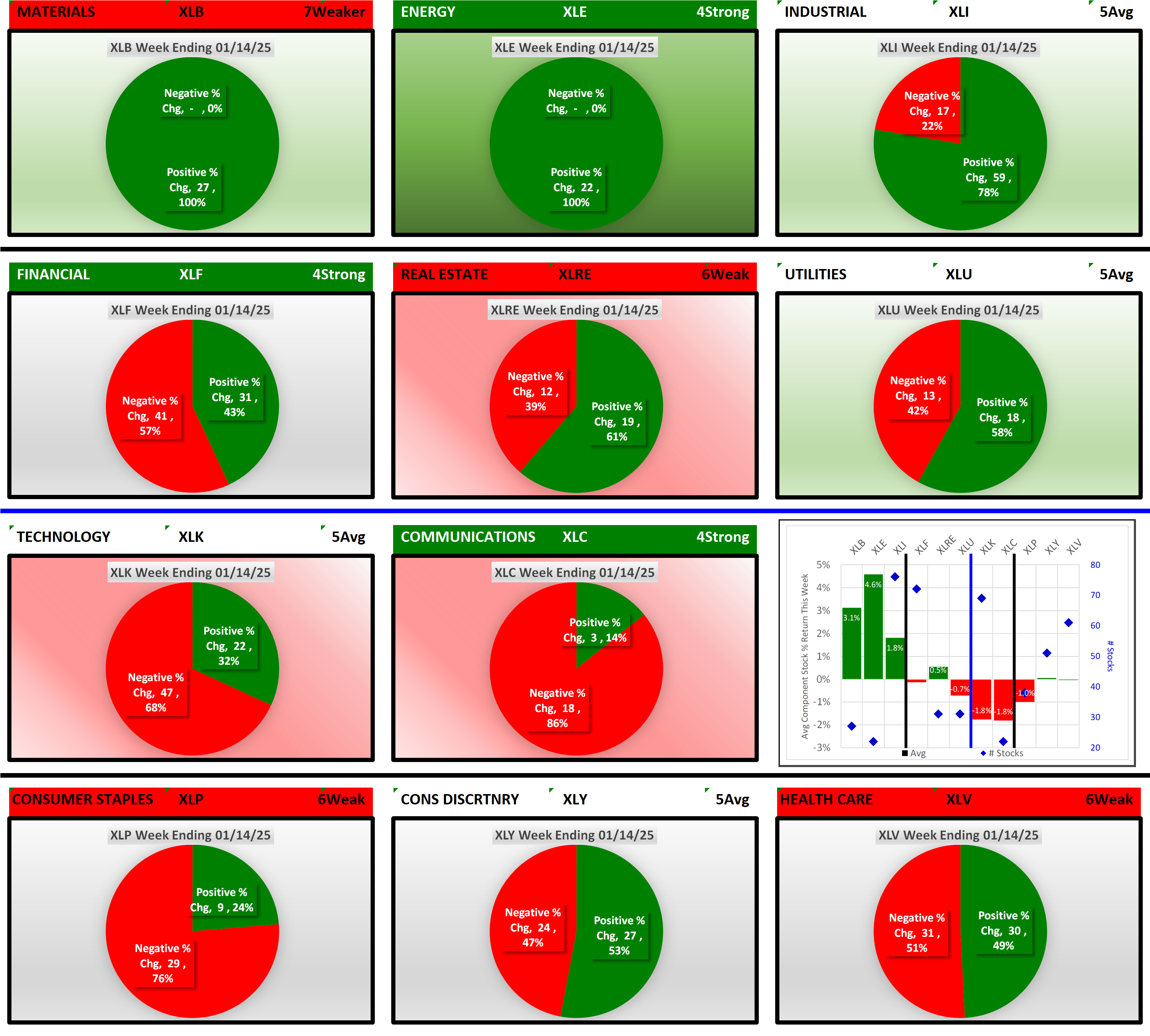

1.2 Current: Component Stocks Positive vs. Negative Weekly Returns

The following pie charts show the breadth of positive and negative returns for the week for the component stocks of each ETF.

Both XLB/Materials and XLE/Energy had 100% positive stocks. XLE had the highest positive average return at +4.6%.

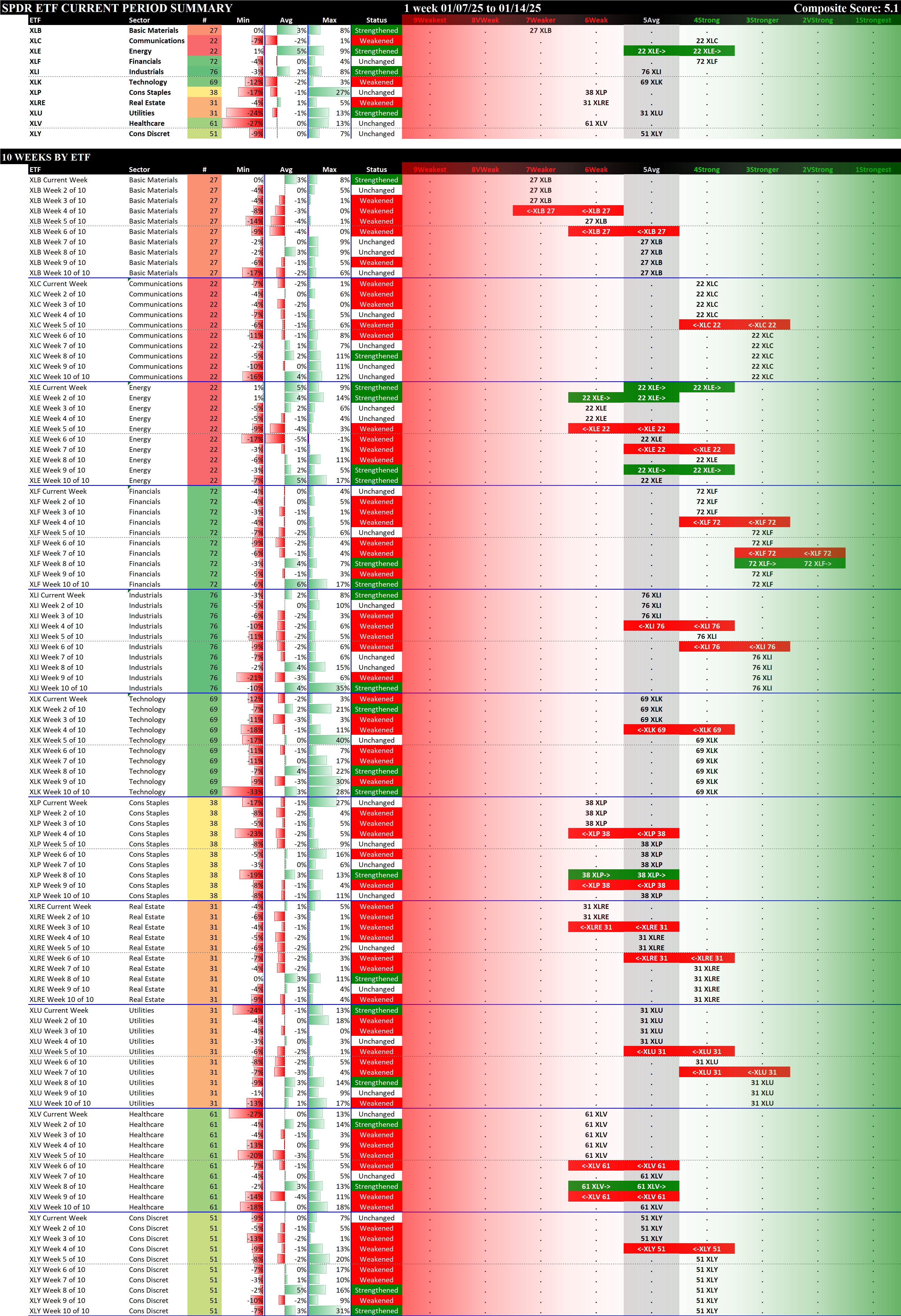

1.3 Historical: 10 Week Ratings by ETF

Below are 10-week historical strength rating summaries of the ETFs, sorted by ETF - each grouping shows the 10-week ratings change for individual ETFs. This shows the path each ETF has taken over the past 10 weeks to arrive at the current strength rating.

1.4 Historical: 10-Week Ratings by Week

Below are 10-week historical strength rating summaries of the ETFs, sorted by week - each grouping shows one week for all 11 ETFs in newest-to-oldest format. This reveals the weekly strengthening/weakening path of all the ETFs.

2. ETFs Detail

Details for each of the 11 ETFs are provided below. Comments:

- The top section shows the strength rating of the sectors comprising each ETF, based on the eight original Stock Market Organizer classifications and NOT the 11 ETF classifications. For example, the XLB Basic Materials ETF consists of 19 Basic Materials stocks, 6 Consumer Goods stocks, and 2 Industrial Goods stocks.

- The middle section shows the previous 10 weeks' strengthening and weakening of the relevant sectors. For example, since the XLB has Basic Materials, Consumer Goods, and Industrial Goods stocks, these three sectors are shown in the middle section of the XLB detail. The XLF (Financial) has Financial, Services, and Tech stocks.

- The bottom section shows strengthening/weakening for the underlying ETF component stocks, and includes the listing of their Stock Market Organizer industries and sub-industries. These stocks are listed in order based on Sub-industry then strongest to weakest comparative stock strength rating. The Basic Materials XLB ETF includes both Newmont Corporation/NEM in the Gold sub-industry within the Metals & Mining industry and Dow Inc./DOW in the Specialty Chemicals sub-industry within the Chemicals industry.

In these bottom sections, one can visually see the strength/strengthening and weakness/weakening of the component stocks in each ETF.

2.1 XLB Materials (27 stocks, small), Strengthened at 7Weaker = WORST

2.2 XLC Communication Services (22 stocks, small), Weakened at 4Strong = tied for BEST

2.3 XLE Energy (22 stocks, small), STRENGTHENED RATING TO 4Strong = tied for BEST

2.4 XLF Financial (72 stocks, large), Unchanged at 4Strong = tied for BEST

2.5 XLI Industrial (76 stocks, large), Strengthened at 5Avg

2.6 XLK Technology (69 stocks, large), Weakened at 5Avg

2.7 XLP Consumer Staples (38 stocks, mid-sized), Unchanged at 6Weak

2.8 XLRE Real Estate (31 stocks, small/mid-sized), Weakened at 6Weak

2.9 XLU Utilities (31 stocks, small/mid-sized), Strengthened at 5Avg

2.10 XLV Health Care (61 stocks, large), Unchanged at 6Weak

2.11 XLY Consumer Discretionary (51 stocks, mid-sized/large), Unchanged at 5Avg

3. Stock Detail

The downloadable PDF below lists all component stocks in order of first Strongest to Weakest ETF and second Strongest to Weakest Stock. The difference between this report and the 11 ETF stock listings above is this report consolidates all component stocks whereas the above listings are segregated by ETF.

Download the following Excel file if you are interested in sorting results yourself.