SMO Exclusive: SPDR Sector ETFs Strength Report Tuesday 2024-11-12 Mixed/Unchanged at 3.9 Strength Score

Background

This analysis consists of the Stock Market Organizer stock-by-stock strength analysis applied to the 500 stocks that comprise the 11 SPDR Select ETFs.

These results are combined with overall market environment readings (via the Market Strength Score and the Sector Risk Gauge) to discern appropriate portfolio exposure given prevailing market and sector conditions.

Context: Comparison to Previous Weeks

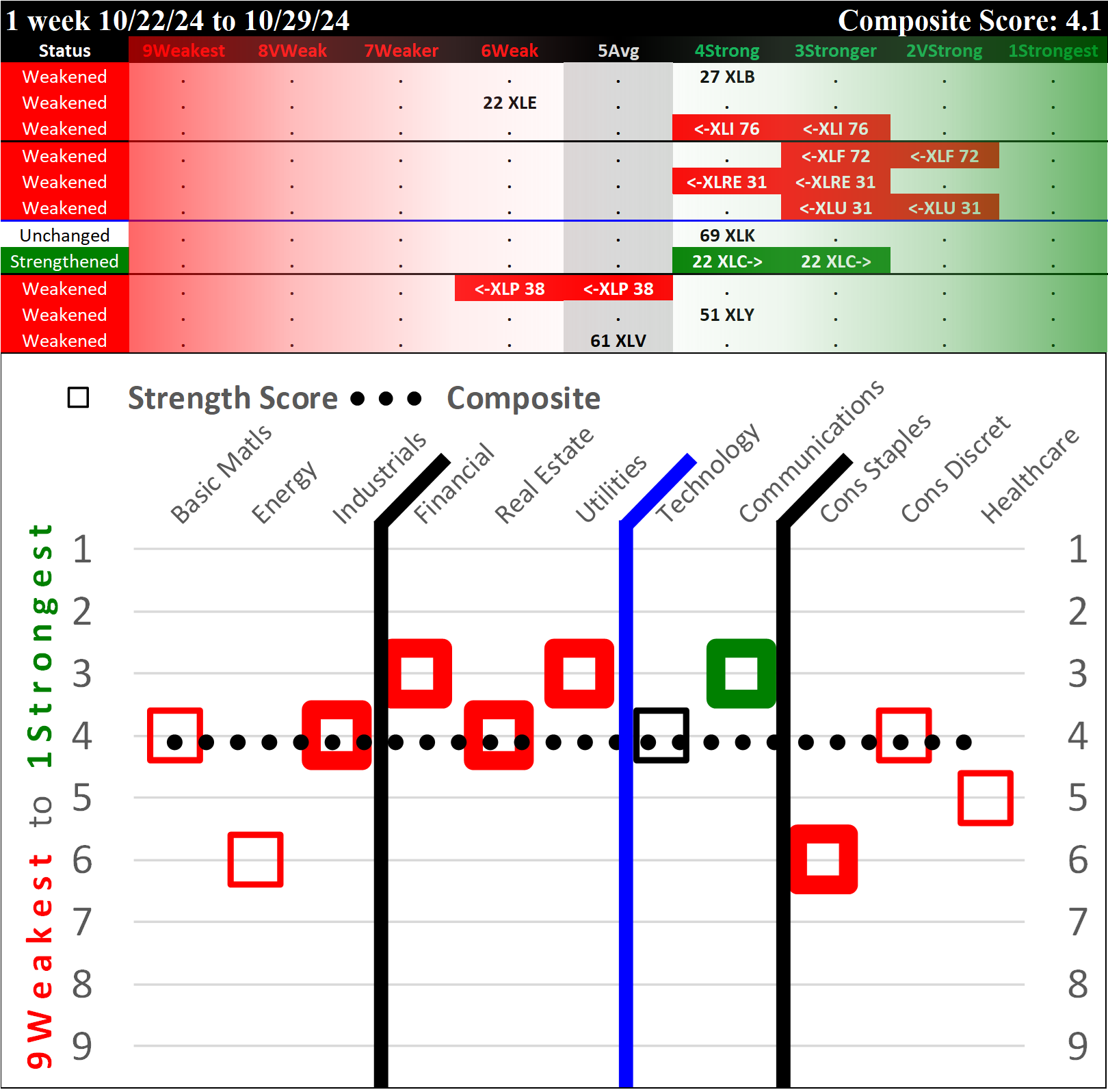

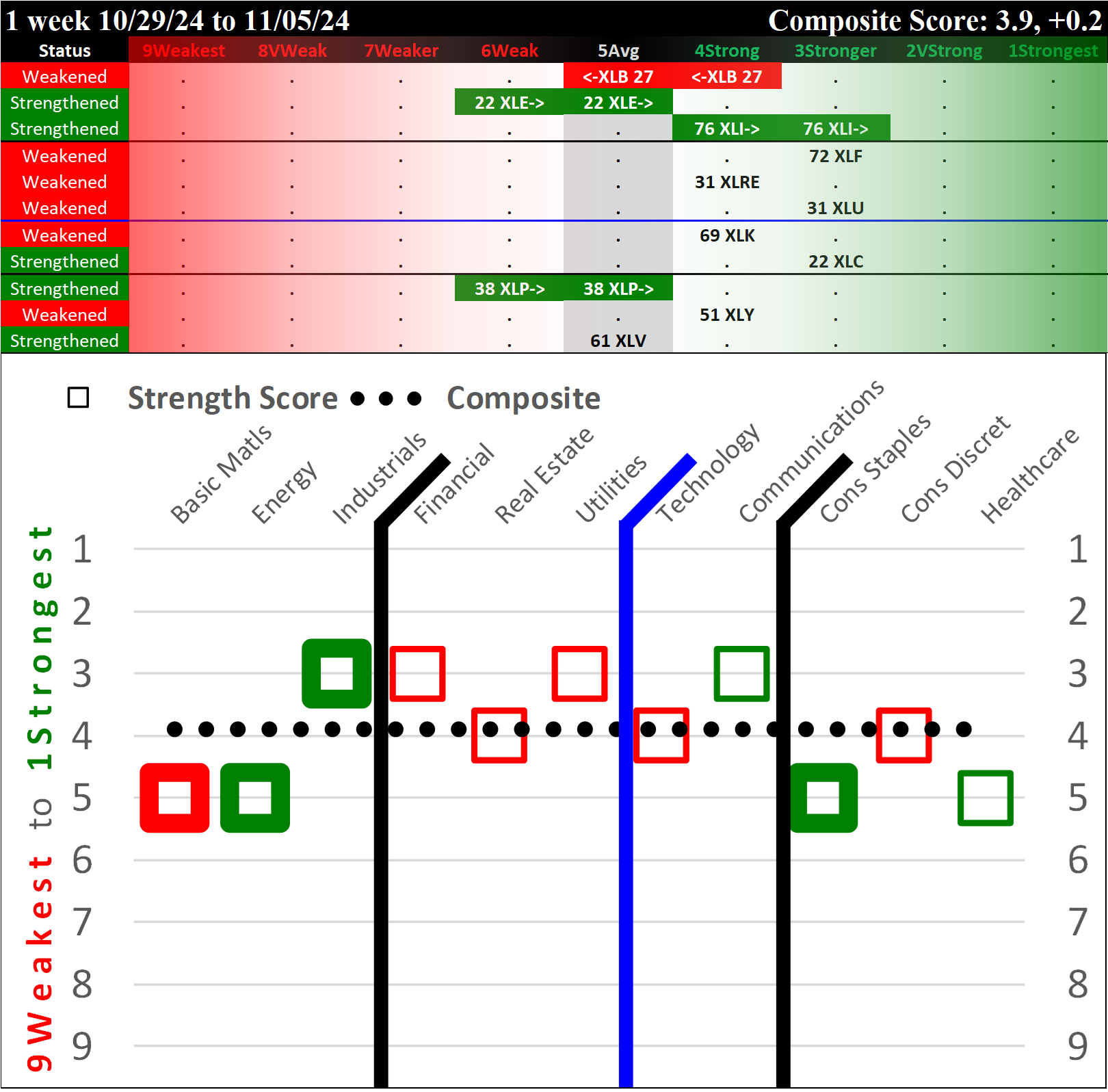

The following graphics show recent week-to-week changes ending on Tuesdays:

- 10/29/24: Weakened

- 11/05/24: Mixed/Strengthened

- 11/12/24: Mixed/Unchanged

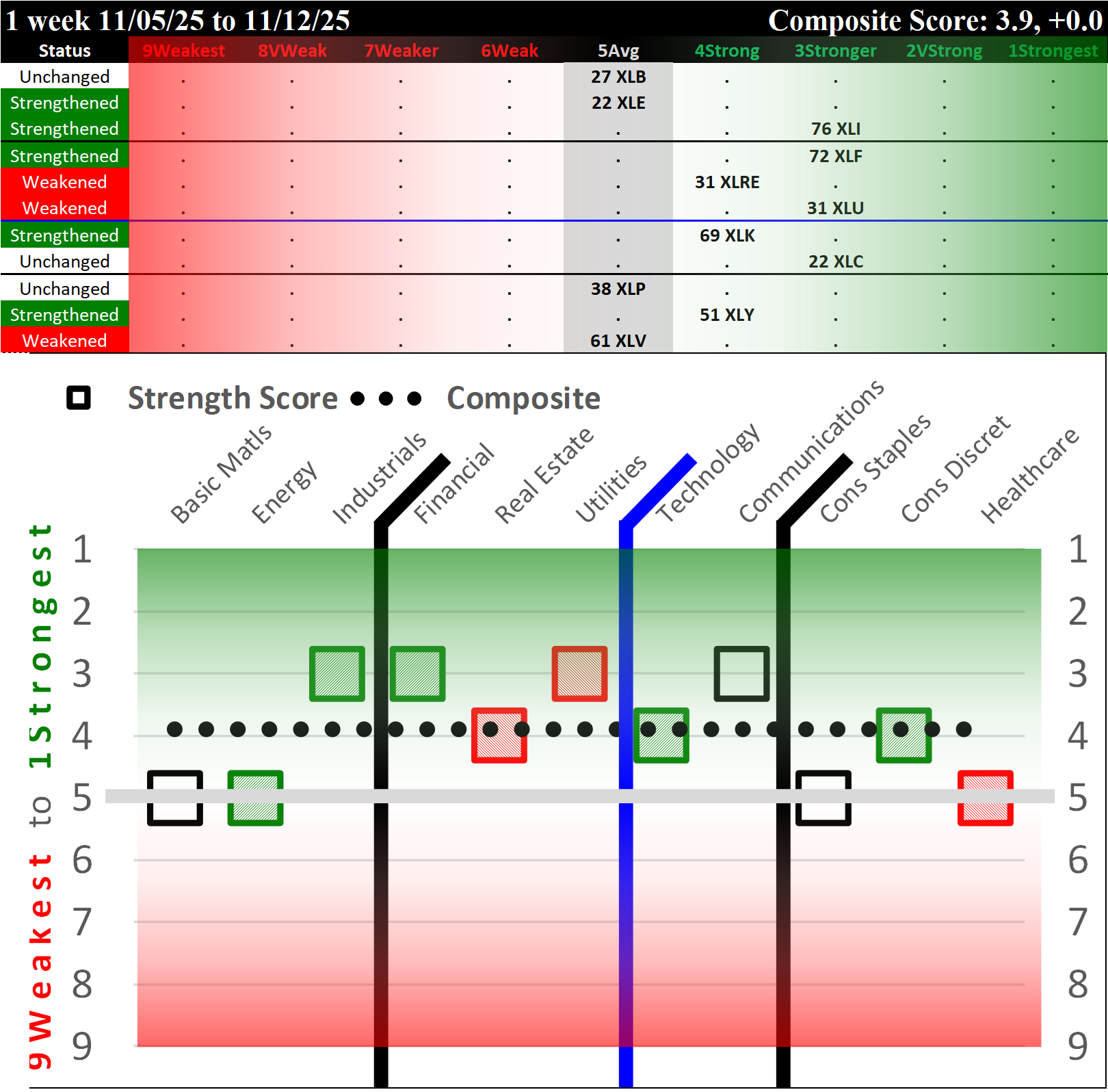

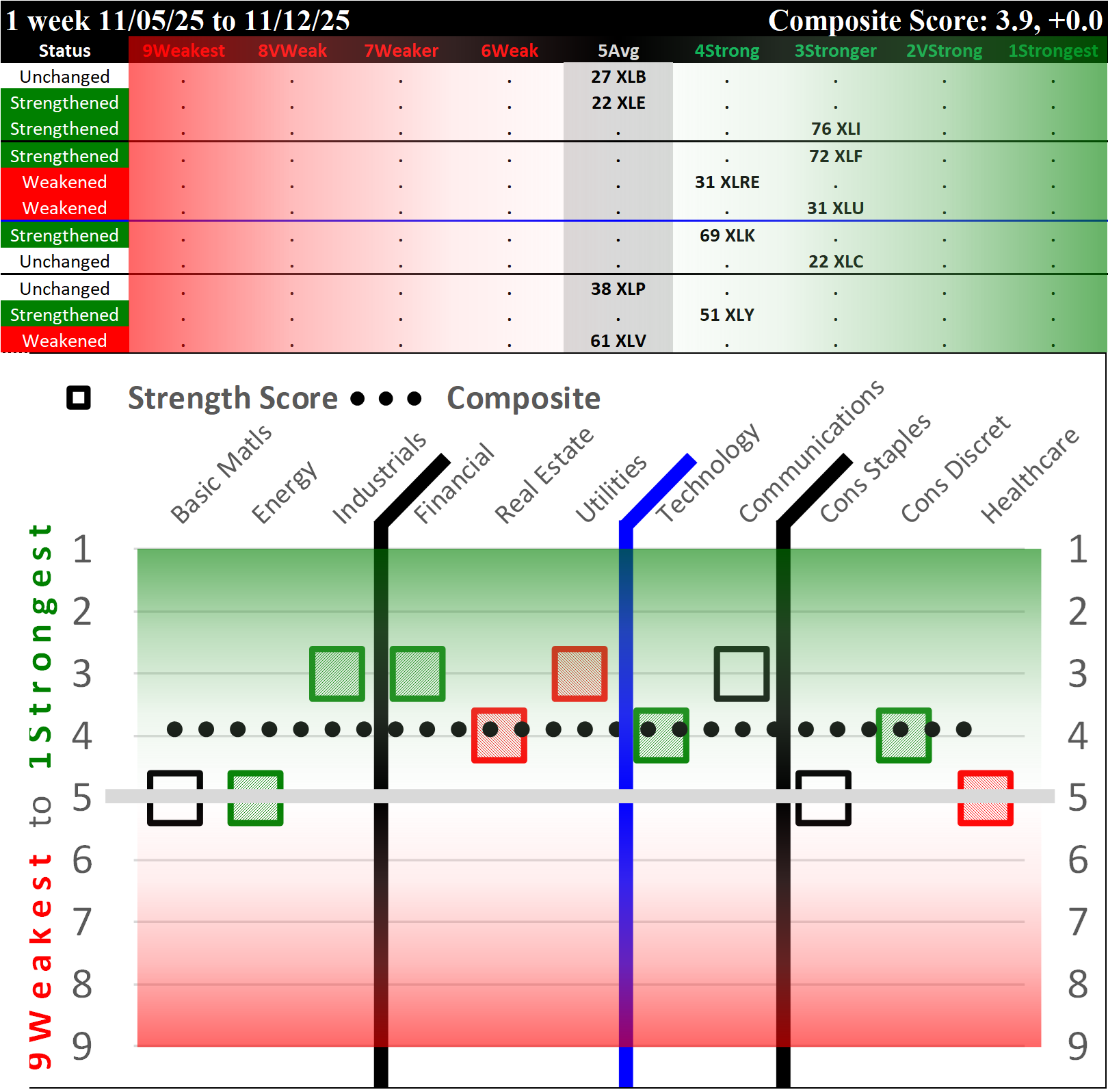

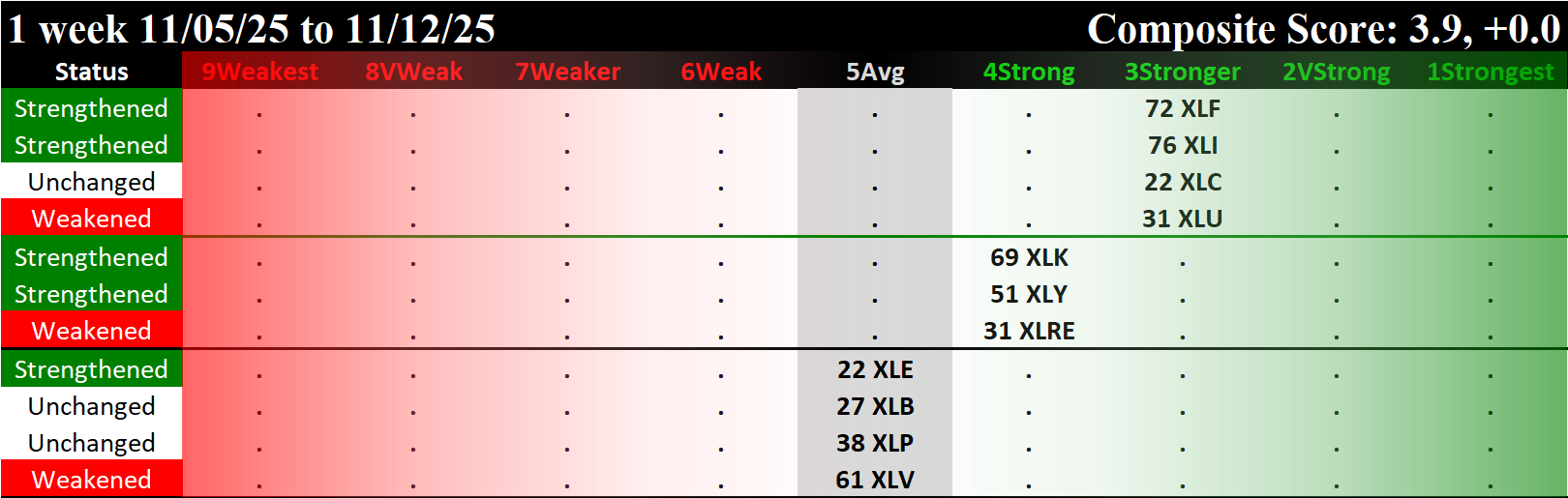

Mixed/unchanged week for the just-completed week ending Tuesday, 2024-11-12.

Current Status: 3.9 Composite Score, unchanged this week

3.9 is a slightly better than a 4Strong rating. Per the comparison to previous weeks above, this is +0.2 from 2024-10-29 and unchanged from 2024-11-05.

This shows that the top four ETFs are rated 3Stronger and are XLC/Communications, XLF/Financials, XLI/Industrials, and XLU/Utilities.

The weakest ETFs at 5Average are XLB/Materials, XLE/Energy, XLP/Consumer Staples, and XLV/Health Care.

This shows the ETFs in decreasing order of Strength Rating and strengthening for the week. Sectors with the same rating are listed in order of as follows: first, sectors that strengthened rating during the week; second, sectors with ratings that did not change during the week but did strengthen; third, sectors with ratings that did not change during the week but did weaken; and fourth, sectors which weakened rating during the week. The color-coded lines delineate different ratings - 4Strong or stronger are separated by green lines, 6Weak or weaker are separated by red lines, and 5Average is separated by black lines.

The ETFs are listed below based on their strength rating.

1Strongest

None

2VeryStrong

None

3Stronger

- XLF/Financial (Strengthened)

- XLI/Industrials (Strengthened)

- XLC/Communications (Unchanged)

- XLU/Utilities (Weakened)

3.9 - Composite Score

4Strong

- XLK/Technology (Strengthened)

- XLY/Consumer Discretionary (Strengthened)

- XLRE/Real Estate (Weakened)

5Average

- XLE/Energy (Strengthened)

- XLB/Basic Materials (Unchanged)

- XLP/Consumer Staples (Unchanged)

- XLV/Healthcare (Weakened)

6Weak

None

7Weaker

None

8VeryWeak

None

9Weakest

None

Today's Market Context

Key Headlines

"Stock Market Today: S&P 500 snaps 5-day winning streak, Treasury yields surge ahead of CPI report"

"10-year Treasury yield breaks through key resistance levels on way to 5%"

"Bitcoin resumes its climb, briefly touching $90,000 in late afternoon trading"

(Marketwatch)

"Gold drops over 2% as dollar strengthens; investors await Fed policy cues"

"Oil falls as China stimulus fails to boost sentiment, US dollar strength"

(CNBC)

Key Current Readings

SP500: 5,983.99

Nasdaq: 19,281.4

Nasdaq 100: 21,070.79

Russell 2000: 2,391.85

10Y Treasury: 4.435%

2YT: 4.349%

Oil (WTI Crude): $68.07

Bitcoin: $88,188

Dollar Index: 106.02

Gold: $2,604.5

VIX: 14.71

(CNBC)

Sector ETF Analysis Contents

The following Stock Market Organizer strengthening/weakening analysis looks at the 11 SPDR ETFs and their underlying component stocks for the week ending Tuesday 2024-11-12, as follows:

- ETFs Summary

1.1 Current Overview

1.2 Historical Summaries - ETFs Detail

2.1 XLB Basic Materials

2.2 XLC Communications

2.3 XLE Energy

2.4 XLF Financials

2.5 XLI Industrials

2.6 XLK Technology

2.7 XLP Consumer Staples

2.8 XLRE Real Estate

2.9 XLU Utilities

2.10 XLV Healthcare

2.11 XLY Consumer Discretionary - Stock Detail (downloads)

1. ETFs Summary

1.1 Current Overview

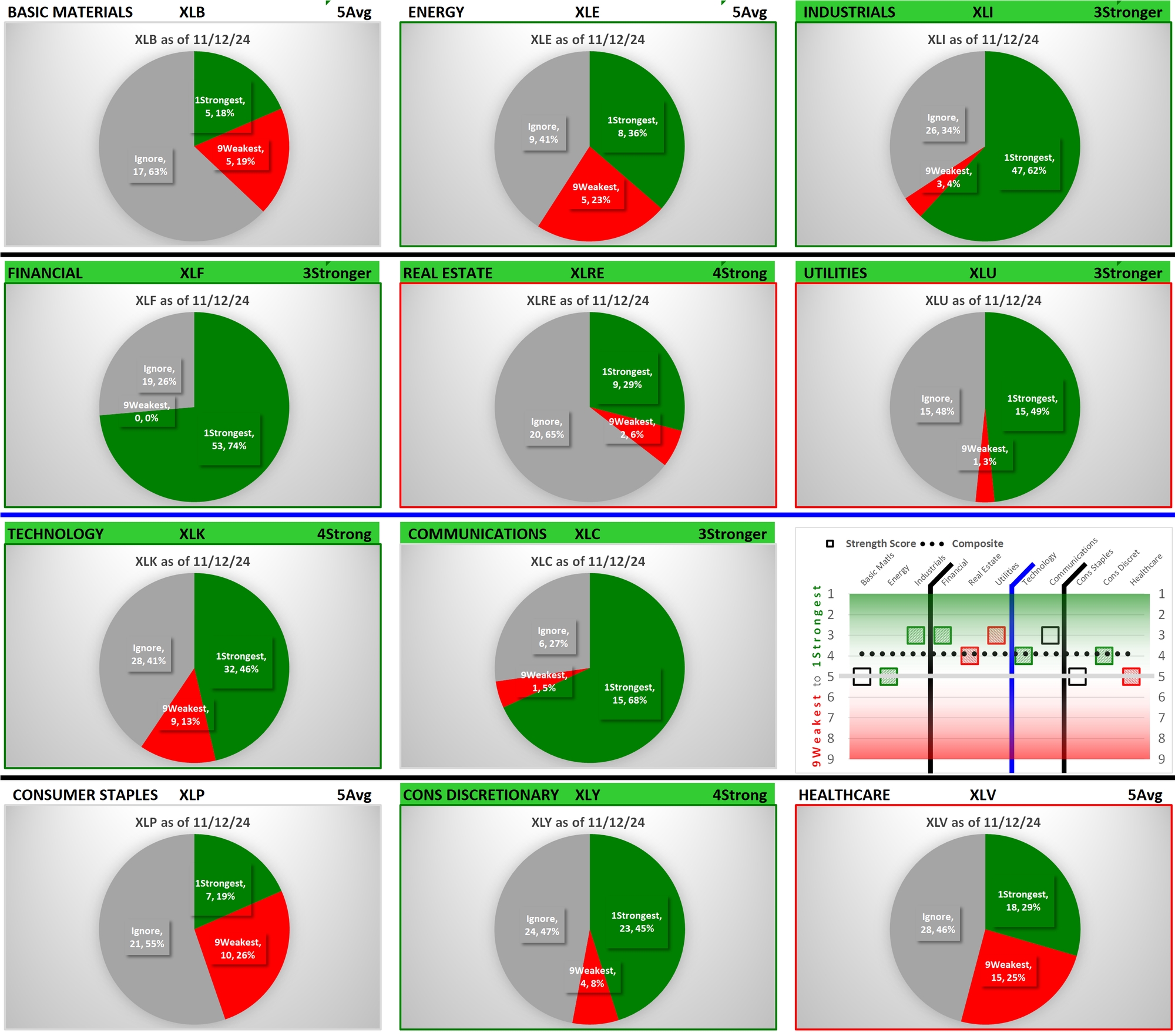

The following graphs reflect the composition of each of the ETFs based on their underlying stock strength ratings which range from 1Strongest to 9Weakest. Since I only care about the strongest and weakest in each sector, stocks rated from 2VeryStrong through 8VeryWeak are categorized as "Ignore."

- Top row: XLB/Basic Materials, XLE/Energy, and XLI/Industrials

- Second row: interest rate-sensitive ETFs XLF/Financials, XLRE/Real Estate, and XLU/Utilities

- Third row: XLK/Technology and XLC/Communications

- Bottom row: XLP/Consumer Staples, XLY/Consumer Discretionary, and XLV/Healthcare

The headers for each graphic are color-coded. ETFs rated 4Strong or better have green headings - currently, 7 of 11 ETFs qualify. The weakest ETFs XLB/Basic Materials, XLE/Energy, XLP/Consumer Staples, and XLV/Health Care have 5Average ratings. ETFs that changed rating this week have thick green or red borders. ETFs that strengthened or weakened but did not change rating have thin green or red borders.

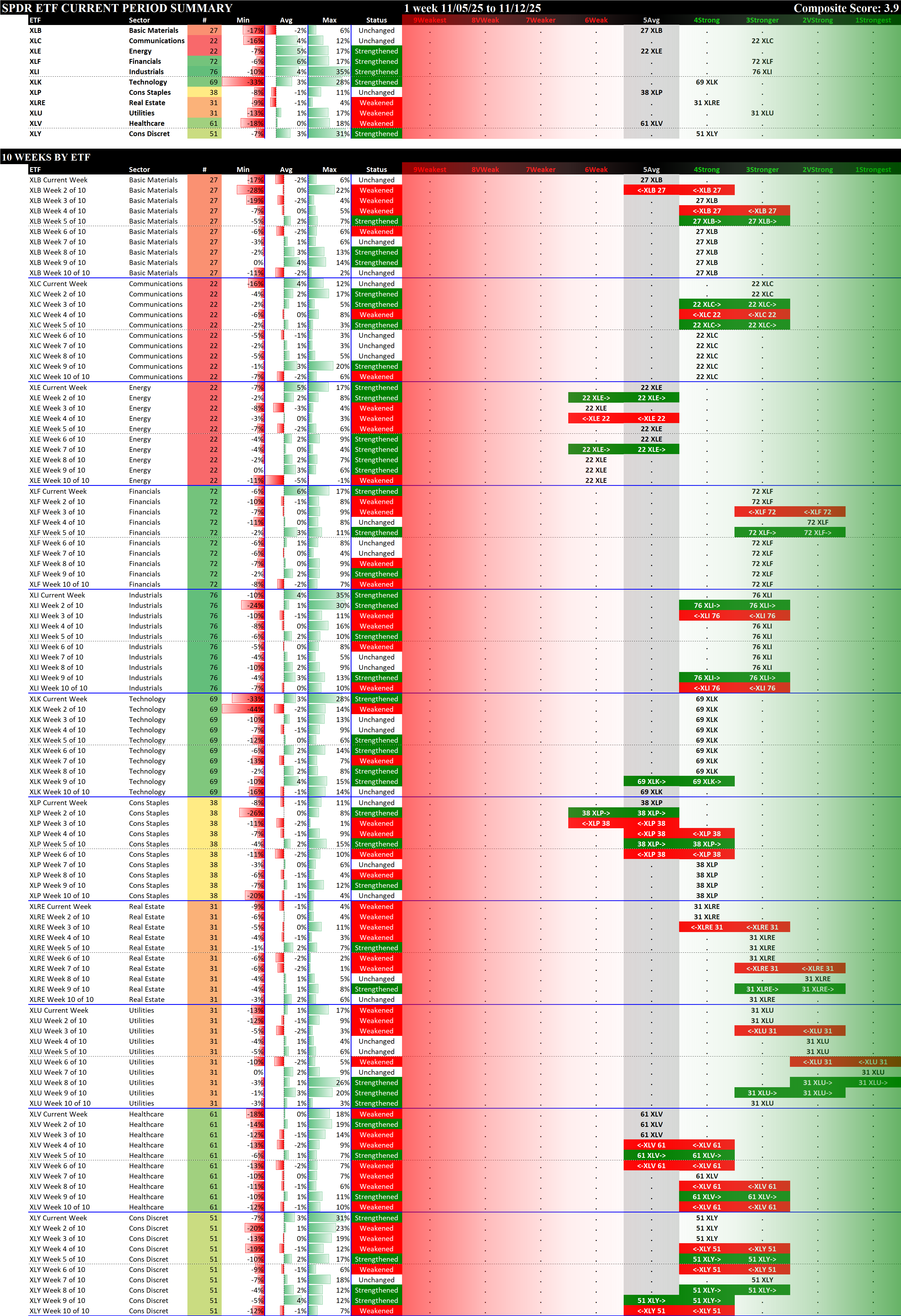

1.2 Historical Summaries

Below are 10-week historical strength rating summaries of the ETFs, sorted first by ETF and then by Week. The graphics make it easy to compare strengthening and weakening between ETFs over the most recent 10 weeks.

Sorted by ETF

This graphic shows the past 10 weeks strengthening and weakening segregated by ETF.

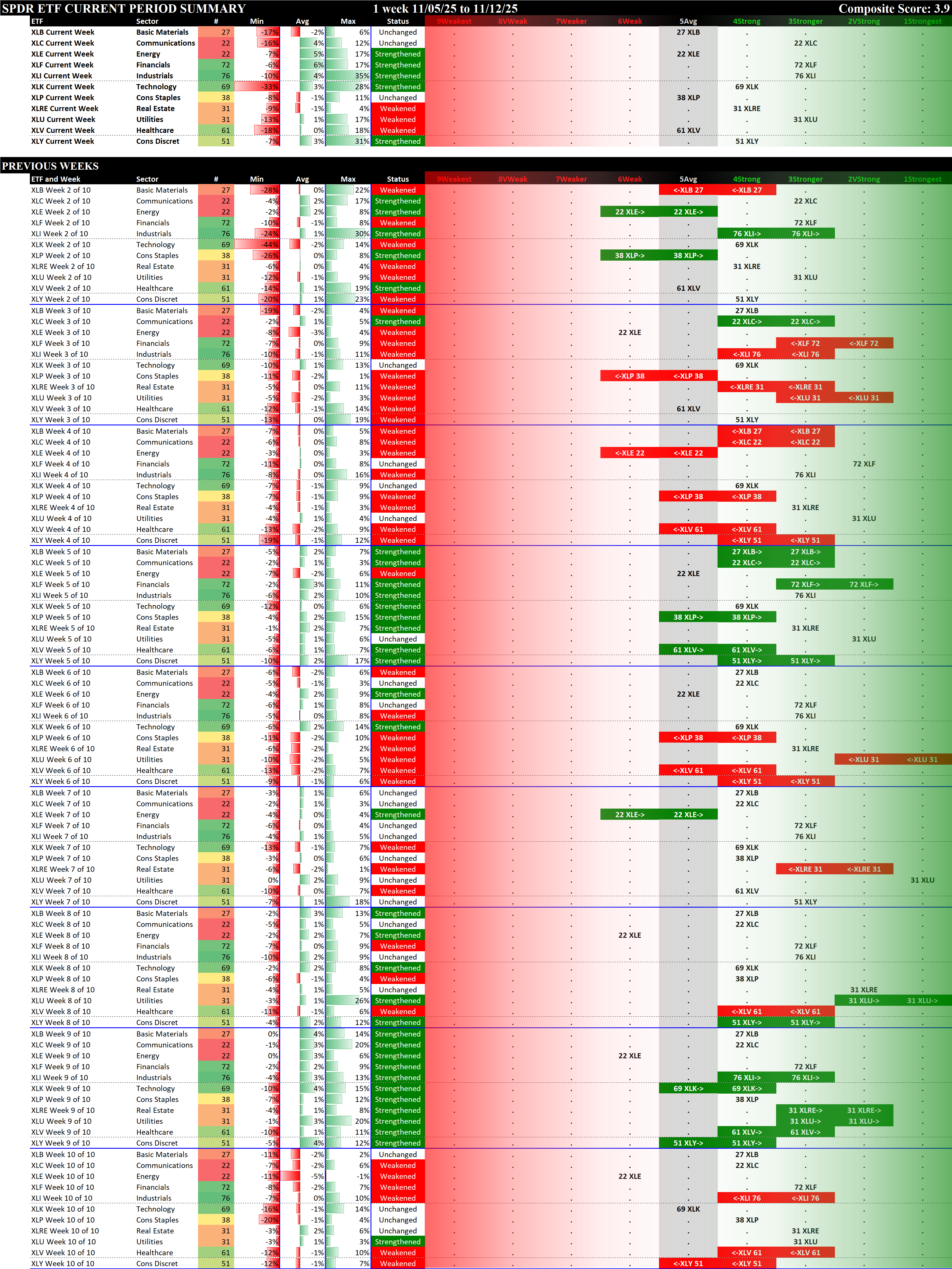

Sorted by Week

This graphic shows the past 10 weeks strengthening and weakening segregated by week.

2. ETFs Detail

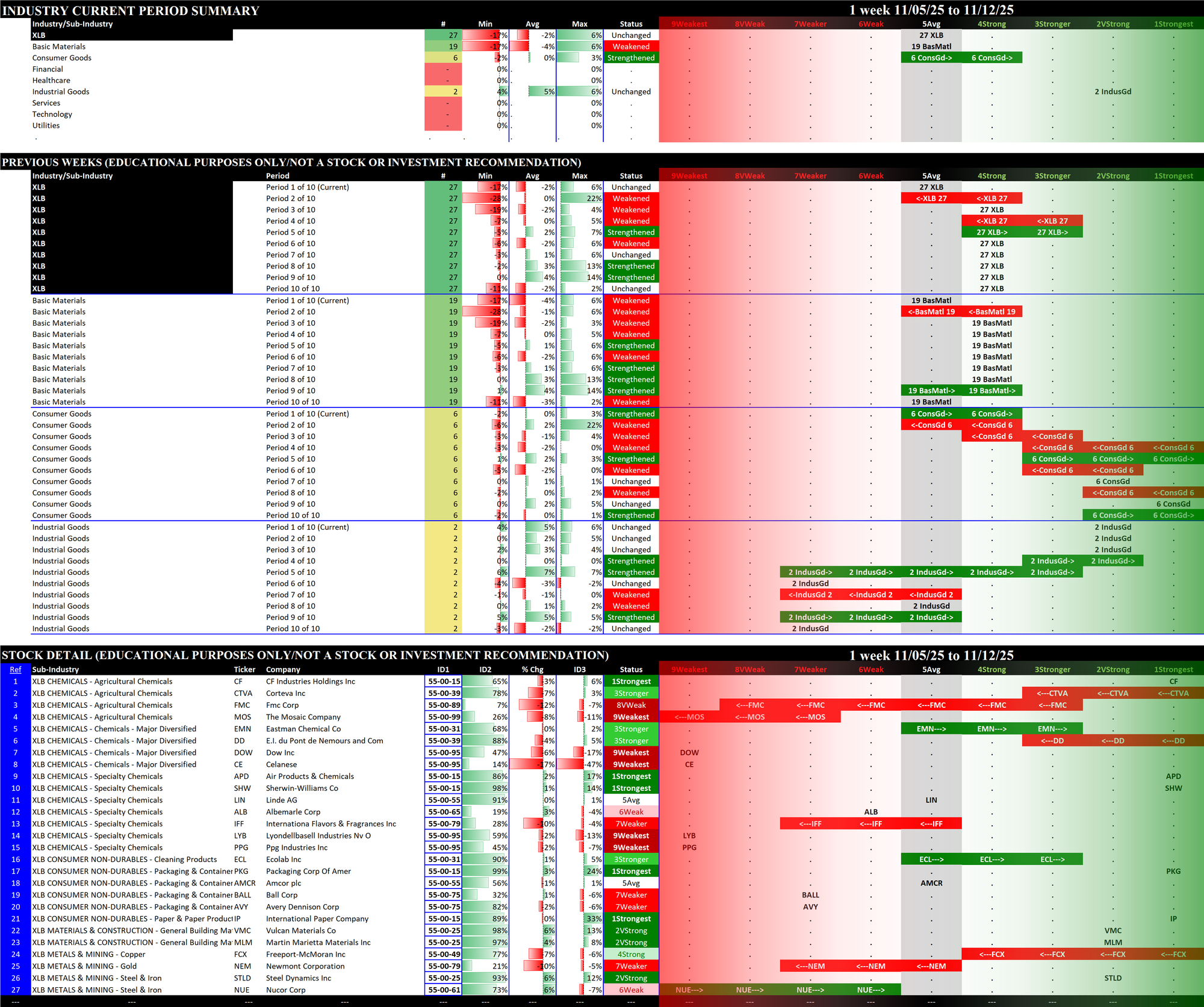

Details for each of the 11 ETFs are provided below. Comments:

- The top section shows the strength rating of the sectors comprising each ETF, based on the eight original Stock Market Organizer classifications and NOT the 11 ETF classifications. For example, the XLB Basic Materials ETF consists of 19 Basic Materials stocks, 6 Consumer Goods stocks, and 2 Industrial Goods stocks.

- The middle section shows the previous 10 weeks' strengthening and weakening of the relevant sectors. For example, since the XLB has Basic Materials, Consumer Goods, and Industrial Goods stocks, these three sectors are shown in the middle section of the XLB detail. The XLF (Financial) has Financial, Services, and Tech stocks.

- The bottom section shows strengthening/weakening for the underlying ETF components stocks, and includes the listing of their Stock Market Organizer industries and sub-industries. These stocks are listed in order based on Sub-industry then strongest to weakest comparative stock strength rating. The Basic Materials XLB ETF includes both Newmont Corporation/NEM in the Gold sub-industry within the Metals & Mining industry and Dow Inc./DOW in the Specialty Chemicals sub-industry within the Chemicals industry.

In these bottom sections, one can visually see the strength/strengthening and weakness/weakening of the component stocks in each ETF.

2.1 XLB Materials (27 stocks, small) - unchanged 5Average = worst rating (tied, XLE/Energy, XLP/Consumer Staples, XLV/Health Care)

Includes securities of companies from the following industries: chemicals; metals and mining; paper and forest products; containers and packaging; and construction materials.

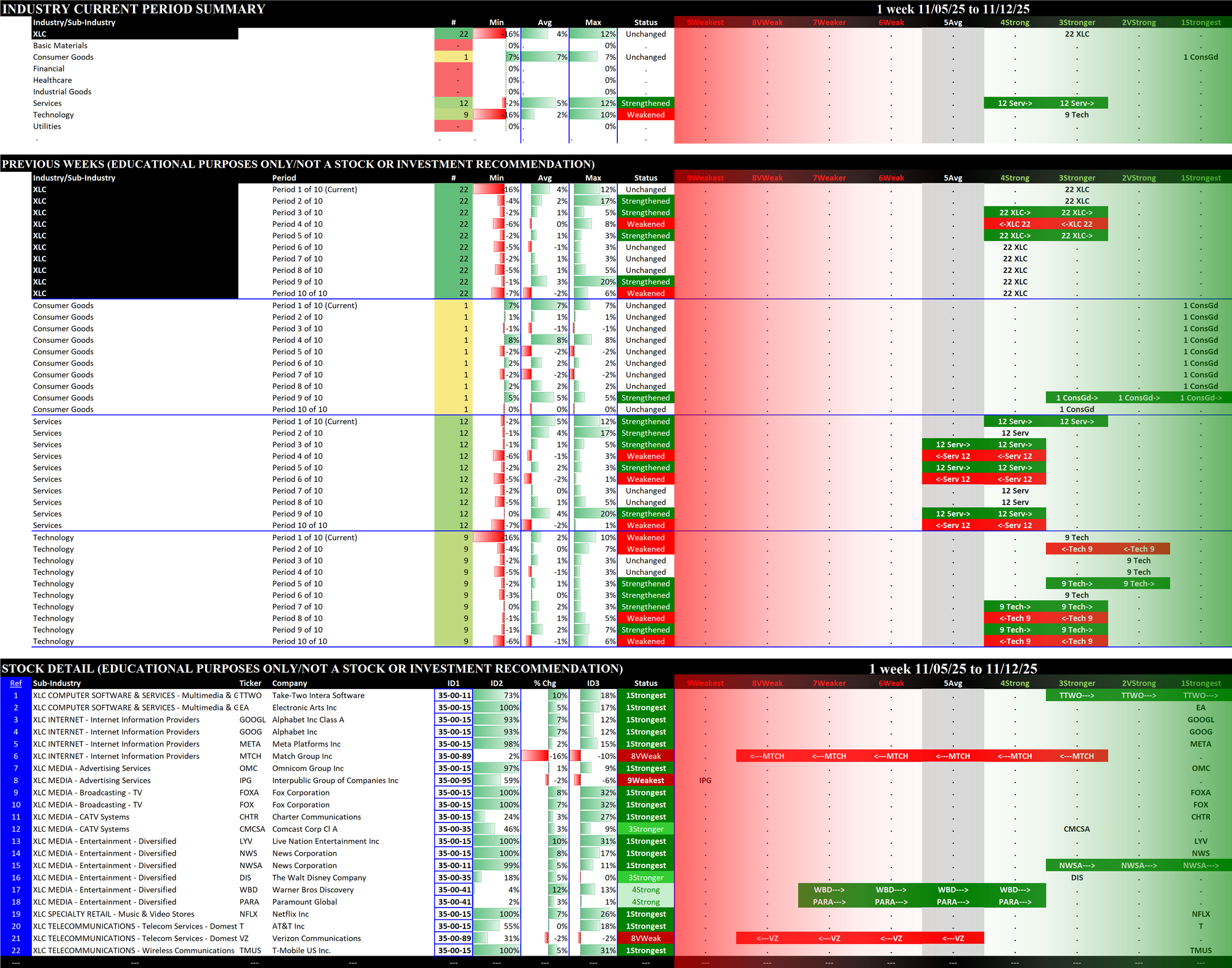

2.2 XLC Communication Services (22 stocks, small), unchanged 3Stronger = best rating (tied, XLF/Financials, XLI/Industrials, XLU/Utilities)

Includes companies that have been identified as Communication Services companies by the GICS®, including securities of companies from the following industries: diversified telecommunication services; wireless telecommunication services; media; entertainment; and interactive media & services.

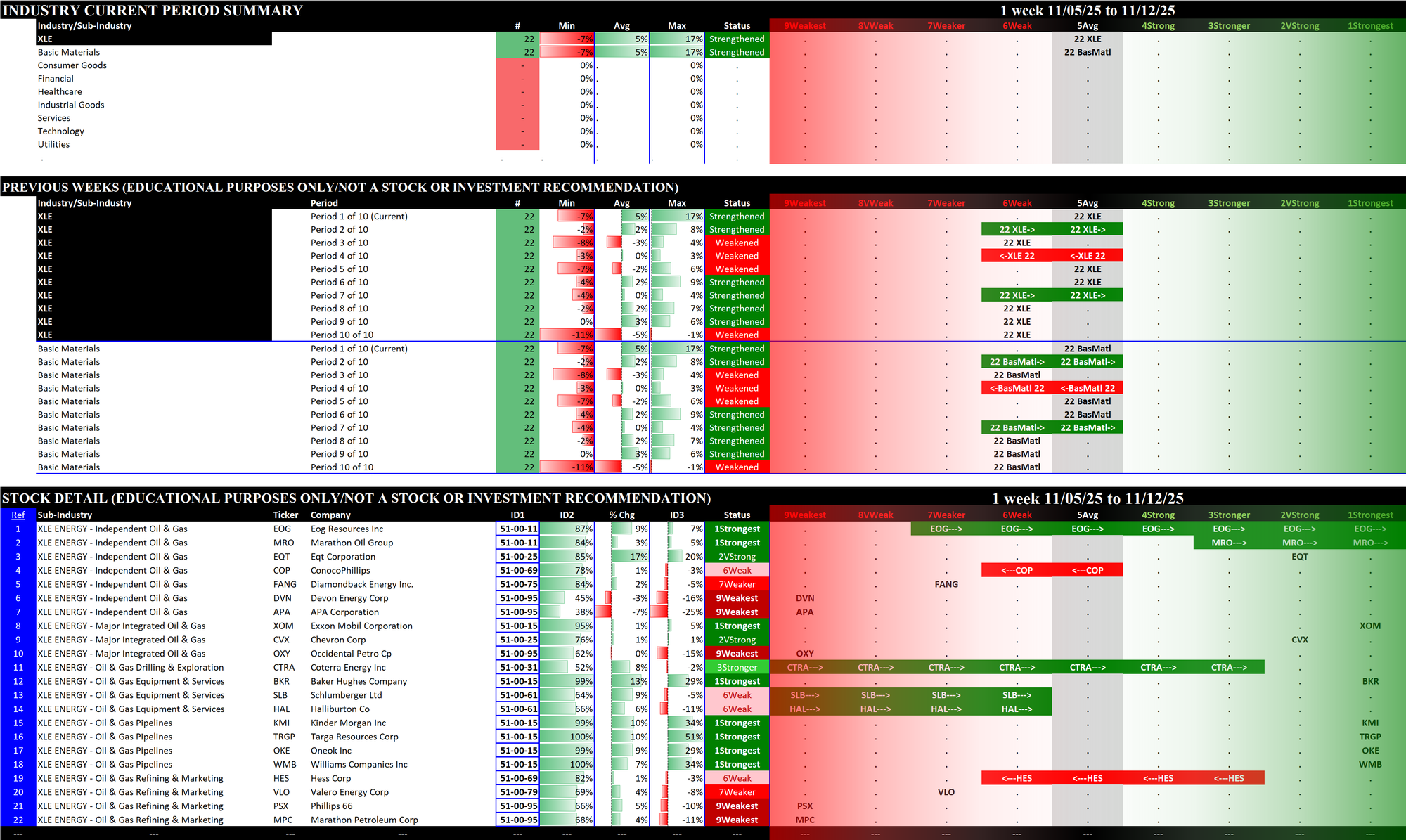

2.3 XLE Energy (22 stocks, small), unchanged 5Average = worst rating (tied, XLB/Materials, XLP/Consumer Staples, XLV/Health Care)

Includes companies that have been identified as Energy companies by the GICS®, including securities of companies from the following industries: oil, gas and consumable fuels; and energy equipment and services.

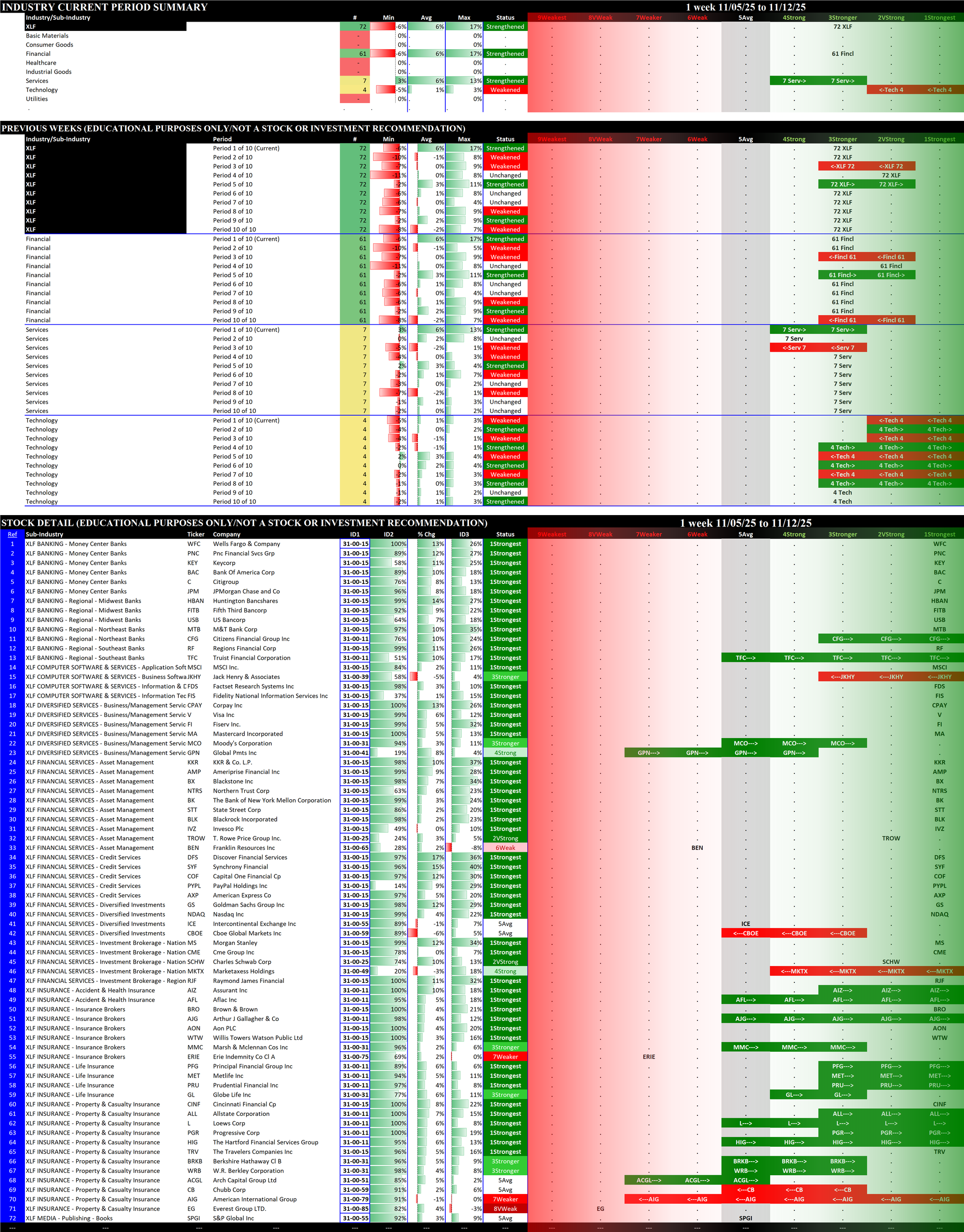

2.4 XLF Financial (72 stocks, large), unchanged 3Stronger = best rating (tied, XLC/Communications, XLI/Industrials, XLU/Utilities)

Includes companies that have been identified as Financial companies by the Global Industry Classification Standard, including securities of companies from the following industries: financial services; insurance; banks; capital markets; mortgage real estate investment trusts; and consumer finance.

2.5 XLI Industrial (76 stocks, large), unchanged 3Stronger = best rating (tied, XLC/Communications, XLF/Financials, XLU/Utilities)

Includes companies that have been identified as Industrial companies by the Global Industry Classification Standard, including securities of companies from the following industries: aerospace and defense; industrial conglomerates; marine transportation.

2.6 XLK Technology (69 stocks, large), unchanged 4Strong

2.7 XLP Consumer Staples (38 stocks, mid-sized), unchanged 5Average = worst rating (tied, XLB/Materials, XLE/Energy, XLV/Health Care)

Includes companies that have been identified as Consumer Staples companies by the GICS®.

2.8 XLRE Real Estate (31 stocks, small/mid-sized), unchanged 4Strong

Includes companies that have been identified as Real Estate companies by the Global Industry Classification Standard (GICS®).

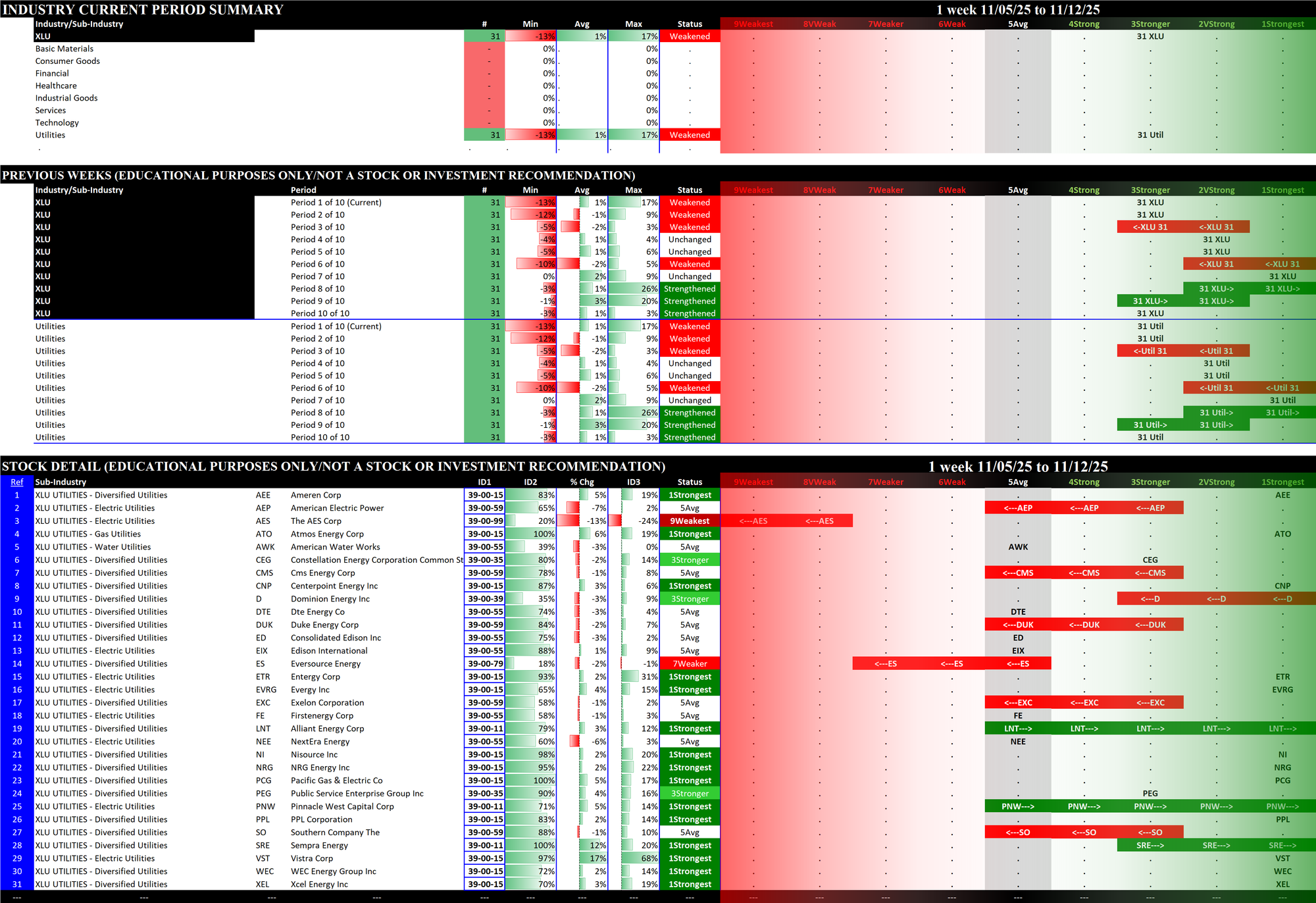

2.9 XLU Utilities (31 stocks, small/mid-sized), unchanged 3Stronger = best rating (tied, XLC/Communications, XLF/Financials, XLI/Industrials)

Includes securities of companies from the following industries: electric utilities; water utilities; multi-utilities; independent power and renewable electricity producers; and gas utilities.

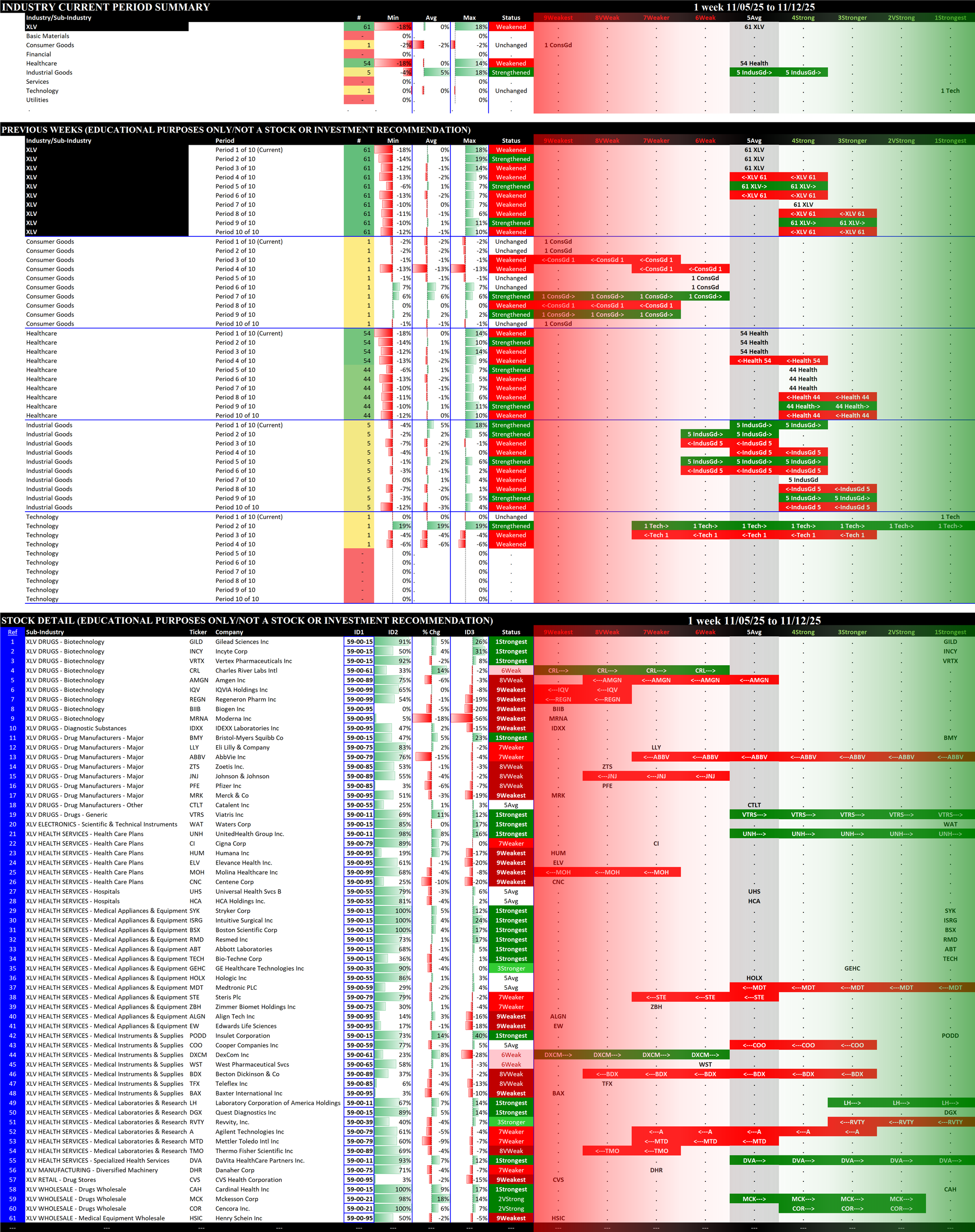

2.10 XLV Health Care (61 stocks, large), unchanged 5Average = worst rating (tied, XLB/Materials, XLE/Energy, XLP/Consumer Staples)

Includes companies from the following industries: pharmaceuticals; health care equipment & supplies; health care providers & services; biotechnology; life sciences tools & services; and health care technology.

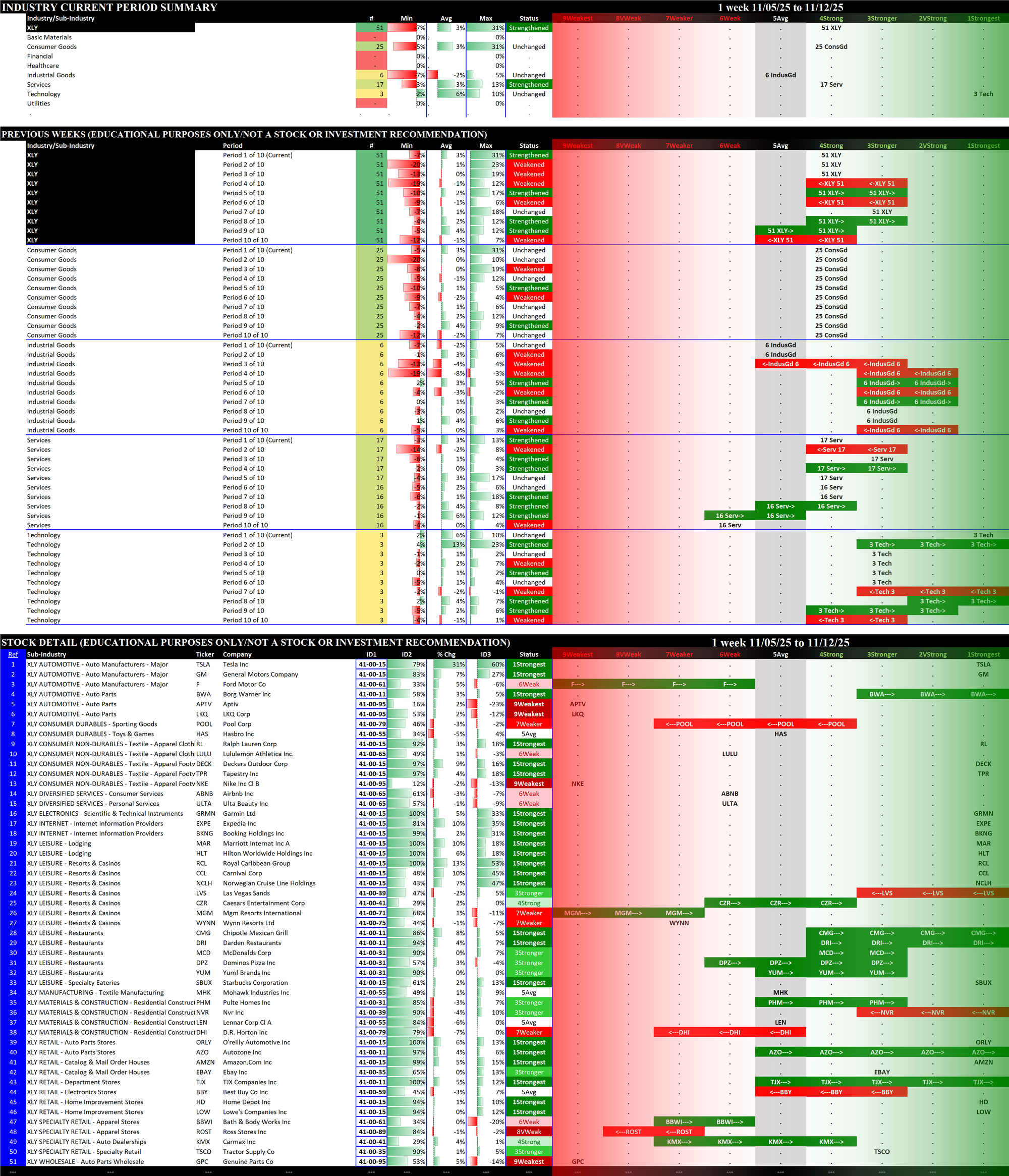

2.11 XLY Consumer Discretionary (51 stocks, mid-sized/large), unchanged 4Strong

Includes companies that have been identified as Consumer Discretionary companies by the Global Industry Classification Standard (GICS®).

3. Stock Detail

The downloadable PDF below lists all component stocks in order of first Strongest to Weakest ETF and second Strongest to Weakest Stock. The difference between this report and the 11 ETF stock listings above is this report consolidates all component stocks whereas the above listings are segregated by ETF.

Download the following Excel file if you are interested in sorting results yourself.