SMO Exclusive: SPDR ETF Strength Report 2024-09-06

Background

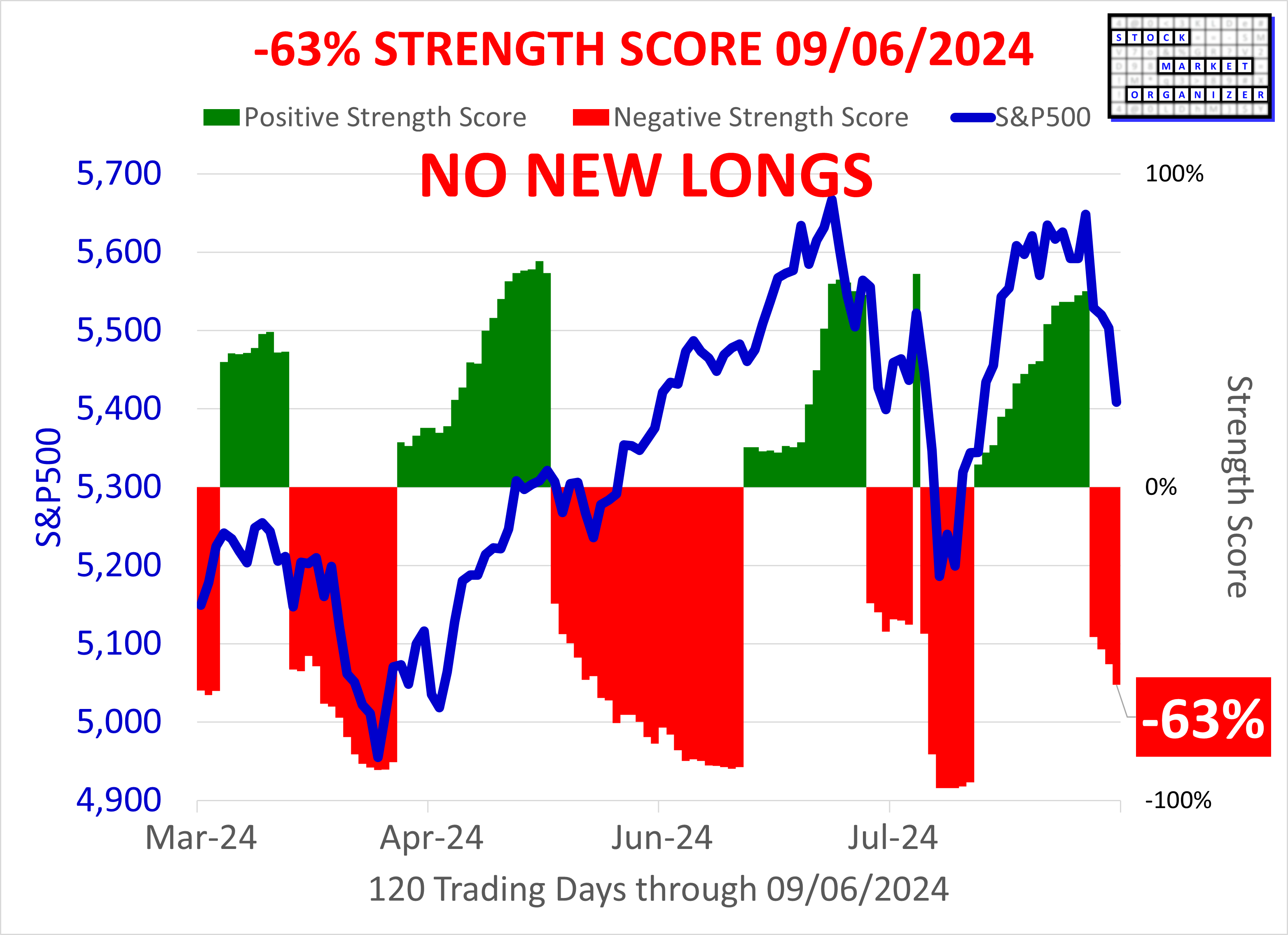

Here's a unique Stock Market Organizer strengthening/weakening look at the 10 SPDR ETFs and their underlying component stocks for the week ending 2024-09-06.

Performance Summary

9 of the 10 ETFs WEAKENED. The Strongest ETFs are XLF Financial, XLRE Real Estate, and Utilities at 3Stronger. The Weakest is XLE Energy at 6Weak.

- XLB Basic Materials WEAKENED from 4Strong to 5Average

- XLE Energy WEAKENED from 5Average to 6Weak

- XLF Financial WEAKENED from 2VeryStrong to 3Stronger

- XLI Industrials WEAKENED from 3Stronger to 4Strong

- XLK Technology WEAKENED from 4Strong to 5Average

- XLRE Real Estate WEAKENED from 2VeryStrong to 3Stronger

- XLU Utilities UNCHANGED at 3Stronger

- XLV Healthcare WEAKENED from 3Stronger to 4Strong

- XLY Consumer WEAKENED from 4Strong to 5Average

- XTL Telecommunications WEAKENED from 3Stronger to 4Strong

Individual ETF Detail

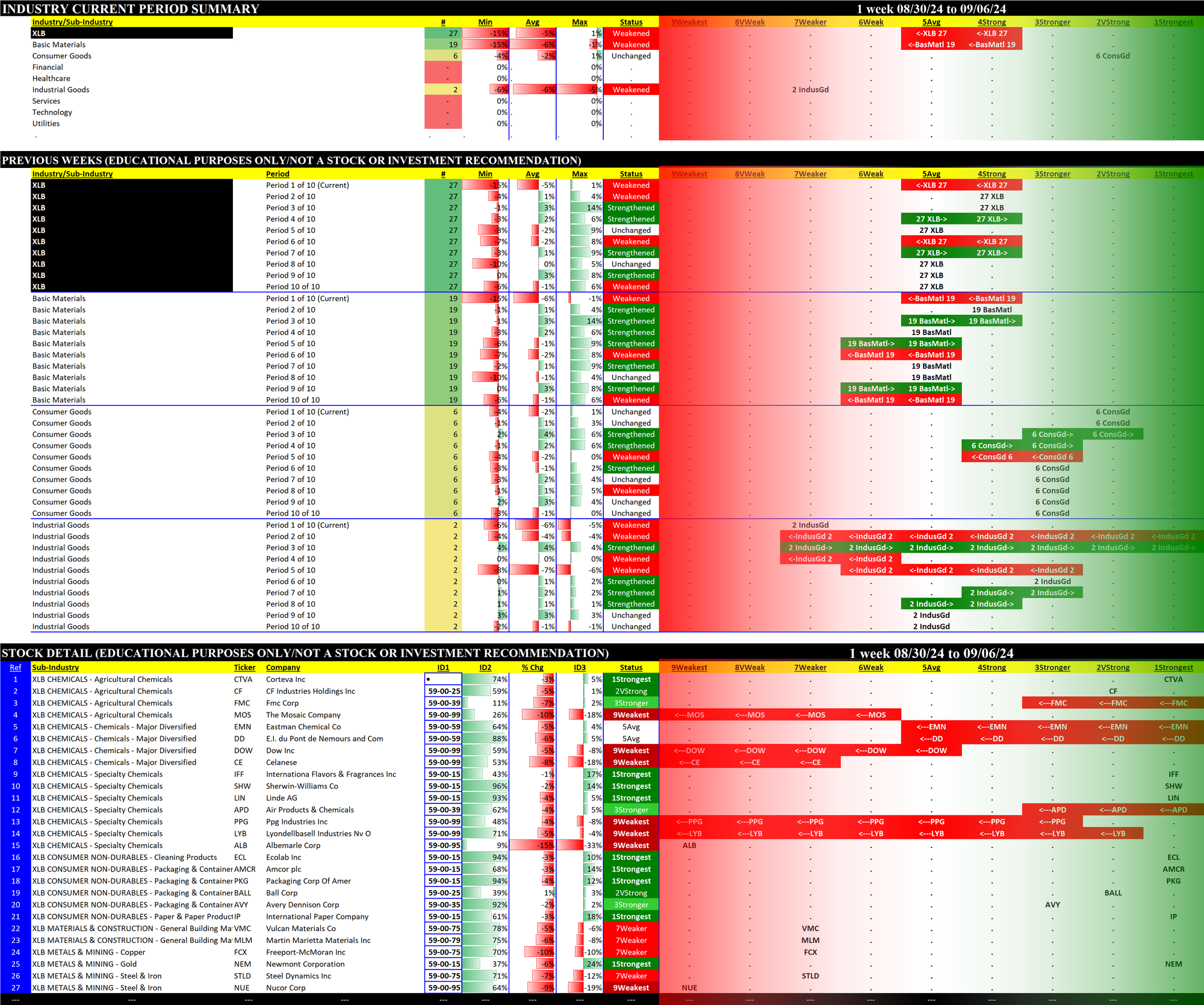

The Materials Select Sector SPDR Fund (XLB)

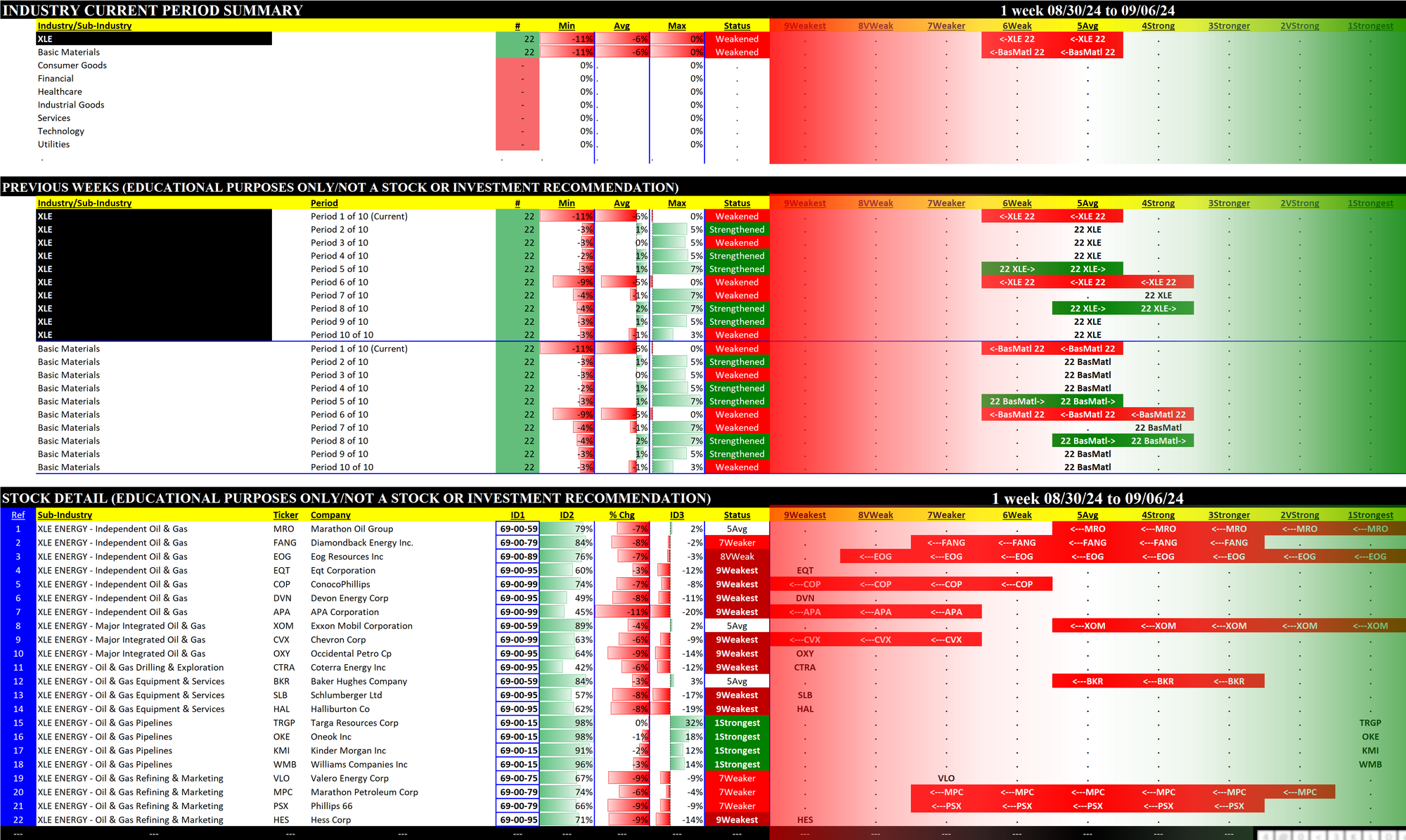

The Energy Select Sector SPDR Fund (XLE)

The Financial Select Sector SPDR Fund (XLF)

The Industrial Select Sector SPDR Fund (XLI)

The Technology Select Sector SPDR Fund (XLK)

The Real Estate Select Sector SPDR Fund (XLRE)

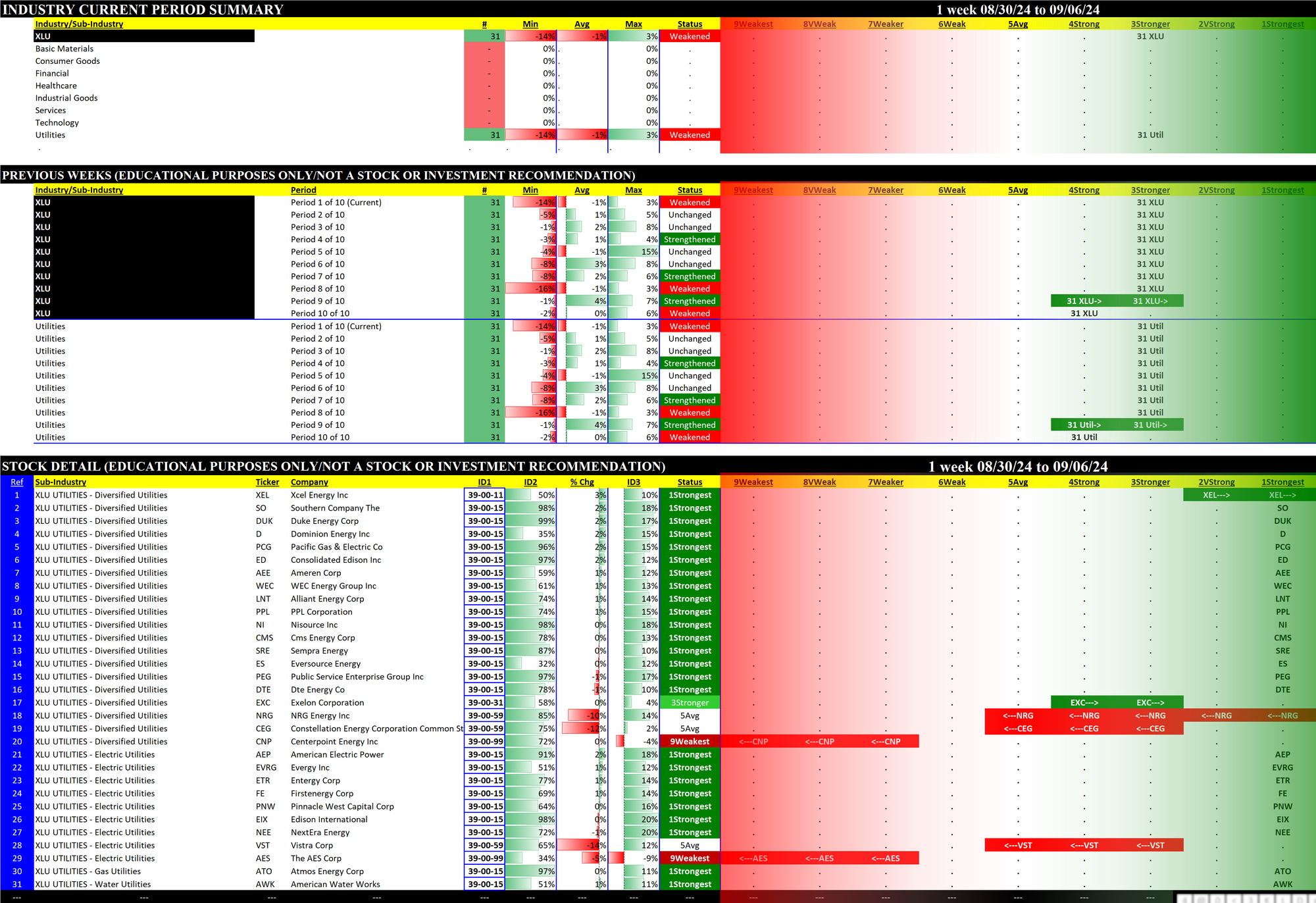

The Utilities Select Sector SPDR Fund (XLU)

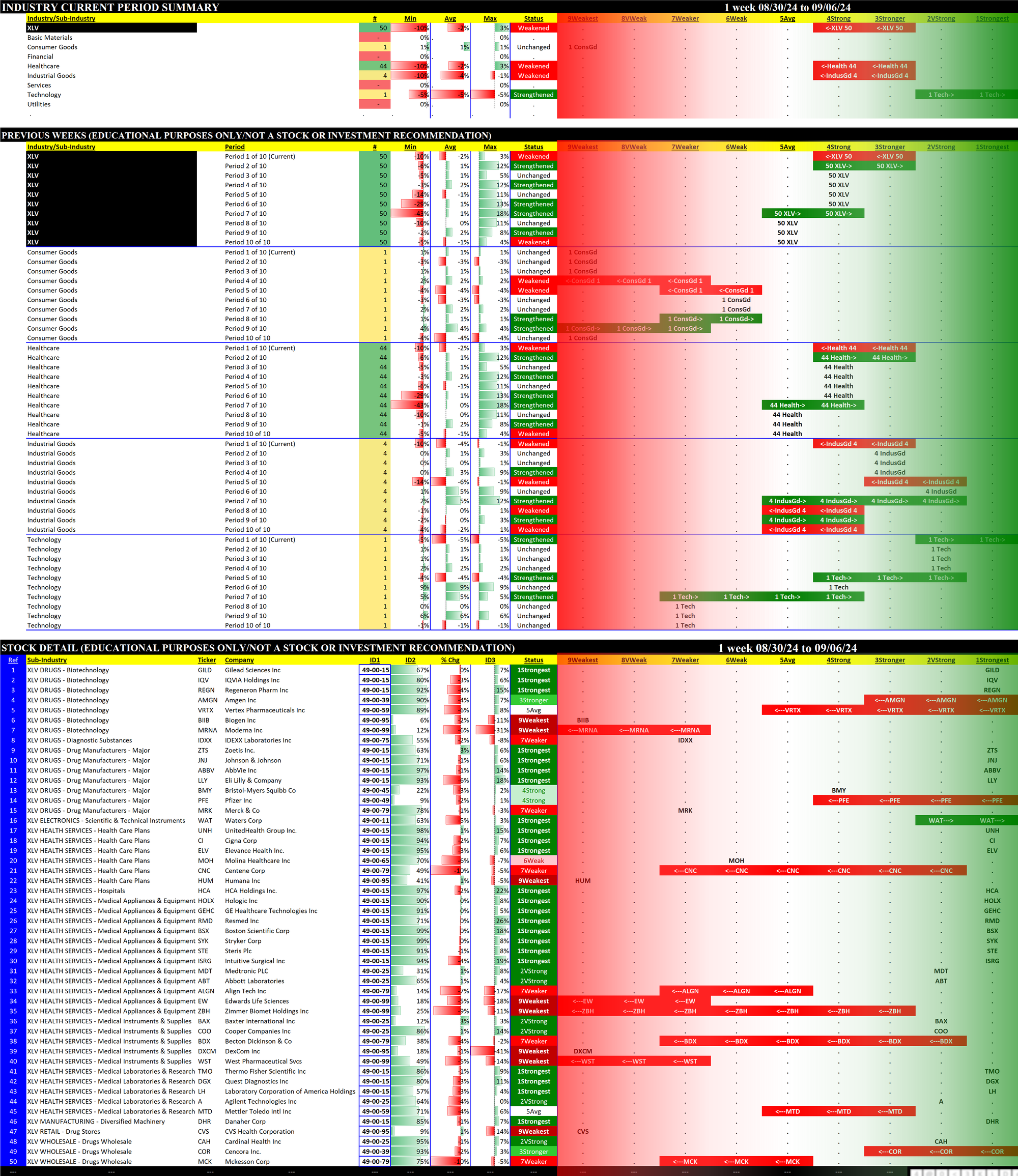

The Health Care Select Sector SPDR Fund (XLV)

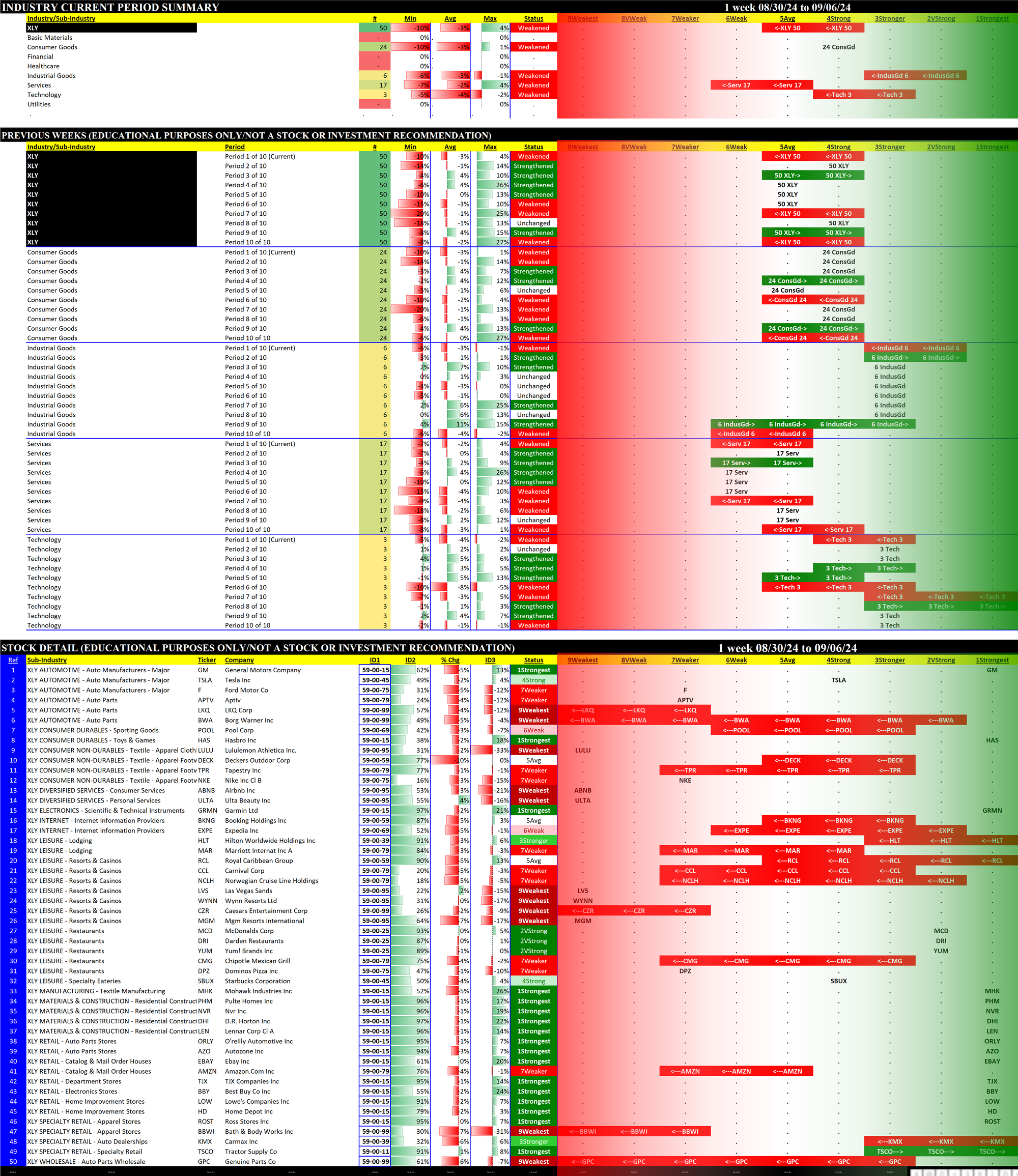

The Consumer Discretionary Select Sector SPDR Fund (XLY)

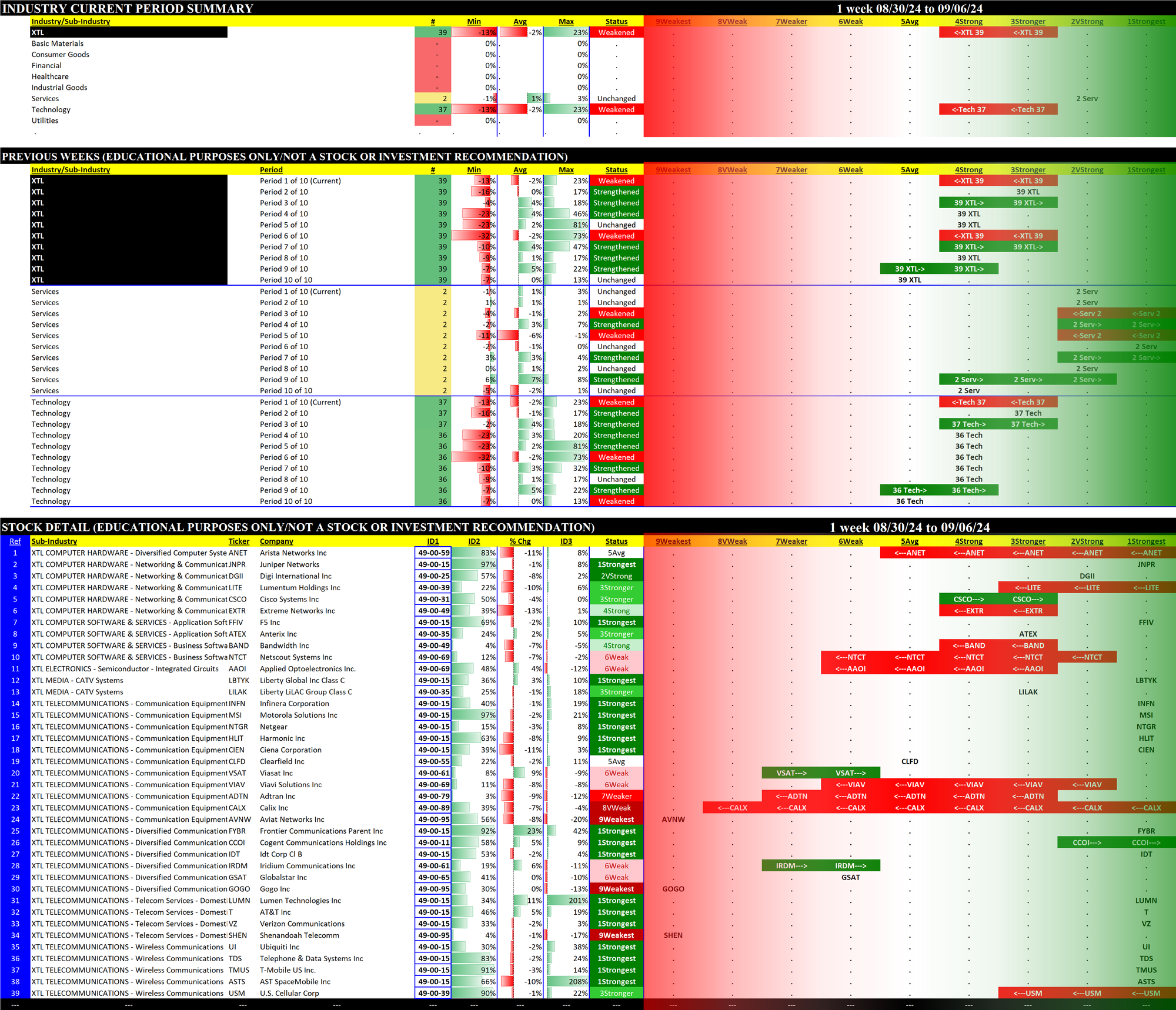

SPDR S&P Telecom ETF (XTL)