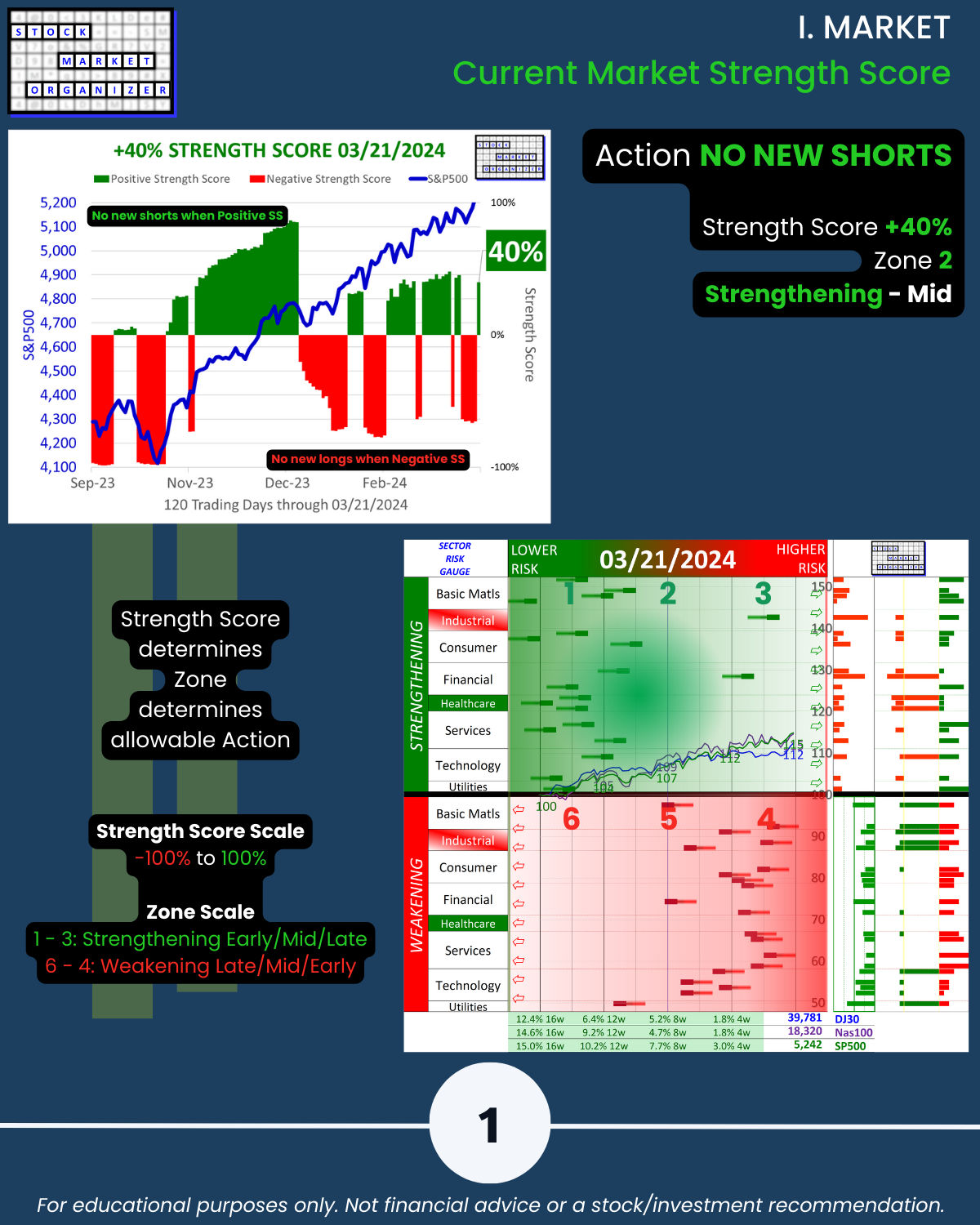

SMO Exclusive: Market Strength Score 2024-03-21 (No New Shorts)

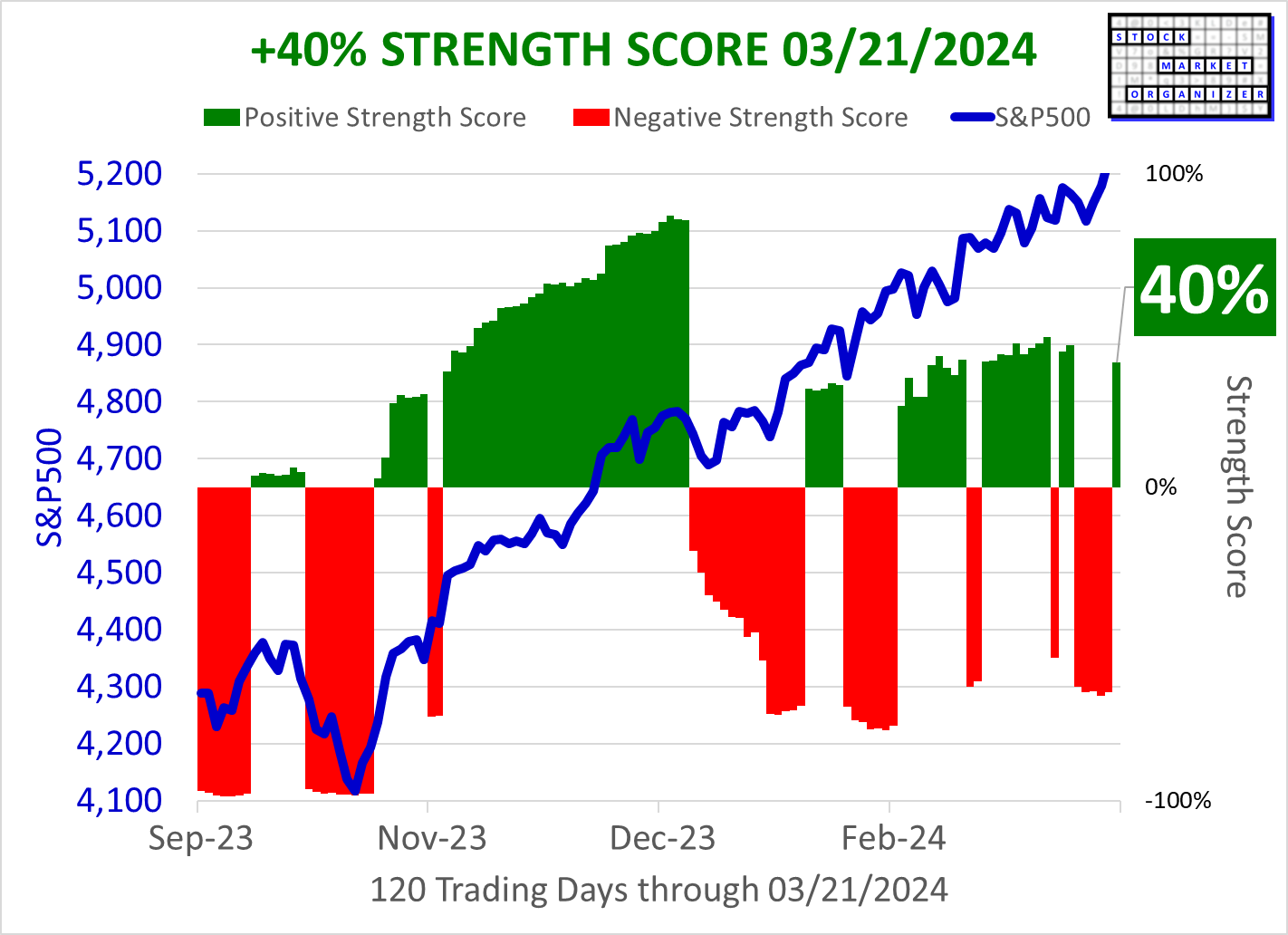

New U.S. stock market highs, how far can it go? Is it stretched? By my count: no. NO NEW SHORTS after 2024-03-21 trading day, per the Stock Market Organizer objectively calculated POSITIVE Market Strength Score (+40%).

I’m focused on Process and Discipline, not Prediction. A “No New Shorts” signal 3 days ago would have been nice. Unfortunately, the perfect indicator will never be built.

What can be built is a tool – like this one – to objectively govern big picture decisions, overriding discretionary instincts that can never be consistently correct. And which can be disastrously driven by emotions.

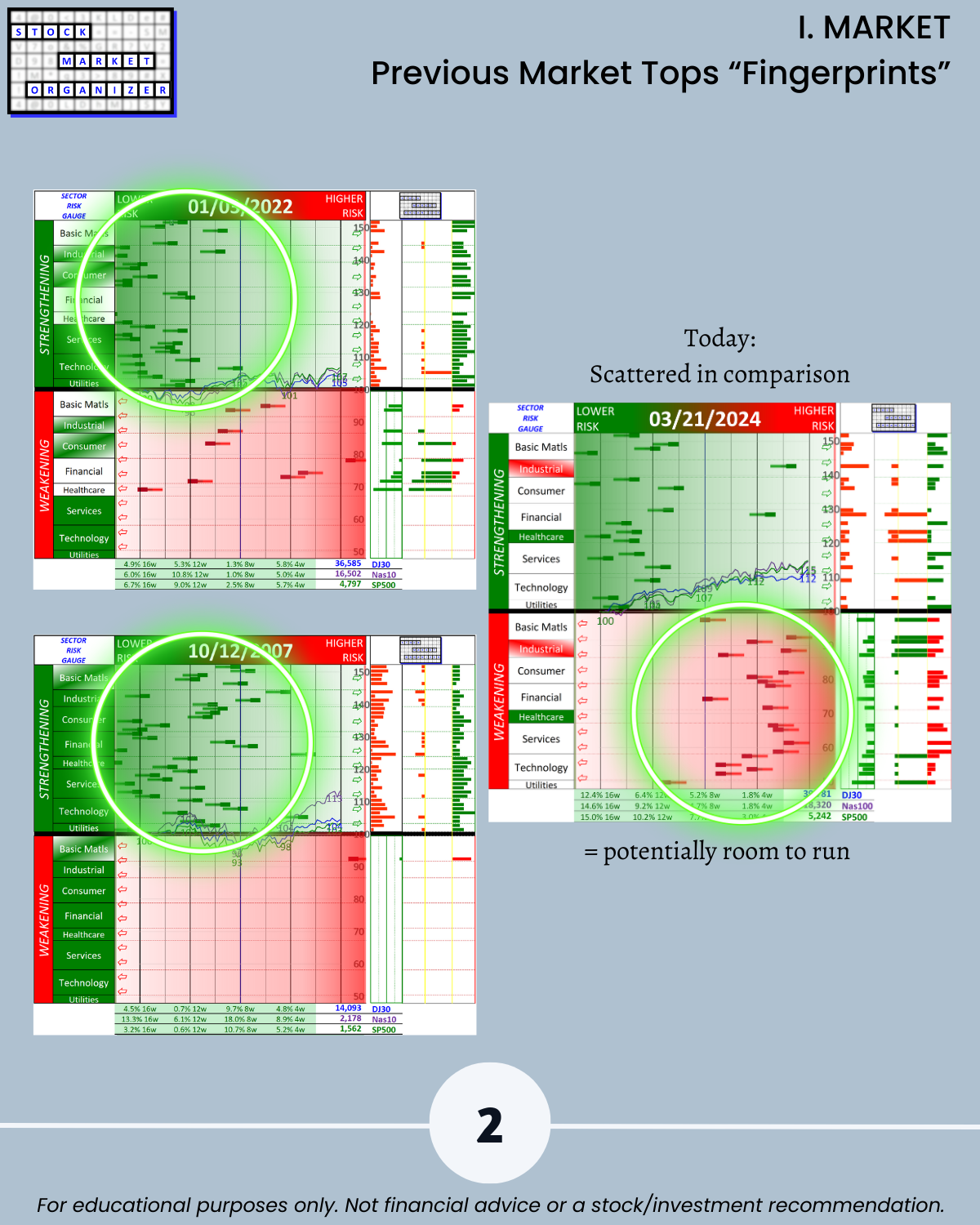

Q: What did I mean by the above “No” statement regarding “is the market stretched?”

A: See page 2 of the attached. It shows two highs from different eras – January 3, 2022 and October 12, 2007.

These clearly look different than today’s “fingerprint.”

Doesn’t mean today’s market will evolve into a fingerprint like the previous tops.

It just means there is room to rise, based on this gauge’s measurement of previous tops.

KEYS

🔹 Signal duration depends solely on objective market action measurement.

🔹 It conveys what “is” – not “why,” or for how long.

🔹 It is an objective, repeatable, and reliable tool to

- enforce discipline,

- prevent unforced errors,

- eliminate emotion and confusion, and

- make sound decisions in all market environments.

DETAIL

This enforced discipline ensures new positions are opened only in the direction of market strengthening or weakening.

If strengthening, only new long positions can be opened.

If weakening, only new short positions can be opened.

Why? Trend respect.

Market weakening does not mean “exit existing long positions.” Only potential new positions are impacted by the critical question of “what is the market doing now?”

Existing open positions are exited when their behavior negates the entry thesis.