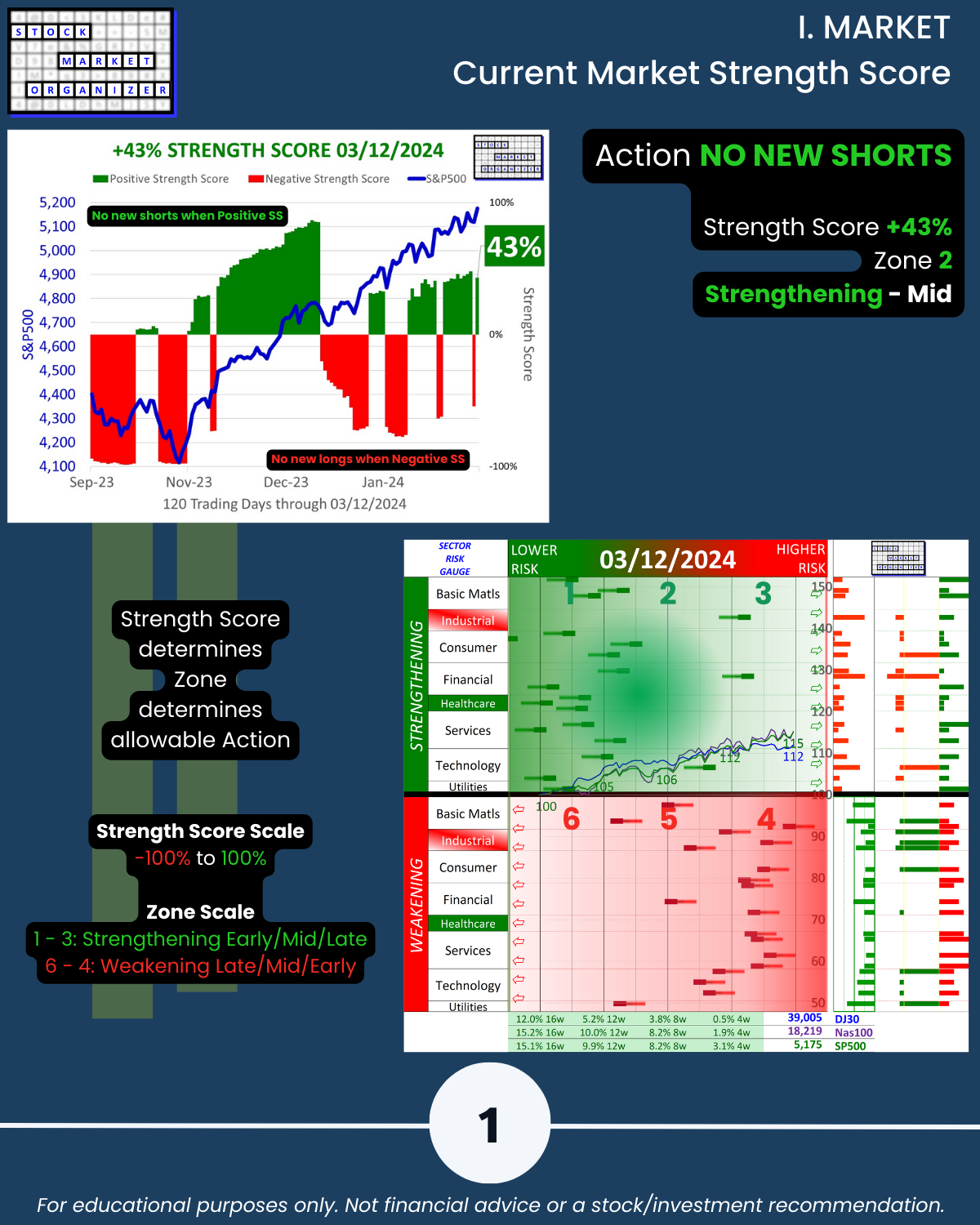

SMO Exclusive: Market Strength Score 2024-03-12 (No New Shorts)

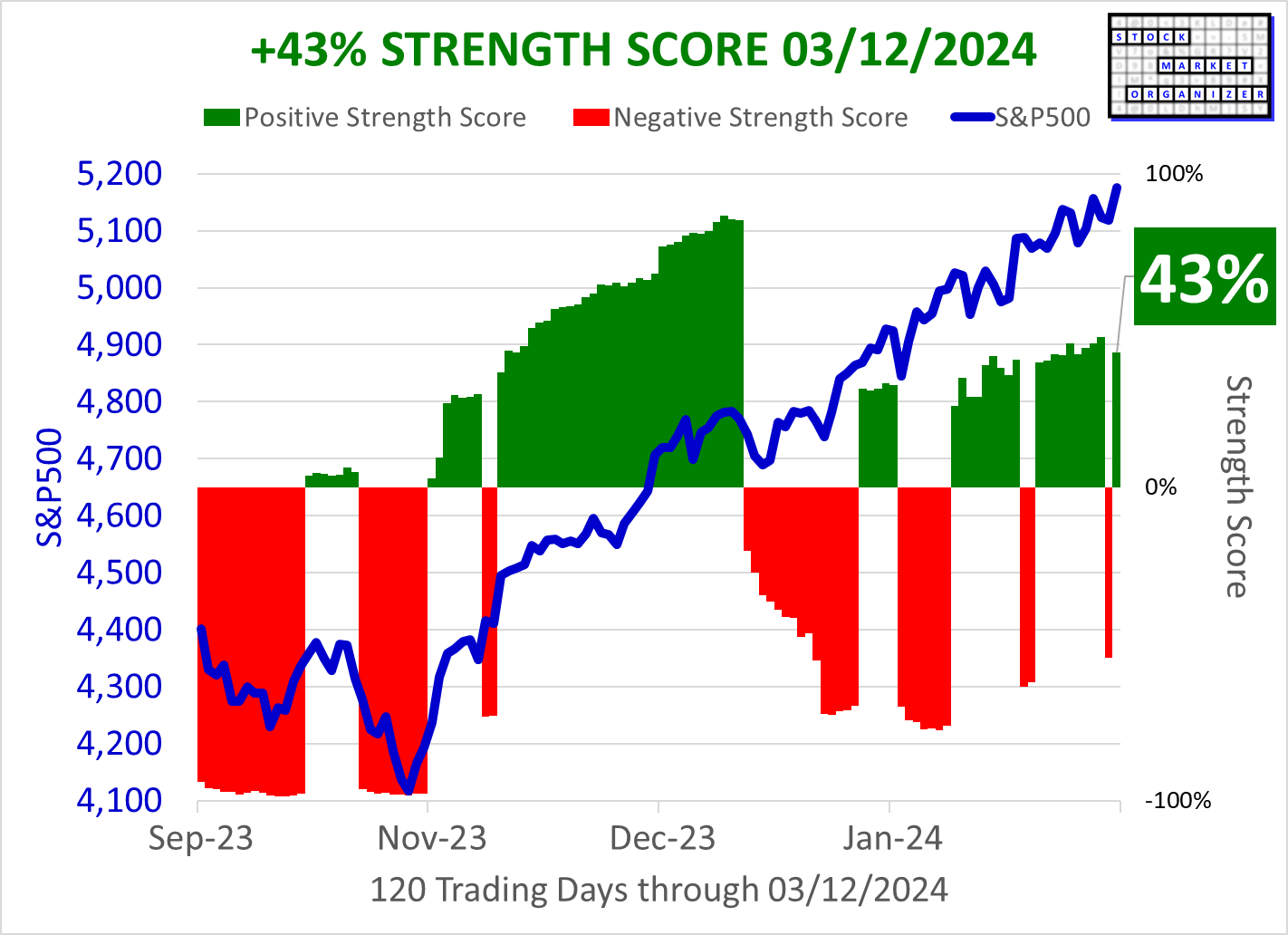

Market trying to find its footing, U.S. stock market 2024-03-12 now in “No New Shorts” mode with a current +43% Market Strength Score.

Yes, it changed yesterday to No New Longs.

A logical question: is a quick change troublesome?

No, for at least the 3 reasons noted below.

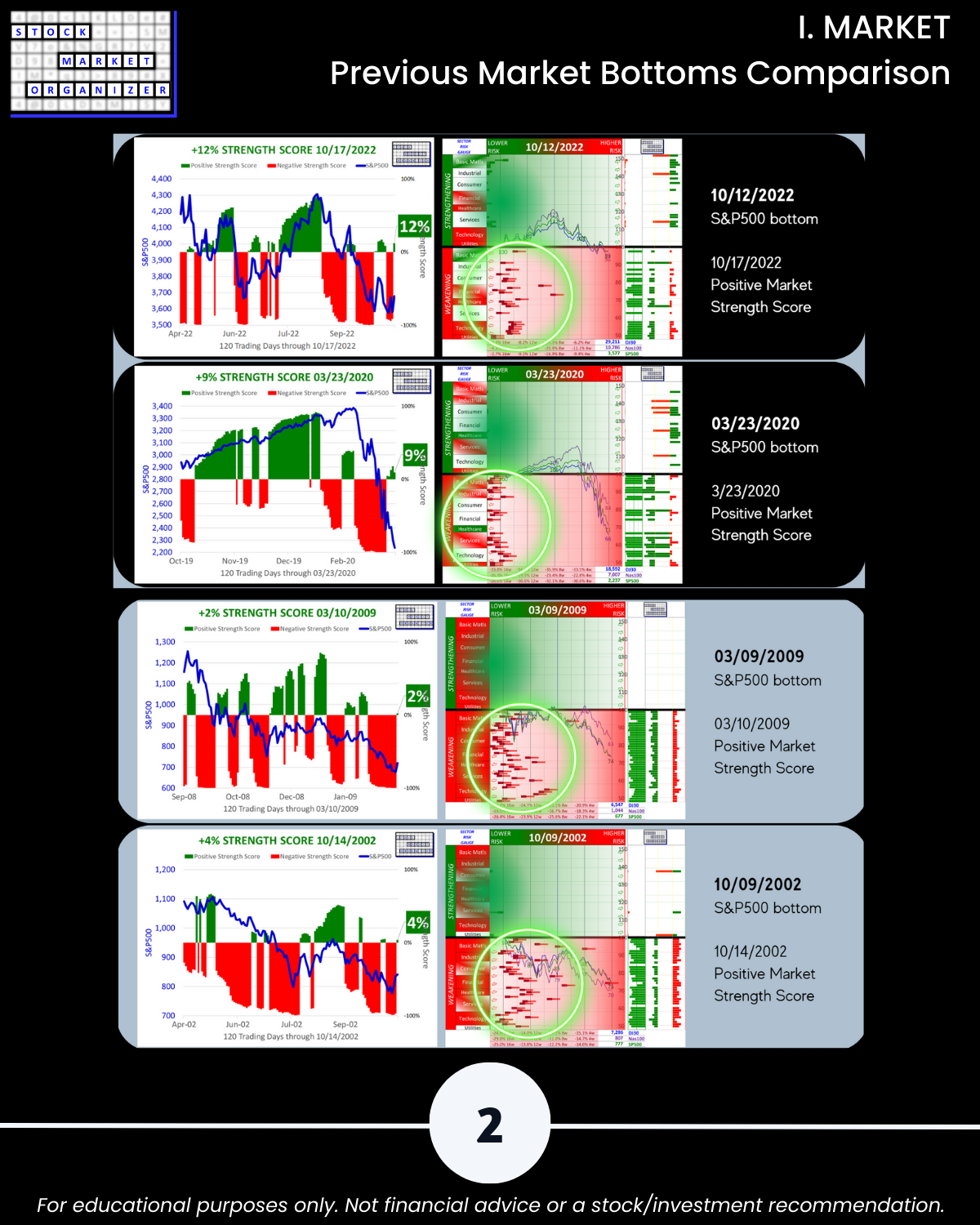

First, there are no rules on what a gauge like this is supposed to look like day-to-day. That it has changed twice in two days indicates nothing other than it has changed twice in two days. It does not negate this gauge’s value in identifying market extremes, such as those that occurred at major market bottoms illustrated on page 2 of the attached.

Second, it isn’t intended to be perfect. No such tool exists. It is intended to keep me going in the right direction of the market for new positions. It isn’t used to exit existing positions (per description below) – it governs my ability to open new ones.

Third, conceptually there looks to be a change underway in the market. One Mag 7 stock is struggling badly (TSLA) and two are down double digits from their highs (GOOG, AAPL). If existing leaders falter then others may step up. As this potential transition happens, one might expect a transition also in the readings of a gauge like this intended to measure market direction.

KEYS

🔹 Signal duration depends solely on objective market action measurement.

🔹 It conveys what “is” – not “why,” or for how long.

🔹 It is an objective, repeatable, and reliable tool to

- enforce discipline,

- prevent unforced errors,

- eliminate emotion and confusion, and

- make sound decisions in all market environments.

DETAIL

This enforced discipline ensures new positions are opened only in the direction of market strengthening or weakening.

If strengthening, only new long positions can be opened.

If weakening, only new short positions can be opened.

Why? Trend respect.

Market weakening does not mean “exit existing long positions.” Only potential new positions are impacted by the critical question of “what is the market doing now?”

Existing open positions are exited when their behavior negates the entry thesis.

U.S. stock market 2024-03-11 now in “No New Longs” mode with a current -55% Market Strength Score.

KEYS

🔹 Signal duration depends solely on objective market action measurement.

🔹 It conveys what “is” – not “why,” or for how long.

🔹 It is an objective, repeatable, and reliable tool to

- enforce discipline,

- prevent unforced errors,

- eliminate emotion and confusion, and

- make sound decisions in all market environments.

DETAIL

This enforced discipline ensures new positions are opened only in the direction of market strengthening or weakening.

If strengthening, only new long positions can be opened.

If weakening, only new short positions can be opened.

Why? Trend respect.

Market weakening does not mean “exit existing long positions.” Only potential new positions are impacted by the critical question of “what is the market doing now?”

Existing open positions are exited when their behavior negates the entry thesis.