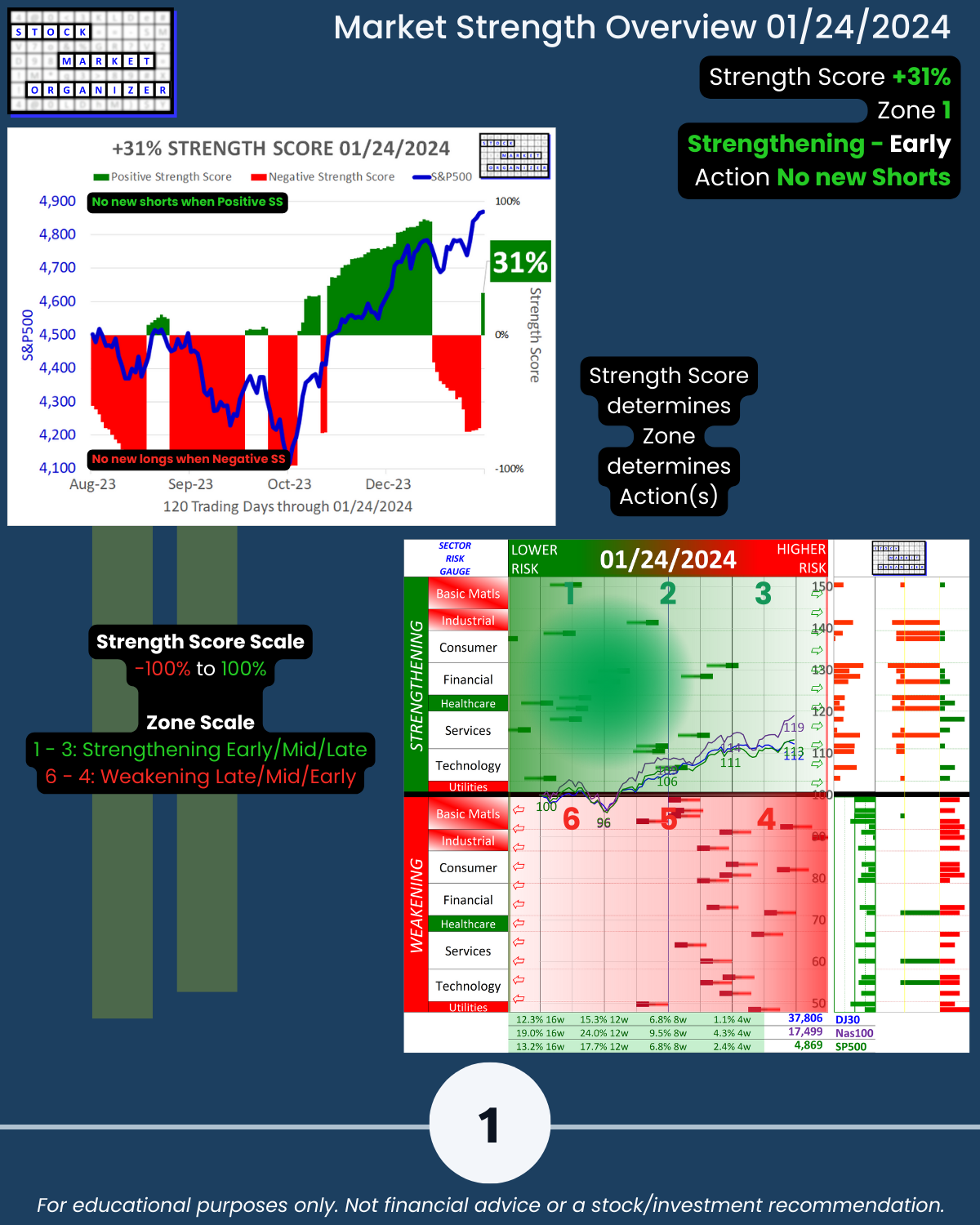

SMO Exclusive: Market Strength Score 2024-01-24 (+31%, Zone 1)

U.S. stock market = “No New Shorts” mode as of 2024-01-24 with +31% strength score. Market is classified as “Strengthening – Early.” In practical language, the market cap-weighted strength shown by the index highs do not betray underlying “overbought” conditions, while there has been enough underlying strengthening to re-classify the market as “Strengthening.” It had previously been “Weakening” as of 2024-01-02.

What is this, exactly?

SHORT ANSWER: Enforced discipline so I only open new positions in the direction of market strengthening (longs) or weakening (shorts). Why? Because most stocks do what the market does. I’m not trying to be a hero.

LONGER ANSWER: It’s a tool I’ve created and use to answer the critical question “is the market strengthening or weakening?”

If strengthening, only new long positions can be opened.

If weakening, only new short positions can be opened.

Why? Because I only want to go in the same direction as the market.

This does NOT mean I’d exit existing long positions. This question and its answer only impact opening of new positions.

For existing open positions, these will be exited only if they exhibit behavior that negates the entry thesis.

🔹 Signal duration depends solely on objective market action measurement.

🔹 It conveys what “is” – not “why,” or for how long.

🔹 It is a reliable tool to enforce discipline, prevent unforced errors, eliminate emotion and confusion, and make sound decisions in all market environments.

There is never any telling how long the prevailing positive or negative Strength Score will last.

All it does is tell you what is. Never a why, or for how long.

That’s all it can do. But this is enough to

🔹 crush market confusion and emotion,

🔹 enforce discipline, and

🔹 prevent unforced errors.

From here, the rest is up to you.