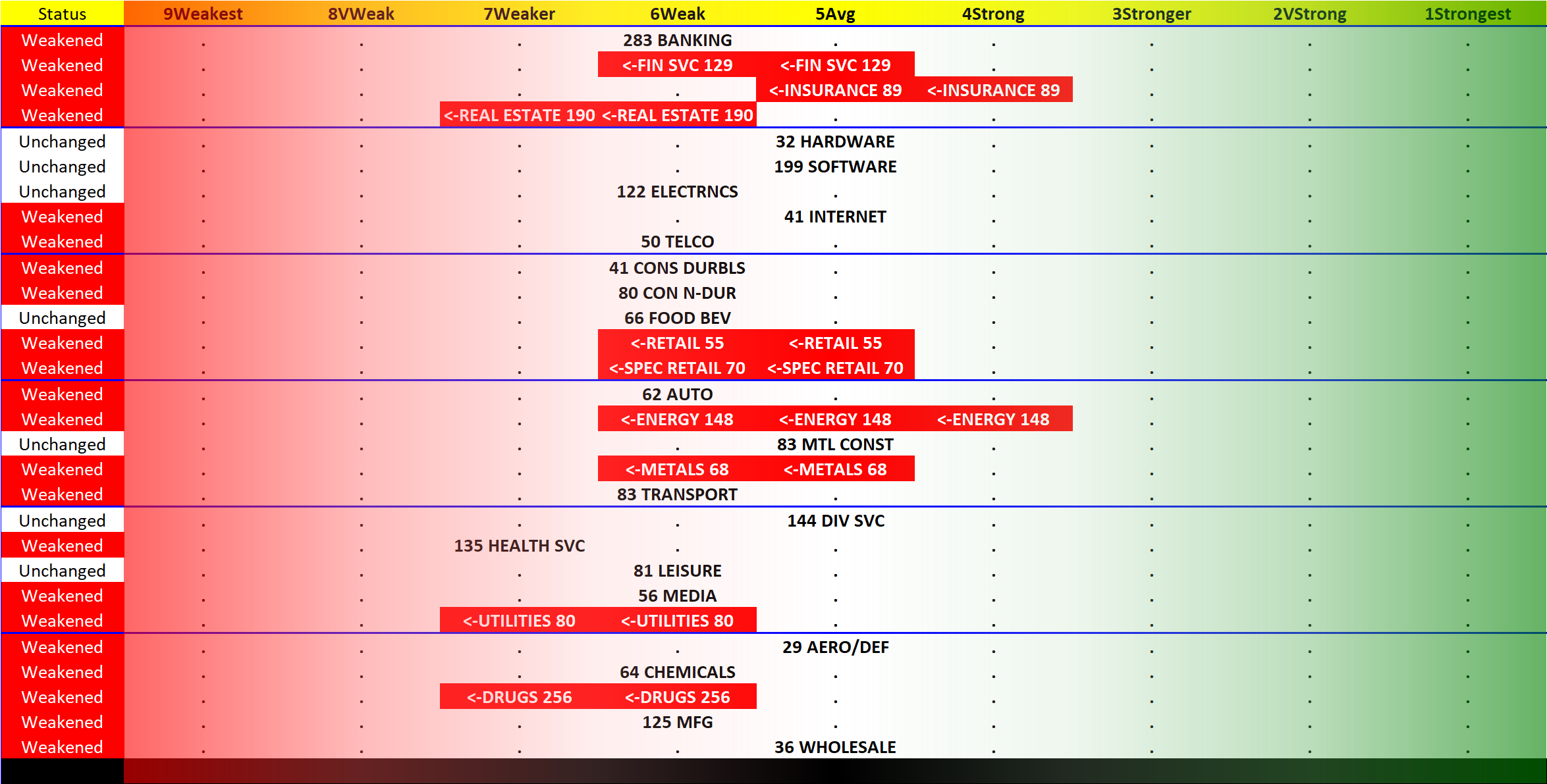

SMO Exclusive: Industry Strength Report 2023-11-10, Weighted Average -0.3 to 5.8 Strength Score (Average-Weak)

This 10-week Industry Strength Report provides market clarity and context - this report is for the week ending 2023-11-10:

What’s happening beneath the surface of the market indexes? Weakening/stalling, based on my measurements. Nothing says the market won’t rocket upward from here, but the objective measurements listed below reflect calculations that enforce discipline and ensure an active focus on all items key to my process throughout all phases of the market cycle –without emotions, bias, or interpretations.

Statistics

🔹 Energy and Insurance, last week’s two strongest industries, both weakened – Energy by 2 levels

🔹 29 industries weighted average strength score (scale 1-9, strongest = 1): 5.8 (Average-Weak). Last week: 5.5 (Average-Weak)

🔹 0 industries strengthened

🔹 9 industries weakened

1. Financial Services

2. Insurance

3. Real Estate

4. Retail

5. Specialty Retail

6. Energy

7. Metals

8. Utilities

9. Drugs

🔹 Strongest industries (Average rating, 5th strongest of 9 levels):

1. Insurance

2. Computer Hardware

3. Computer Software & Services

4. Internet

5. Materials & Construction

6. Diversified Services

7. Aerospace/Defense

8. Wholesale

🔹 Weakest industries (Weakest rating, 7th strongest of 9 levels):

1. Real Estate

2. Health Services

3. Utilities

4. Drugs

Background

The goal of this?

To objectively and reliably find strengthening and weakening in the U.S. stock market.

Why?

The stronger your stocks, the greener your P&L.

Driving principle?

Market conditions matter - most stocks do what the market does and, when the market strengthens, likely so will your stocks. (Did you know 99 of 100 stocks fell during the Covid shutdown decline? See Market Conditions Matter.)

What does this mean at a practical level?

- In an uptrend, there will be more technical breakouts and price recognition of undervalued stocks.

- In a downtrend, there will be more technical breakdowns and undervalued stocks will become more undervalued.

In turn…

- Know when to be aggressive and conservative (position sizes and stops) and when your favorite set-ups are more likely to work/fail.

REPEATING:

Market conditions matter.

IT REALLY DOESN’T HAVE TO BE SO COMPLICATED.