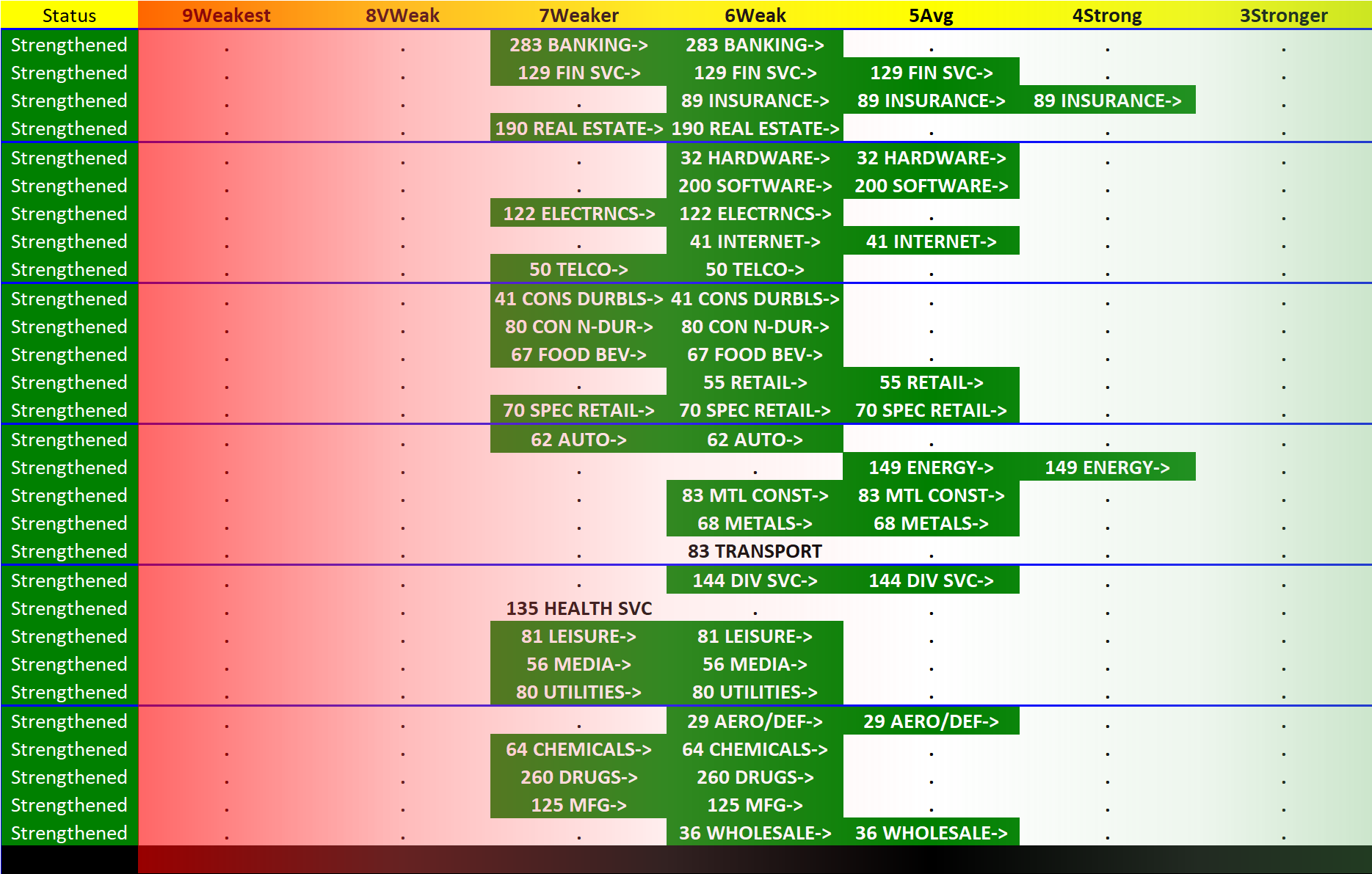

SMO Exclusive: Industry Strength Report 2023-11-03, Weighted Average +1.0 to 5.5 Strength Score (Average-Weak)

This 10-week Industry Strength Report provides market clarity and context - this report is for the week ending 2023-11-03:

Results:

🔹 Energy and Insurance = the two strongest industries, both rated Strong , both rated Strong (4th strongest of 9 strength levels)

🔹 Weighted average strength score 29 industries: 5.5 (Average-Weak). Last week: 6.5 (Weak-Weaker)

🔹 No industries weakened

The attached summary:

🔹 crushes market confusion and emotion,

🔹 enforces discipline, and

🔹 prevents unforced errors.

How?

By obsessively organizing the 24/7/365 information tsunami. This consolidates my industry reports to give you a helpful and unique big picture perspective.

The goal?

To objectively and reliably find strengthening and weakening in the U.S. stock market.

Why?

The stronger your stocks, the greener your P&L.

Driving principle?

Market conditions matter - most stocks do what the market does and, when the market strengthens, likely so will your stocks. (Did you know 99 of 100 stocks fell during the Covid shutdown decline? See Market Conditions Matter.)

What does this mean at a practical level?

- In an uptrend, there will be more technical breakouts and price recognition of undervalued stocks.

- In a downtrend, there will be more technical breakdowns and undervalued stocks will become more undervalued.

In turn…

- Know when to be aggressive and conservative (position sizes and stops) and when your favorite set-ups are more likely to work/fail.

REPEATING:

Market conditions matter.

IT REALLY DOESN’T HAVE TO BE SO COMPLICATED.