SMO Exclusive: Flash Industry Report 4x D34th Match 2024-07-05

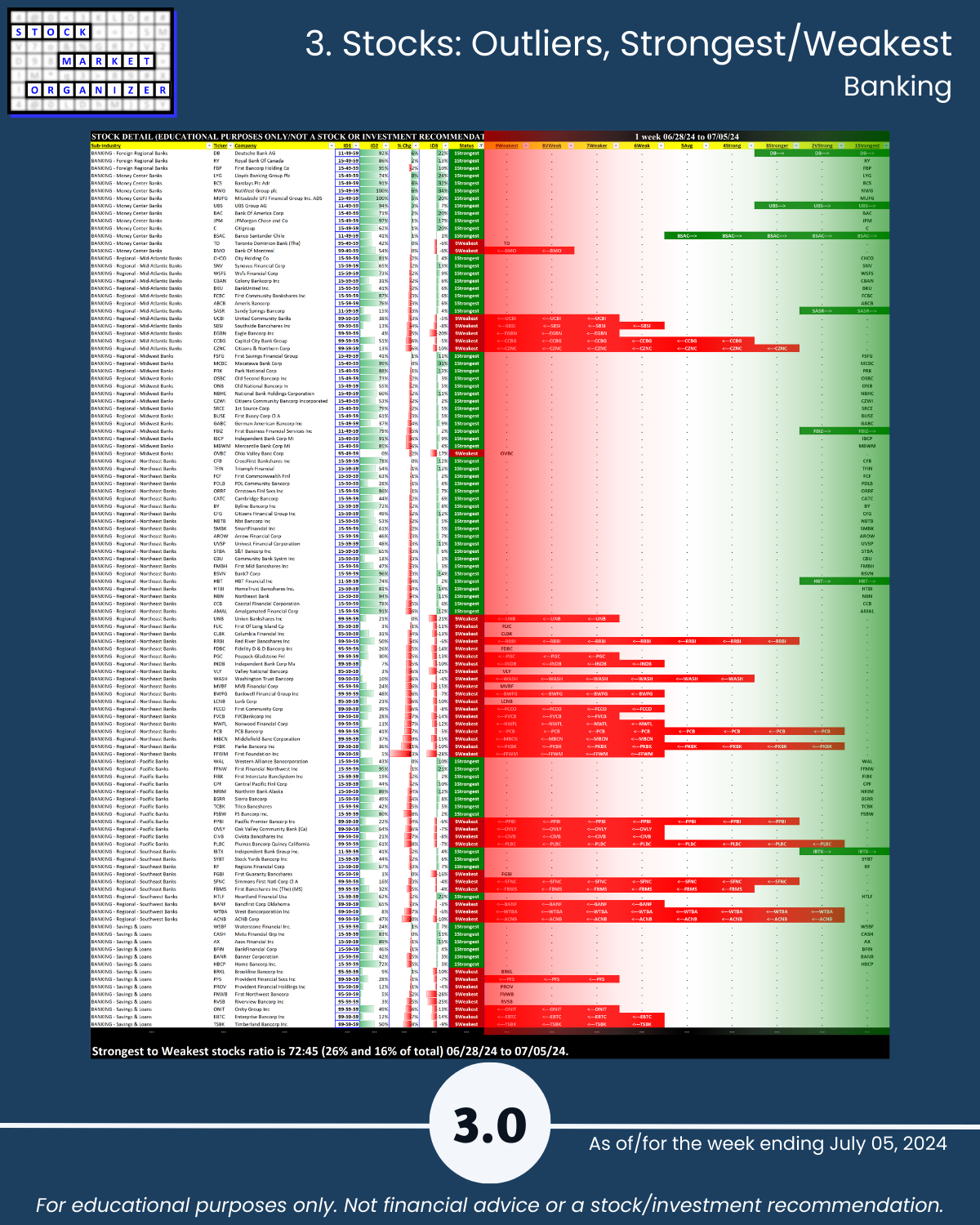

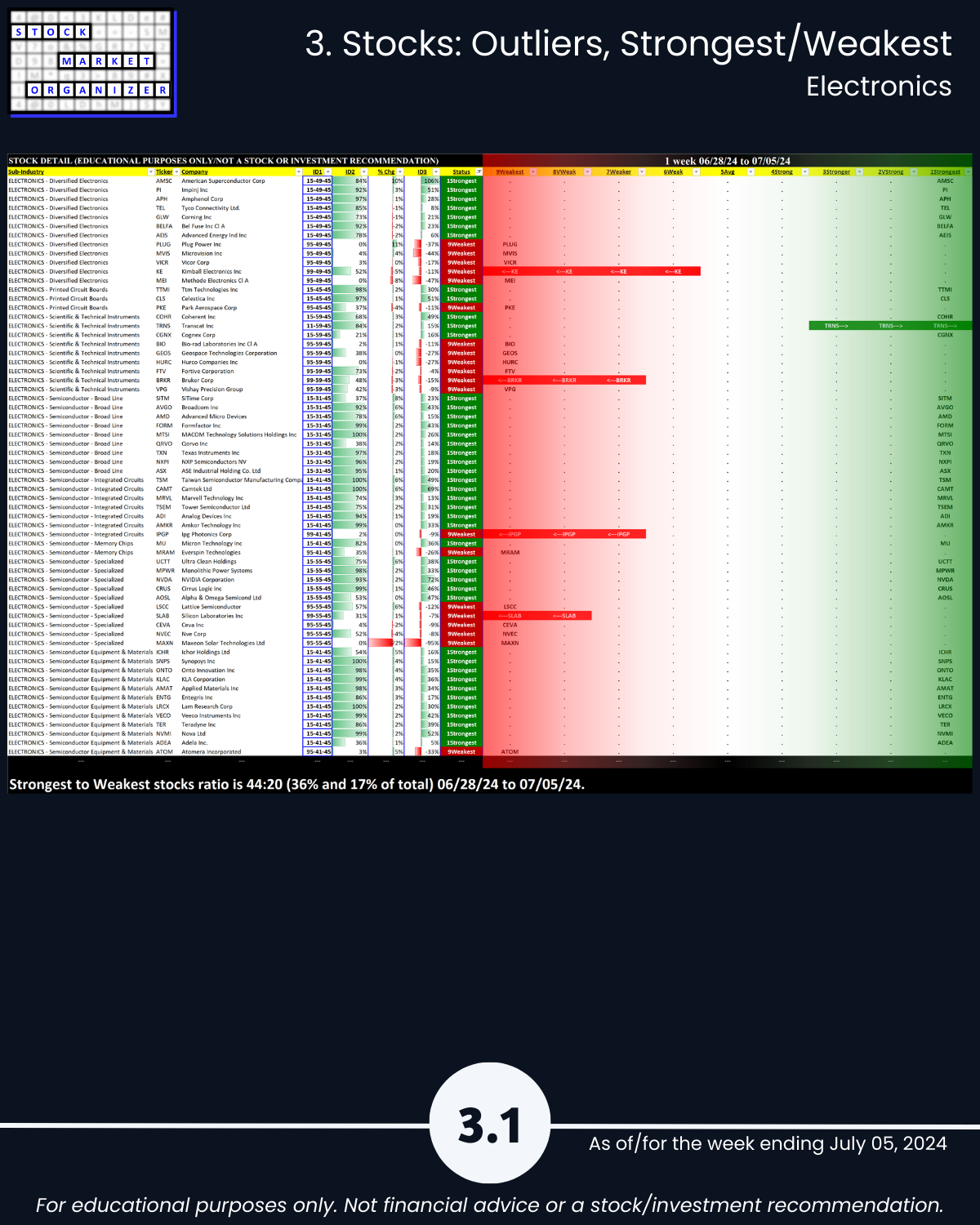

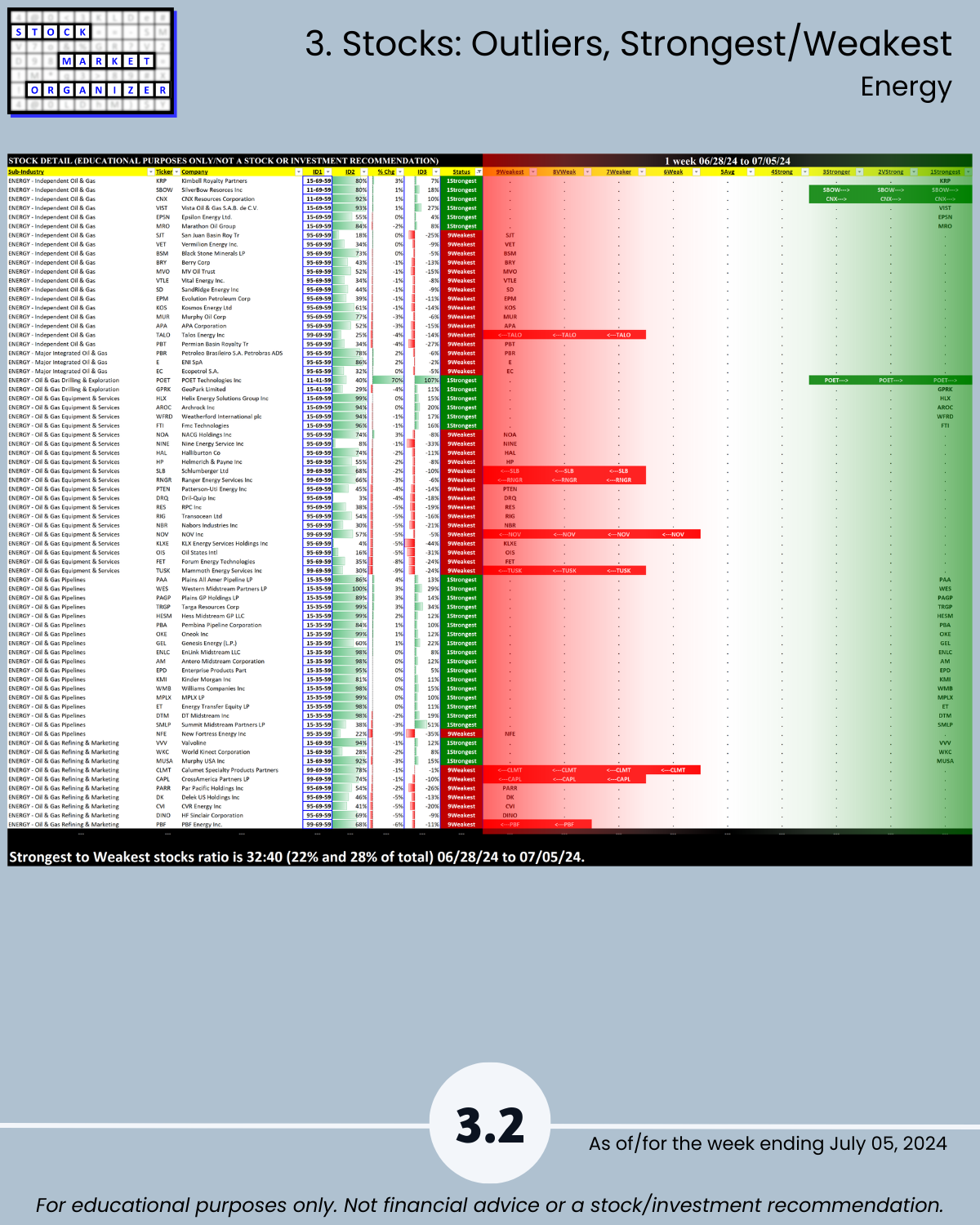

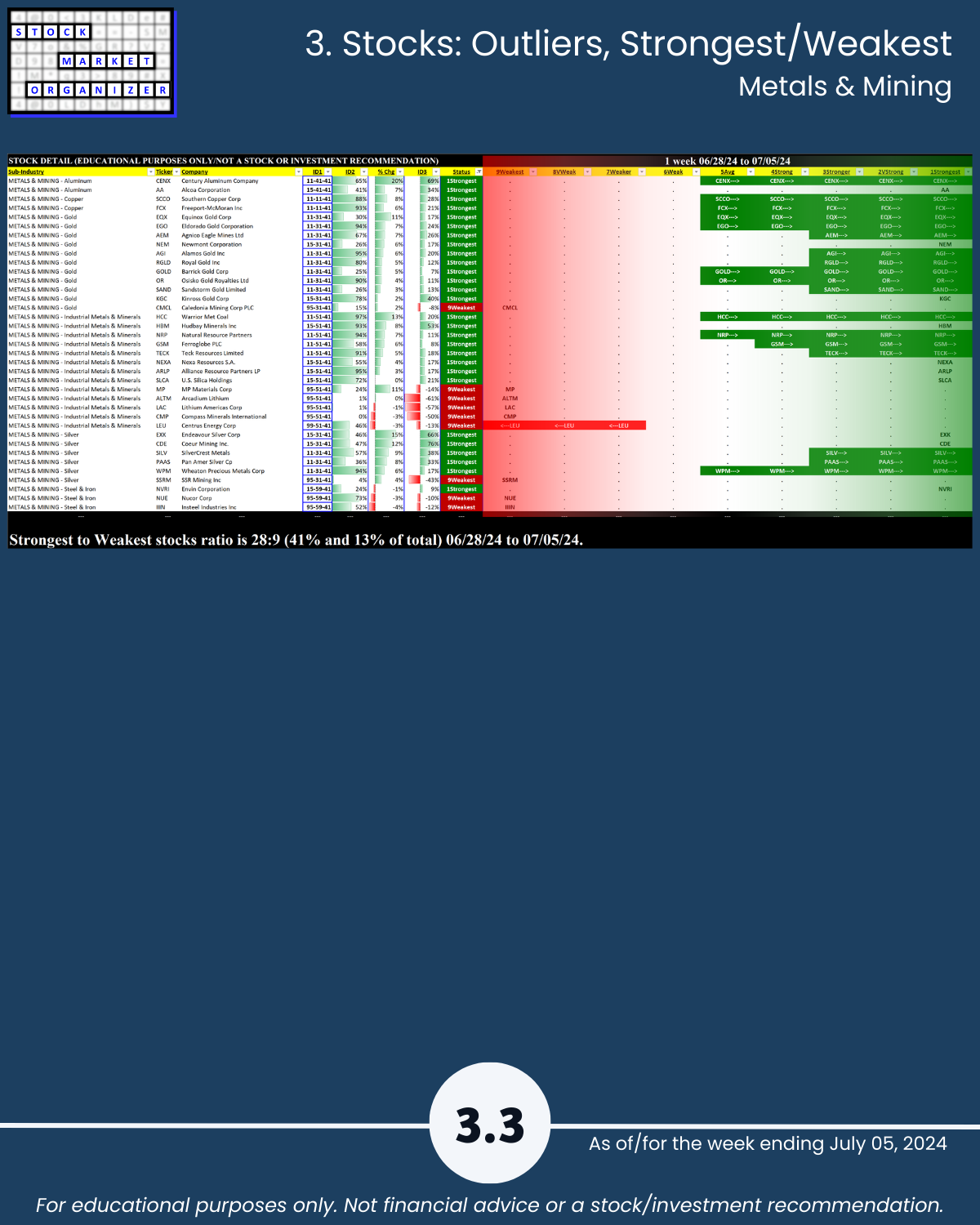

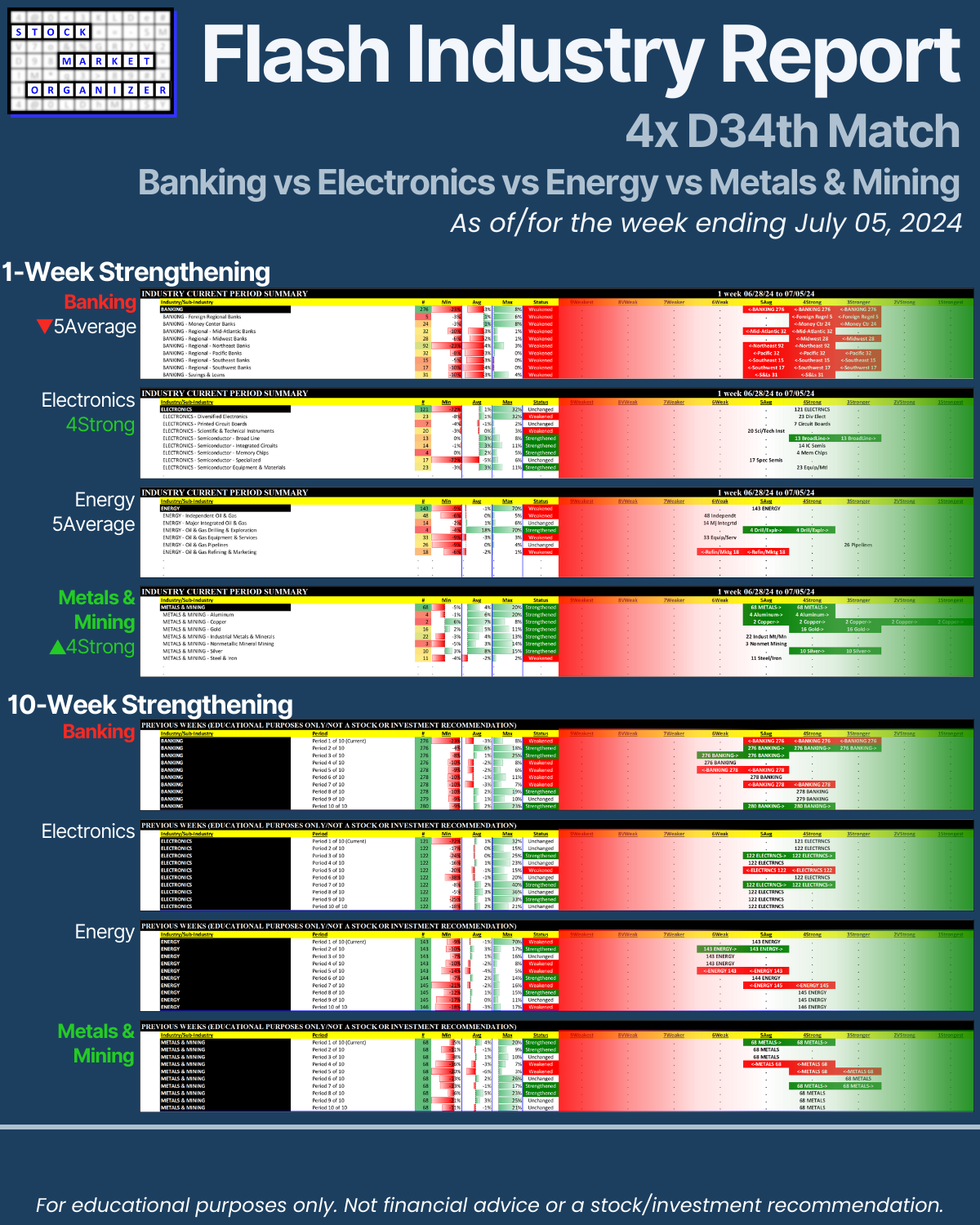

7/5/24 how can you objectively compare strength/strengthening for the disparate Banking (weakened 2 levels to 5Average), Electronics (chips/semis, no change at 4Strong), Energy (no change at 5Average), and Metals & Mining (strengthened to 4Strong) industries? One method is attached. Named in honor of the MTV Claymation celebrity brawl series, this Industry D34th Match Report gives you a direct strength comparison of these industries, their sub-industries, and their individual stocks.

DID YOU KNOW?

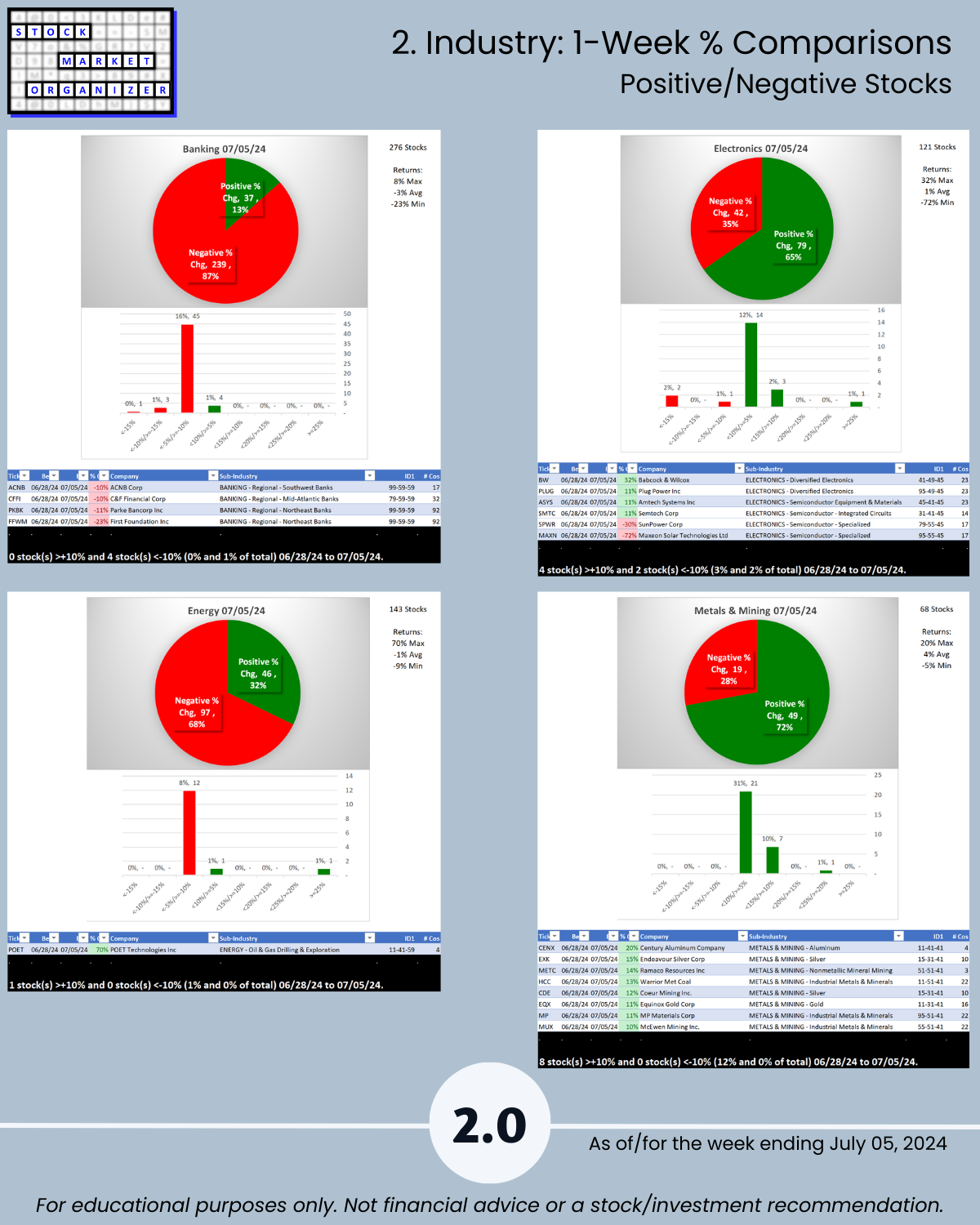

- In what could/should have been a low volume July 4th holiday week some banking stocks took it on the chin on higher-than-average volume.

- Two low-priced stocks had standout weeks (BW in Diversified Electronics, POET in Oil & Gas Drilling & Exploration). Possible CVNA copies? (Not a prediction/recommendation.)

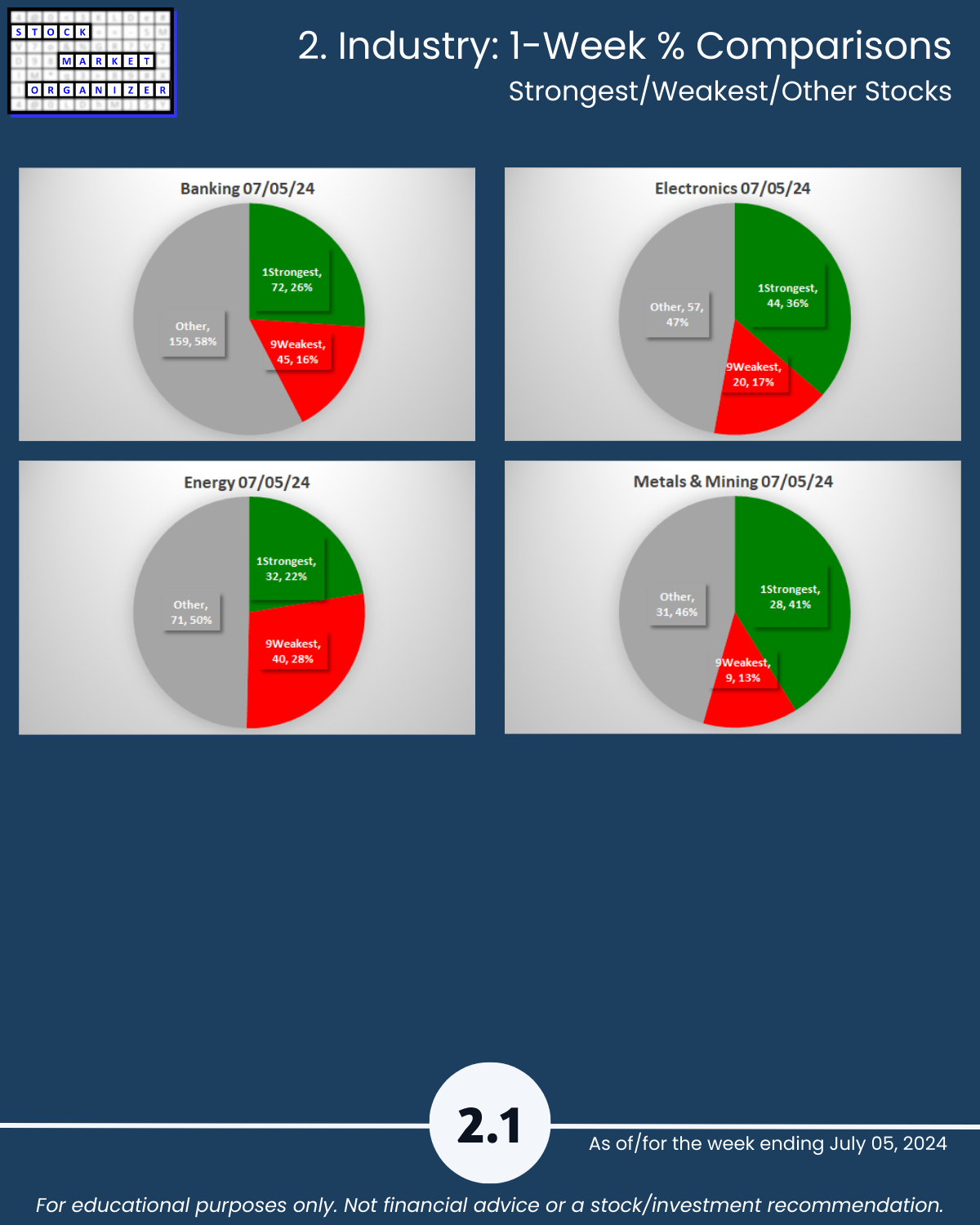

- In Gold, one stock is ranked 9Weakest and 10 are ranked 1Strongest. Hope you don’t own the one.

WHY DO YOU CARE? (See Section 3)

Want value opportunities? See stocks rated 9Weakest. Breakout buyer? See those rated 1Strongest.

To stack strength find a strong stock in a strong/strengthening sub-industry/industry.

HOW TO READ THE ATTACHED

Cover INDUSTRY– directly compares 1-week and 10-week strengthening for these 4 industries. What strengthened/weakened and where are they rated? Is an industry prone to volatility? Or is it flat as a pancake? Is it at 10-week strength “highs” or “lows”? Check personalities and both relative and absolute strength.

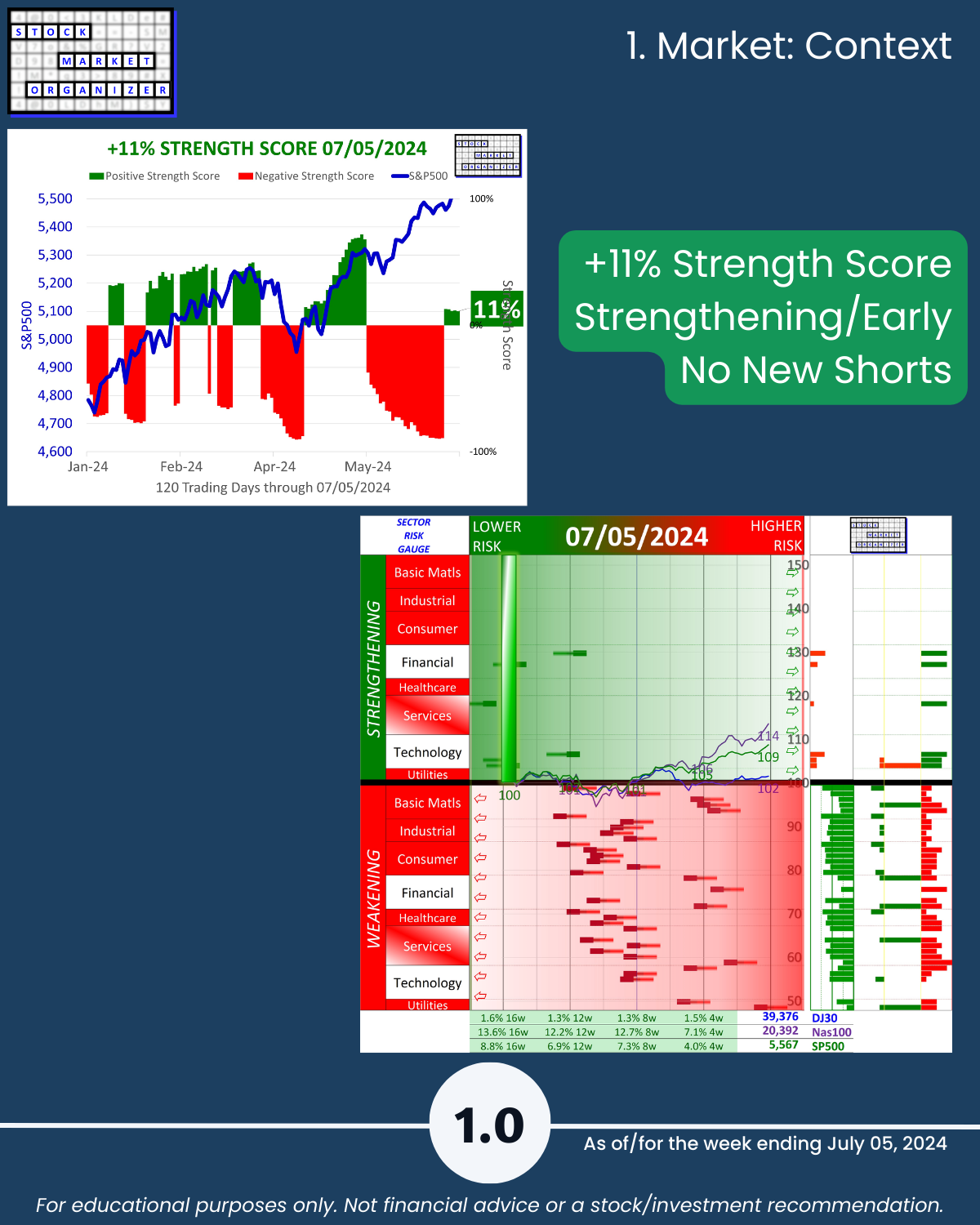

Section 1 MARKET –shows the proprietary Market Strength Score which is currently +11%. This means No New Shorts. Important to have something like this if you believe rising tides lift all boats.

Section 2 INDUSTRY – provides a direct weekly comparison of positive and negative stocks and strongest/weakest stocks. Banking had a terribly negative week (87% negative stocks). Will this continue? No clue, I don’t predict, I just know what it DID. I can then act appropriately with this insight. Meanwhile, Metals & Mining has 41% stocks rated 1Strongest. This is nearly double that of Energy.

Quickly see on page 2.0 outlier stocks >10% and <-10% by industry.

Section 3 STOCKS – noted above. Note also this is only provided after looking at Market and Industry/Sub-industry conditions.

ANALYSIS BACKGROUND

You won’t find what you aren’t looking for.

This report offers unique, logical, and actionable insights from using conventional tools in unconventional ways.

It may resonate with you if you subscribe to the following:

- The stock market does not have to be so complicated.

- “What” matters, not “why.”

- Market conditions matter.

- The 100%+ rally begins with a 10% rally.

- The multi-month rally begins with one up week. (Also applies to declines.)

- The stronger your stocks, the greener your P&L.

1. Introduction/Critical Concepts

2. TOC, Market Context, Industry 1-Week % Comparisons

3. Stocks Outliers