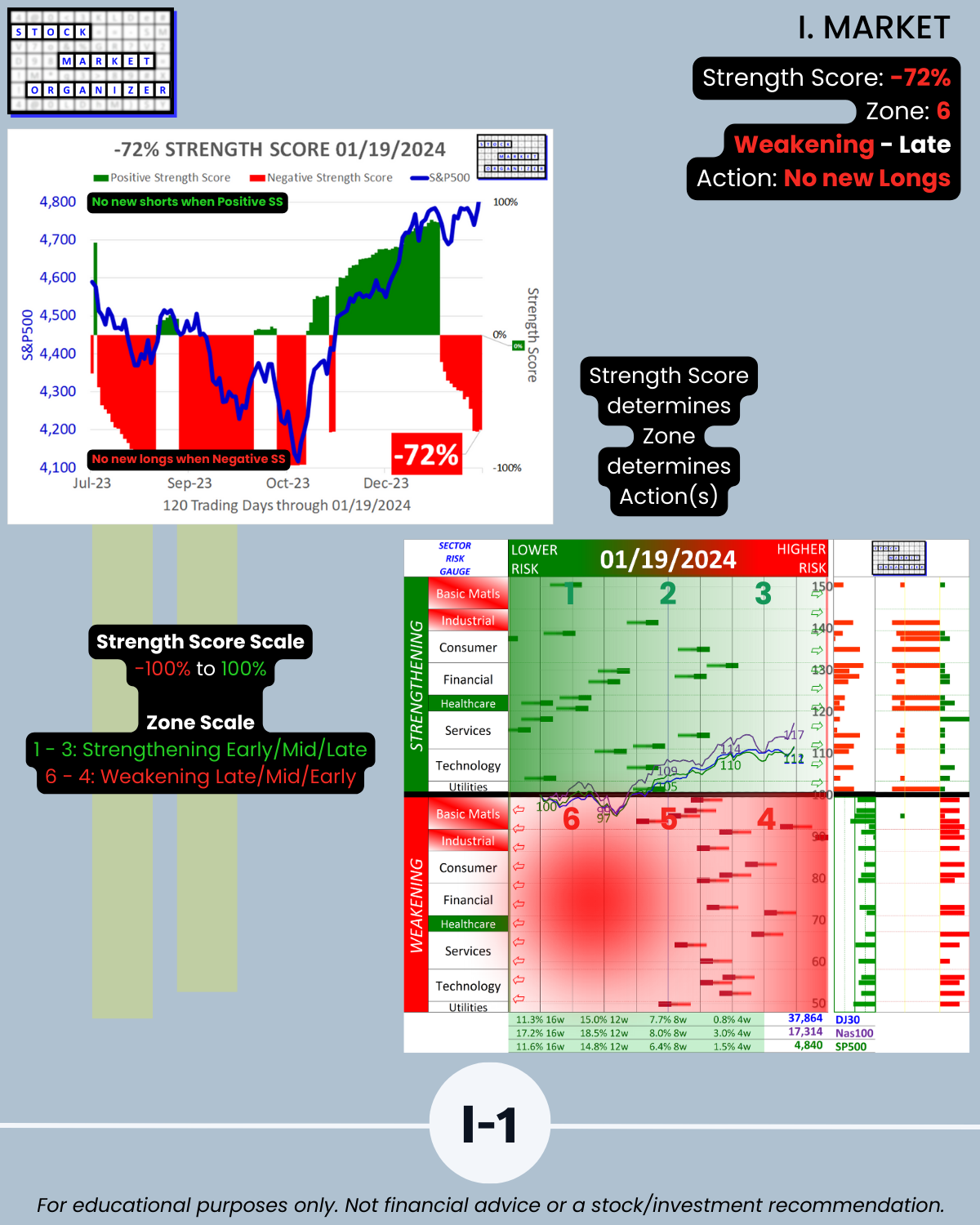

SMO Exclusive: Comprehensive Market Report 2023-01-19

If you believe in momentum or trend-following, the following information will be helpful. As the S&P500 and Nasdaq 100 hit all-time highs, how is THE MARKET overall doing?

The 1/19/24 answer is attached along with answers to other interesting questions such as:

🔹 Are current market strengthening and weakening conditions conducive to new longs or to new shorts?

🔹 Is market strengthening or weakening early or late in a meaningful cycle?

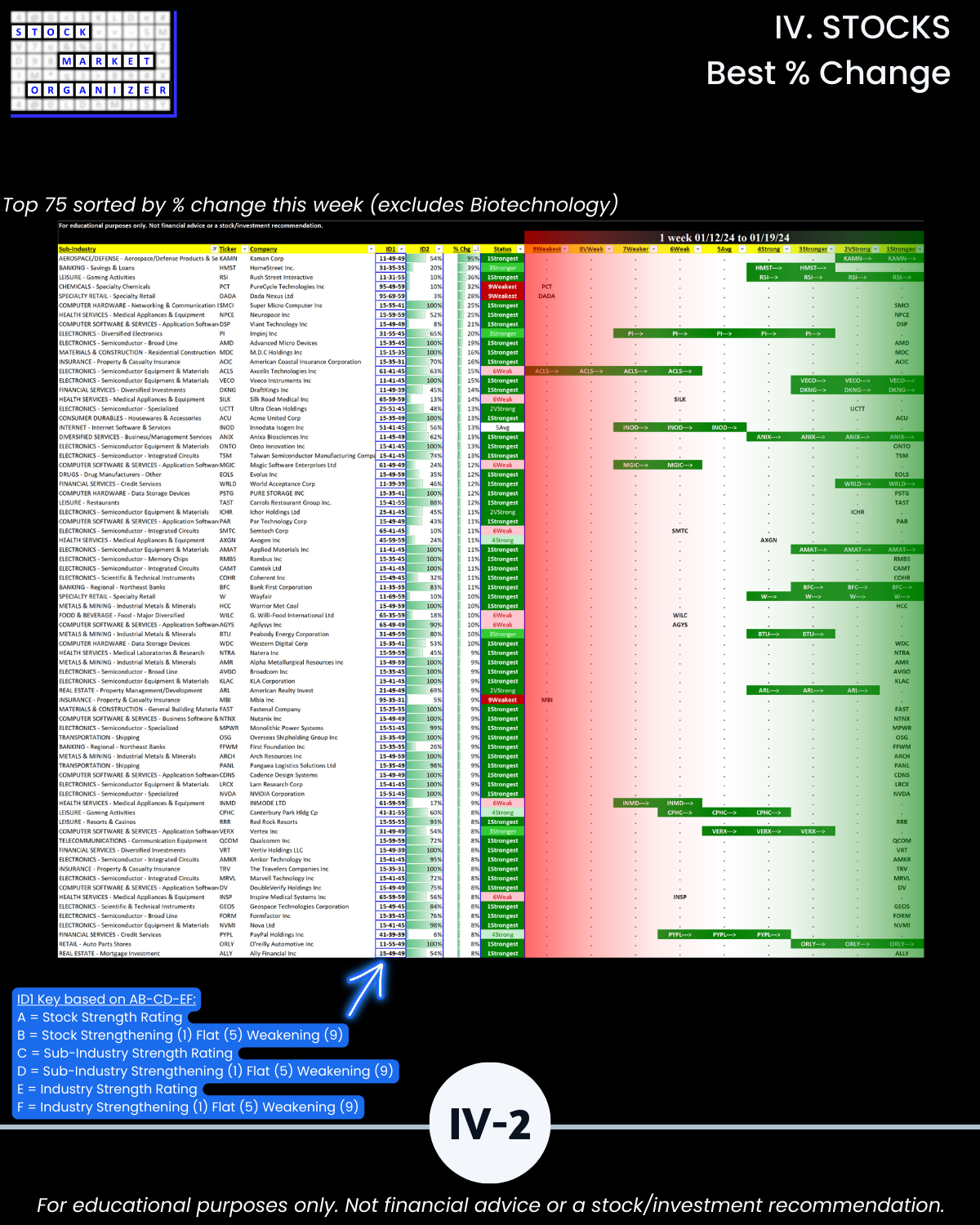

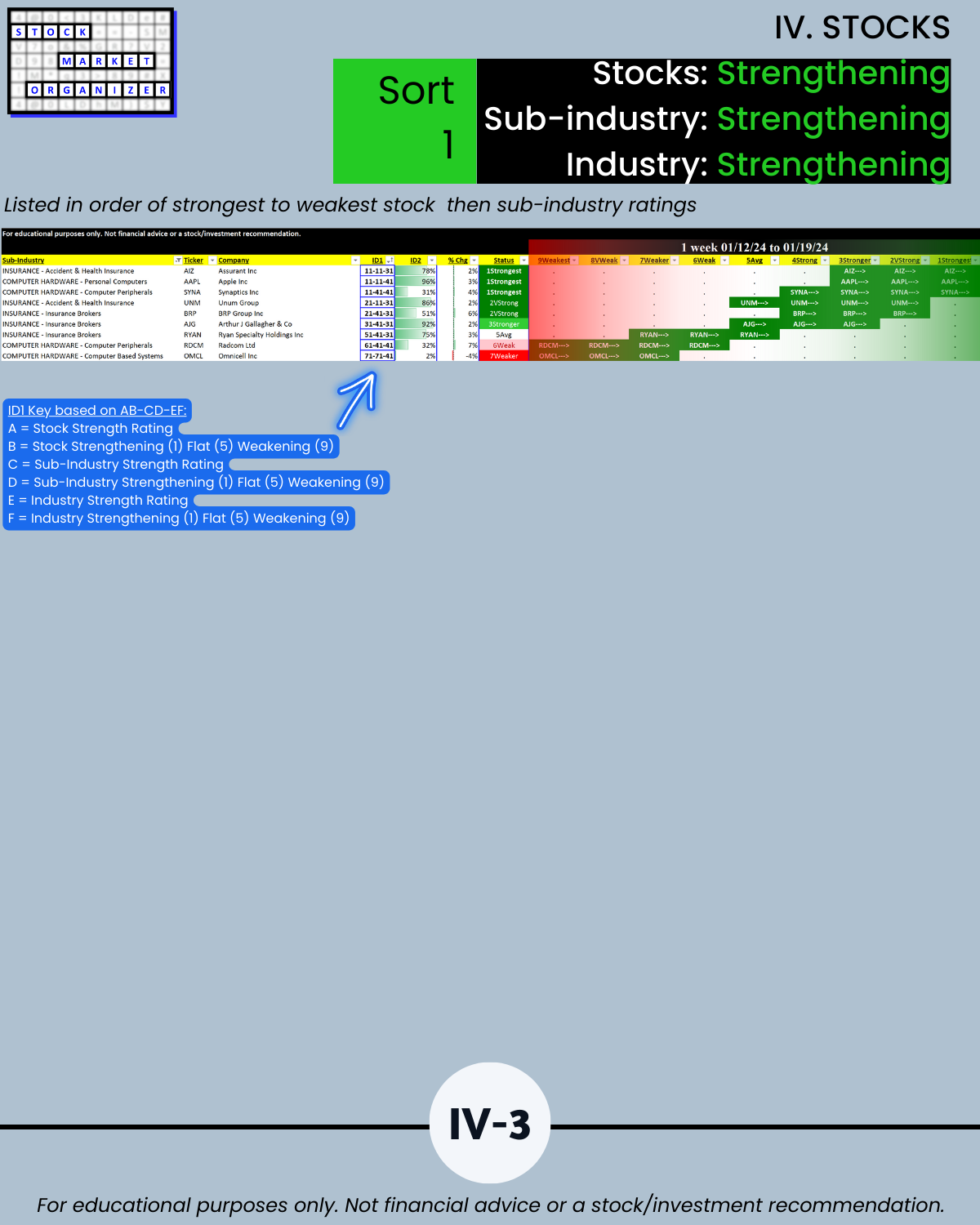

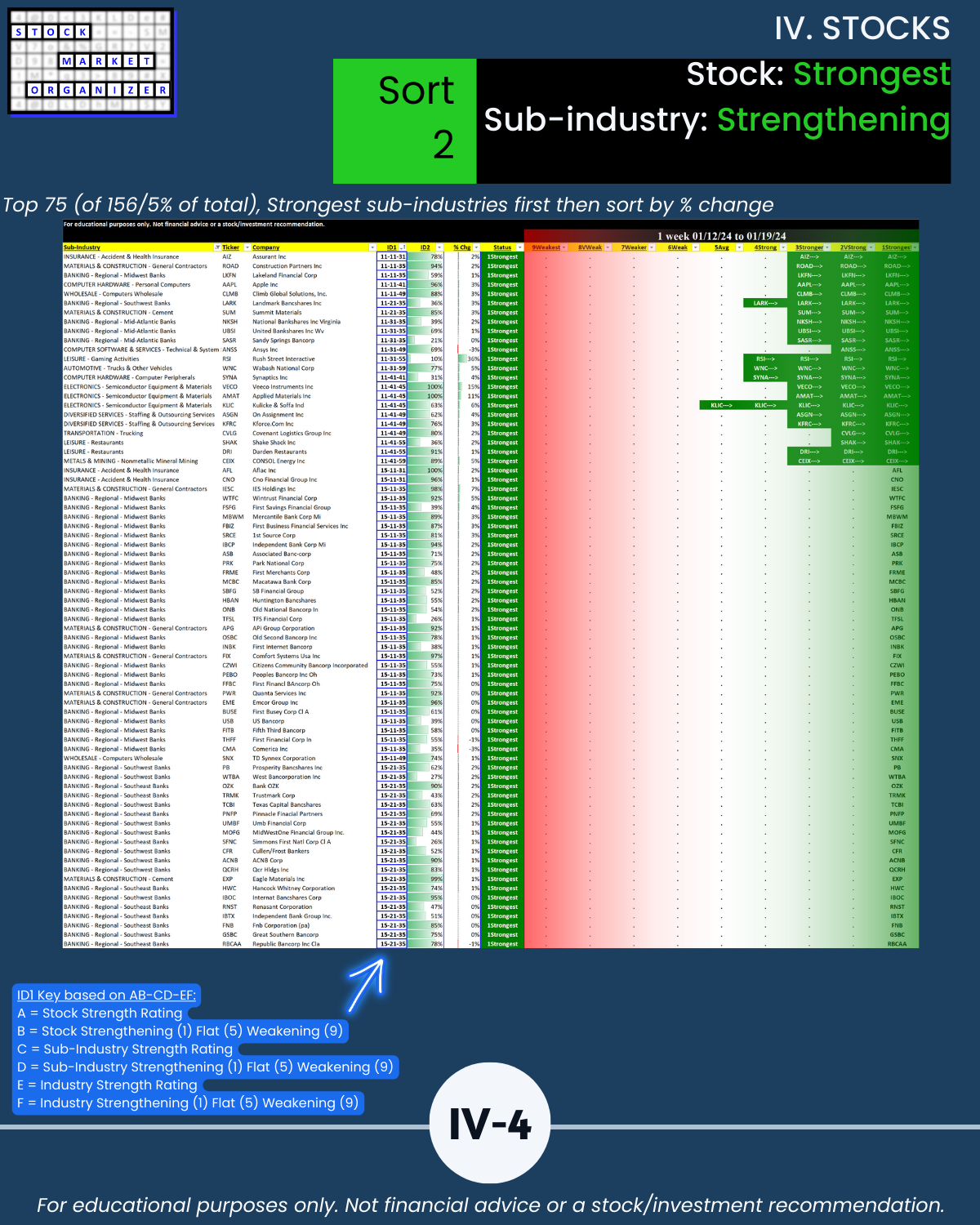

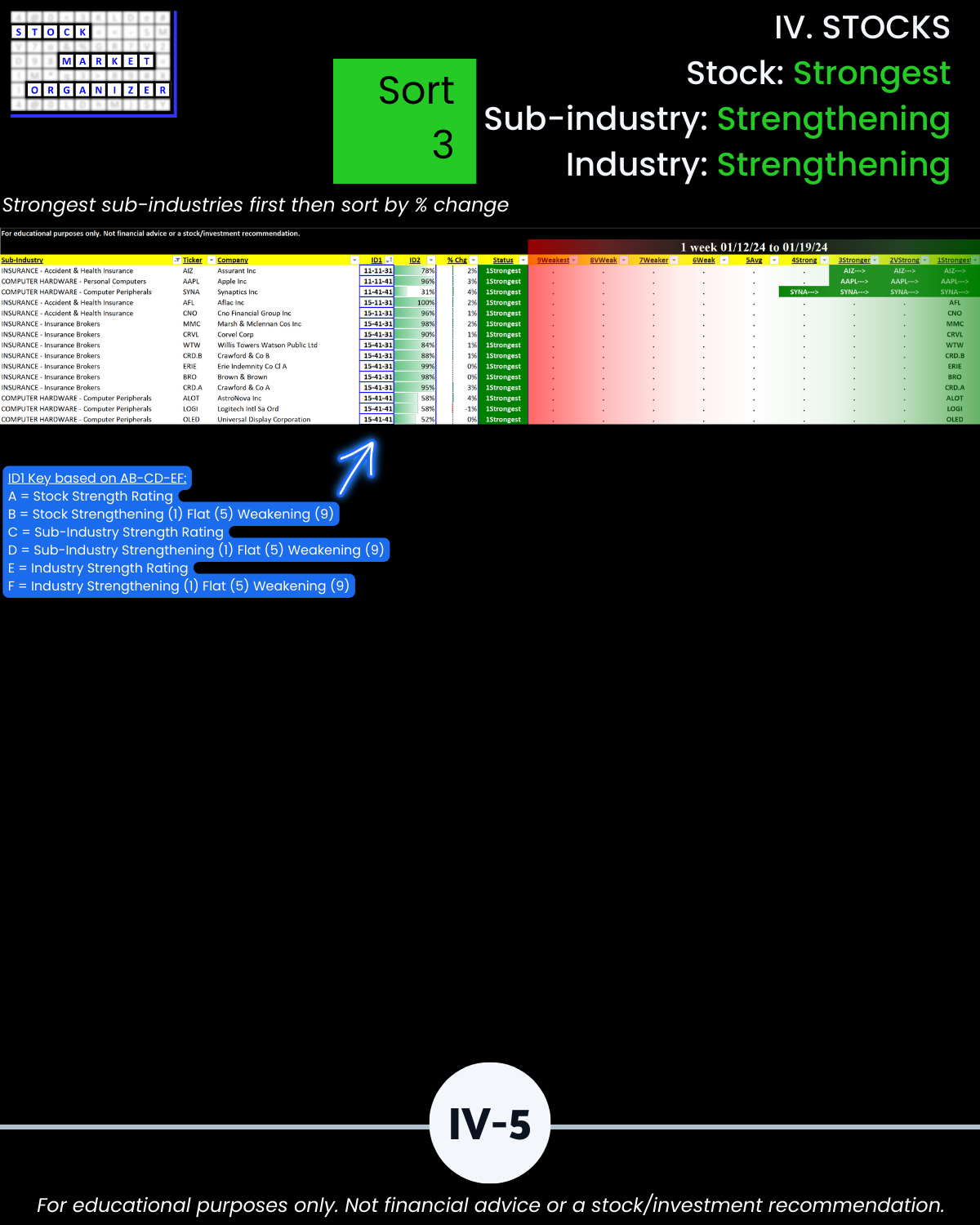

🔹 What are the strongest-rated stocks in strengthening sub-industries and industries?

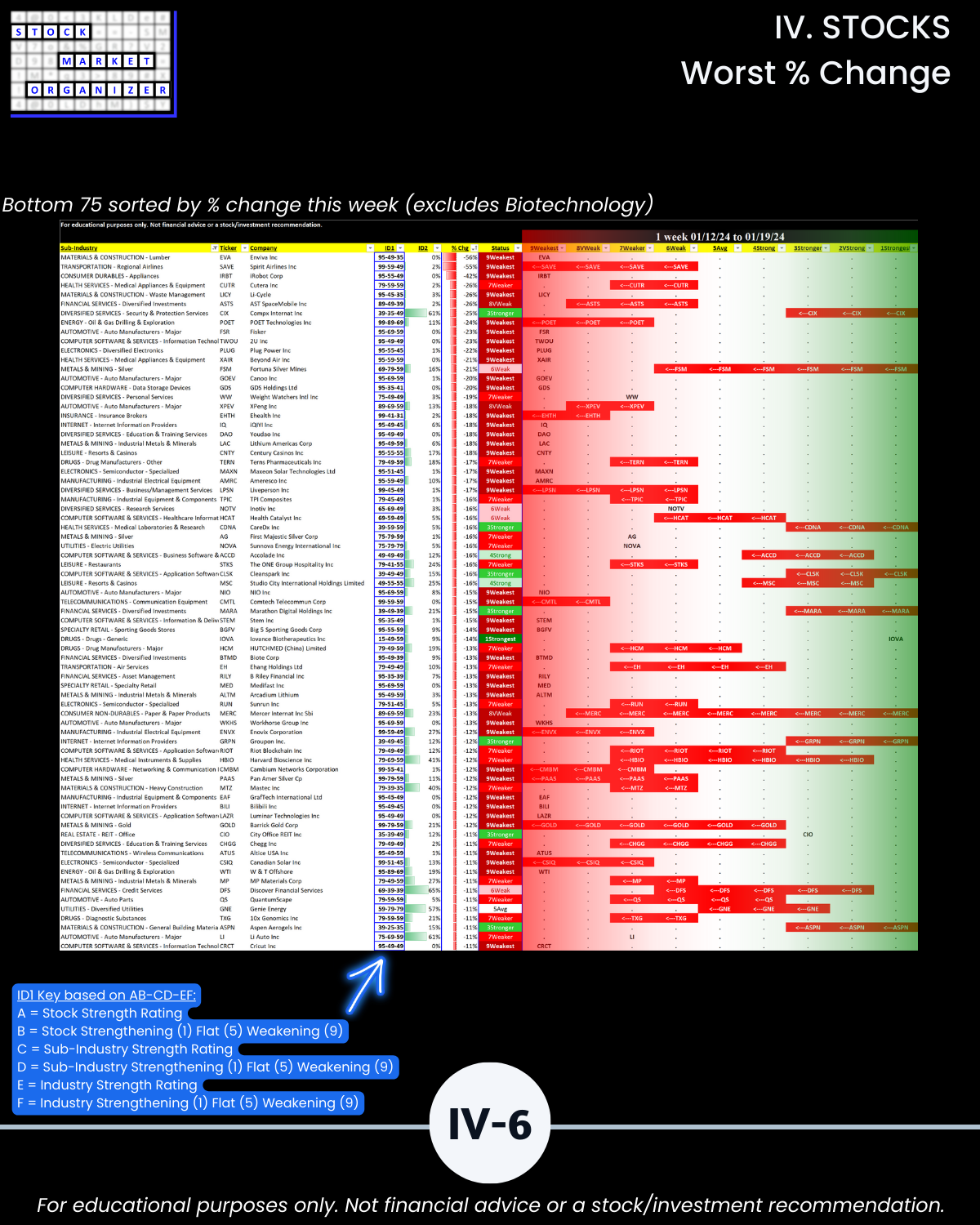

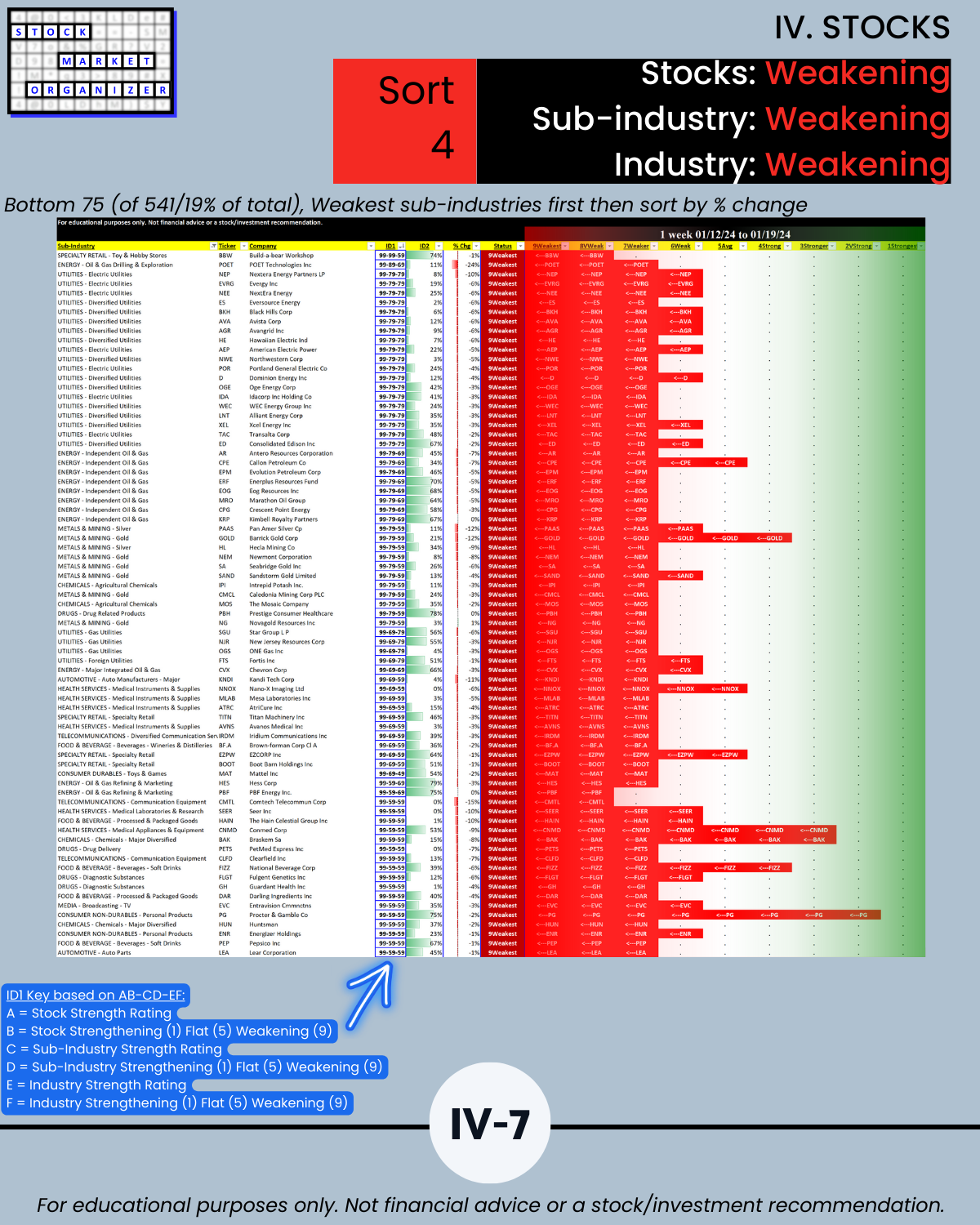

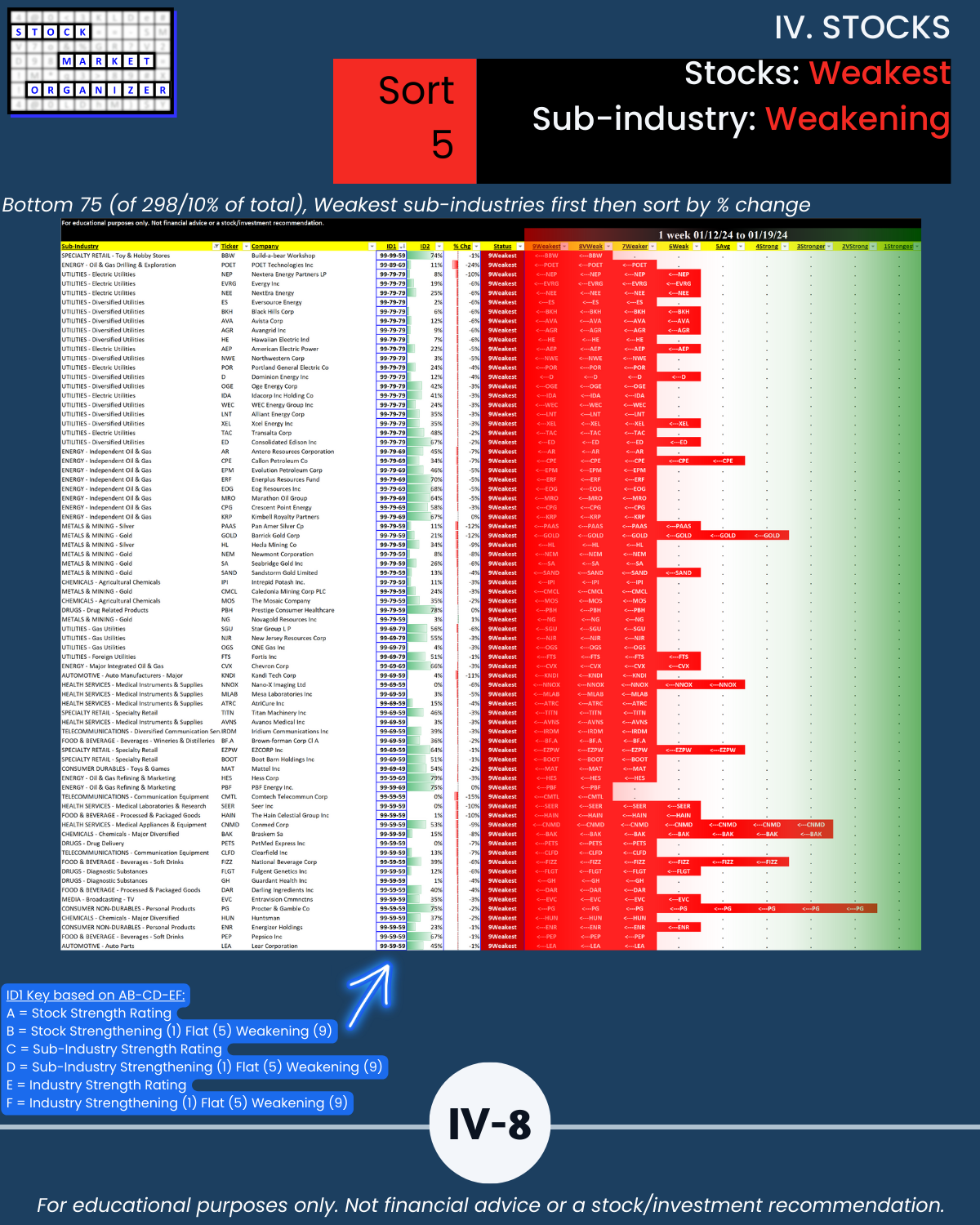

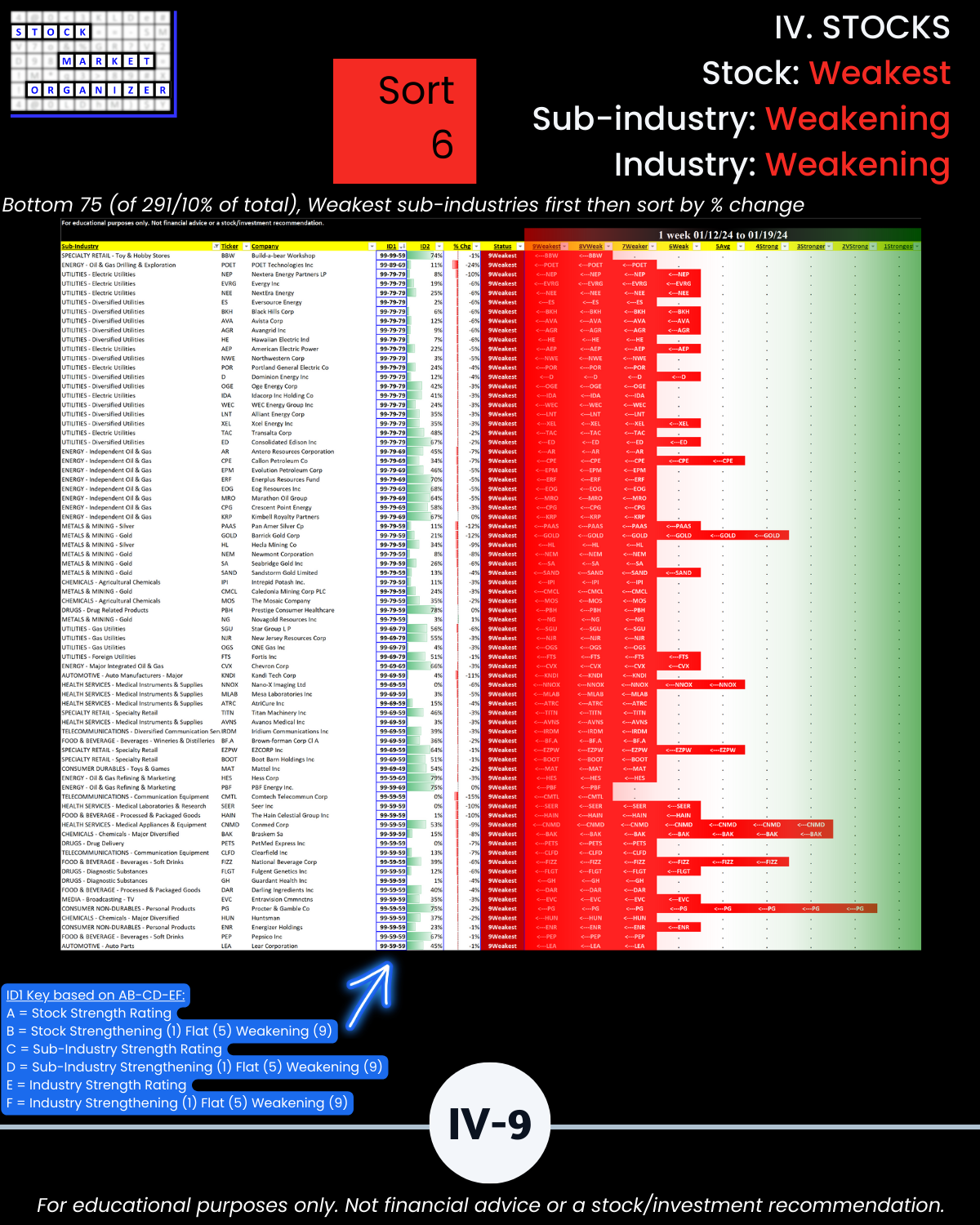

🔹 What are the weakest-rated stocks in weakening sub-industries and industries?

(Congratulations NVDA holders on the blast-off through $500/share. Unlikely this has been on the radar screen of value investors. Is there really any controversy about strength begetting strength?)

DID YOU KNOW?

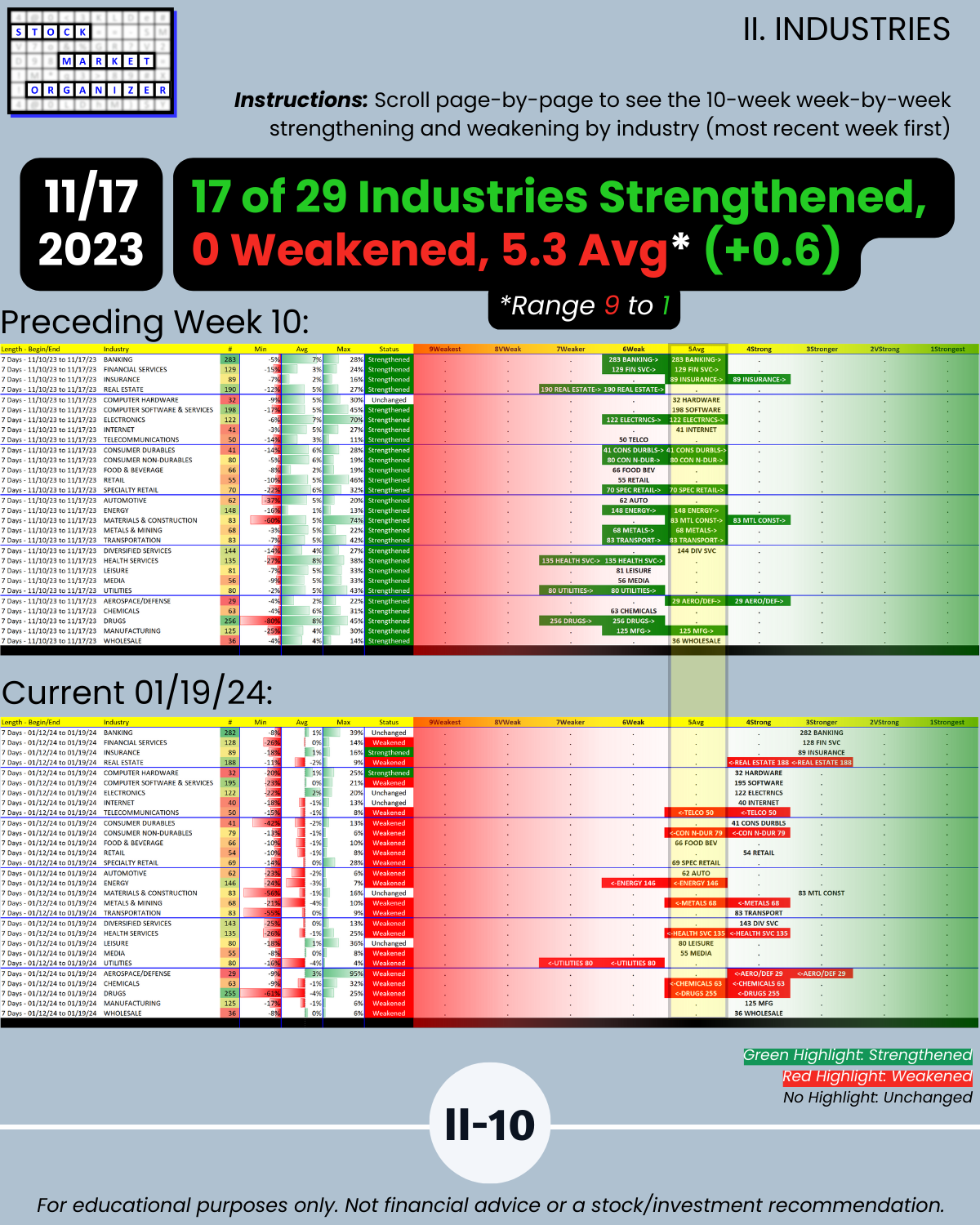

What IS: the overall market is weakening week of/ending 1/19/24

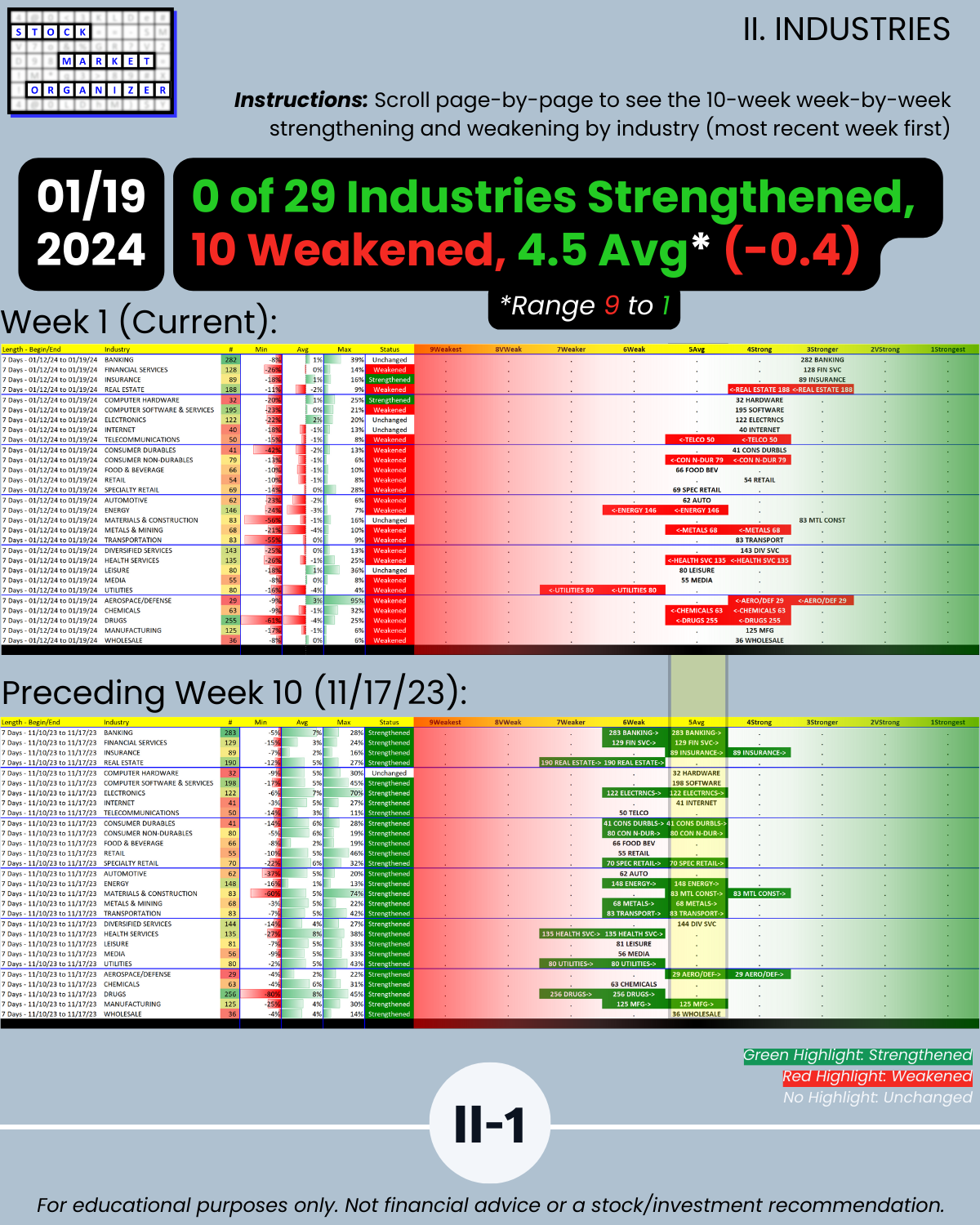

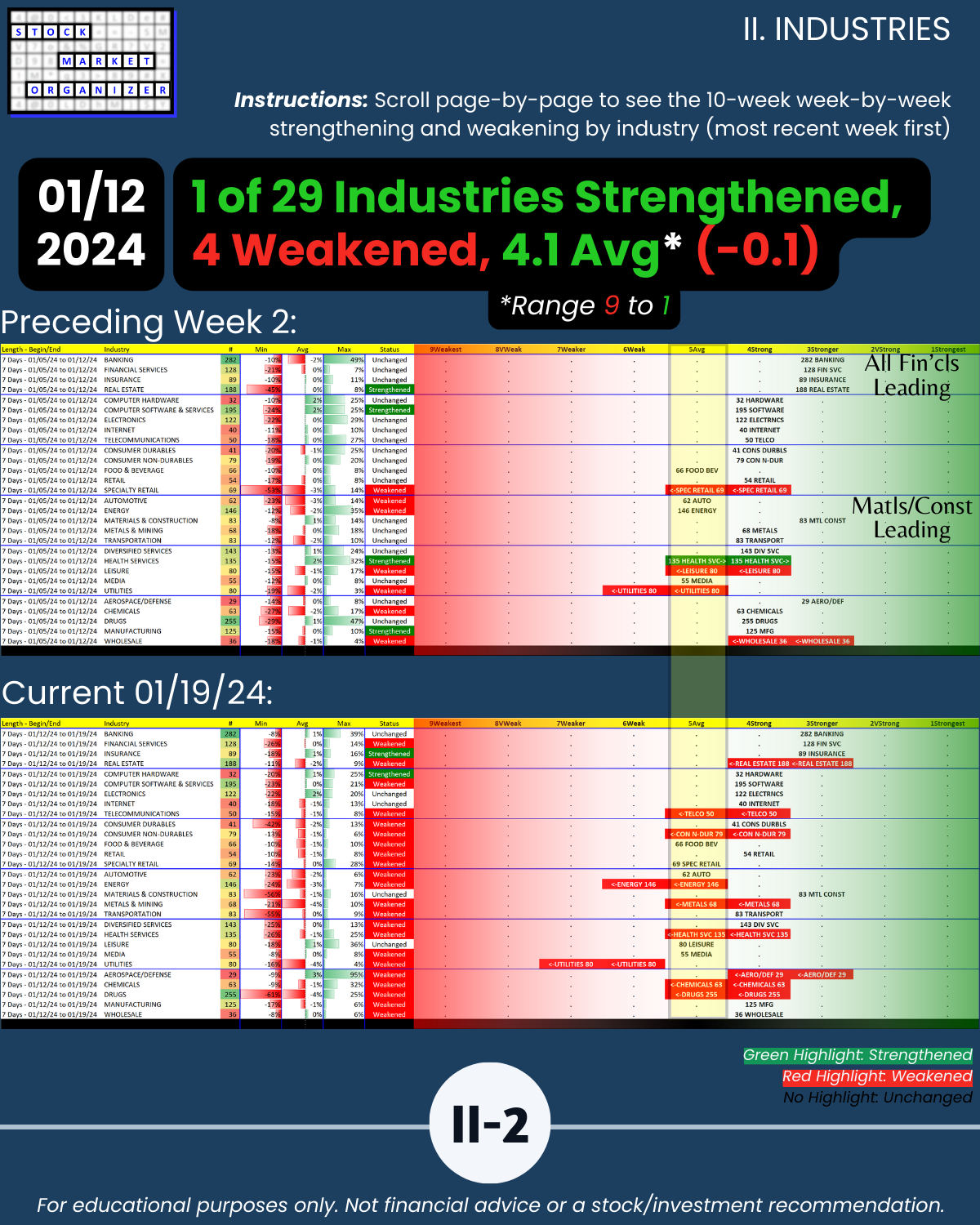

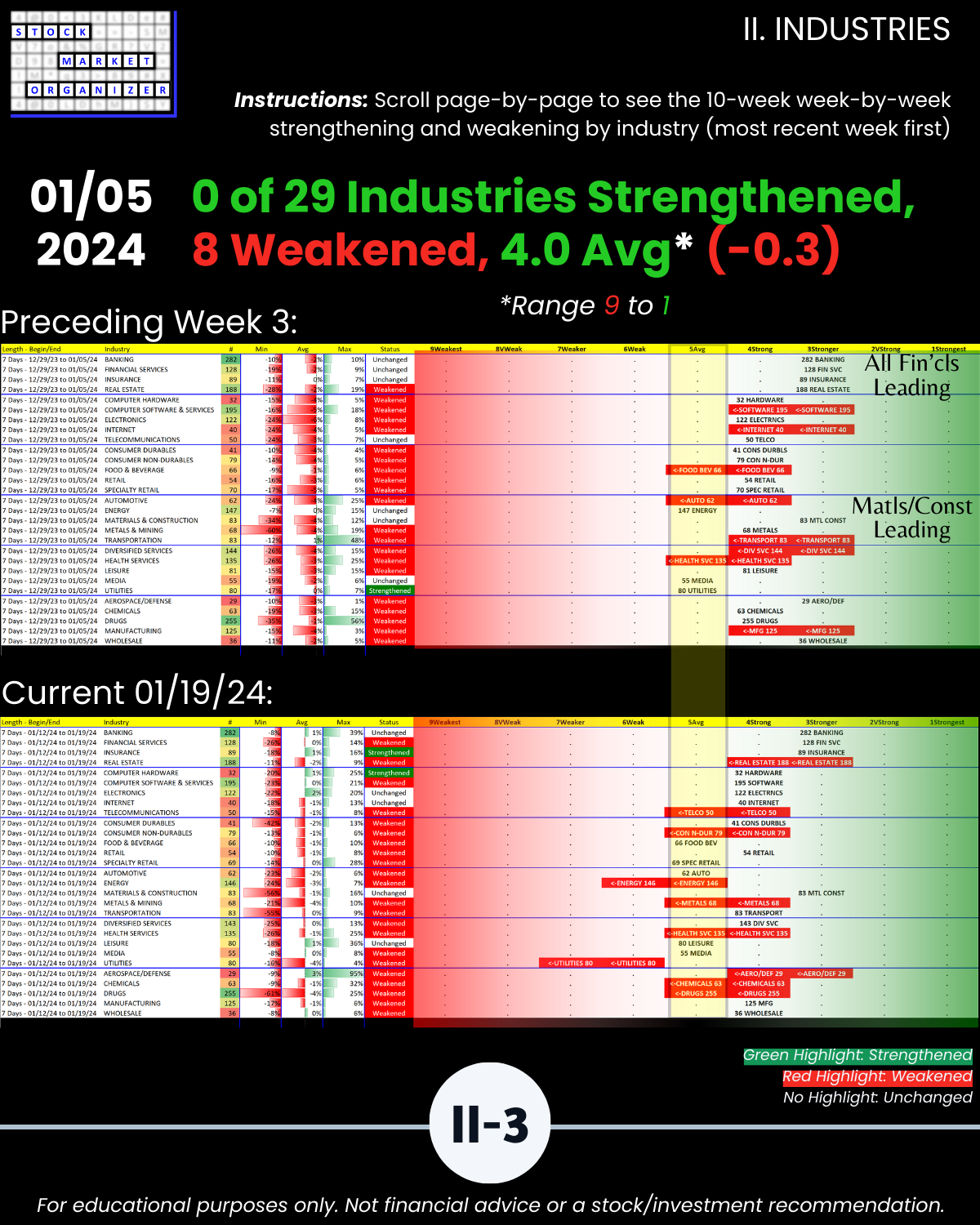

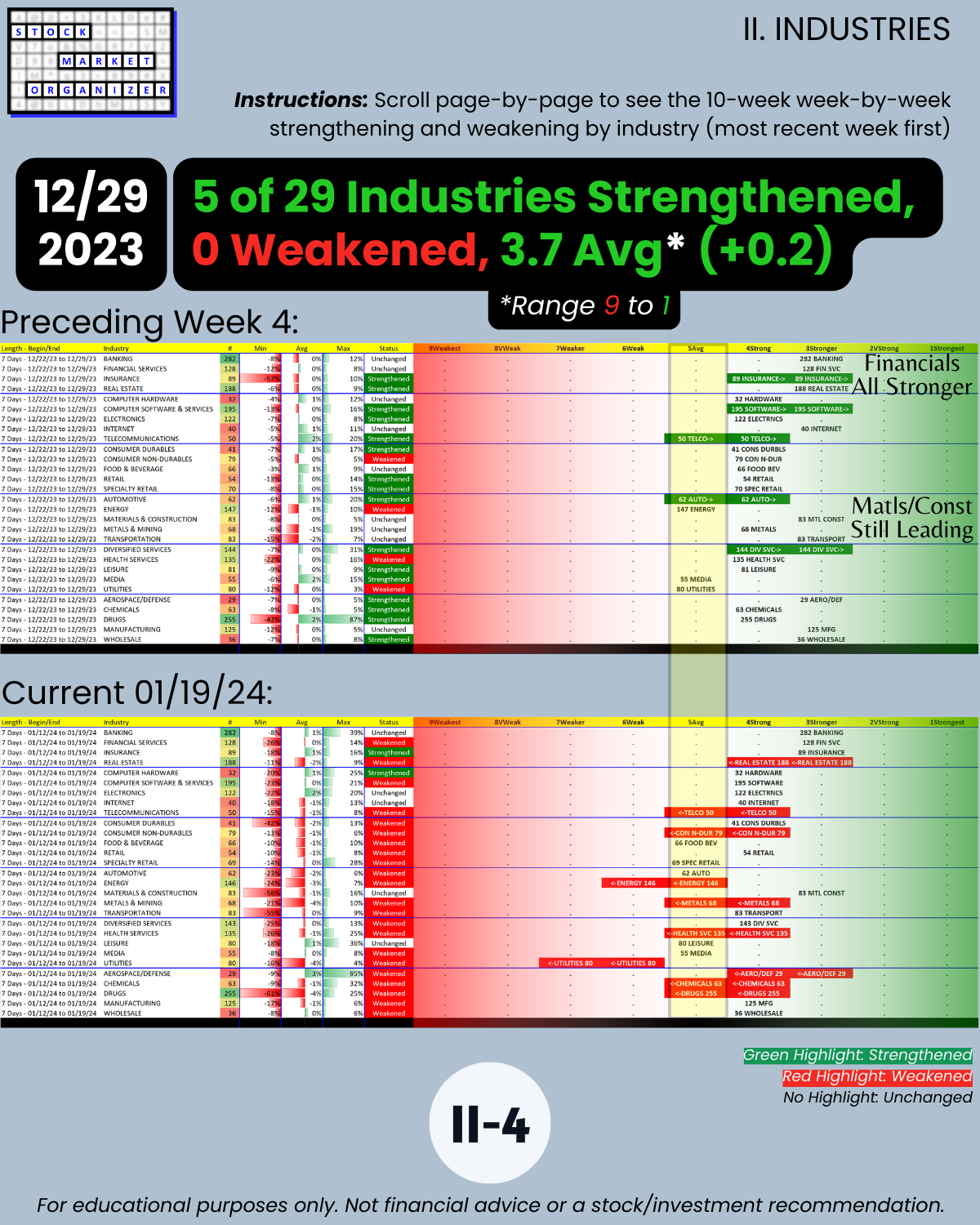

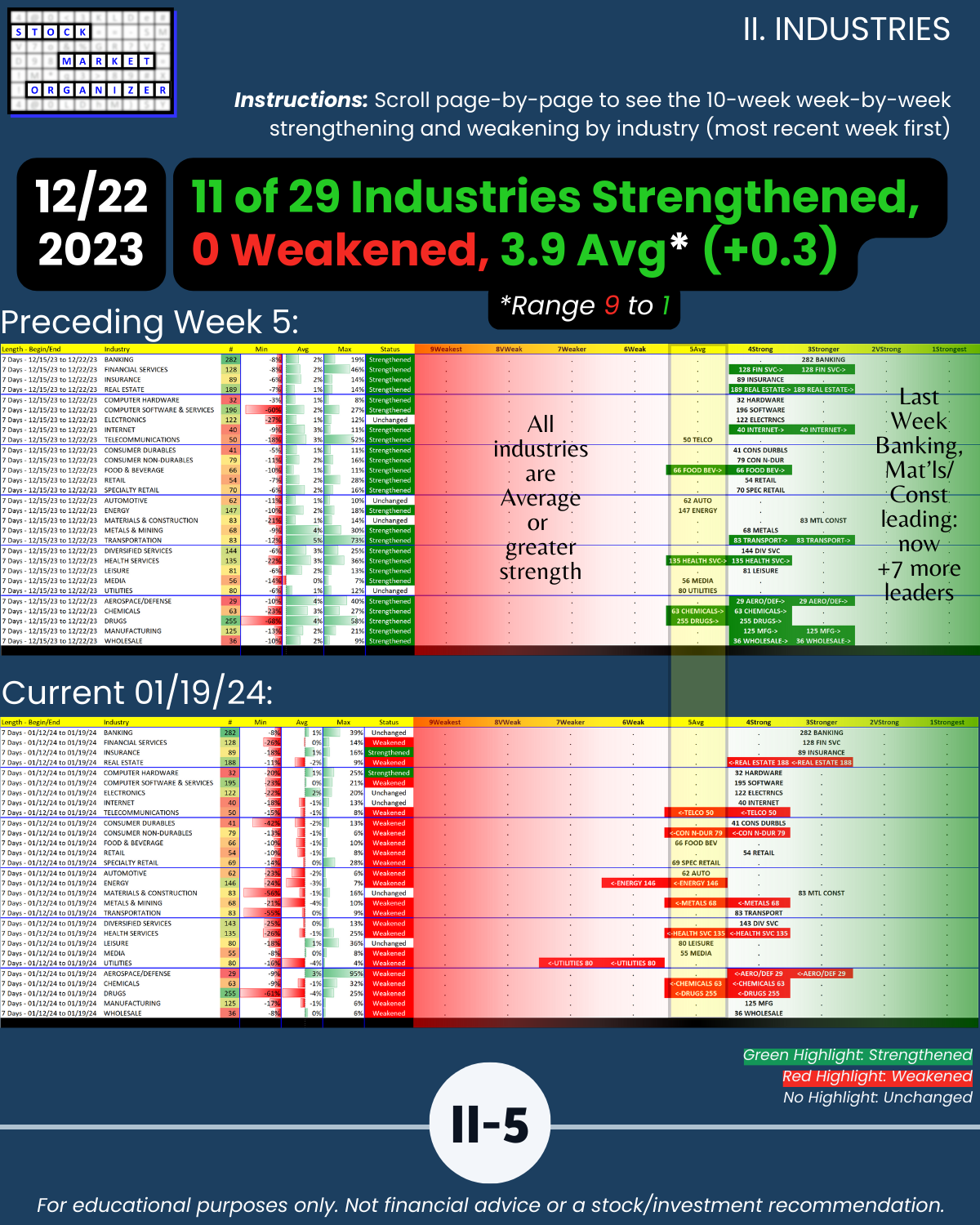

🔹 10 of 29 industries weakened and 0 strengthened last week

🔹 The -72% market strength score means it is in late “no new longs” territory with no telling exactly for how many days it will remain “late”

🔹 12/29/23 = 12 industries rated Stronger (3rd strongest of 9 levels), 1/19/24 = 4

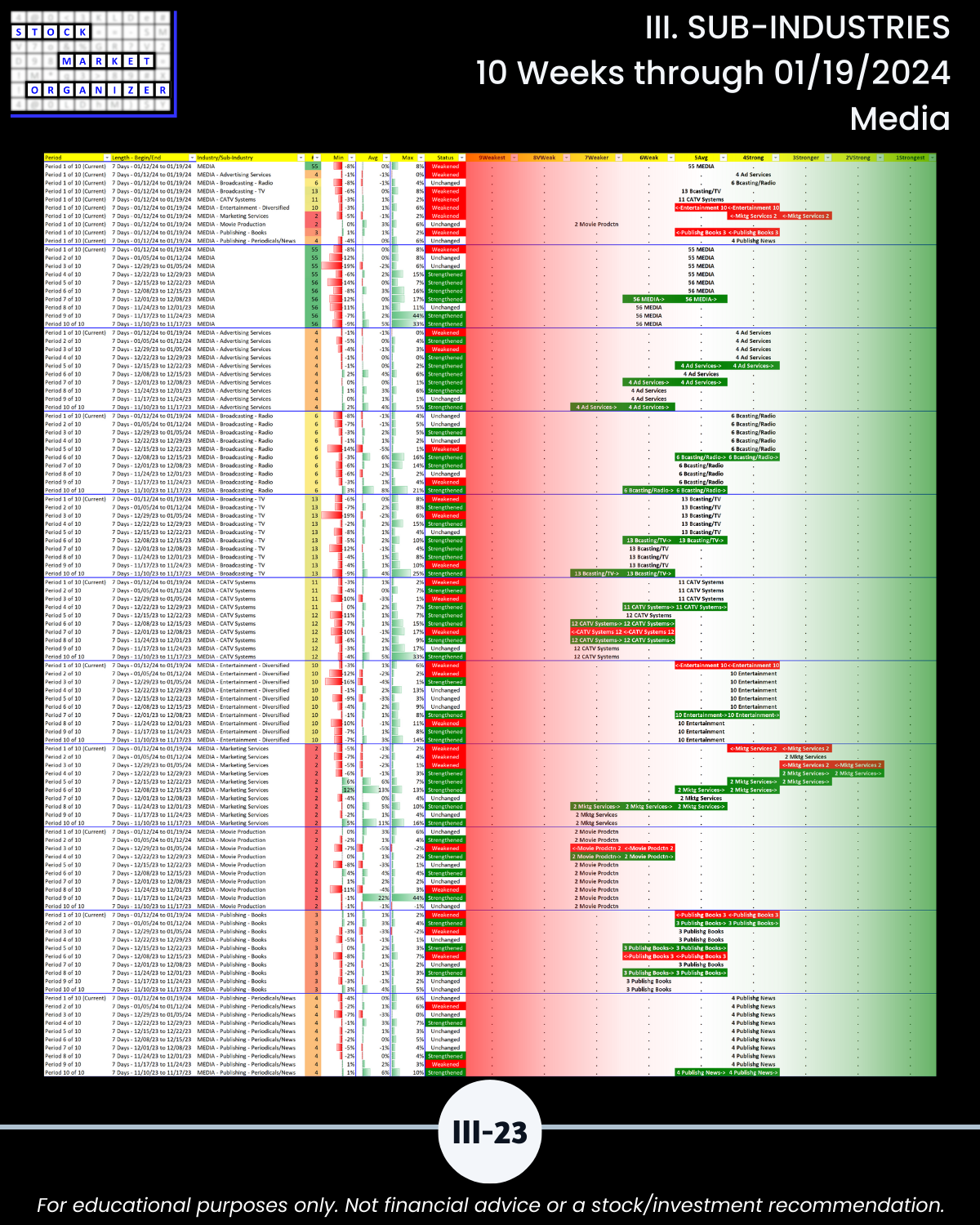

🔹 13% vs. 58% sub-industries Strengthening vs. Weakening (199 total Sub-industries)

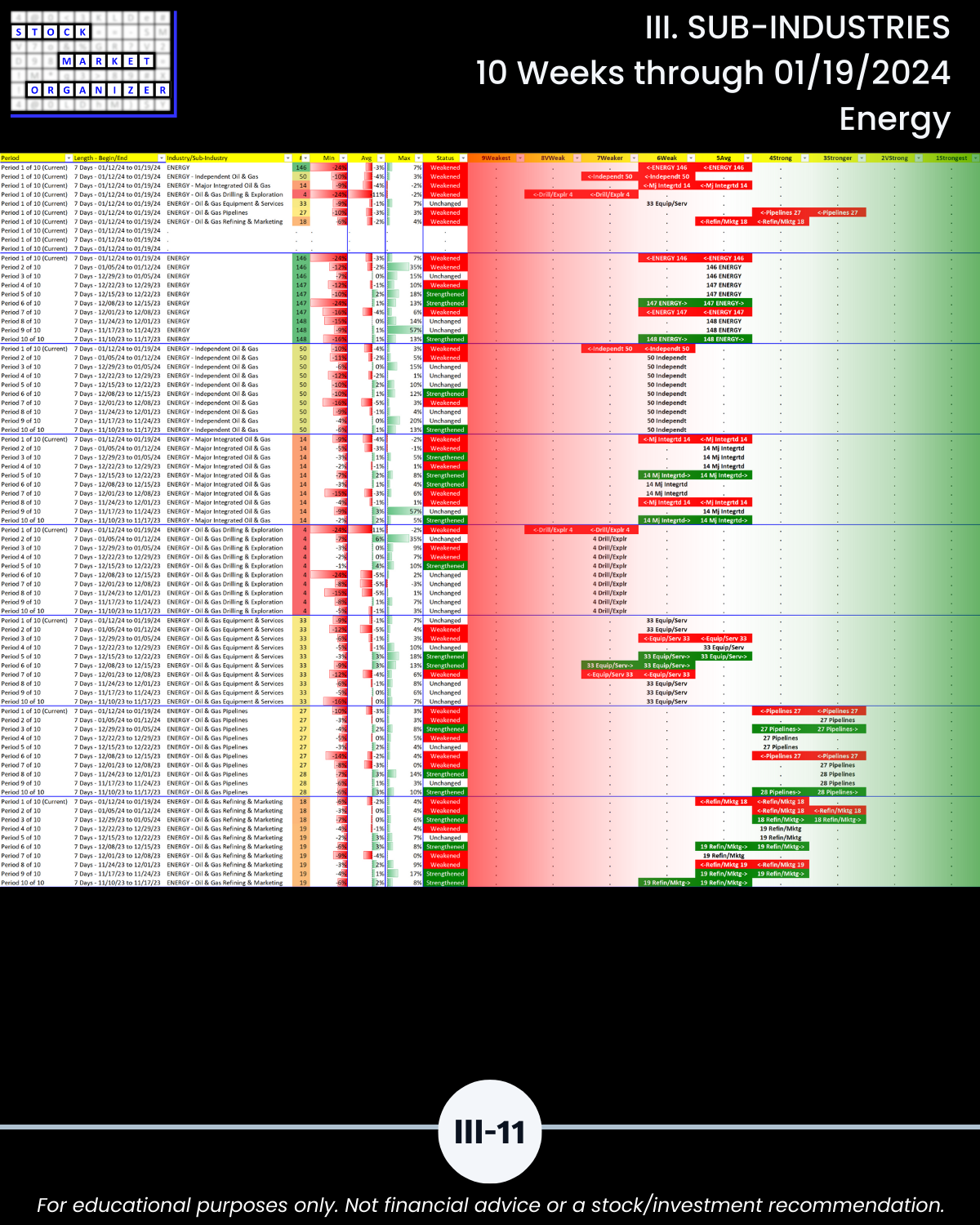

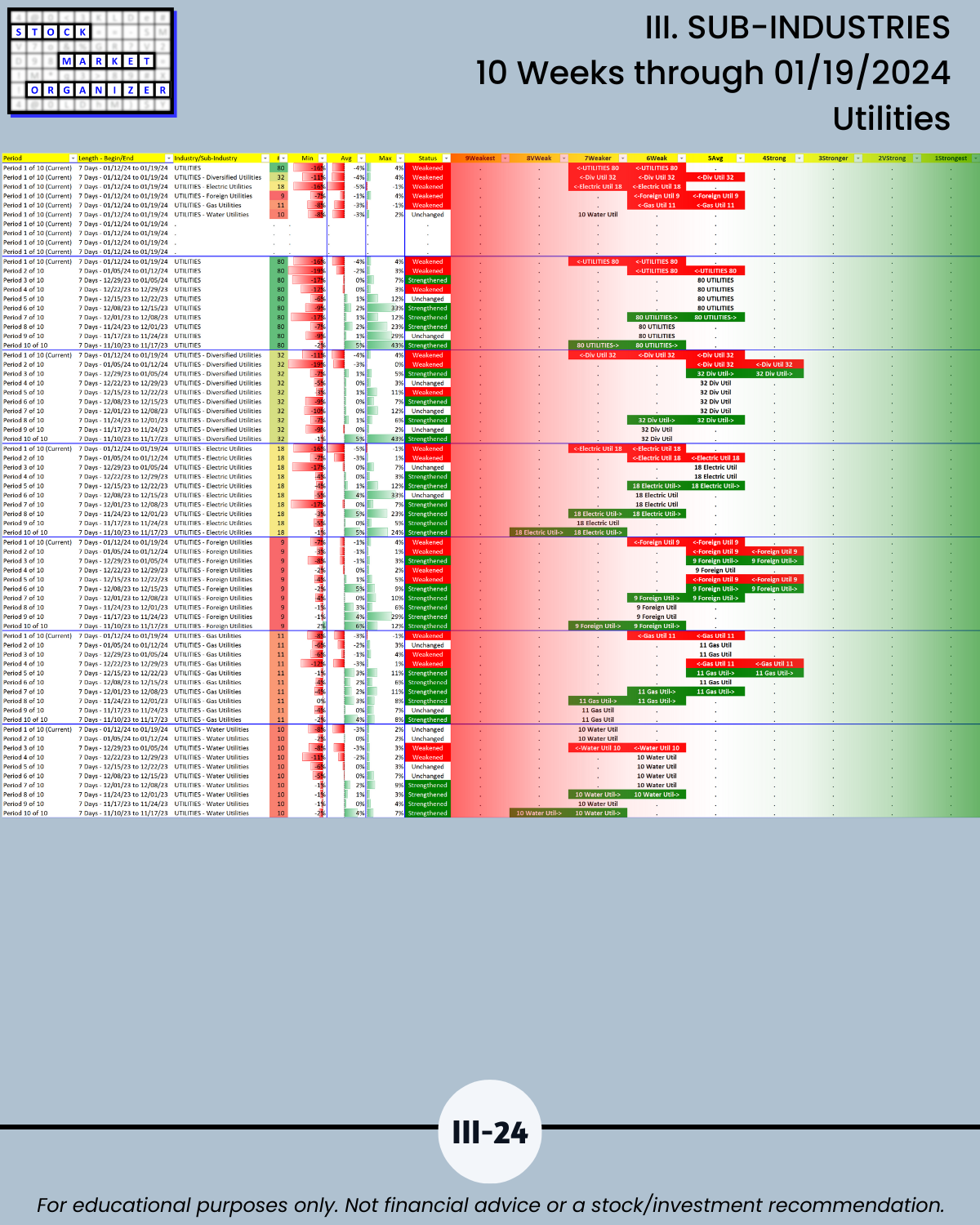

🔹Utilities and Energy are the two weakest industries

What WILL BE:

I have no idea. Neither does anyone else. Execute your plan and follow your rules based on what IS.

WHAT’S INSIDE?

Few stocks buck the market trend.

At the same time, the market can only do what its underlying stocks do.

“What’s inside” is a detailed look at what you can find out about the market, sectors, industries, sub-industries, and finally individual stocks when you analyze a factor common to all of these: their strengthening and weakening.

WHO CARES?

This is intended to be helpful for everyone interested in the U.S. stock market, especially so if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

I. Introduction/Market Strength Score

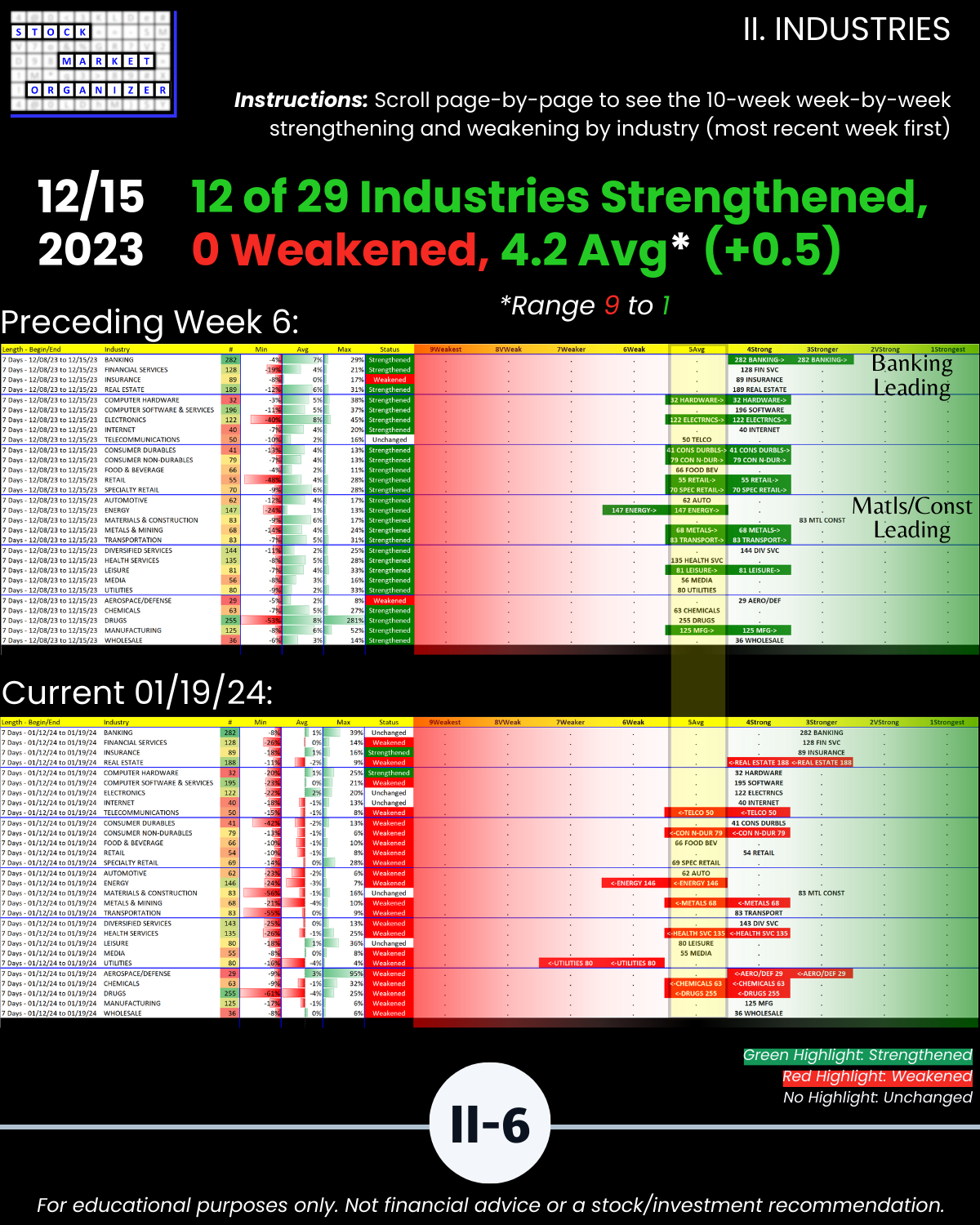

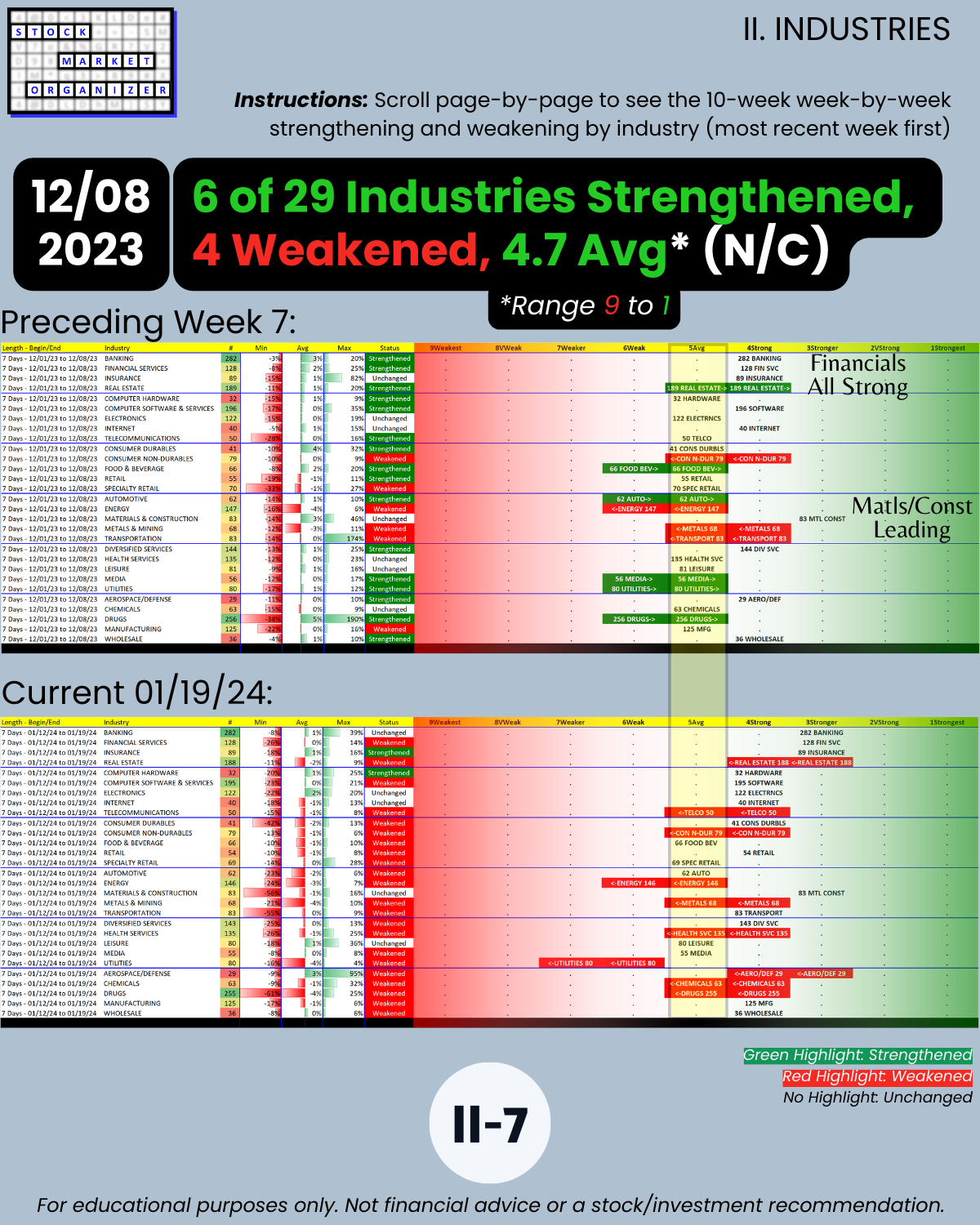

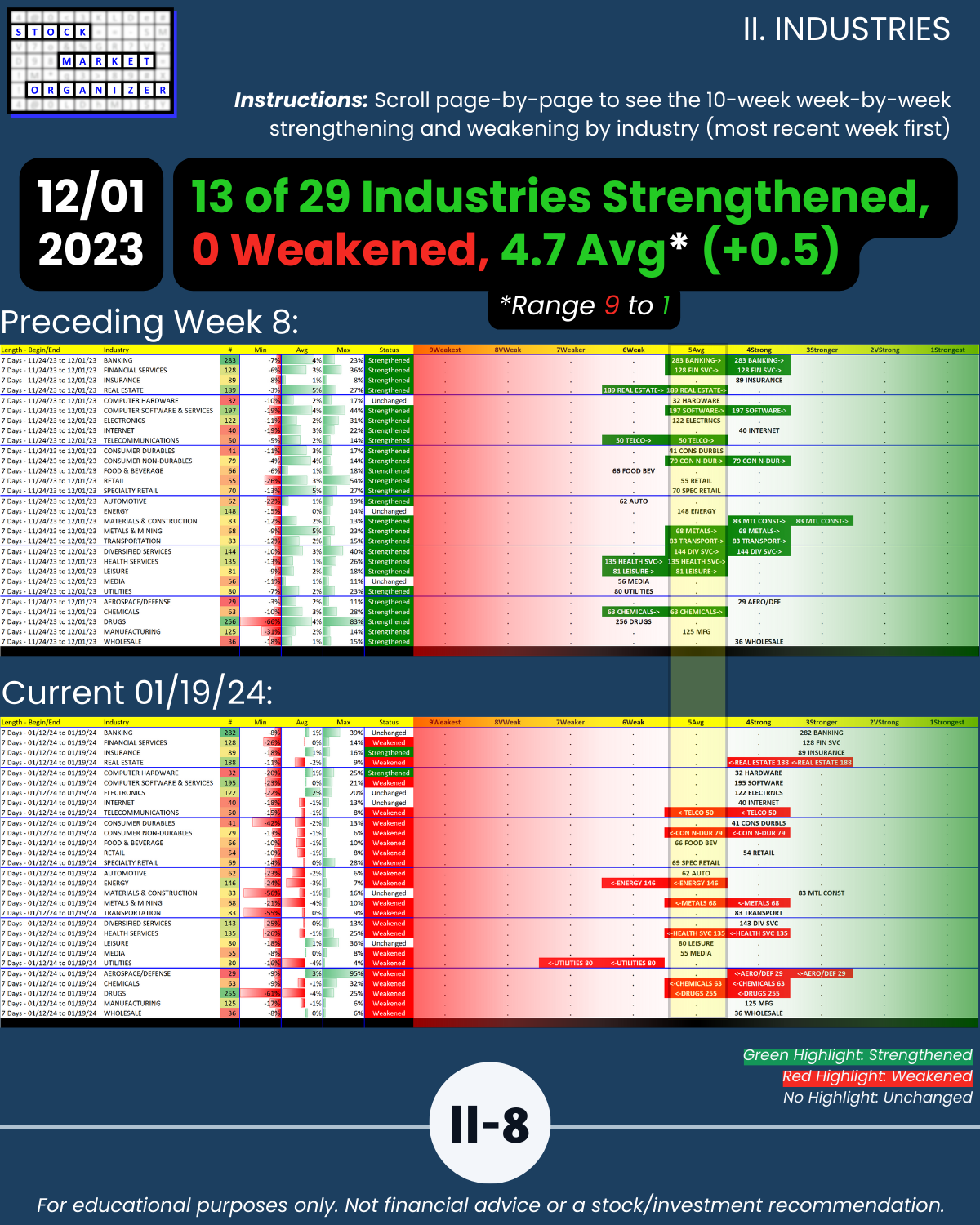

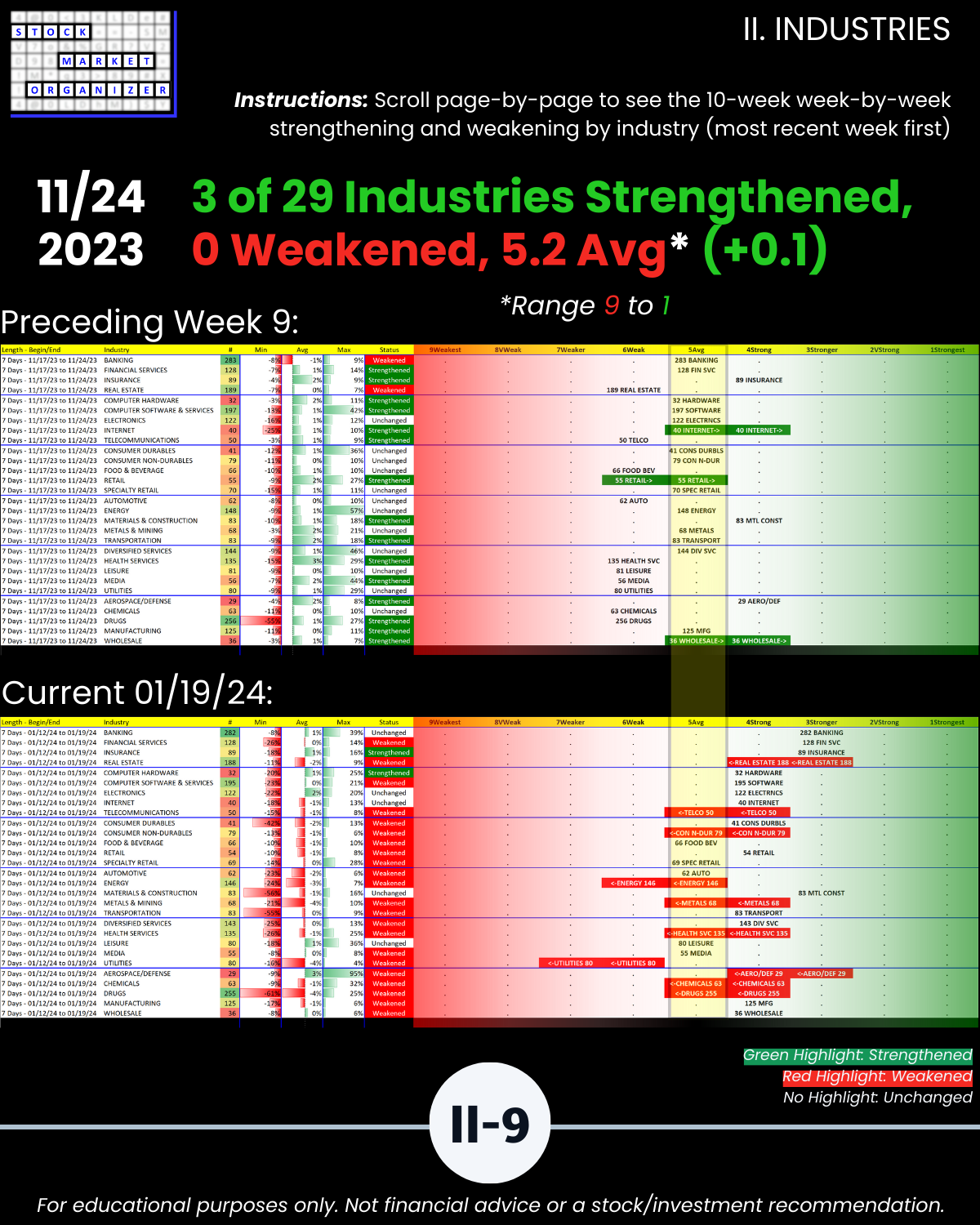

II. 10-Week Week-by-Week Industry Strength

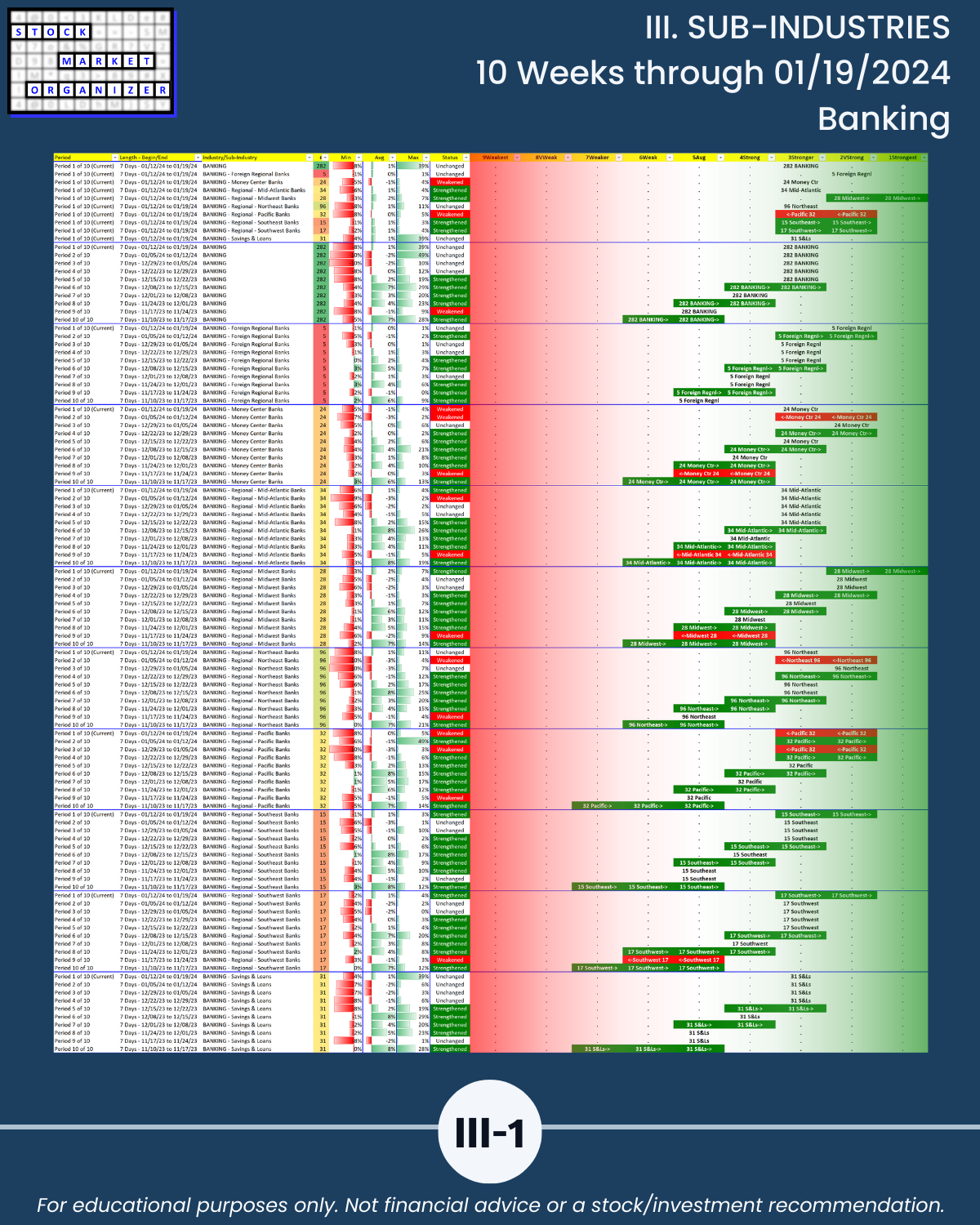

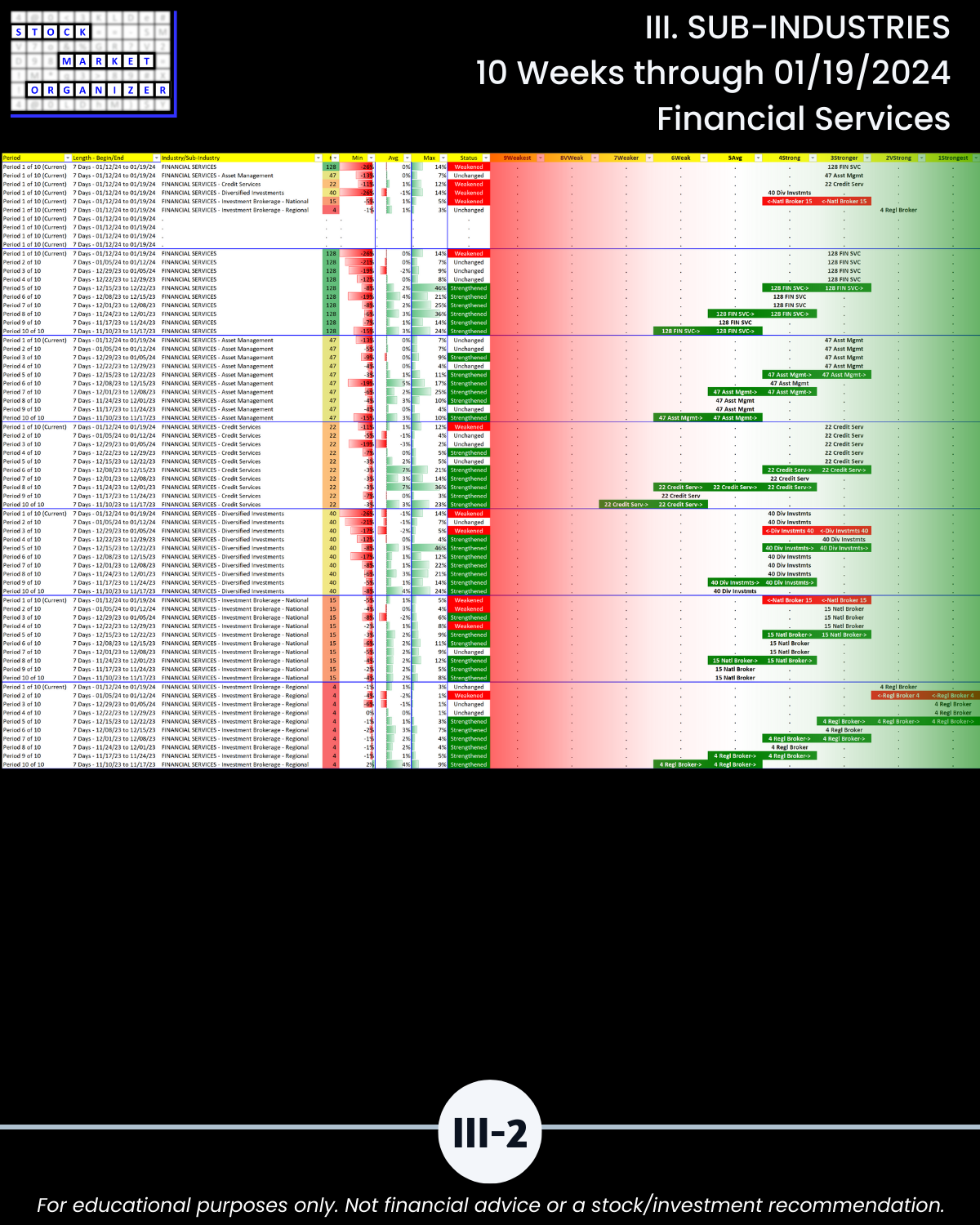

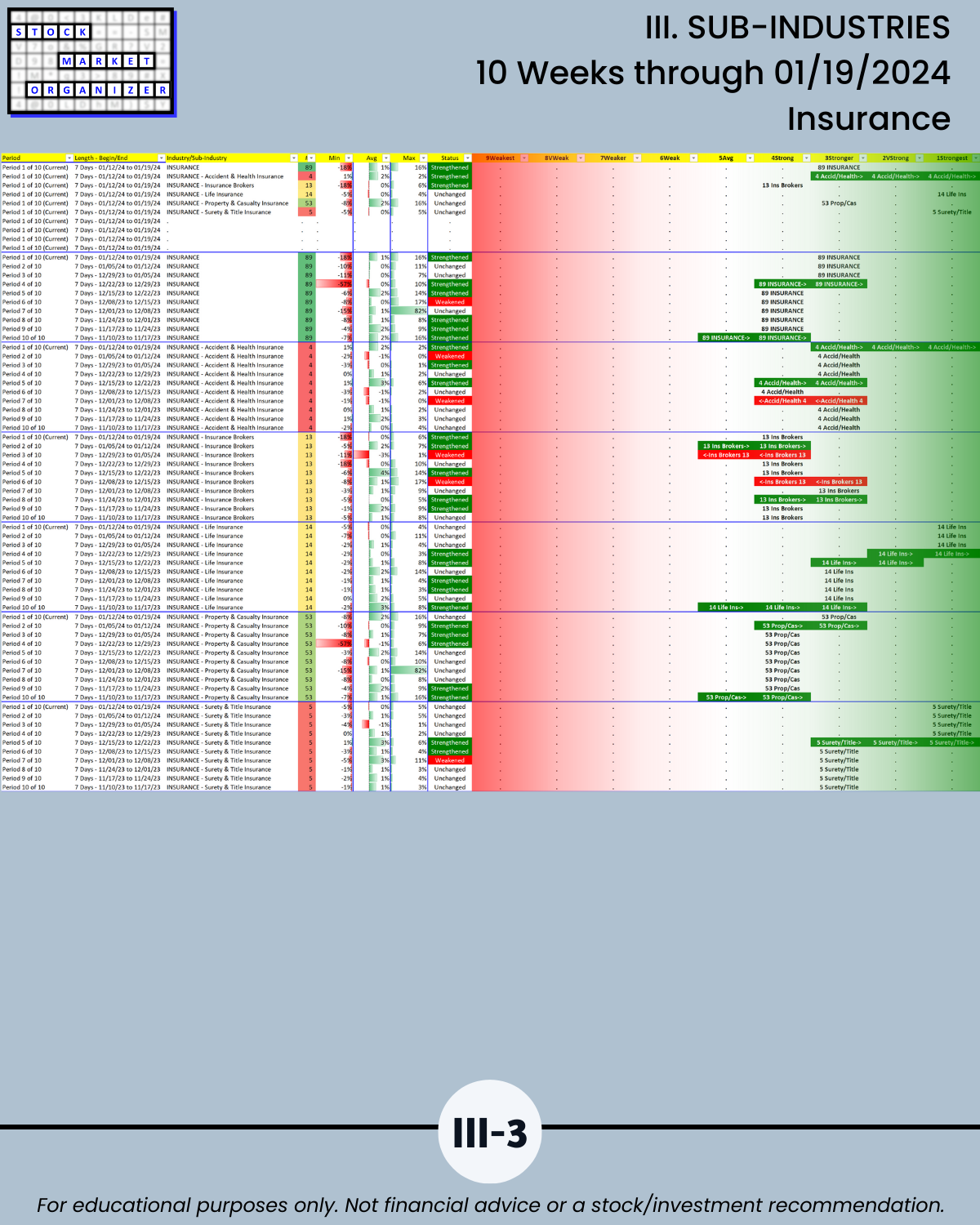

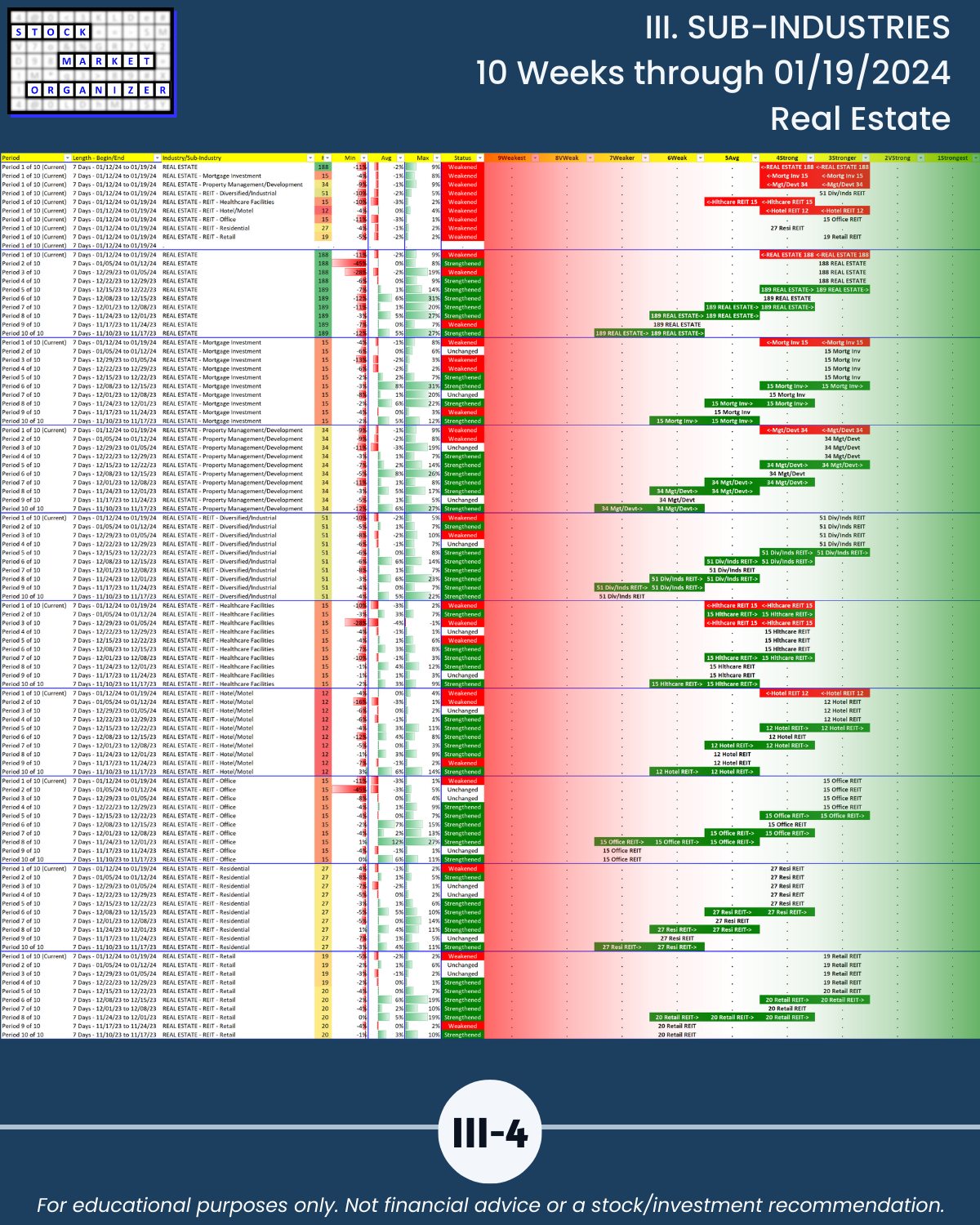

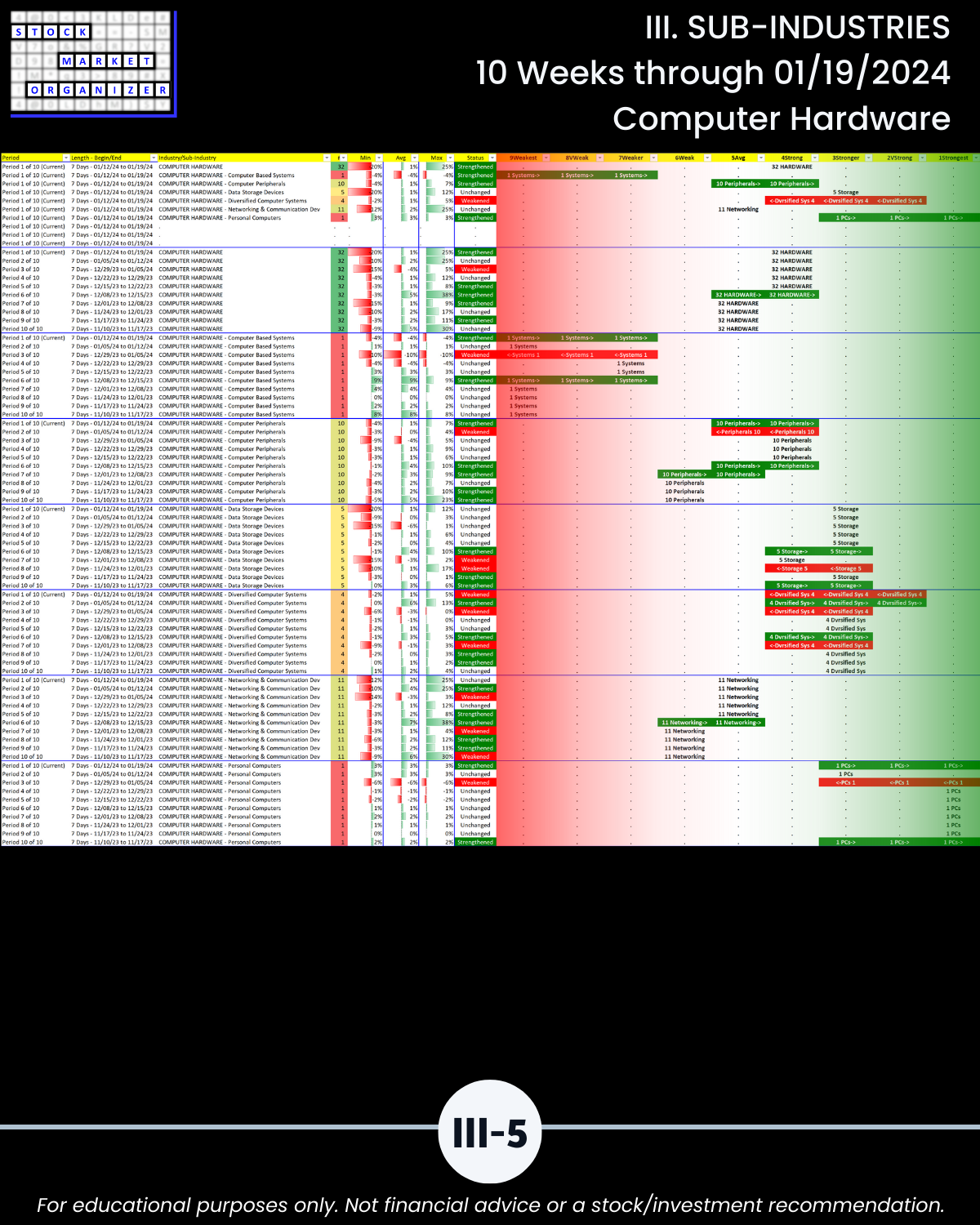

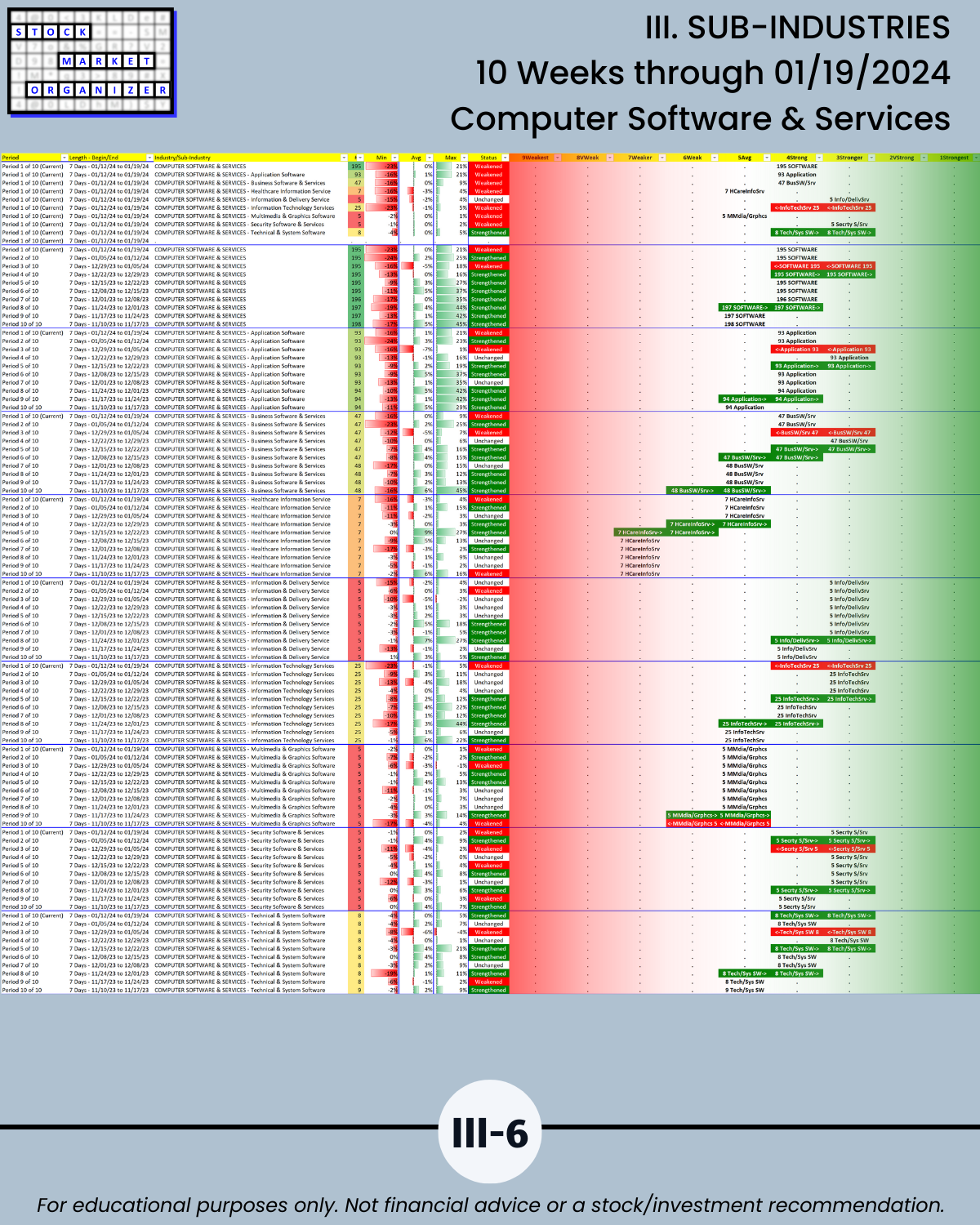

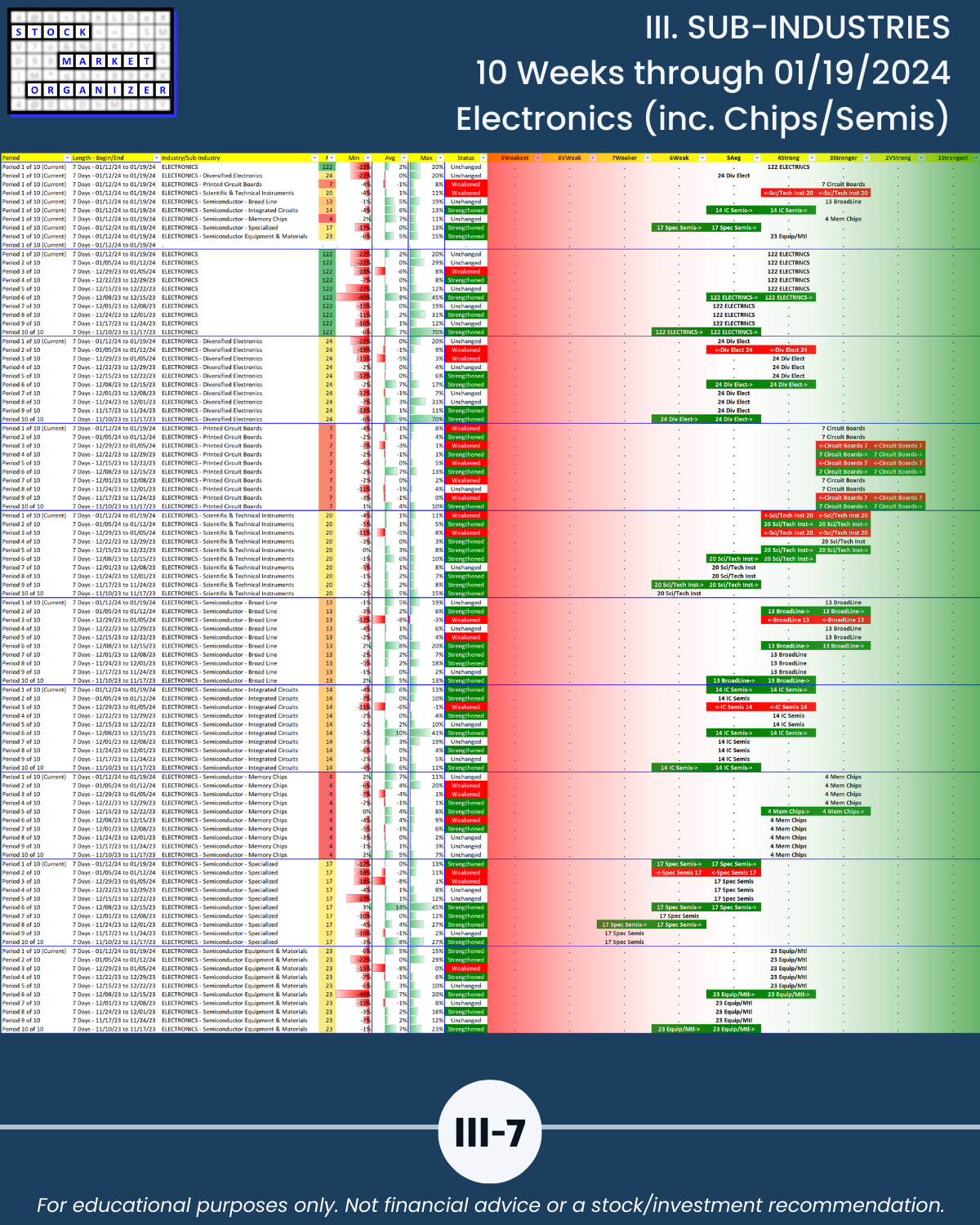

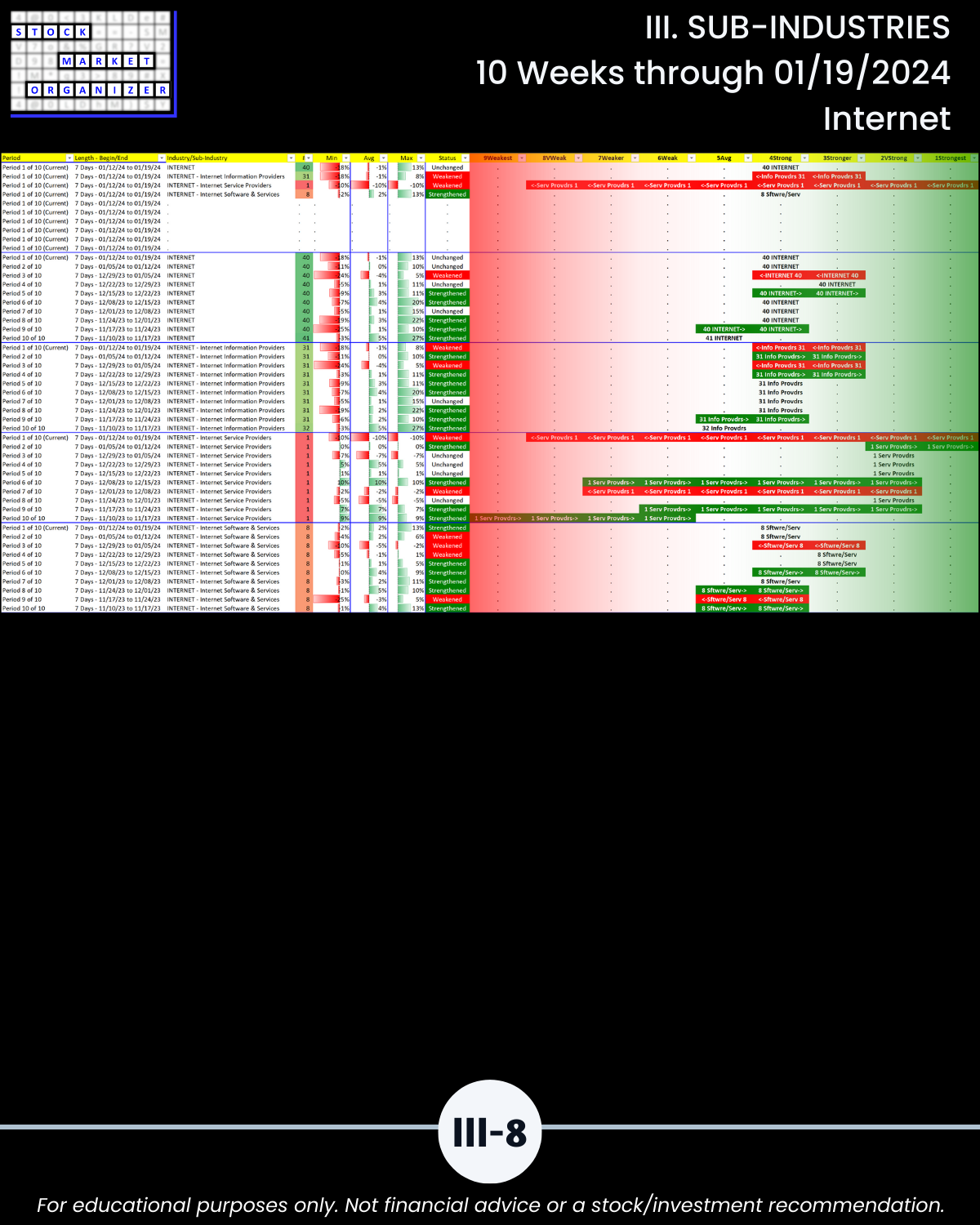

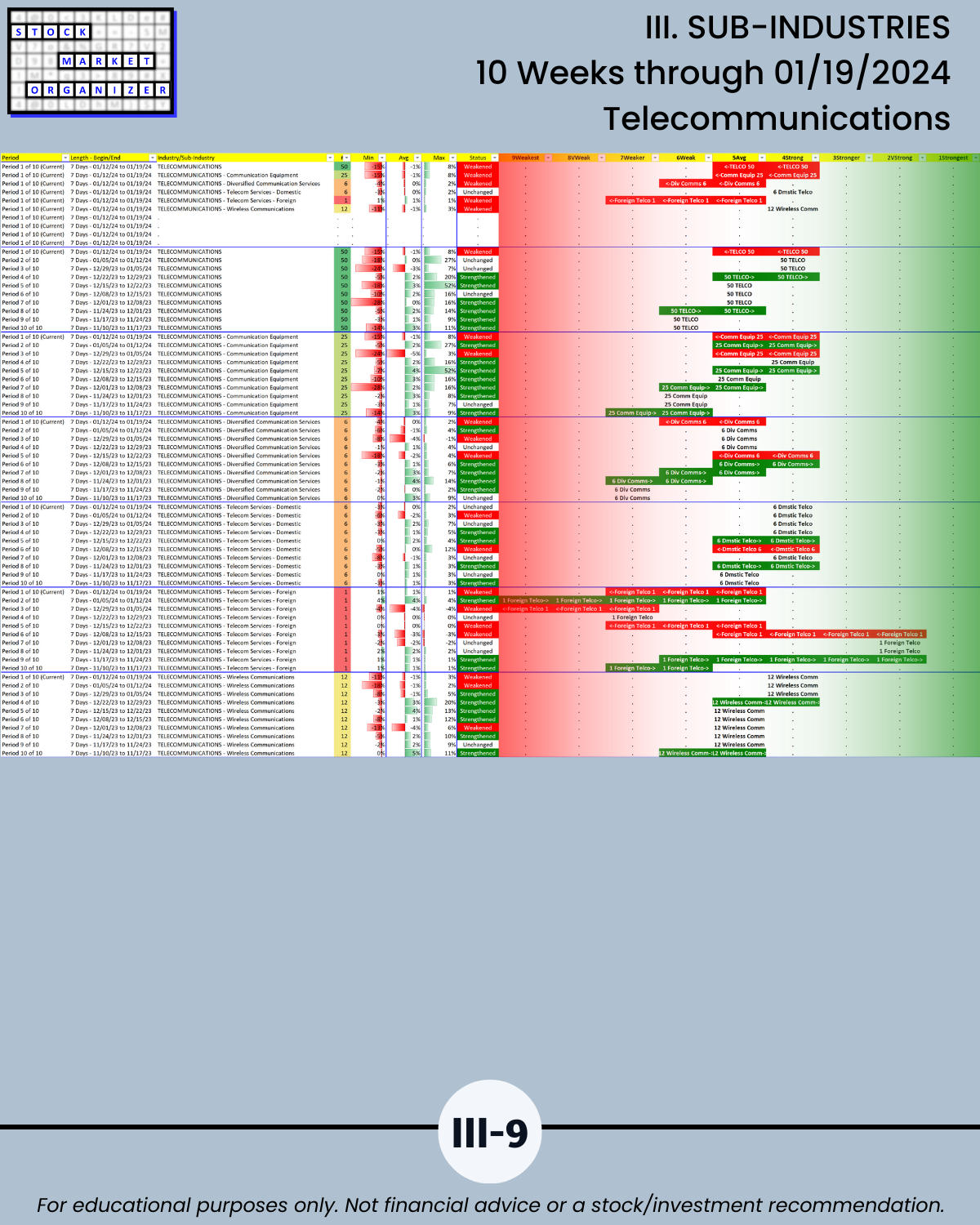

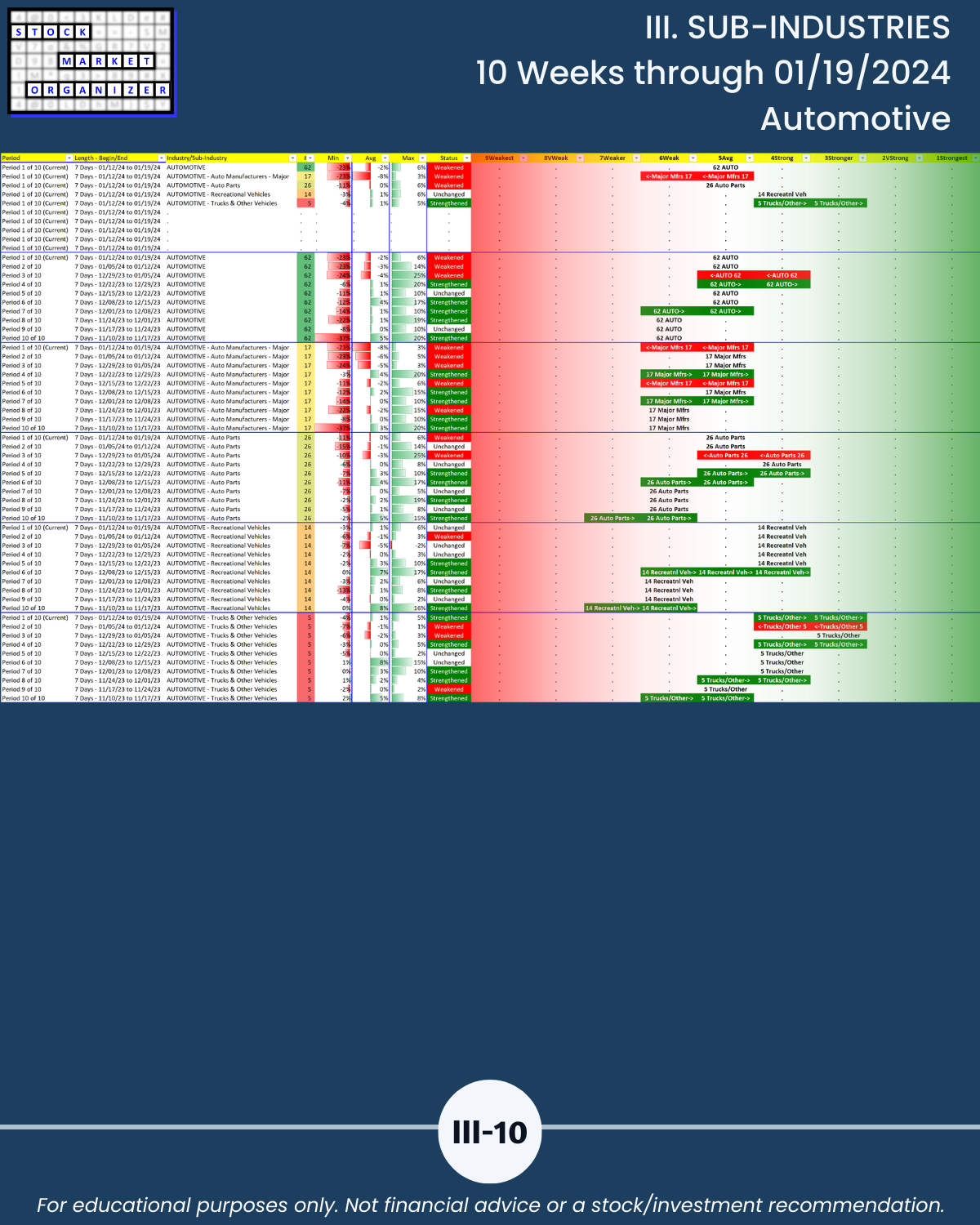

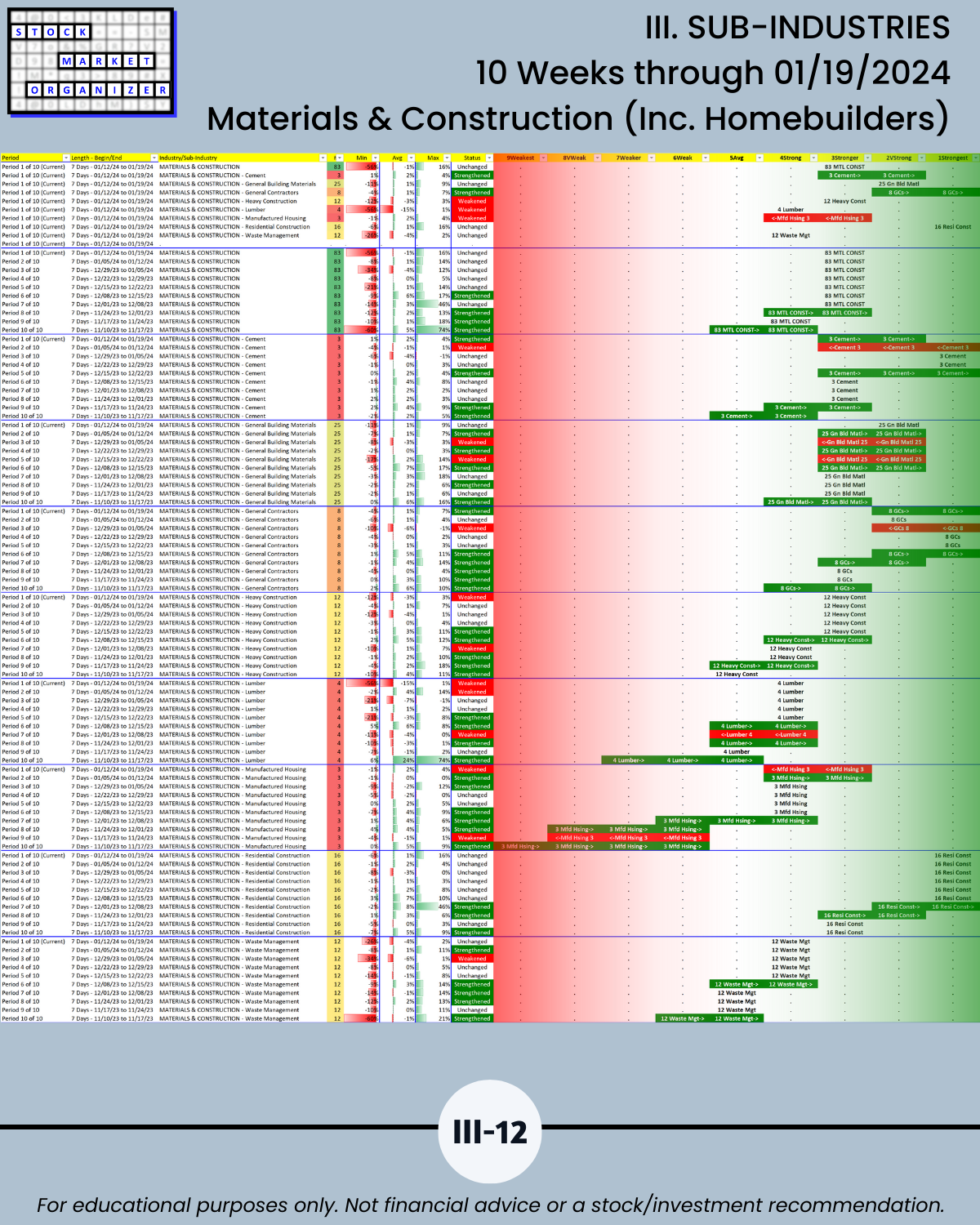

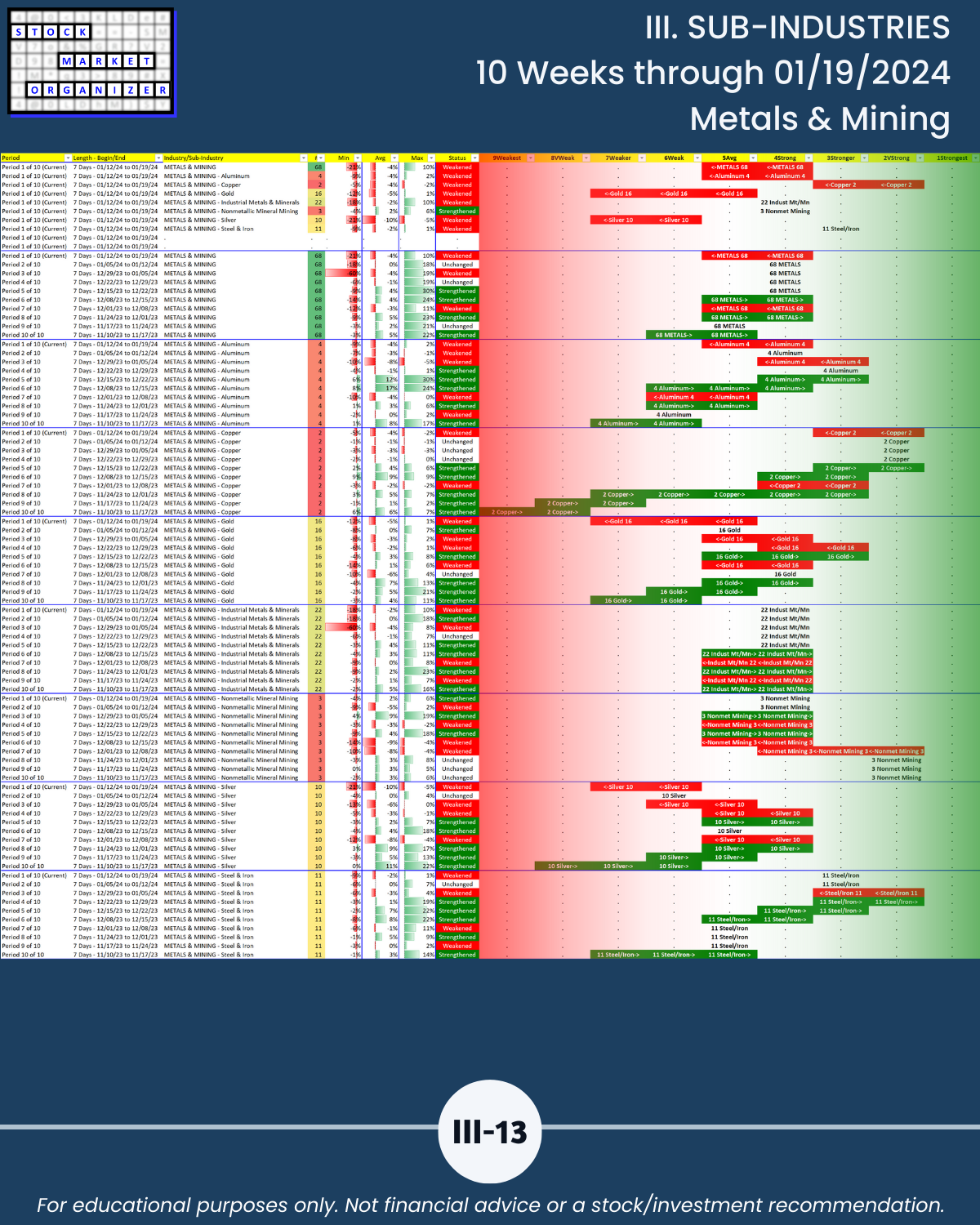

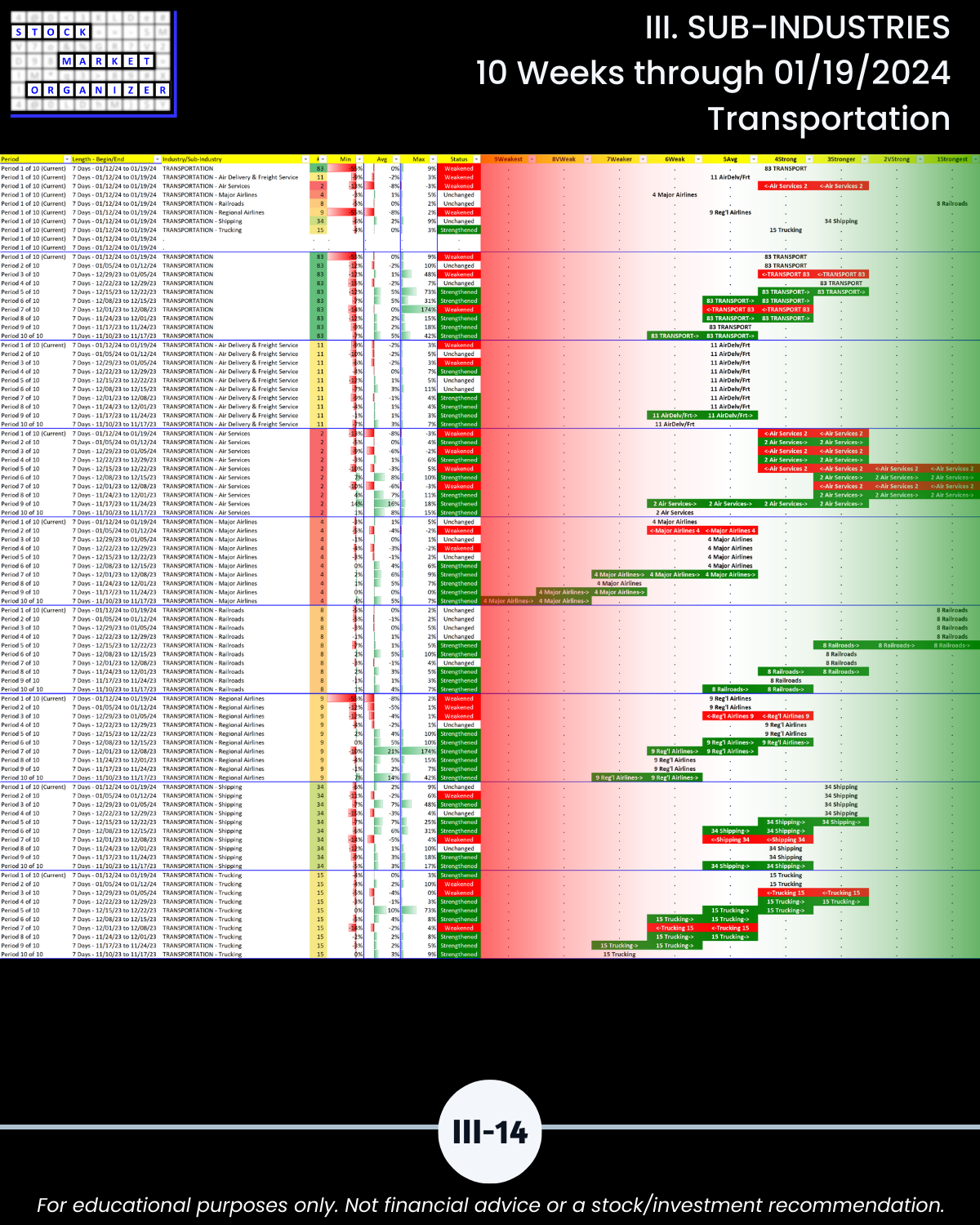

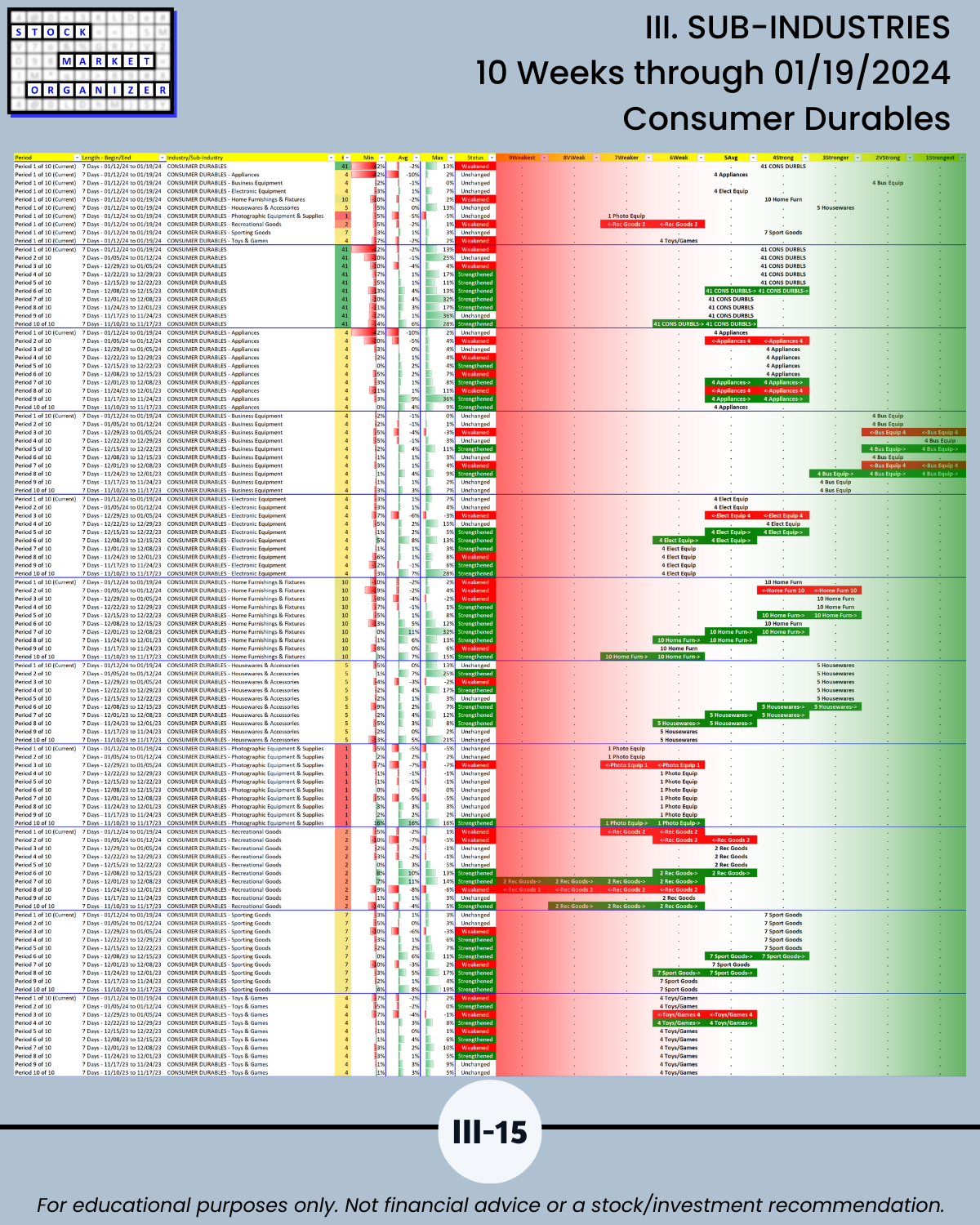

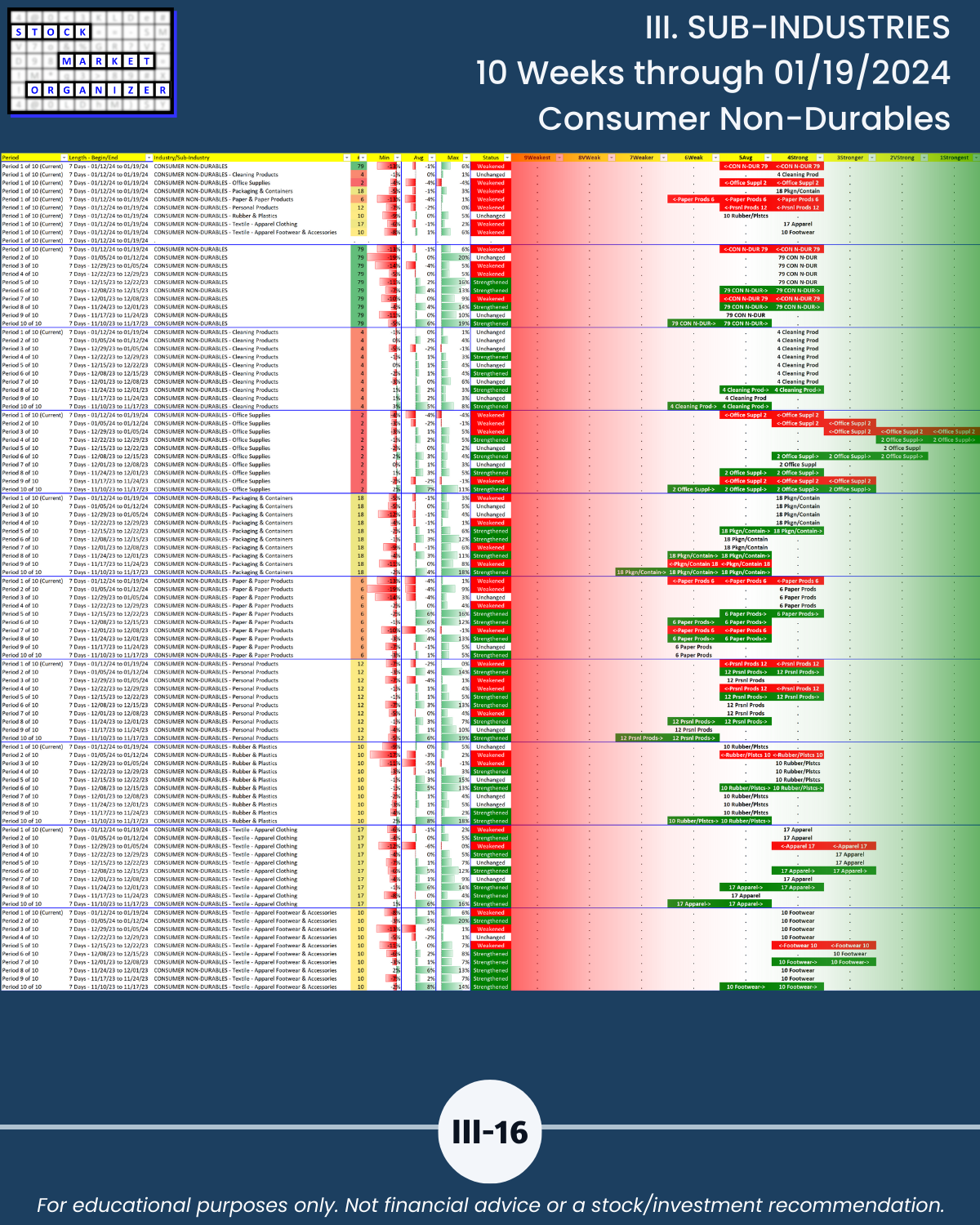

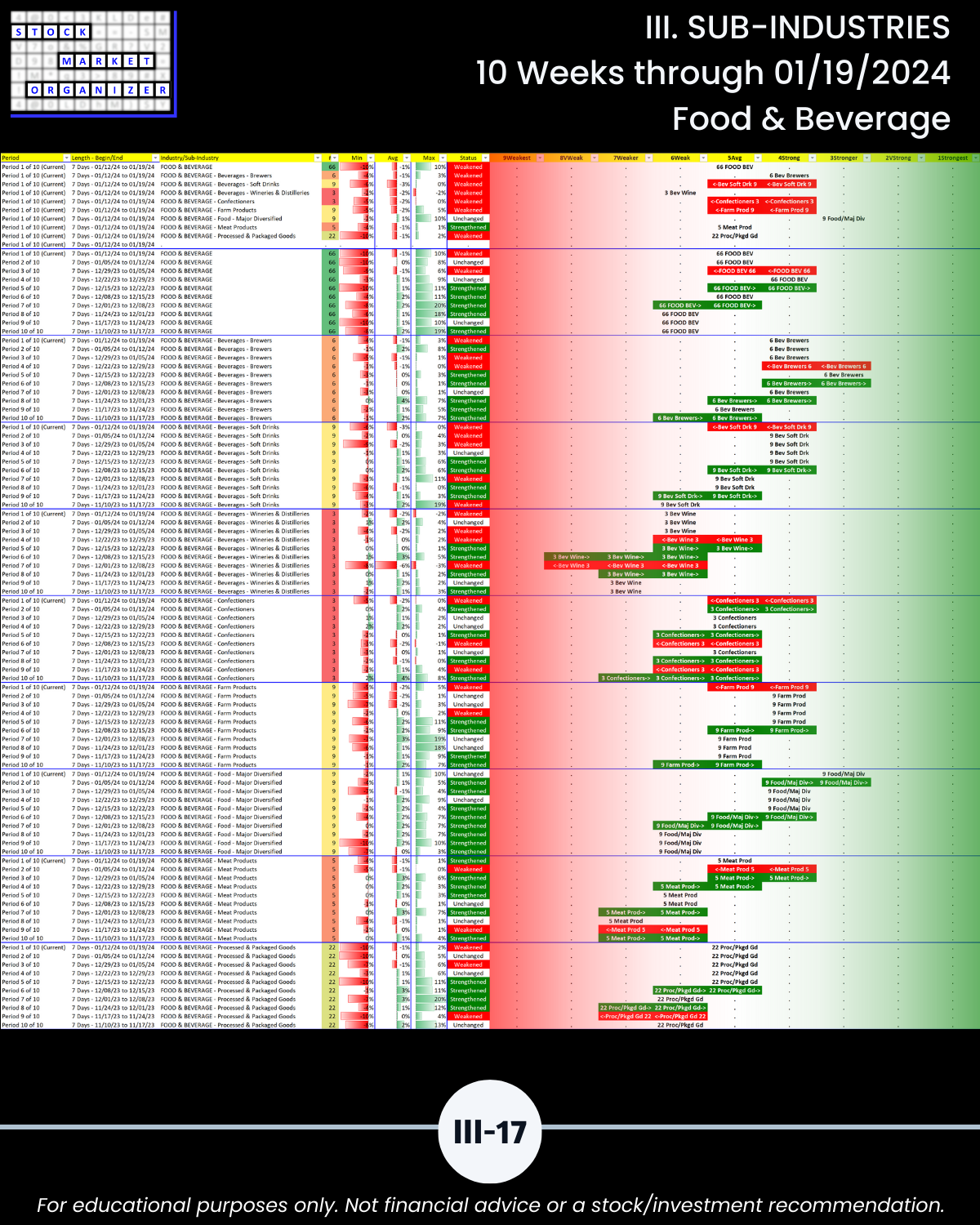

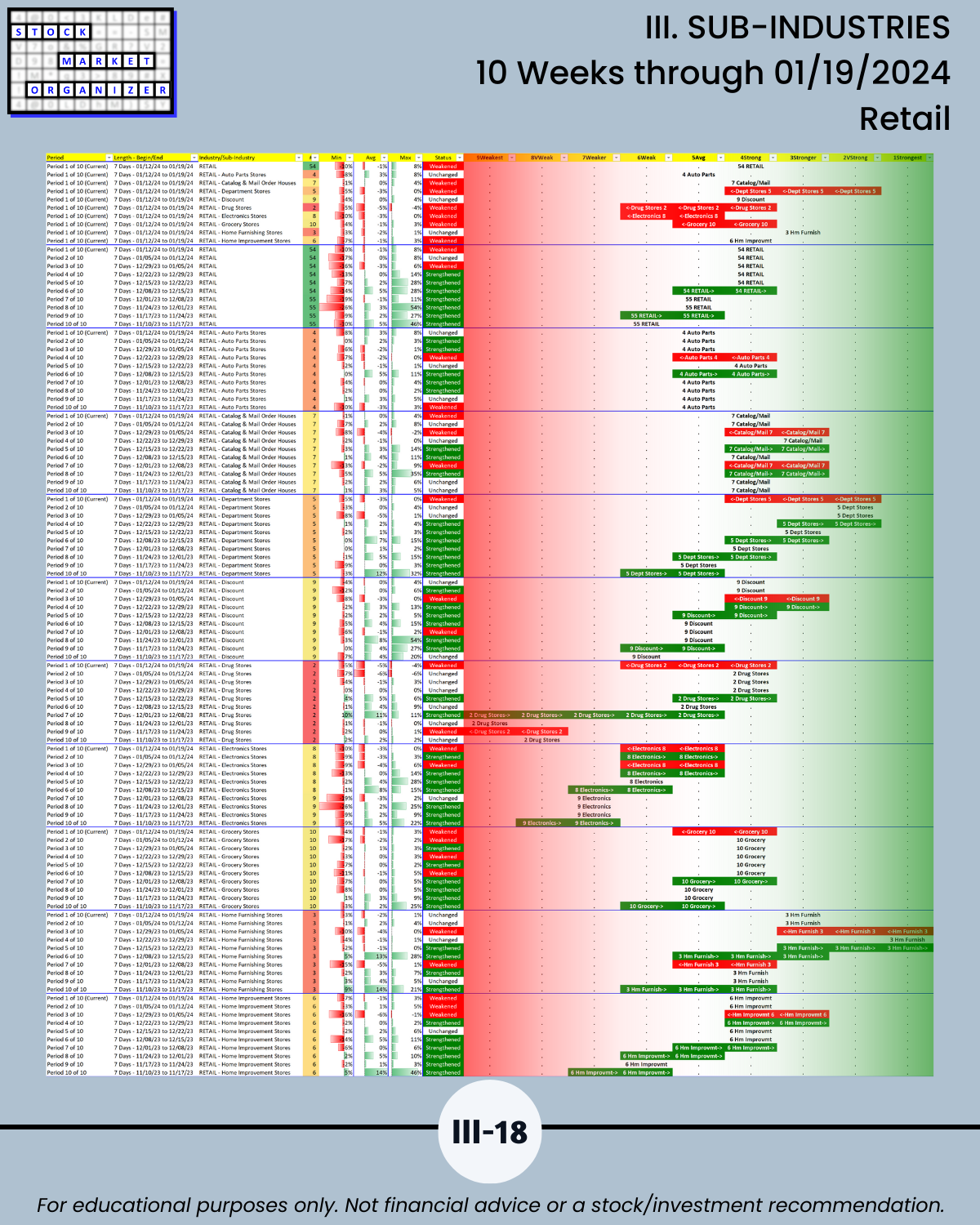

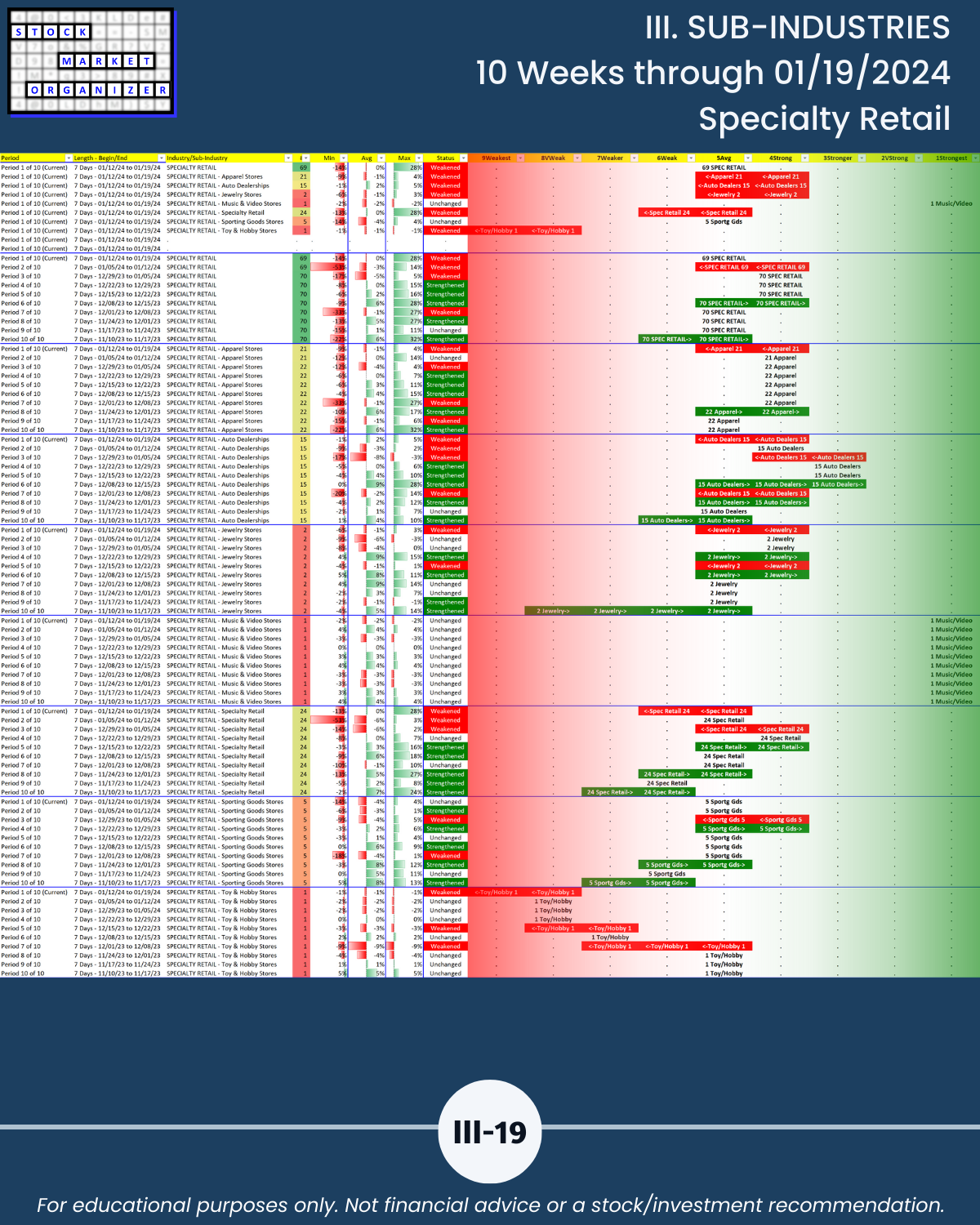

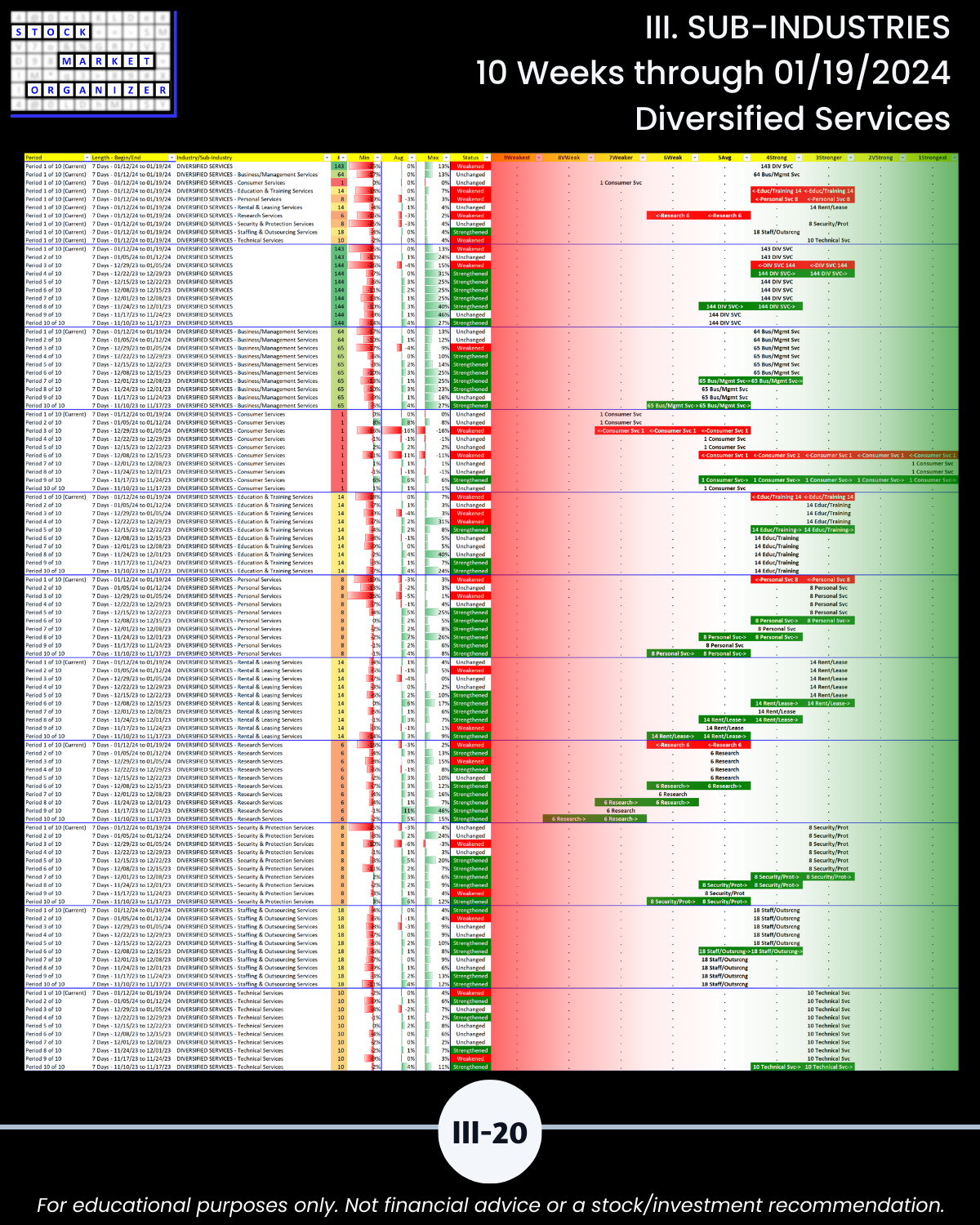

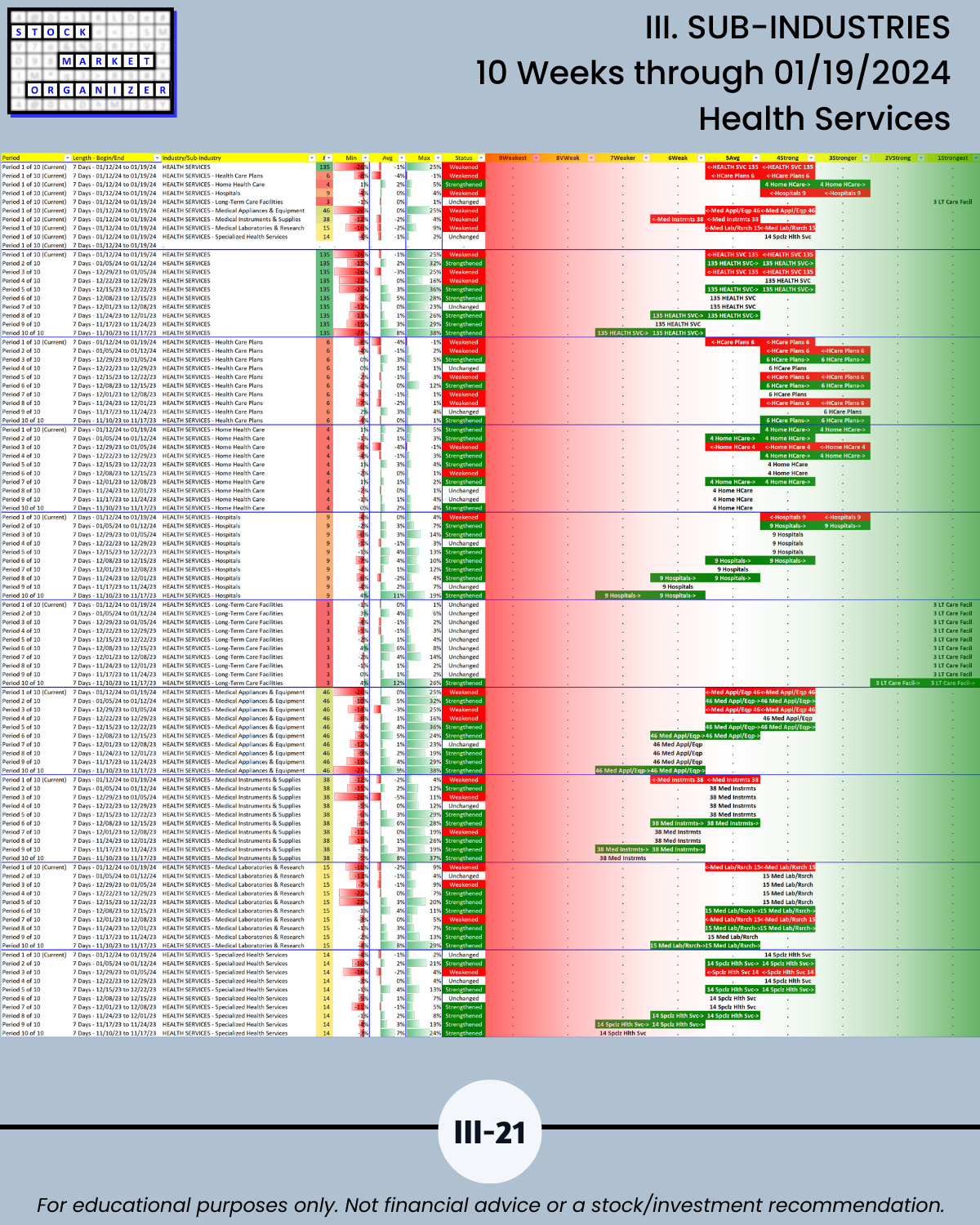

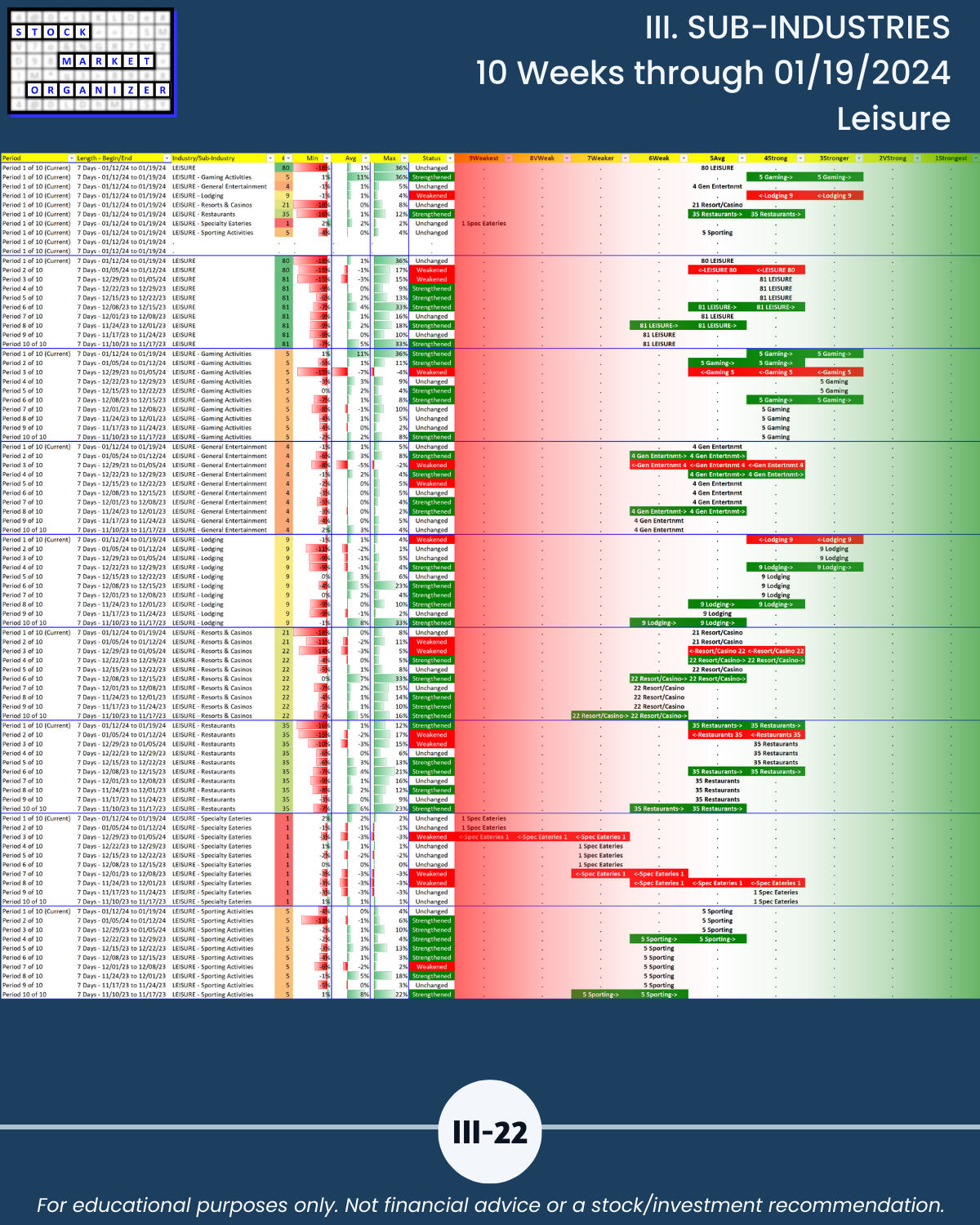

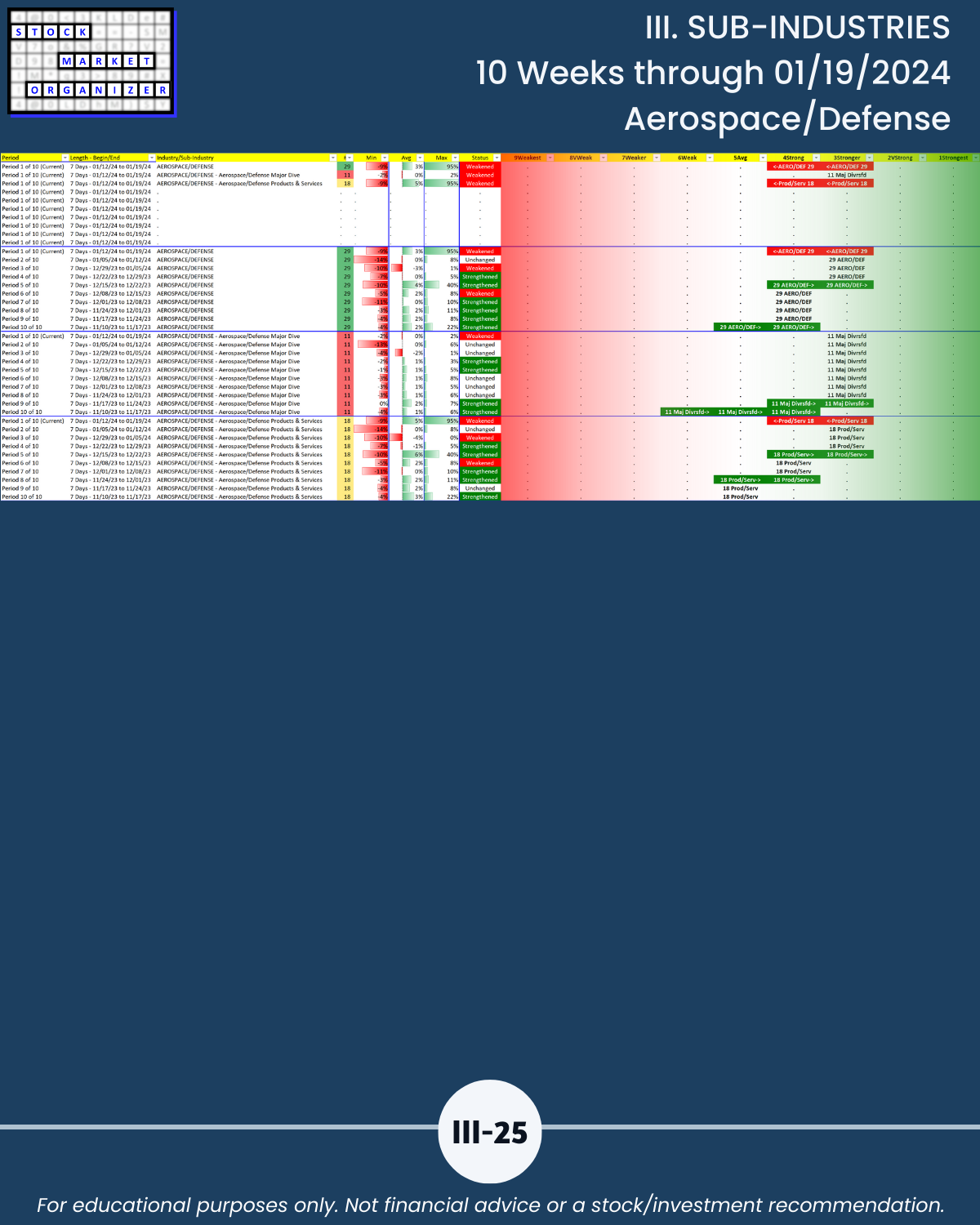

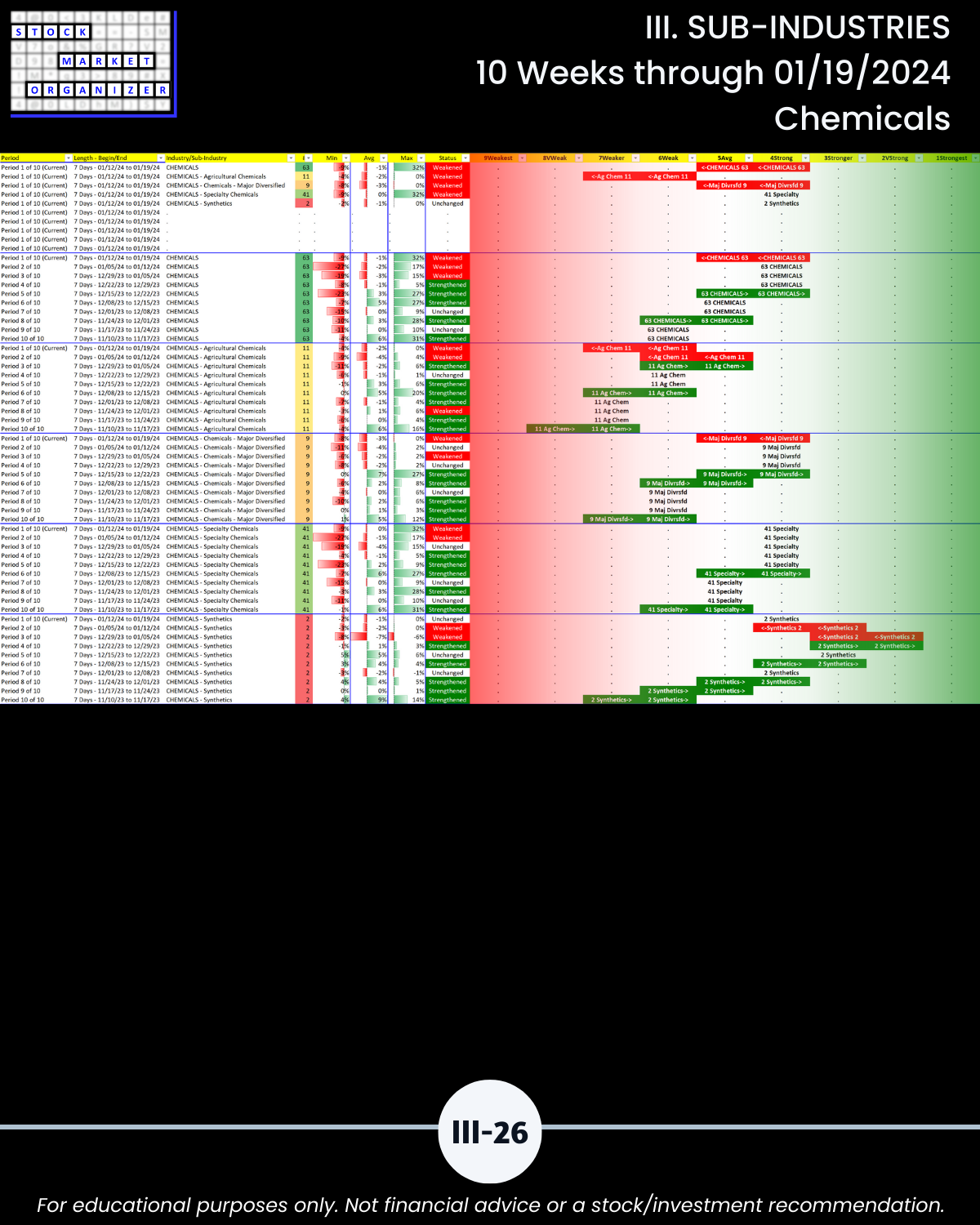

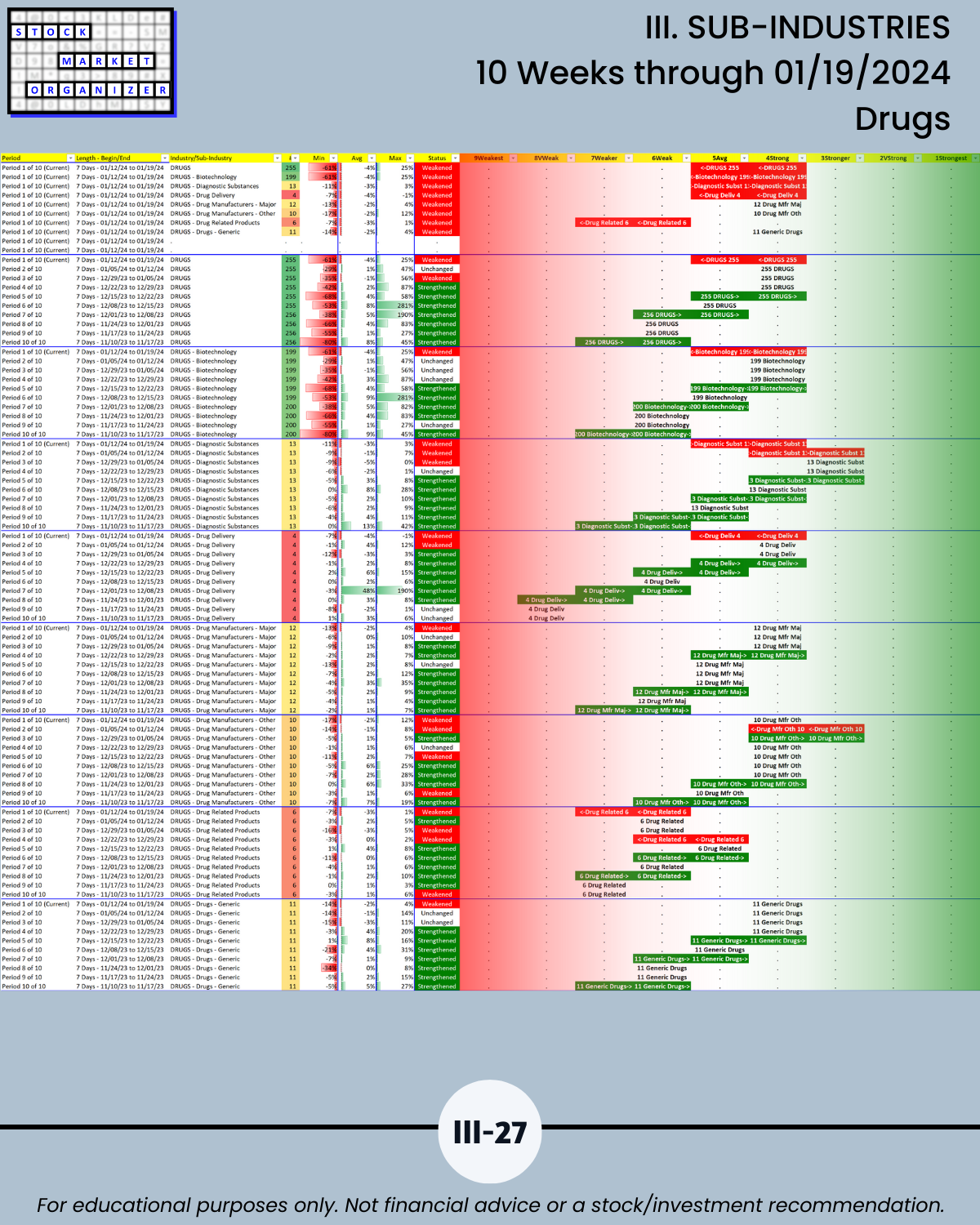

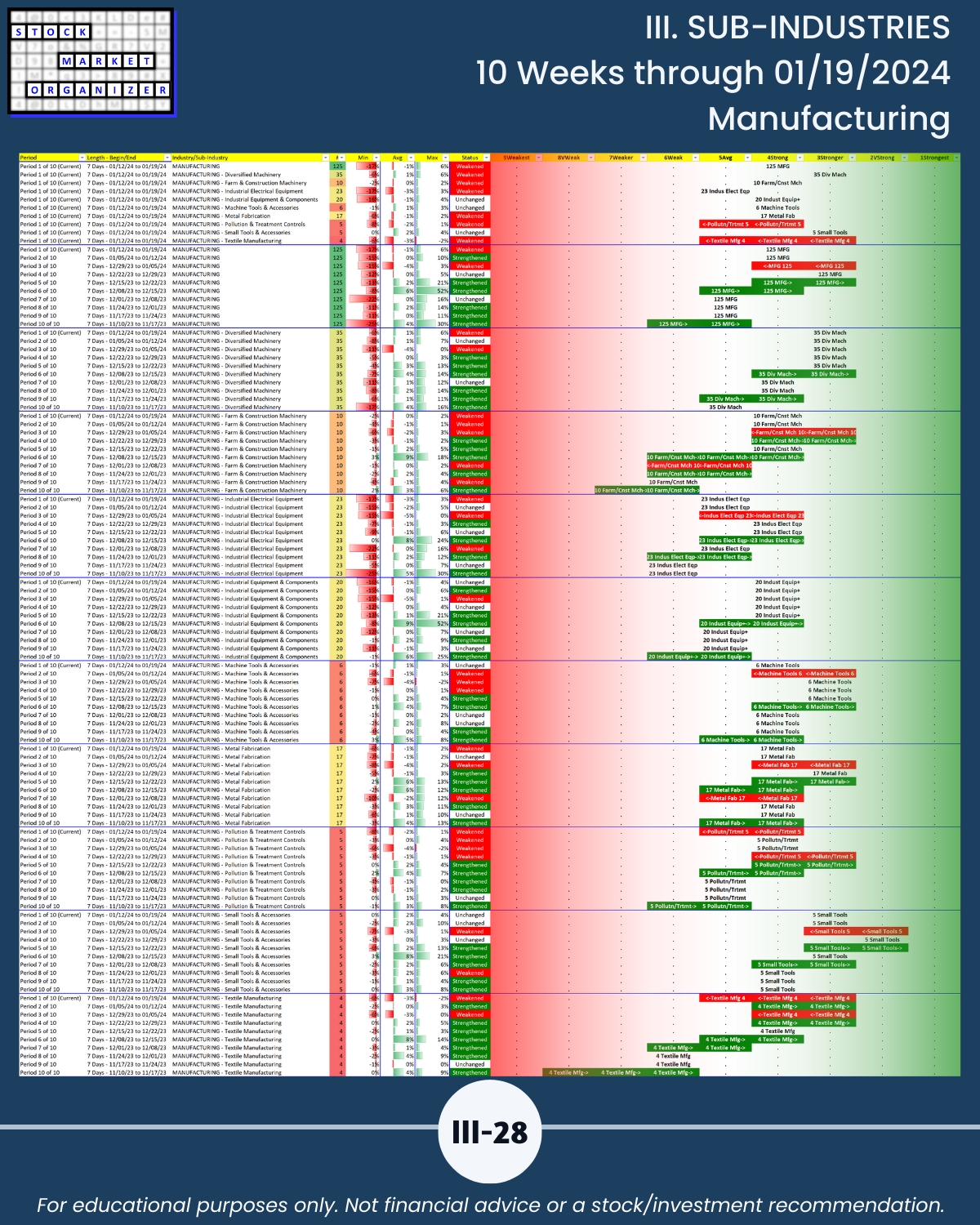

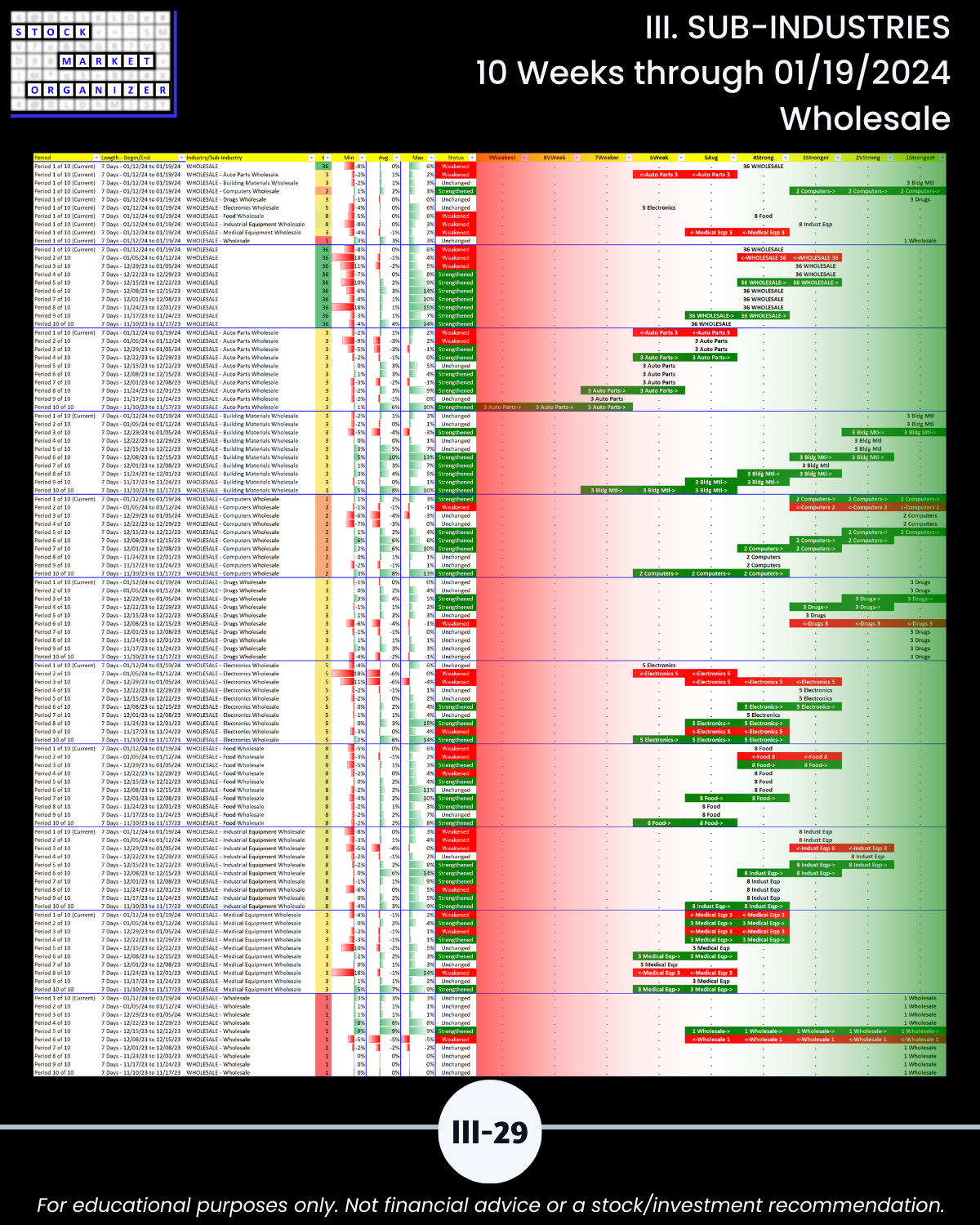

III. 10-Week Individual Sub-Industry Strength Reports

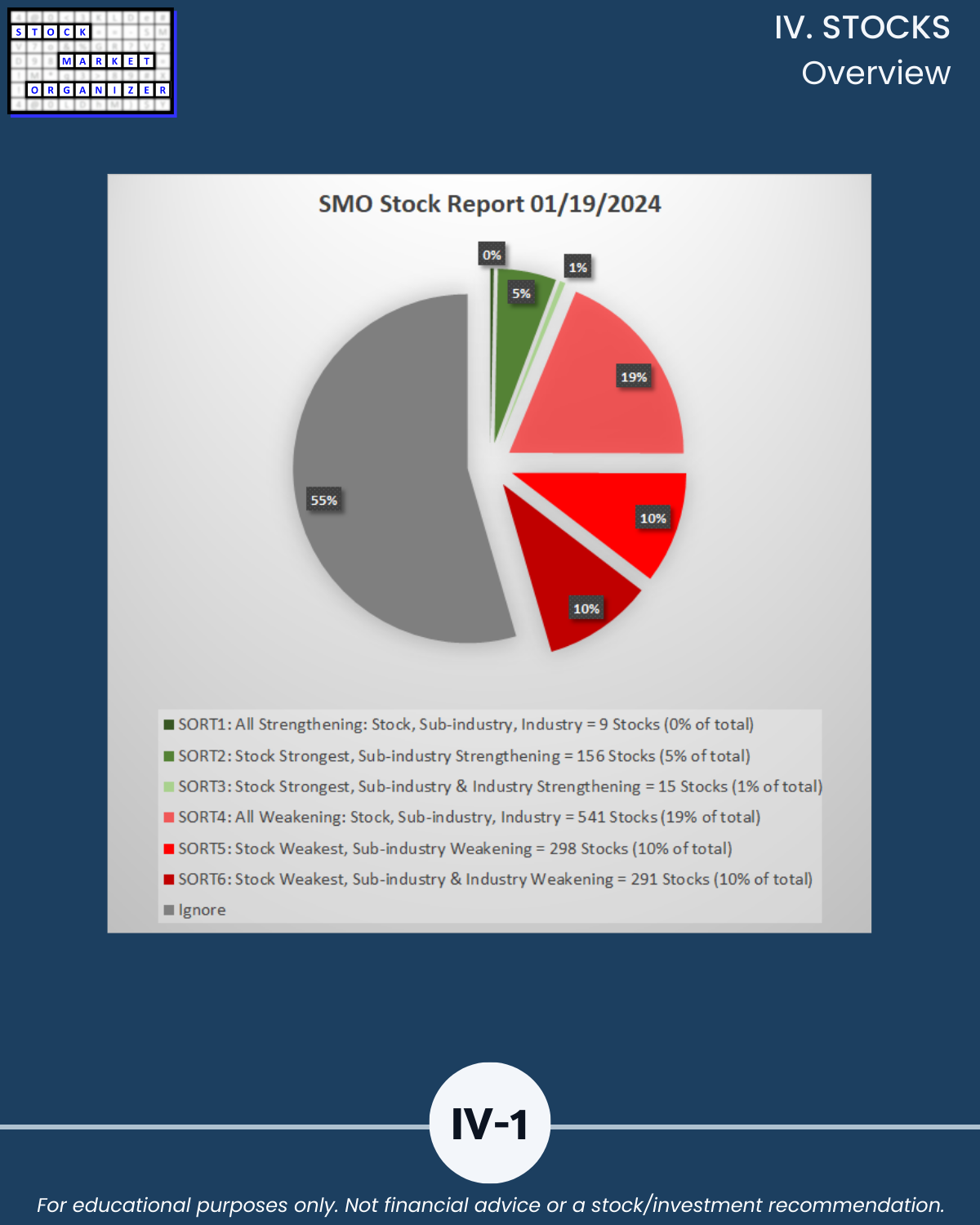

IV. Stock Sorts