S&P500 strength status as of 2023-04-21? (With a Specialty Chemicals digression)

The S&P500 is hugging the midline - not strong and not weak. Average strength, and unchanged over the past week. This is purely a measurement and not a prediction.

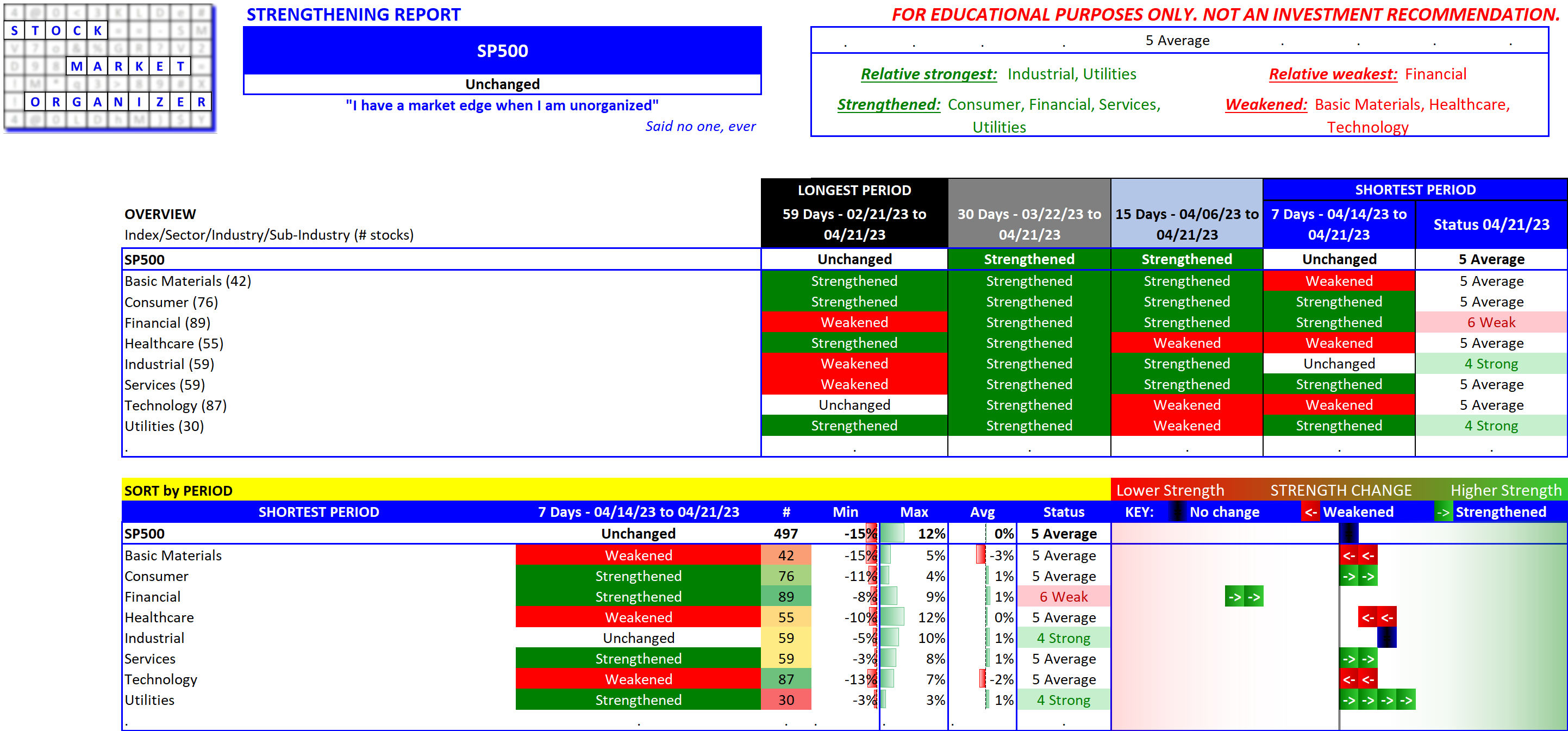

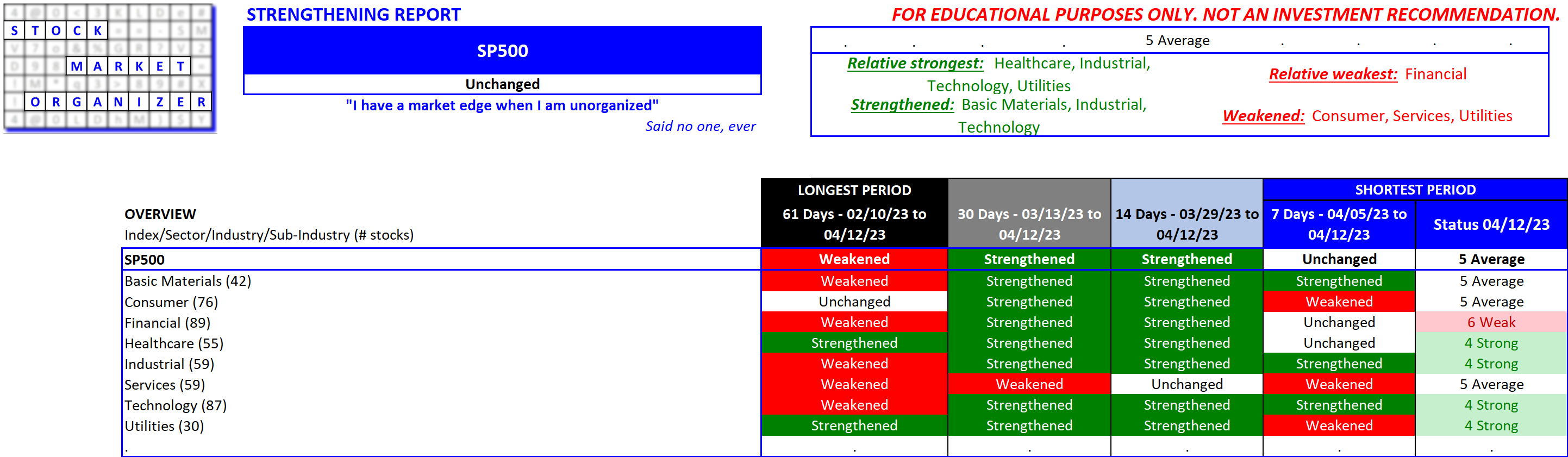

Here is a summary look today vs. April 12:

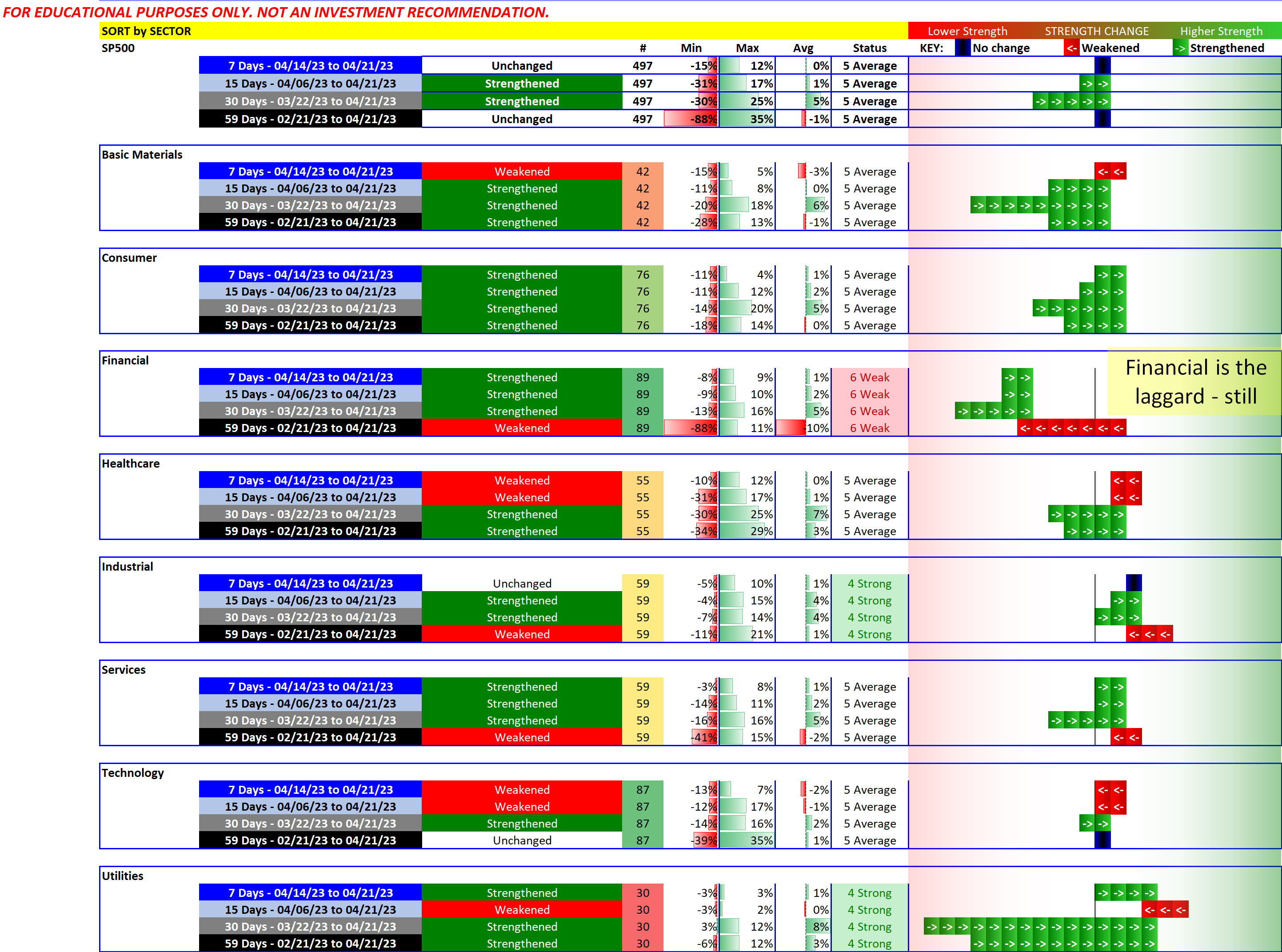

A look by sub-industry

Here's a visual showing the comparative strength of the sub-industries - the notable measurement being the continued lagging of Financial, clearly reflected below.

The Financial sector's eventual strengthening could represent a chance for larger gains as compared to other sectors. Assuming one gets in early into this strengthening, which will be possible only if one is watching closely. For maximum insight it will help to have a detailed Financial strength look at the full sector beyond the 89 financial companies in the S&P 500 index. An example of such a look is available here.

Downloadable report - strongest and weakest stocks focus

The report linked below shows solely the strongest and weakest S&P 500 stocks right now. The strongest are the ones leading the pack. The weakest are those which may be prone to big "pops" as shorts cover and value players jump on potential bargains.

Not many feelings rival - in a bad way - enjoying a huge paper gain only to give it all back. Never overstay your welcome. AKA don't marry a stock you should just date.

A benefit of this strong/weak stock report

This report is helpful because one can identify stocks in the early stages of making important moves.

Examples: Intuitive Surgical/ISRG and Snap On Inc./SNA. These are both now strong, with the latter having made a big move this week (#notastockrecommendation).

Would you have seen these otherwise? And been able to easily put them into context of their competition in their respective industries/sub-industries?

This report is also helpful because one can identify alternative opportunities to weak stocks.

If you own Albemarle/ALB, you already know about Friday's 10% decline. What is your "uncle" point and are you certain there aren't better alternatives SOMEwhere in the stocksphere? Someone focusing on support and resistance might argue this is now at a "support" line (based on the Feb/Mar 2022 low and the Jan 2021 high) and is actually a buy/add to right now. As a Specialty Chemicals company, should one be so wedded to having a Specialty Chemicals stock, perhaps consider PPG Industries/PPG, Linde AG/LIN, and Air Products & Chemicals/APD (again, #notastockrecommendation).