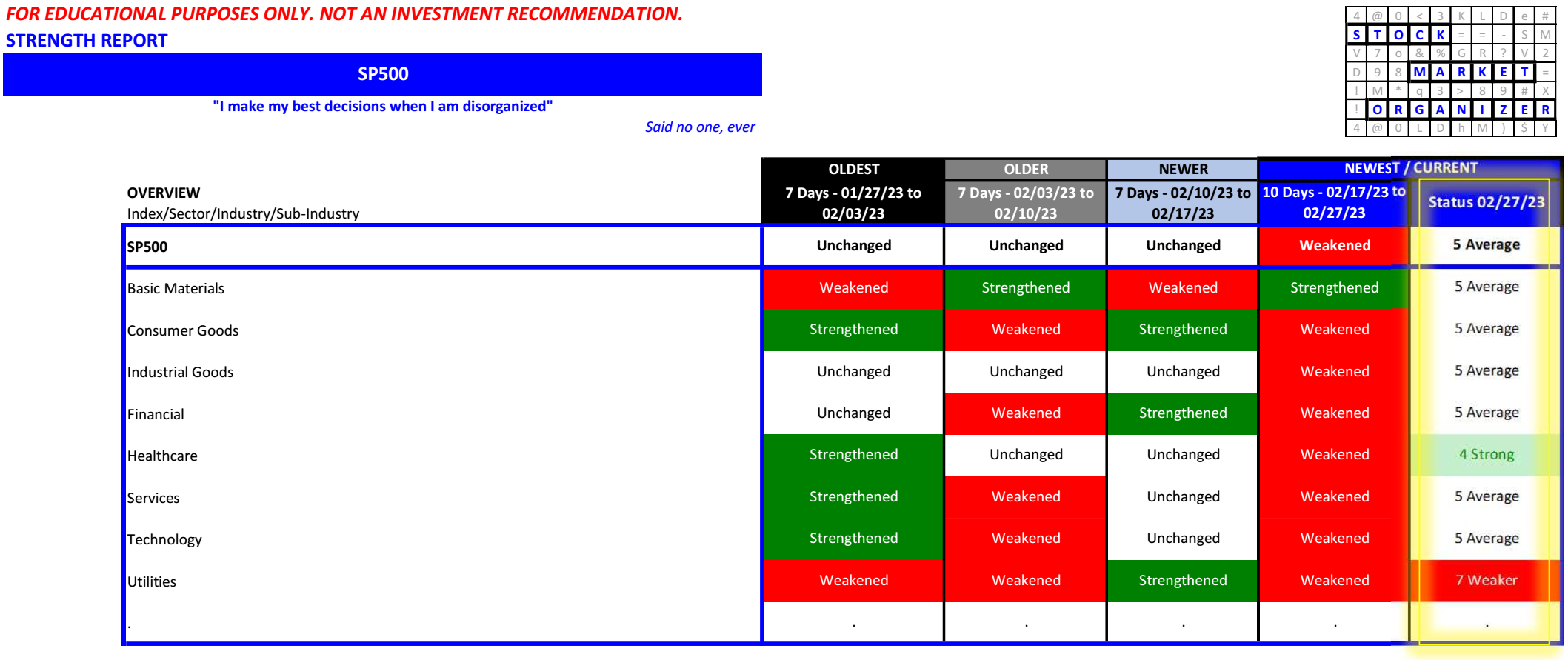

S&P500 2023-02-27 - except for basic materials, all sectors weakened (comparatively decent week for energy stocks)

Market weakened this past week and overall is at Average strength. Neither high nor low. This does not say which direction the market will go from here, nor do I care. Predictions are for others.

What this analysis can tell you is what is currently strengthening and weakening, at the stock, industry, and sub-industry levels, so if you have dry powder you can quickly and confidently target a strengthening stock in a strengthening/strong sub-industry and industry. There are no guaranties this will lead to profitability. But it certainly offers you a better chance than if you are solely focusing on the stock alone.

This is not equally beneficial for all sub-industries and industries. The more homogenous the better (energy, metals, real estate).

A simple example is real estate. Higher interest rates are not good for real estate. Doesn't matter in which sub-industry is a stock (hotel vs. retail vs. some other REIT grouping, property management/development, mortgage investment). Rates up, values down. One can expect a rising rate environment to be unfavorable for the real estate industry. If all sub-industries are strengthening, then the industry is strengthening, and so will be the underlying stocks.

The Bottom Line

Context means everything and to ignore key information such as sub-industry and industry strength is to leave valuable information on the table.

Downloadable report links below

All member stocks report downloadable here: