S&P500 2023-02-17 - strength unchanged past 3 weeks, but... what if you have energy exposure?

The fastest and most meaningful slice and dice of the S&P500 you're going to see. Know where to look, when, and why.

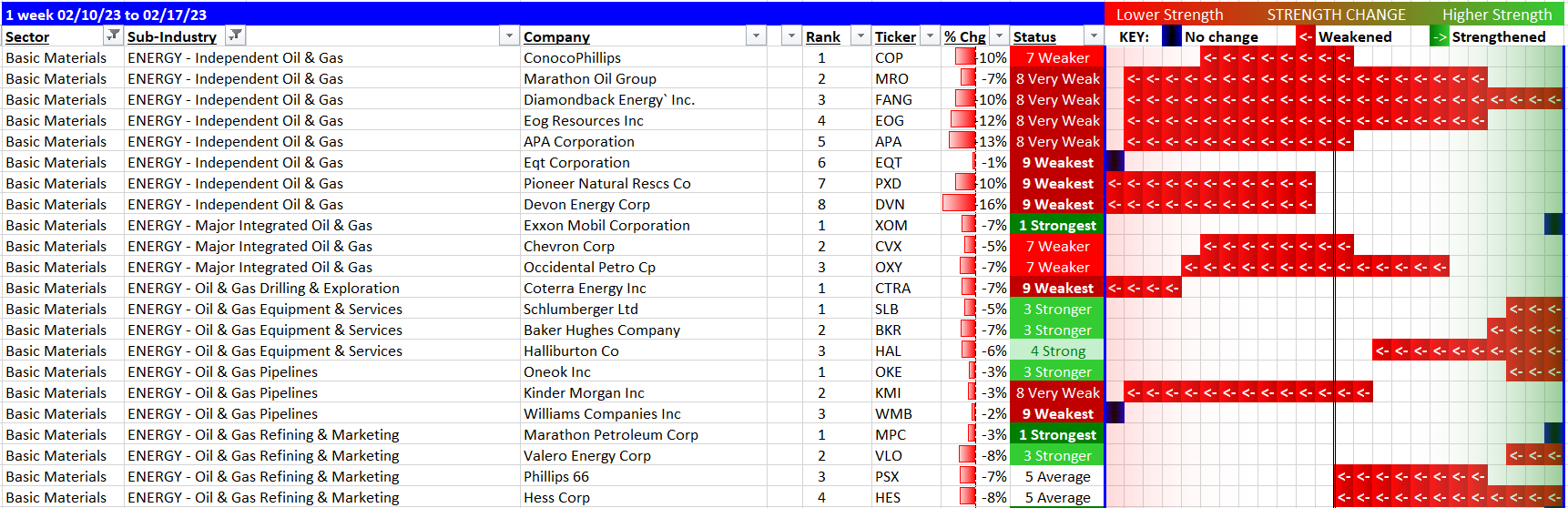

Can you objectively and consistently measure in what sectors, industries, and sub-industries there was weakening and strengthening in the S&P500? If not, look below for one way to do this. Energy:

So many questions!

The caption to the photo above raises a good one. Here are a few more as quick food for thought - generated simply by taking a quick look at the table.

1. Why has XOM held up? Better to swap out OXY for XOM, or instead pick up CVX?

2. Why did DVN and APA have such bad weeks? Bigger picture, what is wrong in Independent Oil & Gas?

3. Will MPC stay comparatively strong as VLO, PSX, and HES head in the wrong direction?

4. These are just the energy stocks in the S&P500. Would a look at all energy stocks be enlightening, either regarding the above questions or pertaining to new questions that could be generated?

Downloadable report links below

All member stocks report downloadable here:

Strongest:

Weakest: