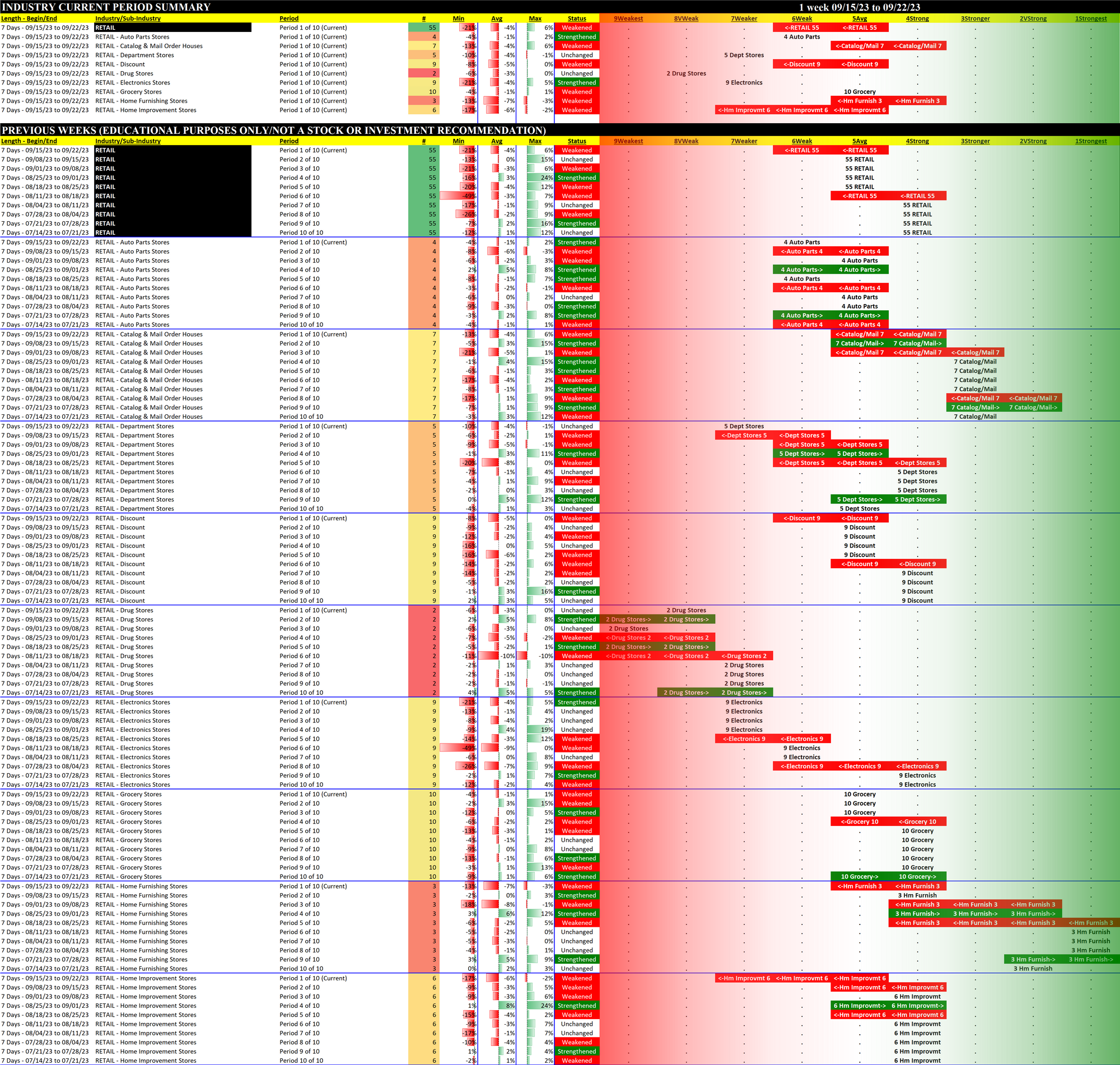

Retail 2023-09-22: DOWN -1 to WEAK strength rating (6th strongest of 9 levels), previous move was also DOWN

TABLE OF CONTENTS

- INDUSTRY OVERVIEW

1A. Performance

1B. Background - SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

2B. Sub-Industries 10-Week Strengthening Analysis

2C. Stocks 1 Week Strongest and Weakest - STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week

1. INDUSTRY OVERVIEW

1A. Performance

Past 10 Weeks Strengthening/Weakening week-by-week, per the following chart:

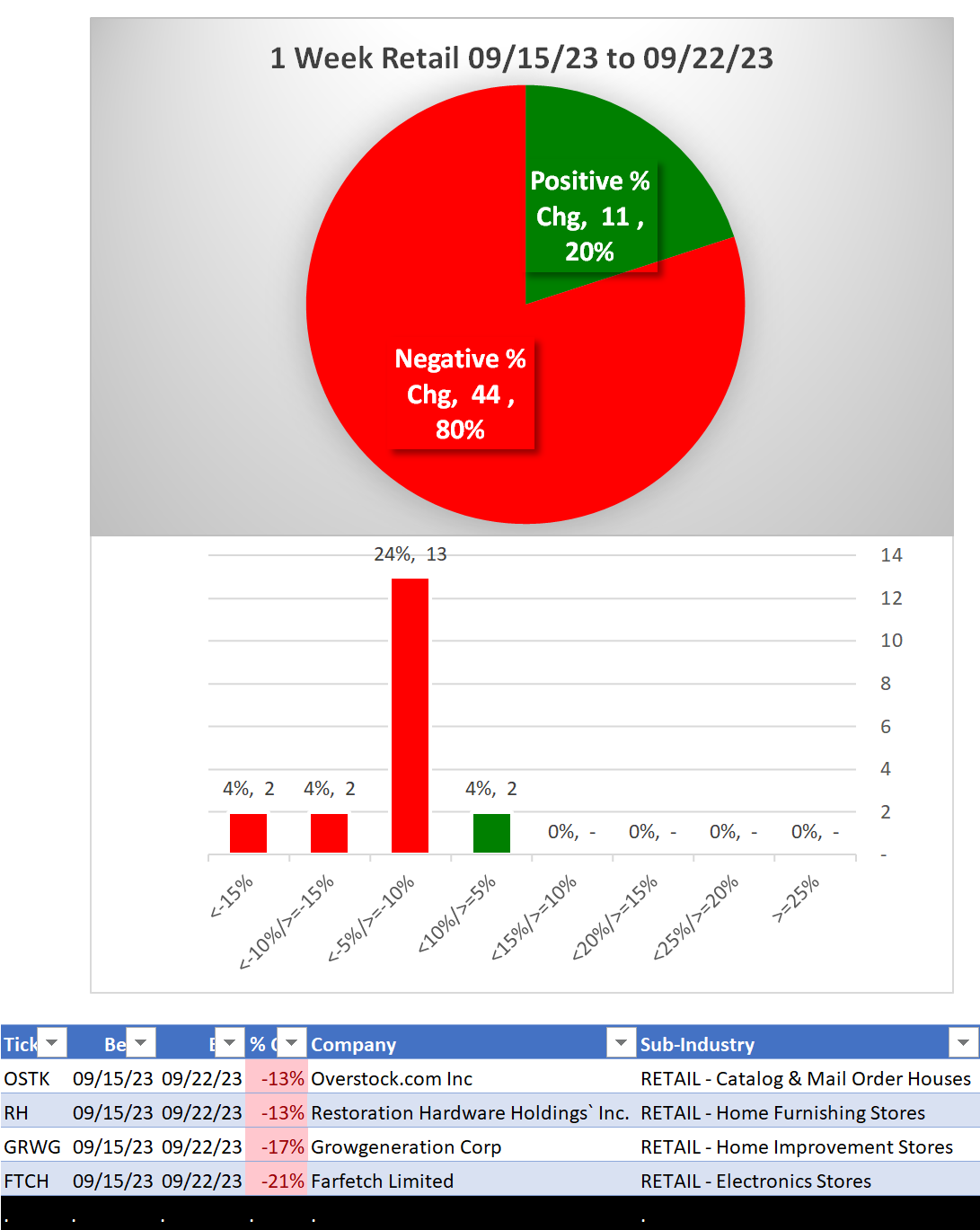

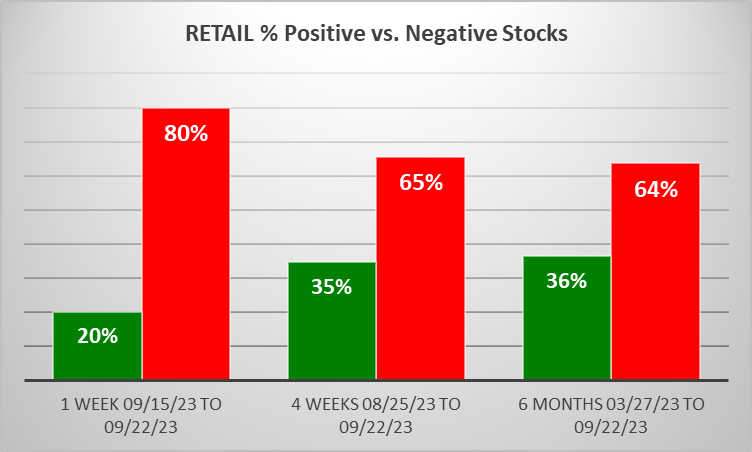

WEAKENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is LOWER than both 4 weeks and 6 Months, per the following chart:

Comment:

- Weakest stocks are currently 42% of total.

1B. Background

Largest of 9 sub-industries (55 stocks, average 6):

- Grocery Stores (10 stocks)

- Discount (9 stocks)

- Electronics Stores (9 stocks)

- Catalog & Mail Order Houses (7 stocks)

Top 10 by Market Capitalization:

AMZN/Amazon.Com Inc, WMT/Walmart Inc, HD/Home Depot Inc, COST/Costco Wholesale Corp, LOW/Lowe's Companies Inc, TJX/TJX Companies Inc, CVS/CVS Health Corporation, MELI/MercadoLibre Inc, TGT/Target Corporation, ORLY/O'reilly Automotive Inc

2. SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

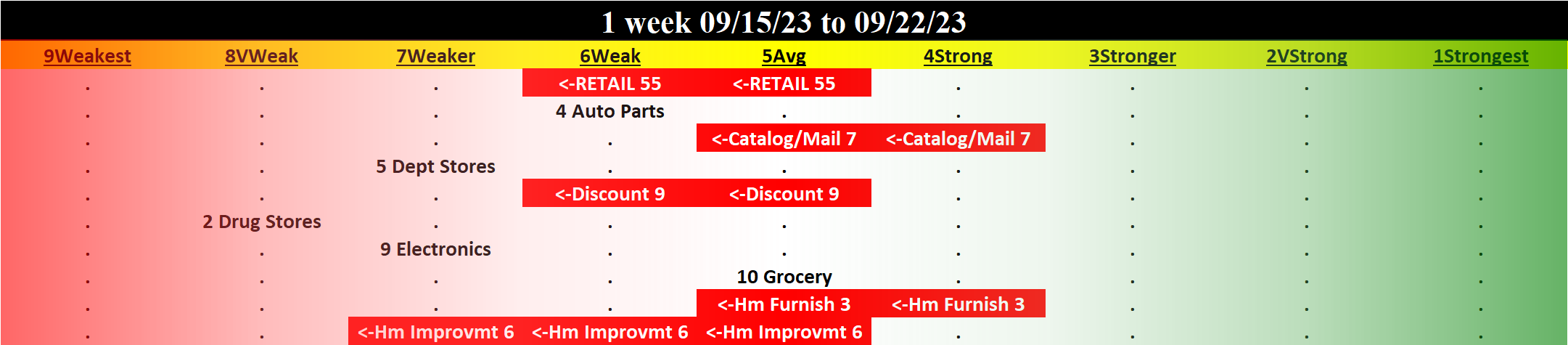

Strengthened: 0/9 sub-industries

Weakened: 4/9 sub-industries

STRONGEST at Average rating/5th strongest of 9 levels:

- Catalog & Mail Order Houses (7 stocks)

- Grocery Stores (10 stocks)

- Home Furnishing Stores (3 stocks)

WEAKEST at Very Weak rating/8th strongest of 9 levels:

- Drug Stores (2 stocks)

2B. Sub-Industries 10-Week Strengthening Analysis

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

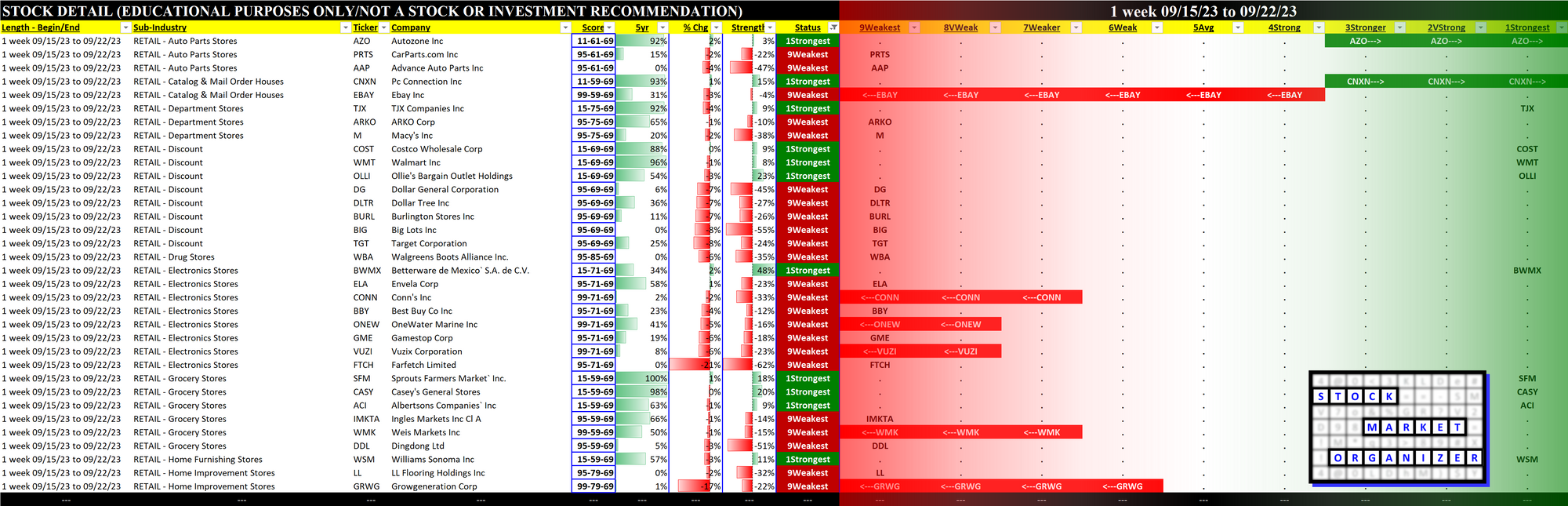

2C. Stocks 1 Week Strongest and Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

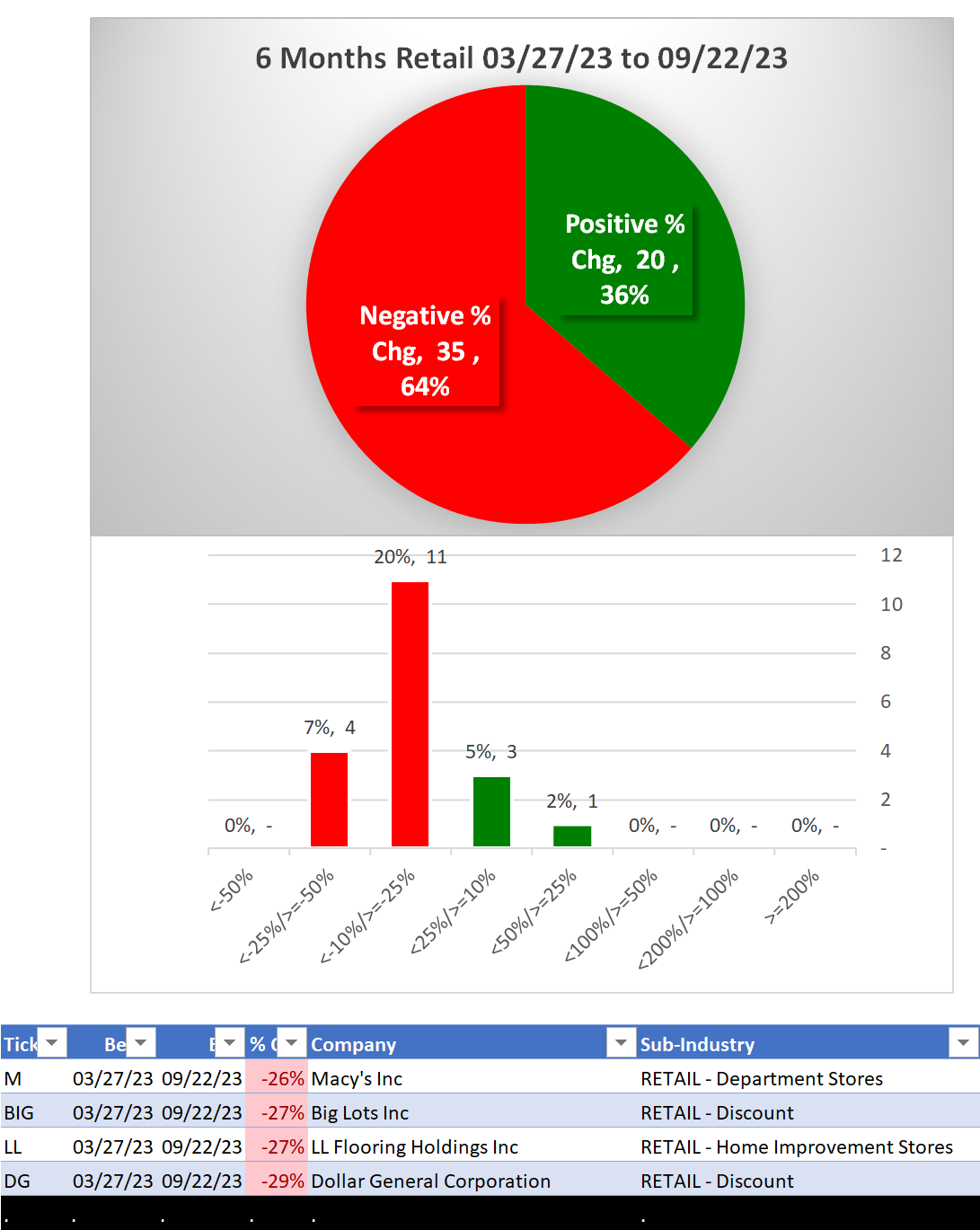

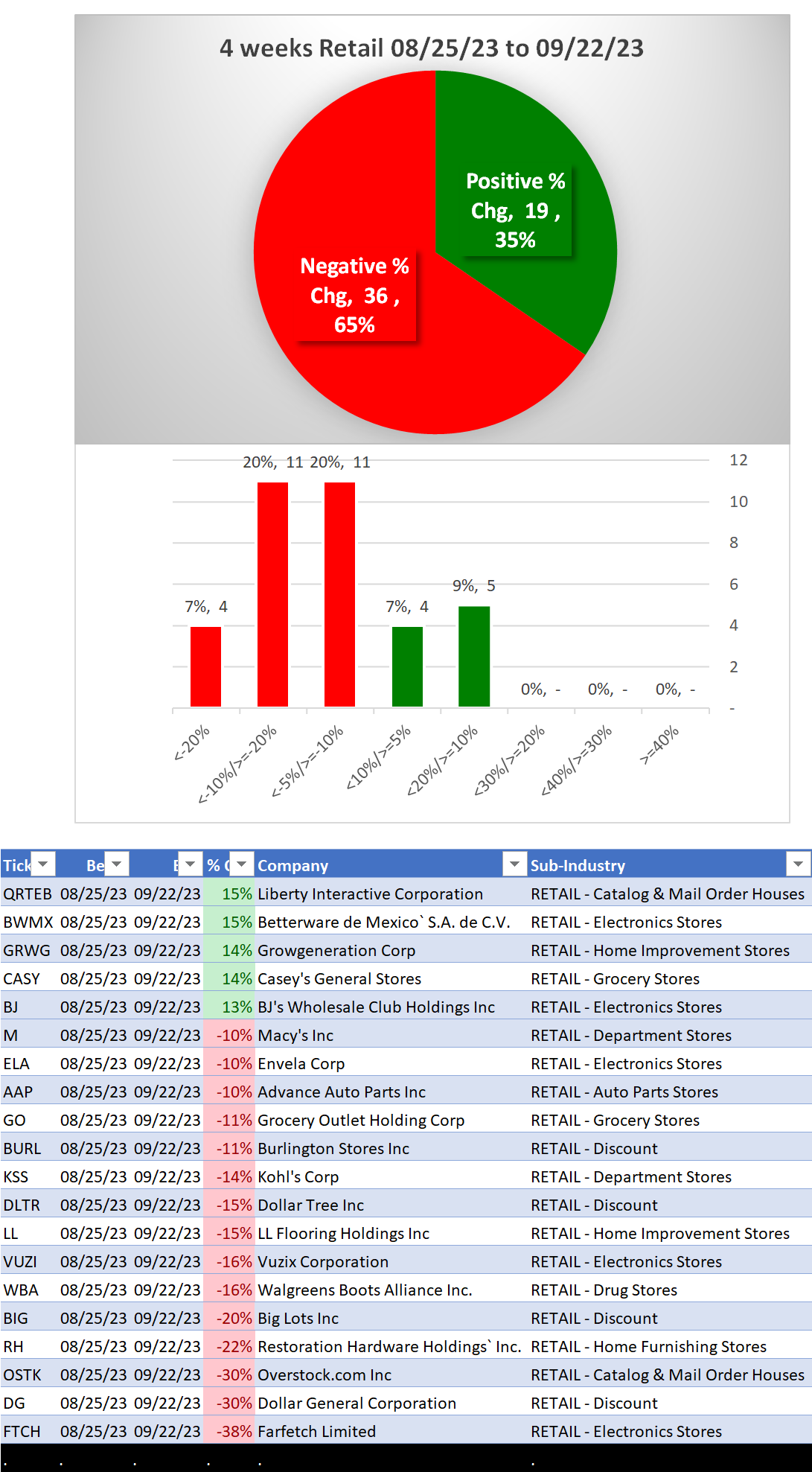

3. STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week