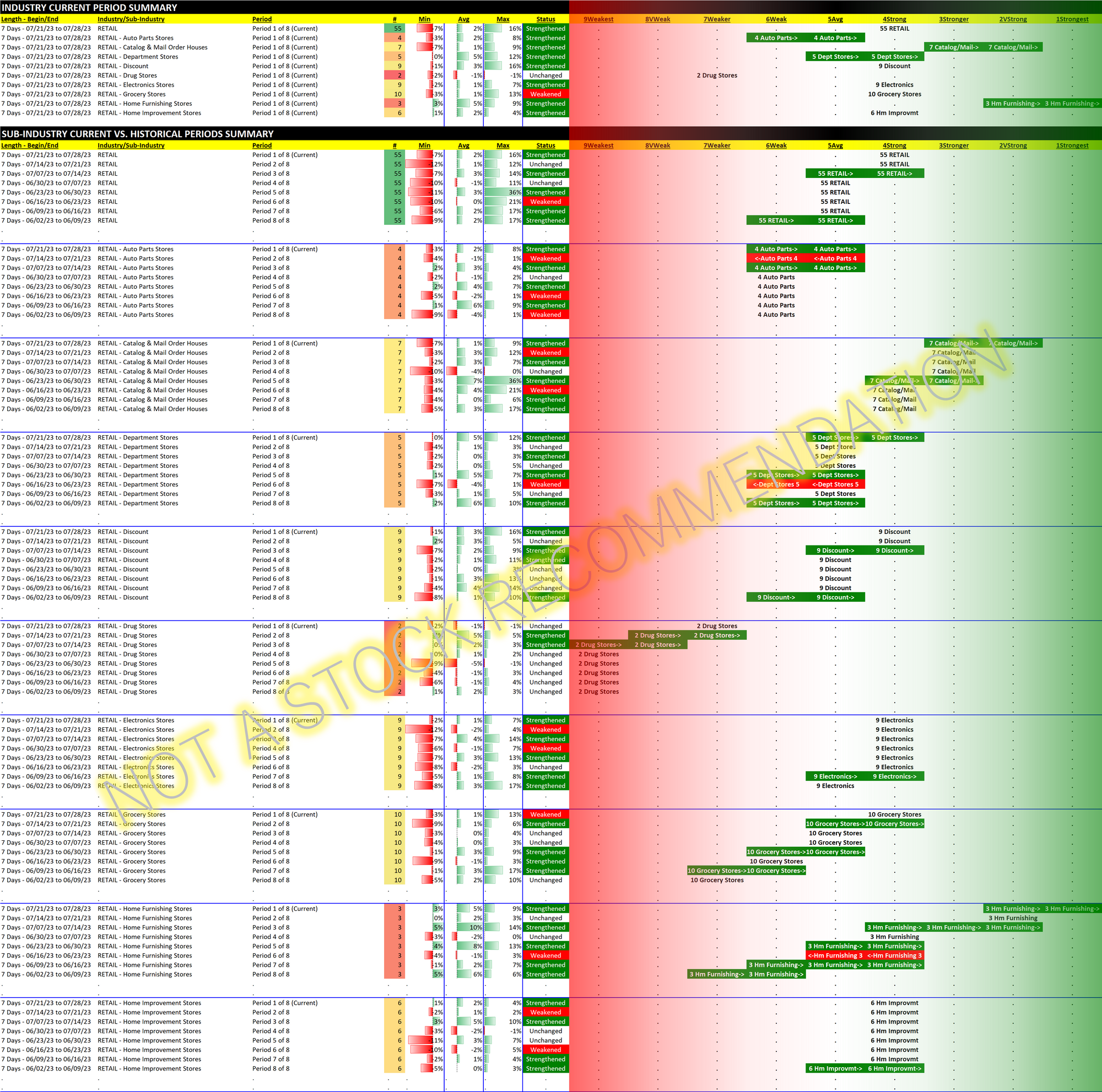

Retail 2023-07-28: Unchanged at "Strong" strength rating (4th strongest of 9 levels), previous move was up

Here's my previous look at Retail.

In that previous look I focused on Grocery Stores, which is the largest sub-industry in this industry with 10 stocks. Below in "a closer look" I focus on the next-largest sub-industry Discount/Variety Stores which includes COST/Costco, WMT/Walmart, and TGT/Target Corporation.

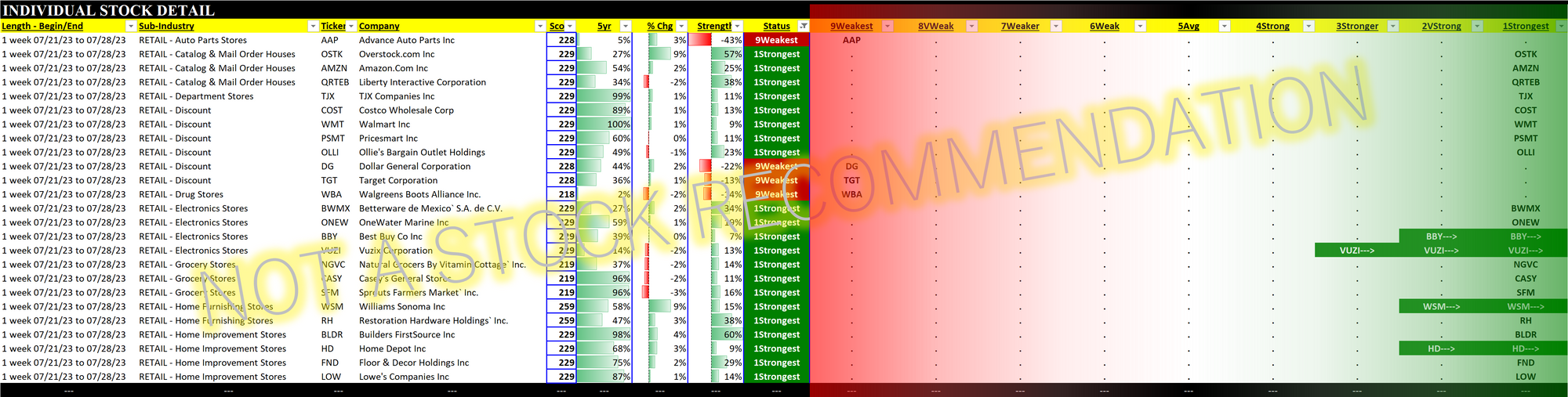

Like Specialty Retail, Retail is also rated Strong (4th strongest of 9 levels). As seen below in "Leaders and Laggards" the industry has 21 Strongest stocks and 4 Weakest stocks. If you own AAP/Advance Auto Parts, DG/Dollar General, Target, and WBA/Walgreen's Boots Alliance (a Dow 30 Industrials member), you might want to consider if there are other better alternatives. It is entirely possible they could enjoy oversold pops as (perhaps) the market rally continues, and as the "we're headed for a soft landing!" narrative gains traction. It is also possible that they could be dead money for a while. If they haven't gained by now, what would be the impetus for gains going forward?

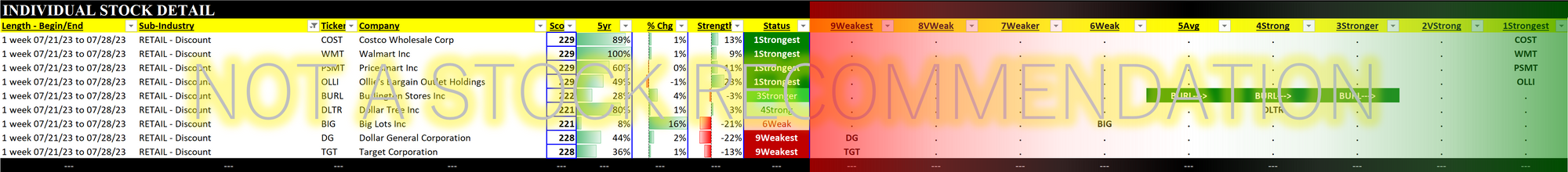

Discount/Variety Stores - a closer look

Discount/Variety Stores is rated Strong (4th strongest of 9 levels) with the four currently rated Strongest being Costco, Walmart, PSMT/Pricesmart, and OLLI/Ollie's Bargain Outlet Holdings. Ollie's has enjoyed a stellar 53% YTD return, with Pricesmart up 29%, Costco +23%, and Walmart +13%.

I would think DLTR/Dollar Tree and Dollar General would be similarly rated, but Dollar Tree is stronger between the two and is +8% YTD while Dollar General has fallen 31% this year. Why? Answer: my typical "I don't know, and I don't care."

If I were to pick between the two I'd prefer Dollar Tree, but neither is of interest. One COULD take a position in one or the other, but - as I like to also say - just because you can does not mean you should. Besides the fact neither of these seem to be big movers, I have no compelling edge I can deploy with regard to either of these stocks. So I would ignore them.

If I have no edge, I have no interest.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.