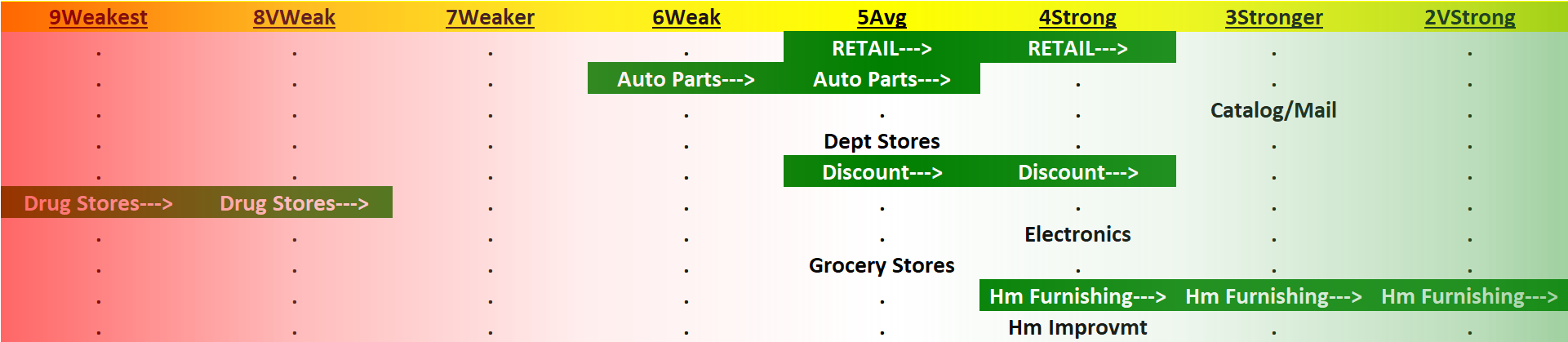

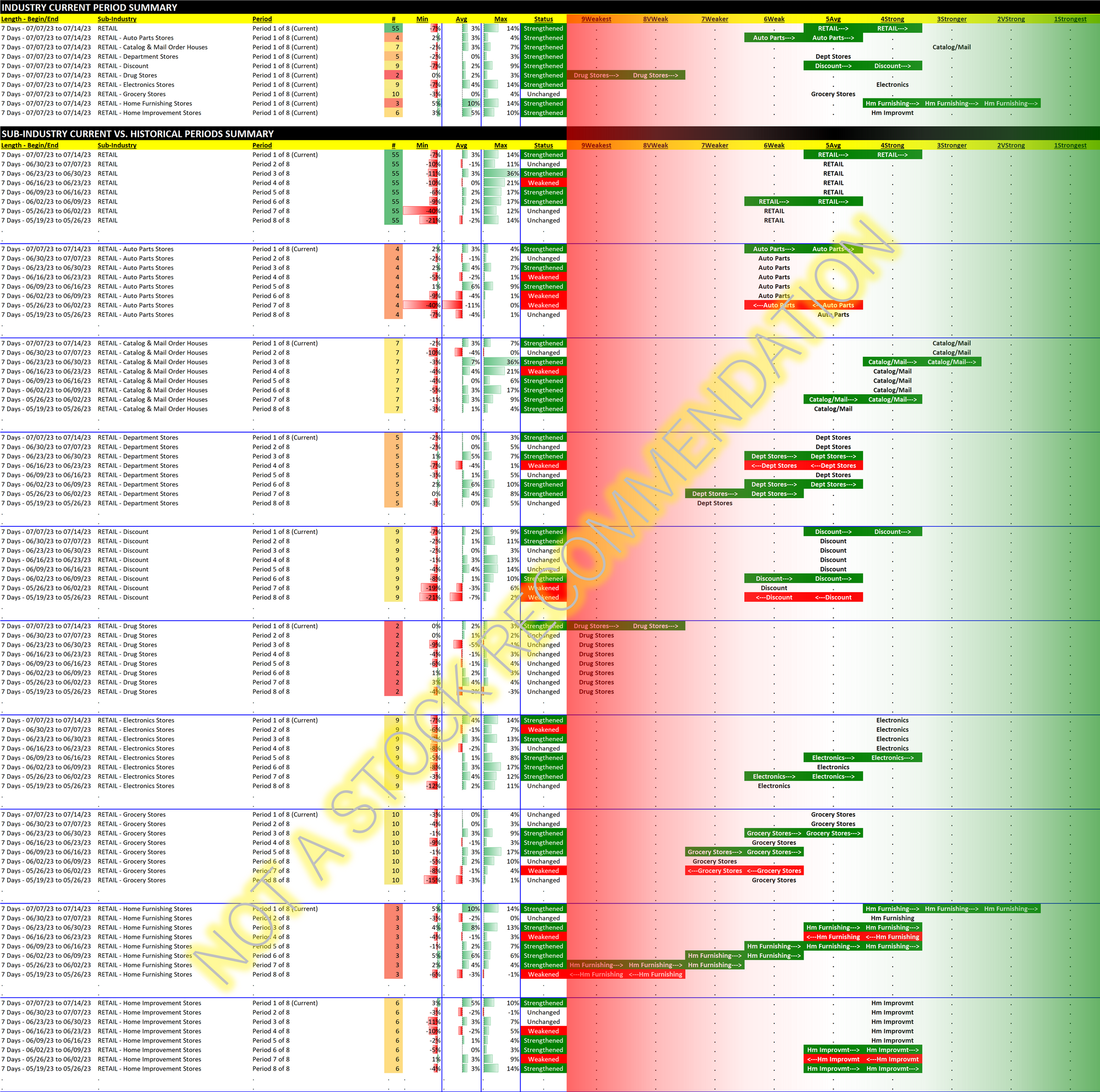

Retail 2023-07-14: +1 to "Strong" strength rating (4th strongest of 9 levels), previous move was also up

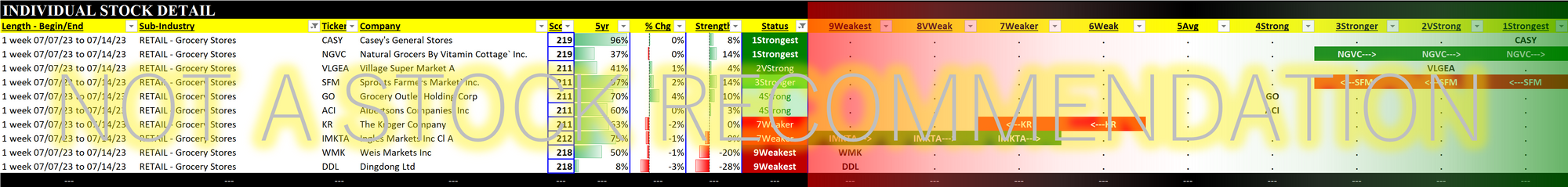

The largest sub-industry is Grocery Stores which has strengthened over the past five weeks but which still does not have a consensus of strength or weakness (see "A Closer Look" below).

Grocery Stores - a closer look

Highlighting this as there is no consensus among grocery stores and it's a good reason to point out DDL/Dingdong. As CVNA/Carvana was rising more than 800% this stock was falling 41%.

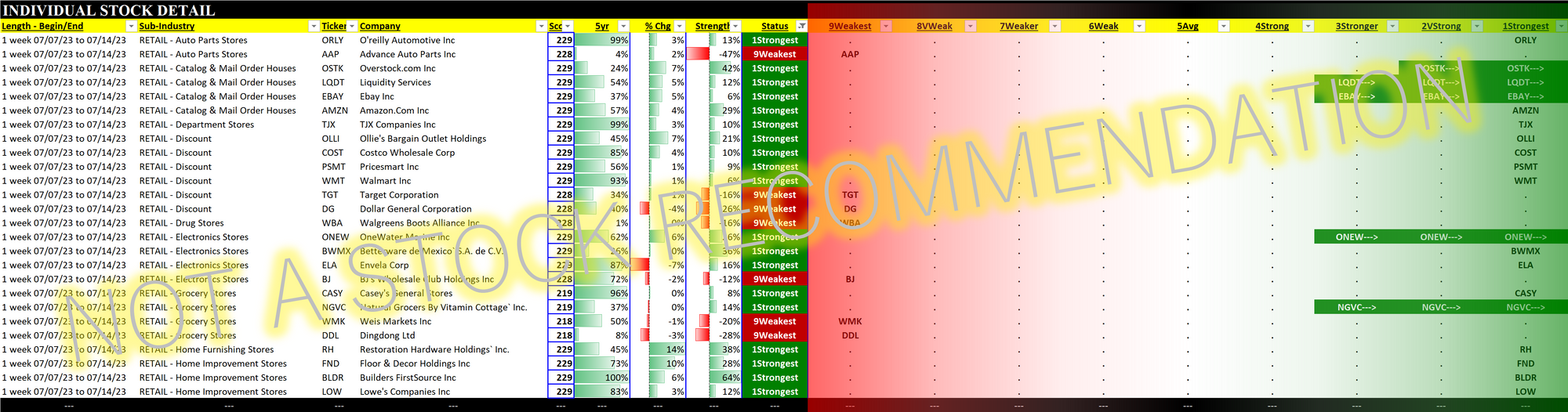

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.