Real Estate strength status as of 2023-05-11?

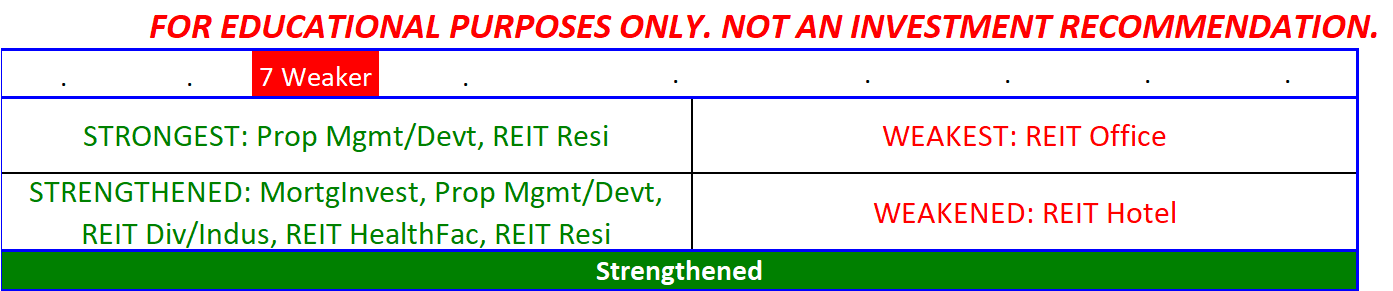

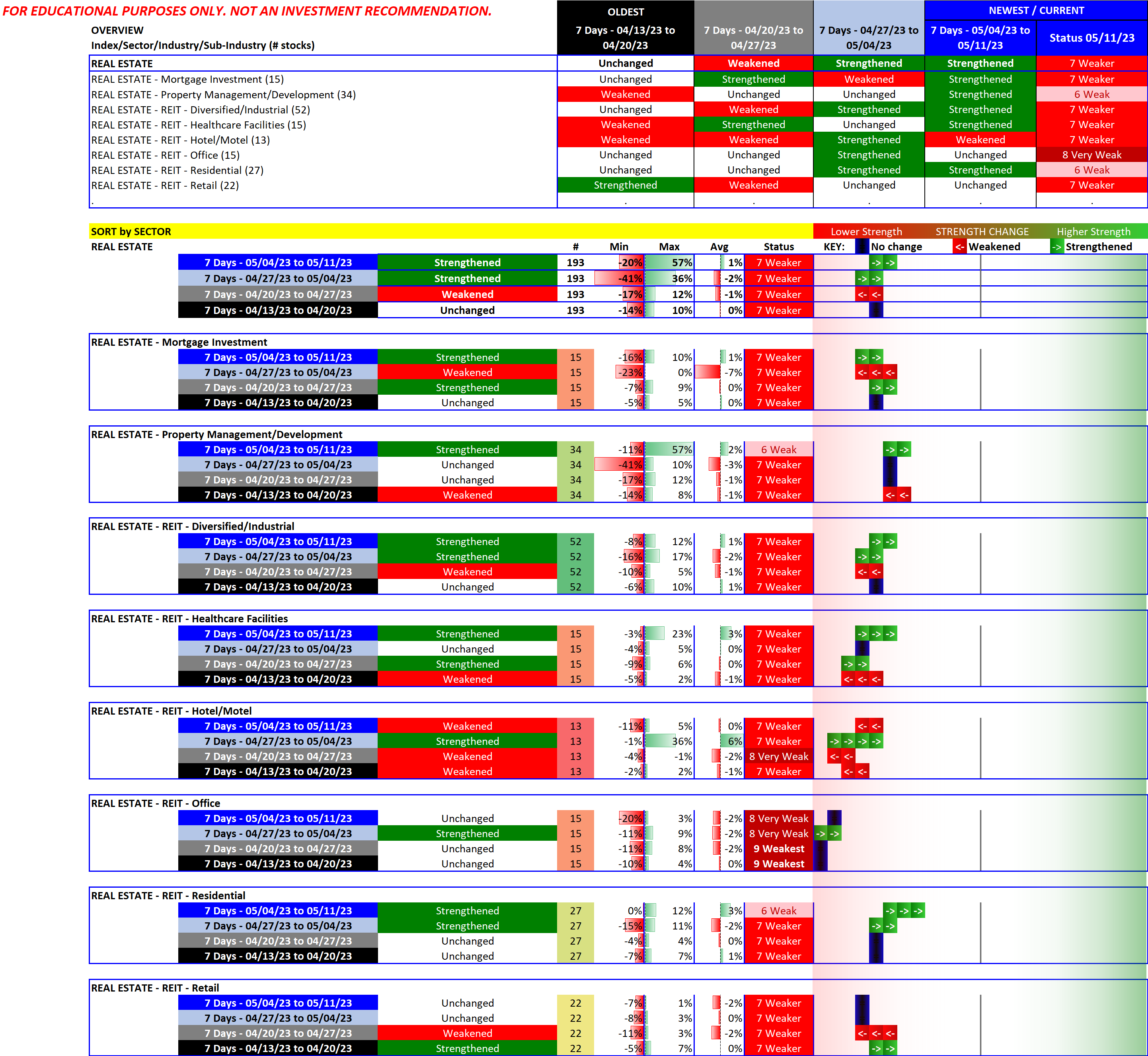

Following up the previous Real Estate-focused post, the current reading shows Real Estate is "Weaker" and strengthened over the past week. There are 14 stocks rated "Strongest" and 108 rated "Weakest." This is an improvement over the previous week's ratio of 13:128, which itself was a slight improvement over the previous week 4/20-4/27 ratio of 6:131.

A Philosophical Digression

Important: I make no predictions. I have no idea if this strengthening will continue. However, as mentioned in my second Banking post from yesterday:

This is a ludicrously obvious statement I know. But as I have found in more than two decades of closely following the market, this is not how most people think. Thus, they aren't focusing on and measuring the same metrics as I am: strength and weakness, at the stock, sub-industry, industry, sector, and market levels. Because of this, many are not deploying information that could improve their performance.

Five Strengthening Real Estate Sub-industries

Building on the strength of the previous week when four sub-industries strengthened there were five such sub-industries this past week. Residential and Diversified/Industrial REITs have both strengthened for the past two weeks.

The following directly compares the sub-industries:

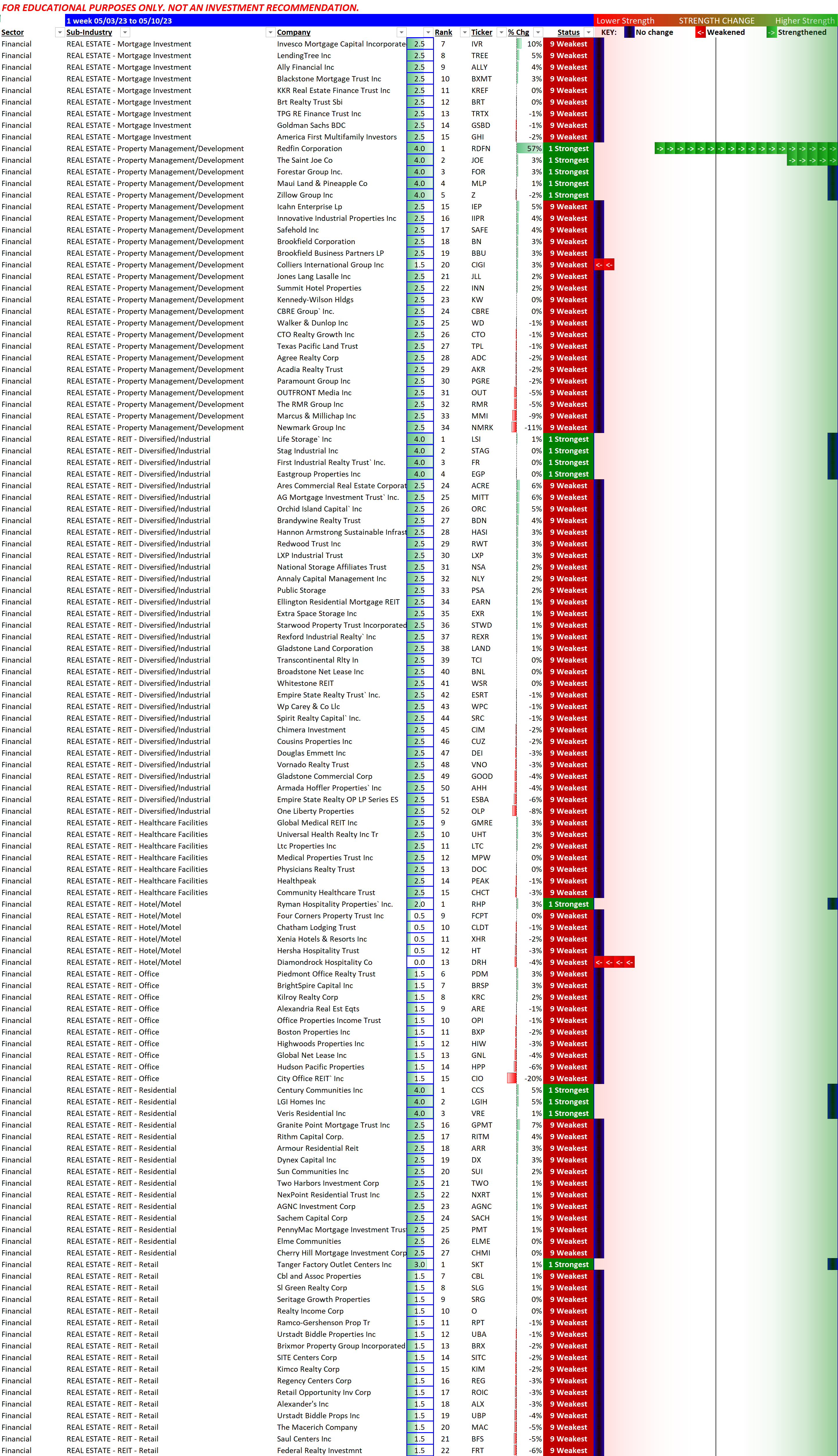

For the record, here are the 14 strongest stocks, followed by a graphic showing the strongest and weakest stocks:

Property Management/Development

Redfin Corporation/RDFN

The Saint Joe Co/JOE

Forestar Group Inc./FOR

Maui Land & Pineapple Co/MLP

Zillow Group Inc/Z

REIT - Diversified/Industrial

Life Storage Inc/LSI

Stag Industrial Inc/STAG

First Industrial Realty Trust Inc./FR

Eastgroup Properties Inc/EGP

REIT – Hotel

Ryman Hospitality Properties Inc./RHP

REIT – Residential

Century Communities Inc/CCS

LGI Homes Inc/LGIH

Veris Residential Inc/VRE

REIT – Retail

Tanger Factory Outlet Centers Inc/SKT

Strongest and Weakest Stocks Detail

Downloadable File

This analysis printout is downloadable at the following link: