Real Estate 2023-12-15: UNCHANGED at STRONG (4th strongest of 9 levels), previous move was UP

Real Estate following Banking’s strength lead, 1 month 57% stocks >10%/1 week 93% positive stocks, 10:1 Strongest:Weakest stocks, RKT +31%, RMAX +26%, TREE +25%.

Full details at downloadable file linked below.

What are you seeing here and why do you care? Partial listing:

🔹 An objective measurement of industry strengthening and weakening so you can objectively compare strength and weakness across/within industries and sub-industries.

🔹 A listing of stocks rated Strongest and Weakest (highest/lowest strength of 9 levels) by sub-industry, saving you significant time finding stocks that may be prone to making bigger moves faster. Stronger stocks have less overhead resistance, Weaker stocks are prone to “pops” from bargain hunting and short-covering yet due to preceding weakness are also prone to falling far and fast.

Details

🔹 26% Strongest Stocks, 3% Weakest Stocks.

🔹 STRENGTHENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is HIGHER than both 4 weeks and 3 Months (93%/92%/70% positive)

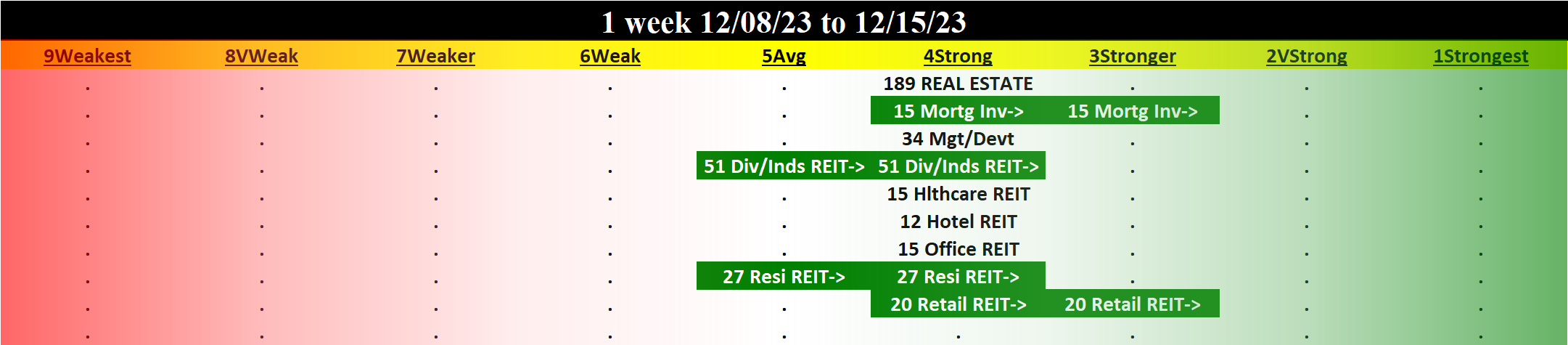

🔹 Sub-industry Overview:

STRONGEST at Stronger rating/3rd strongest of 9 levels:

- Mortgage Investment (15 stocks)

- REIT - Retail (20 stocks)

WEAKEST at Strong rating/4th strongest of 9 levels:

- Property Management/Development (34 stocks)

- REIT - Diversified/Industrial (51 stocks)

- REIT - Healthcare Facilities (15 stocks)

- REIT - Hotel/Motel (12 stocks)

- REIT - Office (15 stocks)

- REIT - Residential (27 stocks)

🔹 Lookback Periods Comparison:

3 Months: 11% stocks >+20% and 3% stocks <-20%.

___UP most:

TREE +84% (Mortg Inv)

RKT +46% (Mortg Inv)

NMRK +45% (Mgt/Devt)

GEO +39% (Hlthcare REIT)

UWMC +32% (Mortg Inv)

___DOWN most:

AHT -30% (Hotel REIT)

IEP -26% (Mgt/Devt)

KW -23% (Mgt/Devt)

ARR -21% (Resi REIT)

MPW -21% (Hlthcare REIT)

4 weeks: 57% stocks >+10% and 2% stocks <-10%.

___UP most:

TREE +83% (Mortg Inv)

HPP +57% (Office REIT)

RKT +52% (Mortg Inv)

HOUS +45% (Mgt/Devt)

Z +43% (Mgt/Devt)

___DOWN most:

CMCT -15% (Div/Inds REIT)

AHT -14% (Hotel REIT)

IEP -10% (Mgt/Devt)

TPL -3% (Mgt/Devt)

STRS -3% (Mgt/Devt)

1 Week: 16% stocks >+10% and 1% stocks <-10%.

___UP most:

RKT +31% (Mortg Inv)

RMAX +26% (Mgt/Devt)

TREE +25% (Mortg Inv)

UWMC +21% (Mortg Inv)

Z +20% (Mgt/Devt)

___DOWN most:

AHT -12% (Hotel REIT)

CHCT -7% (Hlthcare REIT)

CMCT -6% (Div/Inds REIT)

IEP -5% (Mgt/Devt)

NYMT -5% (Resi REIT)