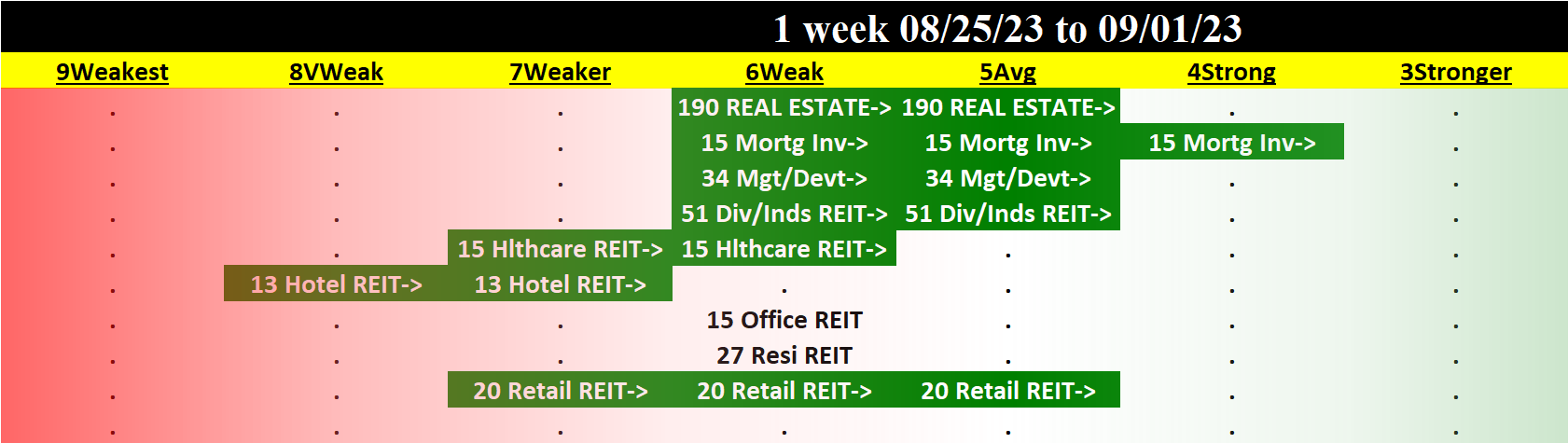

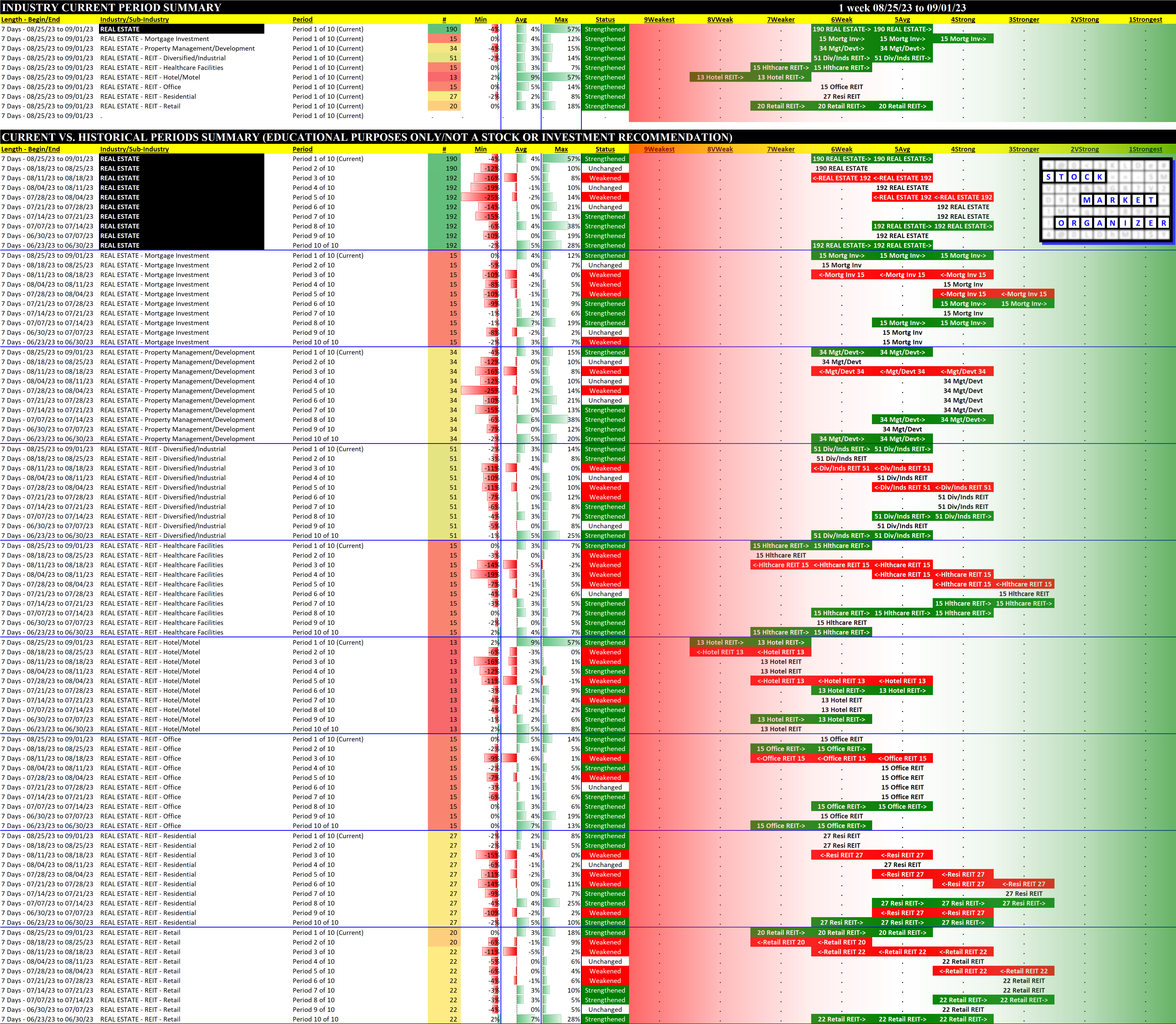

Real Estate 2023-09-01: +1 to "AVERAGE" strength rating (5th strongest of 9 levels), previous move was DOWN

My previous review of Real Estate was August 18, 2023 and is available here.

As noted in my Banking review, this was a light volume week as the last week of summer before the Labor Day holiday. Nonetheless it was a strong week for Real Estate.

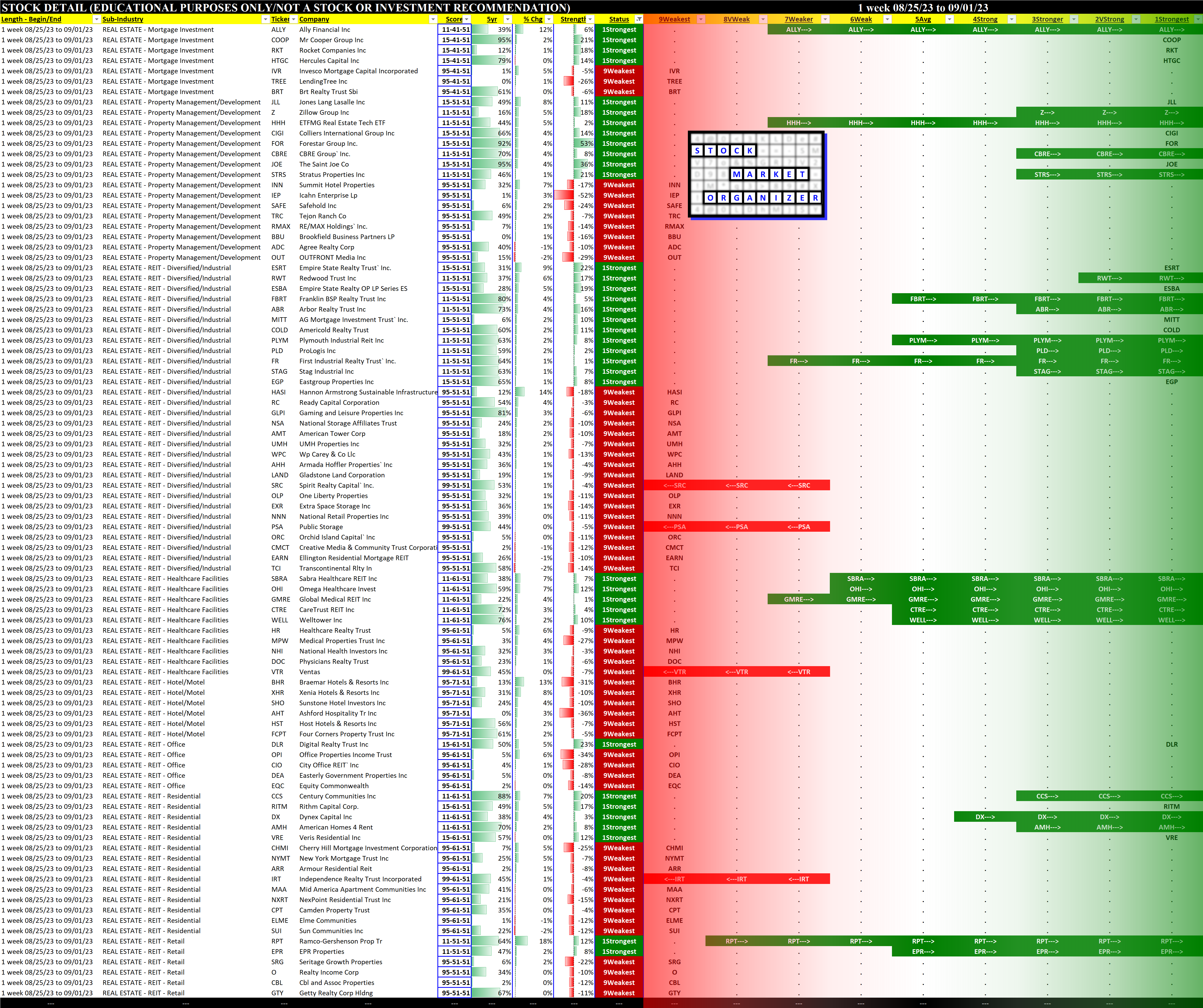

Hotel REITs remain the weakest but did strengthen, with a large +57% gainer in HT/Hersha Hospitality Trust which has agreed to be acquired. RPT/Ramco Gershenson also agreed to be acquired by KIM/Kimco Realty, and was +18% for the week. Finally, IIPR/Innovative Industrial Properties enjoyed a +15% week, ostensibly because as reported by the Motley Fool there were "signs that the U.S. could lower the classification of cannabis, reducing it from a Schedule 1 substance to Schedule III, which would make it easier for multi-state operators to do business." This impacts IIPR, which owns cannabis properties in several states.

I can't resist reporting that dividend-suspender VNO/Vornado Realty Trust is +98% from its May 16, 2023 bottom, trouncing the performance of everybody's favorite AI darling NVDA which is +66% during this time.

Furthermore, since 5/2/23 VNO is +76% while NVDA is +72%.

What, is VNO selling AI chips now?

On the intermediary front, JLL/Jones Lang LaSalle, CBRE/CBRE Group Inc., and CIGI/Colliers International all currently have the Strongest (highest strength) rating. Does the market foresee a pickup in transaction activity?

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.