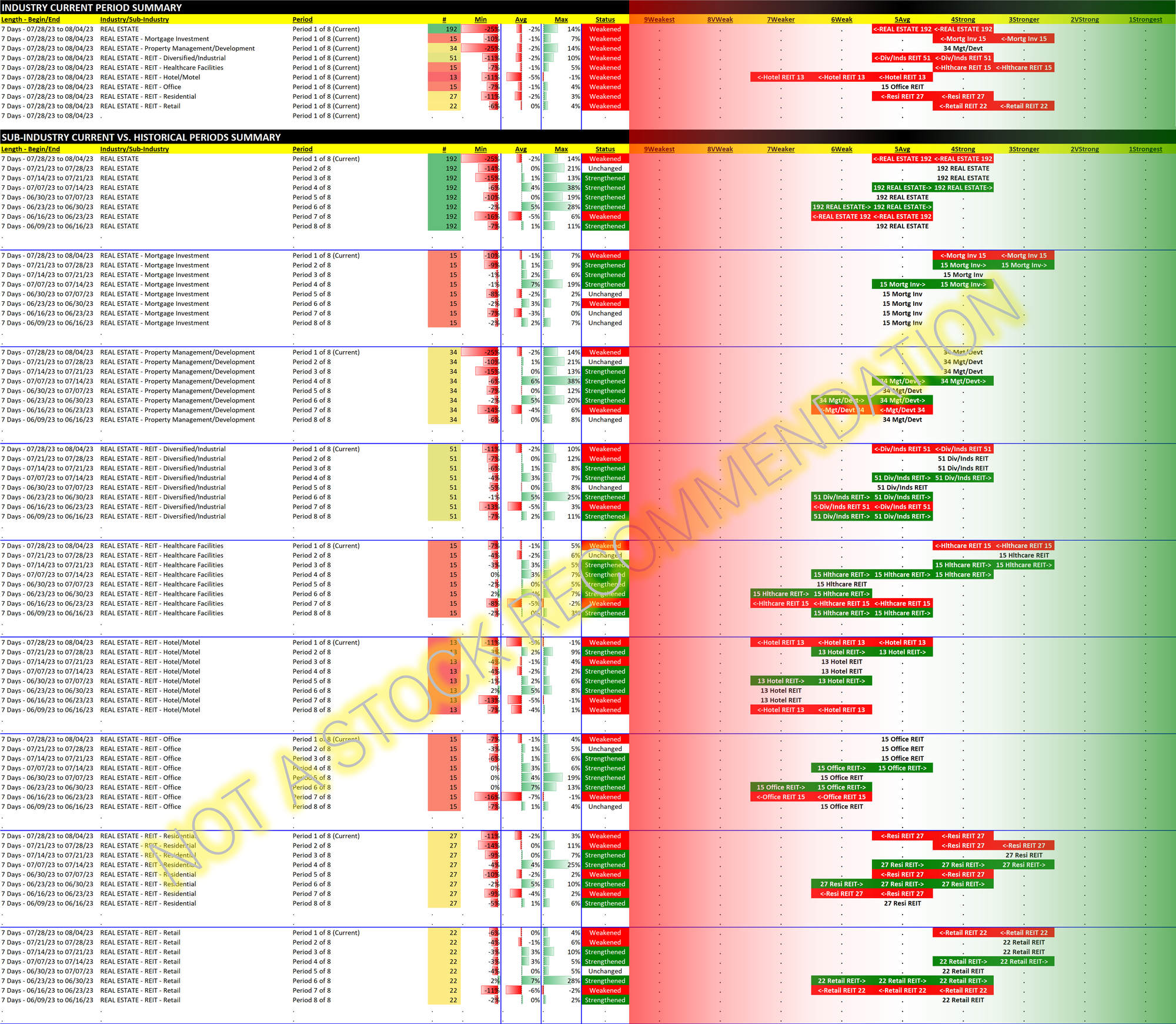

Real Estate 2023-08-04: -1 to "Average" strength rating (4th strongest of 9 levels), previous move was up

Here's my previous look at Real Estate.

I've had fun recently comparing everybody's AI darling NVDA/Nvidia with recent (but no longer) punching bag VNO/Vornado Realty Trust. VNO has, since its recent bottom on May 16, 2023, outperformed all other Real Estate industry stocks through August 4, 2023 with a robust 84% return. This keeps it far ahead of NVDA which has increased 53% during this same period.

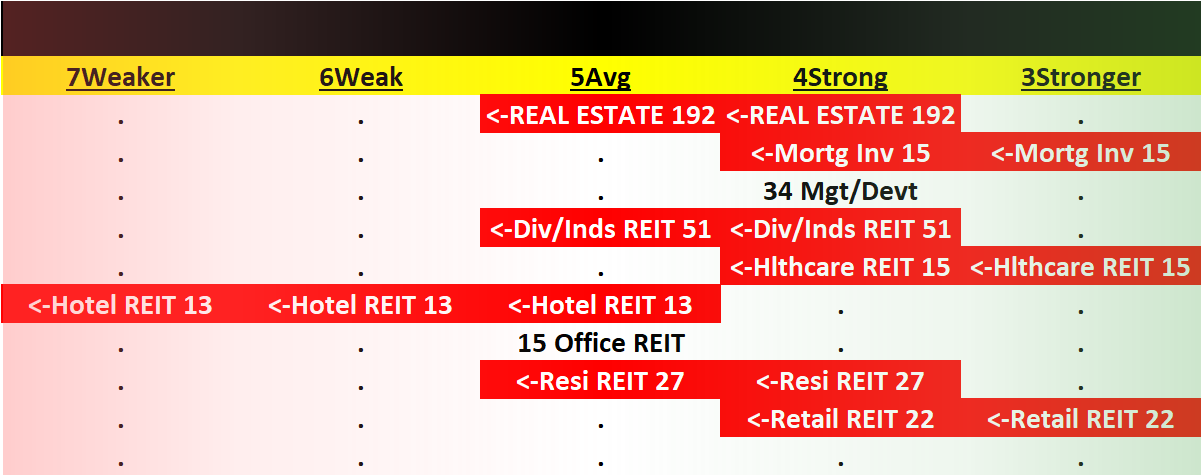

The headline in Real Estate is there was broad weakening throughout all sub-industries. This means no-go on opening new positions in this industry. The first step in a multi-week decline is a one-week decline. No one has any idea how long this will last - one week, 5 weeks, 10 weeks... So to me it makes sense to see a clear sign that this has turned around before contemplating any new open positions.

This does not mean to automatically get out of any existing open Real Estate positions. Sub-industry and industry strength only plays a role in opening positions. Existing open positions are managed based on the individual stock's action, which may or may not be impacted enough by larger forces to trigger an exit. A leader within an industry or sub-industry may remain strong throughout industry/sub-industry turbulence, and may in turn lead the pack coming out of that turbulence.

Note that Residential REITs have weakened by two strength levels over the past two weeks. Meanwhile, Hotel REITs reversed their strengthening of last week and returned to the Weaker strength level from 8 weeks ago.

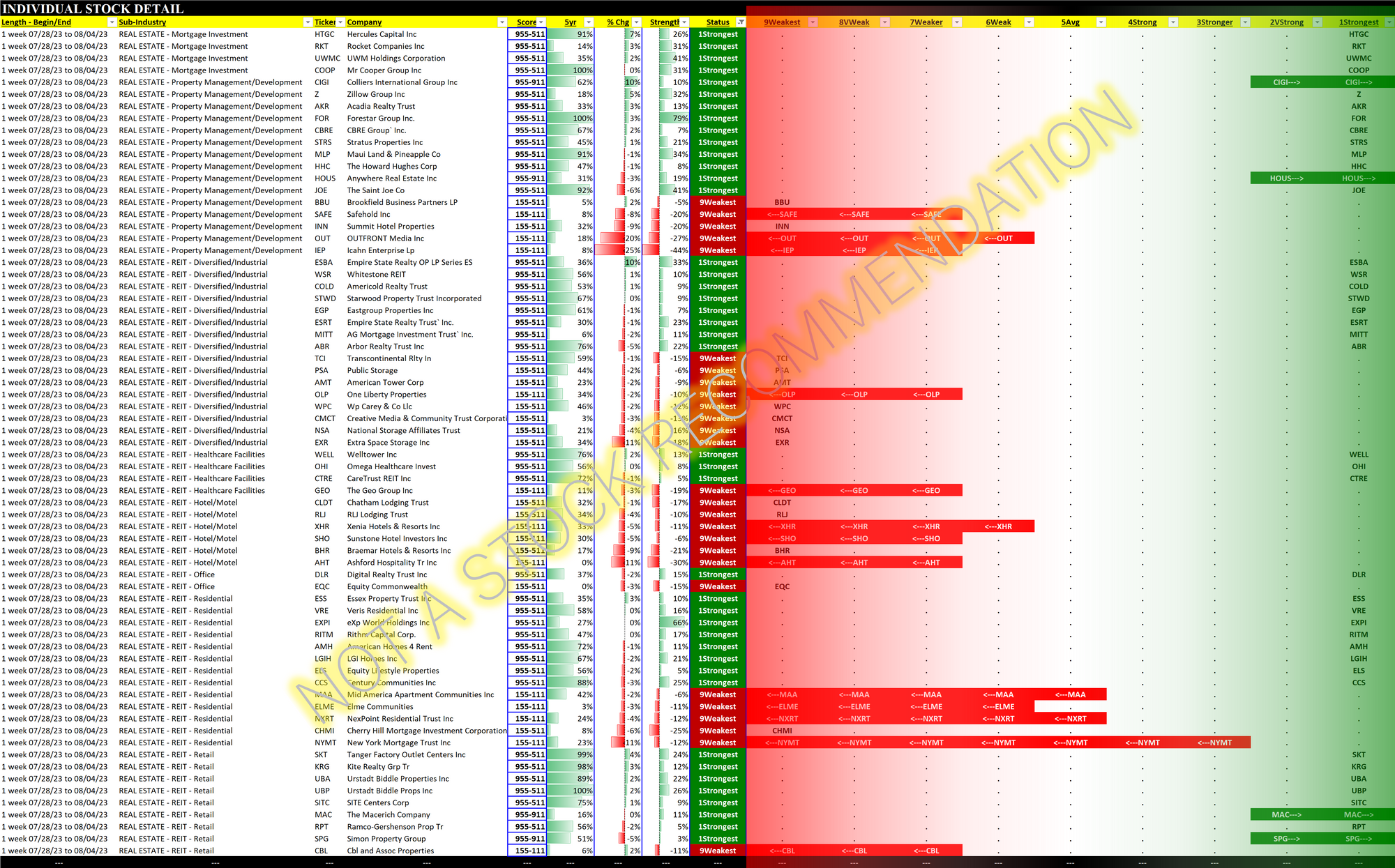

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.