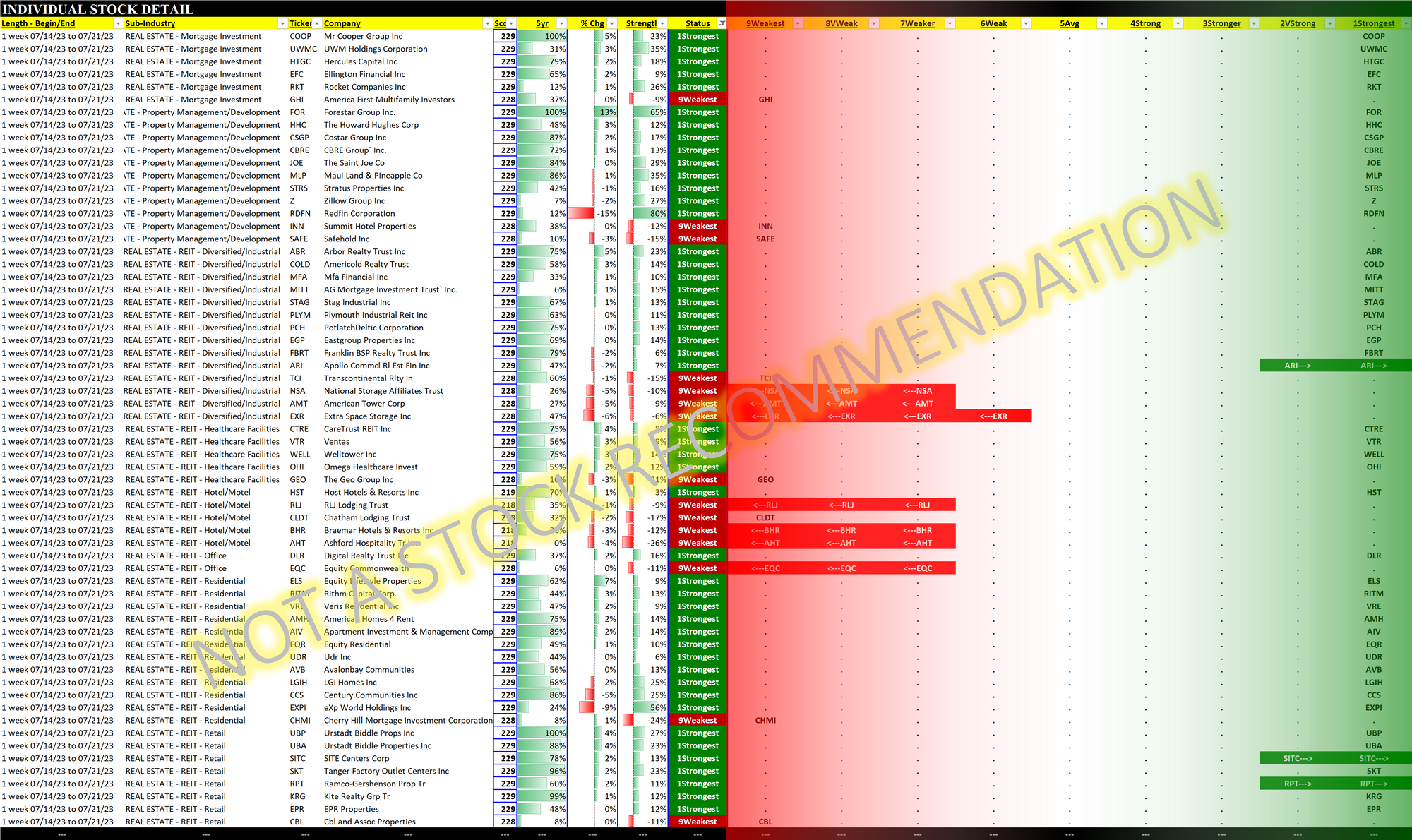

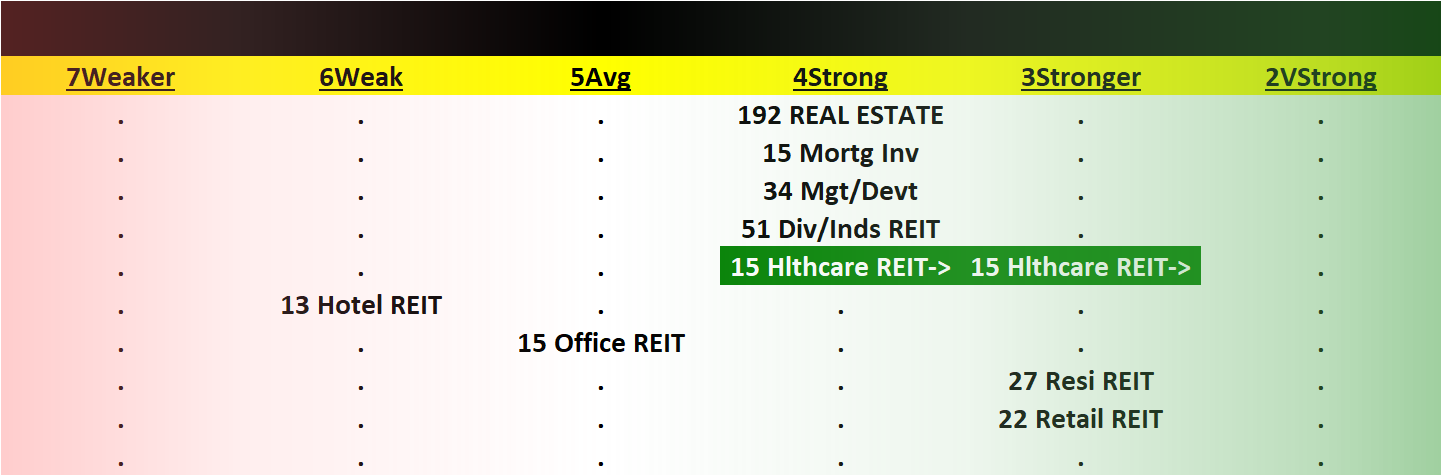

Real Estate 2023-07-21: Unchanged at "Strong" strength rating (4th strongest of 9 levels), previous move was up

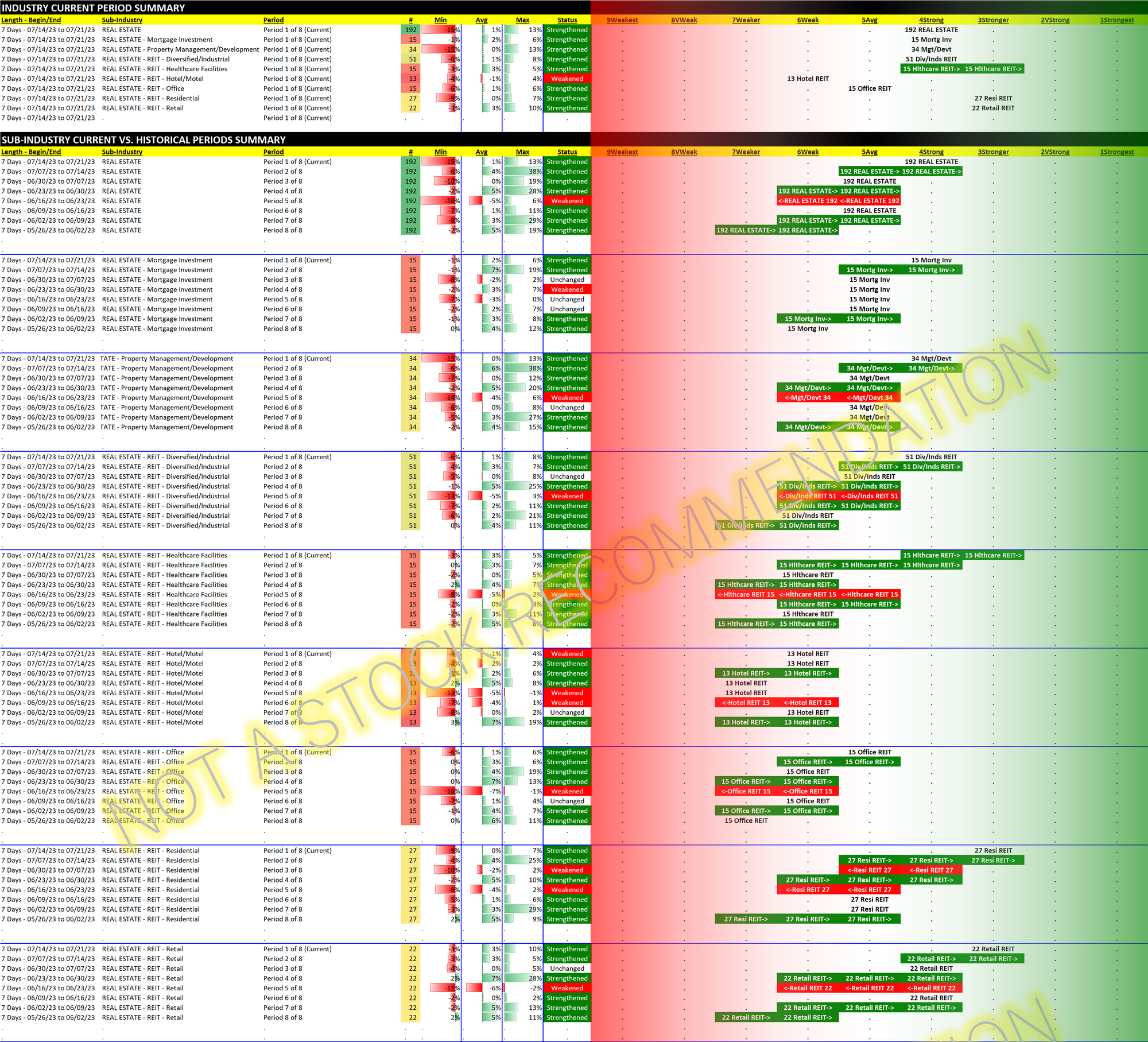

Real Estate continues its improvement, starting at Weaker (7th strongest of nine levels) eight weeks ago and this week staying at Strong (4th strongest). Will this continue? Hotel REITs are weakest of the bunch at Weak (6th strongest) - while post-COVID performance is bouncing back, there appear to be legs to such headlines as the Yahoo! one from today stating "Cerberus, Highgate Miss Payments on $415 Million Hotel Mortgage." Office is having its own issues of course, but it nonetheless is ahead of Hotels at Average strength (5th strongest).

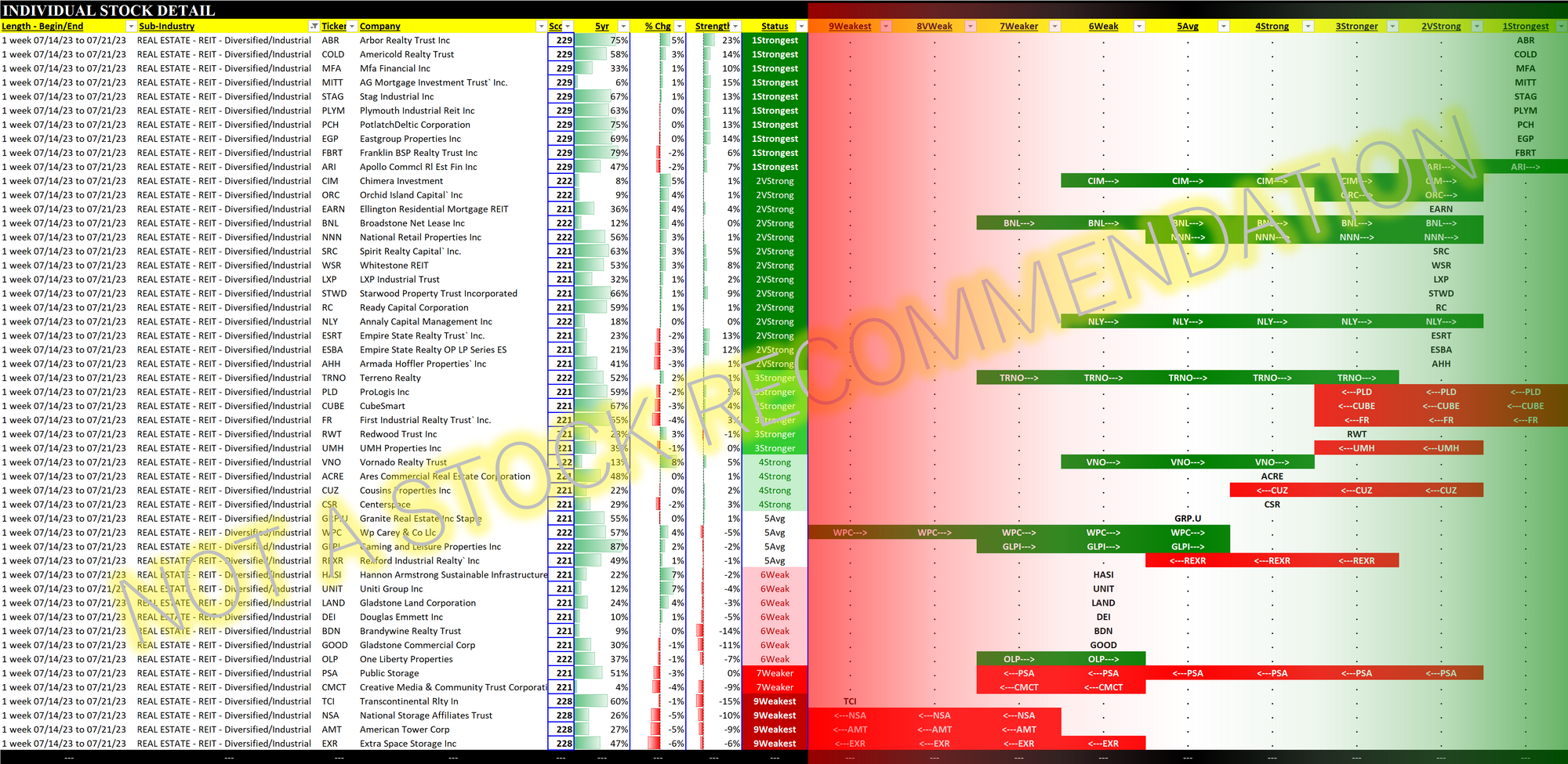

Diversified/Industrial REITs - a closer look

VNO/Vornado has outperformed everyone's favorite AI darling NVDA/Nvidia since May 16, 2023. In terms of strength, VNO has improved to Strong, 4th strongest of nine levels. In this group, there are 30 stocks with stronger ratings than VNO. This does not necessarily mean they outperformed VNO in terms of % return during any given recent period. VNO had the Weakest rating for a period and these stocks many times enjoy significant "pops." This is why I regularly highlight Leaders and Laggards (Laggards are those with Weakest ratings), as they have the highest signal to noise ratio. Thus, it is possible VNO outperformed the stocks rated stronger from a given cherry-picked date. This does not change the comparative strength of these stocks, which are objectively determined.

In my view, these stronger stocks are stronger for a reason. I definitely do not know why, and I don't care because WHAT matters not WHY. This strength is determined by everyone interested in this stock, based on their actions and inactions. I term this #everybodyknowsmorethananybody. By the time, if ever, I find out why there are now 30 Diversified/Industrial stocks rated stronger than VNO, the playing field and key influencing factors will be completely different. The only meaningful practical information I can use to take action is WHAT is currently happening.

#whatmattersnotwhy

About the ever-changing playing field and influencing factors - there is a Heraclitus quote that amply describes the market's dynamic nature:

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.