Real Estate 2023-07-12: +1 to "Strong" strength rating (4th strongest of 9 levels), previous move was also up

Everyone writing the Real Estate obituaries can pause for the moment. Yes, values have precipitously dropped for some properties (San Francisco office buildings are taking it on the chin) and both the cost of capital and cap rates have risen/are rising (neither of which is supportive for values).

Despite all this the industry's stocks are strengthening.

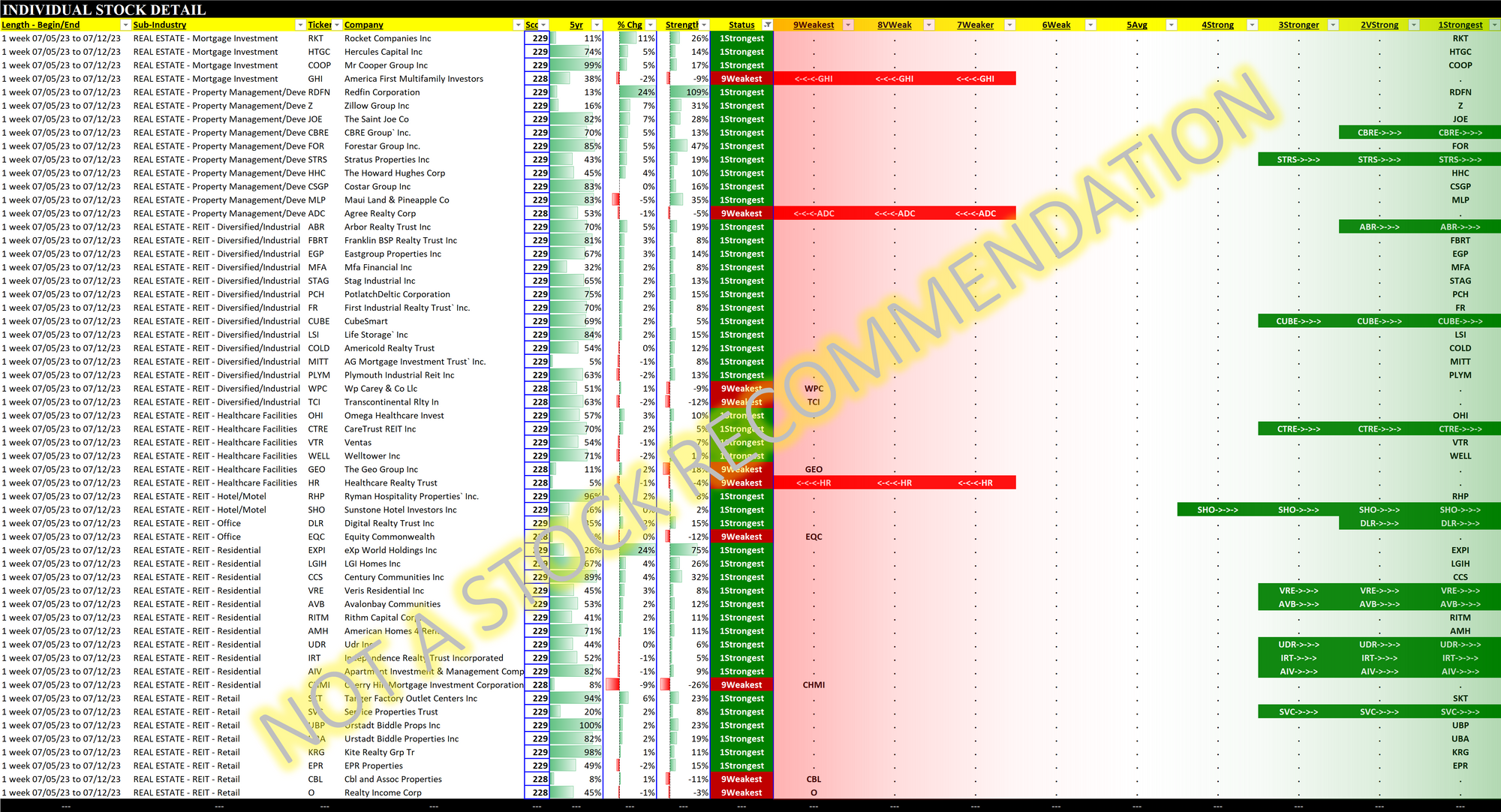

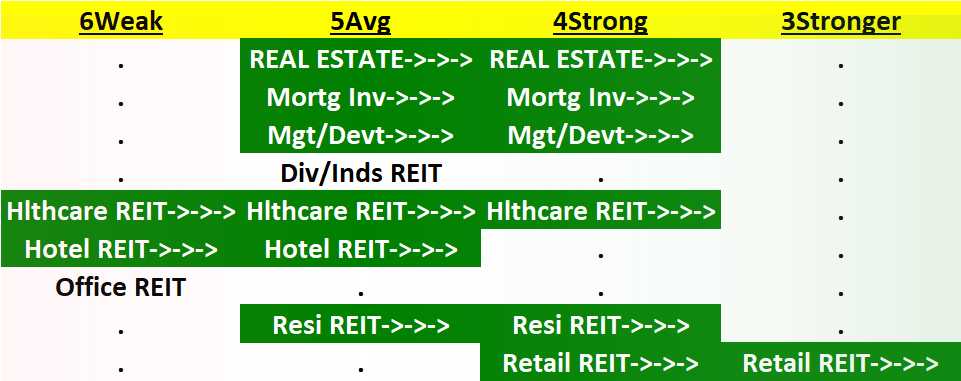

Retail REITs are leading the charge but also strong are Healthcare Facilities REITs and Residential REITS, along with Mortgage Investment and Property Management/ Development stocks.

WHAT Matters, not WHY

Office REITs are bringing up the rear but even they are not as weak as some might expect given the ubiquitous "the sky is falling!!" headlines.

Yes, this can change at any moment, which is why it pays to regularly monitor stock by stock strength. But this is a perfect example of the concept that WHAT matters not WHY.

That is, one can intellectualize all they want about what everybody knows (for example, work from home is destroying office demand, and downtowns are becoming ghost towns because of societal issues). And analysts are right to be concerned about these obvious issues.

But the undeniable fact is Office REIT stocks have strengthened over the past eight weeks. For the moment, at least, Office REIT stocks do not seem to care that analysts are correct to voice concern. Will they over time? I don't know, and neither does anyone else.

What I DO know is WHAT is happening. And the market has a way of confounding the most people it can for as long as it can, so I wouldn't waste time fighting the current tide.

(Your P&L certainly doesn't care about WHY. It just cares that your stocks are strengthening.)

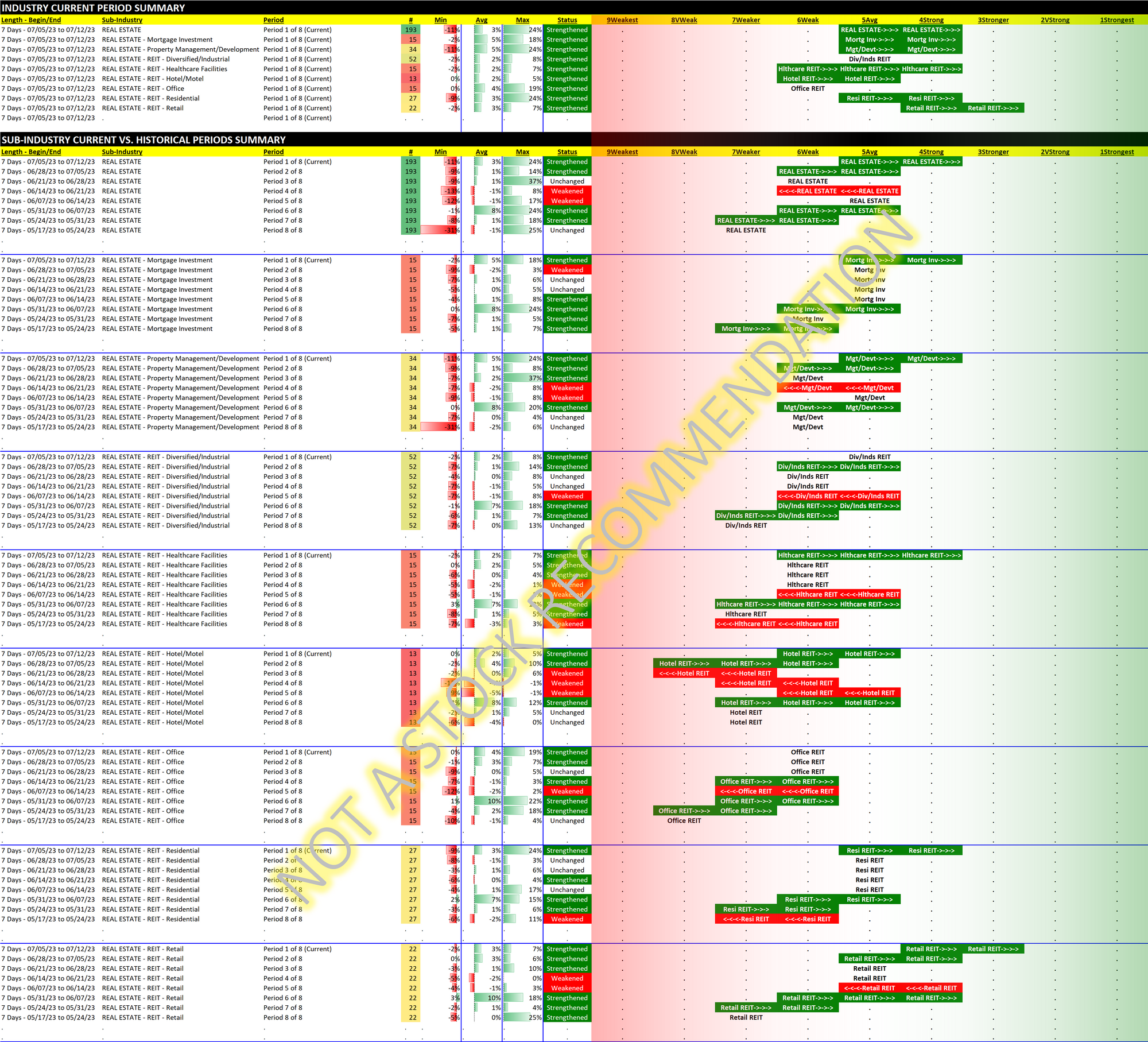

The following graphic shows the evolution of strength over the past eight weeks. Like the other Real Estate sub-industries, Office REIT stocks have strengthened:

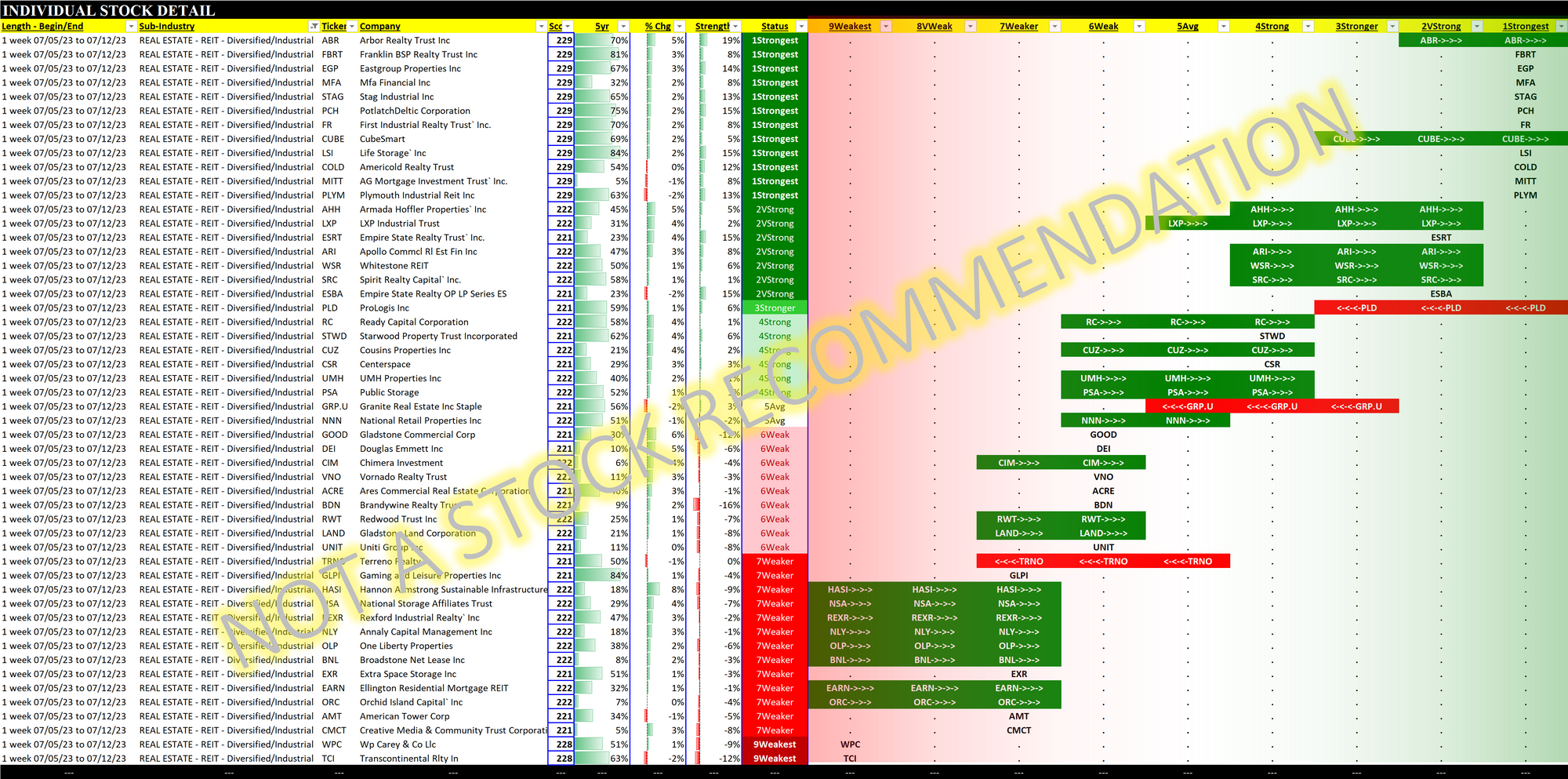

Diversified/Industrial Stocks - a closer look (because of VNO)

Vornado, one of the most well-known REITs, has recently plumbed the depths of 30 year lows to the shrieks of many (suspending its dividend along the way) but has recovered from a 5/16/23 $12.38 closing low to close at $18.74 7/12/23. This is a 51% gain in two months - thus beating out everybody's AI darling NVDA which has returned 50% during this same period.

Many are focused on what the dividend suspension means and are digging in to the underlying properties and their markets and tenancies to ostensibly get a leg up on others doing exactly the same thing. My perspective? VNO is not the only Diversified/Industrial stock. Why not consider all the other potential alternatives, specifically the ones the market already clearly likes, if one wants exposure here?

The graphic below compares these stocks.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.