Real Estate 2023-03-22 can't buy a break... 2 stocks up out of 177 today and since 2023-03-08

Following up this detailed post from last Friday which illustrated the difficulties in the Real Estate industry, the industry had another dismal day today after the Fed raised rates by 25 bps. Commentators remarked on whether Fed Chairman Powell's remarks were hawkish or dovish and then got more to chew on soon after when Treasury Secretary Janet Yellen made some comments that caused the market to reverse post-Powell remarks and drop into the close. Real estate was an area that took it on the chin with only 2 of 177 stocks that I follow ending up in the green.

Were these remarks genuinely that material or is there something deeper going on for Real Estate? How do you know? Do you know in turn what is next? Can you objectively and repeatedly discern that and act upon this information accordingly?

Sidebar - Stock Market Organizer Method creation as a solution to a problem

Perhaps you can. But I could not, historically. Previously, I found it impossible to first get a reasonable handle on the incredible firehose of data being generated daily and second put this data into context so it became usable and actionable information. I spent far much time frustrated and confused and on the wrong end of too many positions.

So I created the Stock Market Organizer method to objectively and in a repeatable, systematic manner take the most important (to me) information and usefully organize it. Fundamental analysts will not consider this relevant, but anyone else willing to consider alternative perspectives might benefit. This method enables me to understand what is happening in all corners of the market so I never suffer from Fear of Missing Out or ignorance about what is happening market-wide, sector-wide, industry-wide, or sub-industry-wide. This provides a bottom-up, top-down, and inside-out perspective unlike any available elsewhere.

Real Estate's weak 8 weeks

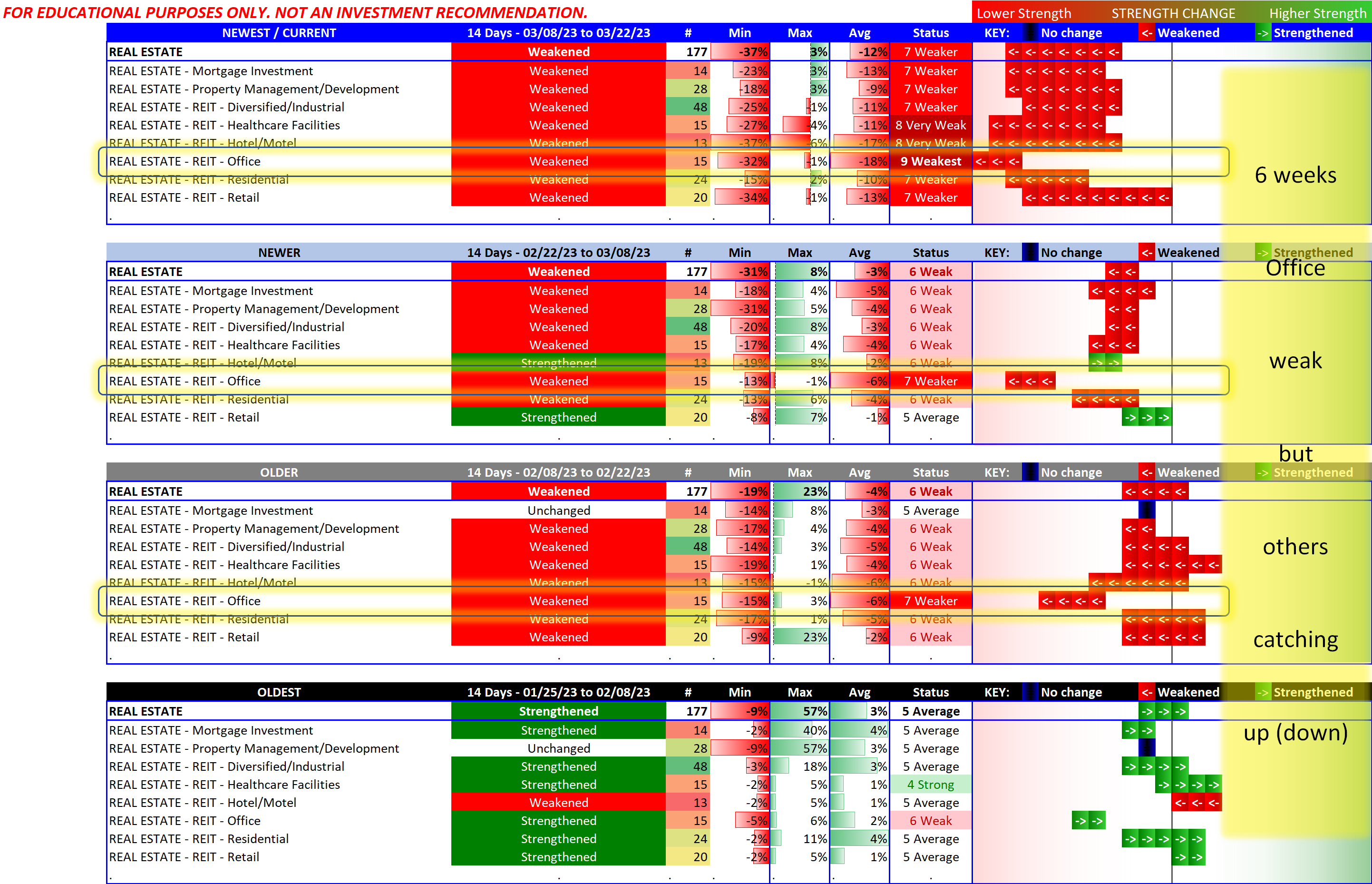

While I typically use a 4-week look back, as originally described in this post I can also use an 8-week look back for a broader perspective. The 3/17/23 analysis used the 4-week look back while this one uses an 8-week look back. For quicker pick-up of potential meaningful changes in direction of an industry or sub-industry I prefer the 4-week look back.

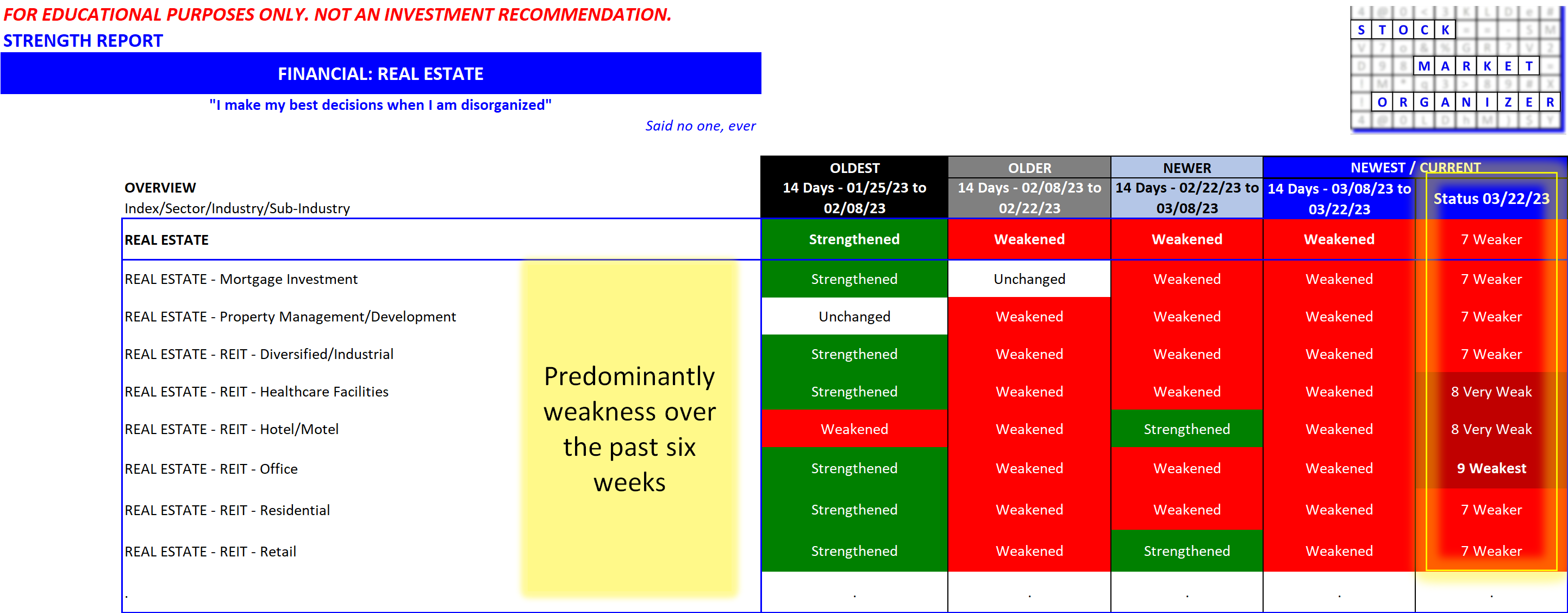

The following graphic summarizes the deterioration in Real Estate over the past 6 weeks which has accelerated over the past two weeks. The average return for these 177 Real Estate stocks in the past two weeks has been -12%.

Is this setting up the industry and its sub-industries for a snap-back rally?

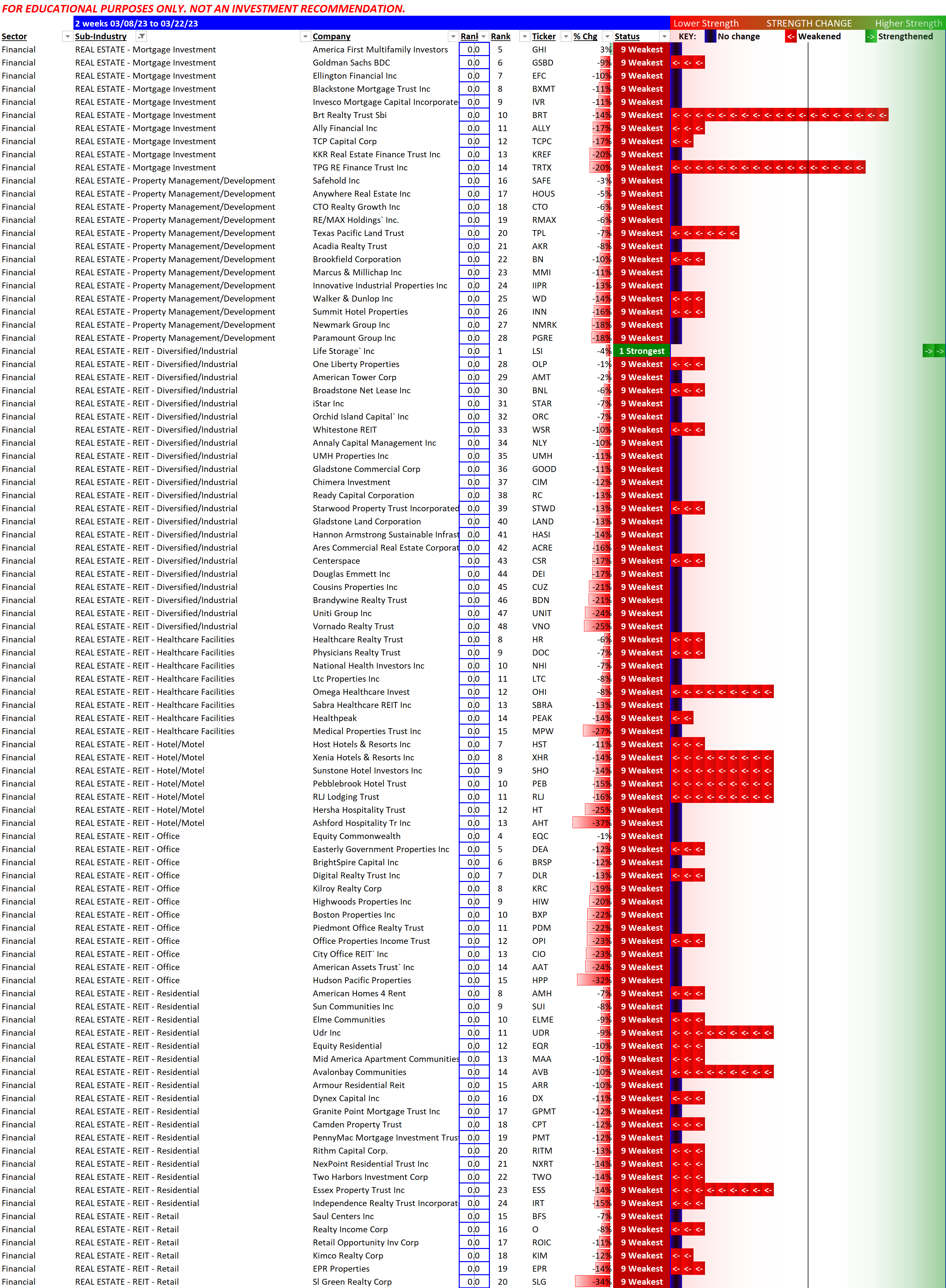

Below is a graphic showing the strongest and weakest Real Estate industry stocks for the past two weeks ending today March 22, organized by sub-industry. Imbalance much? Weakest rated outnumber the Strongest rated by 94:1. How much worse can it get?

Downloadable report

Below is the link to download the 8-week look back stock-by-stock analysis.