PDM/Piedmont Office Realty Trust - a LinkedIn comment lookback back pat

It is easy to get caught up in the daily minutiae and lose sight of the big picture. Let's step back, timewise, and re-visit a LinkedIn post to gauge if there is some value from the analysis provided here. (Spoiler alert: there was in this case.)

Bottom line:

- a July 21, 2023 LinkedIn post about a REIT (PDM/Piedmont Office Realty Trust) stated "So Piedmont is toast, right? Not necessarily..."

- I commented "... agreed it doesn’t look like it will implode or it is toast. But there may be other more attractive Office and other REITs out there."

- PDM (-14%) is the worst-performing Office REIT from July 21 through August 25, 2023.

On July 21, 2023, an exceptional LinkedIn account named CRE Analyst wrote about PDM/Piedmont Office Realty Trust, commenting "Piedmont is a poster child for the office apocalypse narrative. 'A heavily discounted office REIT with decent properties and a maturity wall issues bonds at 9%.' So Piedmont is toast, right? Not necessarily..."

(The post was not necessarily recommending PDM, and its point was strong in highlighting that one needs to dig in beneath the headlines to see a more true story. Their accompanying analysis was stellar - and exactly the type of analysis that can be complemented by what I do.)

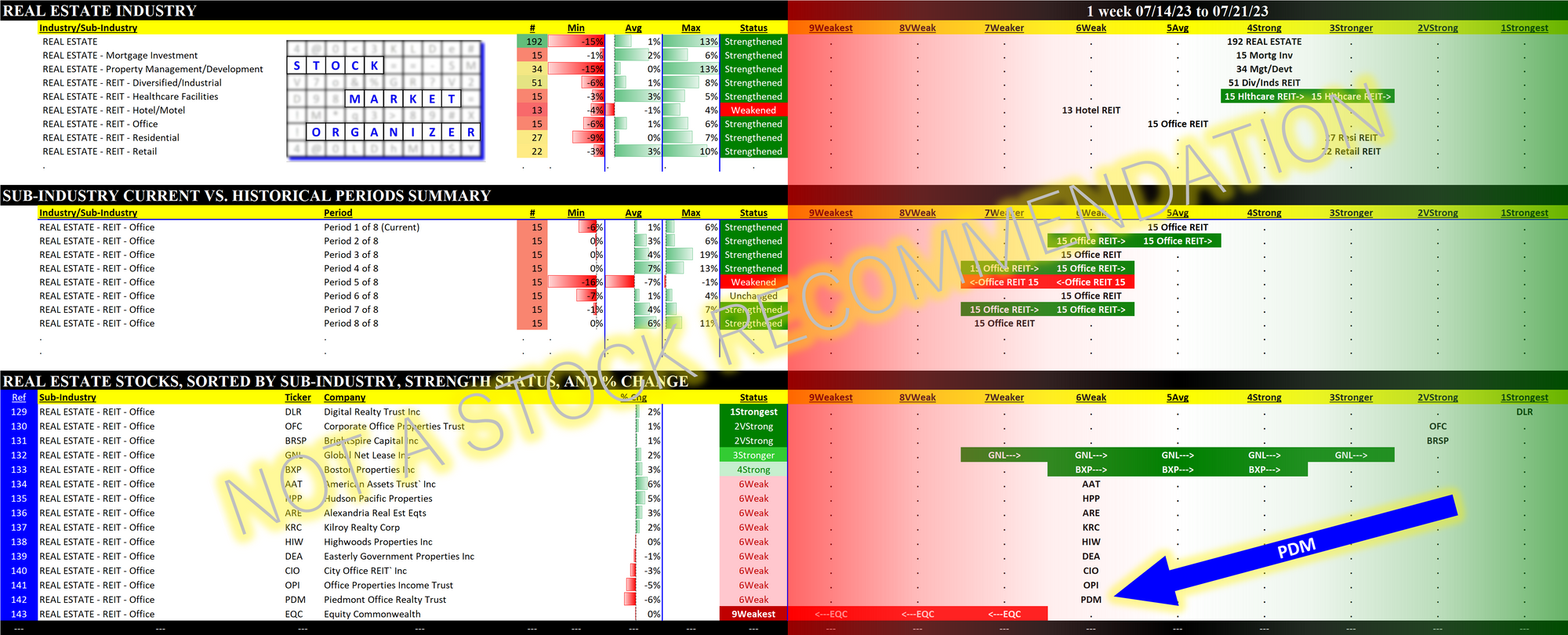

As a response, I agreed, posted this photo, and commented per below:

“…there's no shortcut around diving into the fundamentals.” Amazing analysis, and agreed. Helpful context may be added by measuring strengthening and weakening of stocks, their sub-industries, and their industries. An example is attached. PDM is currently rated Weak, 6th strongest of nine levels. In turn, while up versus eight weeks ago, Office REITs are currently rated Average (5th strongest), ahead of only Hotel REITs (Weak, 6th strongest) among Real Estate sub-industries.

As the market always changes, so are these ratings subject to change. But they are an objective big picture look at where any individual stock, sub-industry, or industry stands right now compared to others.

And... so what? Since we can't know tomorrow's prices, the next best alternative course of action is to determine where we are today and act appropriately based on this information. Change as appropriate based on changed circumstances.

Back specifically to PDM - agreed it doesn’t look like it will implode or it is toast. But there may be other more attractive Office and other REITs out there.