Overall market strength status as of 2023-05-05? (Anything going on with Office REITs?)

Perhaps you've seen heat maps like this sample one. Unfortunately, I cannot tell the importance of the data provided. They spew single day data points without context. So I don't find these helpful.

Context is Critical

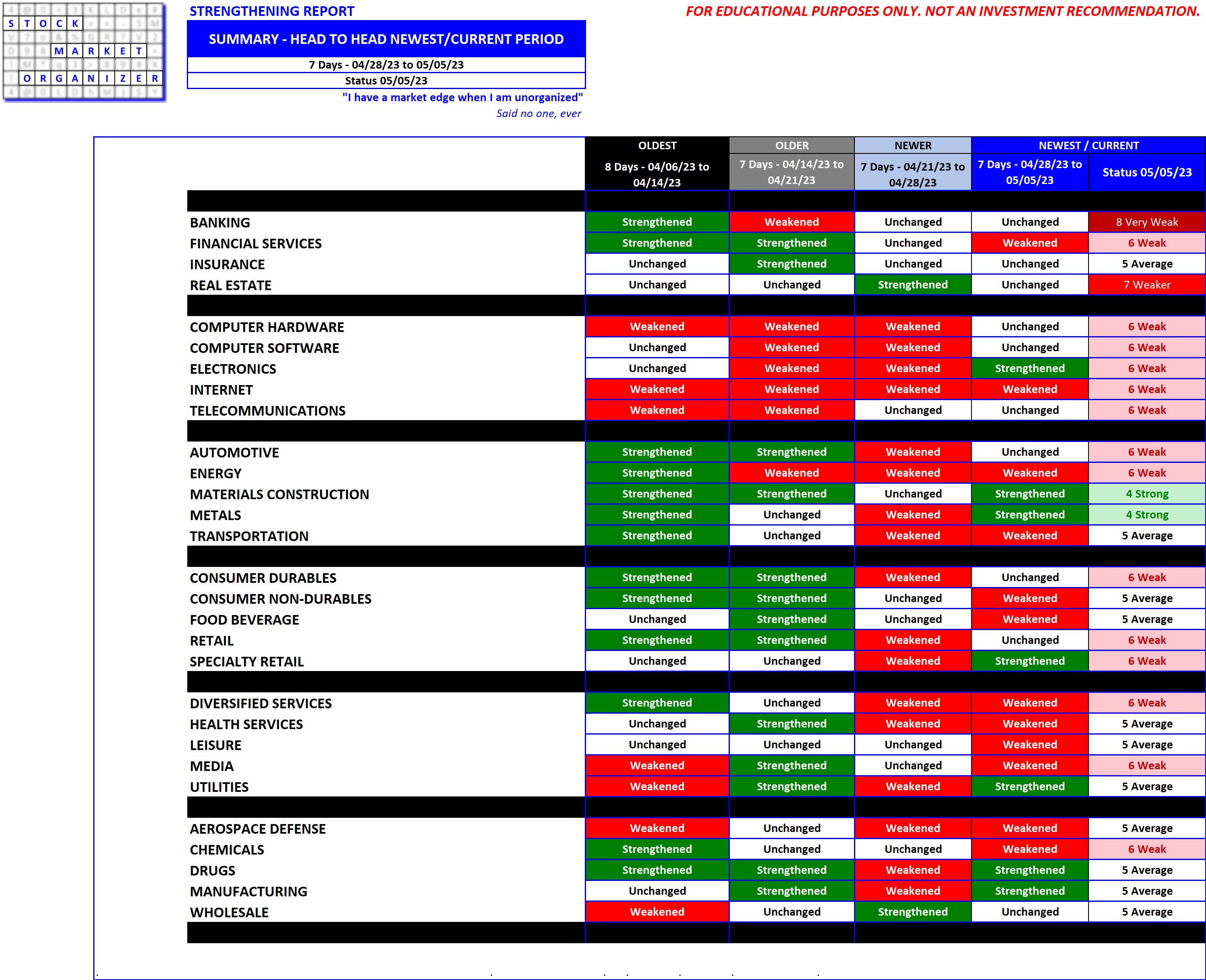

Below is what I do find helpful - because it provides context.

One can quickly see Banking and Real Estate are weakest and Materials/ Construction and Metals are strongest. At the moment, these are the outliers where things are happening. These point me in the direction of where to further focus.

For example - did you know four REIT types strengthened over the past week, including everybody's favorite whipping target Office REITs? Did you know that Homebuilders have been crushing it, and that Gold is leading the charge for Metals?

Whither Office REITs?

Will Office REITs continue to strengthen? I do not know. I make no predictions. What I do know is the journey of a thousand miles begins with one step. Everyone hates Office REITs right now. Perhaps there is no where for them to go but up? Again, I don't know. The value of this analysis is it has objectively flagged this strength. Office REITs are overall very weak still. Yet, I know this the first week in the past four that there has been strengthening in this sub-industry, and now I know to look more closely. Something positive may be brewing. Other methods may not have uncovered this.

Downloadable Report

Detailed report is linked below. This analysis is only available here. Please contact me with questions. This is one front end to the analysis shown in past posts, and future posts will explain further.