NVDA +14% 2023-02-23: it's about facts not opinion (Fact = it was already strong, Opinion = "it is because of A.I.")

Strong gain for NVDA today. A Yahoo article explains

Shares of the graphics chip maker Nvidia (NVDA) rose more than 14% Thursday, despite the fact that the company reported a 21% year-over-year revenue decline for its fourth quarter on Wednesday. The reason? A.I.

Fact or opinion? If it is anything other than what the market says, it is opinion. And you should not care about that opinion because it is not objective, repeatable, materially actionable information.

Heed Market Facts - NVDA was already strong

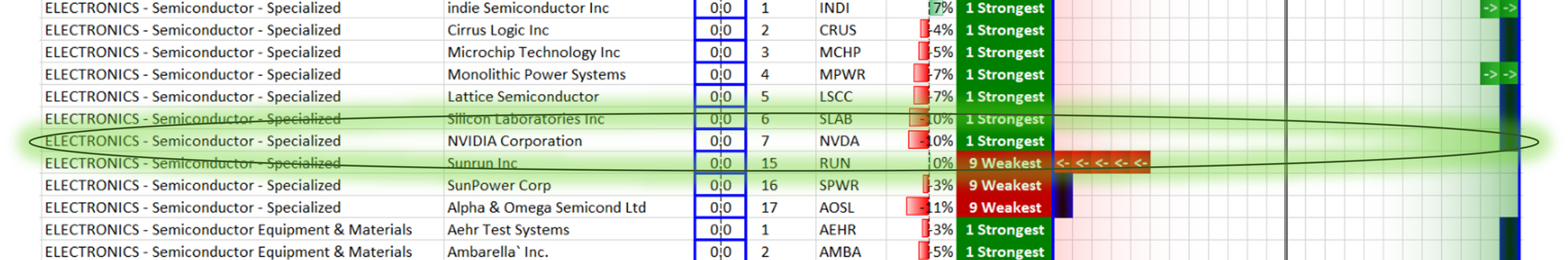

The fact is that as of this post 2 days ago NVDA was already strong, a leader in the Electronics / Semiconductor-Specialized sub-industry.

Per the following two charts, NVDA has made a strong move up since October and has made up a good portion of its decline from late 2021 to then:

Why has this been the case?

I don't know. Neither do you. It just is. This is the kind of action that leads to green P&Ls. Act accordingly.

Will it keep going?

I don't know. Neither do you. Anyone who says they do is BSing.

The fact that it is going up says it has fans. No fans, no support. If you prefer to be the first to "discover" a stock, you'll pass. If all you care about is green on your screen, that others like it is an important fact.

Can I buy now?

Why not? Per above, if you do: act accordingly. (This is not a stock recommendation.) Position size by taking into account your portfolio size, how much per position you'd like to risk, and the volatility of this stock, then once in manage it according to its subsequent action.

Is this any less legitimate than entering based on a detailed fundamental analysis? (There are no style points in the market)

Who cares?

Regardless of how much or how little fundamental analysis you've done - or the experts whose opinions you decide to heed - you will never control what happens to that stock's price once you are in. Your goal at that point is to prevent a catastrophe (if you end up in a losing position) and to ride it as far up as possible (if you end up in a profitable position).

What you WILL be able to control is how you manage your position to accomplish these goals. And seek to have this position management be logical, not based on blindly-accepted platitudes that do not reflect reality ("my favorite holding period is 'forever'" - the gentleman originally purportedly quoted as saying that doesn't even hold forever. Example: airlines, early Covid 2020 era.)

Think of Bitcoin the first time it went through $30k. It had by then enjoyed a strong run. It had plenty more to go from there. Without any fundamental factors to explain this rise. Yet many made substantial profits.

Unfortunately all too many gave back too much in paper profit for lack of deploying disciplined, pre-planned position management rules.

It wasn't the lack of fundamental analysis that did in plenty of crypto buyers. It was their lack of position management discipline.

Worry more about your position management than friends and family opinions about your fundamental analysis. All that matters is green on your statement. And if you get gobs of green looking solely at strengthening and weakening in your stocks and their industries and sub-industries, then who will argue with you?