Not a good “against market timing” argument (spoiler alert: the best/worst market days cluster)

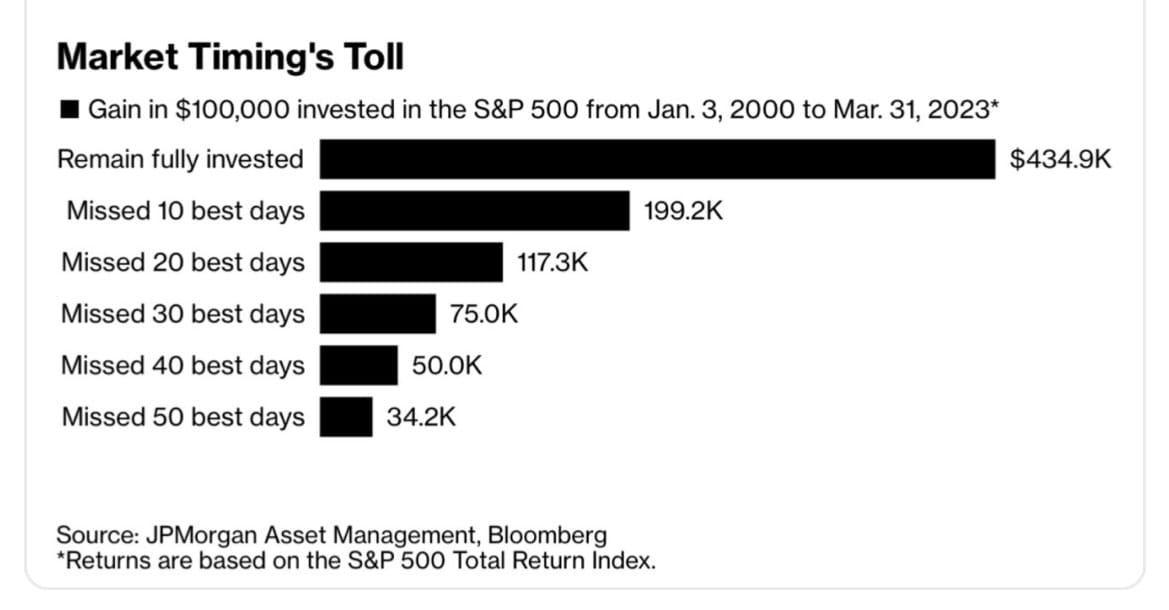

Did you know? “Conventional wisdom” isn’t necessarily wisdom. “If an investor were to simply miss the 10 best days in the market, they would have shed over 50% of their end portfolio value.”

The above quote is from a Visual Capitalist article yesterday (search for "Timing the Market: Why It’s So Hard, in One Chart") and comes from its argument against market timing.

The portrayed “miss the 10 best days” scenario is impossible.

The author:

- Does highlight that “Over the last 20 years, seven of the 10 best days happened when the market was in bear market territory.”

- But misses/avoids the obvious point that this means one is also invested during the worst market days.

- And omits the opposite argument - what would happen to this hypothetical portfolio if one were to miss the 10 worst market days.

Any “miss 10 best/worst market days” claims need to be immediately ignored and the author mercilessly ridiculed.

Well, in the interests of civility, leave out the ridiculed part.

See my linked analysis below for more detail. Bottom line: the best and worst market days cluster.