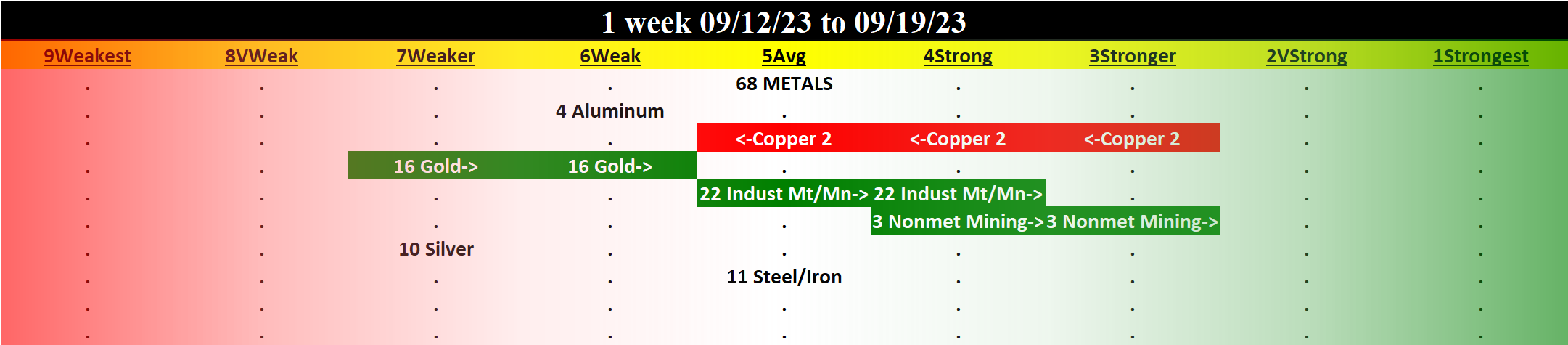

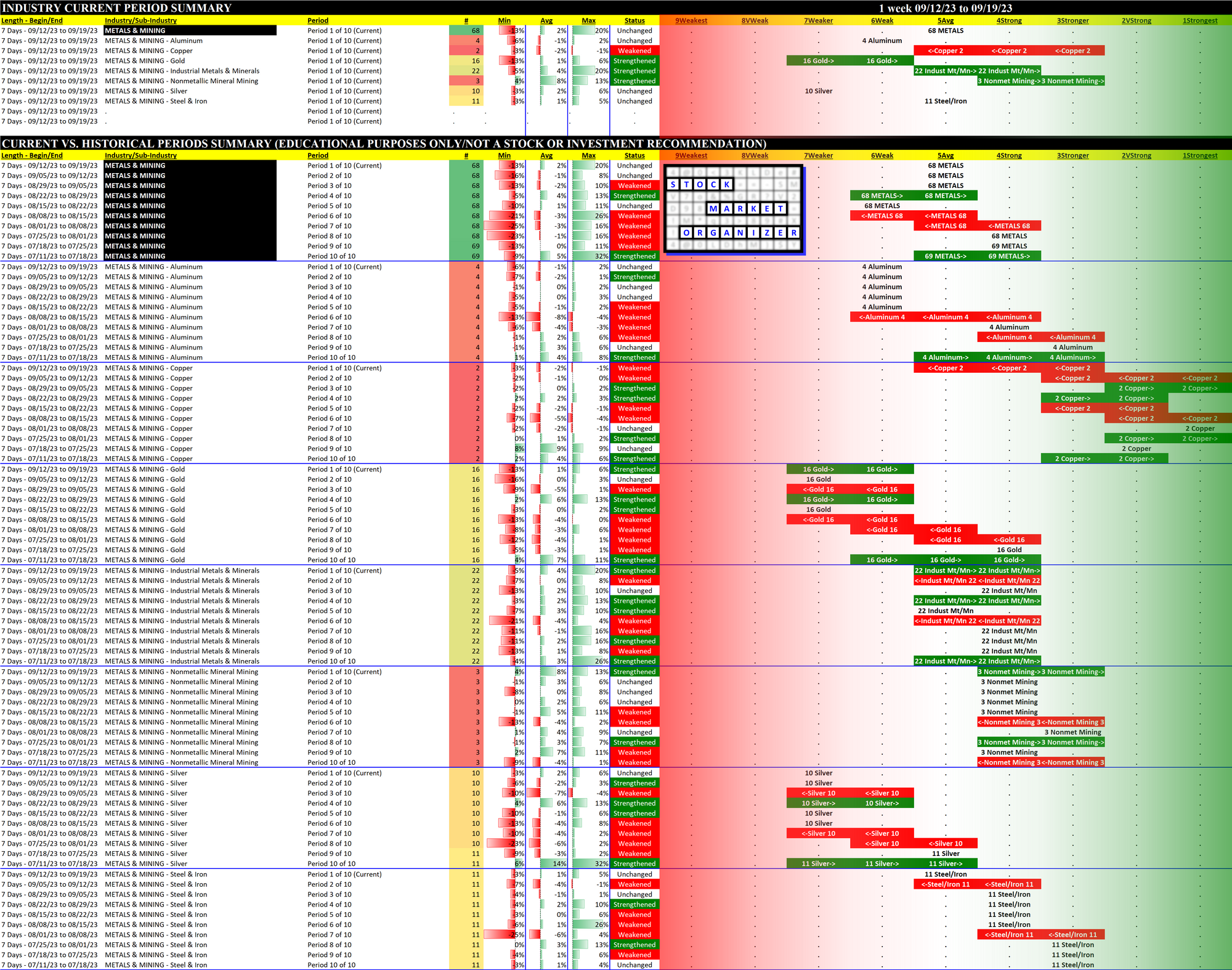

Metals & Mining 2023-09-19: Unchanged at AVERAGE strength rating (5th strongest of 9 levels), previous move was UP

SUMMARY

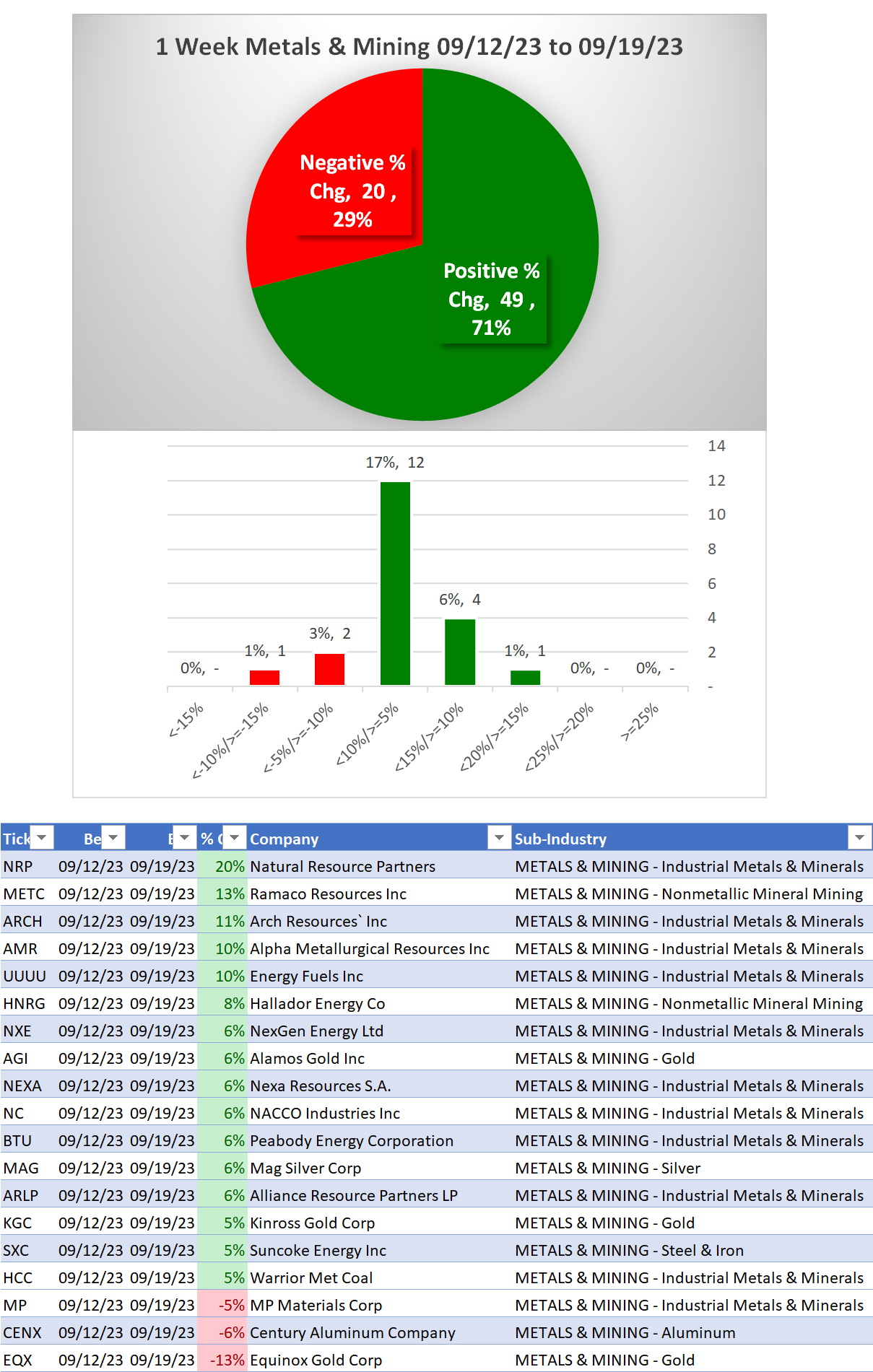

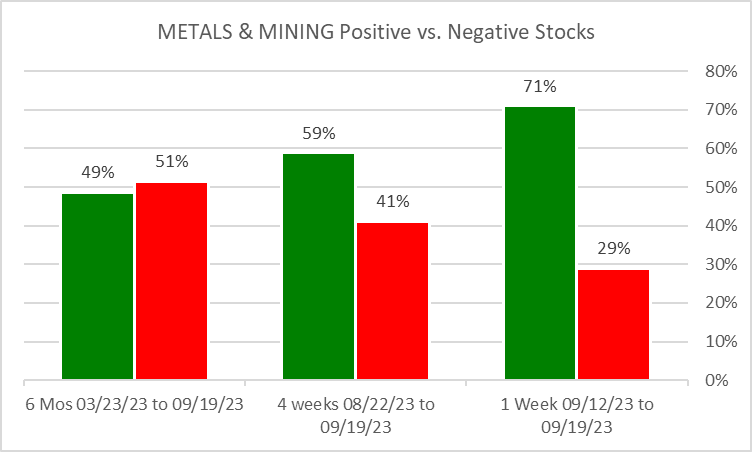

Performance

Bottom Line: net weakening 1 level through 10 weeks of chopping

Context: strengthened 1 week vs. 4 weeks/6 months

Other Notes:

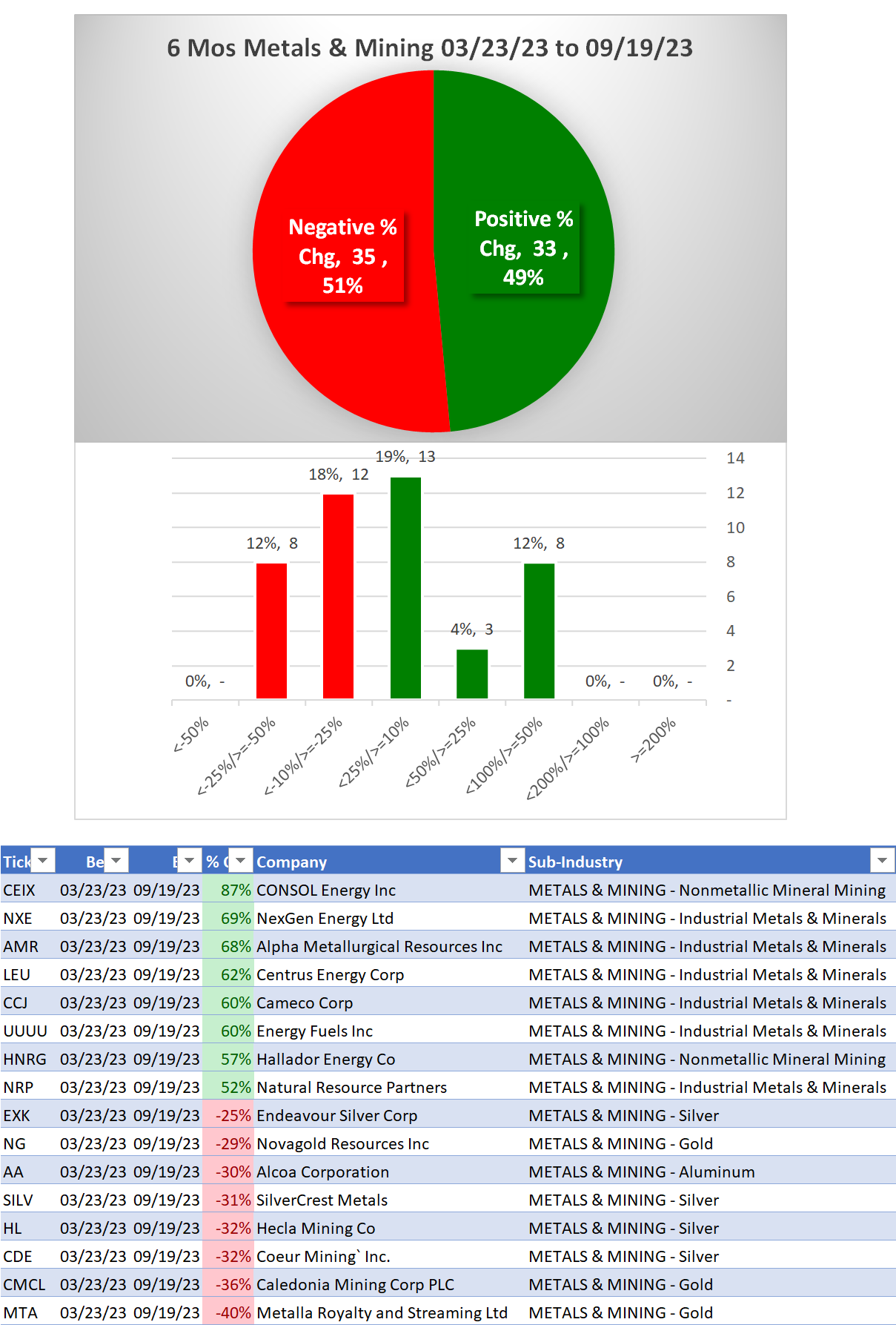

6 Months

CEIX/CONSOL Energy Inc (Nonmetallic Mineral Mining) +87%

SILV/SilverCrest Metals (Silver) -31%

HL/Hecla Mining Co (Silver) -32%

CDE/Coeur Mining Inc. (Silver) -32%

CMCL/Caledonia Mining Corp PLC (Gold) -36%

MTA/Metalla Royalty and Streaming Ltd (Gold) -40%

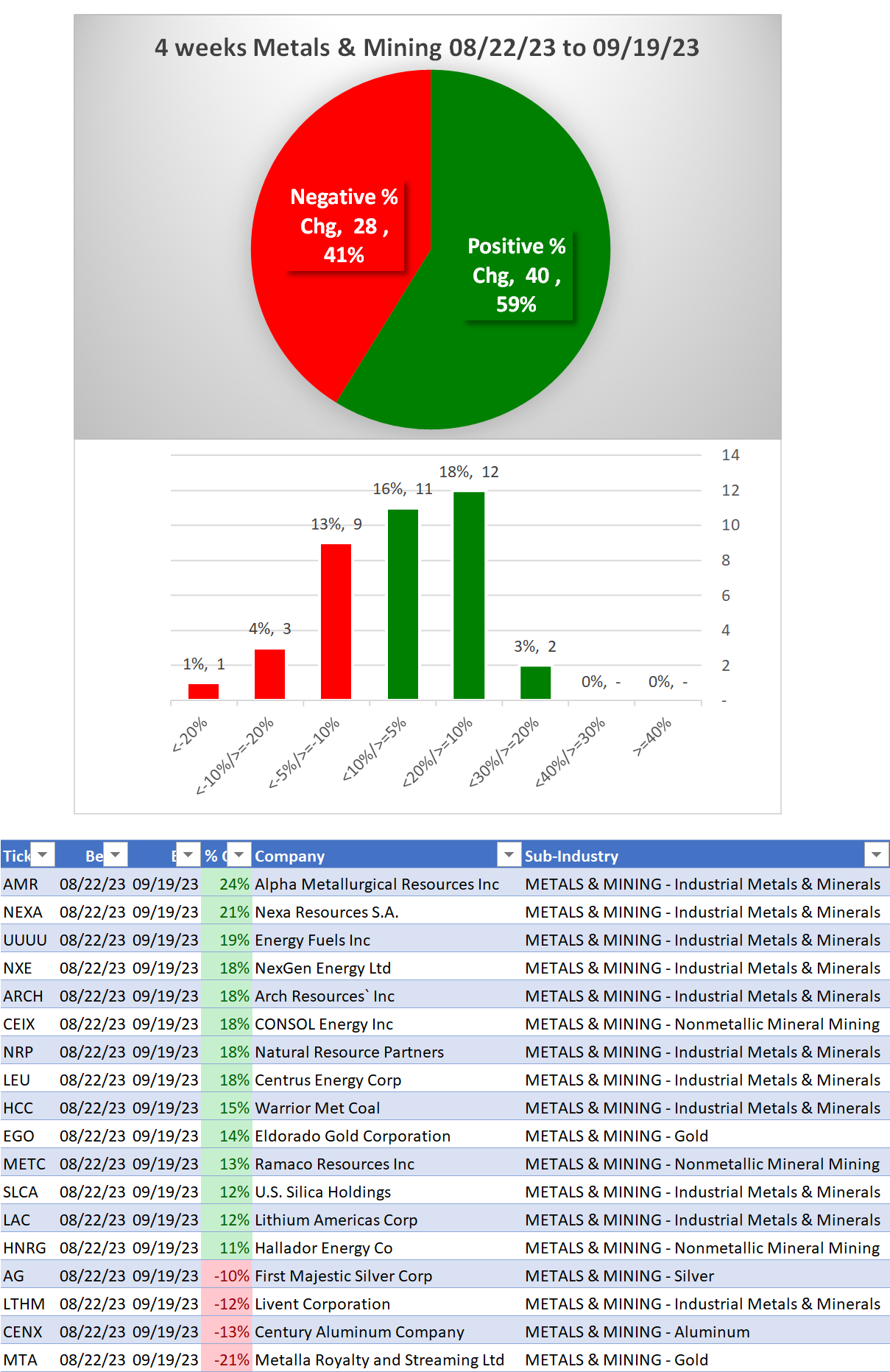

4 Weeks

AMR/Alpha Metallurgical Resources Inc (Industrial Metals & Minerals) +24%

NEXA/Nexa Resources S.A. (Industrial Metals & Minerals) +21%

1 Week

Gold strengthened 1 level

Feast or famine - Strongest stocks 25% and 34% of total, Weakest stocks 34% of total

NRP/Natural Resource Partners (Industrial Metals & Minerals) +20%

Background

Largest/most material of 7 sub-industries (68 stocks total, average 10 stocks/sub-industry):

22 stocks Industrial Metals & Minerals

16 stocks Gold

11 stocks Steel & Iron

10 stocks Silver

10 Biggest Market Cap stocks: SCCO, FCX, NUE, NEM, GOLD, FNV, AEM, TECK, WPM, STLD

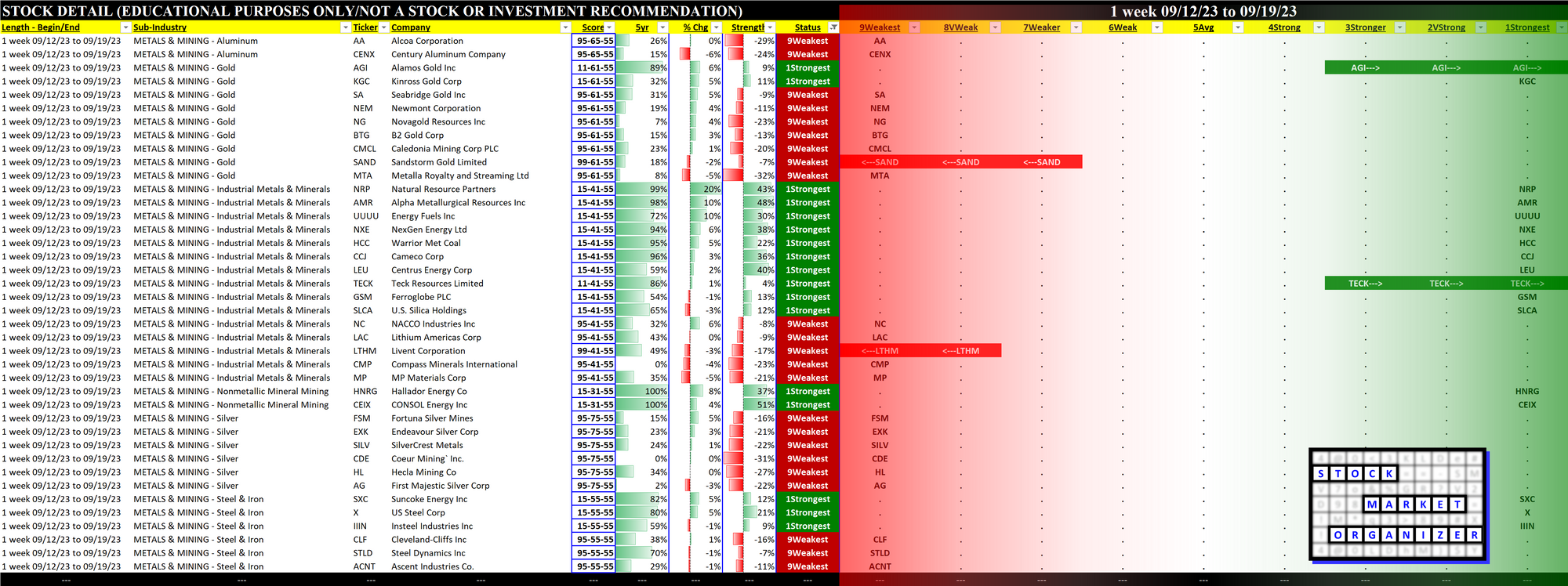

DETAIL: 1 Week Performance Review

Status

Strengthened: 3/7 sub-industries

Weakened: 1/7 sub-industries

Strongest at Stronger rating/3rd strongest of 9 levels:

3 stocks Nonmetallic Mineral Mining

Weakest at Weaker rating/7th strongest of 9 levels:

10 stocks Silver

Detail Charts: Sub-Industry and Stock

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

DETAIL: Lookbacks 6 Mos vs. 4 weeks vs. 1 Week

6 Mos Lookback

4 weeks Lookback

1 Week Lookback