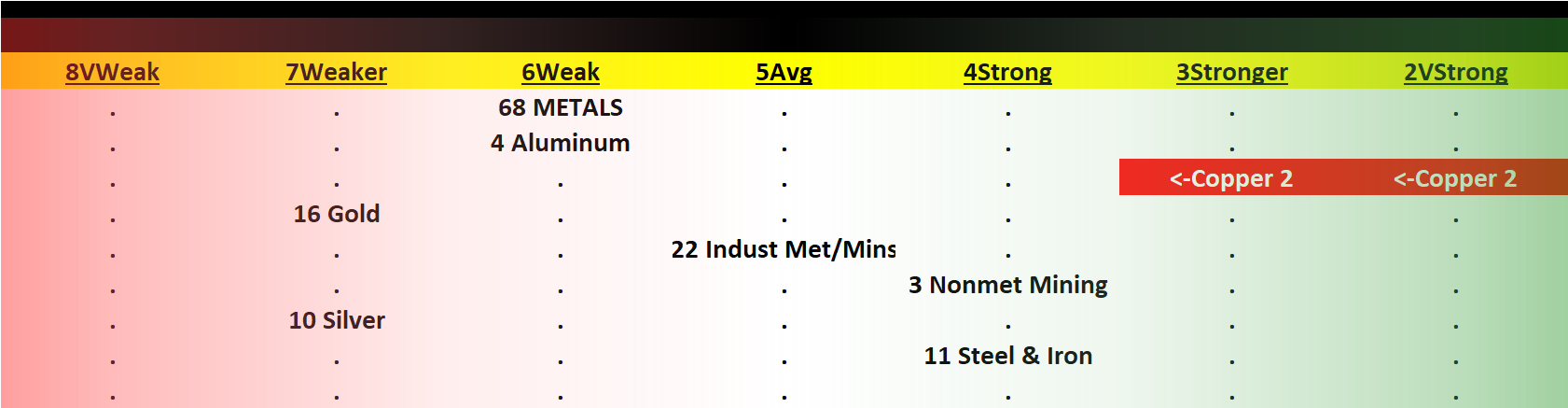

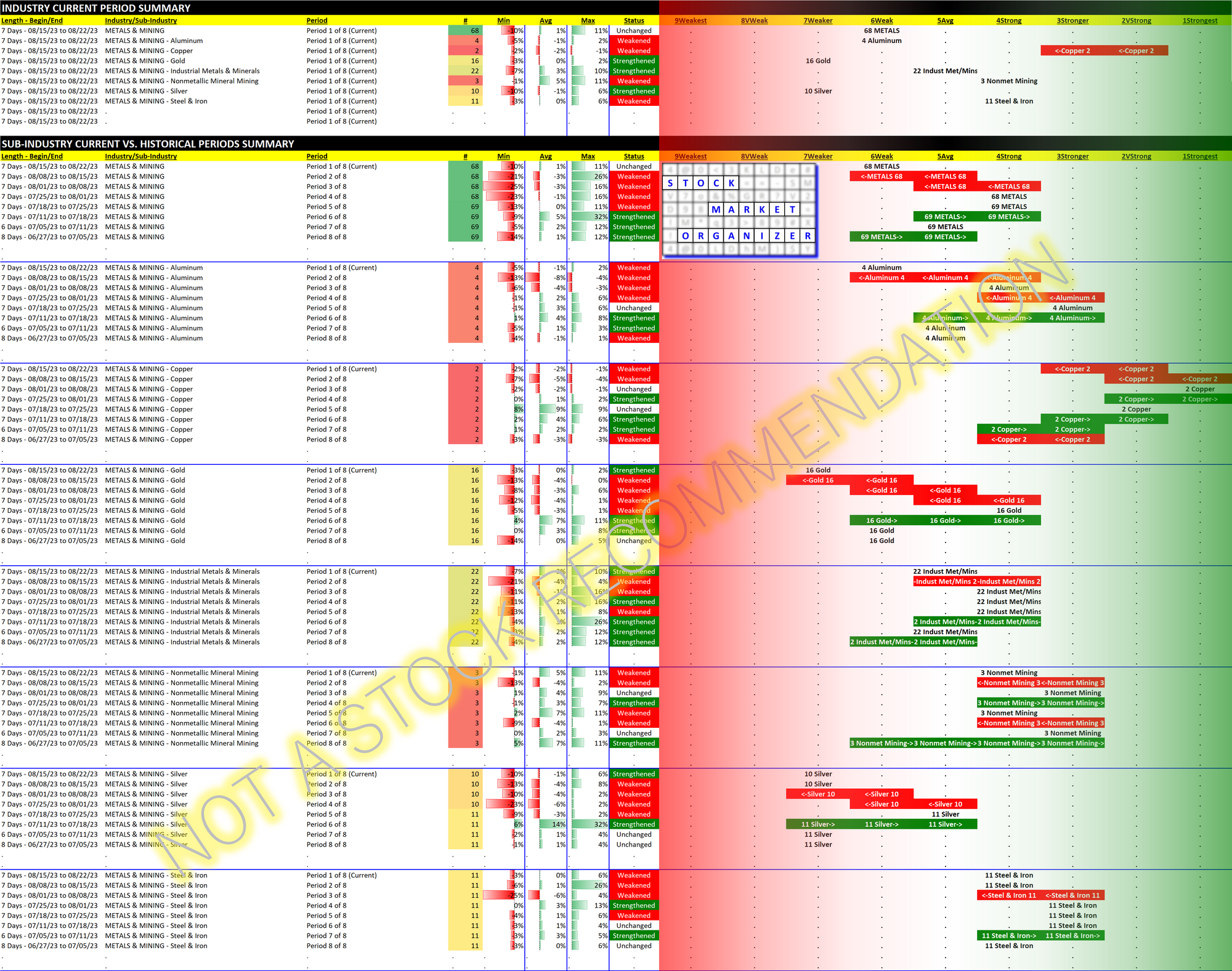

Metals 2023-08-22: UNCHANGED at "WEAK" strength rating (6th strongest of 9 levels), previous move was DOWN

Here's my previous look at Metals from 8/15/23.

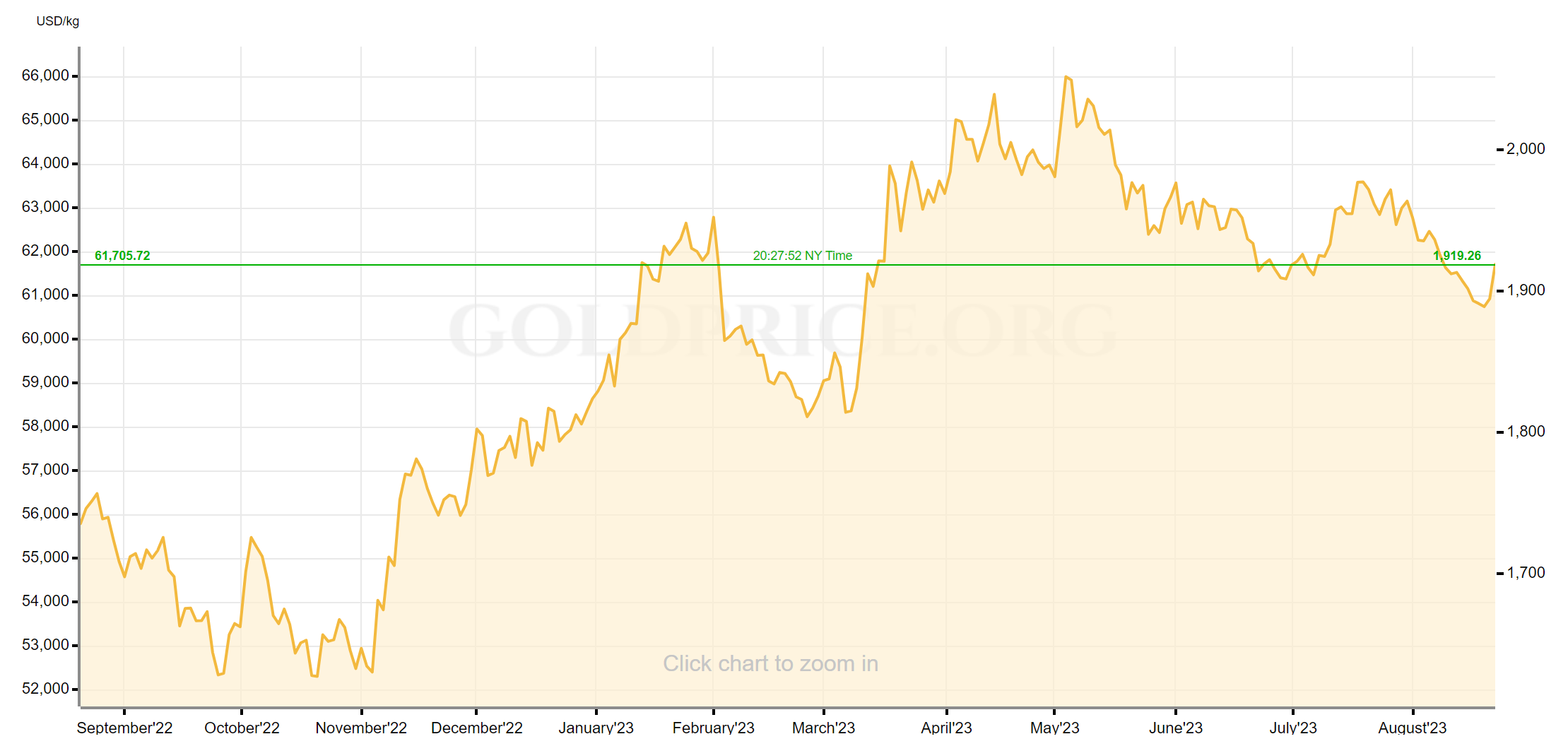

For reference, gold is now a little over $1,900/ounce. While it has been rising in recent days, it has generally been moving down from its 5/3/23 $2,052 high but has been rising in recent days from its 8/18/23 $1,889 low. Over the past 3 months gold has generally bounced between $1,900 and $1,975.

In this context, the headline above about the strength of the industry makes sense.

As a proxy for the specter of inflation, gold seems to be saying it is not an issue. Which in turn makes one wonder about the direction and level of interest rates, and the timing of any change in rates.

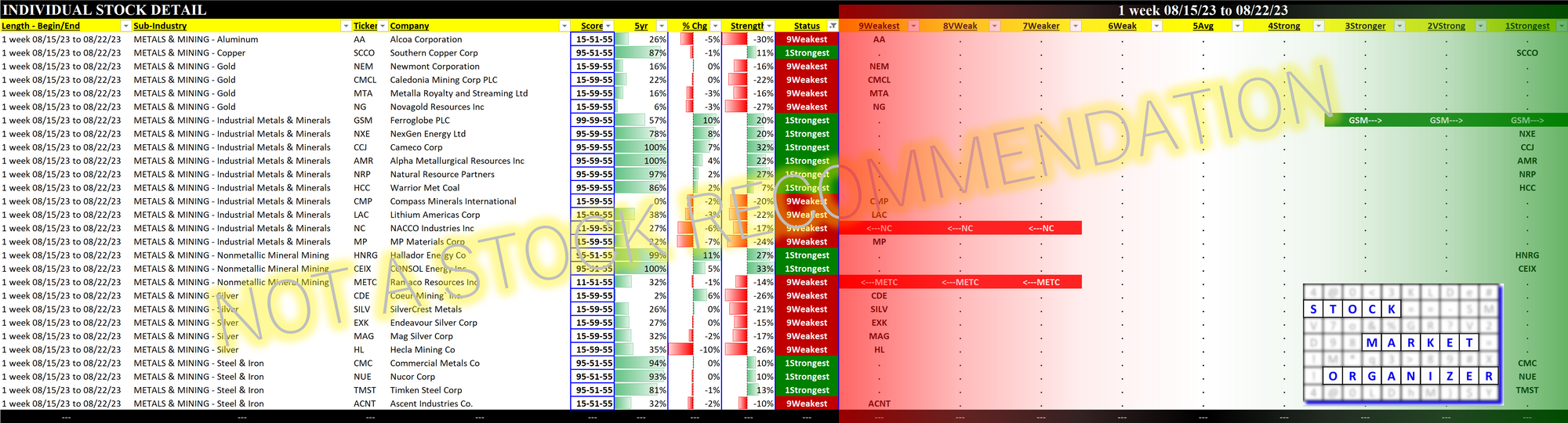

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.