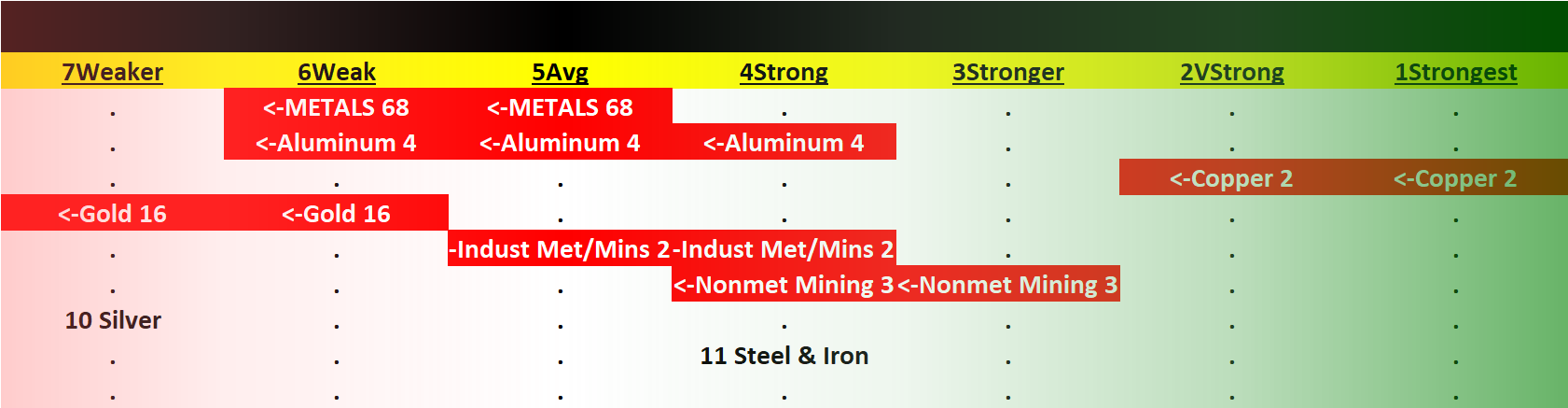

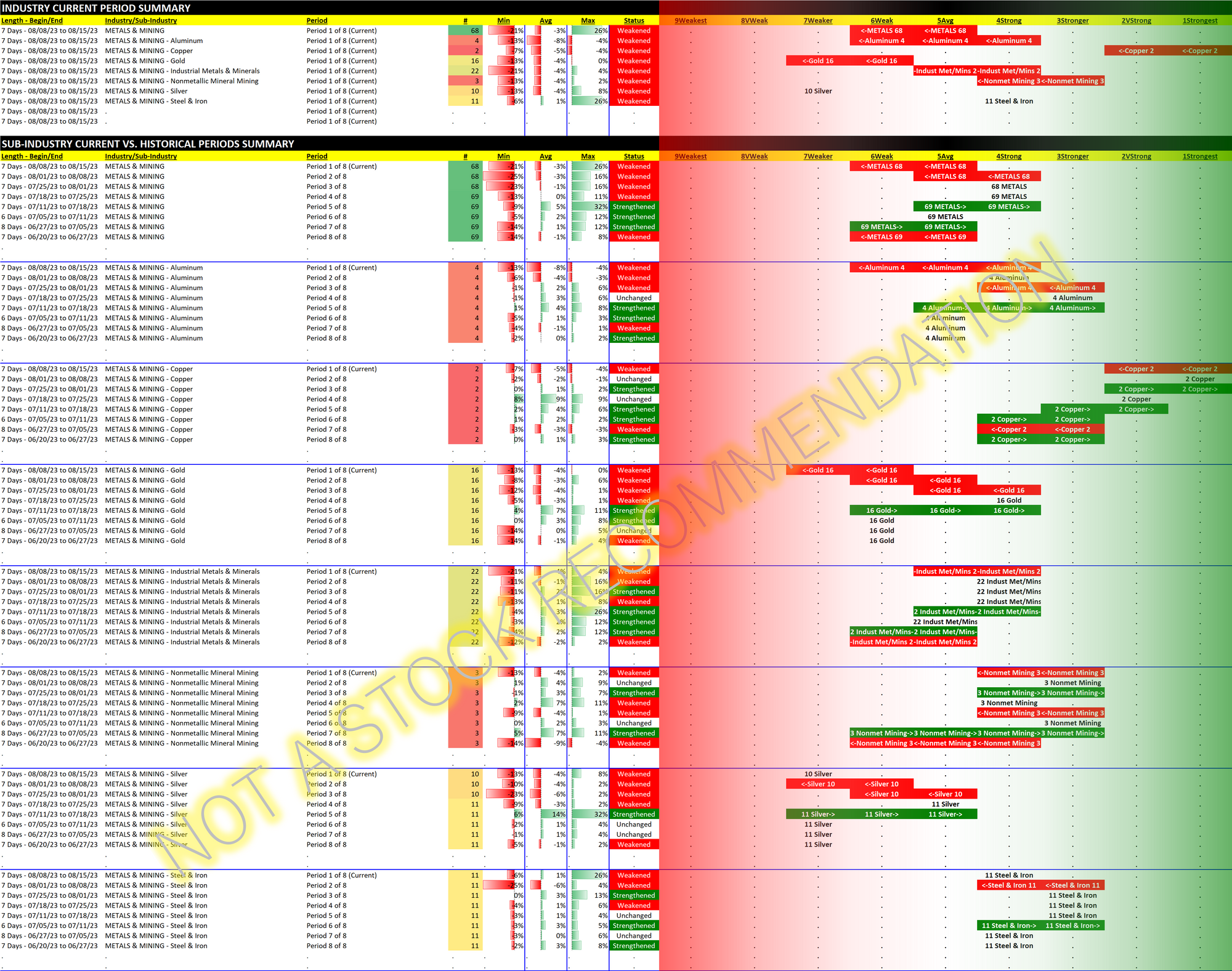

Metals 2023-08-15: -1 to "WEAK" strength rating (6th strongest of 9 levels), previous move was DOWN

Here's my previous look at Metals from August 8, 2023.

This week? Weakening throughout the industry.

Gold has weakened for 3 straight weeks and shares with Silver the weakest sub-industry rating at Weaker (7th strongest of 9 levels).

One could argue this is setting up for some attractive buying opportunities. This is true. As is the fact that any existing positions aren't getting any love.

Of course, no one knows how far these could fall. If you haven't heard the phrase "catching a falling knife," just know it is probably more painful to experience this in the stock market than it is in real life. Well, probably not - but suffice to say it is nothing you want to do.

Which is why I would not open new positions in sub-industries that are weakening. I referenced this concept in this post on Energy. It is much better to open positions in strengthening stocks in strengthening sub-industries. If you do that, you'll never be in danger of catching falling knives.

This is the benefit of a process - to objectively prevent you from making egregious mistakes. I recognize the allure of bottom-ticking a purchase. But to me it is too risky a proposition to justify the potential reward.

My process has been refined from making egregious mistakes and is constructed to eliminate them. Because I cannot control outcomes, I seek to enhance performance by eliminating potentially damaging actions. Like trying to catch a falling knife.

#processnotoutcome

Off topic but related... I once came in third in a real estate poker tournament (meaning multiple dozens of real estate people got together for a poker night during the Great Financial Crisis since no one was doing any business and everyone had time on their hands). I knew the basic rules but I was not a good poker player. I was close to losing the last of my chips when I realized everyone else had self-destructive, reckless tendencies. I started playing it close to the vest, focusing on not making mistakes rather than swinging for home runs. If I didn't have anything, I folded. I didn't even bother trying to bluff. By only engaging when I had a good hand, I survived the first round and made it to the finals table. There, my lack of poker skills was revealed as those who came in first and second genuinely knew what they were doing. But my point for that night is that, once I stopped shooting myself in the foot with dumb mistakes (as did everybody previously eliminated), I did very well. If I recall correctly I won $50 for third place.

Lesson learned: simply not making mistakes can be profitable. Add this to stock market experience and it is clear that eliminating mistakes MUST be a part of a solid stock market process.

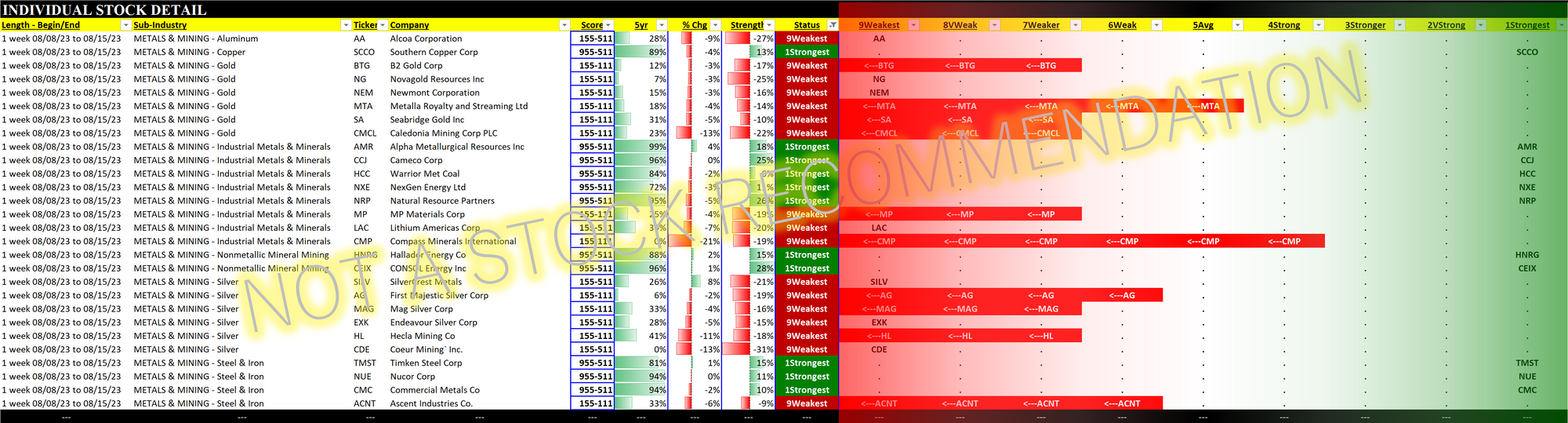

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.

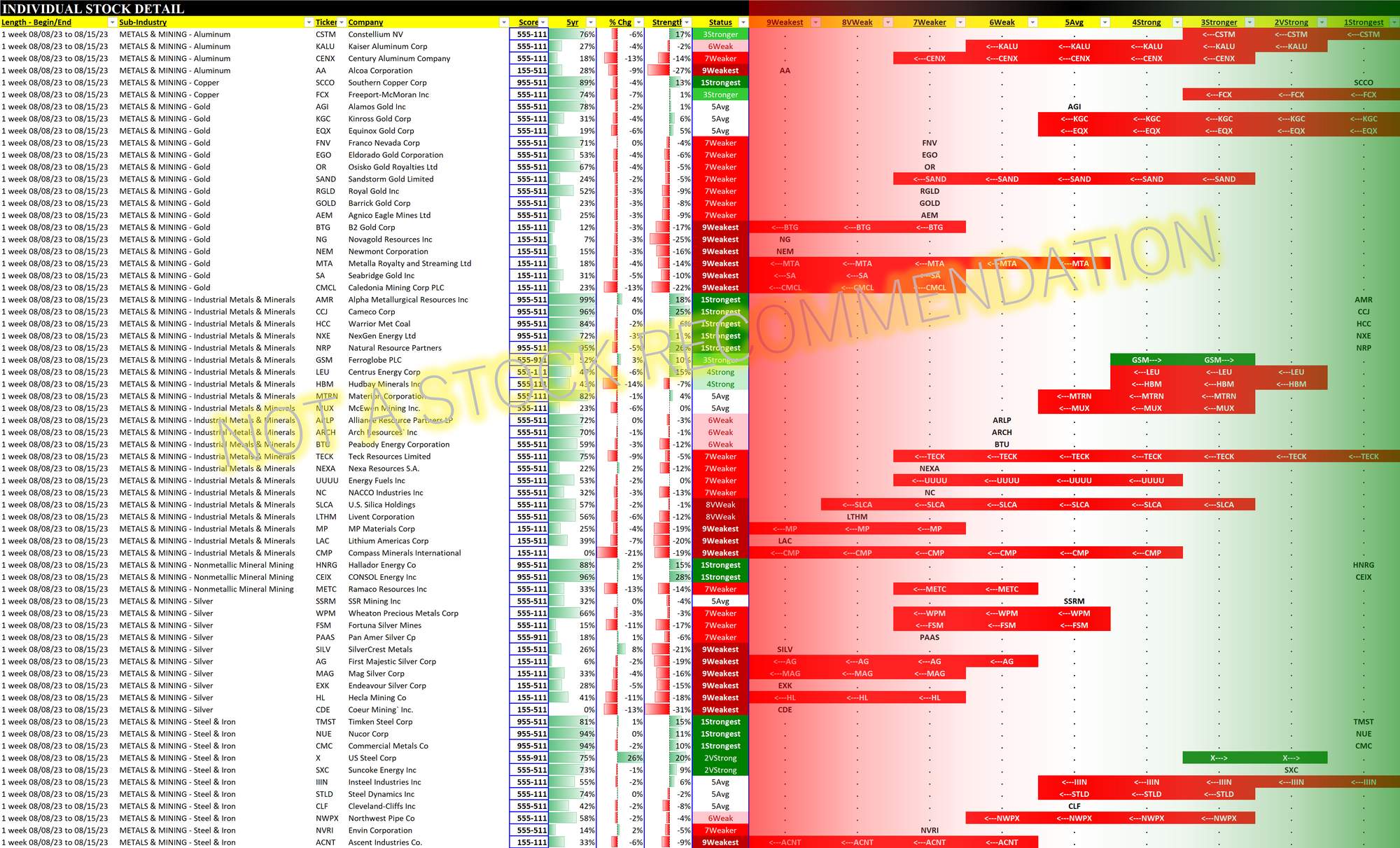

BONUS: Stock by Stock Look

Want to see the guts of a weakening industry? Check out all the red. Opportunity is on the way, but I wouldn't do anything at this point.