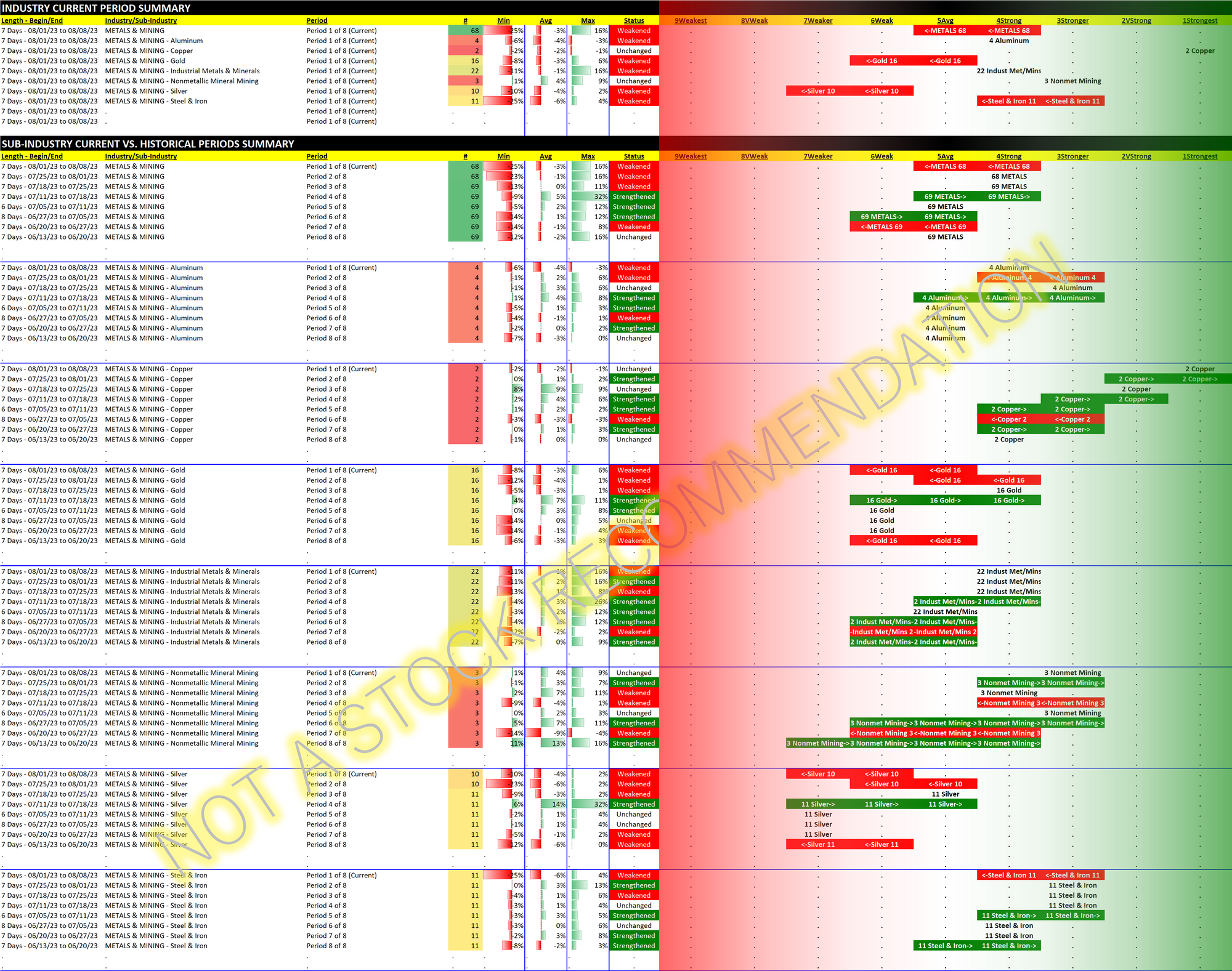

Metals 2023-08-08: -1 to "Average" strength rating (5th strongest of 9 levels), previous move was up

Here's my previous look at Metals from July 25, 2023.

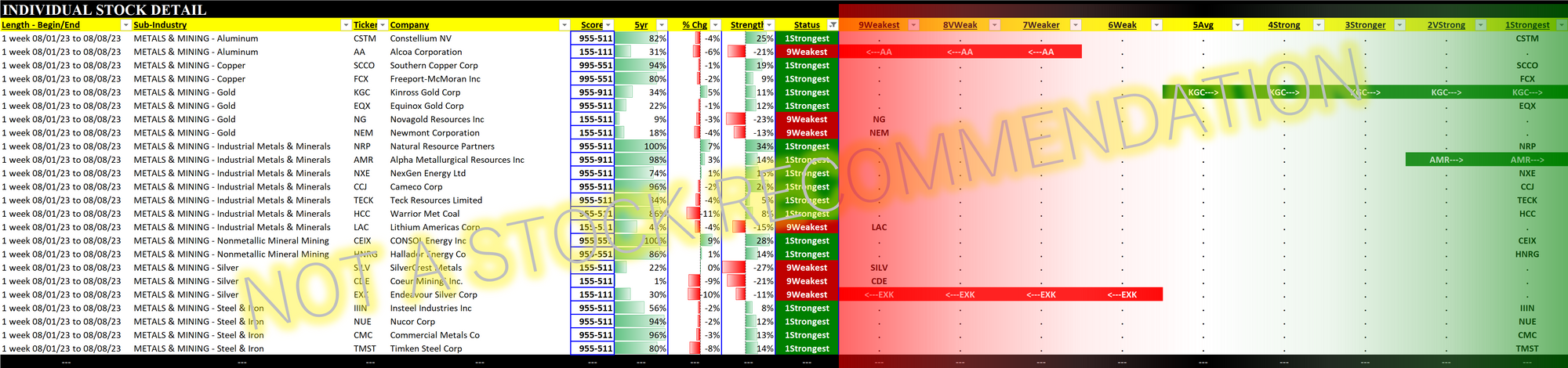

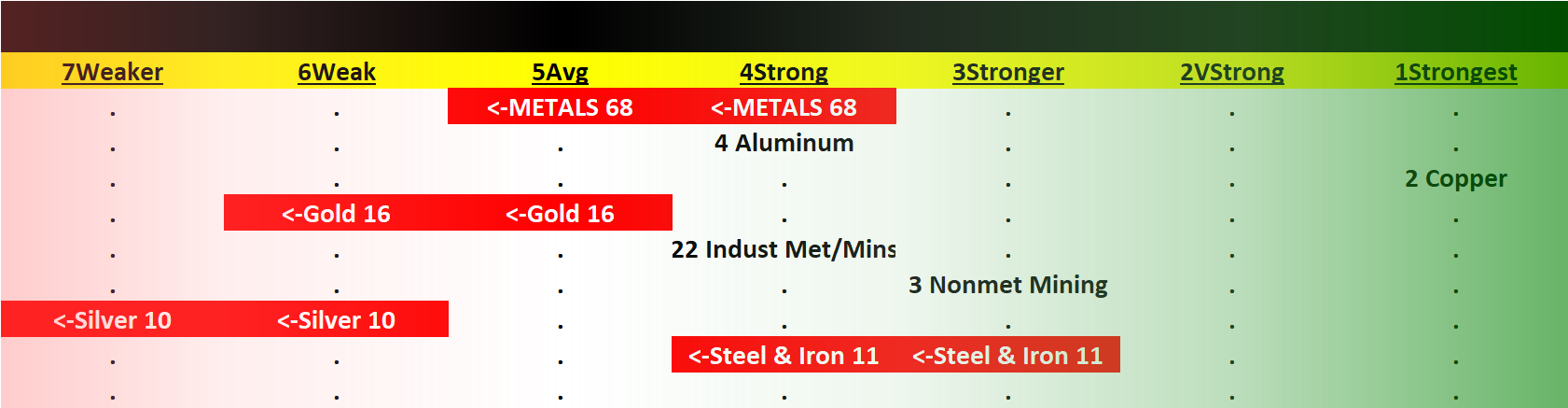

Gold has fallen over the past two weeks from Strong to Weak, the 6th strongest of 9 levels. It is now back to its strength level from 8 weeks ago. NEM/Newmont Gold, the most well-known of these stocks and currently the largest market cap by a small margin, is rated Weakest (lowest rating) along with NG/Novagold Resources.

Is this a statement on inflation?

Silver is the weakest sub-industry, rated Weaker (7th strongest of 9 levels).

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.