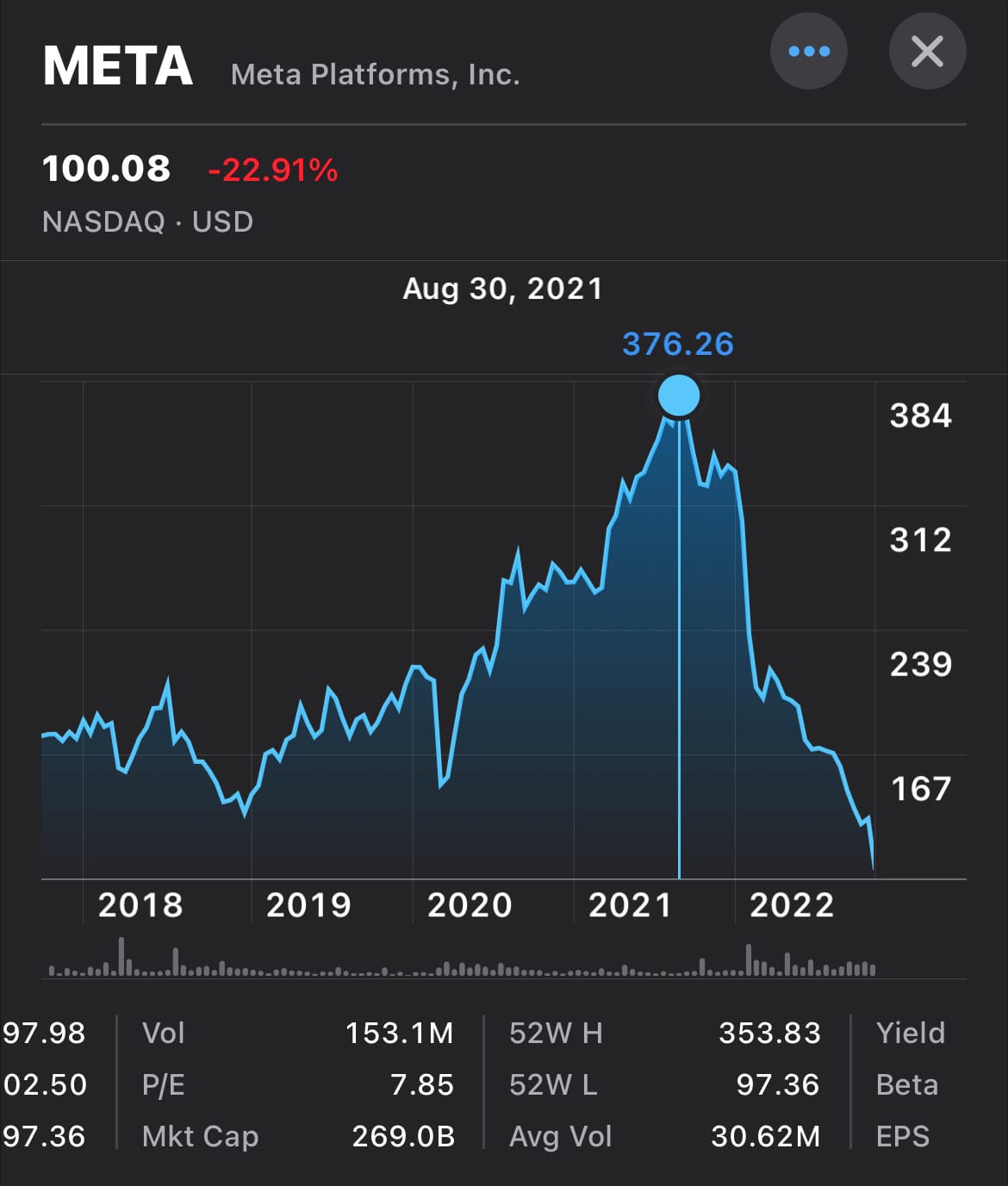

Meta/Facebook Faceplant 2022-10-27

META aka Facebook down from $376 14 months ago to below $100 today. Anyone thinking it is going to rocket back from here is not appropriately aware. This will take a while from which to recover. It is dead for a long time and there are at least 3,500 other stocks (of a minimum price and volume) to heed while it recovers.

The underlying practical rationale for why this will take a while to heal, completely unrelated to earnings, is as follows. There are tons of people who made paper profits during Facebook’s rise. Now that it has fallen nearly 3/4 of the way off its high from August 2021, there are many current holders drowning in red ink and incredibly frustrated they have ridden the stock down. If and when the stock starts going up, these will be the people who will tell themselves "if it rises to $XX then I will sell and make back some of my losses.”

Riding a stock down like this is how an army of holders is created that will sell into strength. This will cap the potential for a long-term rise in this stock until such time as the majority of owners have transitioned into those who will buy the dip because they 1) are profitable on their positions, and 2) are seeking to add to their holdings at pricing they wish they had previously gotten.

The reason it will take a long time for META/Facebook to recover from this disastrous decline is because it will take a while for the majority of its owner base to transition from red ink drowners using rallies to alleviate losses into opportunistic buyers seeking to increase holdings at more advantageous pricing.

In the meantime - there are plenty of stocks not named META that have already gone through this transition, or are most of the way there. Those are the stocks to pay attention to if and when one has dry powder.

But, most people aren’t looking for the above, they are looking to calculate earnings. Do those matter?

You will not find what you are not looking for.