Meaningfully comparing disparate industries 2023-03-15 (Banking vs. others)

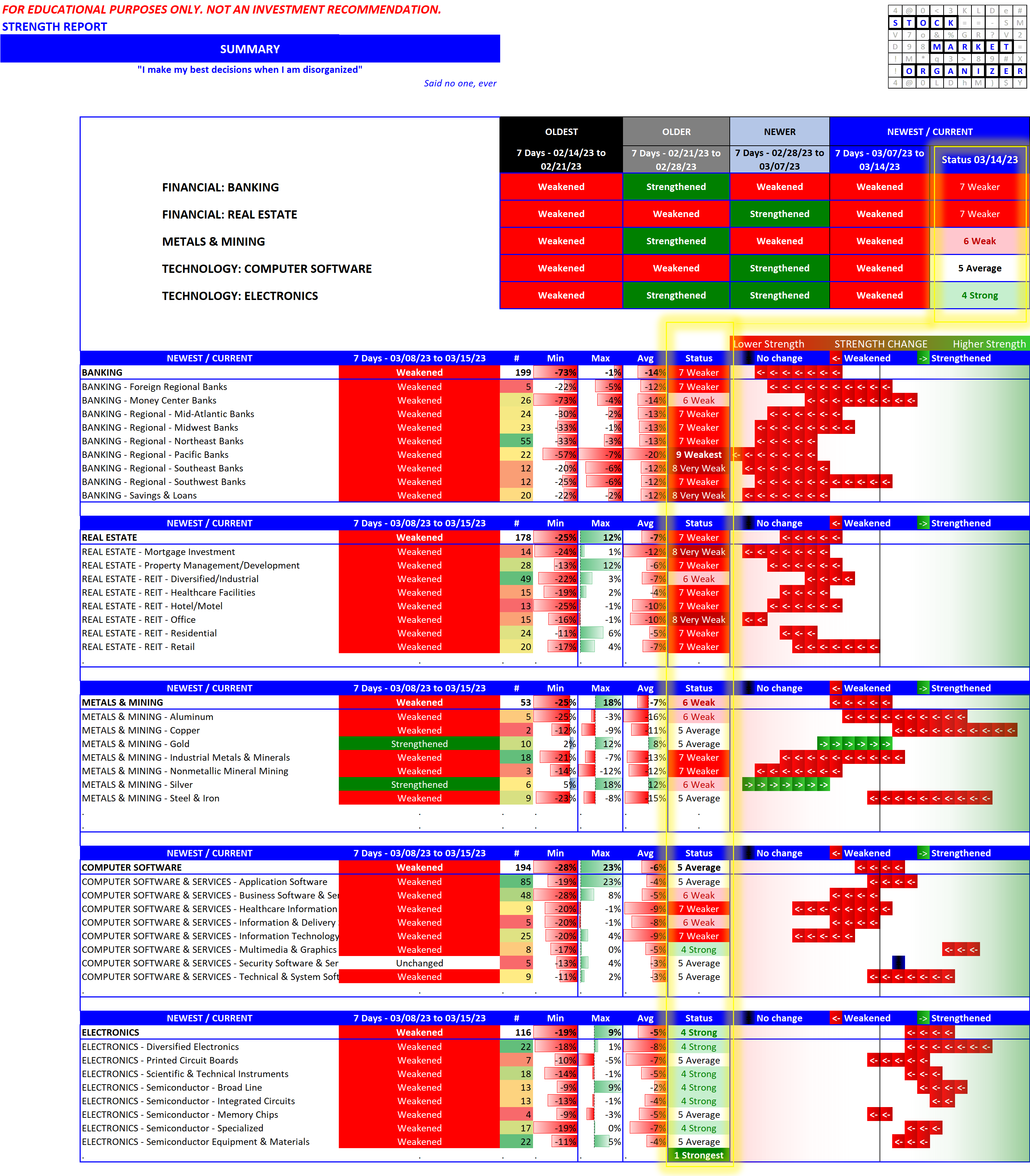

Following up this post which was a one-day break from looking at bank stocks, today I compare those stocks with Real Estate, Metals and Mining, Computer Software, and Electronics.

Some stats - you may or may not know that, for the week ending today:

- All five industries weakened.

- Of the 40 sub-industries, two strengthened, one was unchanged, and 37 weakened.

- The strengthening sub-industries were Silver and Gold. Security Software & Services was unchanged.

What do you do with this information? If you have no dry powder, nothing. If you have investable capital, the only sub-industries of interest (among those covered in these five industries) are Silver and Gold. #notastockrecommendation

No new longs in any of the other sub-industries.

Never go long a stock in a weakening sub-industry. Why think you'll pick the one stock that will buck a larger trend? Find a strong/strengthening stock in a strong/strengthening sub-industry.

Tie goes to the one in the strong/strengthening industry, if it is one where the components are comparatively homogenous.

Downloadable reports

Detailed reports for each of the above are downloadable at the following links. This first one directly compares the past four weeks action for the five industries:

The following are detailed stock-by-stock reports for each industry.

Banking: Has the intervention helped? (Spoiler alert: not one of the followed bank stocks had a positive return for the past week.)

Real Estate: how does instability in banking impact this fellow financial sector industry?

Metals: how is the prospective pause in interest rate increases (and in turn the inflation fight) impacting this industry?

Computer Software: how is this industry holding up - any pockets of strength?

Electronics: How is Intel among the Broad Line Semiconductors?