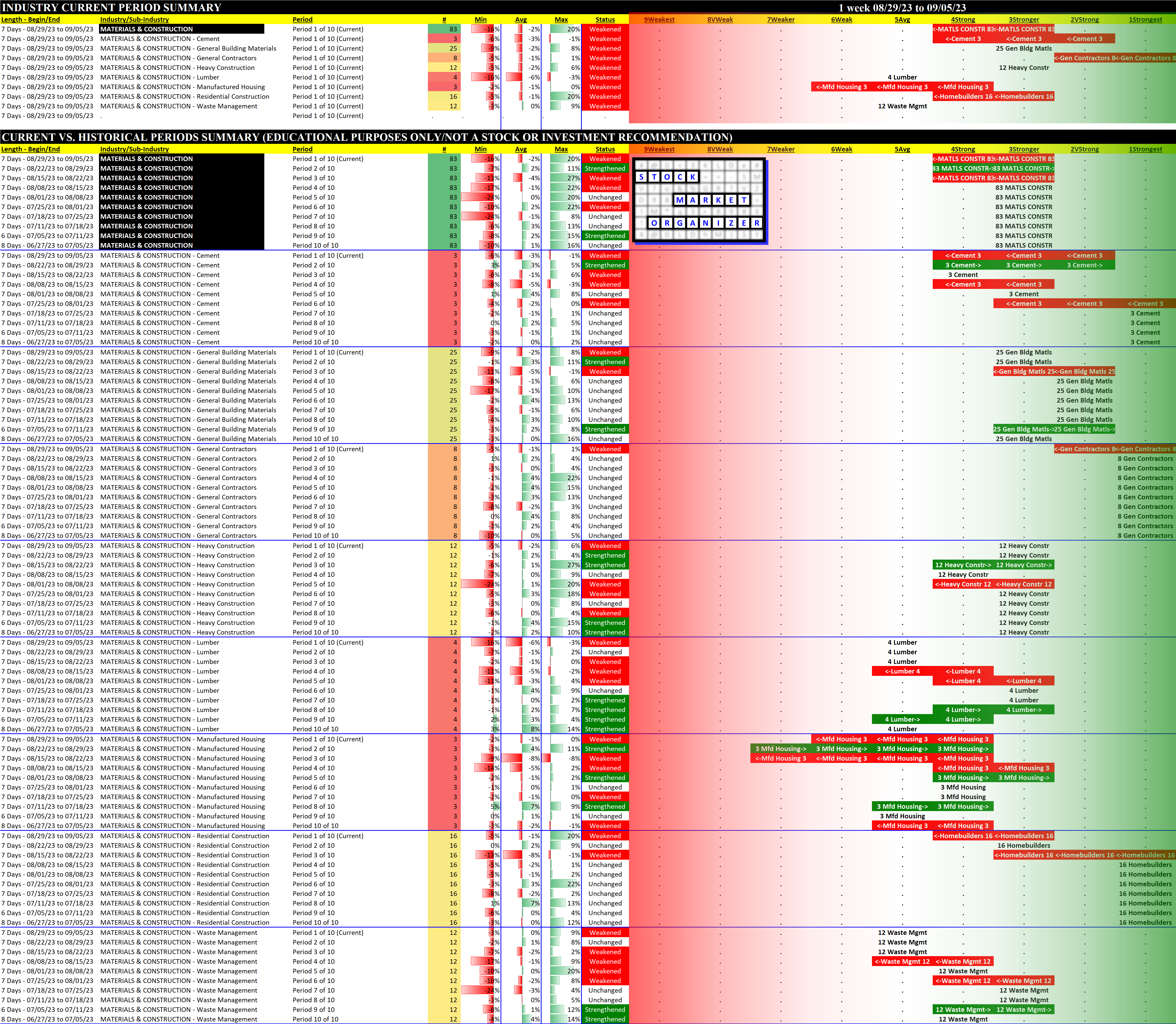

Materials/Construction incl. Homebuilders 2023-09-05: -1 to "STRONG" strength rating (4th strongest of 9 levels), previous move was UP

Here is my Materials & Construction (Homebuilders) review from August 22, 2023, along with my review from August 29.

Homebuilders were going strong for a while this year but the last three weeks have shown some wobbling and as noted below it got worse today.

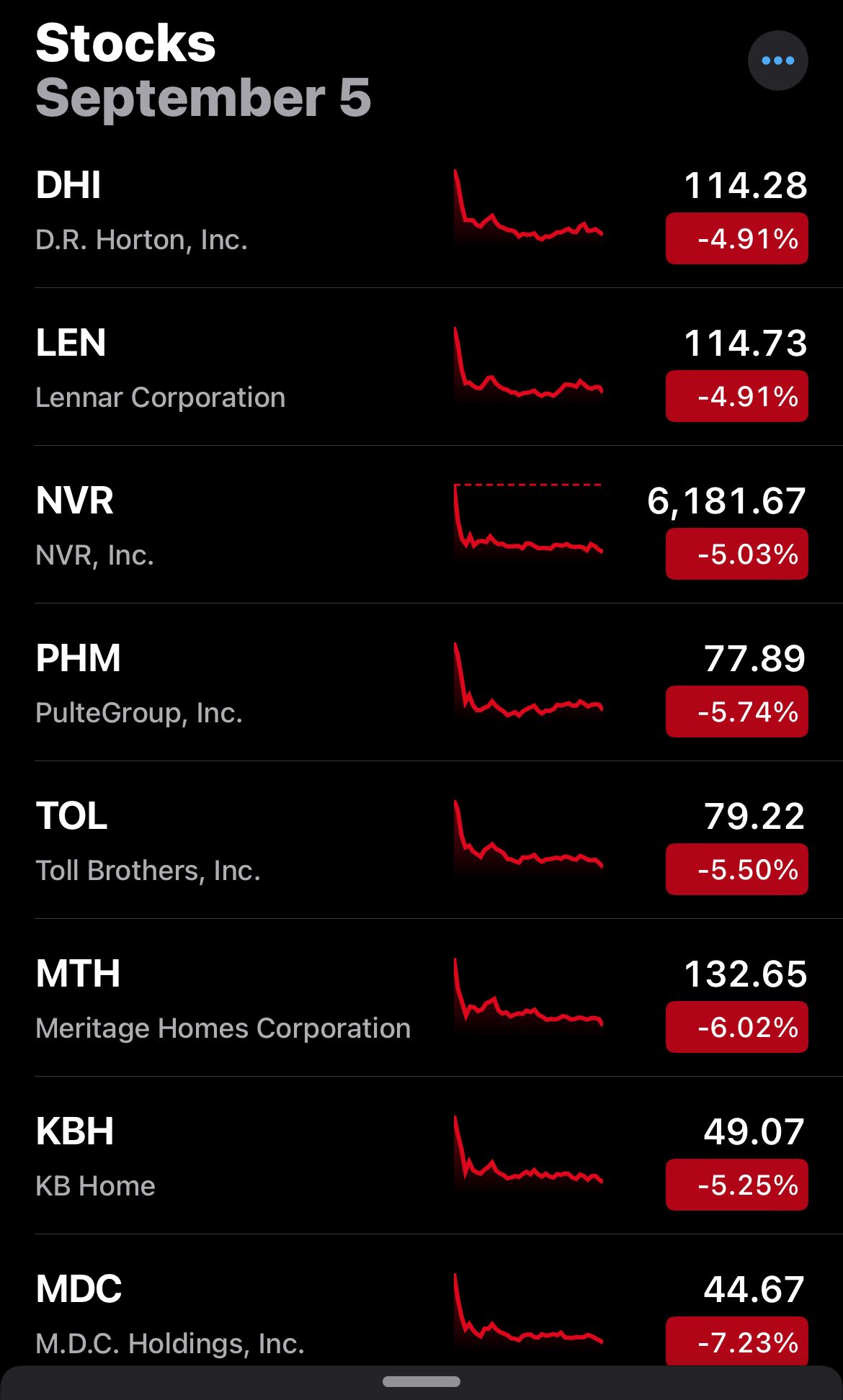

Today 9/5/23 was not a good day for the Homebuilders with the largest market cap firms at -5% to -7% just today.

Nothing says this can't recover, and if you look at the charts it still looks like these are in uptrends. Look at HOV/Hovnanian going back to last November - is this a problem?

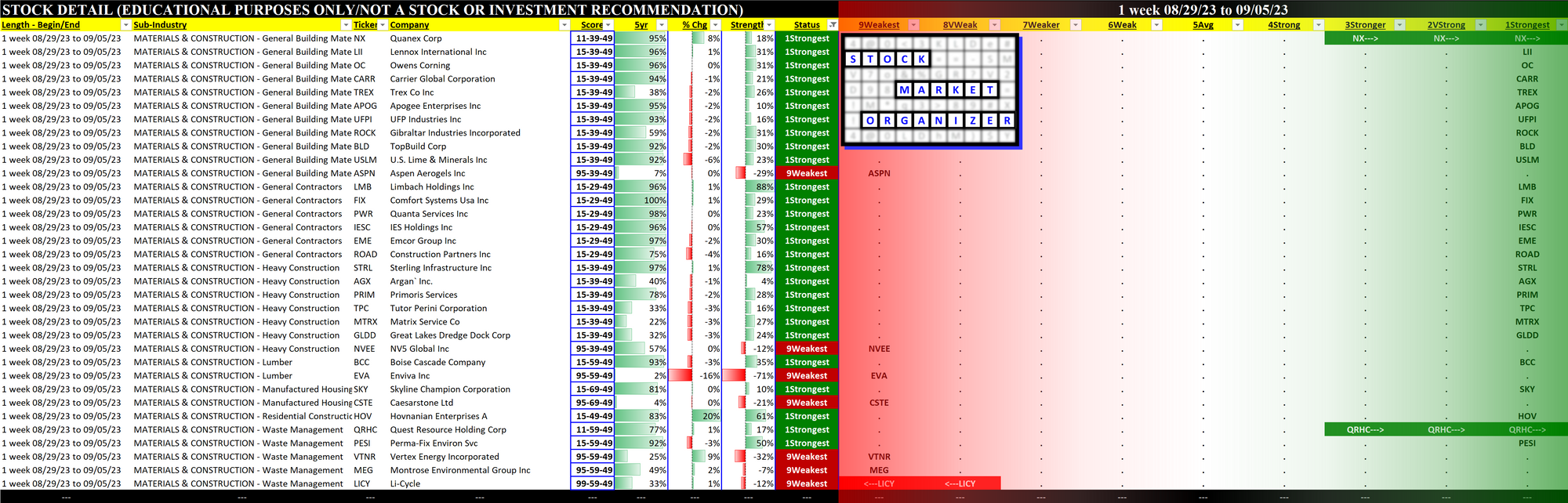

Their upward movement is clearly waning, though, and HOV is the only Homebuilding (aka Residential Construction) stock currently with a Strongest rating.

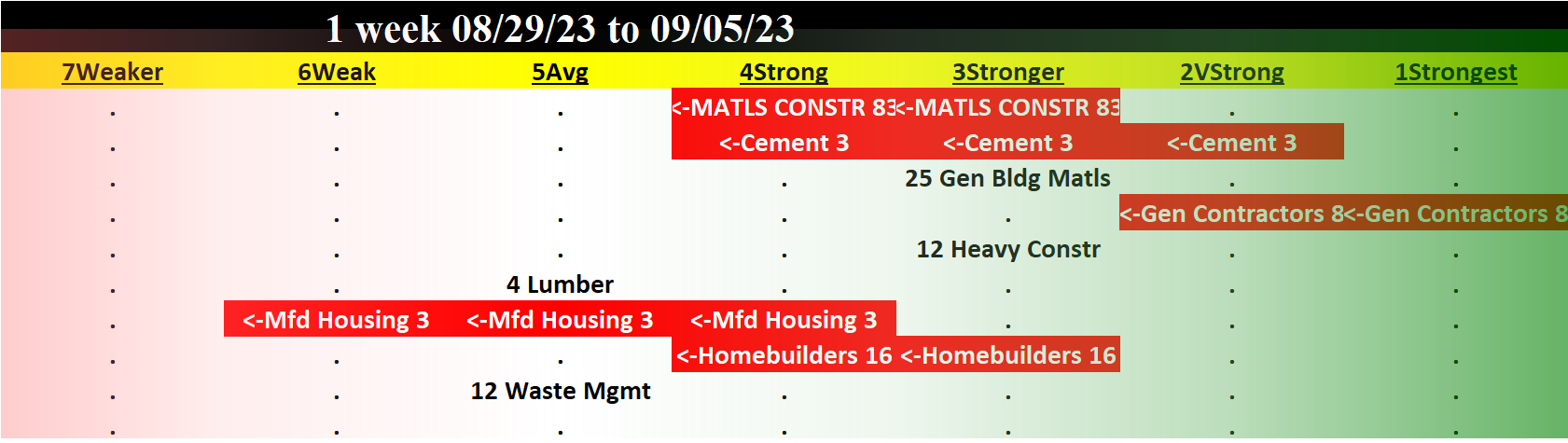

Per below, in the past 3 weeks Residential Construction has fallen 3 strength levels from Strongest (where it was for a while) to Strong (4th strongest of 9 levels).

Note also that General Contractors has been rated Strongest for about 2 months and it has also now weakened, one level to Very Strong (2nd strongest).

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.