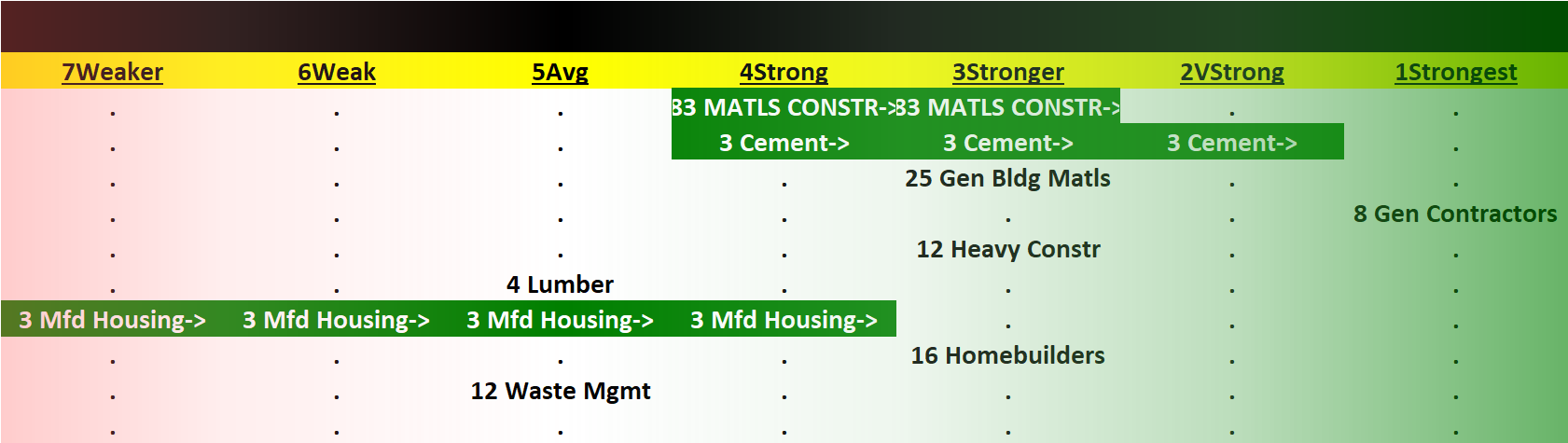

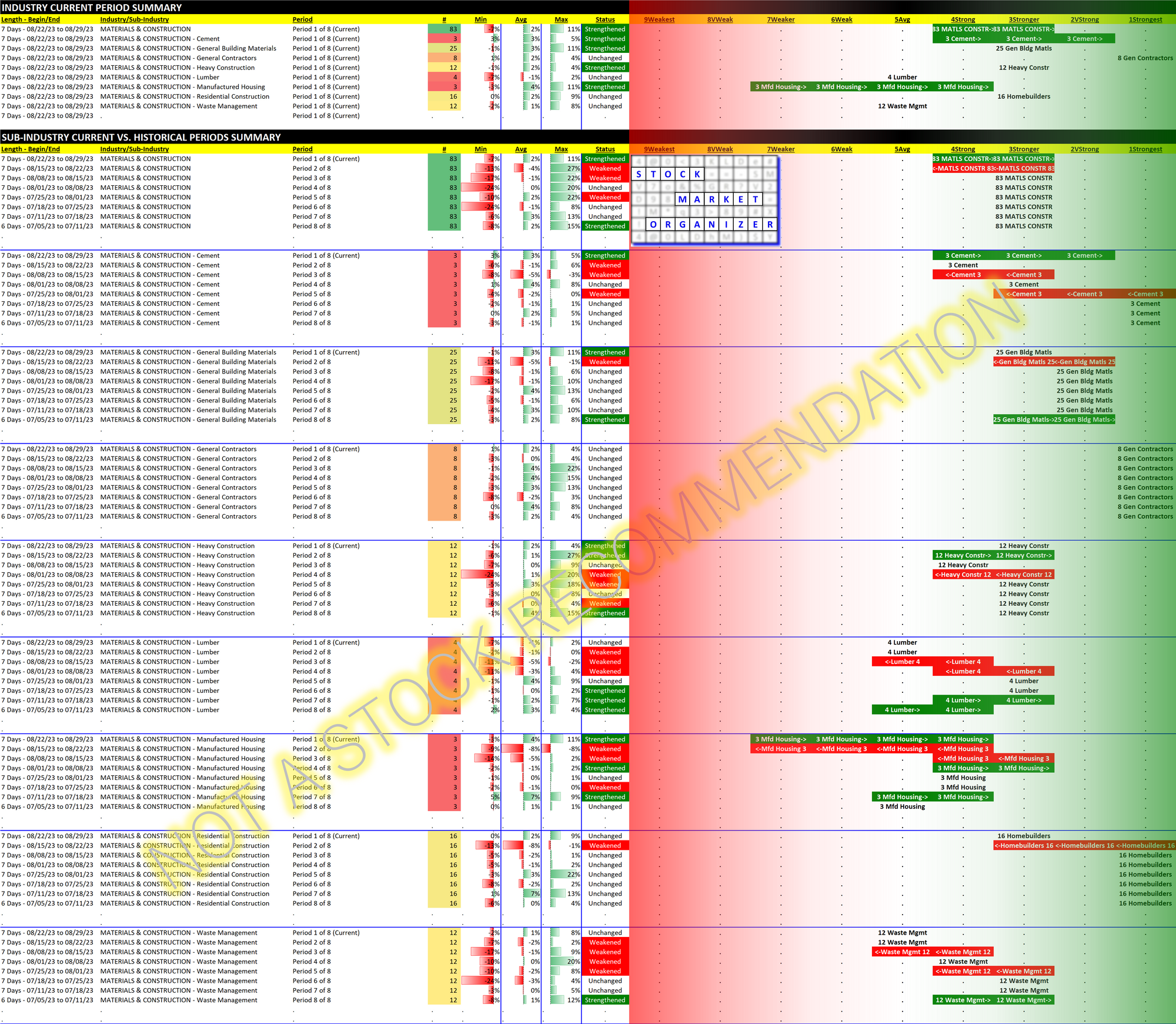

Materials/Construction incl. Homebuilders 2023-08-29: +1 to "STRONGER" strength rating (3rd strongest of 9 levels), previous move was DOWN

Here is my most recent previous Materials & Construction (Homebuilders) review from August 22, 2023.

The week ended 8/22/23 was the first down week in 2 months for the industry but it reversed course this week, retracing the strength level previously lost.

BZH/Beazer Homes did have a positive day +1.1% but broke its weird streak of having sensational 28th days of the month. As noted in my previous two reviews,

... BZH/Beazer Homes [which] jumped 28% July 28. It also had jumped 11% June 28. And 24% April 28. (May 28 was not a trading day. Wonder what is on tap for August 28, likely a dead-as-a-doornail market day overall as the last summer Monday?)

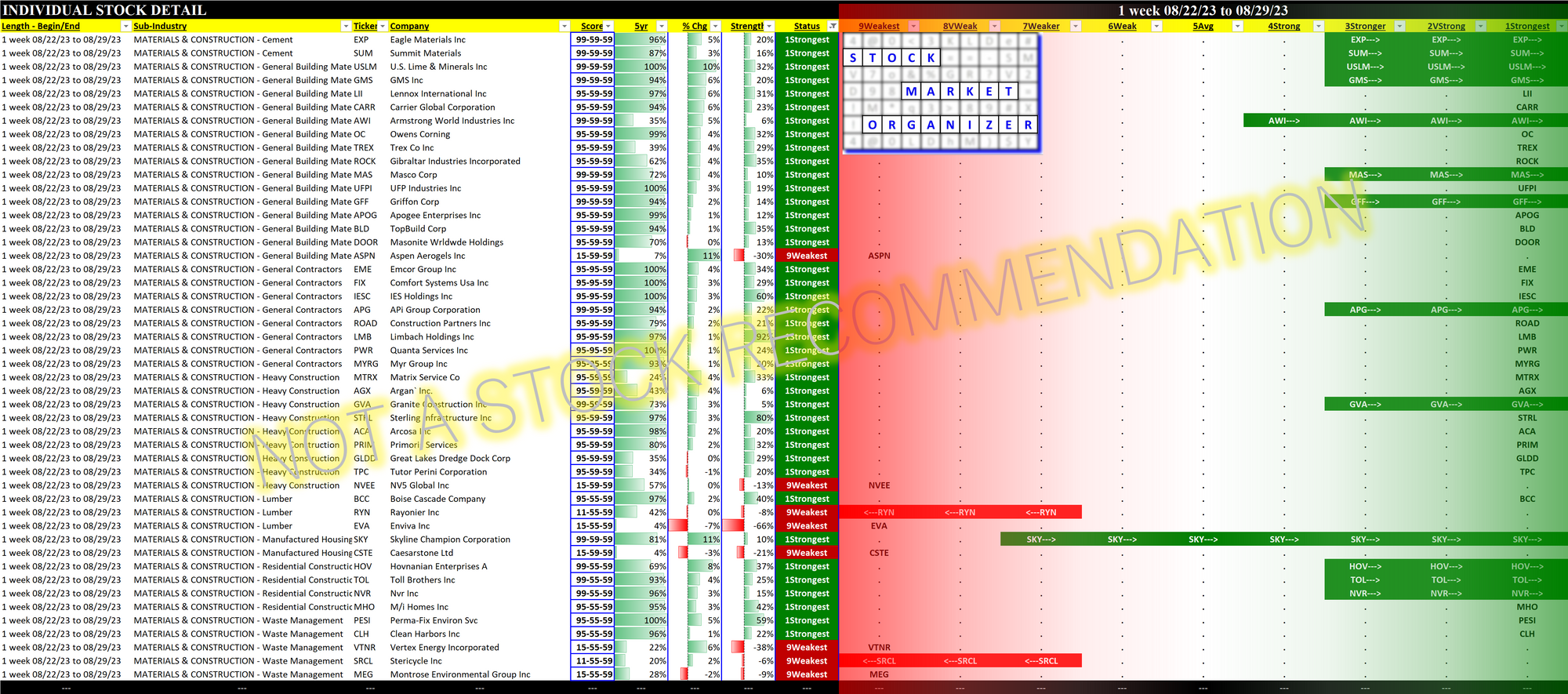

Residential Construction/AKA Homebuilders has 4 stocks with the Strongest strength rating: HOV/Hovnanian Enterprises, TOL/Toll Brothers Inc., NVR/Nvr Inc., and MHO/M/i Homes Inc.

Homebuilders have performed exceptionally well in 2023, led by 4 stocks >+100%: HOV +139%, BZH +125%, M/i Homes +106%, and GRBK/Green Brick Partners +101%. 5 more are >+50%, and the "worst" is LEGH/Legacy Housing Corporation +17%.

The largest sub-industry with 25 stocks is General Building Materials, which has also had a strong 2023 and which has a "STRONGER" rating (3rd strongest of 9 levels). The leader BLD/TopBuild Corp. is +83% YTD, while there are 9 other stocks >+50%. The lowest positive return is NX/Quanex Corp. +11%.

The YTD worst General Building Materials stock is ASPN/Aspen Aerogels, -41% YTD. It started out the year at the Weakest (lowest) strength level, and it has remained weak all year. Is this stock destined to be lifted out of the doldrums by the strength of its sub-industry brethren?

Saving the best for last, General Contractors (8 stocks) notably remains at the Strongest (highest strength) level. Its leader is LMB/Limbach Holdings +236% YTD and it is joined in the >+100% club by IESC/IES Holdings at +107%. The laggard in this sub-industry is still at an excellent +31% YTD (ROAD/Construction Partners).

Stock Market Organizer Goal: Sustained Price Movements

The General Contractors sub-industry provides excellent examples of this system's explicit goal: to participate in the "meat" of Sustained Price Movements.

This system will never bottom-tick nor will it top-tick. Instead, it seeks to

1) enter after both the stock and its sub-industry have proven they are strengthening, and

2) exit after the stock's price action proves it is no longer strengthening.

In short, the system enters positions based on sub-industry and stock conditions, and exits based on stock conditions. Specifically, the stock has changed character to weakening, thus negating the reason for being in the stock. Thus, the system dictates selling that stock and redeploying that capital into a new candidate that is strengthening in the context of a strengthening sub-industry.

The following graphic shows #sustainedpricemovement examples from the General Contractors sub-industry:

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.