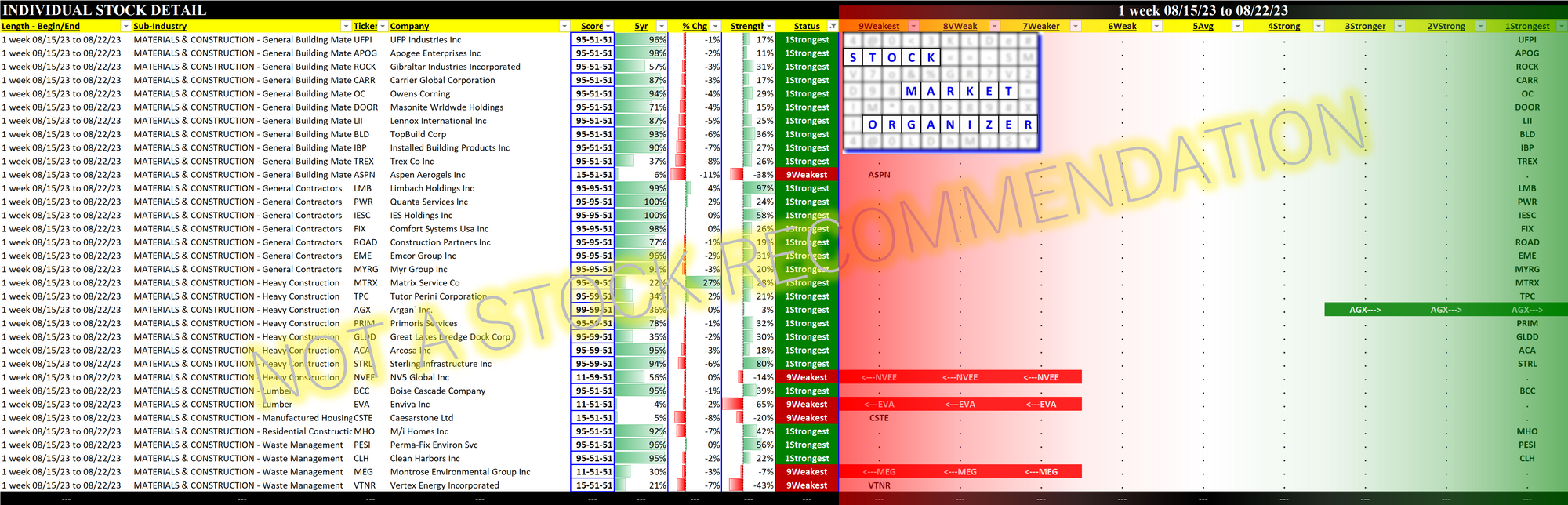

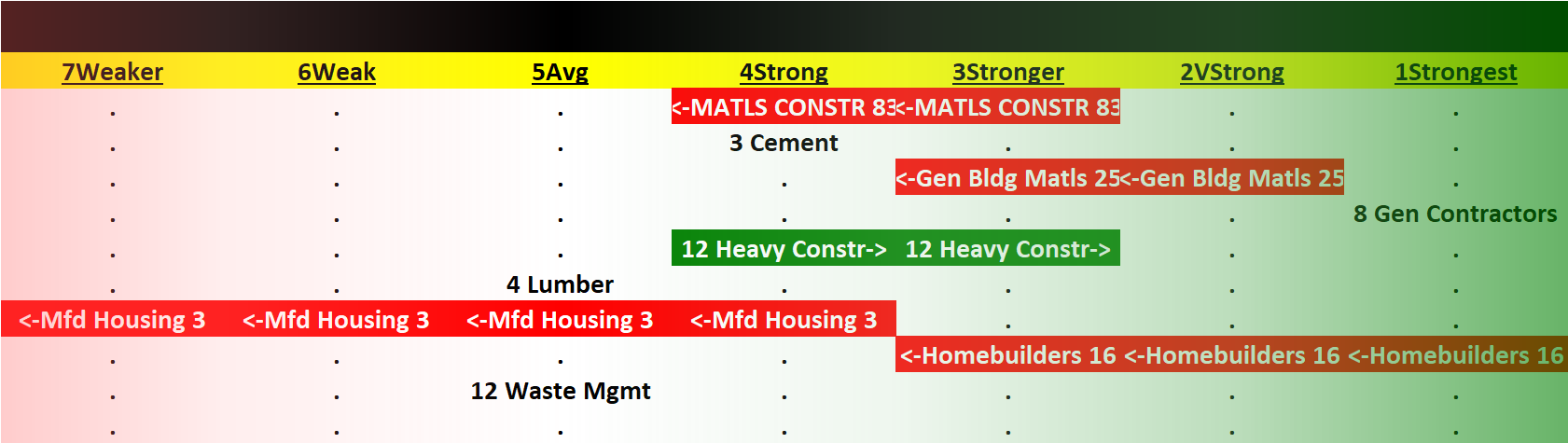

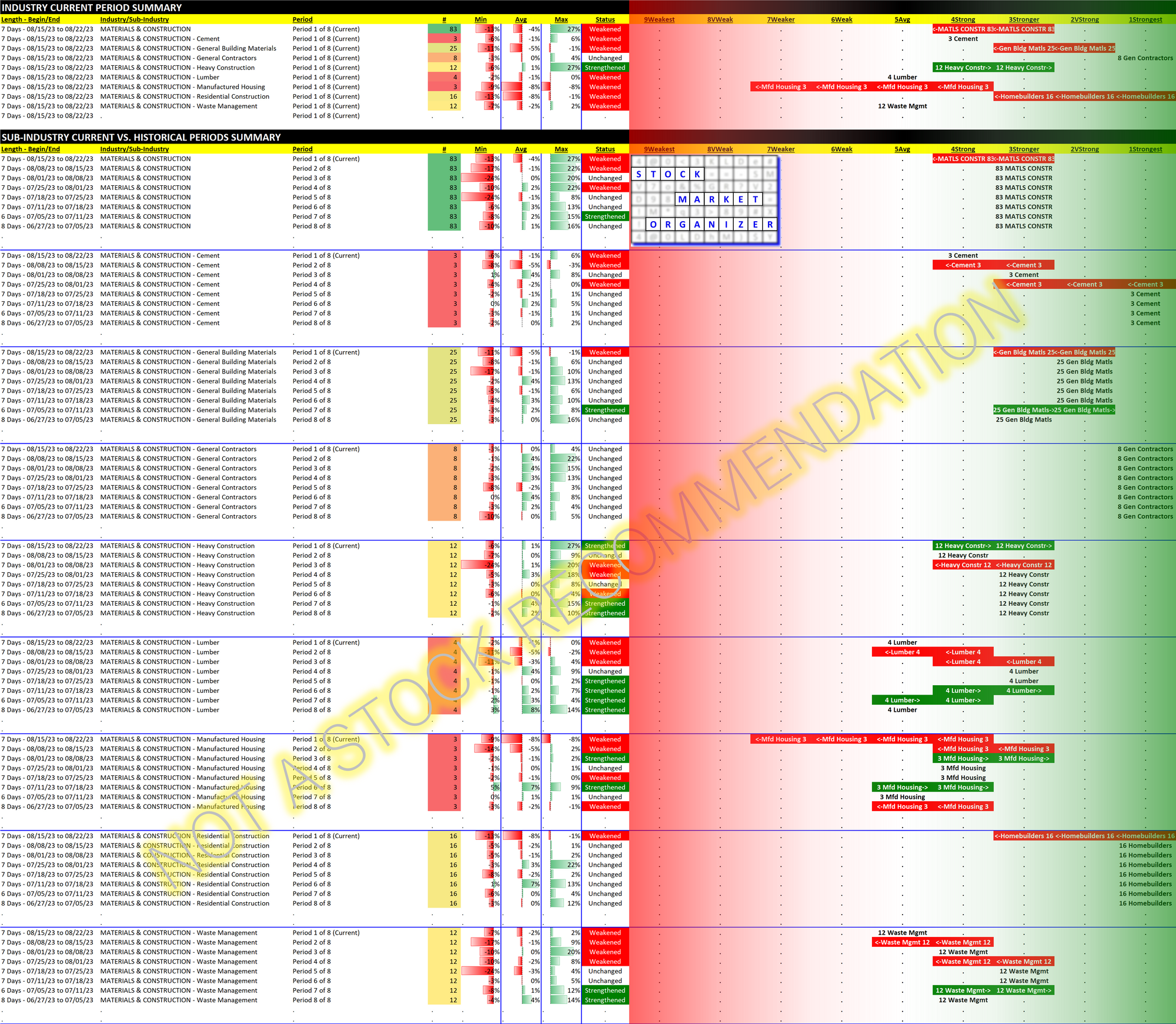

Materials/Construction incl. Homebuilders 2023-08-22: -1 to "STRONG" strength rating (4th strongest of 9 levels), previous move was UP

Here is my Materials & Construction (Homebuilders) review from August 15, 2023.

Here's a quote from that review:

There was some underlying weakening, with 4 of the 8 sub-industries weakening by one level each... Last week all 16 Residential Construction (aka Homebuilders) stocks were Strongest. This week, 2 stocks weakened 2 levels from Strongest down to Stronger - not enough to change the sub-industry's strength rating, but this does reflect new weakness in the sub-industry.

The 2 stocks weakening was a precursor to additional weakness in the sub-industry. For the week ending 8/22/23, all 16 homebuilding stocks covered weakened/declined, ranging from NVR/NVR Inc. -1.5% to BZH/Beazer Homes -13%.

Seems to be feast or famine for Beazer - and remember to look out for next Monday 8/28. As noted in my August 8 review of this industry, the 28th day of 3 of the past 4 months going back to April has been exceptionally kind to Beazer. Specifically, it was +24% April 28, +11% June 28, and +28% July 28. (May 28 was a weekend day.) Although 8/28 is the last summer Monday before Labor Day, so it should be a slow trading day.

A decline doesn't mean an implosion is on the way. It could just be a case of the sub-industry and its holders digesting a strong rally and setting up for more gains.

In an uptrend, there are buyers that are left behind that jump at the chance to either start positions or add to existing positions at better prices. If/when enough of these buyers step in, the decline is stopped and potentially reversed. This then sets a new higher low that is noticed by other buyers - who then may step in themselves, excited to get on an upward-pointing trend.

This is how trends continue.

At the same time, the first step in a multi-week decline is a one-week decline. Since we don't know if this will continue, in my mind it is safer to step aside until the strength in the targeted sub-industry re-asserts itself before potentially opening any new positions.

Furthermore, it is wise to look elsewhere in the market where there may be stocks and sub-industries that are strengthening. If one is locked and loaded onto just looking at certain stocks of interest to the exclusion of considering other potentially better alternatives, one might be leaving returns on the table. But unless you are actively looking for these other opportunities, you certainly won't find them.

#youwontfindwhatyouarentlookingfor

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.