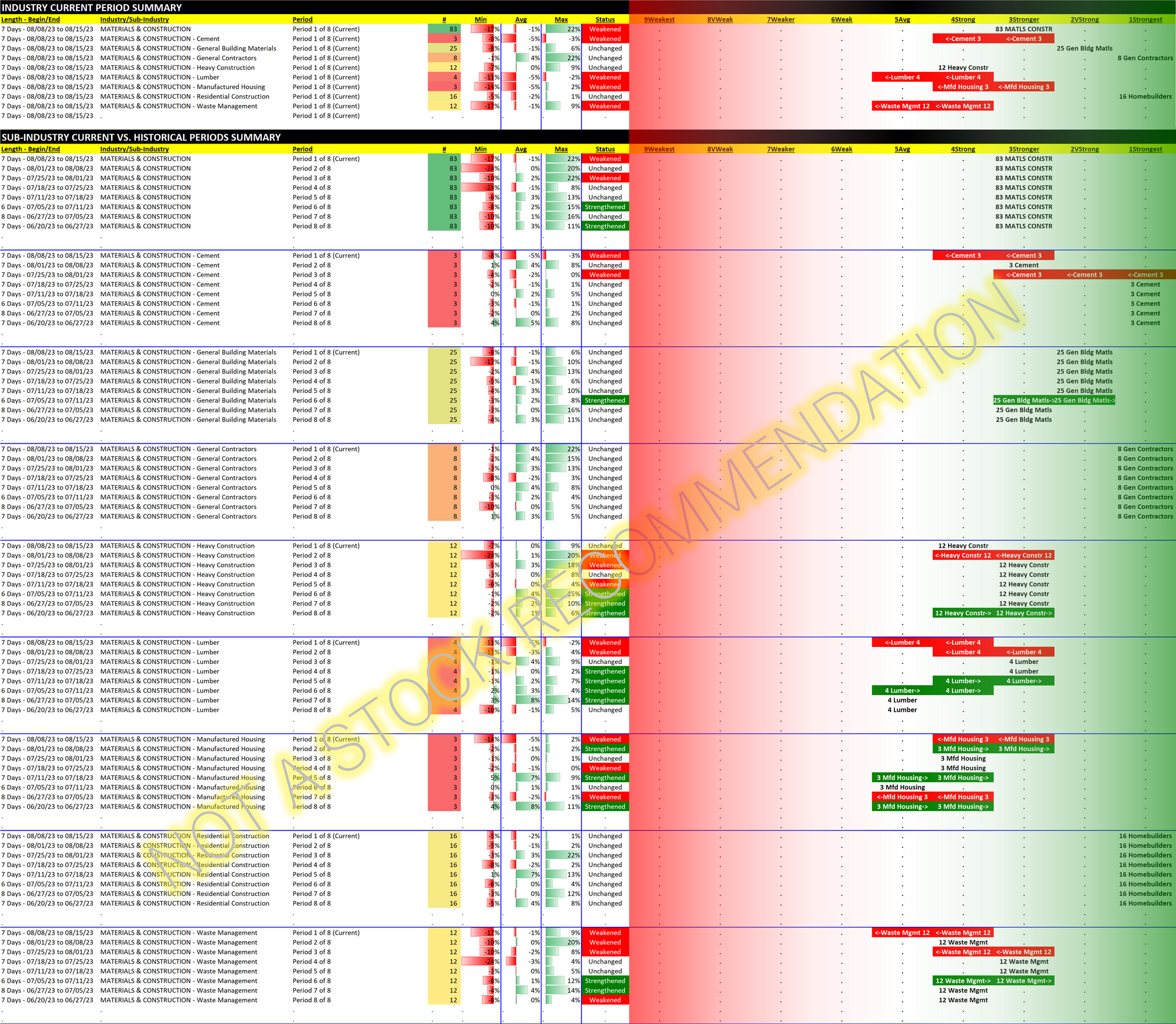

Materials/Construction incl. Homebuilders 2023-08-15: Unchanged at "STRONGER" strength rating (3rd strongest of 9 levels), previous move was UP

Previous review of homebuilders is here.

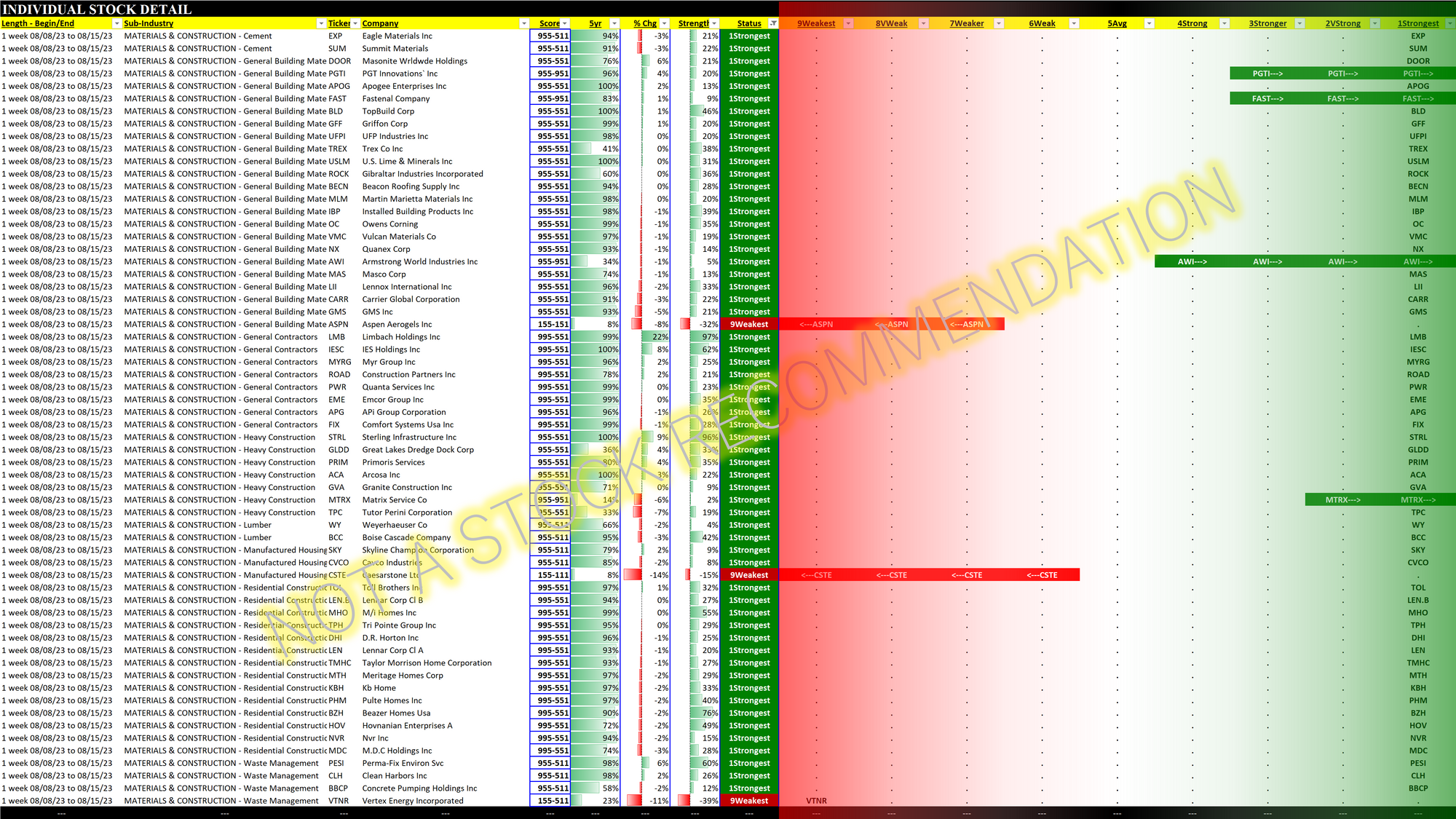

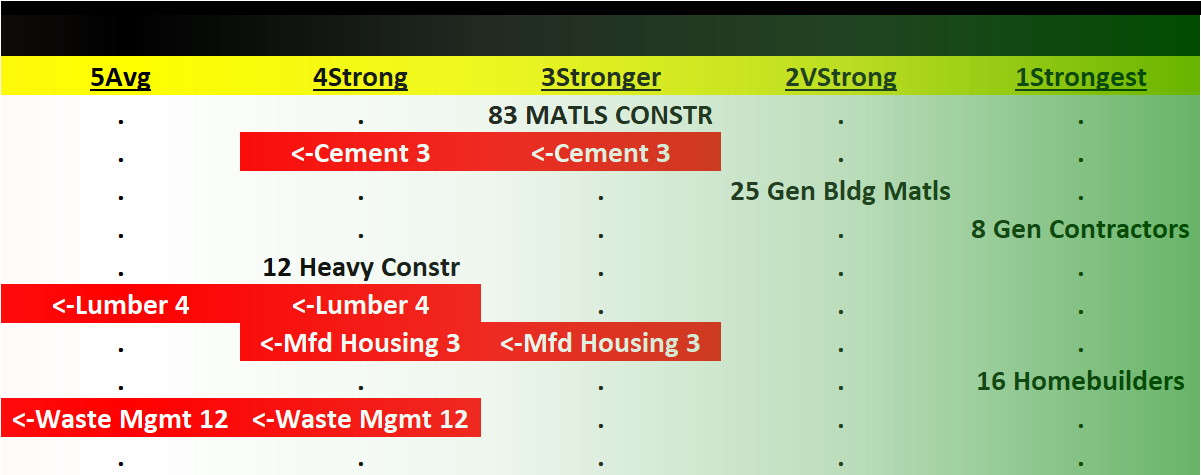

The industry has been flat at Stronger for the past 8 weeks. There was some underlying weakening, with 4 of the 8 sub-industries weakening by one level each. There was no industry-level strength change, however, because the underlying sub-industry weakening was not enough to enact such change.

Last week all 16 Residential Construction (aka Homebuilders) stocks were Strongest. This week, 2 stocks weakened 2 levels from Strongest down to Stronger - not enough to change the sub-industry's strength rating, but this does reflect new weakness in the sub-industry.

Is this weakness in 2 stocks in the Homebuilding sub-industry meaningful? It certainly has meaning. But we don't yet know if this is meaningful.

A note about position management: Let's say you own BZH/Beazer Homes. You see this weakness in the sub-industry. It may or may not lead to more weakness. This sub-industry weakness does not mean you would be on the watch to exit your BZH position. Strengthening sub-industry and industry conditions set the stage for a position entry, but NOT a position exit. A position is exited only when it violates the boundaries you have set that determine it is no longer a "strong" position. This means you'll be giving back some paper gains before exiting. But this is a necessary price to pay that allows you to give the position room to run on the upside.

The punch line: sub-industry/industry conditions get you in, individual stock action takes you out.

The above is a lot of words that would be better shown via a diagram, which I'll do in a future post.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.